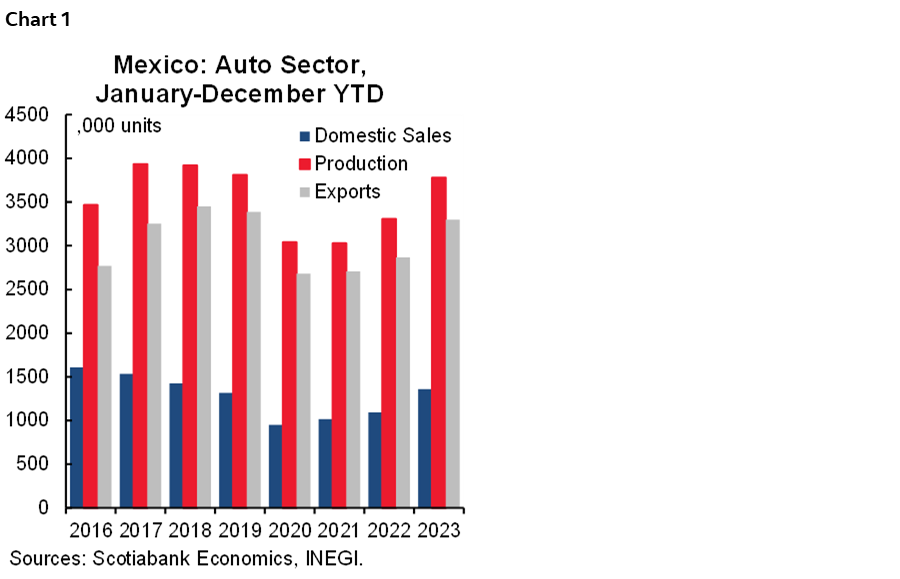

The Mexican light vehicles sector ended 2023 close to an all-time production high, despite an economic slowdown expected in the US and, to a lesser extent, in Mexico. December results showed a still-dynamic pace in the sector, as demand for light vehicles remains solid, supported by a favourable trend in household income, owing to a strong labour market and increases in real wages. Additionally, production and exports have benefited from a further stabilization of supply chains, outperforming other manufacturing sectors that have felt a greater impact of restrictive interest rates and changes in consumption patterns. Going forward, we believe that the outlook for the sector still includes certain risks and uncertainty, in line with the overall outlook for the economy, but is biased to the upside on the possibility of nearshoring, relocating a bigger share to value chains in Mexico (chart 1 and table 1).

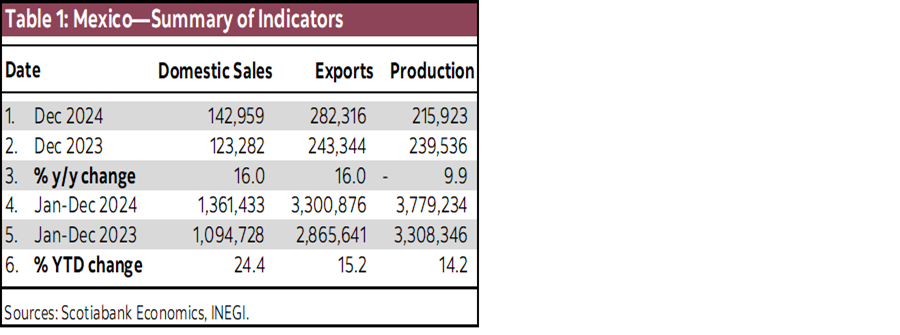

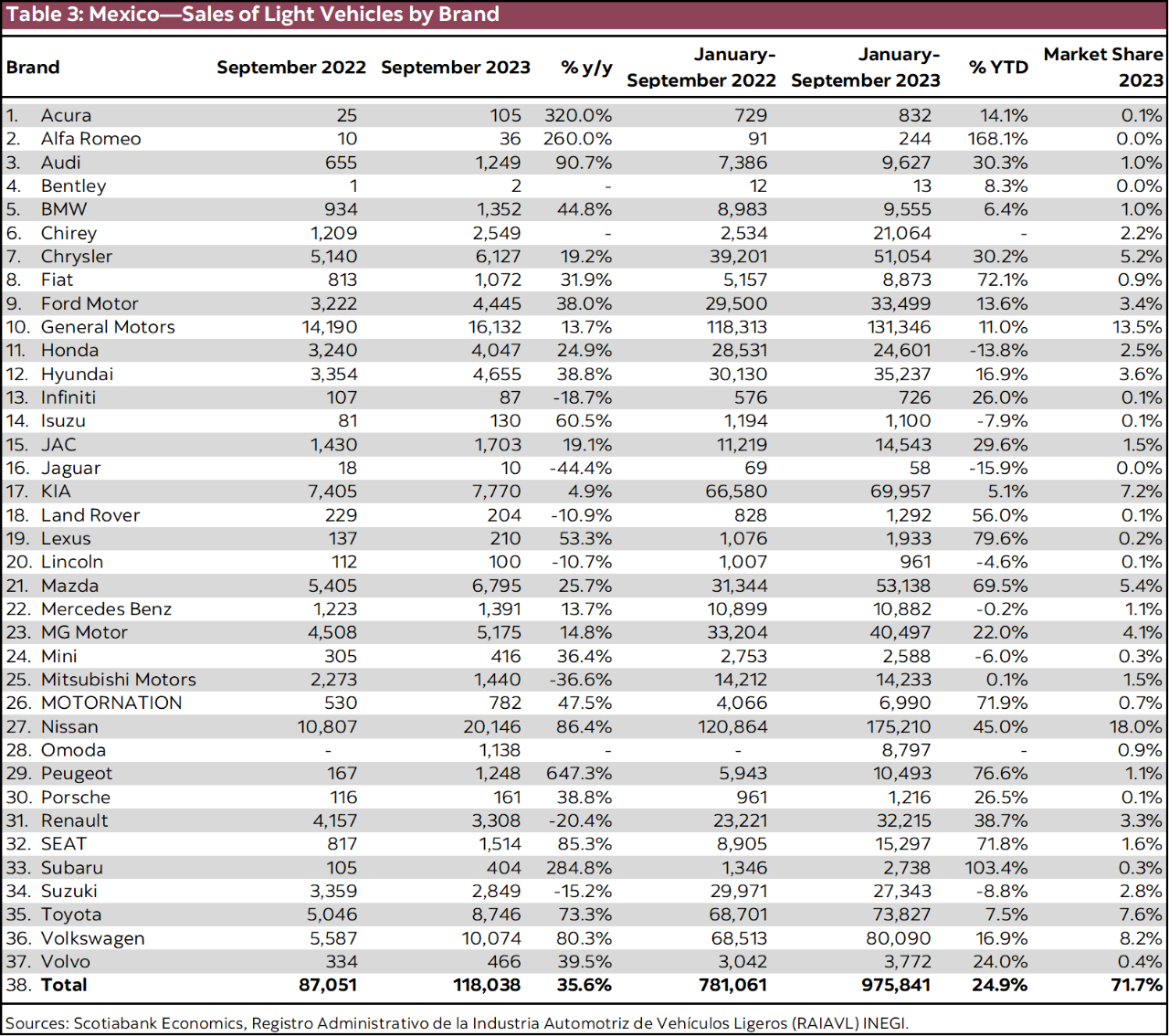

Domestic sales of light vehicles closed 2023 with a cumulative increase of 24.4% y/y with 1,361,433 units, its highest annual increase on record, since 2005, although below 2016’s all-time high by -15.3%. In December alone, sales presented a total of 142,959 units, equivalent to an annual increase of 16.0% y/y. In terms of market share, Nissan (17.7%), GM (13.5%), Volkswagen (8.4%), Toyota (7.6%), and Chrysler (5.2%) hold just over half of the total, although we highlight the recent increase of new competitors, most of them from Chinese brands (Chirey, JAC, MG Motor, Motorination and Omoda), whose trend we expect to continue in the medium term (chart 2).

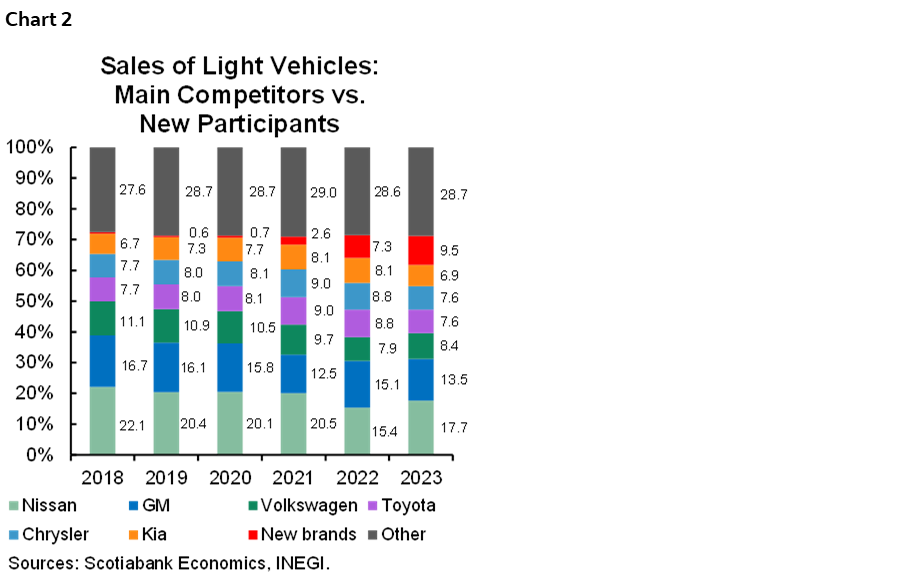

On the exports side, light vehicles grew less than domestic sales, although also with significant dynamism. During 2023, foreign sales totaled 3,300,876 units, representing an annual increase of 15.2% y/y, its highest pace in the last six years. Yet, exports are still -4.4% below its best year, in 2018, which totaled 3.451 million vehicles. December’s annual advance was similar, at 16.0% y/y. In recent months, vehicle inventories in the United States have increased more than sales, which implies that the ratio of sales to inventory has shown a significant recovery, although still far from the ratio observed prior to the disruptions in value chains (chart 3). Although the news of stabilization in inventories is positive, it is also reacting to the deceleration of retail sales, affected in turn by higher financing costs owing to restrictive interest rates, although with a positive outlook in the medium term, as the upcoming cutting cycle in the United States takes effect. For a detailed look at the global automotive outlook, see here for the most recent publication from our economist John Fanjoy, based in Toronto.

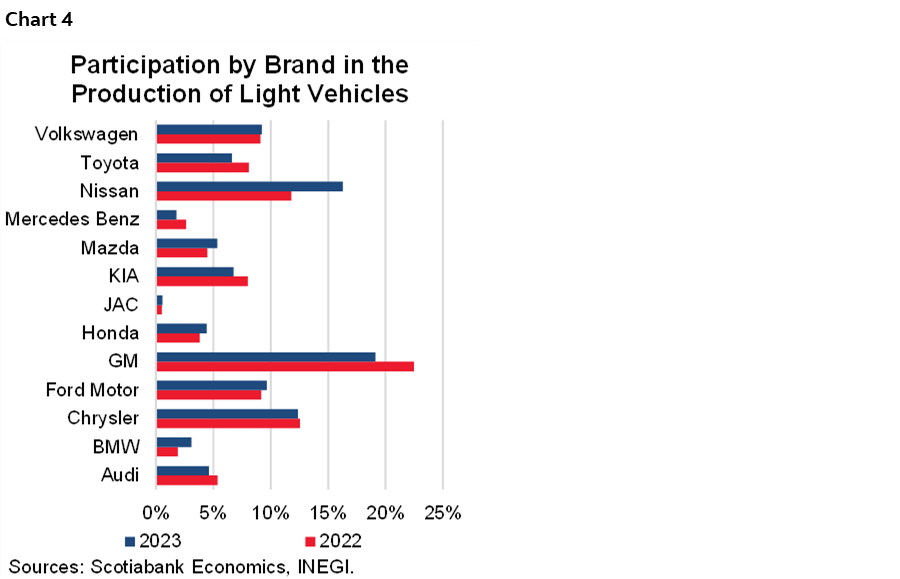

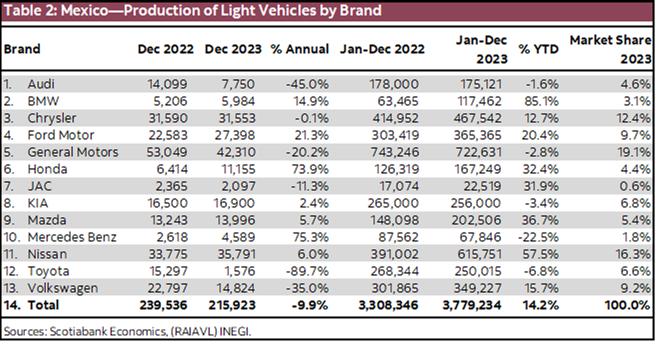

On the supply side, light vehicle production in 2023 achieved its highest increase since 2011, to 14.2%, summing 3,779,234 units assembled. However, in comparison to its stronger year, in 2017, when it reached 3,933,154 units, production holds with a -3.9% decline. By brand, GM continued to lead, although it lost some shares, going from 22% to 19% of total units, while Nissan, the second largest competitor, went up from 12% to 16%, followed by Chrysler (12% vs. 13% the previous year), Ford (10% vs. 9.0% previous) and Volkswagen (9% in 2022 and 2023). In terms of annual variations, GM’s lower participation came from a -2.8% y/y decline, while Nissan increased its production lines by 57% y/y. We also highlight the increases in production of Mazda, Honda and JAC, with advances of 36.7% y/y, 32.4% y/y and 31.9% y/y, respectively (chart 4). In this sense, the normalization of production lines has allowed for a greater increase in vehicle production, narrowing the gap with respect to demand for automotive vehicles. We believe that in the short term, production will continue to make significant progress, despite an expected slowdown in the US economy. However, we believe the nearshoring expectations yield a more favourable outlook in the auto sector than the rest of the manufactures owing to its exports-oriented profile.

Despite favourable expectations in the sector, we believe that significant risks remain on the horizon:

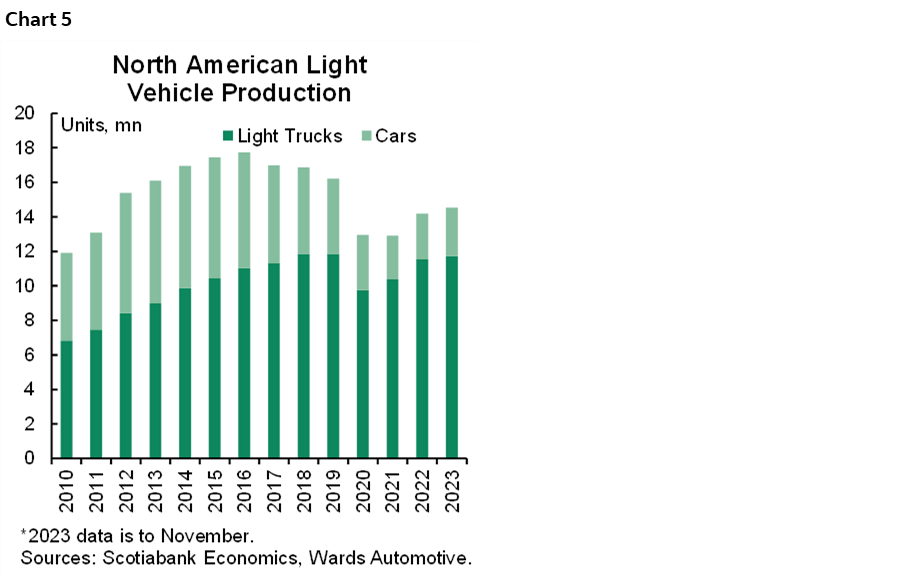

- The worst stage of global supply chain disruptions has possibly ended, along with the pandemic, but the risks of new disruptions persist. In this sense, the prospect of a major relocation of supply chains will benefit Mexico in the medium and long term. However, for some time, the automotive sector will continue to be subject to input value chains from other regions, where geopolitical tensions could limit the supply of semiconductors (chart 5).

- Also related to geopolitical tensions and uncertainty, the US presidential campaigns could inject an additional dose of uncertainty owing to the possibility of changes in the USMCA and protectionist measures within campaign proposals.

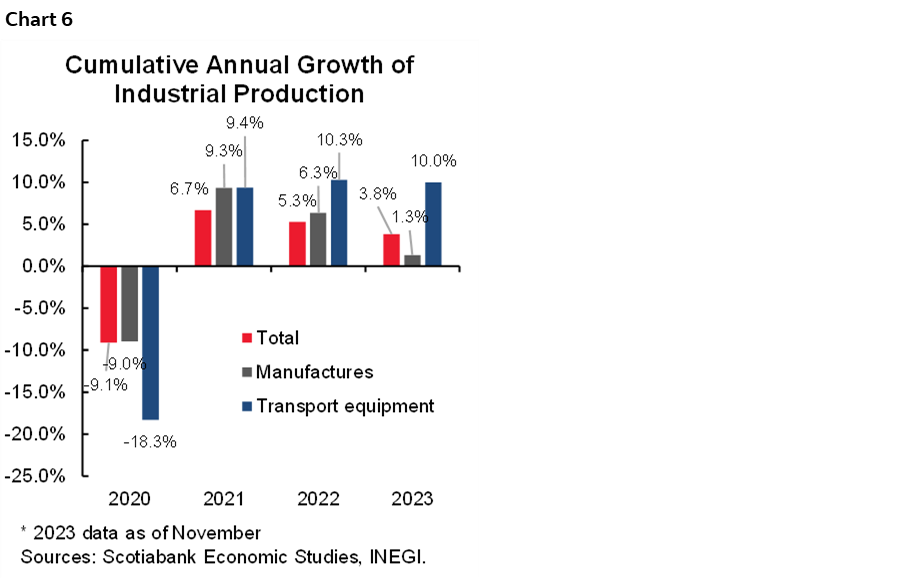

- The possibility of new climate adverse conditions affecting production chains has become more relevant in recent years. Although nearshoring seeks to mitigate the impact of global disruptions, new regulations encourage the development of processes and technologies that favour the use of clean energy. In this regard, the change in the adoption of green technologies and electromobility will pose as part of the priorities for the sector in the long term (chart 6).

- In the short term, a final risk for production and exports, but no less relevant, is the expected slowdown in the US economy. The auto sector has been the exception in the drop in both manufacturing production and exports observed since mid-2023 in Mexico. By 2024, higher interest rates could negatively impact the sector. However, we believe that supply has not yet caught up with demand. In this sense, we believe that in 2024 we could see new record levels, owing to the stabilization of value chains, and in the domestic market, due to a solid labour market that allows the incorporation of new competitors.

In our opinion, public sector participation will be necessary to promote a series of policies and programs that will allow the automotive sector in Mexico to take advantage of its potential and its strategic global position. In view of this, the proposals to be presented by presidential candidates will be relevant for future investment projects and public policies in the automotive sector.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.