Earlier this month, the FOMC revised its dot plot, signaling that its base case for 2024 is now only one 25bps cut as a robust labour market, resilient growth, and stubborn inflation warrant prolonged policy tightness. In addition, following the Mexican elections on June 2nd, markets in Mexico have come under pressure (MXN –7%, 10yr Mexico–US swap spread around 70bps wider). The combination of these two factors is likely to add a layer of caution towards Banxico’s policy in the looming policy decision. Looking at domestic data, the picture is more nuanced and complex, with what we see as balanced upside and downside inflation risks.

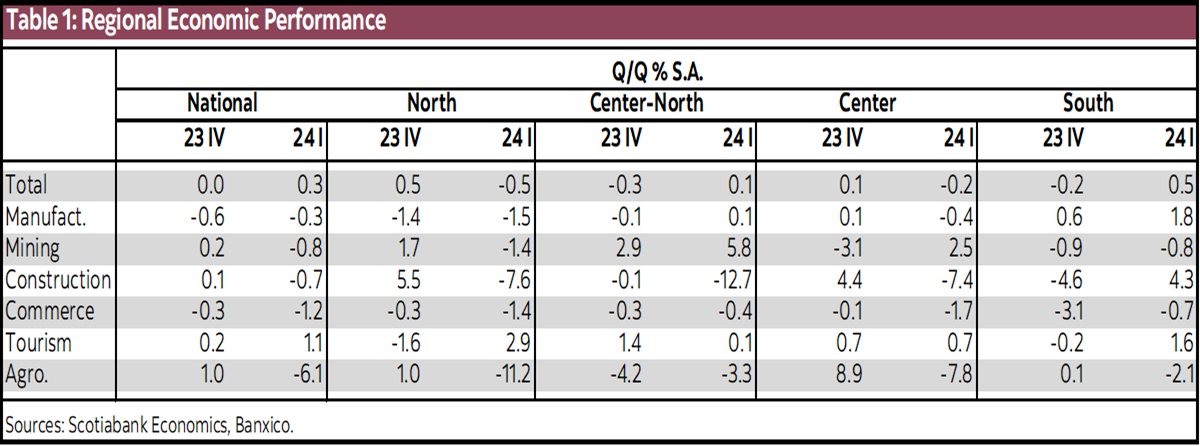

On the growth side, data for the first few months of the year (and the close of 2023) shows a material slowdown in growth in Q1 (retail sales and the monthly GDP proxy turned negative to close Q1). Outside of tourism, at the national level, all key sectors of GDP posted q/q contractions to start the year (Q1). This presents Banxico with a challenging balancing act as a pure inflation targeter, as domestic markets have suffered material volatility, the Fed has signaled delayed rate cuts, inflation remains high and stubborn, and some inflation risks loom on the horizon (see table 1 below).

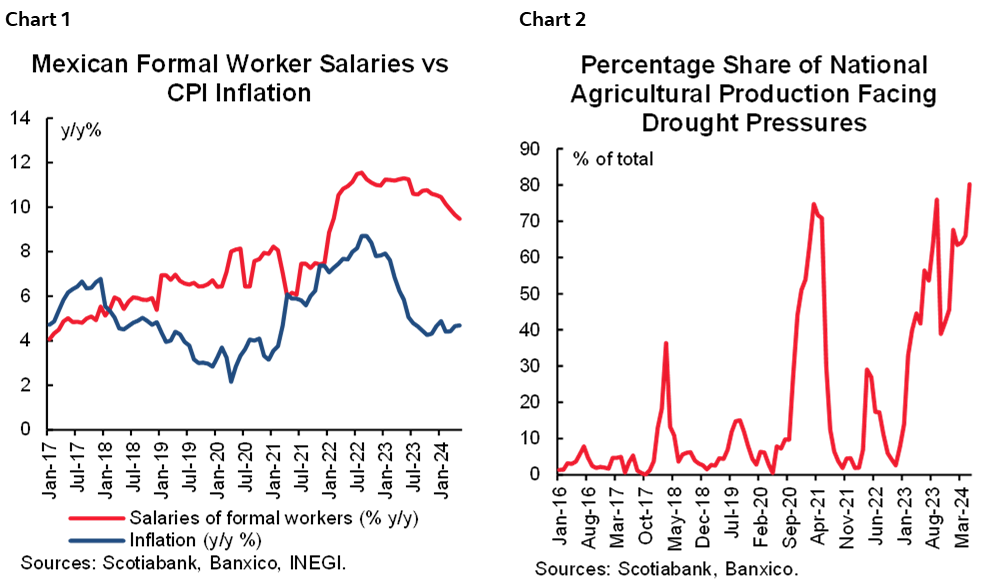

The first challenge looming on the inflation horizon is that despite the drop already seen in inflation, wages significantly trailed in their decline. With Mexican labour markets still very tight, and strong yearly minimum wage hikes (one of the incoming government’s proposals would constitutionally mandate minimum wages hikes above inflation every year), wages have continued to post strong gains (chart 1). This is likely to continue to prop-up CPI inflation, particularly in the more labour-intensive services sector. The second looming potential shock is food prices. As global media discussed earlier this year, and chart 2 shows, the past few months have seen Mexico endure a strong drought, that has not only been severe, but long lasting. This risks pressuring food prices, particularly heading into the final 3–4 months of the year.

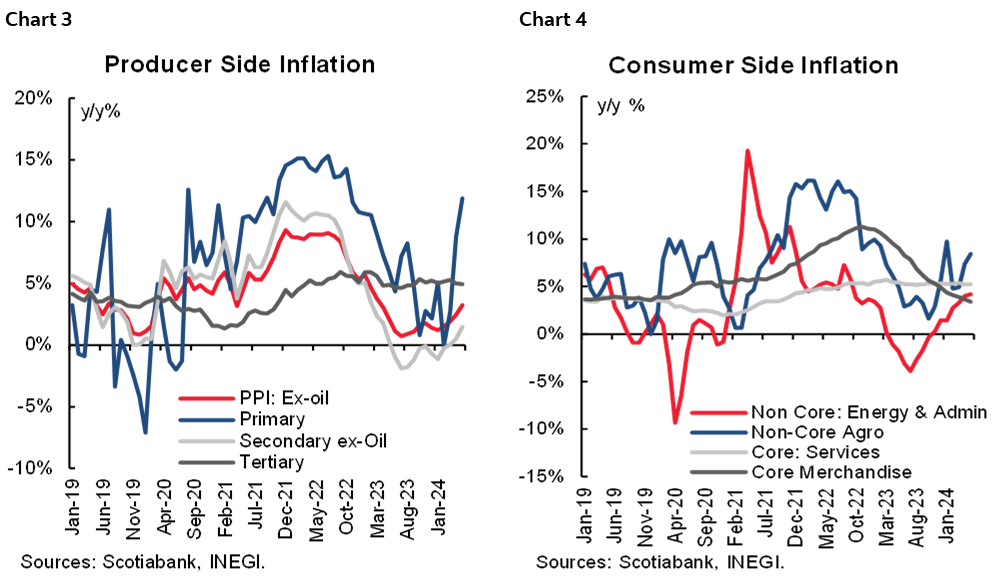

Additionally, PPI has often given us a 3–6 month preview of turns in CPI cycles (secondary sector inflation sheds light on core goods, and tertiary sector inflation on core services). As charts 3 and 4 show, so far, core services inflation has been very sticky (which we see as partly driven by tight labour markets), but core goods prices trends have been a relief for Banxico. However, if the PPI-CPI relationship holds, the good news on core goods CPI may soon turn into bad news considering the recent run up in secondary PPI.

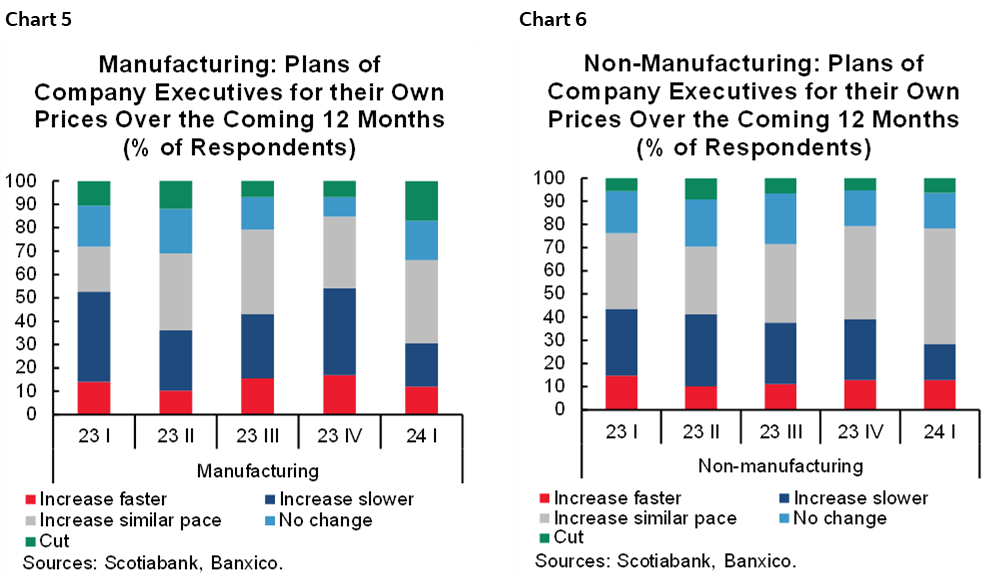

On the positive, and highly relevant end, expectations of price-setters provided good news for Banxico at the end of Q1, with the share of both manufacturing and non-manufacturing company executives planning on accelerating price increases falling materially in Q1 (charts 5 and 6). This is particularly good news for services sector inflation, as core services CPI has so far been tough to tame. This could be consistent with the dip we’re seeing in activity data at the start of the year. The counter argument lies in the spike in PPI that we also saw at the start of the year, which could undermine the willingness of producers to cut prices, eating directly into their margins on all sides (rising input prices, cutting their own prices, while dealing with lower demand if the economy continues to slow).

Overall, the Banxico policy outlook is challenging, but given current heightened levels of uncertainty we think risk-reward favours prudence. We anticipate Banxico will stay put in its looming policy-setting meeting (we would not be surprised by a 5–0 “hold” decision), and we maintain a September cut lightly penciled in (with the eraser already at the ready), and a higher conviction 25bps cut in December, alongside the Fed. We think this would be a prudent path for the central bank, particularly given that Mexican market uncertainty could pick up as we head into the final stretch of the year, due to: a) the budget presented by the government for 2025 with its potential changes to tax policy or the reactions of rating agencies, b) the government’s “constitutional reform” package which could be submitted to Congress in that window, c) the final stretch of the US electoral process, where Trump’s tariff proposals could also impact both rates (due to the impact of tariffs on inflation), and FX markets.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.