Latam new per-capita COVID-19 infection trends below northern peers

Early signs of second-wave impact in leading and coincident indicators

LATAM NEW PER-CAPITA COVID-19 INFECTION TRENDS BELOW NORTHERN PEERS

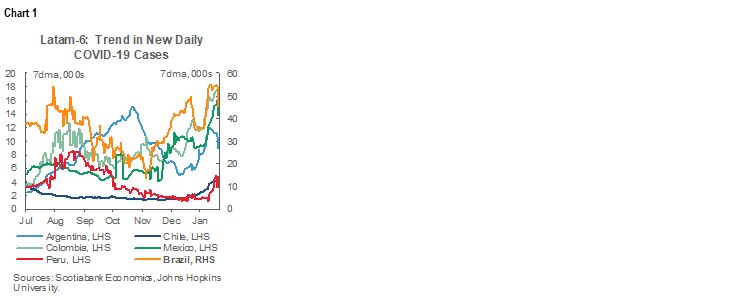

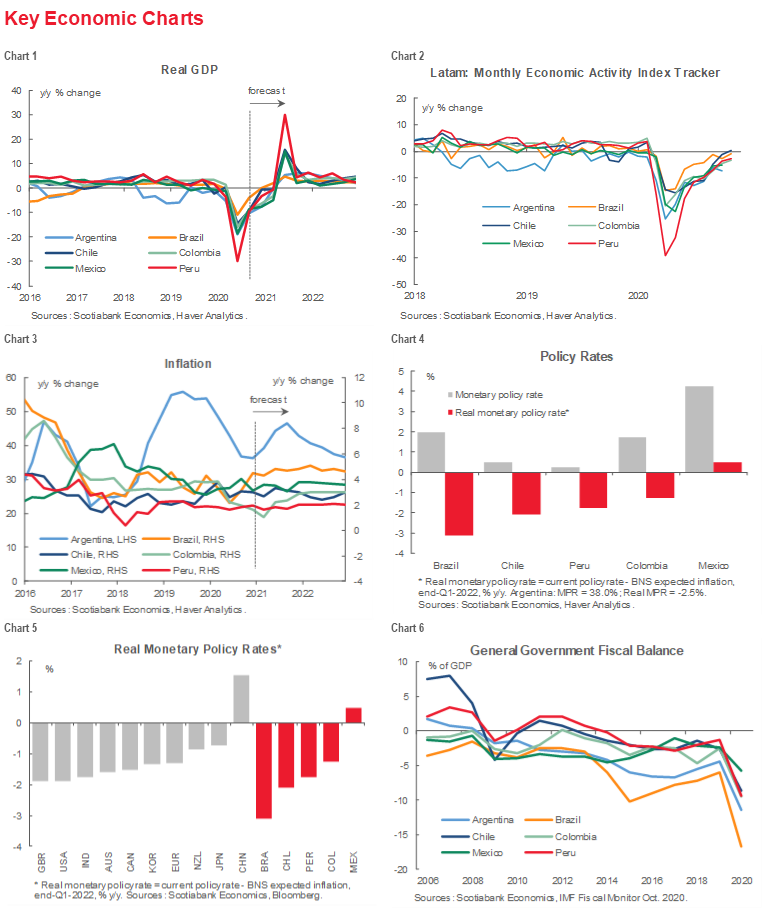

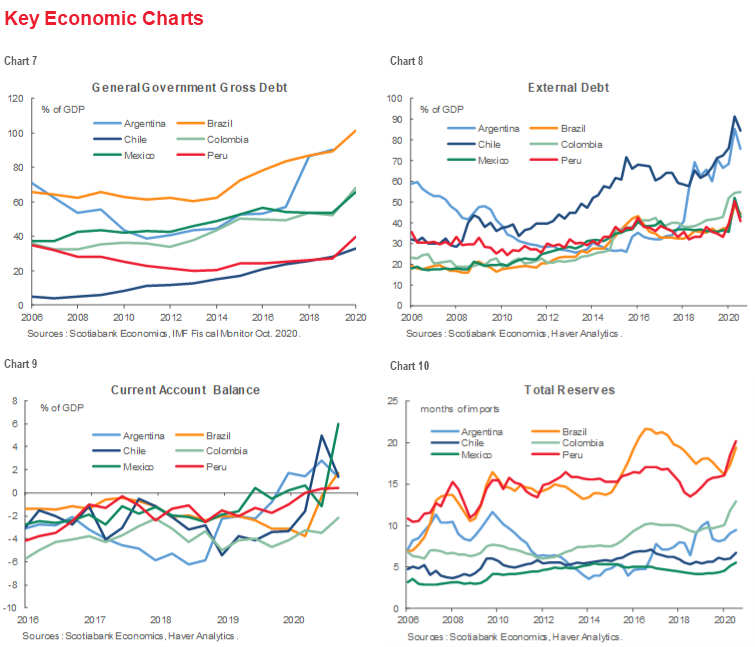

As in most of the world, COVID-19’s second wave is beginning to rise in Latin America despite the mitigating effects of summer in the southern hemisphere, but new case numbers remain relatively muted in per capita terms. Seven-day rolling averages of new case numbers at end-2020 and in the first few weeks of 2021 are up substantially across the Latam-6 countries we cover (chart 1; also see the Key COVID-19 Charts appendix).

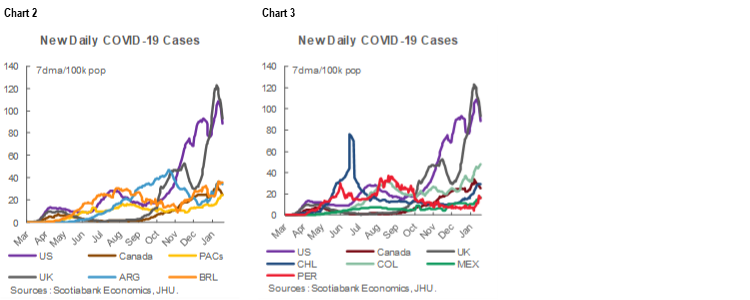

Still, leading trends on a per-capita basis in the Pacific Alliance countries (PACs)—Chile, Colombia, Mexico, and Peru—continue to look better than in their regional neighbours Argentina and Brazil, on par with new per-capita case counts in Canada, and much better than the ongoing surge in the US and the UK (chart 2). One caveat on these numbers is that the PACs’ relatively strong performance is underpinned by still-low new per-capita COVID-19 incidence in Mexico and to a lesser extent Peru (chart 3). Mexico’s relatively encouraging numbers on new per-capita inflections likely reflect limited testing rather than progress in containing a second wave. Mexico accounts for about 55% of the Pacific Alliance countries’ total population, so its data have a disproportionate effect on the PACs’ aggregate numbers.

EARLY SIGNS OF SECOND-WAVE IMPACT IN LEADING AND COINCIDENT INDICATORS

Following sustained rebounds in activity across most major economies in both Q3 and Q4 2020, signs of the impact of COVID-19’s second wave are beginning to assert themselves around the world in coincident and leading indicators for Q1-2021. Purchasing-managers’ indices for Q1-2021 in the Eurozone and the UK out on Friday, January 22, both pointed to deeper than expected dips in growth in response to new lockdown and contagion control measures. Similarly, Japan’s Jibun PMIs retreated more deeply into contractionary territory, while Australia’s services and manufacturing indicators cooled, but remained expansionary. See Scotiabank Economics’ Daily Points for January 22 for charts and analysis. Similarly, PMIs in Latin America ended 2020 on a downbeat, with a deepening contraction in Mexico’s manufacturing PMI for December and mixed results in Colombia’s December manufacturing PMI print.

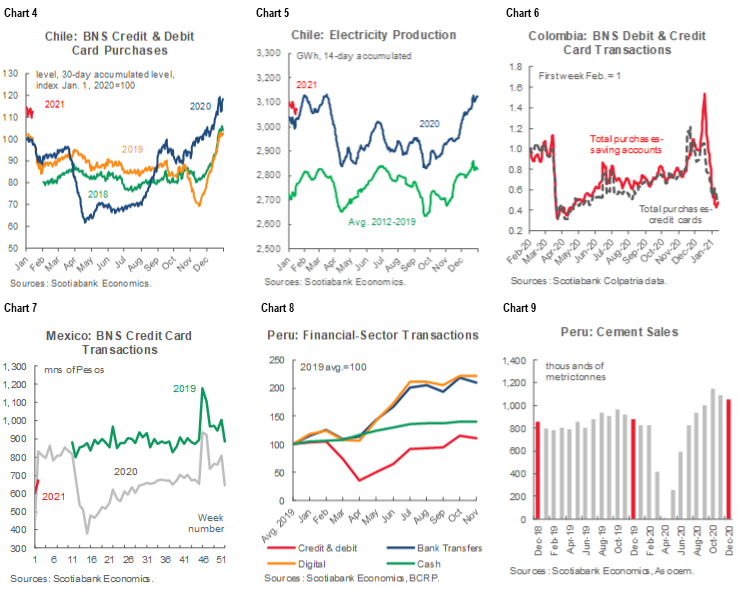

High-frequency data in the Pacific Alliance for end-2020 and early-2021 tell mixed stories tied to contagion control measures and policy support efforts specific to each country. In Chile, Scotiabank credit- and debit-card transactions volumes have averaged 12% above year-ago levels so far in 2021, down only slightly from the average 10% y/y gains in December 2020 (chart 4). Household finances and retail activity continue to benefit from the two withdrawals of pension assets and substantial fiscal support. Chile’s total daily electricity production, a good proxy for economic activity, has averaged about 1% higher in January than in December (chart 5). In contrast, retail card transactions volumes at Scotiabank Colpatria in Colombia dropped about 55% from December’s pre-Christmas peak to January 15 owing to renewed restrictions in Bogota and other major cities (chart 6). Scotiabank Mexico’s retail credit-card volumes for the first two weeks of January are down about 14%, on average, from December, but these transactions are highly seasonal and they are off only about -0.7% y/y from January 2020 (chart 7). Economy-wide transactions data for Peru are available only through end-November 2020, which pre-dates the recent upturn in new COVID-19 cases in January 2021 (chart 8). As we noted in our January 20 Latam Daily, though, some coincident real-economy indicators point to a strong hand-off into 2021: cement sales, which provide a good proxy of construction activity, rose 20% y/y in December 2020 (chart 9) and imply -2% y/y GDP growth in December 2020, the best performance since March.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.