- The commercial sector explained almost entirely the resilience in labour markets, looking like more a puzzle than genuine strength for now

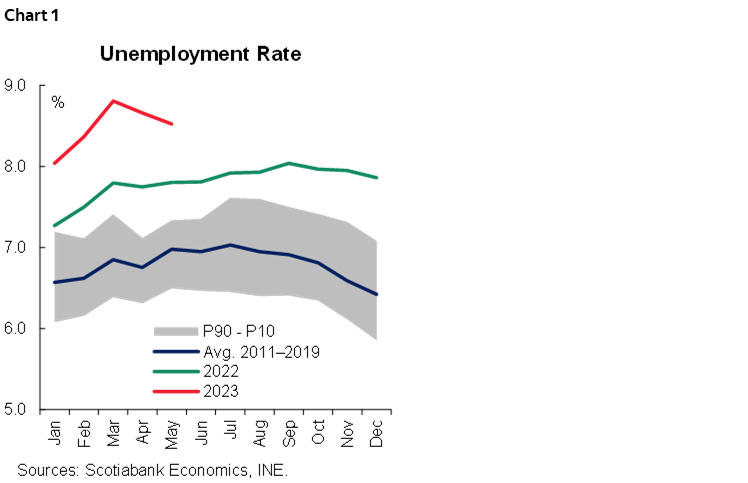

Today, the statistical agency (INE) released unemployment rate data for the quarter ending in May, showing a decline to 8.5% (chart 1), positively surprising both the market’s and our expectations. The fall in the unemployment rate was explained by a smaller increase in the labour force (+0.2%) compared to job creation (+0.3%). However, rather than leading to a reading of stabilization of the labour market, it raises questions given that job creation originated in a specific sector of the economy that is not in good shape, cyclically speaking.

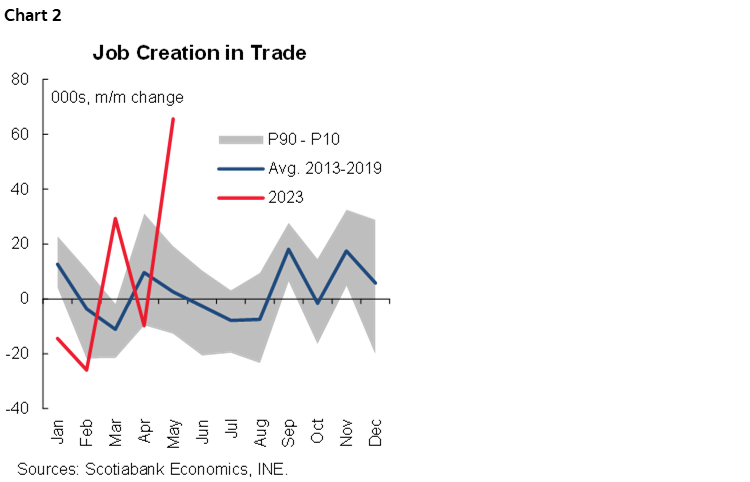

In this sense, the labour market created 28k new jobs, where the most striking—and which manages to avoid an increase in the unemployment rate—was the creation of 37k private salaried jobs, mainly in the trade or commercial sector. This is difficult to explain at the moment, given the successive decline in sales and economic activity in this sector. Recall that commercial activity has experienced year-on-year contractions since May 2022, and almost consecutive seasonally adjusted contractions since January 2023.

We propose some hypotheses in this regard that should be verified: (1) a positive transitory effect on employment as a result of CyberDay; (2) a gradual implementation of the 40-hour law in some shopping centers with national coverage that could result in salaried hiring to maintain the quality of service; (3) a notable increase in the use by employers of the Emergency Family Income (IFE) subsidy for new hires, ahead of the program expiry at the end of the current month.

Beyond the surprising rise in trade sector employment, the labour market remains weak, with zero job creation in most industries and even losses in some services. Excluding trade employment jobs, the economy would have shed some 38k jobs in the month. Trade then appears as the main, if not the only, job-creating sector in the month. Trade created 66k jobs (chart 2), 50k of them salaried. This surprising increase is also much larger than the usual job creation in the sector for a month of May (2.5k jobs). Other sectors that contributed, but to a much lesser extent in the month, were transportation, which created some employment beyond seasonal norms. All other sectors performed similarly or worse than seasonally for the month, revealing a generalized weakness in the labour market that has been ongoing for several months in the private sector.

The public sector, after significant job creation in the first quarter—which we’ve highlighted in the past—has begun to normalize. In fact, salaried employment in the sector has been falling for three consecutive months, highlighting the destruction of 24k jobs in May. With April figures, progress in the execution of public investment spending continues at a slow pace, especially in employment-intensive ministries such as public works and housing.

As we anticipated, the labour force recovered the lost momentum. In April, the labour force contracted by 15k people, which we interpret as a seasonal and transitory effect and which generated a drop in the unemployment rate (see our Latam Daily). Although the unemployment rate fell again in May, this time it was explained by an increase in employment that leaves more doubts than certainties. What does seem more certain and is ratified with this new INE publication is that the labour force recovered its dynamism (+15k), so it will be necessary to see a consolidation of the job creation that we observed in May—especially in commerce—in order to not experience increases in the unemployment rate in the coming months. At Scotiabank, we project a deterioration of the labour market in the coming months, which will lead to increases in the unemployment rate.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.