- The Petro Administration proposes 1.72% of GDP (COP 25 tn) tax reform

THE PETRO ADMINISTRATION PROPOSES 1.72% OF GDP (COP 25 TN) TAX REFORM

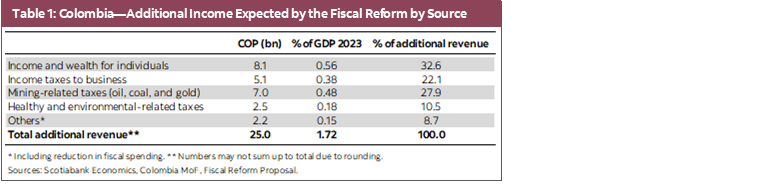

On Monday, August 8, one day after President Gustavo Petro took office, the new Finance Minister, José Antonio Ocampo presented the long-awaited tax reform proposal to Congress. The reform, which is packaged as “Tax reform for equality, and social justice”, aims to increase tax collection by COP 25 tn in 2023 (1.72% of GDP in 2023, table 1). The main revenue sources are individual and business taxes; from a sectoral perspective, the mining-related sector (oil, coal, and gold) would be hit by a new marginal tax.

Our first take on the reform is positive. Despite the size of the proposal being more ambitious compared with past reforms, on average, the potential additional revenues are feasible. In sectoral terms, the mining sector will feel the highest pressure, an incidence that is aligned with the environmental policy advanced by Petro in his campaign.

The effects of the tax reform on debt issuance policy and the Fiscal Rule plan will be revealed when the government presents its new Budget. So far, Ocampo affirms that the government will comply with the fiscal rule. Given that, for now, we don’t expect actions from credit rating agencies.

Key takeaways:

- Carrot-and-stick approach: The tax reform is intended to improving social welfare. After the pandemic, poverty increased, and the government is aiming to main some key social programs. That said, the size of the social program wasn’t revealed. And while Minister Ocampo said that the National Budget will be modified to accommodate these programs, he also emphasized that the government will comply with the Fiscal Rule, with details to be provided in the Budget proposals.

- Additional tax sources: In 2023 about 33% of total additional tax revenues would come from individuals, with approximately 22% from business. Roughly 28% would come from green taxes on oil and coal, and about 11% of new tax revenues would be related to health and environmental taxes. The balance (8.7%) includes other measures, such as the elimination of the VAT holiday and reduction in fiscal spending.

- Individual taxes (33% of additional revenue): The reform proposes to simplify the tax code and consolidate all income sources into the same scheme (extraordinary income, pensions, salaries, etc.). The second main change is to reduce tax exemptions, limiting deductible income only up to 3%. That said, the MoF calculates an impact on the 2.4% of the population with higher incomes (34 thousand individuals). Similarly, wealth taxes will start for wealth above COP 3 bn (approximately USD 700k).

- Business taxes (22% of additional revenue): The proposal would reduce some tax exemptions and make permanent the surcharge on the financial sector (3%). Additionally, the treatment of business in free trade zones will be conditioned to export activity.

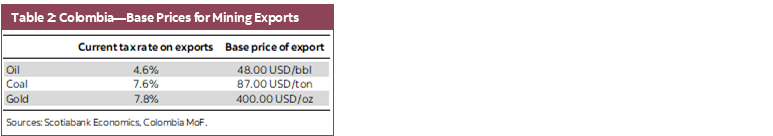

- Mining-related sector taxes (27.9% of additional revenue): The mining sector will face a higher effective tax rate after the reform. In 2022 income tax rate for the mining sector is around 27%. In the proposal, the government intends to implement a 10% tax on exports made above-defined base price (table 2).

Rule for mining exports tax:

Tax = Exported value (spot price-base price / spot price) * 10%

Additionally, royalties would no longer be deductible from income taxes.

- Health and environmental-related taxes (10.5% of additional sources): The government will implement taxes on sugary drinks and junk food. In the same vein, they will implement taxes for one-use plastic times and carbon taxes.

- Other measures (8.7% of additional revenue): The government plans to change some taxes in free trade zones, and some special tariffs on imports that don’t comply with FTA rules.

What is next?

The government has said that the tax reform will follow the traditional process (wasn’t sent with urgency). That said, the fiscal reform will be discussed in parallel with the National Budget, which in regular terms has to be approved by October 20. Our initial take is that the tax reform has a good chance to be approved by Congress.

Looking ahead, it will be important to monitor how the National Budget changes and what implies the tax proposals imply for the fiscal rule trajectory and debt issuance plans.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.