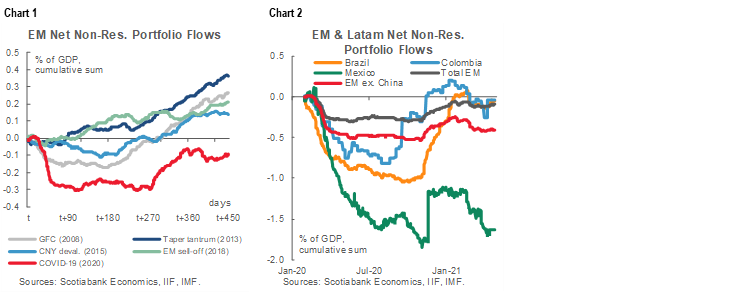

- EM net non-resident portfolio flows remain well below their pre-pandemic numbers. The gap is even bigger when one abstracts net inflows to China from the aggregate EM numbers.

- In Latam, IIF daily estimates imply that Brazil and Colombia have outperformed the rest of EM with nearly complete recoveries in net foreign flows into their fixed-income and equity markets. In contrast, Mexico’s net non-resident portfolio flows remain close to their 2020 nadir.

CAPITAL CONTRASTS

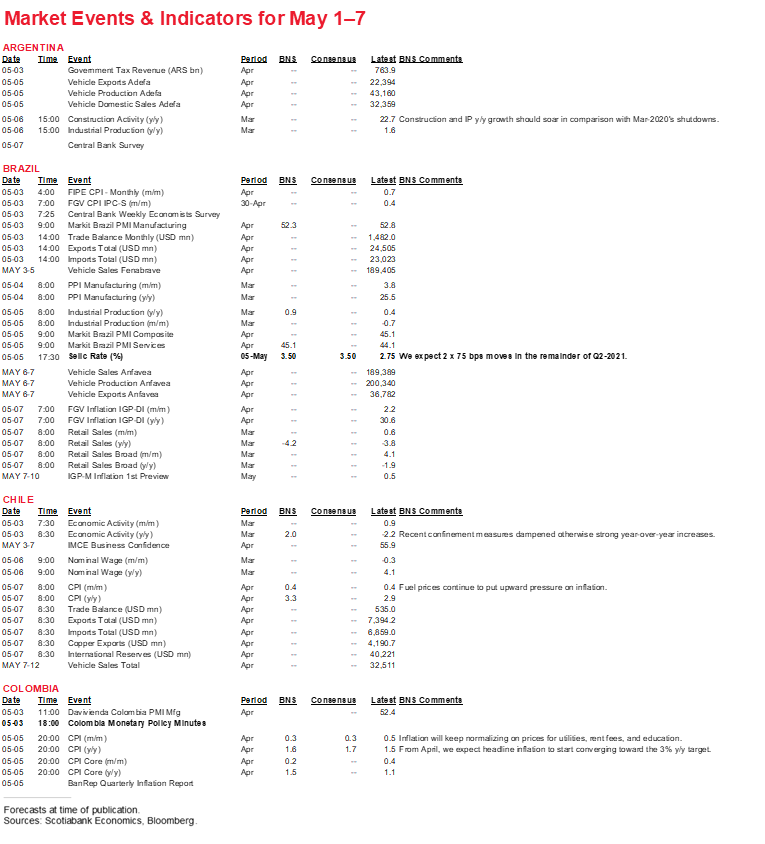

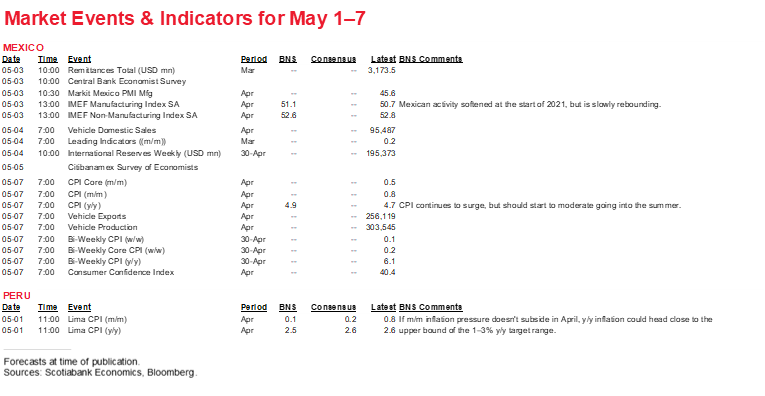

Daily IIF data on net non-resident portfolio flows to emerging markets (EMs) show partial recoveries from their deep pullback during 2020, but cumulative numbers remain well below their pre-pandemic levels (chart 1). Moreover, the return of foreign capital has been even more anaemic when compared with the rebound from past financial crises (chart 1, again). When one removes net inflows to China from the data, the picture looks even softer (chart 2).

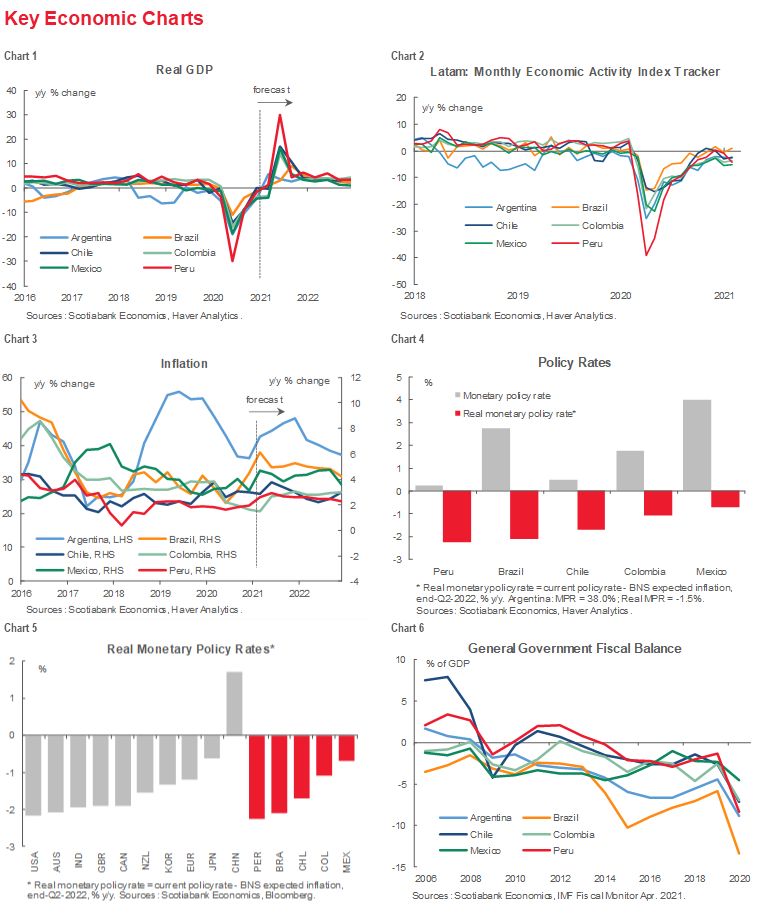

Looking specifically at available data on Latam’s major markets, investor flight last year from Mexico was amongst the quickest and deepest, and has remained quite persistent, notwithstanding an anomalous jump in the numbers in late-2020 related to rollovers of public-debt instruments. Although Mexico’s real interest rates have been amongst the highest in both the Latam and EM spaces over the last year and a half (chart 5, p. 3), this hasn’t been enough to compensate for other factors that have weighed on Mexican markets. In contrast, Brazil and Colombia appear to have seen nearly complete reversals of the foreign-capital outflows they experienced last year. High-frequency data on Argentina, Chile, and Peru are not available given the smaller size of their markets.

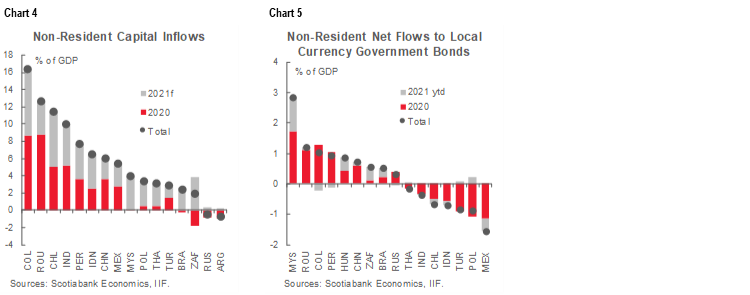

Quarterly balance-of-payments data capture 2020’s outflows (chart 3), but are too lagged to incorporate yet both the rebounds and the extended doldrums reflected in the high-frequency daily estimates.

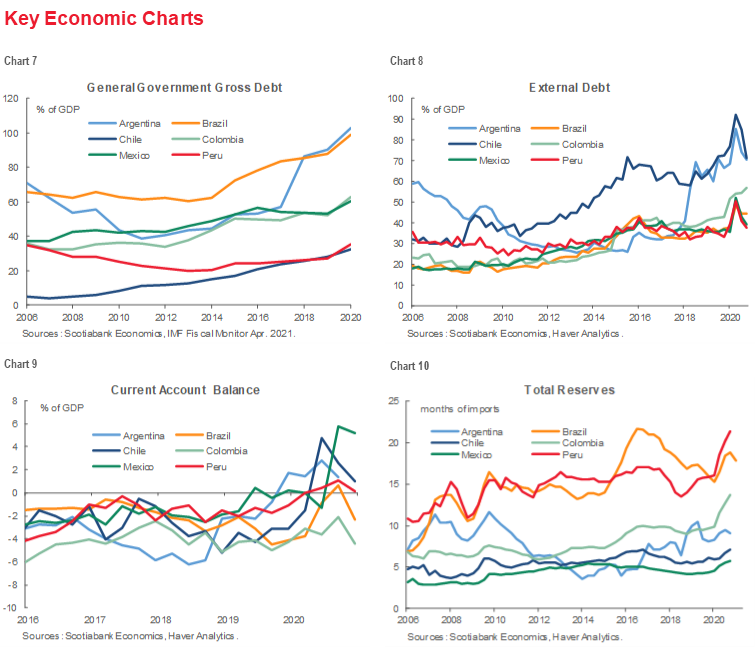

IIF estimates of total external financial and capital account net flows into EMs rank Colombia, Chile, and Peru amongst the best performing countries during 2020–21 (chart 4). This reflects, in part, the substantial foreign-currency government bond issuance by all three countries and their subsequent uptake by international investors. Net international participation in EM local-currency debt markets in 2021 has been limited so far compared with 2020, where Colombia and Peru both saw substantial inflows from foreign buyers (chart 5). Looking ahead, heavy positioning against Mexico may be set for the most substantial unwind.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.