Emerging-market central banks are shifting to more hawkish stances in the face of rising developed-market rates and capital-market volatility.

In Latam, central banks in Brazil and Mexico have made the most dramatic turns, with Argentina expected to follow if its authorities get serious about locking down a new IMF arrangement. Domestic conditions in Colombia, Chile, and Peru imply a little more room to run before policy rates may need to rise as domestic economies recover.

SHIFTING MONETARY STANCES

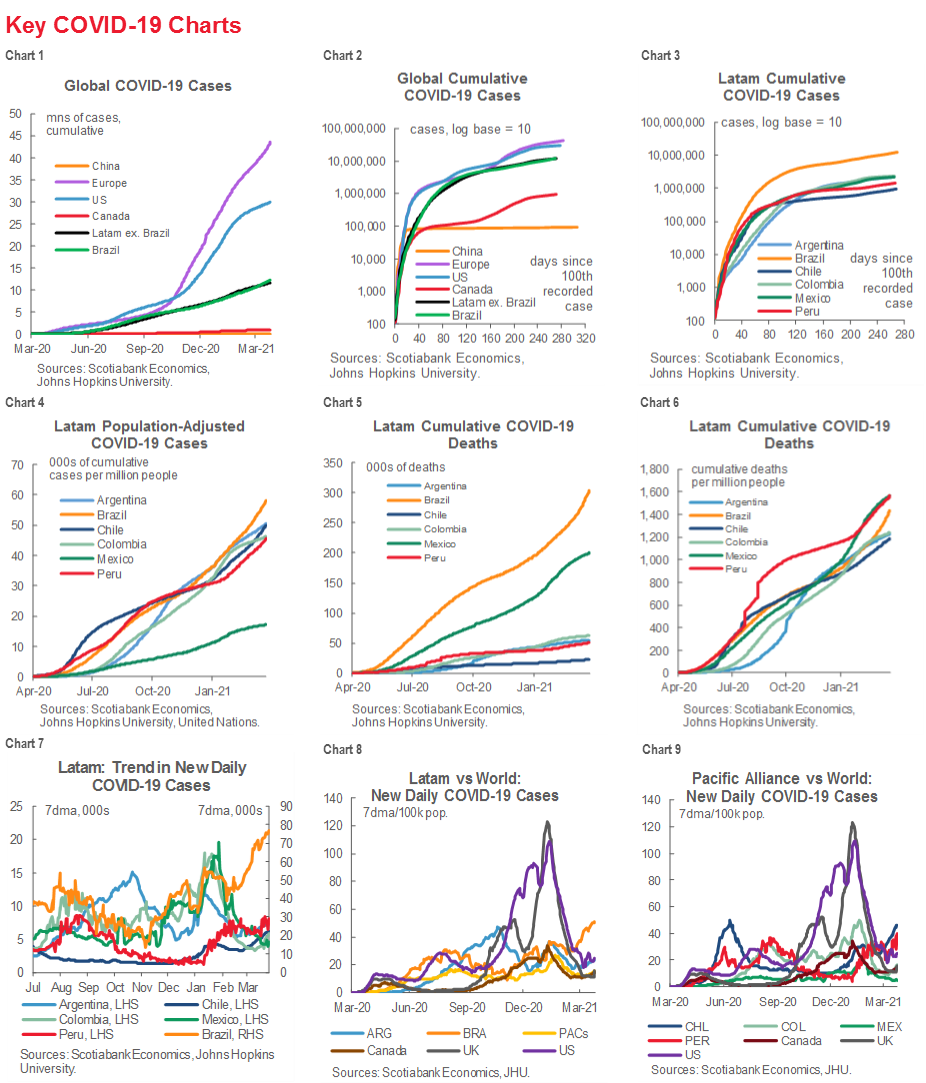

Quickening vaccine rollouts, stronger evidence of further recoveries in many advanced economies, and rising developed-market (DM) yields continue to shift the terrain for emerging-market (EM) central banks haunted by the spectre of the 2013 “taper tantrum”. In recent weeks, both Russia’s and Turkey’s monetary authorities have taken actions to tighten their policy stances, while South Africa’s SARB indicated on Tuesday, March 23, that it may raise rates at the next meeting of its monetary policy committee (MPC). Future moves by the CBRT are, of course, up in the air since its recent surprise rate hike prompted President Erdogan to sack and replace the central bank’s governor.

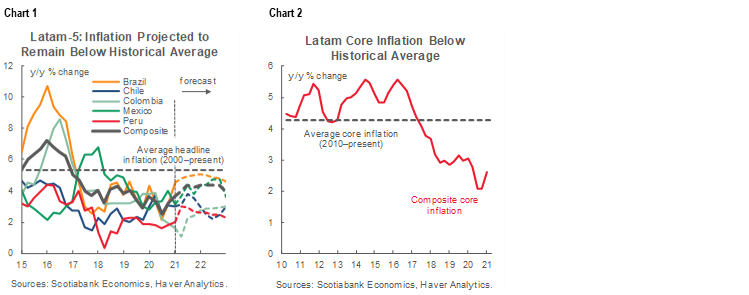

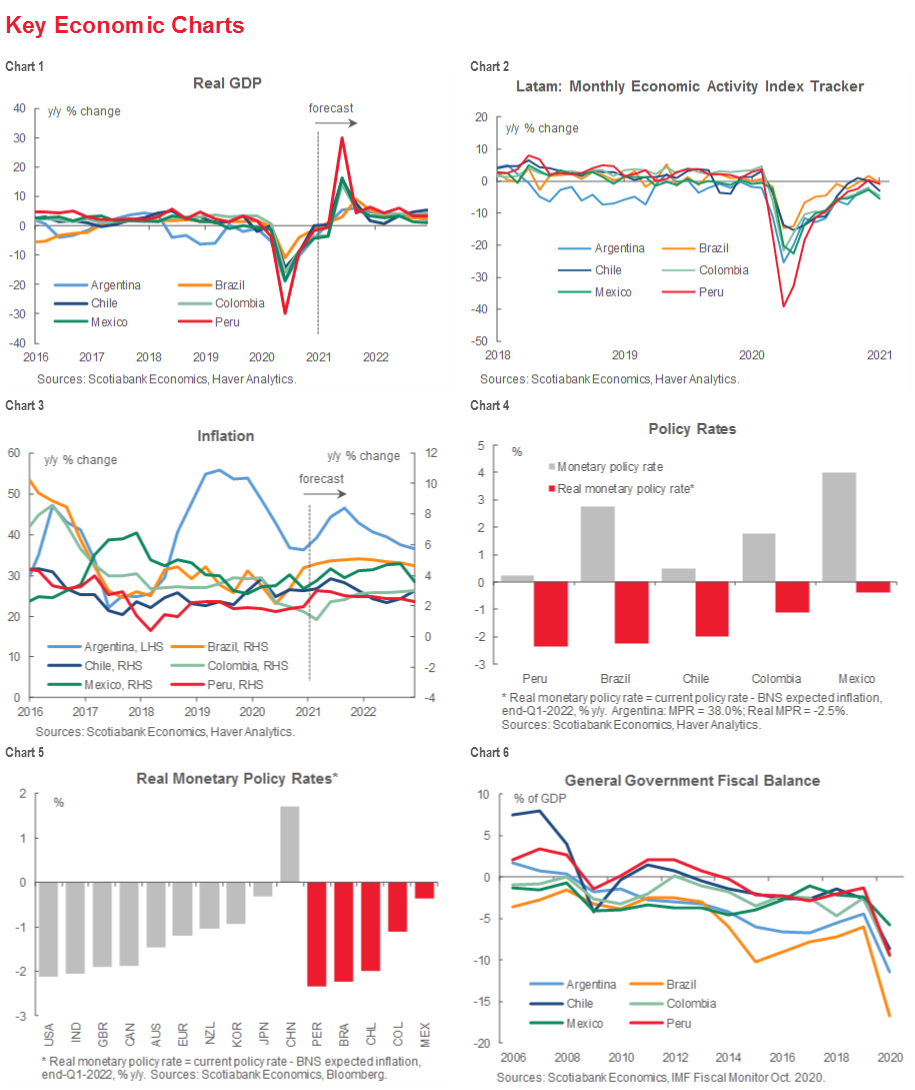

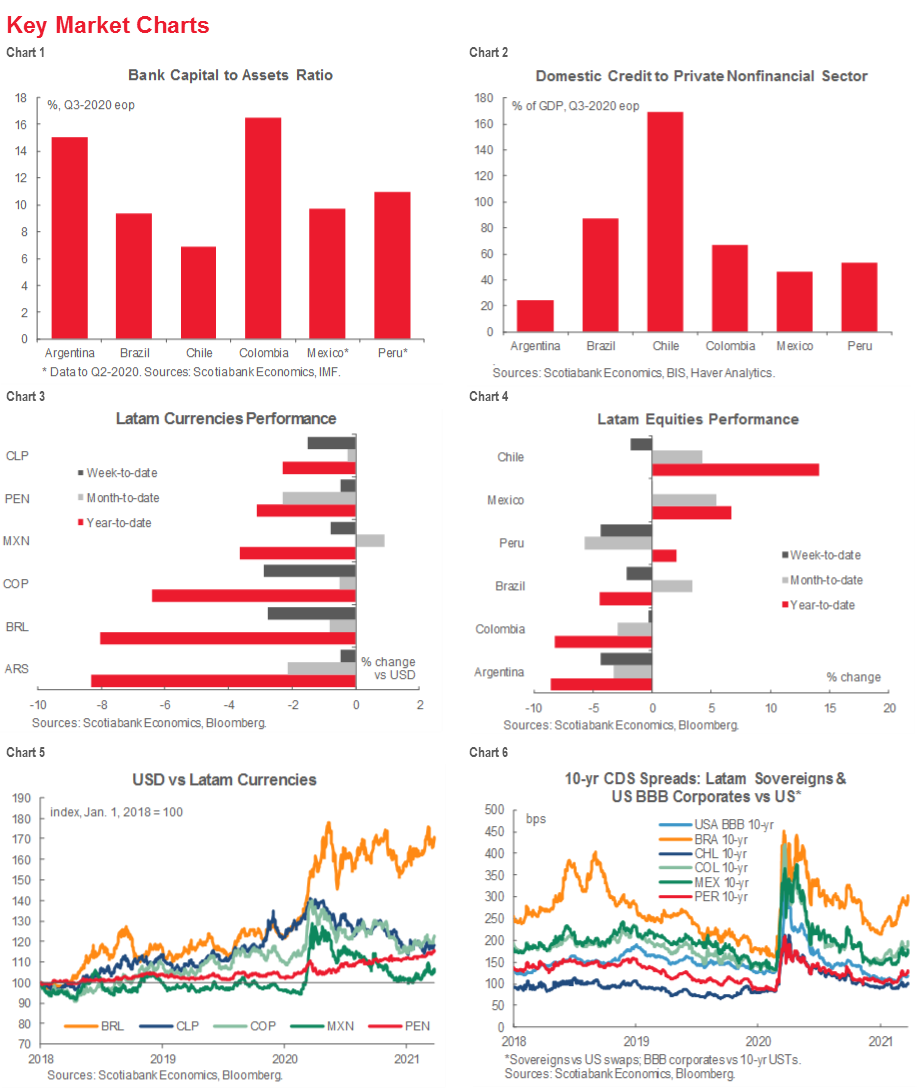

Sentiment has started turning amongst Latam central banks as well, but the region splits into two groups when it comes to current stresses on EM monetary policymakers. In one set of countries—Brazil, Argentina, and to a lesser extent Mexico—already high and/or rising inflation merits a refresh of the monetary stance; and in another set of countries—Colombia, Chile, and Peru—inflation is comparatively low, but rising US rates and volatile international markets imply financial stability concerns amidst relatively low real rates and narrowing carry trades. That said, it’s worth recalling that we continue to forecast inflation to stay muted by historical standards across the four Pacific Alliance countries through 2022 (chart 1) and core price pressures remain well contained (chart 2). Recent FX and equity performances generally reflect the two Latam camps laid out above (tables 1 and 2).

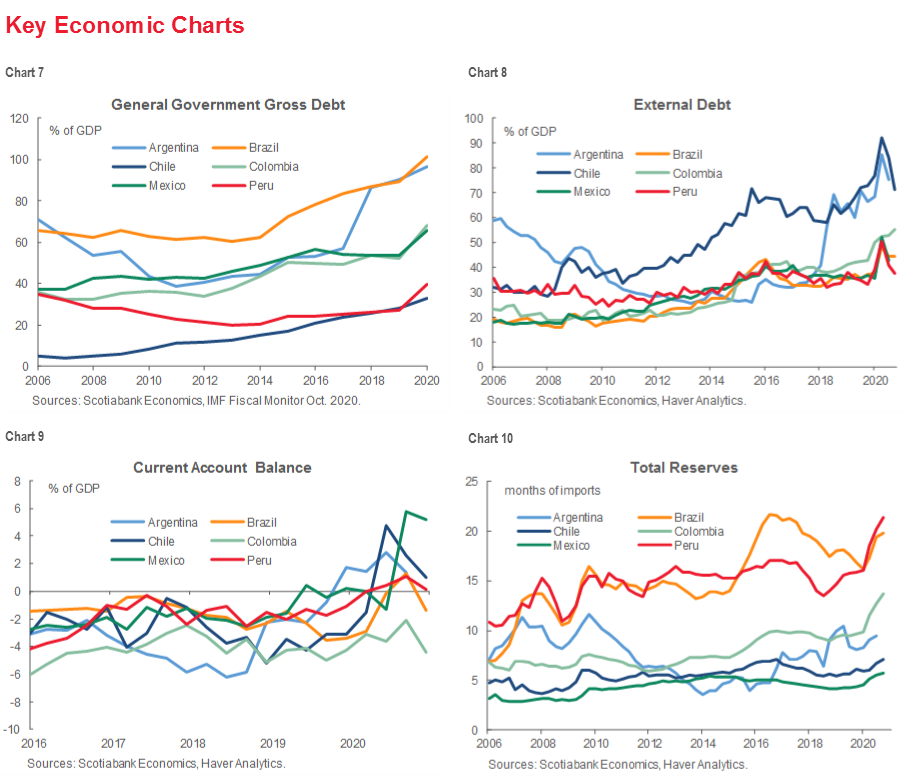

Mexico faces the toughest set of trade-offs of Latam’s major economies. With the highest real rates (key economic chart 5, p. 3) and the slowest real GDP growth forecast for 2021 (see the March 12 Latam Charts report), an end—not just a pause—to Banxico’s easing cycle implies a further drag on the country’s recovery. In contrast, relatively low real rates in Brazil and Argentina (key economic chart 4, p. 3) imply additional space—albeit rapidly shrinking—to normalize monetary policy without immediately implying a brake on activity. In Colombia, Chile, and Peru, comparatively low real rates and low to moderate inflationary pressures imply a more favourable policy mix to sustain their recoveries.

I. Incipient hawks: where inflation pressures conflict with soft growth

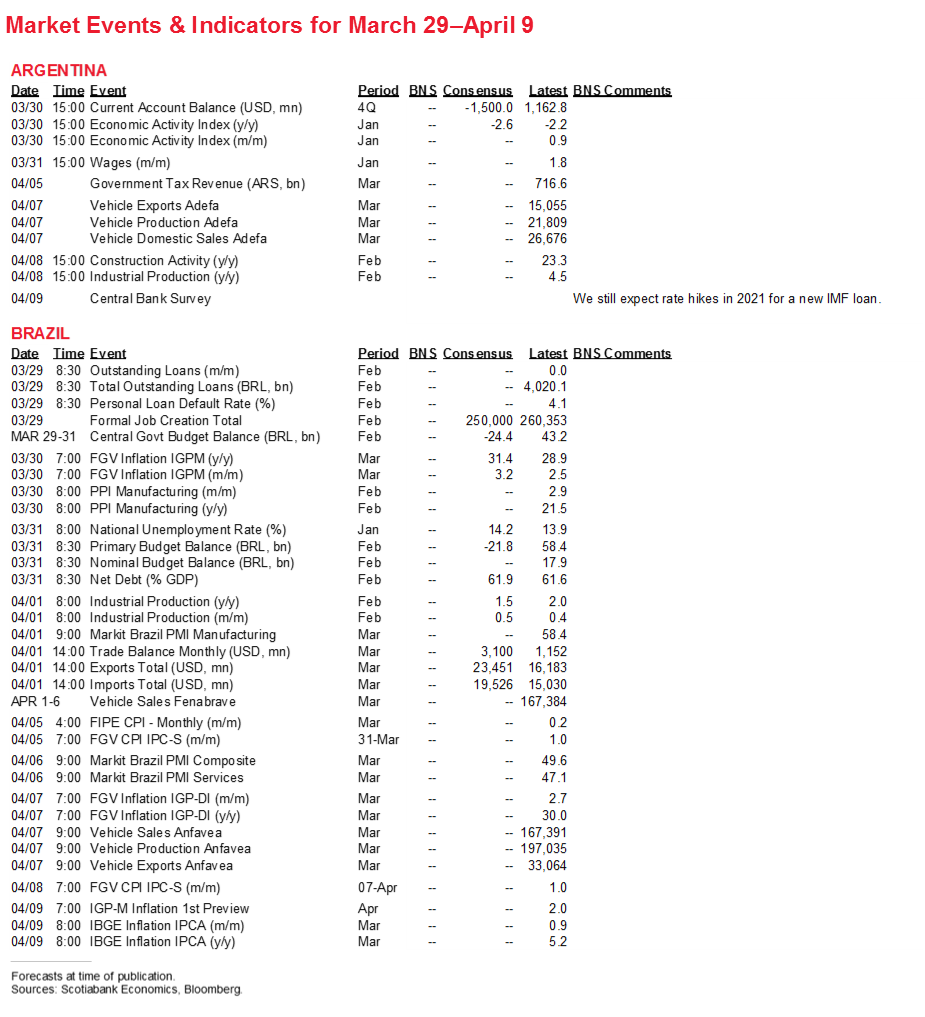

- Brazil. As expected, the BCB’s Copom initiated the region’s first hiking cycle at its meeting on Wednesday, March 17, but it did so with even more gusto than we or most analysts had expected. In line with the consensus, we had expected a 50 bps hike in the Selic, but the Copom unanimously voted to deliver a 75 bps rise, its first hike in six years and its biggest upward move in over a decade, now under its newly-minted independence. The Copom also noted in its statement that it intended to raise rates again by the same delta at its next meeting unless inflation projections or risk assessments shift.

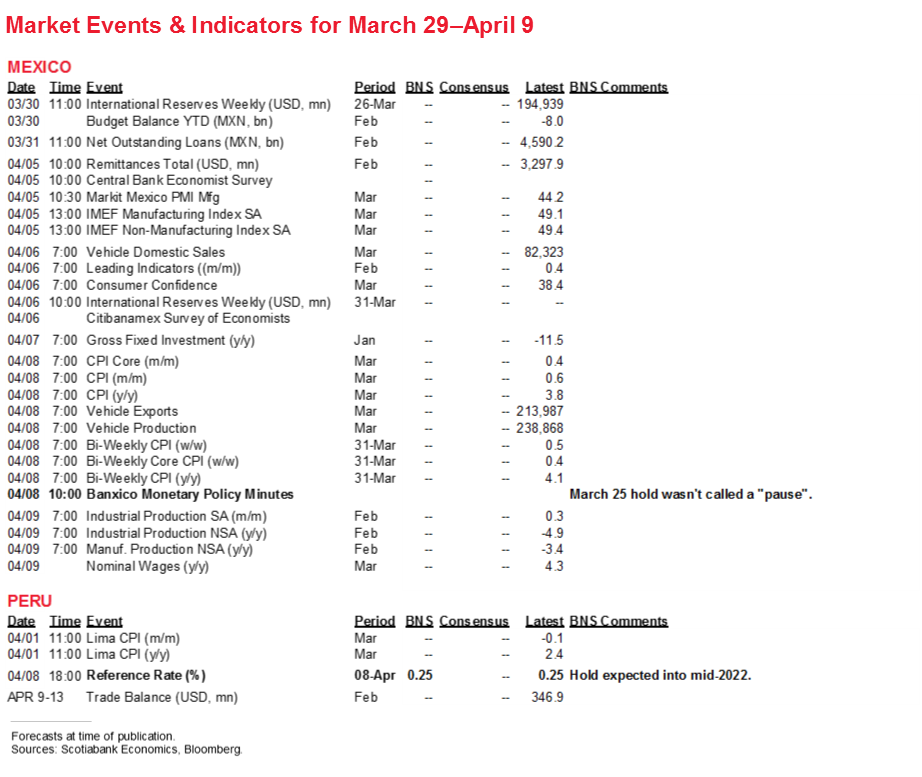

- Mexico. Banxico’s Board also took a step back from further easing at its Thursday, March 25, meeting where it voted unanimously to keep its overnight target rate at 4.00%. The hold had a hawkish tilt as it was a turnaround from the unanimous decision to cut by -25 bps from 4.25% to 4.00% at the Board’s February 11 meeting. Only two months before, the Board “paused” its easing cycle in a split 3–2 decision to hold at 4.25% at its December 17 meeting. Yesterday’s hold lacked a clear characterization that it was a temporary stay. Combined with the Board’s concern that both headline and core inflation moved above Banxico’s 2–4% y/y target range in the first half of March, the outcome of the meeting narrowed further the space for further monetary-policy easing in Mexico. Still, we believe the door isn’t entirely closed and that one more cut could be delivered during Q3-2021 given that we forecast Mexican real GDP growth at a relatively lacklustre 4.9% y/y in 2021 and the real policy rate remains amongst the highest in in Latam. But Banxico’s next steps likely depend more on international developments and financial stability concerns than on ongoing softness in domestic activity. Even if a further cut fails to materialize, our team in CDMX doesn’t expect a first hike until Q1-2022.

- Argentina. We’ve long expected the BCRA to initiate a fresh hiking cycle in a move away from monetizing deficits to tame inflation that is currently running at 40.7% y/y. Real policy rates are currently hovering around -2.5% and will need to be pushed back into positive territory over the course of 2021. We expected the BCRA to begin increasing its key policy rates during Q1-2021 to signal to the IMF that the country is serious about undertaking meaningful adjustment. But with few advances in talks with DC since last August’s sovereign debt restructuring, Vice-President Fernandez de Kirchner warning that Argentina won’t be able to repay the IMF, and President Fernandez pushing a gradual approach to negotiations, IMF deliberations are likely to blow through the already loose May target and stretch deeper into 2021. Consequently, moves by the BCRA to raise rates could be delayed even further.

II. Birds of a different feather: monetary molting can take more time

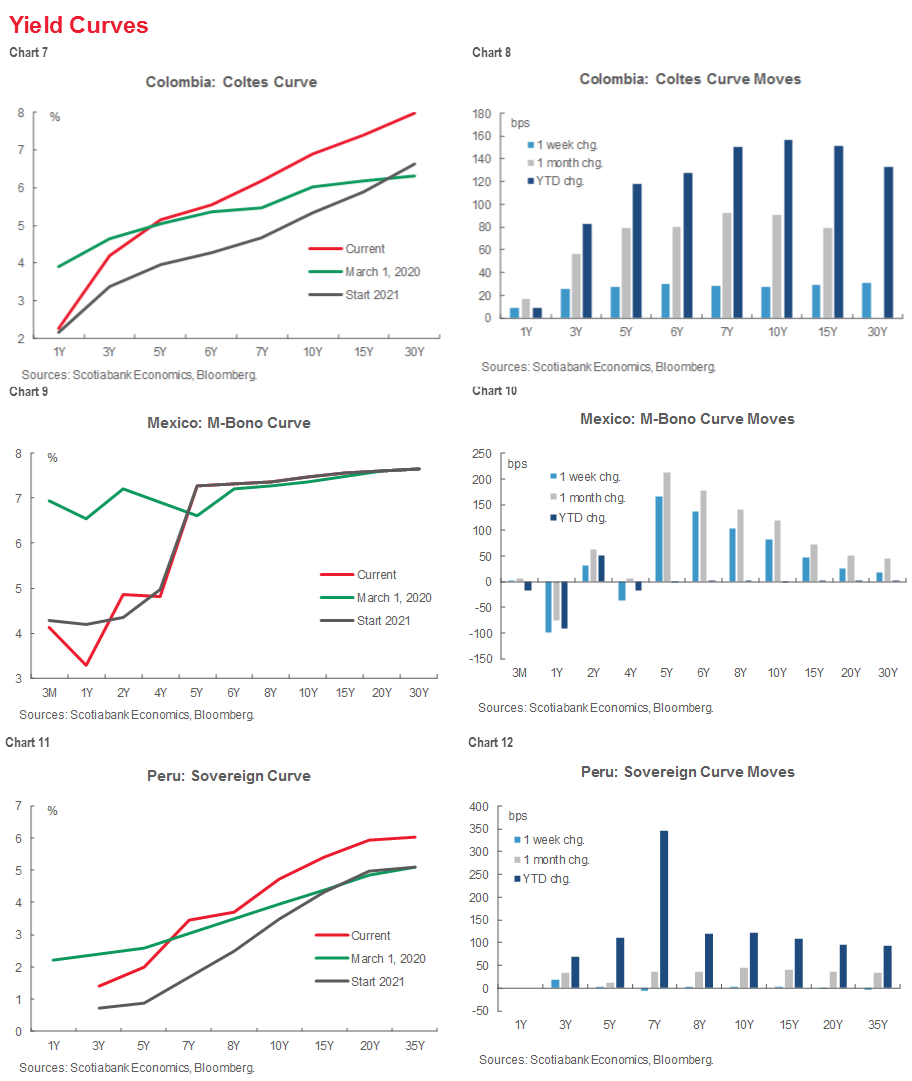

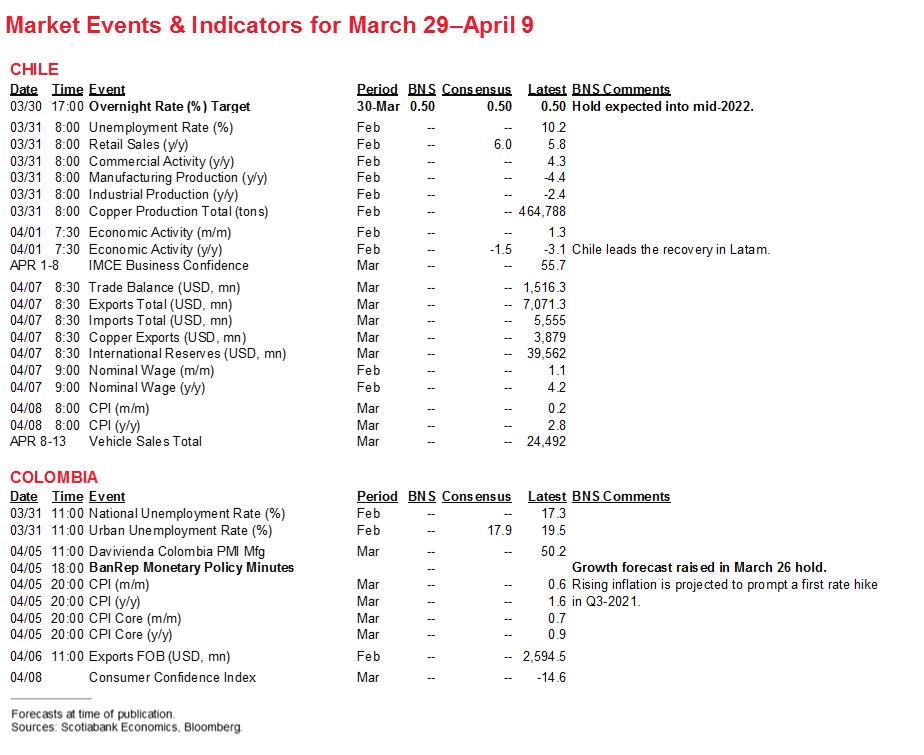

- Colombia. The BanRep Board followed its counterparts in Brazil and Mexico with a unanimous decision earlier today (March 26) to hold its benchmark policy rate at 1.75% after a split 5–2 decision at its January meeting that saw two members vote for a cut. Annual inflation remains well below the 3% target and inflation expectations are contained, but the BanRep staff raised its 2021 real GDP growth forecast from January’s 4.5% y/y to 5.2% y/y, which put a hawkish gloss on the decision. Our team in Bogota still expects a first hike in Q3-2021 from the BanRep, but this remains contingent on both international financial conditions and follow-through in April on the next steps in the government’s fiscal-reform program.

- Chile. The Board of Chile’s BCCh next rate decision falls on Tuesday, March 30, and a hold at 0.50% is nearly universally expected. The Board’s deliberations will have to balance rising DM yields against the possible hit to growth from new lockdowns in Santiago, waning demand effects from two rounds of pension withdrawals, and uncertainties around the constitutional renewal process. We continue to anticipate that the Board will look through recent international developments and put off a move to raise rates until Q2-2022.

- Peru. The BCRP Board next meets on rates on Thursday, April 8, and with inflation having subsided from a surprise at the beginning of the year, there is little pressure from the domestic economy to move the policy rate off its record-low 0.25% or to change the Board’s forward guidance. Our team in Lima continues to expect the BCRP to stay on hold through Q3-2022.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.