March’s EM sell-off has echoes of 2013’s “taper tantrum” that imply a need for a shift in messaging at next week’s FOMC meeting.

The Pacific Alliance countries’ (PACs’) risk assets are performing relatively well through this storm.

ECHOES OF 2013 AND AN INFLECTION POINT FOR THE FED

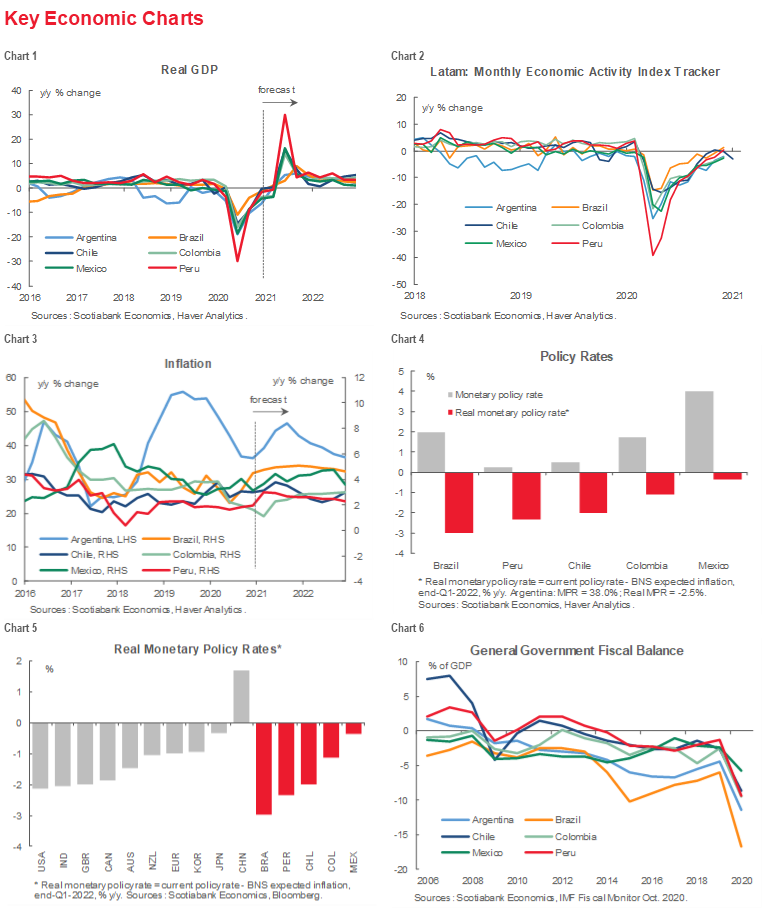

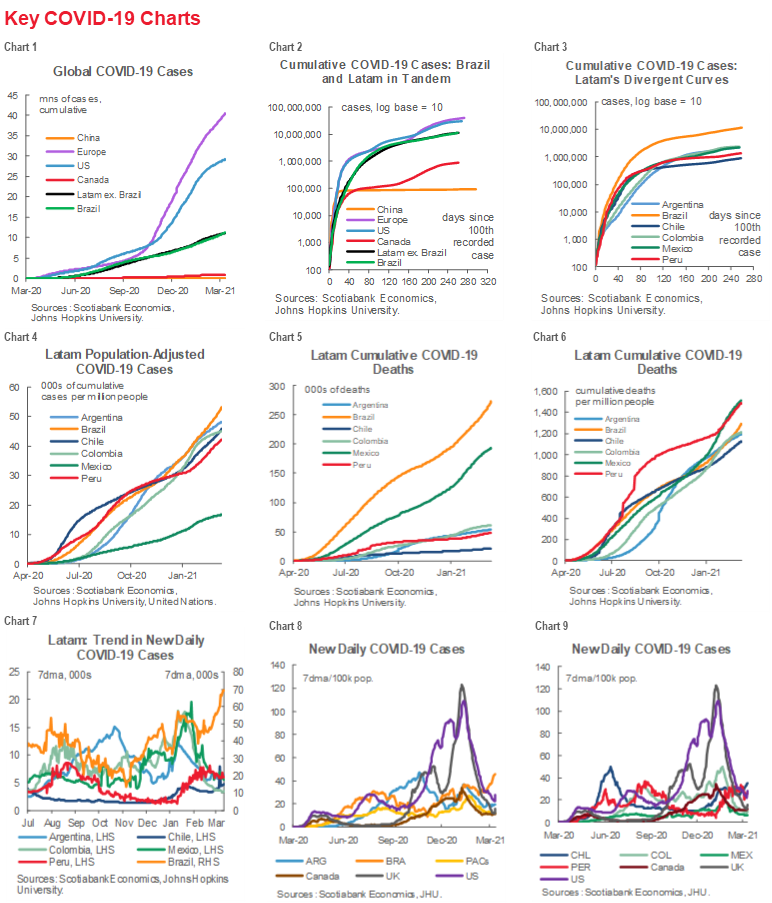

The recent back-up in US yields on strengthening recovery data, improving vaccination news, the Biden Administration’s stimulus package, inflation concerns, and the Fed’s pass on quelling taper speculation in its recent communications have translated into a substantial, but differentiated, sell-off across emerging-market (EM) risk assets so far during March. IIF data (subscription) show that capital flows out of EMs are reversing the recovery from last year’s pandemic-induced sell-off and are approaching the pace observed at the peak of the 2013 “taper tantrum”. Investors are looking through the potential positive spillovers from the US stimulus package on EMs, particularly Mexico, through increased demand for their exports, higher commodity prices, and direct transfers via remittances that have been estimated by, amongst others, the OECD.

All of this makes the March 16–17 FOMC meeting and ensuing Fedspeak critically important for the next few weeks in EMs. At the outset of 2013’s EM sell-off, the Fed accepted rising yields as a by-product of strengthening growth prospects, which deepened the rout when the FOMC moved ahead with the announcement at its June 2013 meeting of a plan to taper QE. Capital outflows from EMs were staunched only when the September 2013 FOMC meeting took a pass on pursuing the taper that had been teed up. Next week’s Fed communications will need to take the emphasis off the near-term quickening of the recovery and refocus markets on longer-term growth prospects in an attempt to anchor the far end of the US curve and reduce pressure on EMs. The bonus for the US is that such a move may also dampen the return to a strong USD that could impair efforts to raise inflation and boost exports.

PACIFIC ALLIANCE COUNTRIES: SAILING ROUGH FED WINDS

The Pacific Alliance countries (PACs) haven’t been immune to global market developments, but so far they are weathering the storm better than most EMs. We look at the performance of the PACs’ major risk assets since the beginning of March versus their peers.

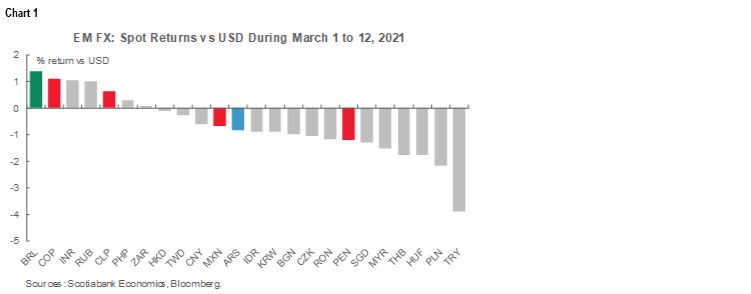

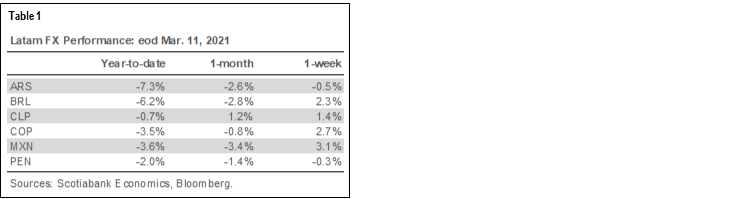

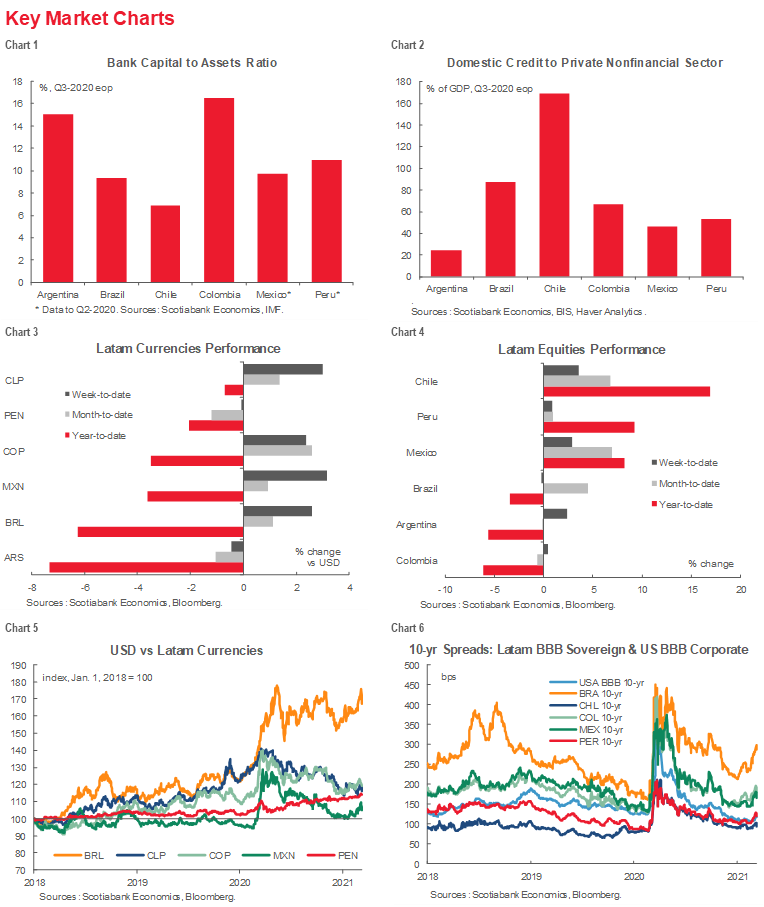

- FX. The PACs’ currencies have performed reasonably well during the taper tantrum redux (chart 1 on p. 1, table 1, and charts 3 and 5 on p. 6).

- COP has been the star of the group, up 1.1% against the USD in March.

- The declines in the CLP (-0.62%) and PEN (-1.22%) versus the USD have been relatively contained considering the concurrent moves in copper prices.

- MXN has rebounded this week: after being down -2.65% versus the USD during the month to March 9, it has recovered to being off only -0.70% in the month. Still, the peso is down -3.4% over the last four weeks (table 1). The peso’s initial softness reflected the MXN’s role as a liquid proxy for the generalized weakening in EM risk sentiment as UST yields rose; it also priced Mexico’s relatively soft growth prospects compared with its regional peers (see our macro forecasts on p. 3). Since then, inflation and activity data, as well as the temporary suspension of the AMLO Administration’s new Electricity Industry Law, have all helped improve views on Mexico’s relative outlook.

- The BRL also benefited from a turn in sentiment this week as markets further priced a rate hike on March 17 by the BCB. After recording one of the weakest performances amongst EM FX in 2020 (chart 5, p. 6), the BRL is now up 1.38% in March.

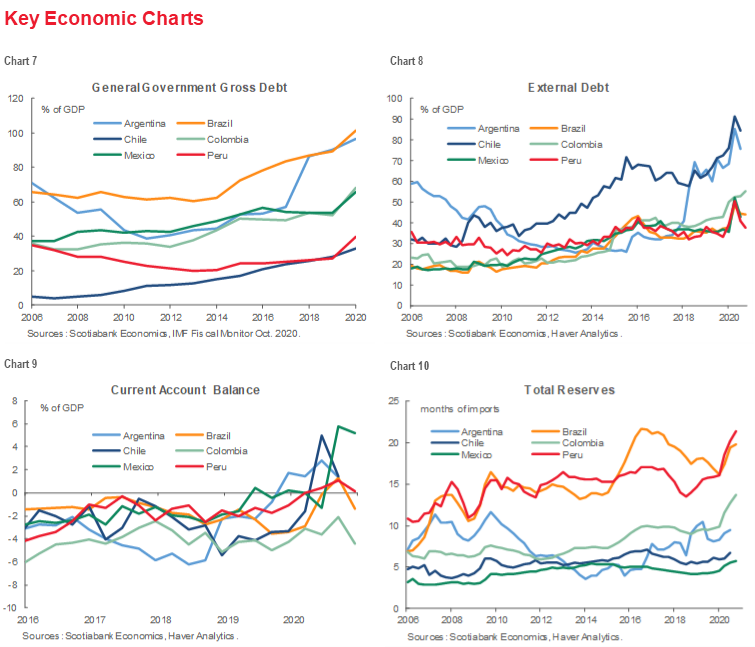

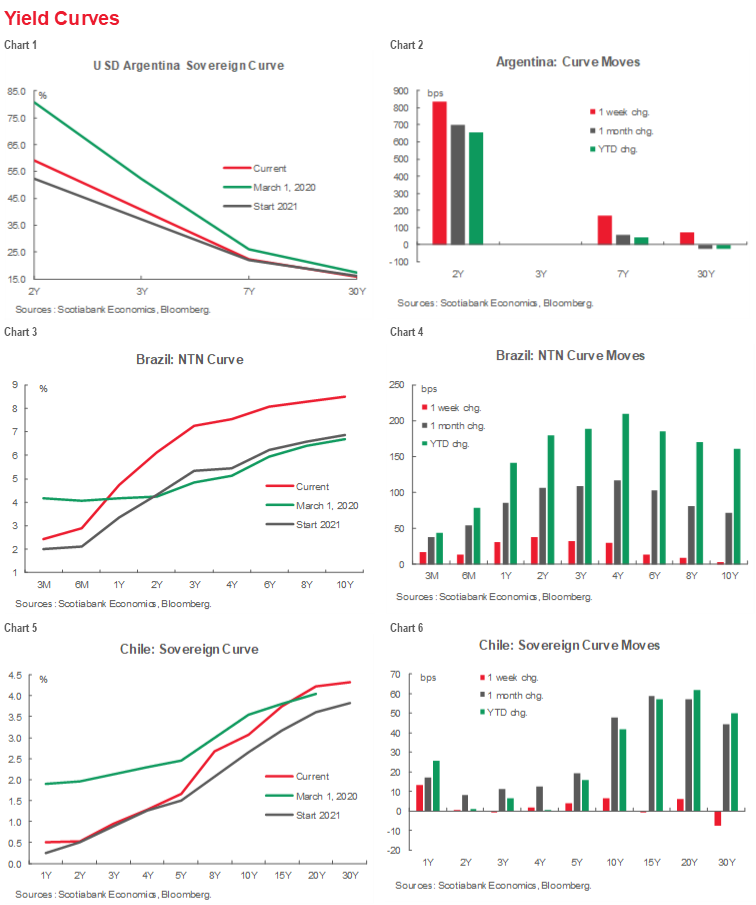

- Bond yields. Yields have backed up and spreads have widened versus USTs, but at the 10-year tenor, for instance, Chile’s and Peru’s sovereign spreads have remained broadly in line with those of US BBB corporates (chart 6, p. 6). Colombian and Mexican government bonds have seen proportionately larger sell-offs, but the PACs’ sovereign debt continues to trade much tighter than Brazil’s paper, where a relative short average maturity heightens roll-over concerns.

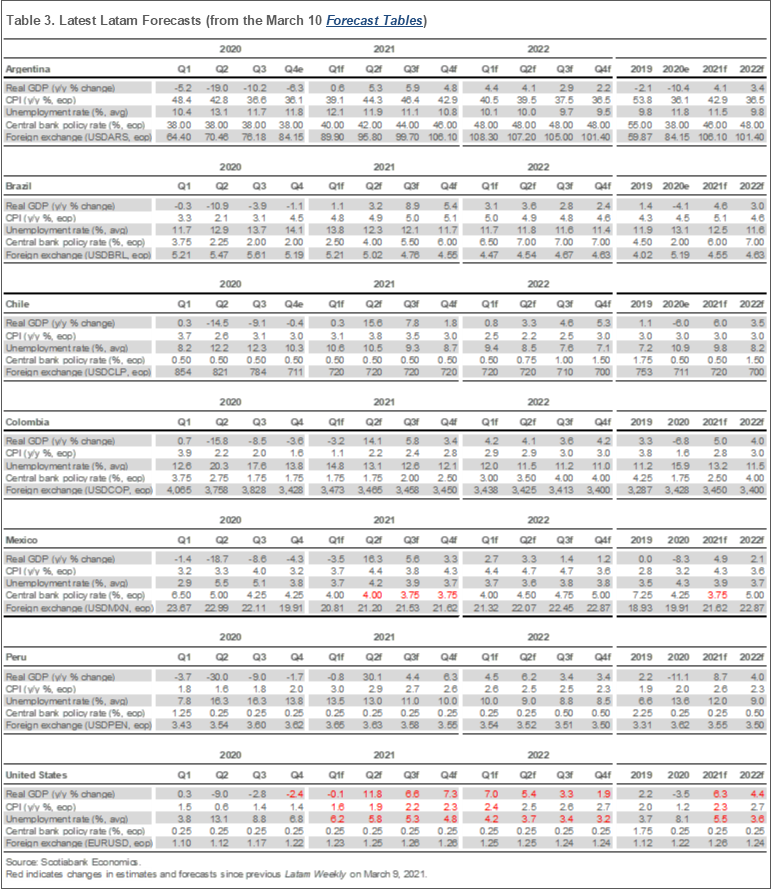

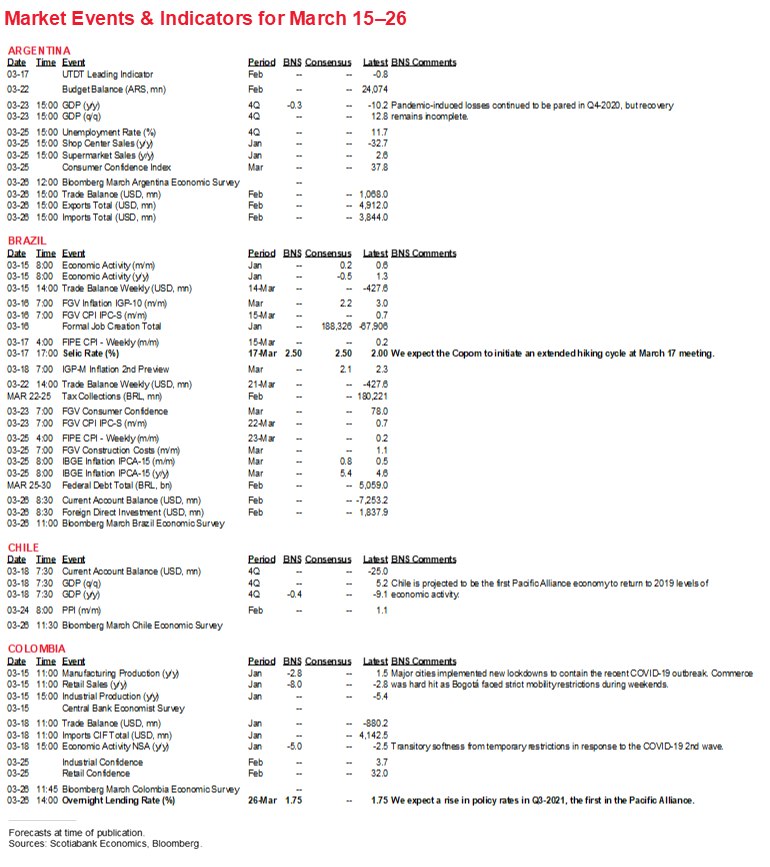

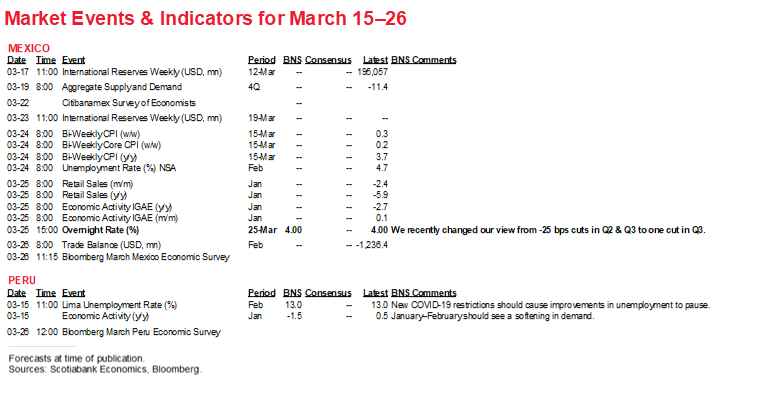

Policy rates. Benchmark central bank rates are not expected to begin normalizing in the PACs until, at the earliest, H2-2021 (forecast table, p. 3).

- Brazil’s BCB is about to kick-off rate increases in Latam with a first move in its hiking cycle at the Copom’s meeting on March 17.

- Colombia’s BanRep is projected to follow with an initial rate increase in Q3-2021.

- Mexico’s Banxico is forecast to cut one more time during Q3-2021, followed by rate increases from Q1-2022.

- Chile’s BCCh and Peru’s BCRP are set to stay on hold at exceptionally low levels until mid-2022.

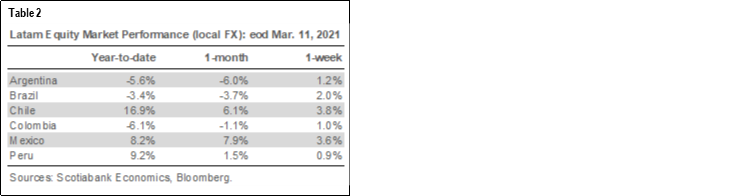

- Equities. Equity markets in the PACs have broadly benefitted during March from weakening currencies that have boosted the competitiveness of domestic industries and provided a fresh buying opportunity for foreign capital (table 2).

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.