- Banxico hiked its key policy rate by 50 basis points for the third consecutive time, to 6.50%.

- In explaining the move, the central bank cited ongoing price pressures and geopolitical factors driving up global commodity prices that threaten to unleash inflation expectations. Banxico has significantly raised its forecast of inflation.

- Scotiabank now expects at least one more 50 bps hike in the current tightening cycle and a policy rate of 8.25% by end-2022.

BANXICO HIKES POLICY RATE 50 BPS TO 6.50%, AS BROADLY EXPECTED

In a unanimous decision and in line with the analysts surveyed by Bloomberg and Citibanamex, Banxico raised its monetary policy rate by 50 basis points for the third consecutive time. The decision was announced unexpectedly at the president's morning conference prior to Banxico's official statement, sparking criticism among financial sector specialists. Notably, the vote in favor of a 50 bps hike was supported by Deputy Governor Esquivel, who had opted for a less restrictive stance since June 2021.

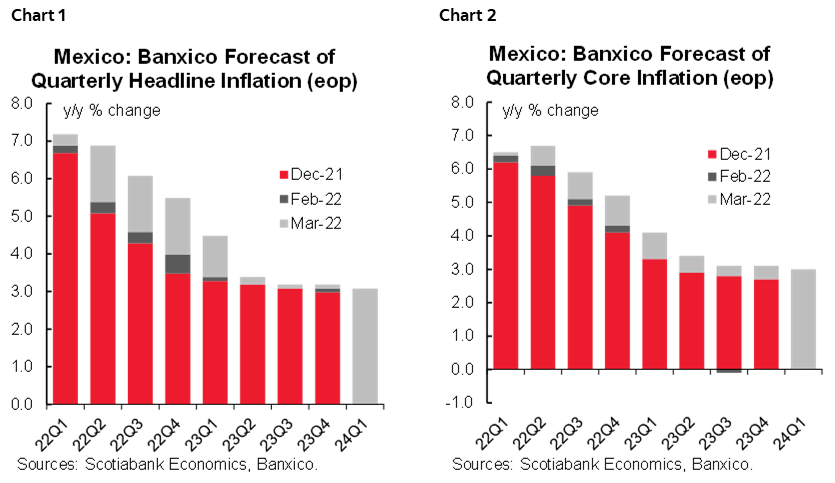

The statement announcing the decision highlights the deterioration in the balance of risks for inflation resulting from higher external price pressures because of the pandemic and Russia's invasion of Ukraine, as well as the depreciation of the exchange rate and the persistence of core inflation. In this regard, Banxico significantly revised upward its inflation forecasts for 2022 and 2023 (chart 1, chart 2), and now expects inflation to return to target in the first quarter of 2024.

Given the current price dynamics, deteriorating expectations, uncertainty in the economic environment and tightening global financial conditions, we anticipate at least one more 50 bps increase in the current hiking cycle. Moreover, we now expect the central bank policy rate to be 8.25% by end-2022.

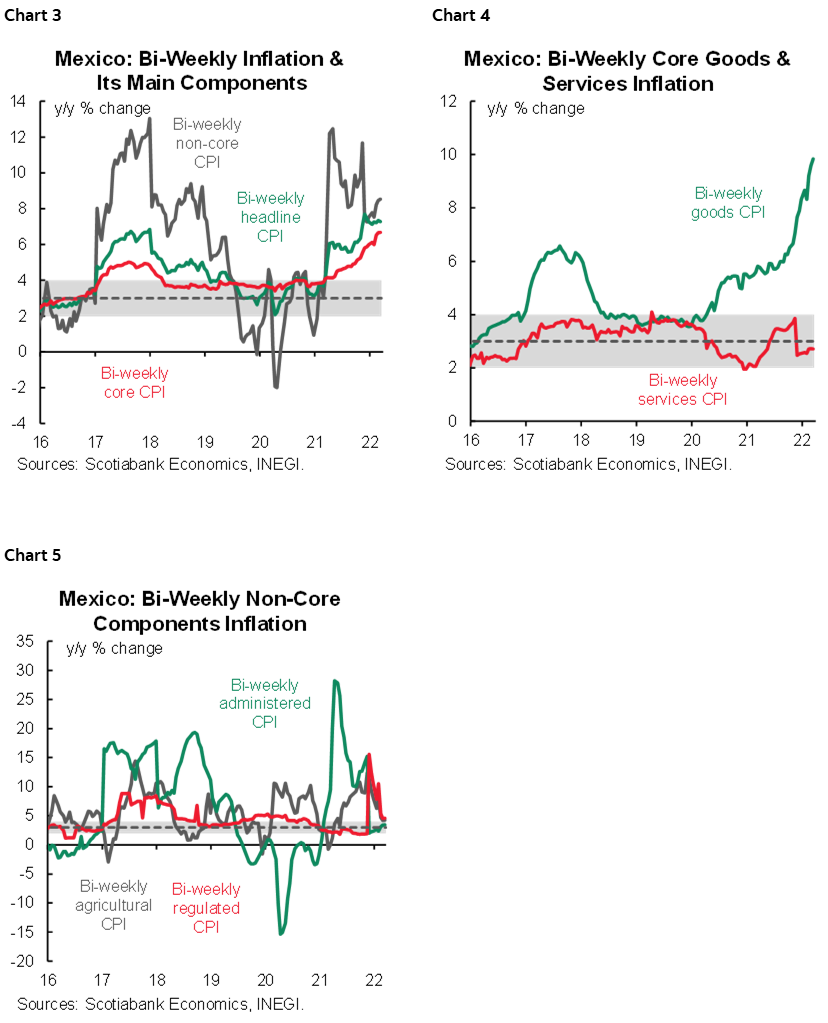

While inflation in the first half of March was below consensus, the outlook has worsened in recent weeks. According to INEGI, in the first fortnight of March, inflation came in at 7.29% y/y (chart 3), below consensus and the previous reading of 7.34% y/y. By components, core inflation moved marginally from 6.67% y/y to 6.68% y/y (chart 4), below the 6.73% y/y consensus. The increase was driven by merchandise prices, which remain on an upward trajectory, rising from 8.45% y/y to 8.54% y/y, the highest rate of increase since the second half of June 2000. Services inflation moderated from 4.66% y/y to 4.57% y/y. Non-core inflation likewise moderated, from 9.34% y/y to 9.10% y/y, with energy prices rising slightly from 4.57% y/y to 4.60% y/y, offset by lower food prices inflation (chart 5) that declined from 16.54% y/y to 15.93% y/y.

On a sequential two-week basis, headline inflation came in at 0.48% 2w/2w, marginally higher than the previous biweekly period level of 0.42% 2w/2w but below consensus (0.53% 2w/2w). Core inflation also surprised downward at 0.35% 2w/2w (0.32% 2w/2w previously, 0.41% 2w/2w consensus). Merchandise prices rose from 0.41% 2w/2w to 0.49% 2w/2w, and services stood at 0.20% 2w/2w (0.21% 2w/2w previously). Non-core inflation increased to 0.86% 2w/2w (0.71% 2w/2w previously). It is worth highlighting the increase in the energy component, which rose 1.82% 2w/2w from 0.52% previously.

In recent weeks, inflation expectations have further increased owing to the war in Ukraine and a deterioration in the economic and financial global environment. In this regard, earlier this week we updated our inflation forecast from 4.75% to 5.50% for 2022, in line with Banxico’s revisions to its forecasts, and revised upward our call on the policy rate at end-2022 to 8.25%.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.