Latam’s currencies have had a soft start to 2021 and are amongst the weakest performers so far in the EM complex.

While our forecasts point to broadly stronger nominal exchange rates in the region, longer-term macro trends imply that the MXN and BRL could particularly benefit from positive policy developments and economic surprises.

SOFT START FOR LATAM FX IN 2021

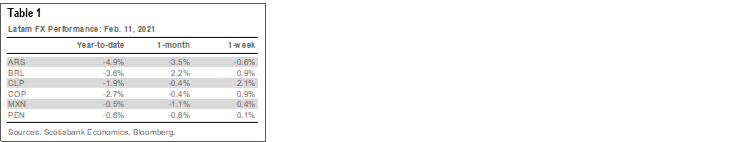

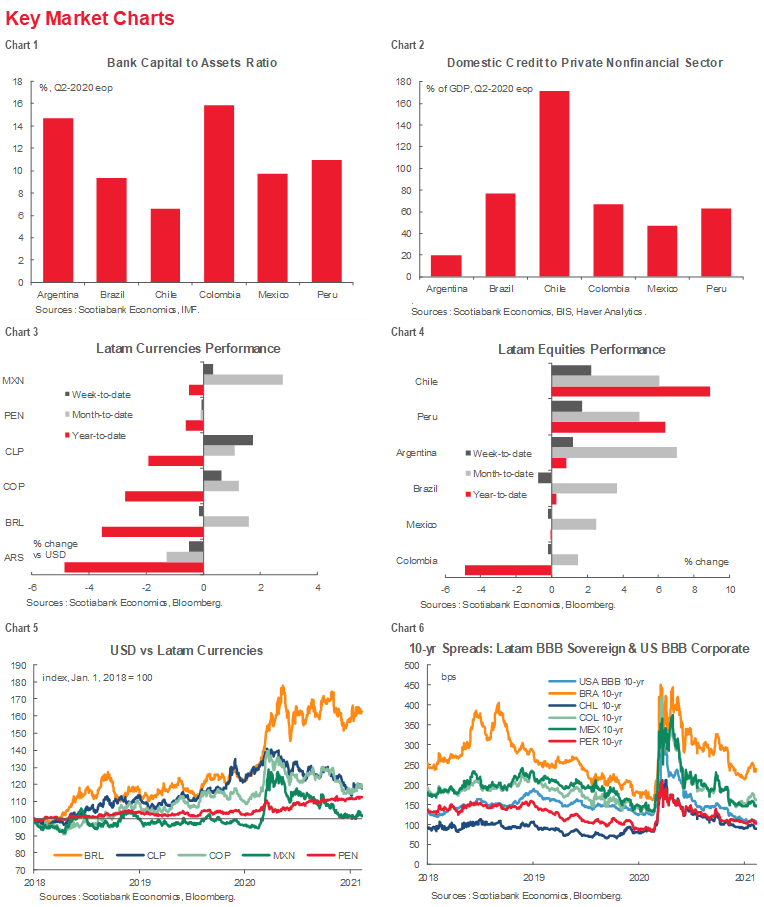

Despite a broad improvement in global risk sentiment owing to the initial roll-out of COVID-19 vaccines and the (eventual) smooth transition between presidential administrations in the US, Latam currencies have had a soft start to the year (table 1).

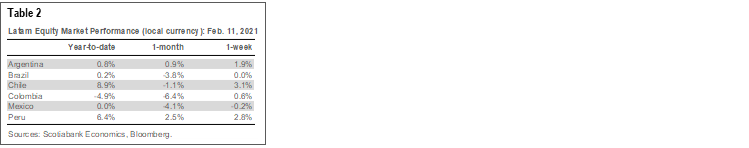

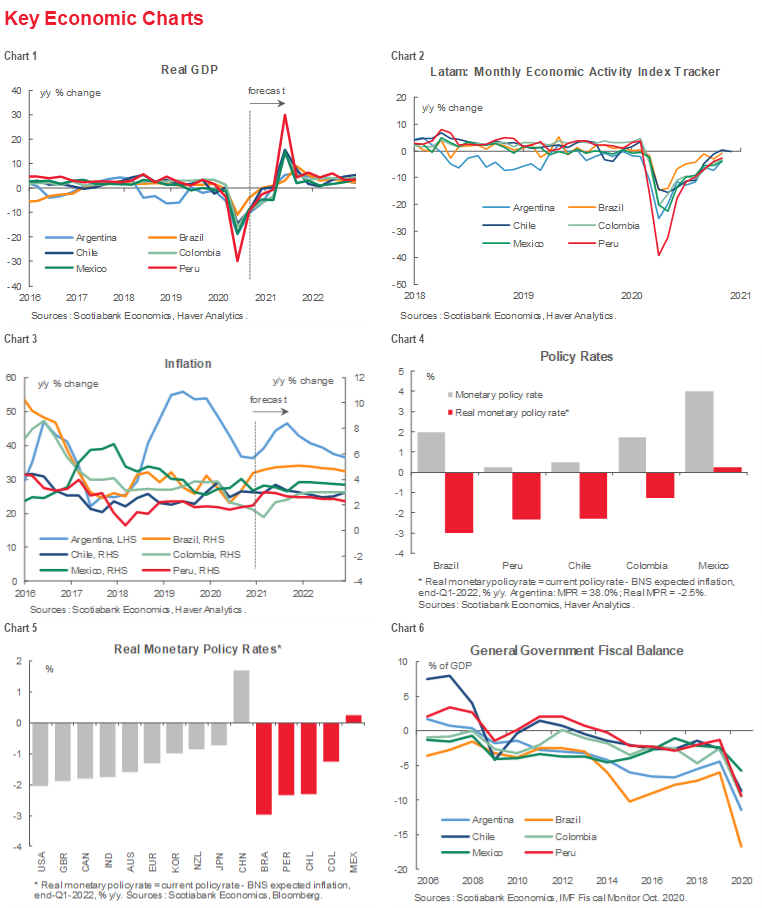

- Depreciations so far in 2021 have been strongest in Argentina and Brazil. Argentine inflation is now running faster than 4% m/m and as we’ve long anticipated, a conclusion to talks on a new IMF lending arrangement remains far off. Meanwhile, as we argued in our February 10 report on Brazil, policymakers face a fork in the road where intensifying fiscal and inflationary pressures are converging. Other risk assets, such as local equities, have mirrored weakness in the ARS and BRL (table 2).

- On the other hand, Chile’s and Peru’s currencies and equity markets have performed relatively strongly compared with their peers (tables 1 and 2, again), reflecting, we think, some reward for strong policy responses to the pandemic even as the second waves of COVID-19 have risen (see below).

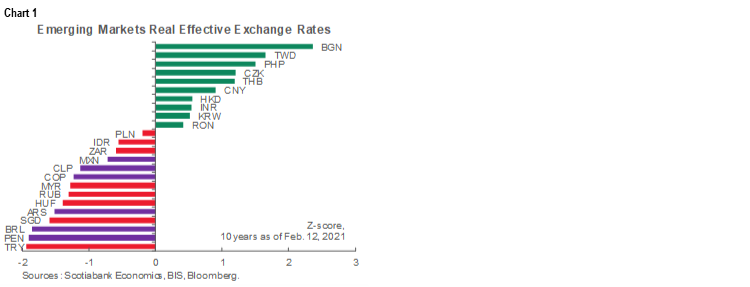

In trade-weighted real effective terms, all of Latam’s major currencies currently sit in the bottom half of the EM complex when judged against the last decade of performance (chart 1). This reflects, in part, Latam’s status as a COVID-19 hotspot for a substantial part of the last year. It’s also a by-product of decisions by local country authorities to prioritize domestic fiscal and monetary support to their economies over the—likely futile—defense of their currencies as the COVID-19 tide swept into Latam and risk-averse global capital flowed out. This policy mix has left Latam’s external sectors in a very competitive position to benefit from rising global demand for their exports.

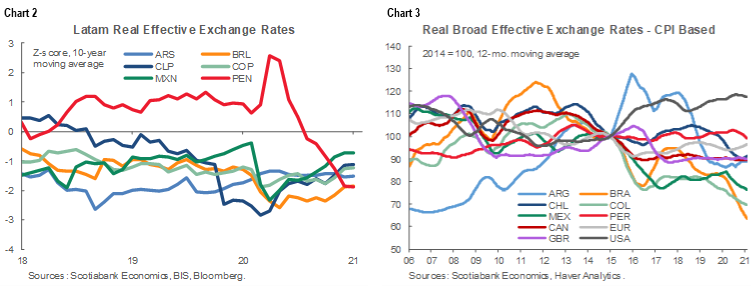

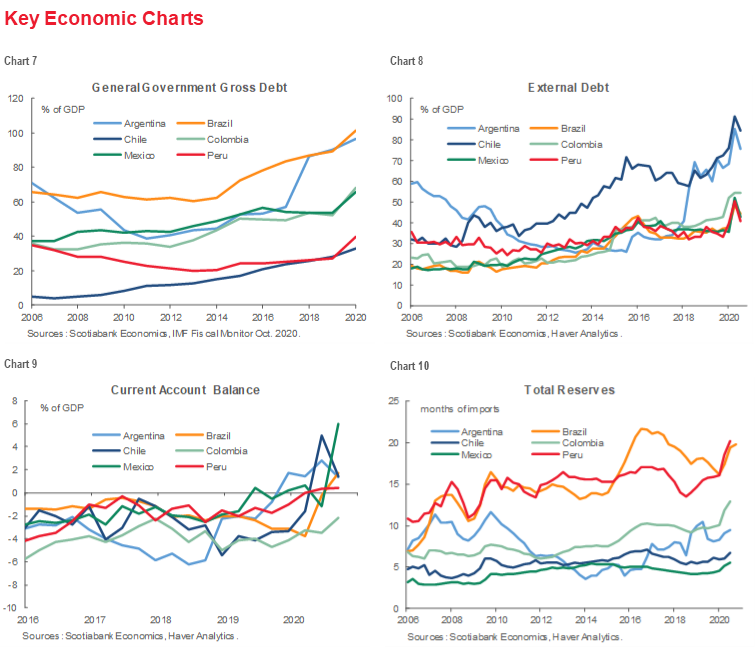

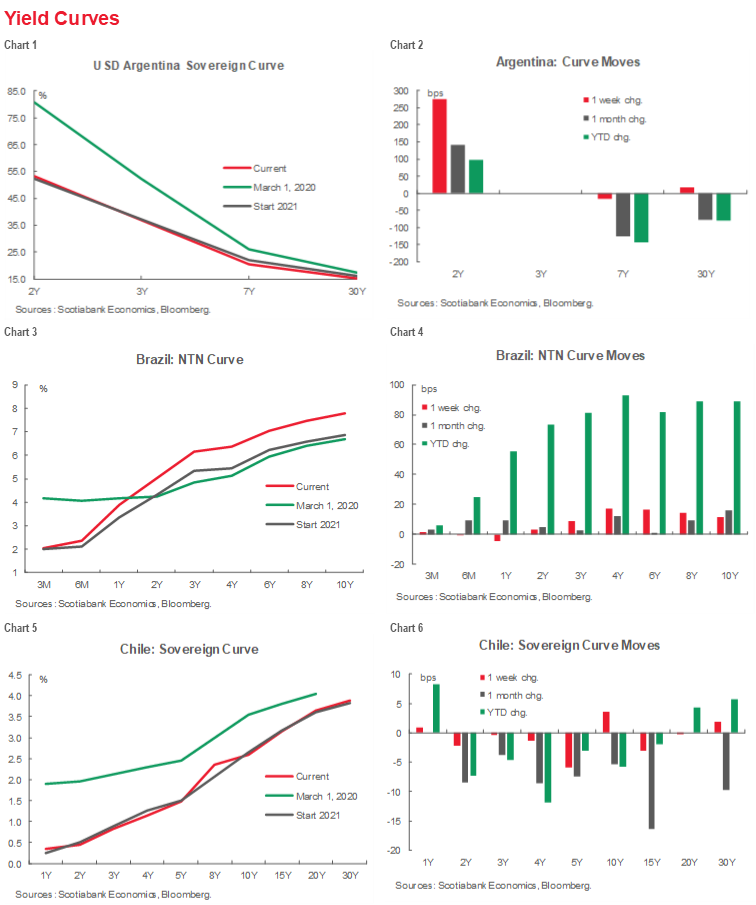

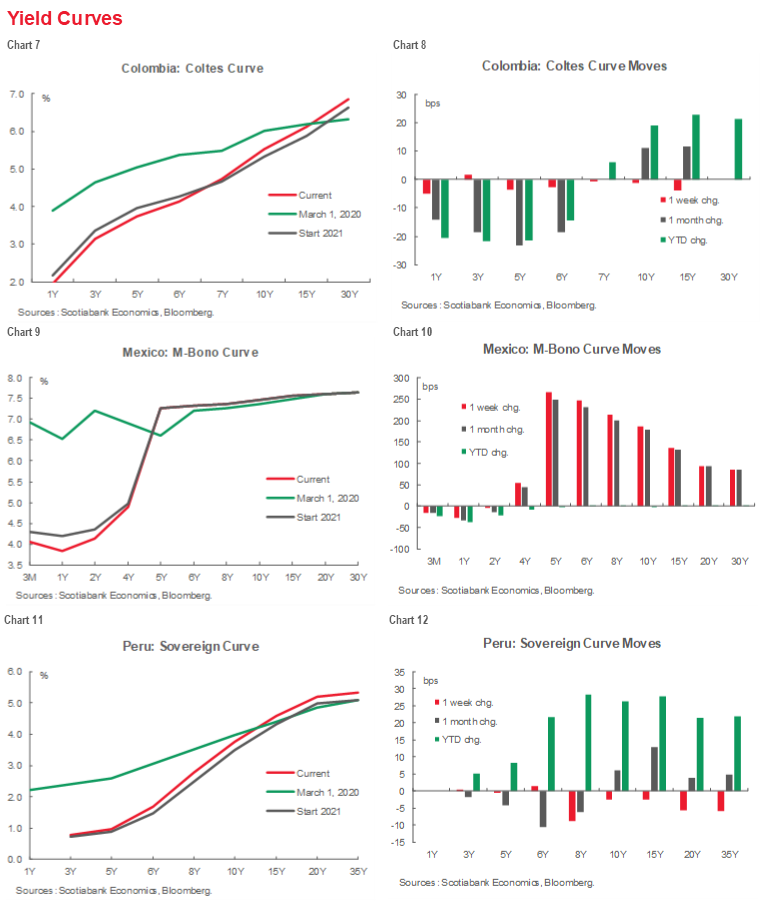

Latam’s relatively soft real effective exchange rates (REERs) also cap the end of longer-term trends. In contrast with the PEN’s recent, pandemic-induced depreciation, Latam’s other major currencies have been persistently weak over the last three years (chart 2). Looking back further to 2013’s Fed-induced “taper tantrum”, Brazil’s BRL, Colombia’s COP, and Mexico’s MXN have been on a consistently soft path—reflecting oil and other commodity prices, mixed policy performance, and lagging productivity growth (chart 3). In contrast with Peru’s PEN and Chile’s CLP, the pandemic isn’t the major determinant of where these currencies find themselves today.

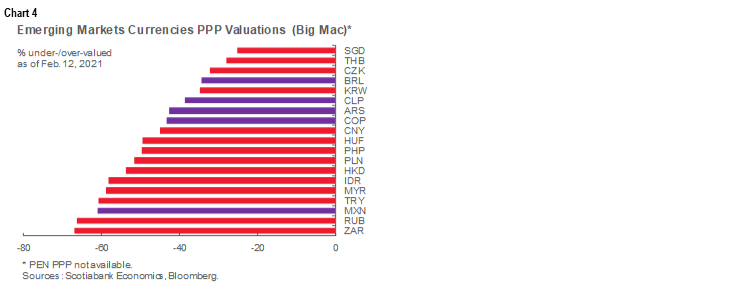

Looking ahead over the next two years, our economics teams expect nominal appreciations in the BRL, CLP, COP, and PEN, with the MXN on track for a mild nominal depreciation owing to Mexico’s anaemic growth prospects; similarly, the ARS is set to slide substantially further in the midst of Argentina’s ongoing adjustment challenges (table 3, p. 3). While currencies can remain dislocated from their underlying long-term fundamentals for years and tend to move through, rather than linger at, fair valuations, purchasing-power-parity (PPP) comparisons indicate that the MXN is the most undervalued currency in Latam (chart 4). While this doesn’t cast our short-term forecasts of MXN nominal depreciation in doubt, it does imply that the Mexican peso could stand to benefit handsomely from upside policy and economic surprises over the longer term, particularly given that the country’s real policy rates remain the highest in the region (see chart 4 in the Key Economic Charts appendix). Similarly, given our expectation that the region’s first interest rate hikes are set to come from Brazil’s BCB, the BRL could catch a lift as well. But all of this is subject to an orderly withdrawal of exceptional monetary policy support in developed markets, as we argued here.

COVID-19 SECOND WAVE UPDATES

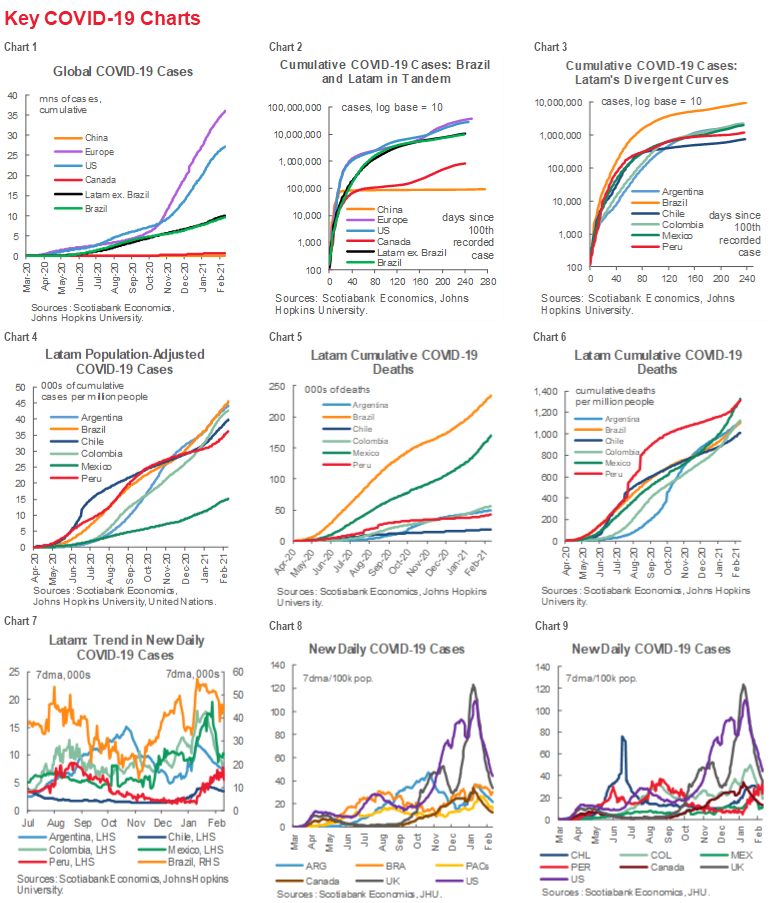

Mirroring developments in Canada and the US, COVID-19 second waves appear to have crested in most Latam countries, with Peru representing the main exception (see COVID-19 charts 1–9, p. 9). With the caveat that testing remains too scarce and positivity rates too high in Brazil and Mexico for the official data to capture accurately recent COVID-19 developments in either country, new COVID-19 case trends are moving downward everywhere but in Peru. Peru’s new COVID-19 case numbers, its new per capita cases, its cumulative COVID-19 case curve, its cumulative per capita curve, and its per capita deaths curve have, in recent weeks, bent the most markedly upward amongst Latam’s major economies. The worst of Peru’s second wave is still ahead.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.