FORECAST UPDATES

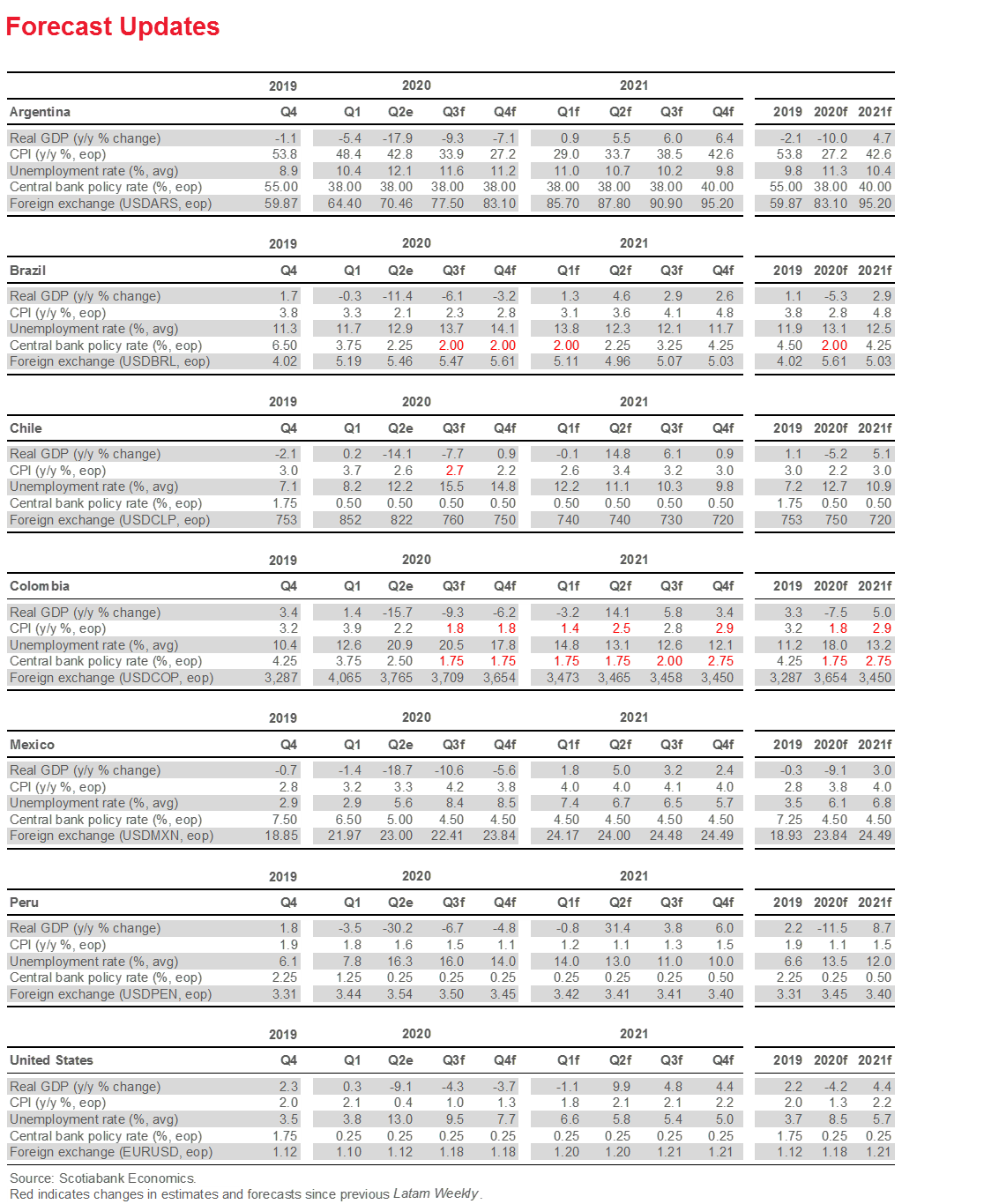

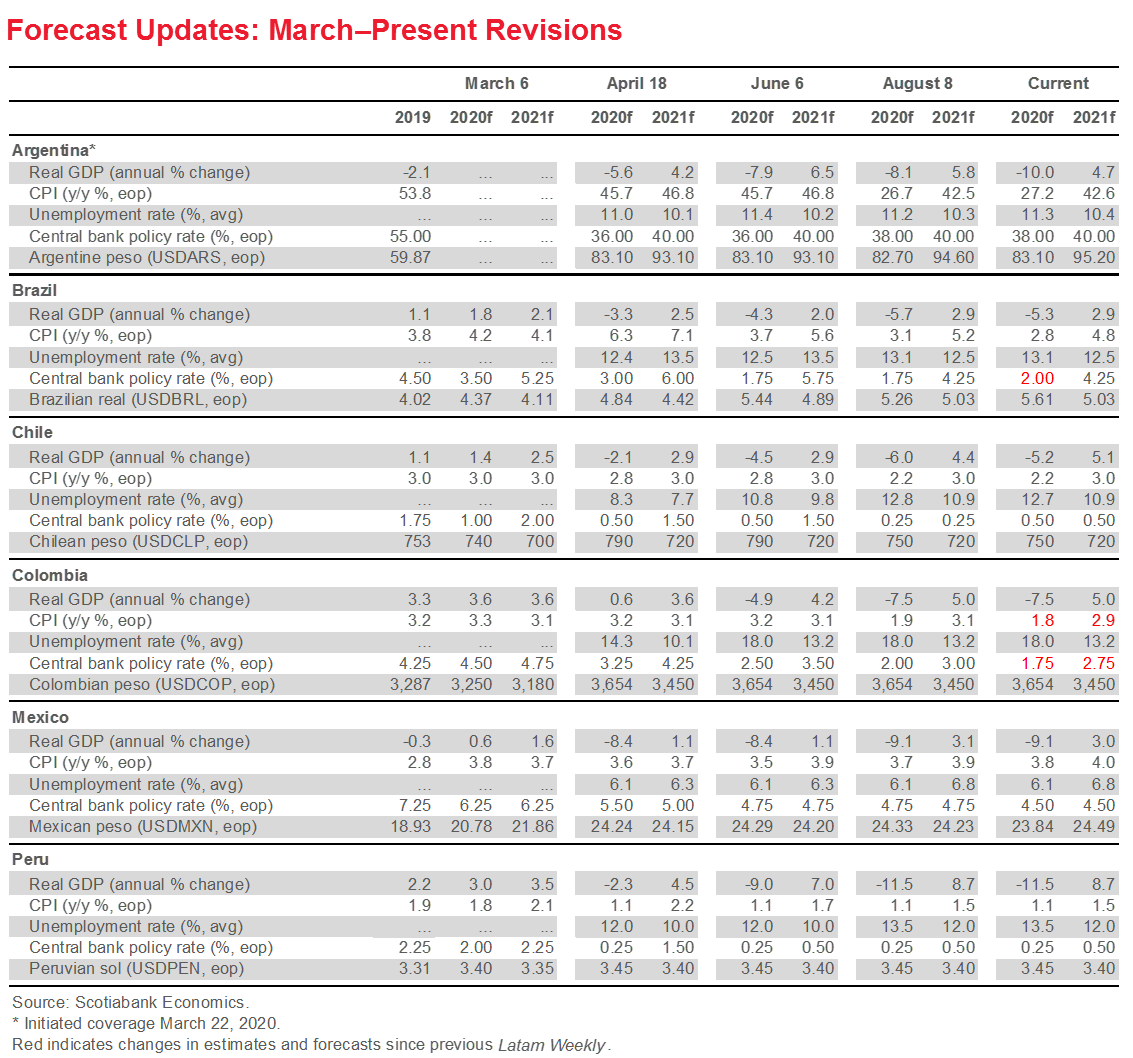

We now anticipate the end of easing cycles across Latam, with updates to our expected terminal monetary policy rates in Brazil and Colombia.

ECONOMIC OVERVIEW

Previews of monetary policy decisions this week in Mexico and Colombia are provided and we assess claims that another “lost decade” is looming in Latam.

MARKETS REPORT

We look to the macroeconomic frameworks that have been published so far by national authorities to get a sense of what new government debt issuance could look like in 2021.

COUNTRY UPDATES

Concise analysis of recent events and guides to the fortnight ahead in the Latam-6: Argentina, Brazil, Chile, Colombia, Mexico, and Peru.

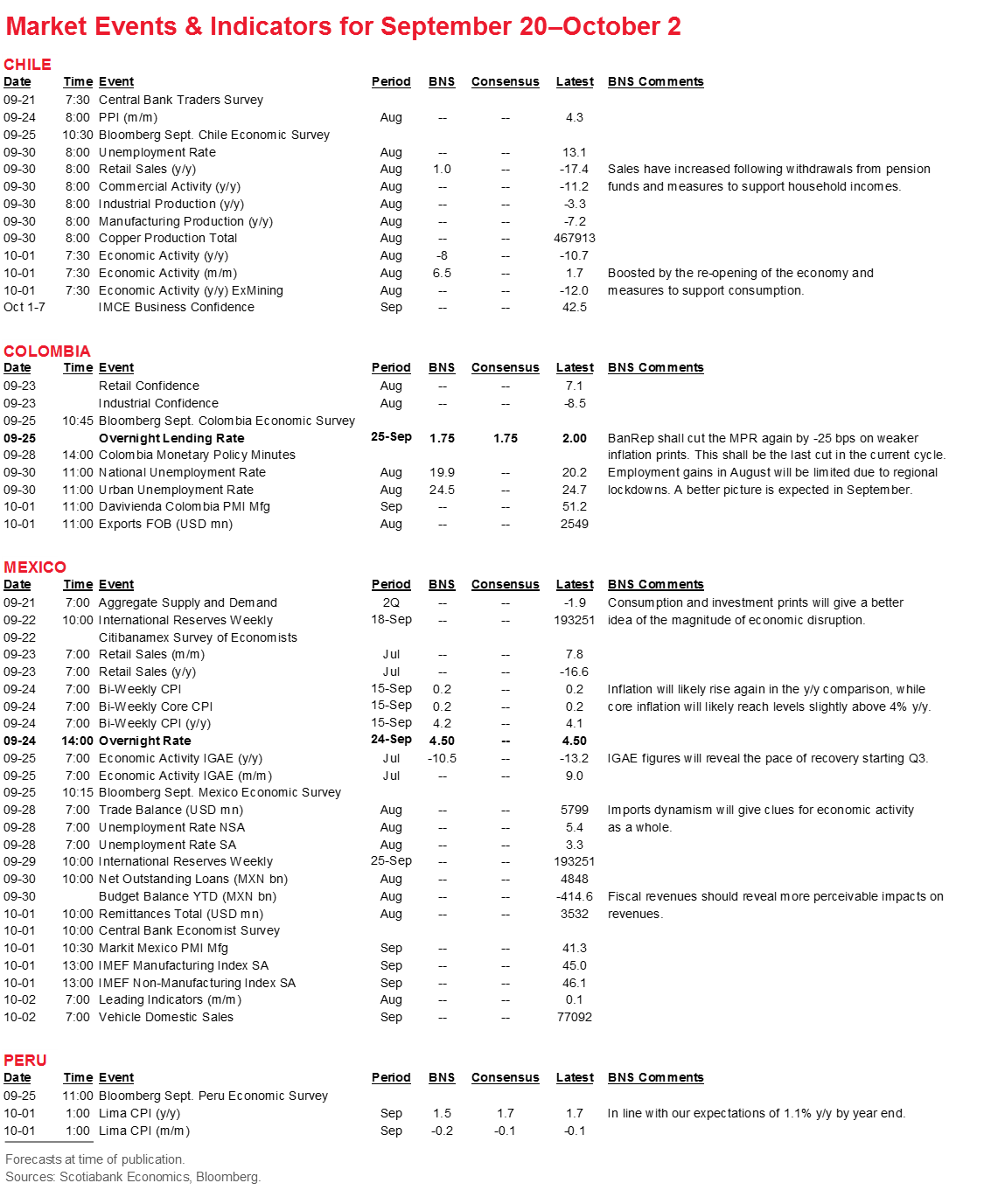

MARKET EVENTS & INDICATORS

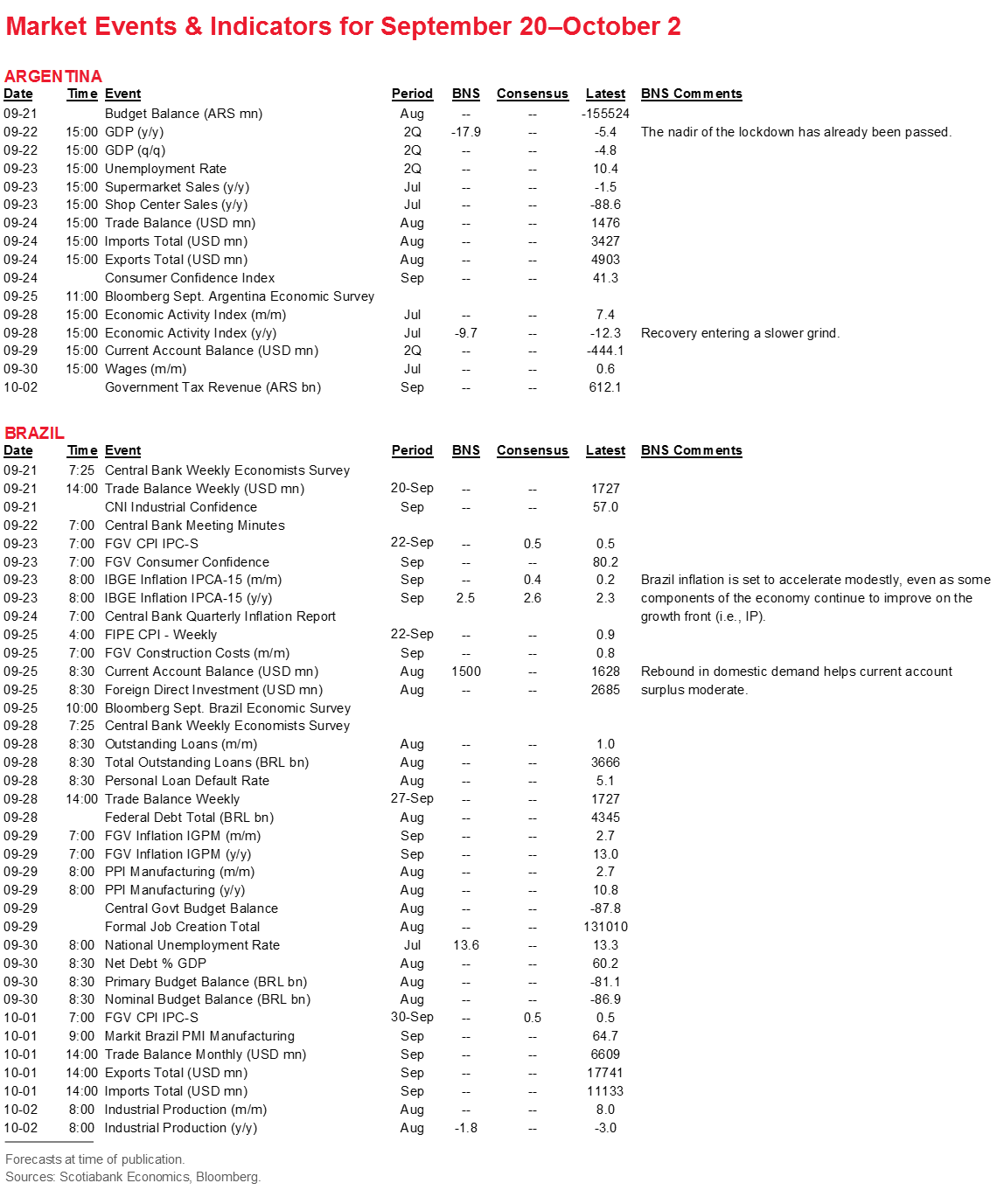

Risk calendar with selected highlights for the period September 20–October 2 across our six major Latam economies.

Economic Overview: The Great Catch-Up

Brett House, VP & Deputy Chief Economist

416.863.7463

Scotiabank Economics

brett.house@scotiabank.com

We now anticipate the end of easing cycles across Latam, with updates to our expected terminal monetary policy rates in Brazil and Colombia ahead of monetary policy decisions this week in Mexico and Colombia.

Claims of a another “lost decade” in Latam look overdone as all of the Latam-6 begin climbing out of Q2’s trough.

FORECAST CHANGES AND MARKET UPDATES

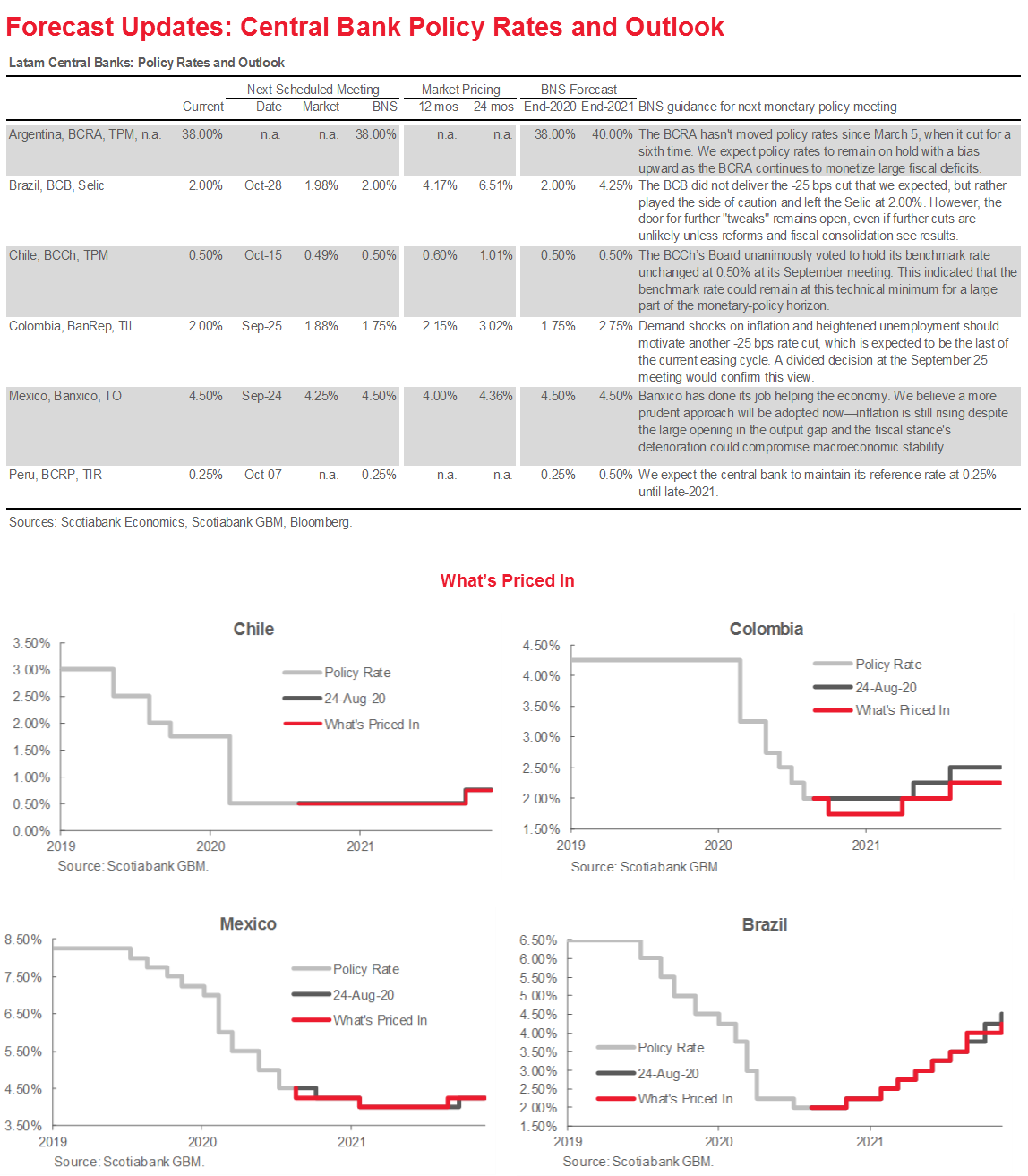

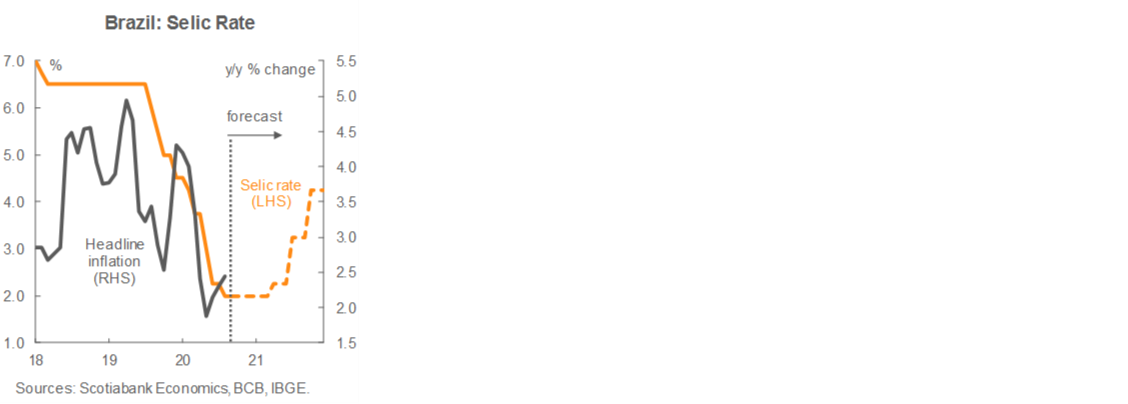

Forecast changes (see tables on pp. 2 through 4) are limited to modifications in the terminal monetary policy rates expected in Brazil and Colombia. Following the hold by the BCB’s Copom on September 16, our Brazil economist now believes the easing cycle is done and the Selic will be maintained at 2.00% until Q2-2021. In contrast, our economists in Bogota have updated their view and have moved from expecting a hold to anticipating a last -25 bps cut from the BanRep Board at its next meeting at the end of this week. Colombia’s monetary policy rate would then be expected to remain on hold at 1.75% through Q3-2021.

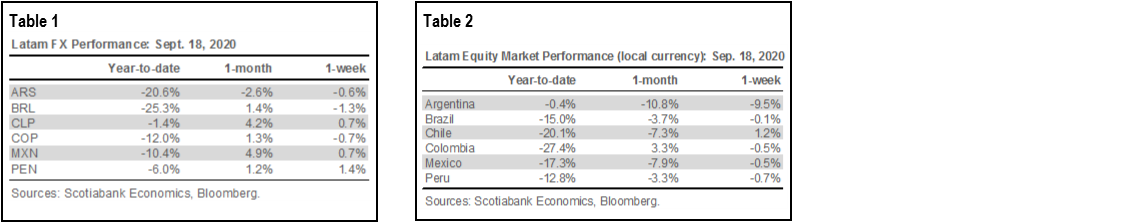

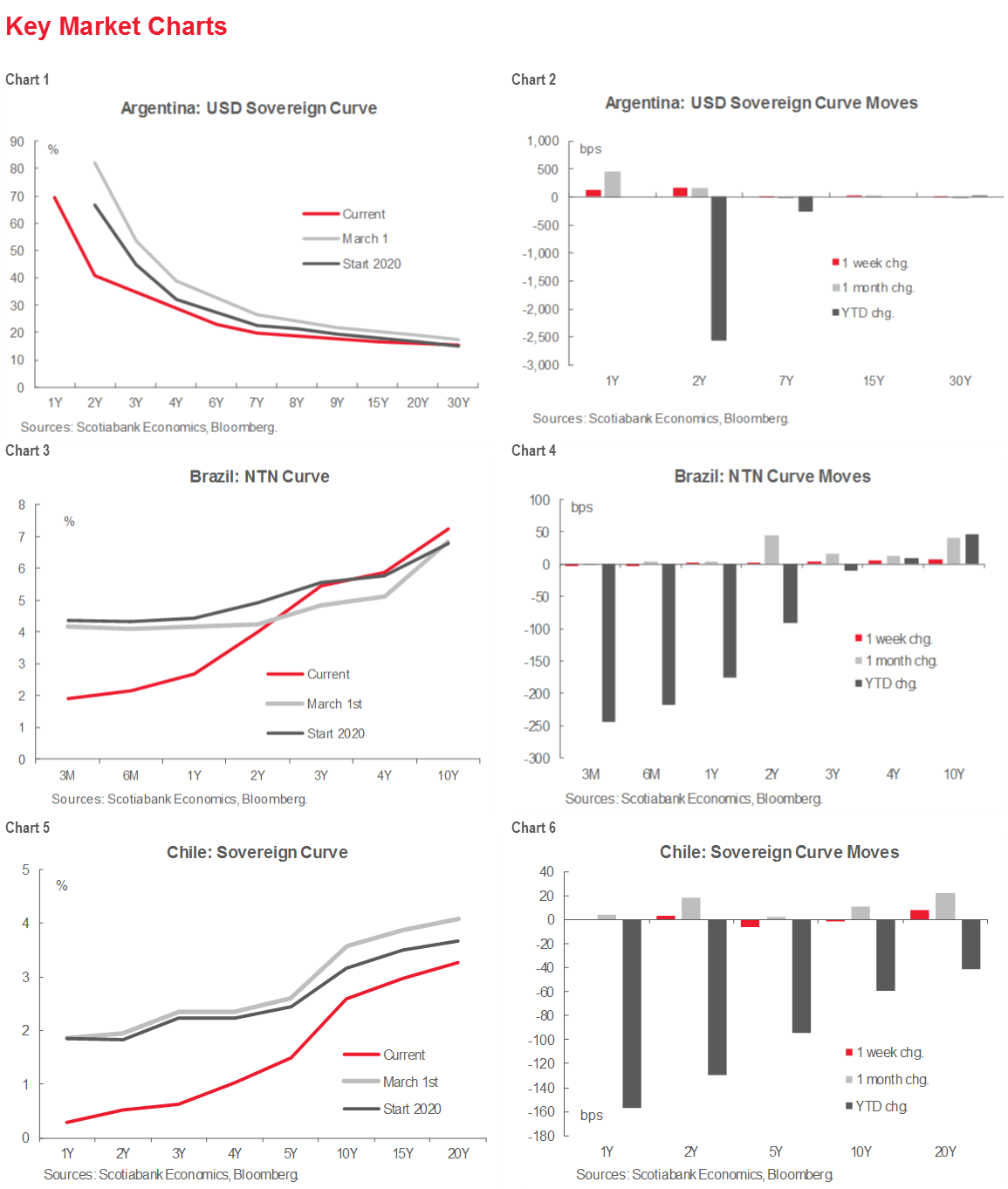

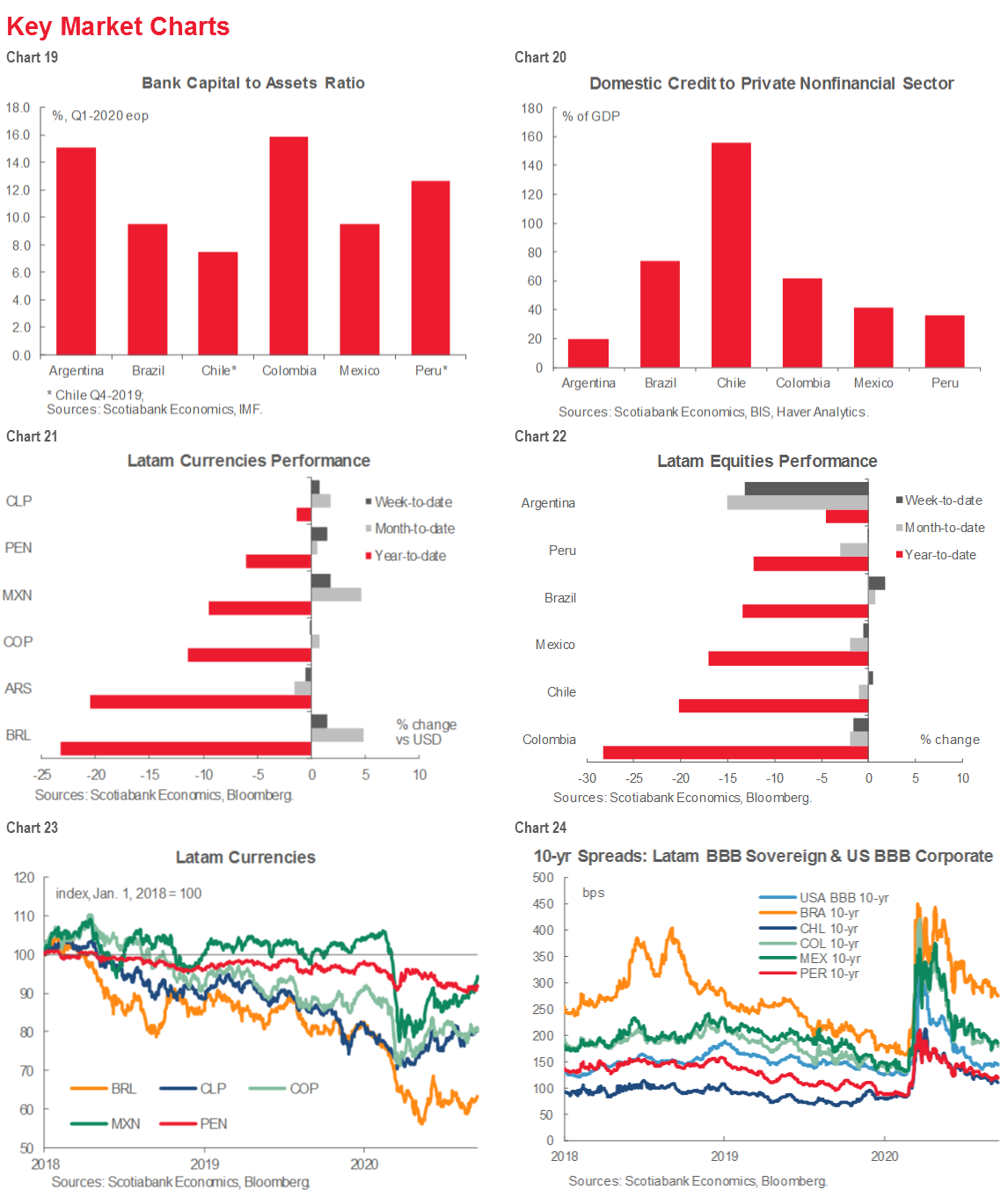

Risk assets continue to trade on macro developments, with Argentina’s currency and equity markets suffering in tandem following this past week’s moves to tighten currency controls (table 1 and 2). The BRL remains the worst performing major currency in the region and across emerging markets.

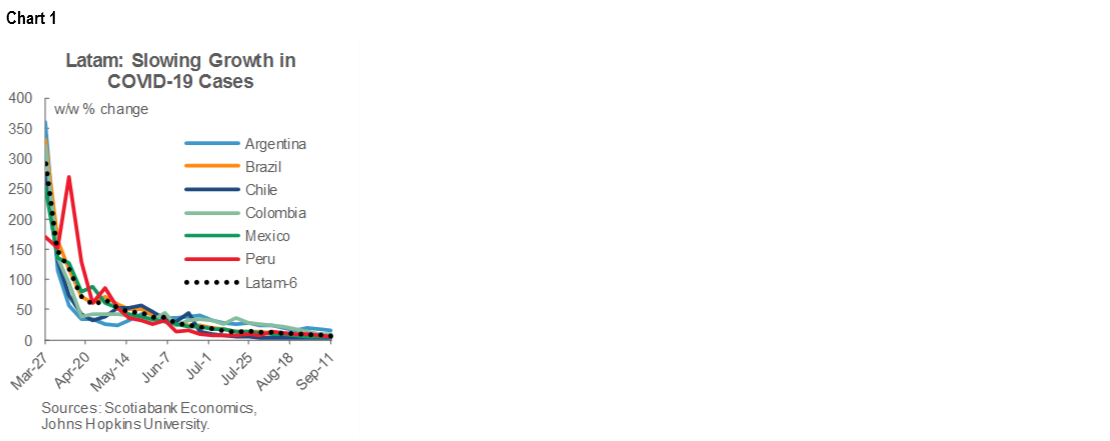

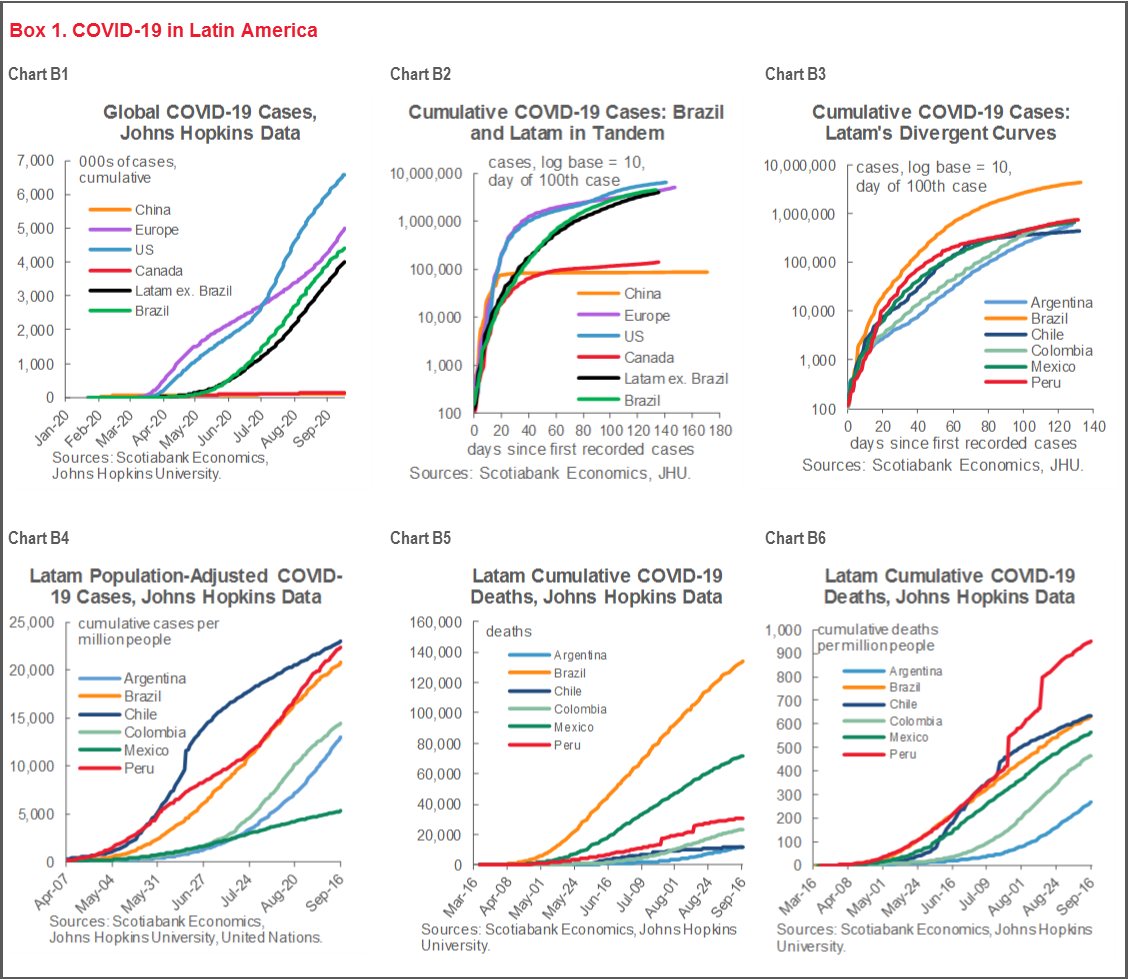

For perspective, we again provide our usual panel of charts on the evolution of the COVID-19 pandemic in Latam in Box 1. Despite Latam remaining a hot zone of community contagion, growth in new infections continues to decline (chart 1) and public health developments don’t seem to be the key macro drivers at present in the Latam-6.

PERSPECTIVE ON THE LAST DECADE

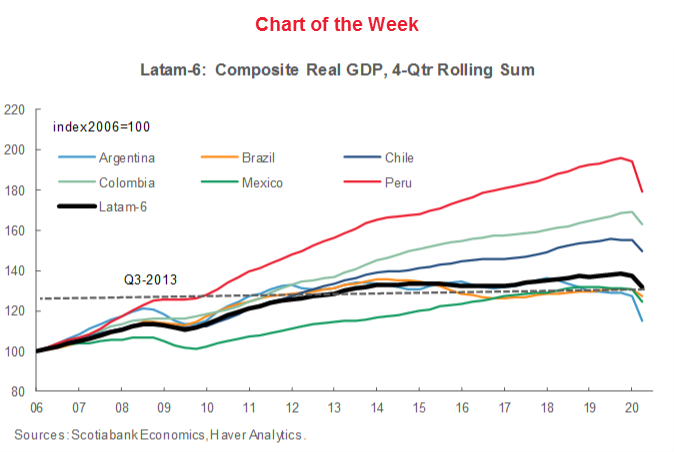

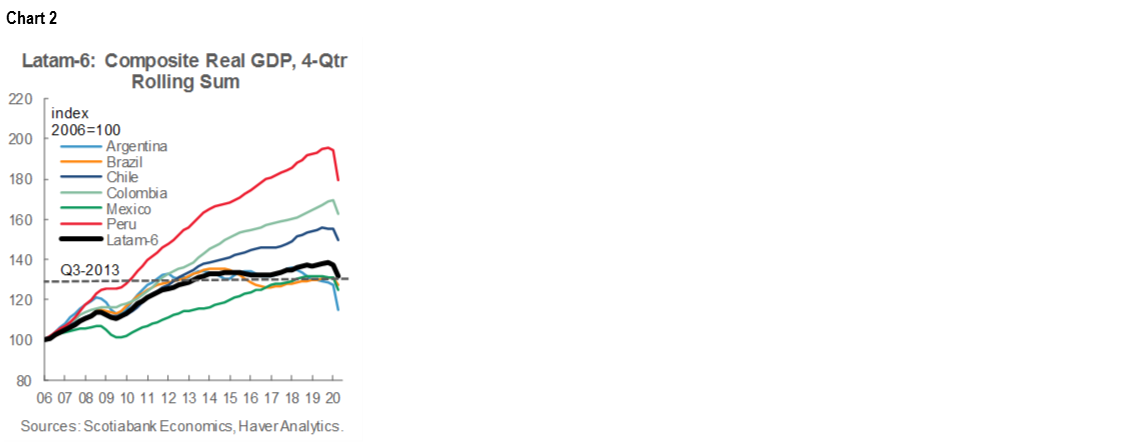

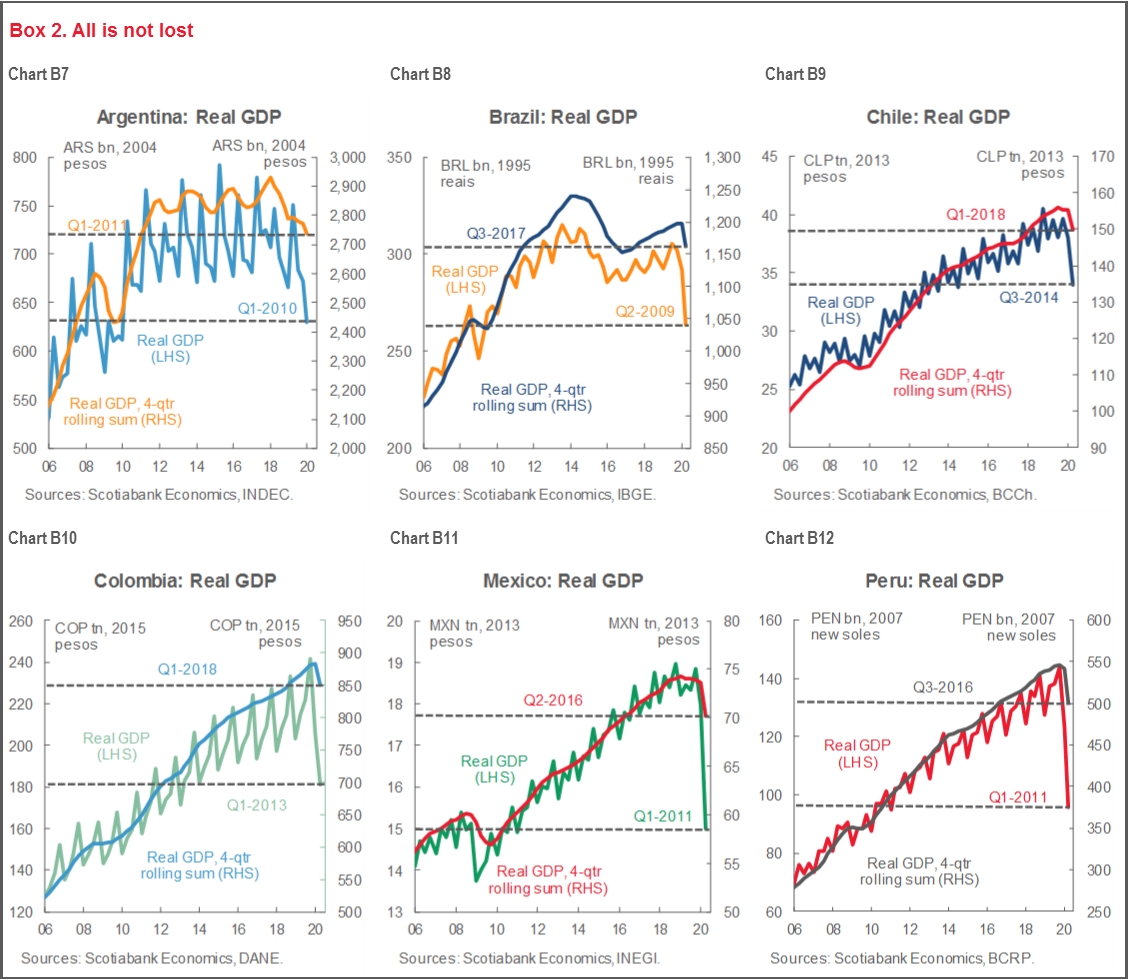

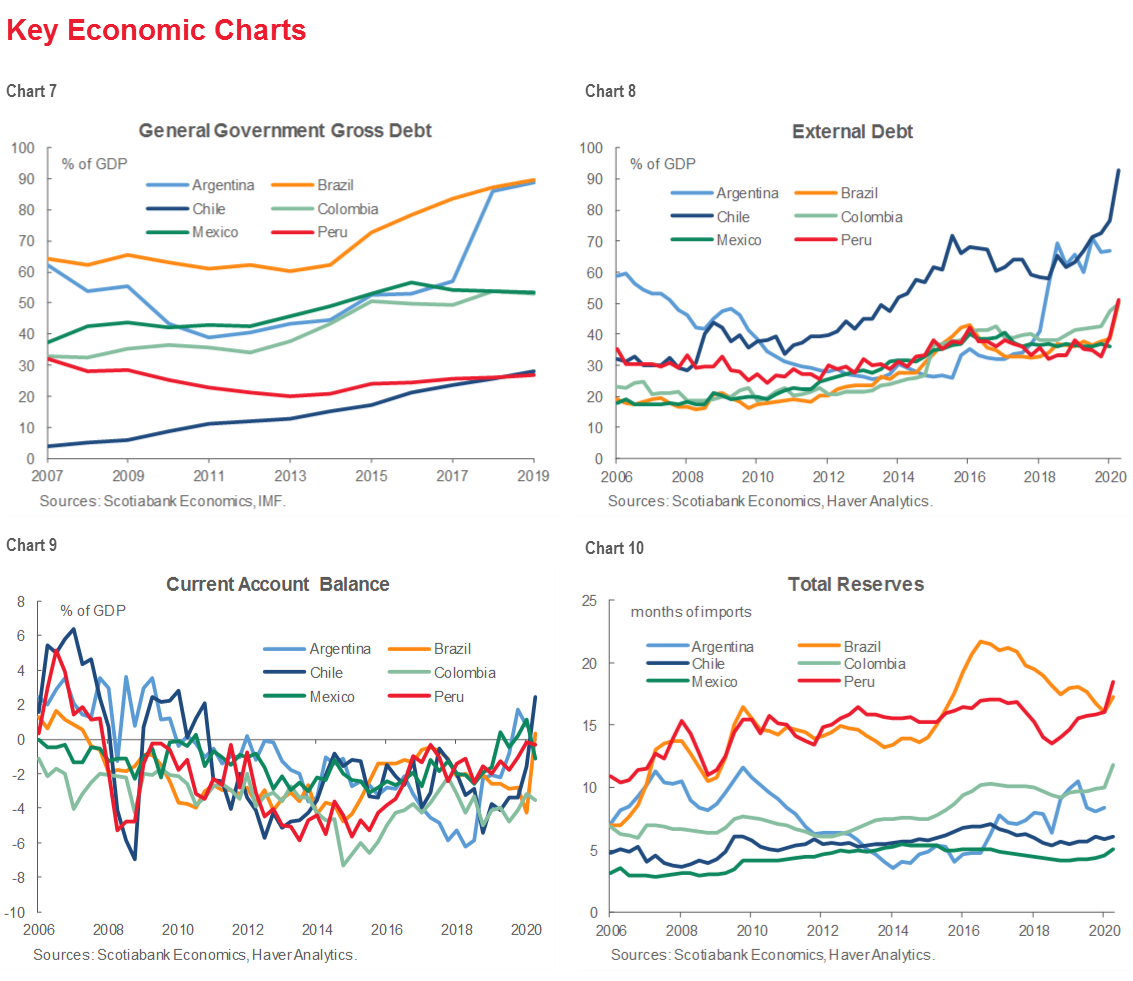

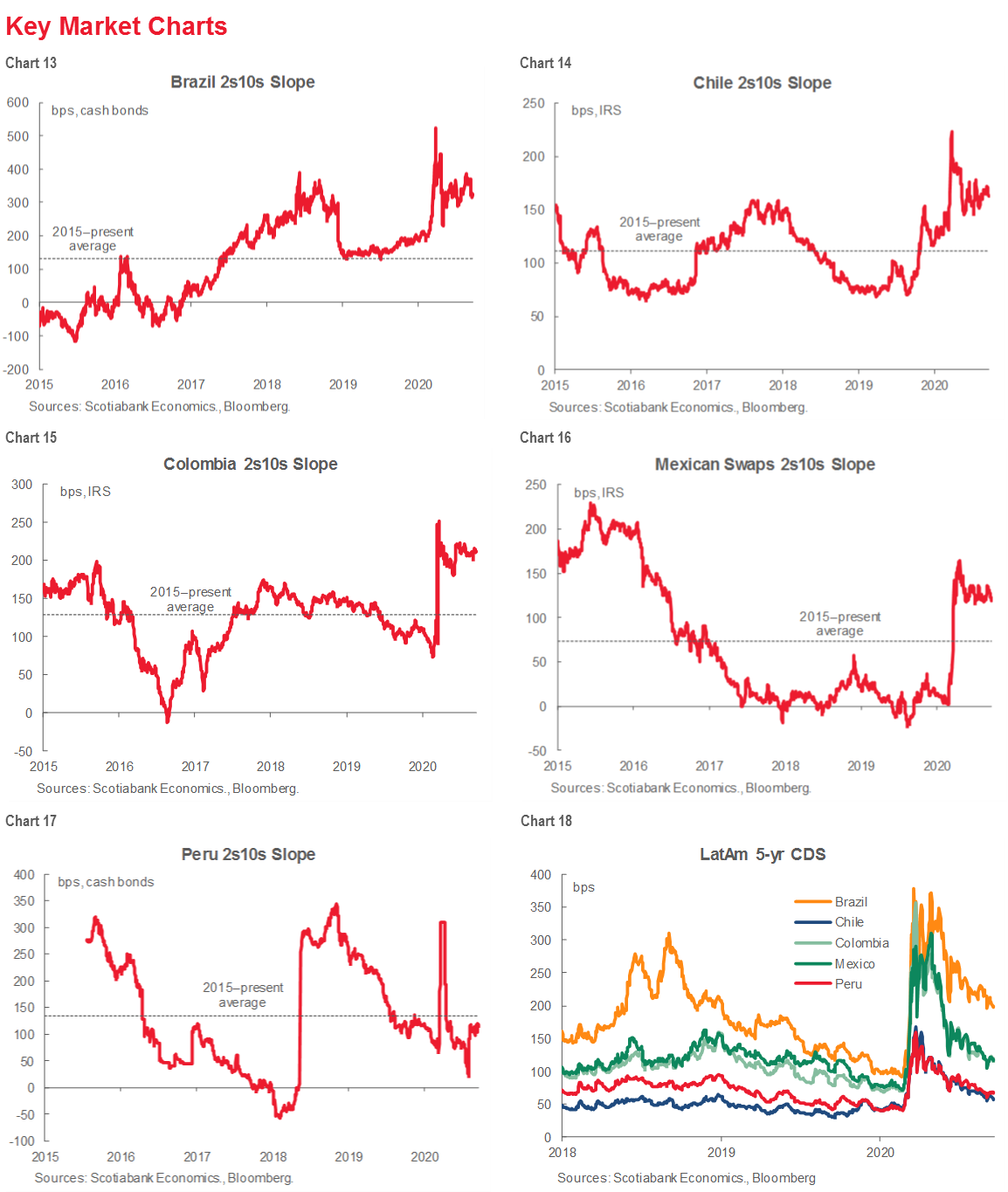

Over recent weeks, chatter on Latin America from think tanks, international media, and even the World Bank has raised the spectre of another “lost decade” in the region, echoing setbacks wrought by the 1980s debt crisis in Latam. In fact, economic developments across the region’s six major economies remain highly differentiated. For the Latam-6 as a whole, the four-quarter rolling sum of economic activity has been rolled back to levels last seen in Q3-2013 (chart of the week and chart 2), but as the data in box 2’s charts B7–12 indicate, sweeping statements about a lost decade are overly general. In fact, Argentina (chart B7) is really the only economy that has seen a decade of economic gains erased by what is now three years of recession that began prior to the advent of the pandemic. Despite suffering the largest real setbacks in the region this year, Peru’s performance over the last decade means that COVID-19 has pushed the economy back fewer years than has been the case in other countries (chart B12 and chart 2, again). Chile (chart B9) and Colombia (B10) remain well ahead of the region’s trend, while modest decanal progress in Brazil (B8) and Mexico (chart B11) relative to the rest of Latam remains rooted in pre-pandemic issues.

EASING CYCLES NEARING THEIR ENDS

We outline below our expectations for major central bank developments and macro data releases over the coming fortnight. Please see the Country Updates section and risk calendar at the back of this report for further detail on other forthcoming key data releases and developments.

I. Central banks

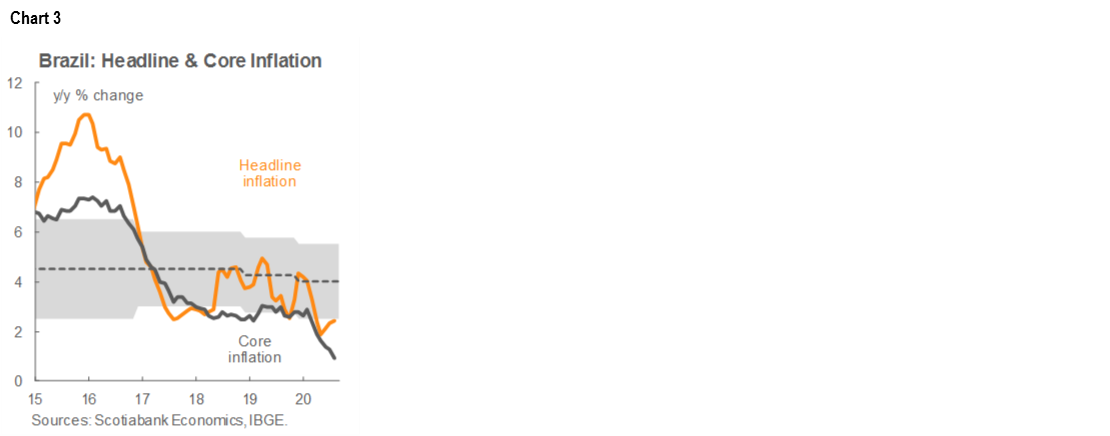

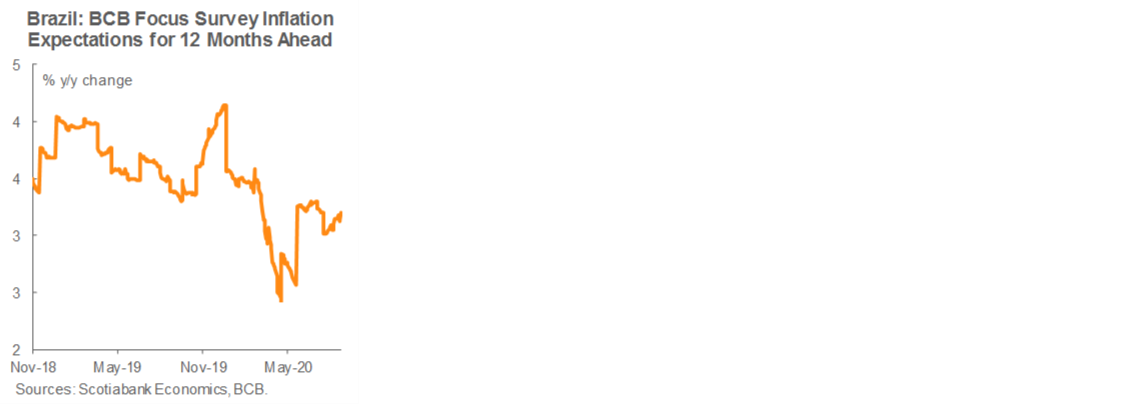

- Brazil. The BCB will publish on Tuesday, September 22 the minutes from the Wednesday, September 16 meeting where the Copom decided by a unanimous vote to keep the Selic on hold at its all-time low of 2.00%. In the Copom’s statement on the meeting, it noted that “the remaining space for monetary stimulus, if it exists, would be small” owing to concerns about prudence and financial stability, and that “greater gradualism” would govern possible future changes in monetary policy, contingent on fiscal developments and the inflation outlook. It kept open by just a crack the door to additional cuts. The Copom strengthened its forward guidance in the decision statement, noting that it didn’t intend (i.e., versus a softer previous reference to not foreseeing) to effect any withdrawal of monetary stimulus unless inflation expectations and projections move back close to target within the current forecast horizon. The minutes should provide greater insight on the specific conditions that will govern the Copom’s next steps in the context of well-below-target inflation (chart 3).

The BCB staff will follow the minutes on Thursday, September 24, with the publication of its Q3 Inflation Report that will lay out updated macroeconomic forecasts through end-2022. GDP growth projections are likely to be upgraded, but the real tell will be in the new inflation outlook.

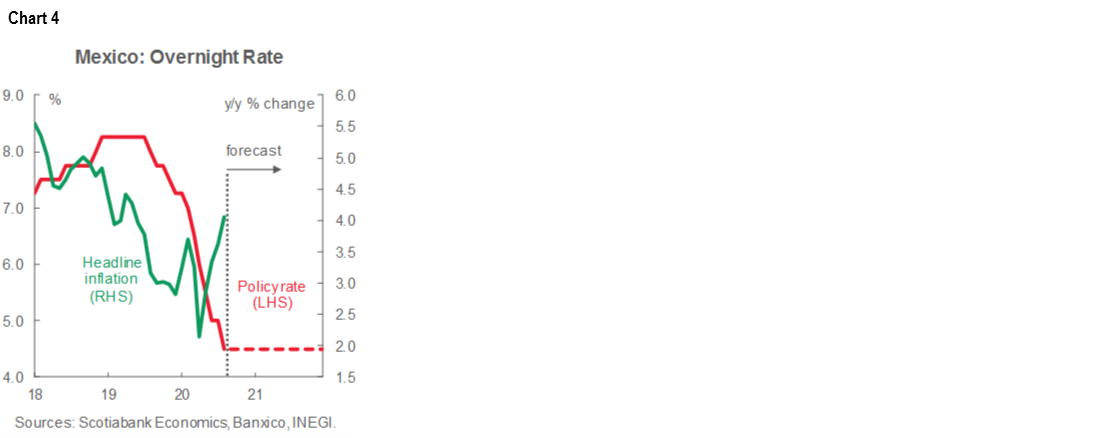

- Mexico. The Banxico Board meets on Thursday, September 24 to review its objective for the interbank rate and our team in Mexico City expects the Banco de Mexico to stay on hold at 4.50% (chart 4). Consensus, however, is tipped toward a -25 bps cut that, if delivered, would likely be the last of this easing cycle, which has already featured five successive -50 bps cuts since March.

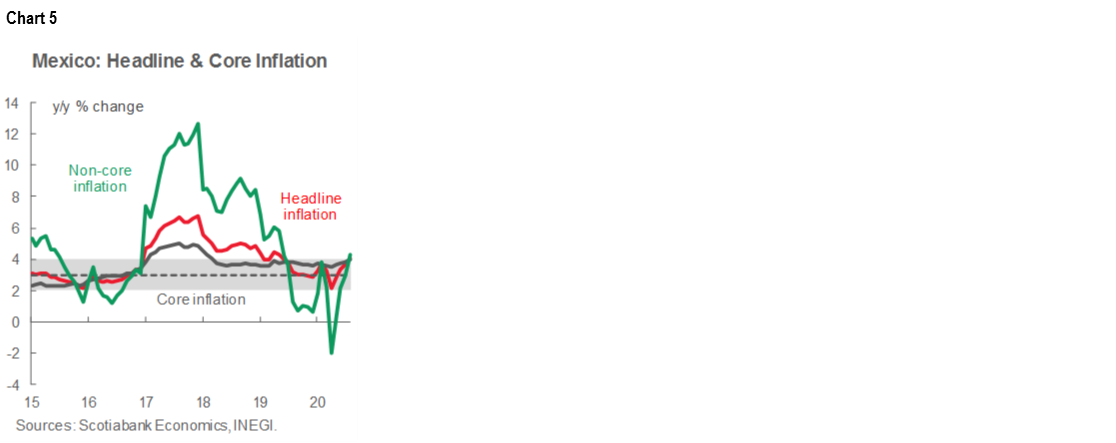

Our team’s expectation of a hold this week is founded first and foremost on the recent acceleration in Mexico’s major inflation readings, including the core (chart 5). The latest price data for the first half of September is due to be published at 07:00 ET on Thursday, ahead of the Banxico announcement at 14:00 ET. It’s entirely likely that the print will register a new headline reading above 4% y/y, which could stay further cuts from the Board. It’s also worth recalling that the last -50 bps cut on August 13 saw one dissenting member of the Board opt for a smaller -25 bps cut. That move sets up a more complicated discussion for the Board at this meeting. Proponents of a further cut will likely cite the still soft economy and large negative output gap as more than sufficient justification for additional easing. They may also point to continued weakness in formal labour markets, tightening consumer credit, the relatively high real policy rate, and expected volatility related to the US elections as further grounds for a cut.

Whatever decision is made on the interbank rate, the Board is likely to adjust its forward guidance, which has remained largely unchanged over the last couple meetings. In the August 13 decision, the Board noted that, “the available room for maneuver will depend on the evolution of the factors that impact the outlook for inflation and its expectations, including the effects that the pandemic might have on both.” This room is clearly getting narrower.

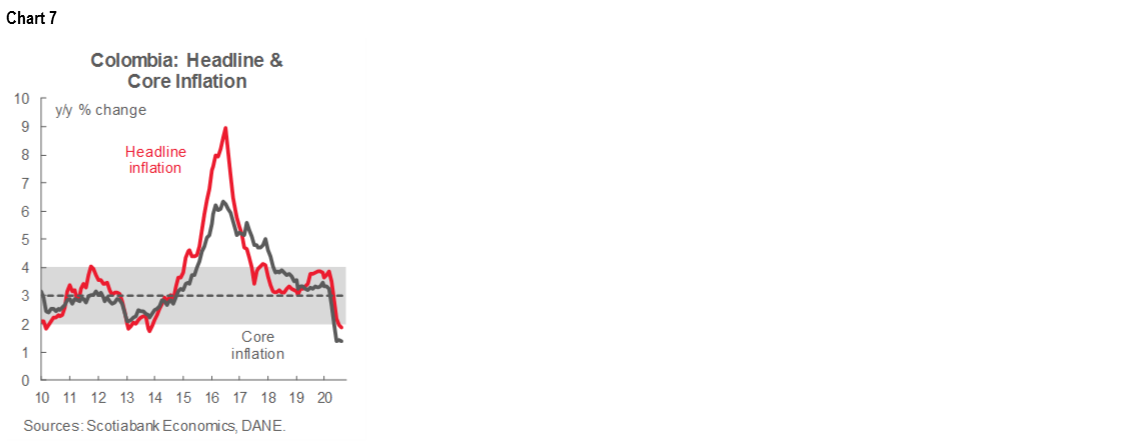

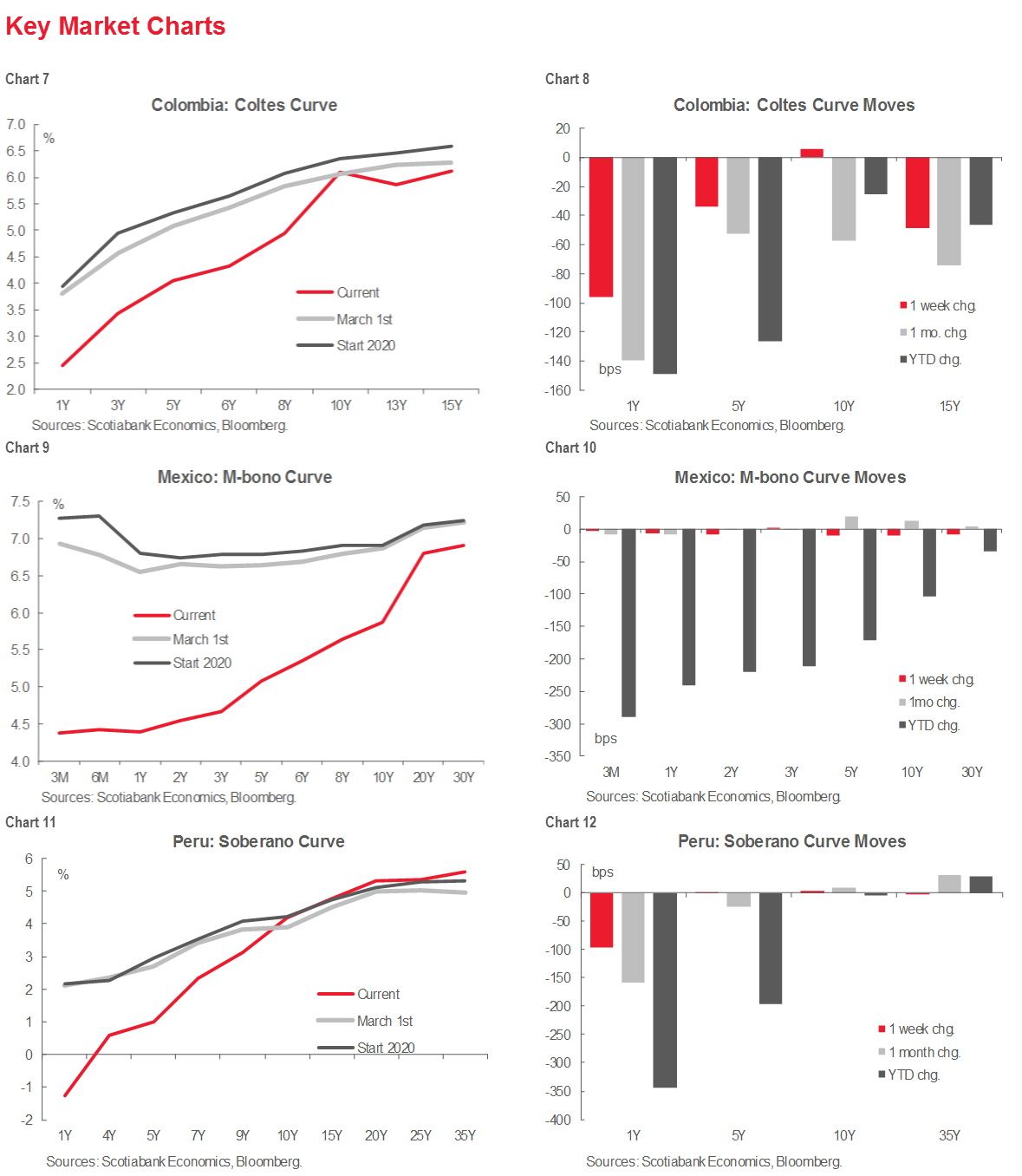

- Colombia. The BanRep’s Board of Directors meets on Friday, September 25, and our team in Bogota expects the Board to reduce the monetary policy rate by a final -25 bps to a record-low 1.75% (chart 6). This move would follow a unanimous decision to cut the policy rate by -25 bps at the August 31 meeting, in line with the Board’s oft-repeated bent for gradualism and data-dependency in the implementation of further adjustments to the BanRep’s stimulus efforts. However, in the statement on that meeting and in the ensuing minutes, the Board hinted that financial stability concerns could play a smaller role in their thinking as external financing needs have come down, which implies room to continue easing. This was one of the factors, along with soft inflation (chart 7), that moved our Colombia economists in the last two weeks to revise their projection from a hold to a quarter-point cut, but they emphasize that this is a closely-balanced call. The minutes of the Board’s deliberations will follow on Monday, September 28.

II. Macro data

- Monthly GDP. The July economic activity proxy for Argentina comes out September 28, while the August readings are scheduled to be released for Mexico (September 25) and Chile (October 1) over the next two weeks. In all three cases, we expect gaps compared with a year ago to continue closing, but we anticipate that the month-on-month pace of recovery will slow in Argentina and Mexico, while the rebound should pick up speed in Chile.

- Inflation. Bi-monthly price data for the first half of September, due in both Brazil (September 23) and Mexico (September 24), are expected to show moderate pick-ups in inflation, while Peru’s monthly inflation reading, out October 1, should see price pressures continuing to decline toward an expected 1.1% y/y reading at end-2020.

USEFUL REFERENCES: FOCUS ON THE PACIFIC ALLIANCE

With global trade down, efforts amongst the four Pacific Alliance countries—Chile, Colombia, Mexico, and Peru—to deepen the integration of their markets is intensifying. Developments can be tracked on the Alliance’s home page and Twitter handle.

Events calendar: https://alianzapacifico.net/en/

Twitter feed: https://twitter.com/A_delPacifico

Markets Report: Pacific Alliance—Bond Issuance Prospects for 2021

Tania Escobedo Jacob, Associate Director

212.225.6256 (New York)

Latam Macro Strategy

tania.escobedojacob@scotiabank.com

- In the coming years, fiscal deficits in the Pacific Alliance are expected to remain significant. Governments across the region will likely rely more heavily on debt in 2021 to finance themselves.

- We look to the macroeconomic frameworks that have been published so far by national authorities to get a sense of what new government debt issuance could look like in 2021.

- The highest supply risk, in our view, will be faced by Peru, followed by Chile, which will see structurally higher financing needs.

- Issuance in Mexico and Colombia is expected to be closer to their historical averages and we think additional supply might be absorbed without causing major disruptions in the local curves.

MORE TO COME

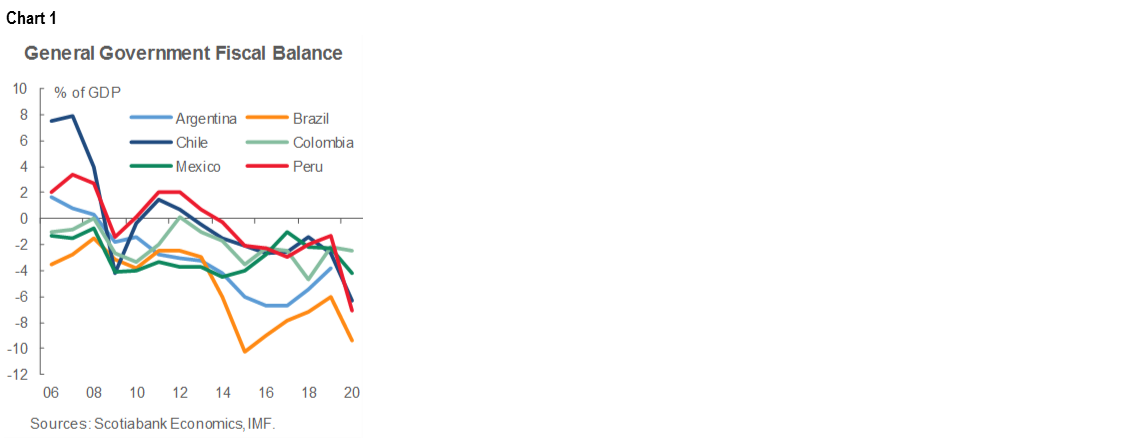

In the aftermath of the COVID-19 crisis, fiscal deficits in the Pacific Alliance are expected to remain significant as a result of the increase in spending needed to push these economies out of recession (chart 1). With drawdowns from “rainy-day-funds” already tapped as a financing source, governments across the region will likely rely more on debt issuance in 2021.

Prospective numbers are not set in stone and projections are prone to revisions, especially in the highly uncertain environment we are facing. Nevertheless, we rely on the macroeconomic frameworks and guidelines that have been published so far by the authorities in each country to get a sense of how the issuance could look in 2021.

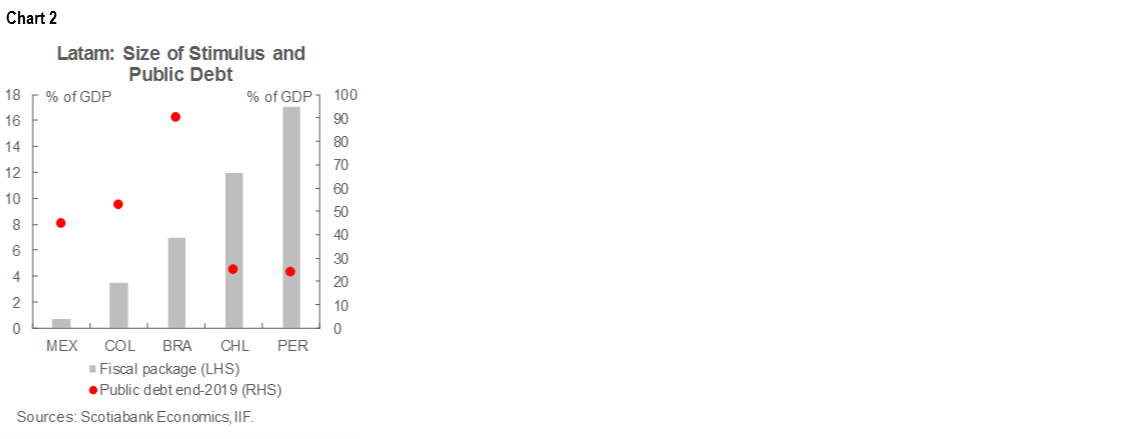

The highest supply risk, in our view, will be faced by Peru, where additional issuance might keep the Soberanos curve steep, preventing any sizeable rally in the longer maturities. Chile will also face structurally higher financing needs that will likely maintain an upward trend of issuance in the coming years, validating a higher risk premium in Chilean yields. Issuance in Mexico and Colombia is expected to be closer to the historical averages, in line with the smaller fiscal responses of both of their governments (chart 2) but will nevertheless see an increase. In both cases, we think that the additional supply should be absorbed without causing major disruptions, in line with the increased investor interest in both countries we are anticipating during 2021.

CHILE

Based on the financing needs for 2021 in Chile, our economic team has built the preliminary forecasts for issuance next year.

We anticipate government bond issuance to total USD 12 bn. From that, between USD 1.5 bn to USD 2 bn might be issued in foreign currency and the rest in local CLP debt. The breakdown between linkers and nominals, as well as the tenors of new issuance, will depend on the market conditions, but a reasonable expectation, in our view, is to see 50% in nominals (BTPs) and 50% in linkers (BTUs). We also do not rule out more liability management operations to extend the duration of government debt.

The USD 12 bn we are anticipating for bond issuance in 2021 is about 30% higher than the amounts we have seen in Chile in recent years, where the cap usually did not surpass USD 8 bn. The higher amounts are in line with the increase in the financing needed to cover the larger deficit—a trend that we think will continue in the coming years.

As we move forward, our economists in Santiago are forecasting an increase in the debt / GDP ratio from the 26% seen in 2019, to 48% in 2023 stemming from the fiscal package implemented to boost the economy in response to COVID-19 and the extra spending that resulted from the social protests of 2019. The constitutional referendum scheduled for October 2020 and the presidential elections coming in 2021 will keep the pressure high for the government to continue spending, resulting in a very narrow space to find a credible path to fiscal convergence in the medium-term and an increased likelihood of sovereign rating revisions in the coming months.

The structurally higher financing needs and the depletion of the sovereign wealth funds will, in our view, maintain the upward trend of issuance in the coming years, validating a higher risk premium in the Chilean yields. For now, we are favouring steepeners in the belly of the BTP curve and payers in the longer end.

COLOMBIA

Based on the information contained in the medium-term macroeconomic framework published by the Ministry of Finance on June 26, our team in Bogota has outlined preliminary prospects for issuance in 2021.

For local debt, we are anticipating that around COP 32 tn will be issued in 2021, which is above the COP 27.5 tn average of issuance in the last five years. From the total, we think that the Ministry of Finance might decide to go for a similar breakdown to the one seen in 2020, which is about 70% of the issuance done in COLTES and 30% in UVRs. As for external sources, the MoF is targeting USD 6.5 bn in funds. There is no official statement about the breakdown between global bond issuance and credit lines/debt from multilateral organizations, but we are anticipating that at least half of the USD 6.5 bn (USD 3.3 bn) will be obtained by issuing FX-denominated sovereign bonds. This amount would be slightly above the USD 2.8 bn average of the last five years.

From these preliminary numbers, we conclude that supply risk in Colombia will be contained next year. The addition of the new 30-year node to the curve and the increased general interest in EM assets we are anticipating in 2021 might also help to facilitate a smoother absorption of the additional amounts.

We are also expecting additional debt swap operations where the Ministry of Finance looks to reduce short-term obligations while increasing the curve's duration. In 2020, the MoF has so far made six debt swaps to increase the outstanding amount of long-term references and lower-coupon bonds; we think future operations will be concentrated in COLTES 24 due to the high coupon (10%) and COLTES 22 since its outstanding stock is one of the largest across the curve.

We still like the Colombian curve and continue to favour flatteners and see the possibility of around 150 bps in yield compression between the shorter and longer ends of the curve. There are a variety of potential ways to express this view.

MEXICO

From the information contained in the budget for 2021 presented by the Ministry of Finance on September 8, we have estimated that financing needs in the coming year will be around MXN 1,700 bn, which compares with the roughly MXN 1,900 bn originally planned for 2020.

For local debt, the deficit plus the amortizations forecasted for next year point to the need to issue about ~MXN 1,550 bn, which compares to the MXN 1,320 bn in 2020. In terms of global bonds, amortizations—which are the bulk of the financial needs for next year—are stable at USD 5.1 bn in 2021, compared with USD 5.2 bn in 2020.

In general, it looks like the liability management operations that the government has been pursuing are reducing the financing needs coming from the amortization side of local obligations and are partially offsetting the increase in the nominal annual deficit. If the Ministry follows the pattern seen in previous years, then MBonos and Udis should account for around 30% of the total issuance. This would mean total 2021 issuance of Mbonos of around MXN 230 bn, from the MXN 200 bn of 2020; at the same time, Udibonos would account for MXN 220 bn in new issuance, up from MXN 190 bn in 2020. As usual, maturities and volumes will be decided quarterly by the Ministry of Finance, but we think that it will be biased to increase the duration of its debt profile as much as market conditions allow. We are also expecting additional debt swaps operations to keep reducing short-term obligations while increasing the curve’s duration.

In this scenario, although there will be more paper available in the market, we think the increase in supply will be manageable and relatively easy to absorb, as the massive amount of liquidity in global markets finds its way into higher-yielding assets. Hence, despite the expected increase in supply, we still like the Mexican curve and continue to favour flatteners, with several options for medium-term strategies.

PERU

The financing requirements in Peru for 2021 are around 6.5% of GDP, according to the Macroeconomic Framework published by the Ministry of Finance on August 27. With sovereign funds nearly completely depleted (i.e., only USD 1 mn is left in the Fiscal Stabilization Fund, from the USD 5.3 bn it had at the beginning of 2020), most of the resources that will be needed in 2021 will have to come from new debt issuance.

Our economists in Lima are anticipating new issuance of about PEN 43 bn in Soberanos in 2021, more than two-times greater than the PEN 18 bn average seen from 2016 to 2019 and way above the PEN 4 bn we might end up seeing in 2020. External requirements point to the issuance of about USD 3.3 bn of global bonds in what is left of 2020. This is the biggest increase in supply we are expecting to see in the region

The high amount of debt issuance envisaged for 2021 does pose a supply risk for the Peruvian curve in the medium-term. As we move into the presidential elections in April 2021, the government might struggle to find windows of opportunity to go to the market, as political noise is likely to remain high, the economic crisis could deepen social tensions, and new waves of withdrawals from the AFPs may take place.

Ideally, we think the government would prefer to wait until yields in the longer part of the curve come off their recent highs before tapping the market, but there is only so long they can keep their financing plans on hold. At the same time, any issuance must be mindful of what the market could absorb. Our trading desk calculates that weekly issuance north of PEN 400 mn would be disruptive to the local bond market, which is still carrying a sizeable term premium, as implied by the steepness of the curve.

We think some of the most likely strategies for the MEF to allocate the new debt would be to re-tap the Soberano 2034 and 2040, and / or to issue a new 10-year or 15-year bond to increase the liquidity in the long end of the curve. In any case, we think the new supply will keep the Soberanos curve steep, preventing any sizeable rally in the longer maturities.

COUNTRY UPDATES

Argentina—The Structure Needs to Adjust

Brett House, VP & Deputy Chief Economist

416.863.7463

brett.house@scotiabank.com

The week just past delivered two major indications that the Fernandez Administration intends to stick with a distinctly heterodox policy stance despite its recent efforts to regularize its relationships with its creditors.

First, rather than using the just-completed swap of 99.4% of defaulted foreign-law bonds as a pivot point from which it could move to more sustainable policymaking, the authorities are instead doubling down on FX and capital controls. From Wednesday, September 16, the BCRA initiated new measures intended to push individuals and businesses to make greater use of the ARS. These included: (1) an additional 35% tax on purchases of USDs, with the limit on USD purchases maintained at USD 200 each month; (2) from September, the 35% tax will also apply to USD credit-card balances, with these balances now subsumed under the USD 200 monthly limit; (3) the holding period on FX-denominated assets settled in ARS was eliminated, but the holding period on FX assets not settled in ARS was extended to 15 days; and (4) companies were encouraged to reduce their foreign-currency debt and those with over USD 1 mn each month in maturing debt are required to present a plan for the related FX transactions.

Second, the Ministry of Economy submitted on Tuesday its 2021 proposed budget to Congress and released its major details, which revealed some rosy growth projections and only modest efforts toward fiscal consolidation. The Fernandez Administration now foresees a drop in real GDP of -12% y/y in 2020, versus our projection of -10% y/y, and forecasts 5.5% y/y real GDP growth in 2021 versus a more modest 4.7% y/y rebound in our forecasts (see Forecast Tables, pp. 2 and 3). Annual inflation is expected to come in at 29% y/y in 2020, in line with our forecast of 27.2% at end-2020.

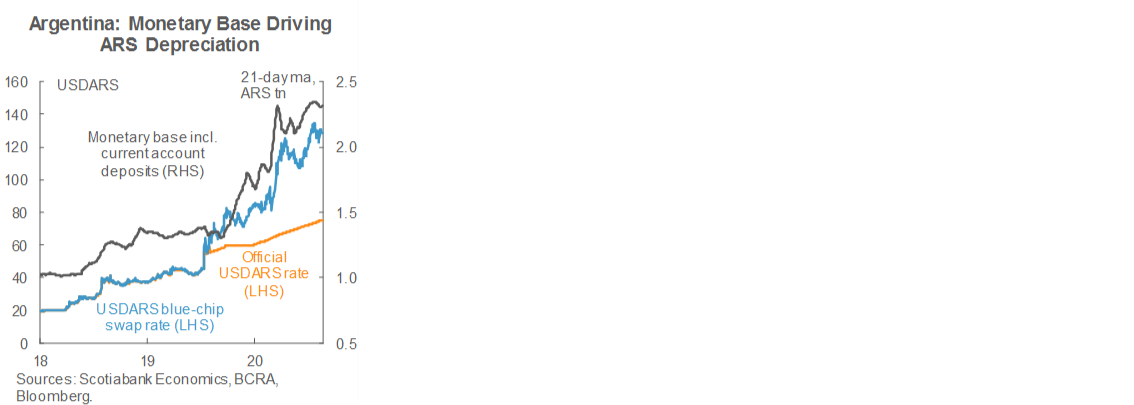

In the meat of the budget, the primary deficit for 2021 is pegged at -4.5% of GDP, compared with consensus expectations of -8.1% in 2020 and -5.0% in 2021. The government numbers represent an improvement in the primary balance between 2020 and 2021 of only about 3 ppts of GDP despite a big pick-up in growth that should swell tax revenues. Fiscal consolidation is set to be held back by a doubling in public infrastructure investment and a 7.5% y/y increase in current spending from 2020. About 40% of the deficit is set to be financed in the local ARS-denominated bond market, while 60% would be monetized by the BCRA. The draft budget acknowledges that, in this context of ongoing growth in the monetary base, even the official exchange rate would depreciate to around USDARS 102 by end-2021, slightly weaker than the USDARS 95 level we have projected. The blue-chip swap rate has already softened much more than this (chart).

Over the next fortnight, two major data milestones lie ahead. Argentina is the last of the Latam-6 to report official Q2 GDP data on Tuesday, September 22. While the print is stale at this point, we expect it to confirm a nearly -18% y/y downturn that marked the nadir of the lockdowns and a third year of recession. This leaves the country on substantially weaker ground than assumed in the IMF’s March DSA and will point to the need for even greater adjustment than envisaged at that time to put the country’s finances back on a sustainable footing. We expect to the July monthly GDP proxy, due on Monday, September 28, to show that the recovery is continuing, but slowing owing to extensions and re-impositions of pandemic control measures. Other data set to arrive over the next fortnight are likely to be aligned with this broad narrative.

Brazil—Prudence won the day at the BCB

Eduardo Suárez, VP, Latin America Economics

52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

Falling in line with the consensus call, and contrary to our expectation for a final cut, the BCB made the unanimous decision to leave the Selic rate unchanged at 2.00%. However, it didn’t go as far as shutting the door on additional easing. Overall, the BCB chose the path of caution in the face of fiscal and financial uncertainty.

The Copom highlighted an improvement in the external environment—noting lower capital flow volatility, as well as an improving growth outlook. However, it also pointed to the uncertainty related to a possible reduction of domestic stimulus—which is expected—hurting growth.

- The statement highlighted the rebound in the Brazilian economy, but one that is following a diverse pace by sectors. In addition, it warned that growth uncertainty is high for 2021, which is compounded by the planned expiry of the COVID-19 shock stimulus package.

- The Committee sees short-term risks to inflation, particularly due to seasonal food price shocks, as well as the normalization of some services prices. However, it also acknowledges that inflation metrics remain sub-target as are expectations for the BCB’s policy horizon (see chart below for 12 month ahead inflation expectations, while end-2021 consensus is 3.01%, and end-2022 sits at 3.50%). In addition, all core inflation metrics remain sub-bottom-of-the-target. We see inflation remaining subdued short term, but as the economy gains traction into 2021, we anticipate the BCB will be forced into a relatively fast-paced unwind of its stimulus, but that is a story for 2021.

- The Committee sees a risk that low capacity utilization will keep inflation below the target range—thus supporting the case for low-for-longer rates. On the flip side of that, the fiscal shock from the pandemic-response, alongside the uncertainty over the reform / fiscal consolidation process, adds risks of forcing rates to the upside.

- The key risk which is holding further stimulus at bay appears to be concerns over fiscal risks affecting financial stability.

The Copom was quite explicit in stating that additional stimulus room is limited, and that such stimulus would be delivered gradually if at all. The main factor capping room for additional stimulus remains the same, according to the BCB—basically fiscal and financial stability risks. Going forward, we see two scenarios for monetary policy over the next 6 months: (1) a hold, as the BCB maintains very loose policy settings to help the economy get back on its feet, and (2) a scenario where reforms make some progress and the economy remains weak, in which case the BCB could cut the Selic further, although in that scenario we’d expect small gradual moves (i.e., intermittent -25 bps cuts, with the total additional easing being 25bps–50bps).

Chile—Withdrawals from Pension Funds Surpass USD 15 bn

Jorge Selaive, Chief Economist, Chile

56.2.2939.1092 (Chile)

jorge.selaive@scotiabank.cl

Carlos Muñoz, Senior Economist

56.2.2619.6848 (Chile)

carlos.munoz@scotiabank.cl

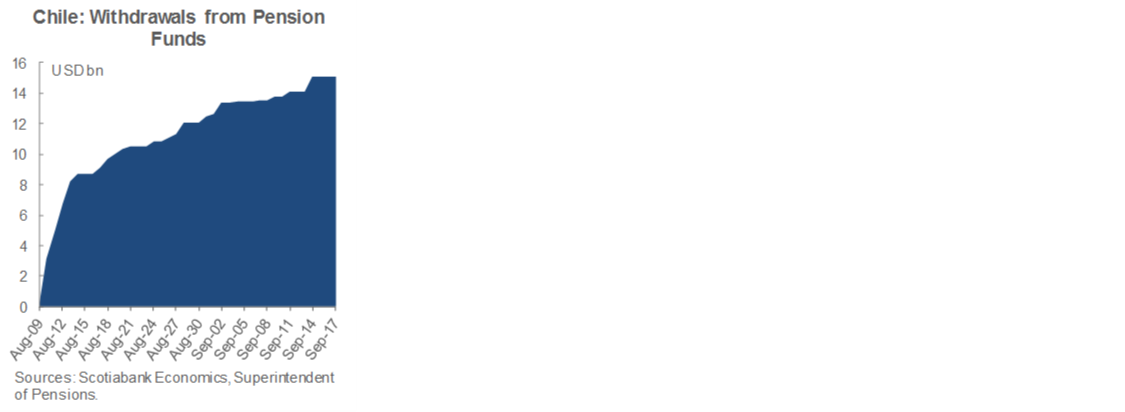

Following a stabilization of the COVID-19 trajectory in Chile, with new cases below the 2,000 per-day threshold, authorities have continued to expand the re-opening of the economy. In Gran Santiago, not only have offices and factories from different sectors resumed activities, but restaurants, shopping malls and recreational centers have also gradually reopened. Thus, our high-frequency indicators show that sales continue as evidence of a strong recovery—exceeding pre-COVID-19 levels and, in September, surpassing the usual Christmas expansion. We observed heterogeneity across sectors: retailers and supermarkets are receiving most of the liquidity from fiscal support and the withdrawal of pension funds, but other sectors/services are starting to recover as well.

Pension fund contributors have withdrawn more than USD 15 bn from their retirement accounts since August 10, and our estimates indicate that more than half of that money will go directly to consumption, contributing around 3 percentage points to GDP. This, along with the other measures implemented by the government to support household incomes, have underpinned the recovery of the economy, which saw its worst declines during April and May.

A concern has arisen in the credit market, as a result of a slowdown in the delivery of loans from financial institutions in late-August and September. Since the pandemic began, credit has flowed counter cyclically to firms, but it shows a worrying slowdown at the margin, especially in commercial loans. In the BCCh’s minutes to the September 1st meeting, released September 16, the Board did not mention this risk, nor did they mention any discussion about the technical minimum of the monetary policy rate, currently at 0.5%. What they did express was their commitment to maintain an expansionary monetary policy to support the economic recovery over the majority of the monetary-policy horizon.

In the following weeks, we will see the release of several tier-1 indicators. First, on September 30, the INE will release employment and sectoral data for August. We expect the unemployment rate to continue increasing, reaching a print of about 14%, after the 13.1% in the moving quarter of May–July. Retail Sales will show a strong recovery in August, increasing around 1% y/y, following the different measures aimed to support family incomes. Then, on October 1, the central bank will publish the monthly GDP indicator for August. We estimate that activity fell around -8% y/y in August, but will show a significant month-over-month growth of around 6.5% as more activities resumed operations. Finally, further out, on October 8, inflation data for September will be released, where we expect an increase of 0.3% m/m. With this print, annual inflation would reach 2.7% y/y, explained by increases in fuels, new cars and transport services. We continue forecasting an annual inflation rate of 2.2% y/y for year-end.

Colombia—USDCOP Hovering Around Fair Value with High Volatility

Sergio Olarte, Head Economist, Colombia

57.1.745.6300 (Colombia)

sergio.olarte@co.scotiabank.com

Jackeline Piraján, Economist

57.1.745.6300 (Colombia)

jackeline.pirajan@co.scotiabank.com

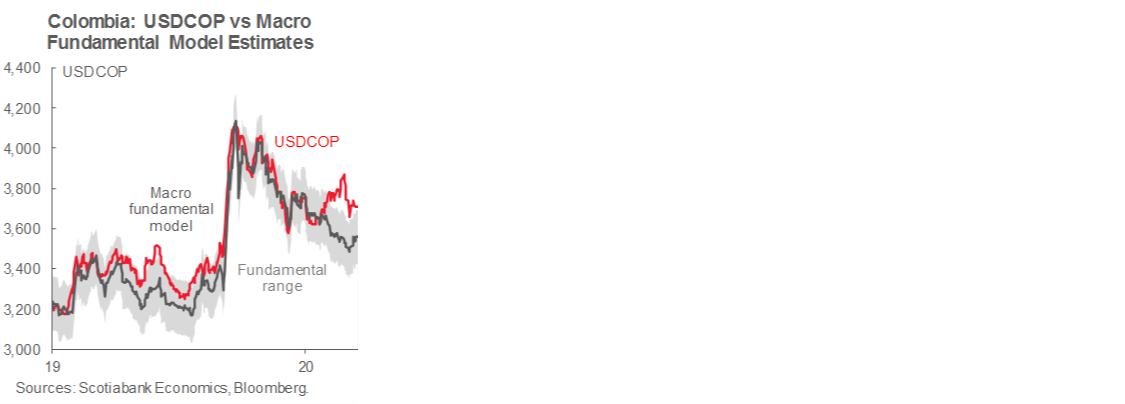

The COVID-19 shock suddenly interrupted the world economy's normal functioning and has intensified fiscal and external imbalances in many countries—and Colombia is no exception. In Colombia, fiscal sustainability concerns have been raised due to the suspension of fiscal rule and the higher indebtedness requirements in 2020 and 2021. In fact, the debt stock is expected to increase to a dangerous over 60% of GDP ratio this year. On the other side, the decline in world trade has raised concerns regarding the external deficit and its financing, especially in countries with a relatively high current account deficit such as Colombia. All these elements have increased the risk premiums in asset prices, and the COP in particular has structurally depreciated as a result of the COVID-19 and oil-price shock: the REER has depreciated by -9.6% YTD. However, it is unclear what the new fair range of the COP is now.

Colombia doesn't do any domestic transactions in dollars, contrary to some regional peers where the use of foreign currency is allowed. This said, the structure of the balance of payments (BoP) is crucial in assessing a real exchange rate equilibrium. In the first half of 2020, BoP results have shown that—although Colombia continues to have a higher current account deficit than peers—it has been reduced significantly due to what we call automatic stabilizers. In fact, while the trade balance did not change much in H1 2020, and remittances only fell by -4.9% y/y, the income account deficit was almost half that of the same period last year on weaker earnings outflows from companies with FDI in Colombia.

On the financing side, it is notable that, although FDI is no longer the main financing source for the current account deficit, it has dropped at a slower pace than was expected, and 67% of total FDI now goes to non-mining-related sectors. In 2020, the main source of current account deficit financing has been the additional public external debt needed to face the COVID-19 shock. That said, from the structural side, we don't see further pressures for the depreciation of COP, whose medium-term fair value is estimated at around USDCOP 3,650, which implies a structural depreciation of -11% y/y.

From a short-term perspective, we evaluate the COP’s fundamental value using a model structure that includes three main elements: terms of trade, interest-rate spreads with the US, and some risk metrics for idiosyncratic and shared characteristics with other emerging markets. The fundamental model concludes that traditional measurable components do not explain recent volatility and COP underperformance. Instead, other non-measurable forces, such as extant global geopolitical uncertainty ahead of the US elections and some risk premium due to rising political concerns in Latin America, among others, are leading to a divorce between the fundamental model’s indications and market pricing of the COP.

Although we believe the significant deviation of USDCOP from its fundamentals is not structurally sustainable, we think FX volatility will continue to be high. However, we expect a convergence of the USDCOP to its fundamental range of 3,550–3,650 after some critical events are resolved. A clearer view of the US elections, joined with more progress on the economic recovery, would reduce uncertainty in the markets and better reflect the improvement of Colombia’s fundamentals, which include higher oil prices, lower interest rates, greater international liquidity, and lower risk perception.

Mexico—Doubling Down on a Risky Bet

Mario Correa, Economic Research Director

52.55.5123.2683 (Mexico)

mcorrea@scotiacb.com.mx

The Government sent to Congress the package of documents that will define a large part of the public policy during 2021. Since there is a majority in Congress from the party in government, it is expected that there will be small changes, if any. The starting point is the macroeconomic framework that outlines the forecasts and assumptions about the main economic variables used to estimate public revenues which then determine the spending side. Once again, there is a very optimistic outlook in the government’s view, especially in the GDP forecasts of -8.0% y/y for 2020 and 4.6% y/y for 2021; when the market consensus is a -10.0% y/y contraction in 2020 and a 3.0% y/y rebound in 2021. Another optimistic assumption is that about oil production, for which the government projects 1.857 mn barrels per day on average during 2021. This apparently excessive optimism is likely to produce an overestimation of fiscal revenues and put extra pressure on a tight budget. Worth noting is the insistence on healthy public finances, but the extraordinary increase in the public debt / GDP ratio represents a deterioration of the fiscal footing. Coupled with a descending trend in the long-term economic growth forecast, as reported by the Banco de Mexico survey; this deteriorated fiscal stance increases the probability of a new downgrade of the sovereign credit ratings in coming months. On the budget, the government is doubling down on its strategy of heavy transfers through the priority social programs and investment focused on their priority projects, such as the Santa Lucía Airport and the Mayan Train. The problem is that, as the Finance Minister Herrera has recognized, there are no more buffers (“guardaditos”) built into the budget, which then will be stressed from the outset. Many other countries provided plentiful fiscal relief packages to their firms and households to facilitate the economic recovery. That was not the case in Mexico, and the consequences of this decision will be seen in the coming months.

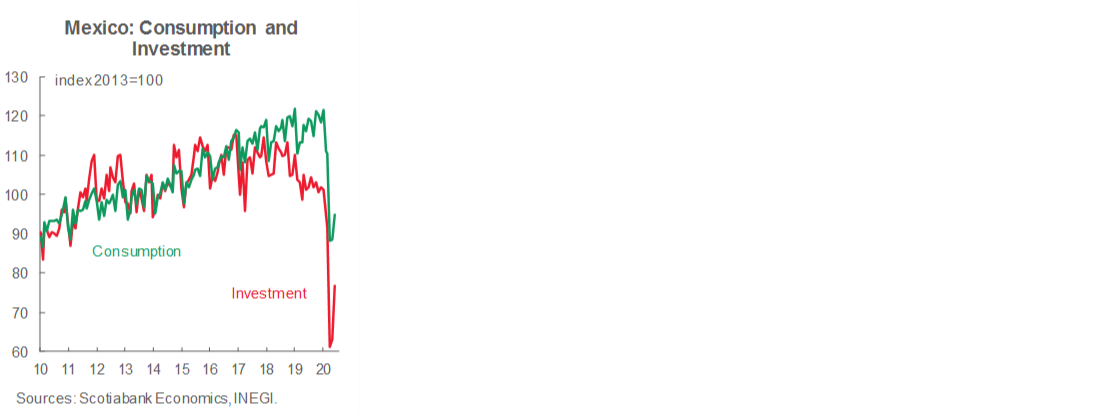

Recent economic activity indicators suggest that the recovery has begun, but at a slow and somewhat tepid pace. In June, gross fixed investment (GFI) grew 20.1% on a monthly basis, but was -25.2% lower than a year ago. Its main components fell -26.6% y/y in construction and -25.3% y/y in machinery and equipment, with a bottom line of weakness across the board. Looking at the not seasonally adjusted figures, investment experienced the seventeenth consecutive decline, to fall -21.3% y/y in the first half of the year, the deepest drop in 25 years.

Domestic private consumption grew 5.5% m/m in June according to seasonally adjusted figures, but was -19.6% below a year ago. In the first half of 2020, private consumption growth averaged a rate of -11.3% y/y (versus 0.7% y/y for the first half of 2019), its weakest rate for the same period since records began in 1994. To have a better idea of the pace of the recovery, we should look at the index level of economic indicators. In the accompanying chart we can see how the recovery in both indicators is slow and we are far from the pre-pandemic levels.

Industrial activity recovered 6.9% m/m in July, but was 11.6% below the level a year ago. The main component of industry, manufacturing activity, rebounded 11.0% m/m and was 9.5% below the level reached twelve months ago. The second most important component, construction, barely grew 0.9% m/m, which implied an annual contraction of -23.7% y/y. While manufacturing is mainly export-oriented and is being pulled by the US economic recovery, construction is driven mainly by internal demand. We should remember that construction is a forward-looking indicator of economic activity, which is a gloomy sign for what is to come in the near future.

The number of people insured in the Mexican Social Security Institute (IMSS) increased by 92.4 thousand in August, which was positive news that points to a recovery in formal employment. IMSS wage data also reported a nominal increase of 6.4% y/y. In real terms, base salary growth for formal workers moderated from 2.7% y/y in July to 2.3% y/y.

Inflation once again surprised on the upside, with readings of 0.39% m/m for the general index and 0.32% m/m for the core component in August. General inflation reached 4.05% in the y/y comparison, above the 4.0% threshold for the first time since May of last year; while core inflation reached 3.97% y/y, the highest since March 2018. Rising inflation when demand has plummeted is somewhat puzzling, and should be one of the key considerations for Banco de Mexico’s monetary policy decisions.

Finally, the consumer confidence index (CCI) remained at 35.1 points in nsa terms, still lower than a year earlier by 8.8 points and marking a ninth consecutive month where the index was lower than in the same month a year before. Still, there were some positive signs in the reading: the index rose for a third month in a row, although by a modest 0.6 points from July to August, taking the CCI to its highest level since April.

For the next week, the monetary policy decision on the 24th will be the key economic event. Most analysts are expecting a -25 bps cut in the reference interest rate that could be the last in the foreseeable future. We, and some others, think that the interest rate will remain unchanged due to the recent inflation performance. Inflation for the first half of September will be published on the same day, and it is likely that a new reading above 4% in the y/y comparison will be observed. Aggregate supply and demand figures for Q2 will be released on the 21st. The Global Economic Indicator for July will be released next Friday, giving us the first hard data of the services production at the beginning of the third quarter, which will be very useful to contrast the pace of the recovery with the onset expectations. Commercial activity figures for July will also be released. For the week starting on September 28, data for the trade balance, financial activity, unemployment, remittances, and public finances for the month of August will be released. Results for Banco de Mexico’s economic expectations survey will be published on October 1.

Peru—Economic and COVID-19 Trends are Improving; Unsettled Politics Continue

Guillermo Arbe, Head of Economic Research

51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

It’s been a busy week in Peru, with significant developments in politics, the economy and COVID-19 statistics. Most COVID-19 trends are improving, with new cases, daily deaths, hospitalizations, and so forth, between 40% and 60% below their heights of four weeks ago. This has given the government room to lift the stay-at-home rule for Sundays and to pre-announce the likelihood that international flights may resume in mid-October.

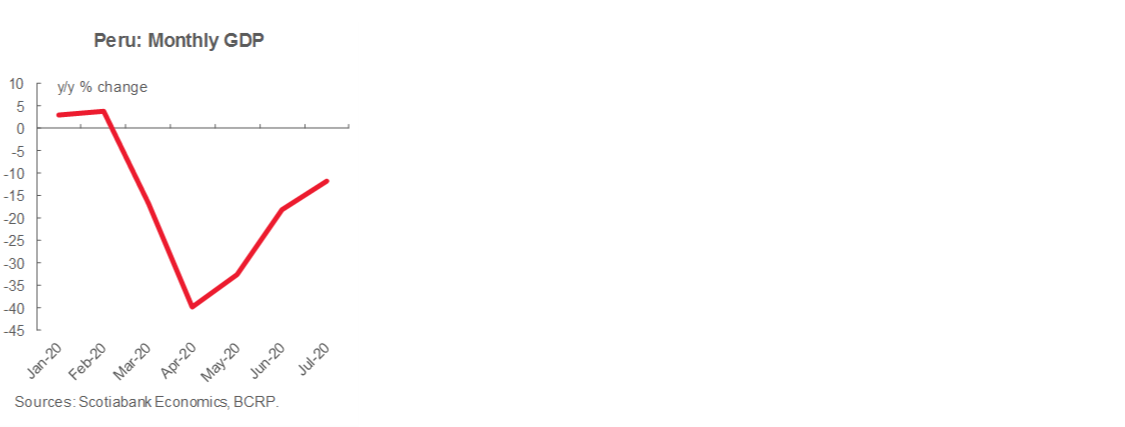

Recent information on the economy has been broadly in line with expectations. GDP growth in July—phase 3 of the unlocking process—was up 7.4% in month-on-month terms (-11.7% y/y), the best performance since March, as the recovery continued. Sectors that are at pre-COVID-19 levels include agriculture, fishing, construction, supermarkets and, presumably, mining. Construction was a pleasant surprise, with sales in August surpassing 2019 monthly average levels. On the other hand, public sector investment disappointed once again in August, declining -20% y/y, and continuing to be the main component of demand dragging on economic growth. There was a silver lining, however. Public investment at the municipal level rose modestly for the first time since February. It’s our understanding that this was linked to the Arranca Perú stimulus program, although it is not quite clear how much of this was actual execution.

The BCRP kept the reference rate at 0.25%, which was pretty much a non-event, as there is actually very little motivation, or expectation, for it to do anything else for a long time. Meanwhile, the PEN finally began to strengthen, despite volatility due to political developments. USD inflows from mining exports are finally beginning to weigh on the market. At the same time, corporate demand to switch out of Reactiva-linked PEN liquidity has begun to ebb.

Much of the economic news was overshadowed by political events, which are still ongoing. The upshot is that President Vizcarra thwarted an attempt by certain members of Congress to oust him. Proceedings for his removal were initiated based on accusations that he had tried to hide evidence of cronyism. The attempt fell through as reports emerged suggesting that this was part of a power play to replace Pres. Vizcarra with the President of Congress, Manuel Merino, with the possible intention of then postponing the 2021 elections. This smelled too much like a coup attempt for even many of the other members of Congress to stomach. However, the lines of confrontation between the Executive and a large portion of Congress have been drawn, and some of the issues of confrontation have yet to be resolved, promising a rocky political ride for a while yet.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | pirajaj@colptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.