- The omicron variant introduces additional uncertainty to an already uncertain conjuncture.

- Increased caseloads or public health measures to limit transmission could disrupt economic activity, resulting in output losses. These losses would be magnified in the event of supply-side bottlenecks that curtail production.

- At the same time, omicron wave disruptions could lead to further price pressures, increasing the urgency on central banks to defend price stability commitments. For Latam countries, external financial conditions are likely to become far less benign.

- In these circumstances, charting a path through the omicron effect requires looking beyond possible near-term developments and embracing sound policy frameworks and strong institutions.

KEY ECONOMIC CHARTS

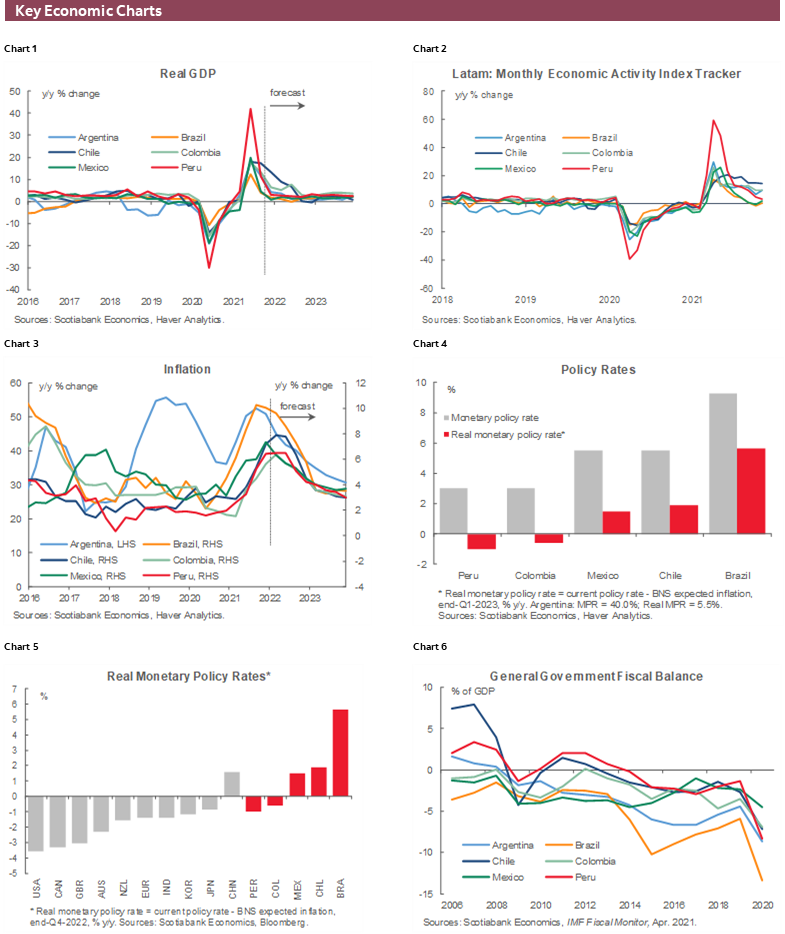

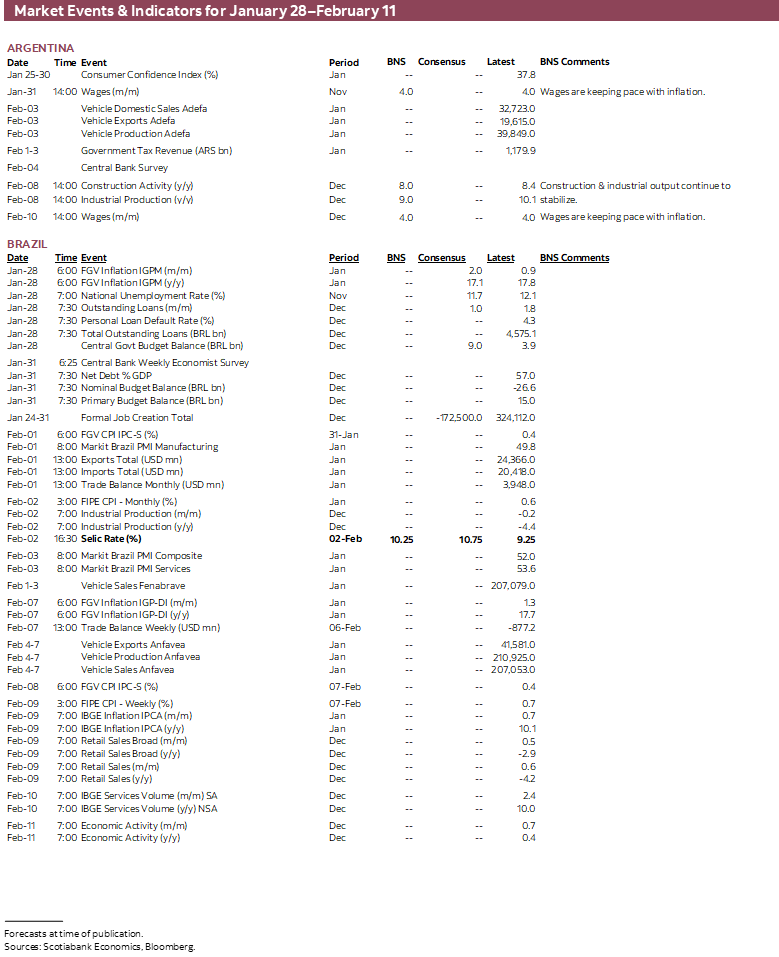

As the new year unfolds, the omicron variant has introduced additional uncertainty to the near-term economic outlook. Recent data suggests that growth in key external markets and the Latam region was strong going into 2022. If this pace is sustained going forward, downside risks to the forecasts of Scotiabank economists in the region would be limited. These projections call for a gradual moderation of GDP growth over the year, following the strong rebound in output recorded in 2021 (chart 1).

Should the omicron variant have far more disruptive effects, however, the expected return to pre-pandemic growth rates could be interrupted. For this reason, market analysts and policy makers will be closely monitoring high-frequency indicators of economic activity in the weeks ahead. For now, the monthly economic activity index tracker (chart 2) does not signal alarm, with recent declines reflecting waning base level effects. That said, as noted in previous reports, the sharp deceleration in Brazil and Mexico warrants watching.

Inflation could be one effect of the omicron variant. Over the past year, supply-side shocks have driven inflation higher and have proven to be more persistent than earlier anticipated. As a result, inflation across the Latam region exceeds central bank inflation targets, significantly so in some cases (chart 3). Additional supply bottlenecks generated by the omicron wave, or prophylactic public health measures to limit caseloads, could prolong price pressures and challenge the credibility of central bank price stability commitments. Such effects would be exacerbated by steady increases in core inflation such as those seen in Mexico that feed through to expectations.

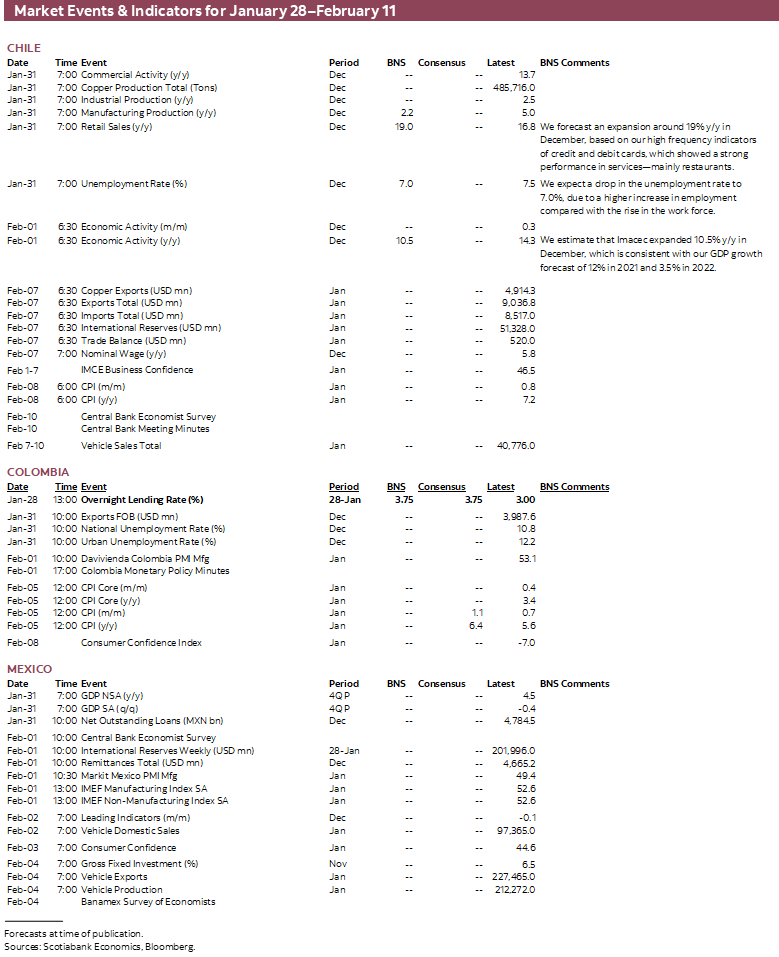

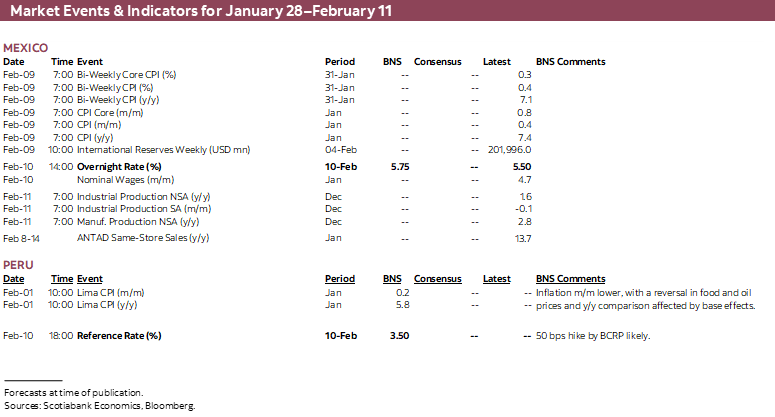

Central banks across the region have raised policy rates to contain inflation (chart 4). In Peru, policy rate hikes, which raises the cost of credit, have been supplemented by increases in reserve requirements that restrict the quantity of credit available.

Brazil’s BCB and Mexico’s Banxico have moved most aggressively, resulting in positive real (adjusted for inflation) policy rates. In Chile, the BCCh has also acted decisively, including a surprise 150 bps move on January 26. Real policy rates remain in negative territory in Colombia and Peru, though tomorrow’s meeting of Colombia’s BanRep is expected to result in a further rate hike. While they lag their regional peers in this respect, the central banks in Colombia and Peru are not out of sync with central banks around the globe (chart 5). But with the Fed and the Bank of Canada signalling imminent rate increases, and the Bank of England having already moved, the breathing space that rate holds elsewhere provide is likely coming to an end.

In this respect, the external financial environment is likely to become far less benign. In that event, attention will increasingly focus on stability and resiliency indicators, including fiscal balances (chart 6). These indicators deteriorated sharply as most governments across the Latam region moved expeditiously—and appropriately—to limit the economic and financial effects of the pandemic and to protect the most vulnerable. With the rebound in output, extraordinary fiscal measures should be scaled back and steps taken to ensure long-term fiscal sustainability. The good news here is that governments across the Pacific Alliance have already taken important steps towards the goal of containing the increase in general government gross debt (chart 7) recorded in the pandemic.

Global investors will also be closely watching external indicators, including external debt burdens (chart 8), current account balances (chart 9), and reserve holdings (chart 10). These indicators do not currently point to impending challenges, though the continued widening of current account deficits in Chile and, especially, Colombia should be monitored.

KEY MARKET CHARTS

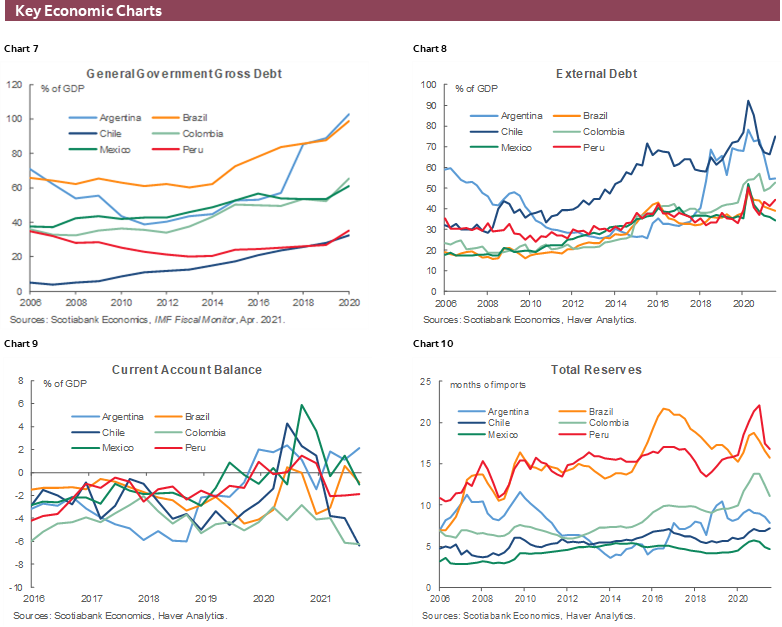

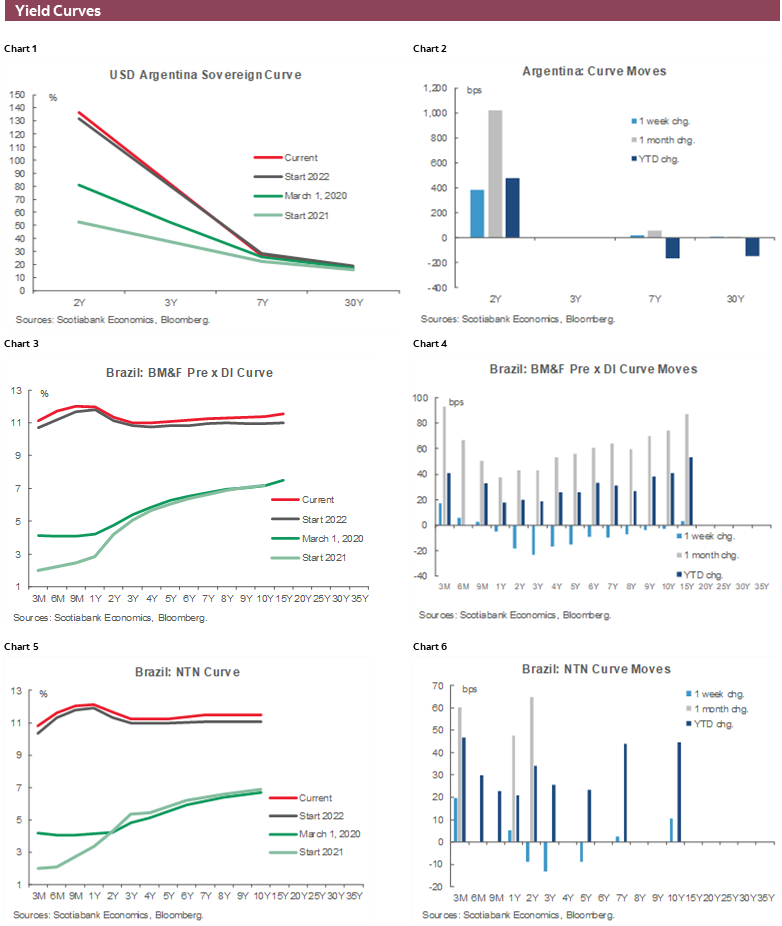

Financial markets across the Latam region have performed strongly in the early weeks of 2022. Most currencies have appreciated against the US dollar (chart 3), as central banks in the region have tightened policy and signalled further rate hikes while most advanced economy central banks have remained on hold. Regional equity markets have likewise gained ground, with Peru’s stock market leading the way. As our team in Lima has previously pointed out, part of that gain reflects a diminution of political uncertainty.

Despite the appreciation of regional currencies in early 2022, a longer timeline (chart 5) reveals that, with the exception of the Mexican peso, most Latam units have some way to go before returning to pre-pandemic levels. Similarly, while 10-year CDS spreads on Latam sovereigns (chart 6) have narrowed from the highs recorded in March 2020, most remain above pre-pandemic lows. The widening in Colombia’s spread observed over the course of 2021 is notable, particularly as it accelerated later in the year. Scotiabank’s economists in Bogota have attributed this trend, in part, to political uncertainty surrounding the upcoming elections.

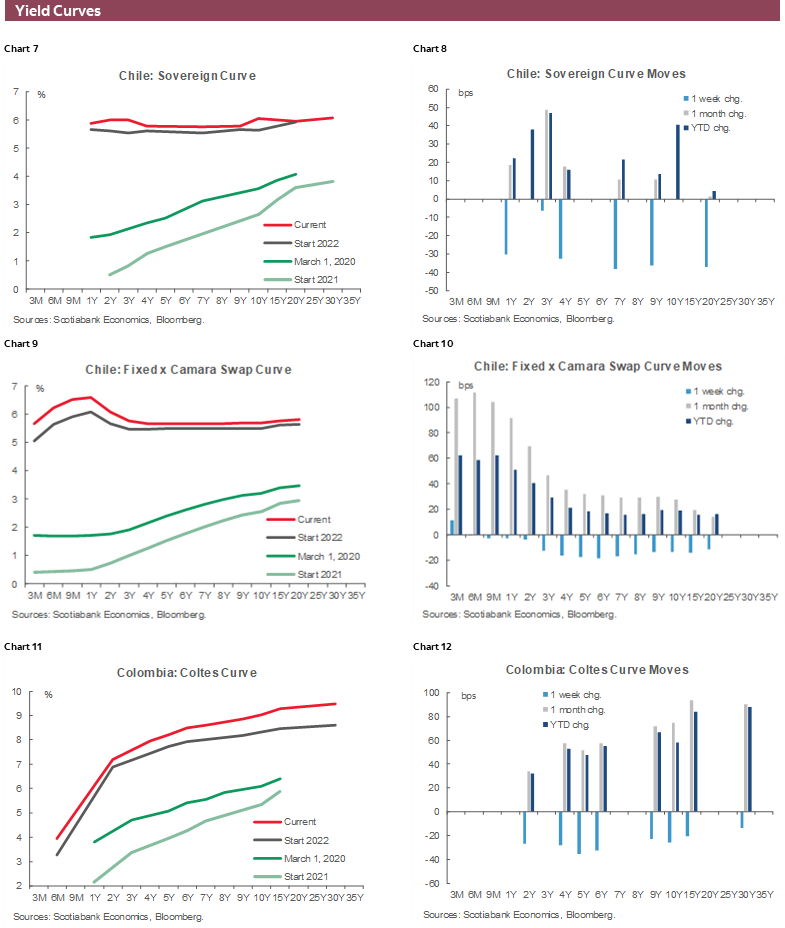

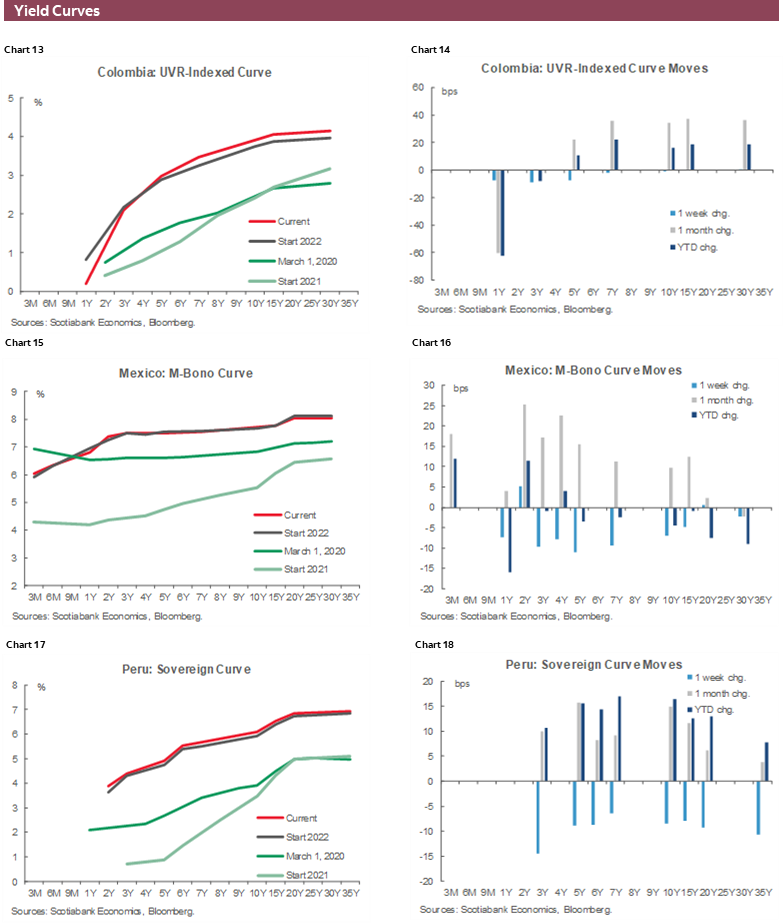

YIELD CURVE CHARTS

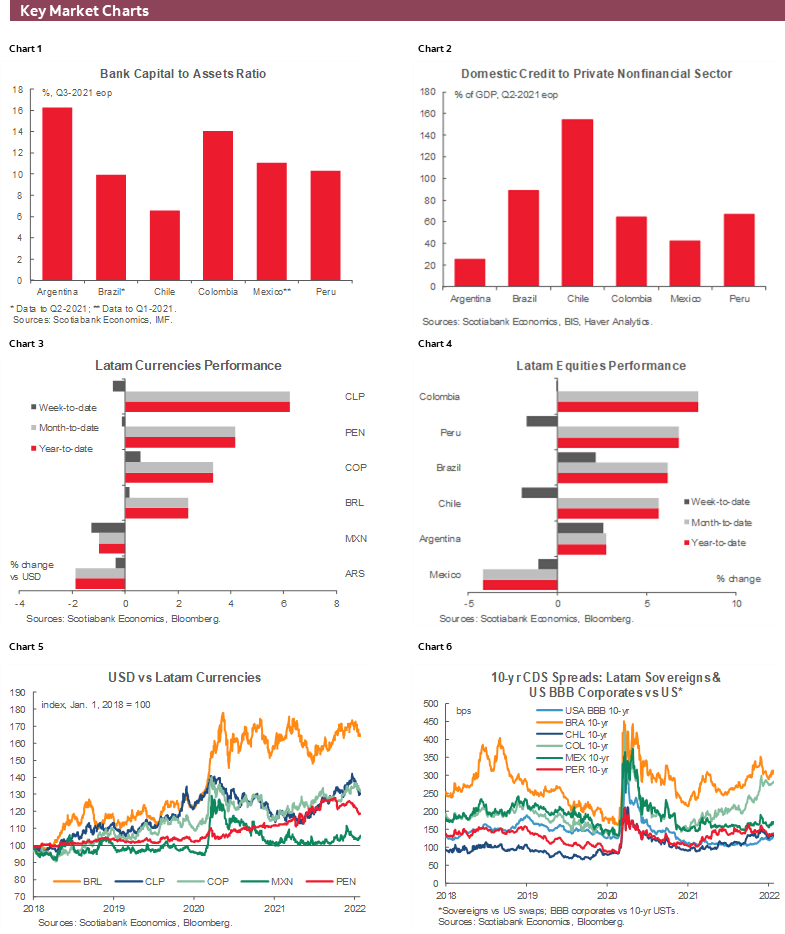

Latam sovereign yield curves shifted up across the maturity spectrum in 2021 as higher inflation and increases in short term interest rates were priced into term premiums (charts 1–18). Since the start of 2022, however, sovereign curves have been stable. Curves have flattened in Brazil and Chile over the past year, while Argentina’s sovereign curve remains highly inverted reflecting the unique circumstances there.

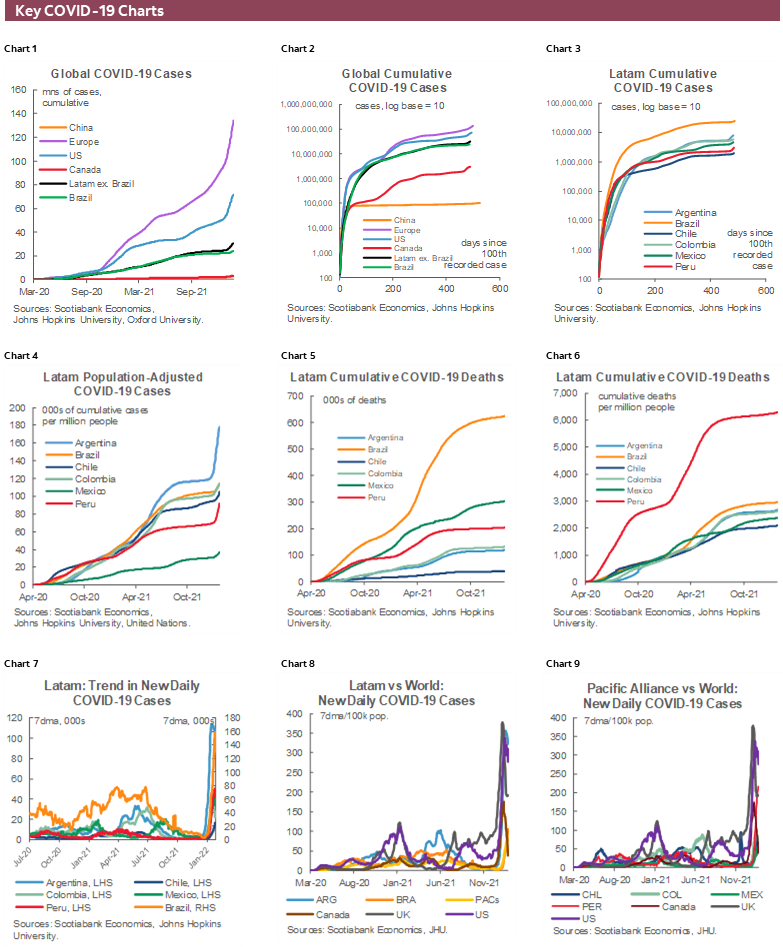

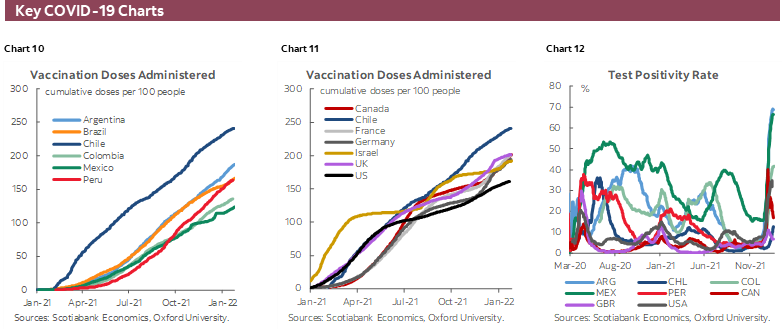

KEY COVID-19 CHARTS

As noted at the outset, the omicron variant looms over the short-term outlook. And the path and progression of the latest wave of the pandemic will have important implications on economic activity, inflation and financial markets. Key monitoring charts (charts 1–12) mark the evolution of caseloads, mortality and vaccinations. They show that while cases (chart 7) and test positivity rates (chart 12) have spiked higher throughout the region, for now at least case rates in Brazil and the Pacific Alliance countries remain below those in the advanced economies that were likely overtaken by the omicron wave earlier (charts 8 and 9). The good news is that mortality rates (chart 5) have thus far not increased, while vaccinations continue to be rolled out with Chile leading the region (chart 10) and the world (chart 11).

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.