- Banxico hiked another 75 bps, following the Fed, but is keeping its options open for smaller increases going forward.

Banxico’s Board of Governors unanimously agreed to raise the monetary policy interest rate by 75 bps, for a second time, to 8.50%. Following the last decision and the hawkish tone of the minutes, the market did not doubt that another 75 bps increase would follow, with all 24 economists surveyed by Bloomberg anticipating the move. However, with a somewhat less aggressive tone than in the previous decision, Banxico indicated that it will evaluate “the prevailing circumstances” in its subsequent decisions, leaving the door open for smaller increases going forward.

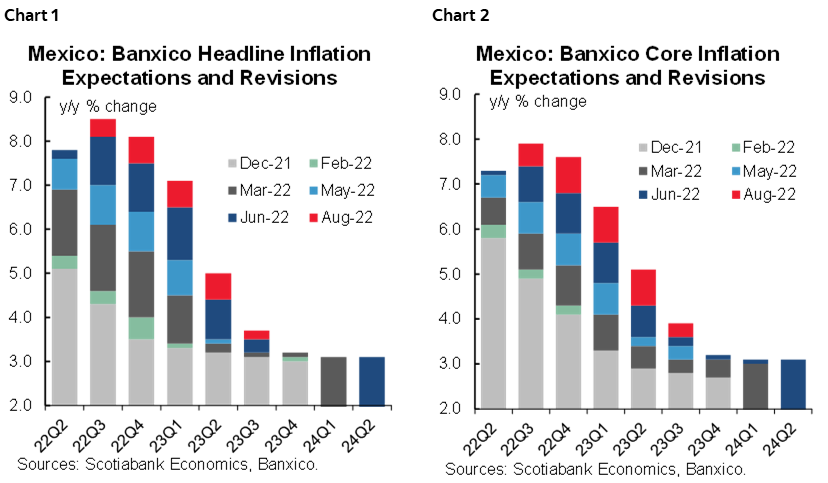

The central bank revised upwards its inflation forecasts for the fifth consecutive time. In its new scenario, inflation peaks at 8.5% (8.1% previously) in the third quarter of 2022, with the largest revisions concentrated between Q4-2022 and Q2-2023, and of up to 80 bps (interestingly, to core inflation), before gradually converging to 3.1% in the first quarter of 2024, as indicated in the March decision, and which has since been unchanged.

Conditions warranted another 75 bps hike: inflation continues to accelerate (although July’s m/m inflation moderated slightly, in annual terms it remains at more than 20-year highs) along with the continued deterioration in expectations (charts 1 and 2), which have consistently increased with each survey; accelerated tightening in global financial conditions, particularly the Federal Reserve’s second 75 bps hike and its commitment to bring inflation to target; and reduced slack in certain sectors of the economy.

Although the balance of risks continues to be skewed to the upside for inflation, the recent deceleration in energy prices could be an indication that we are close to the peak and inflation will begin to fall in the last quarter of this year, as Banxico anticipates. We expect a 50 basis point increase in September (especially after the word “forceful” no longer appears in the statement) and that the central bank will take the rate to 10.00% by the end of 2022. While supply-side price pressures may begin to recede, Banxico and other central banks, cannot let their guard down yet, and will have to continue to demonstrate that they will do whatever it takes to return inflation to target.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.