As widely expected, Banxico raised the interest rate by 50bps to 10.50%, following four consecutive 75bps increases. The decision came in a 4-1 vote, with Deputy Governor Esquivel voting in favour of a 25bps hike. Deputy Governor Esquivel has been the most dovish member of the Board, and this could be his last policy meeting. Among the list of candidates to succeed him are top officials from SHCP, Banxico, and the banking supervisor CNBV; although it is still possible that Deputy Governor Esquivel may be re-nominated.

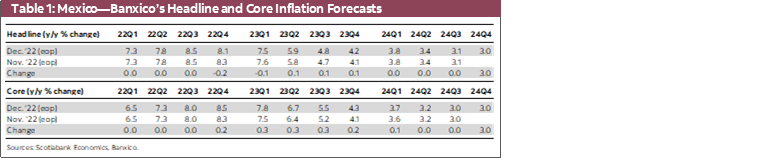

The forward guidance changed with respect to the previous decision. The statement now notes that “The Board considers it will still be necessary to raise the reference rate in its next monetary policy meeting. Subsequently, it will assess if the reference rate needs to be further adjusted as well as the pace of adjustments based on the prevailing conditions”. In addition, Banxico maintained its outlook of converging to the inflation target in 2024Q3 , although it revised slightly downward its headline inflation forecasts in the short term. It also made upward adjustments to its core inflation expectations. The Board considered that the balance of risks in the inflation trajectory remains biased to the upside.

Banxico’s hike followed again the Fed’s move of a 50bps increase. However, the members of the Board have signaled a future decoupling of the Fed’s pace of hikes at upcoming meetings. In this regard, while the forward guidance does signal at least one additional hike, it gives no sign of maintaining the 50bps pace, which could mean a more dovish tone in future decisions. In contrast, the Fed showed a more restrictive stance at this week’s meeting, noting that most members of the Federal Open Market Committee (FOCM) now expect a rate of at least 5.25% by the end of 2023, and Powell mentioned that they do not anticipate cuts over the next year.

In November, both the headline and core inflation numbers came in below analysts’ estimates. However, the trajectory of inflation is still expected to converge to its target in the second half of 2024. The statement highlighted the decrease in headline inflation in November, which stood at 7.80%, reflecting the reduction of the non-core component. However, it highlighted the upward trend of core inflation, now at 8.51%, also marking the persistence of this component as the main upward risk. Other upside risks mentioned in the statement were external inflationary pressures from the pandemic, geopolitical ongoing conflict pressures, exchange rate depreciation, and greater cost-related pressures (these could include wage costs, although this was not specified). Downside risks were a greater slowdown in the global economy, a decline in the intensity of the geopolitical conflict, a better functioning of supply chains, lower pass-through effect of cost-related pressures, and a greater than expected effect of the government’s anti-inflationary plan.

All thing considered, our outlook is for a terminal rate of 11.00%, derived from two additional 25bps increases during the first quarter of 2023, and starting the downward cycle in the last quarter, to end the year at 10.50%.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.