ECONOMIC OVERVIEW

- After a busy couple of weeks of CPI releases and central bank decisions in Latam and the G10, next week’s regional calendar is a fair bit quieter with the release of Peruvian, Brazilian, and Colombian economic activity figures as the highlight.

- A sharp repricing of Fed cut expectations over the past week (and year-to-date) has meant that recent on-expectation or misses in Latam inflation data are unlikely to translate into faster easing from local central banks; in fact, the opposite is more likely.

- In today’s report, our team in Peru previews next week’s GDP print that they expect will show a strong (but perhaps misleading) expansion in output, while our economists in Mexico outline the drivers for the strength of the MXN, the best performing major currency of 2024.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Mexico and Peru.

MARKET EVENTS & INDICATORS

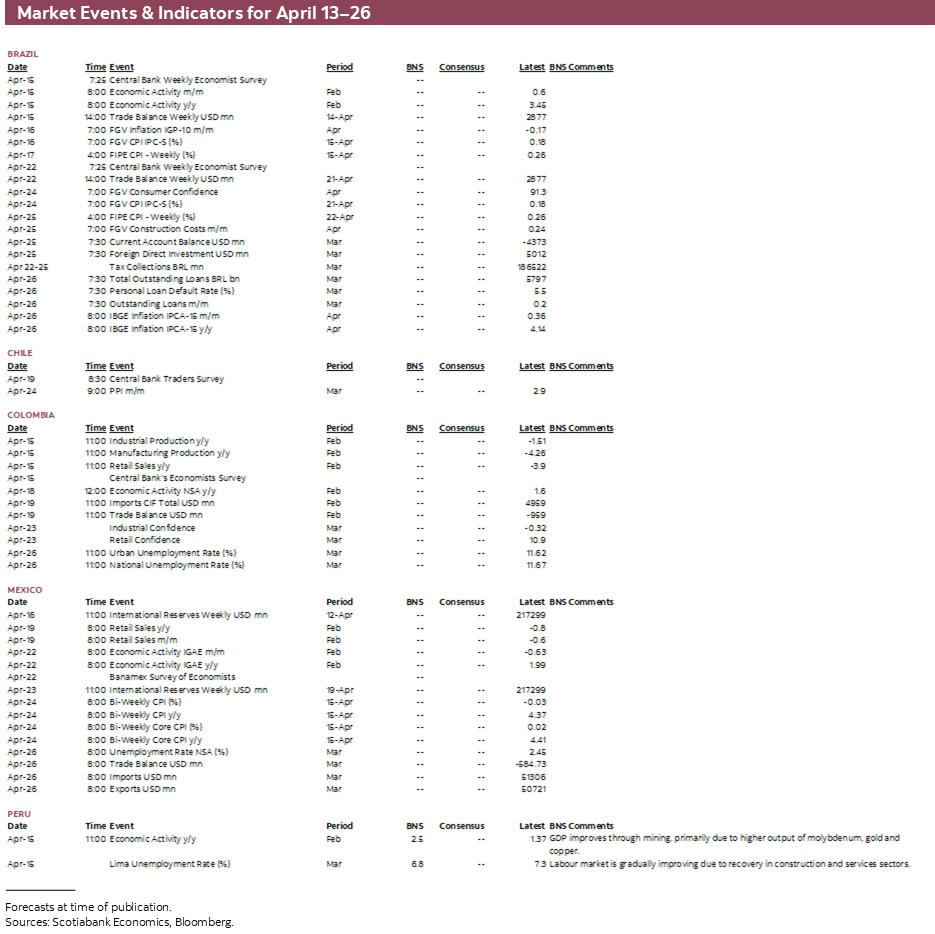

- A comprehensive risk calendar with selected highlights for the period April 13–26 across the Pacific Alliance countries and Brazil.

Chart of the Week

ECONOMIC OVERVIEW: POST CPI ‘CALM’ WITH ECONOMIC ACTIVITY DATA ON TAP

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- After a busy couple of weeks of CPI releases and central bank decisions in Latam and the G10, next week’s regional calendar is a fair bit quieter with the release of Peruvian, Brazilian, and Colombian economic activity figures as the highlight.

- A sharp repricing of Fed cut expectations over the past week (and year-to-date) has meant that recent on-expectation or misses in Latam inflation data are unlikely to translate into faster easing from local central banks; in fact, the opposite is more likely.

- In today’s report, our team in Peru previews next week’s GDP print that they expect will show a strong (but perhaps misleading) expansion in output, while our economists in Mexico outline the drivers for the strength of the MXN, the best performing major currency of 2024.

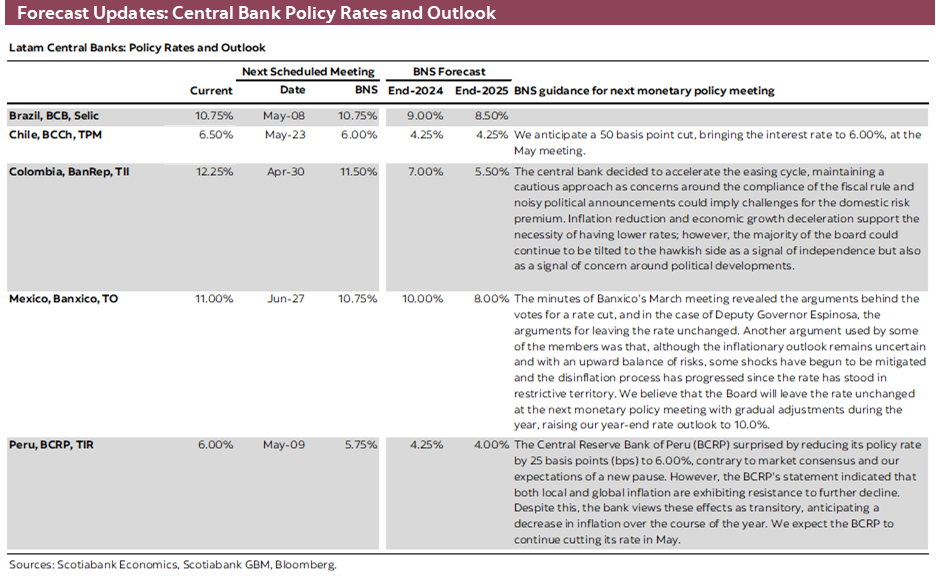

It’s the calm after the storm in Latam and the US. We’re moving on from the flood of March CPI releases in the Americas, where we got a beat in the US and Peru but misses in Chile, Mexico, and Brazil and a roughly as expected Colombian print (we’re not quite done yet, however, as Canadian CPI is due next Tuesday). We also get a bit of a break in between rate decisions from key global central banks after widely expected pauses from the RBNZ, ECB, and BoC and the BCCh’s unsurprising 75bps cut on the 2nd, all in contrast to the BCRP’s surprise 25bps reduction (see Latam Daily).

Overall, considering the BCRP’s surprise cut and the broadly benign set of March inflation figures in the Latam countries, one may have thought that perhaps faster easing from the region’s central banks was on the horizon or being mulled. Wrong. A massive repricing of Fed cut expectations since last Friday’s jobs report—that now amounts to ~120bps less in cuts priced in by year-end—has also resulted in a reassessment of some Latam central bank forecasts (e.g. about a full 25bps cut less priced in from Banxico and the BCCh this year). Narrowing rate differentials vis-à-vis the US can cause unwanted increases in prices via weaker currencies, and also stand as a risk to domestic assets as the relative appeal US paper increases.

Unfortunately, data in local Latam calendars next week are unlikely to significantly move economists or markets one way or the other. From a CPI flood, we now enter a streak of monthly economic activity releases for February, starting with Peru on Monday, Brazil on Wednesday, and Colombia on Thursday; Mexico follows next Monday, and Chile already released a strong beat for the month. Central bank surveys will also be important to follow, with results from BCB and BanRep economist polls and the BCCh’s traders survey.

In today’s Latam Weekly, our team in Peru previews next week’s monthly GDP print, released on Monday alongside unemployment rate figures. Their preliminary tracking of industry/sectoral data points to a ~2.5% y/y expansion—not too shabby after of the last thirteen prints, nine have been contractions. Of course, an extra day in February 2024 helps, as does the low base due to social unrest. Still, progress is progress and Peru’s economy looks on firmer footing in early-2024, and soon we’ll have the flow of pension fund withdrawals adding to domestic demand (see Latam Daily).

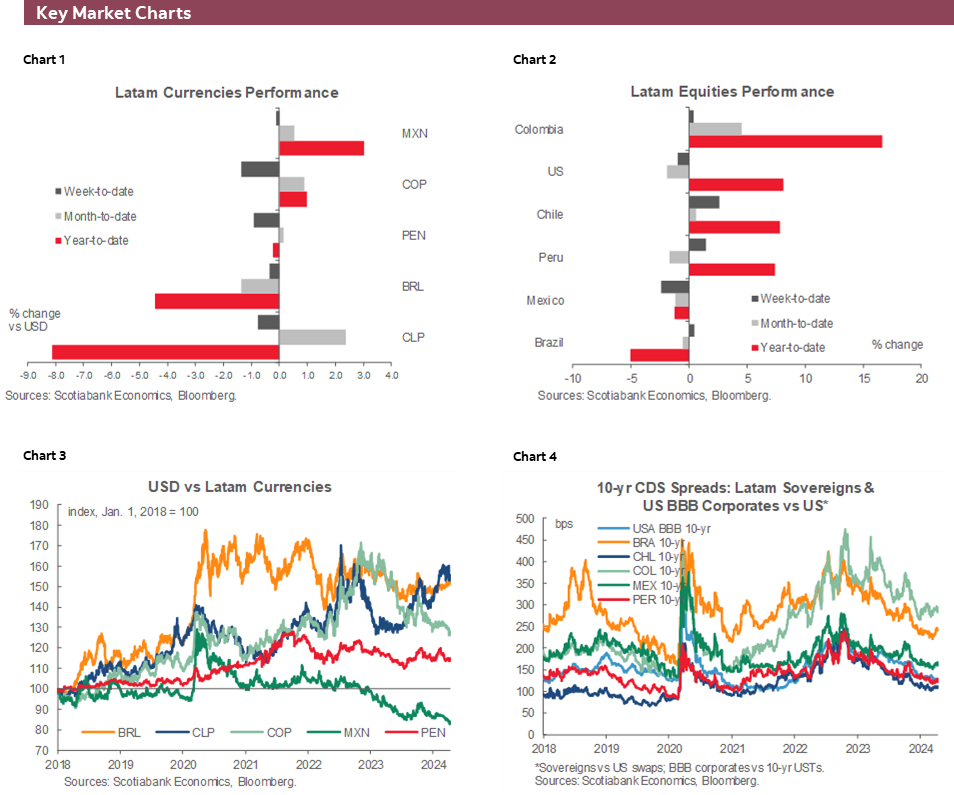

On Tuesday the Mexican peso reached a new best level since 2015, around ~16.25, supported by the expectation that Banxico will take it very slow in its pace of easing—taking notes from Fed policy. But, it’s not just Banxico rates policy that is helping out the MXN. Our Mexico economists outline in today’s report the main reasons behind the peso’s strength that is tracking around 3% year-to-date appreciation that makes it the best major currency against the dollar. In fact, only the MXN and PEN (just about) have appreciated versus the USD in 2024.

From outside of Latam, local markets may be sensitive to US retail sales and a parade of Fed speakers, Canadian and Japanese CPI, UK CPI and jobs/wages, and China’s central bank announcement and Q1 GDP figures, while geopolitical developments (Israel/Iran, Ukraine/Russia) remain a major source for possible sharp moves in commodity and equity/high-beta markets.

PACIFIC ALLIANCE COUNTRY UPDATES

Mexico—Mexican Peso Strength and Drivers

Brian Pérez, Quant Analyst

+52.55.5123.1221 (Mexico)

bperezgu@scotiabank.com.mx

Miguel Saldaña, Economist

+52.55.5123.1718 (Mexico)

msaldanab@scotiabank.com.mx

The Mexican peso has continued to appreciate against the dollar, closing Q1 2024 with a profit of +2.38%, maintaining the strength observed over the last two years. This week the USDMXN reached the lowest levels since 2015, standing at $16.26 (chart 1), and then it bounced back, after Mexican inflation data came in lower than expected, causing some uncertainty about the trajectory that will follow in the next few months, since in the latest surveys the year-end forecast has been revised to up 4.15%. Likewise, the US higher-than-expected inflation data moved the peso back to $16.51, reinforcing the perspective that the Fed could postpone rate cuts, resulting in only two cuts during the year, where some analysts consider that inflation will be so persistent that it will force the Fed rate to remain unchanged during 2024, which is currently in the 5.25%–5.50% range.

The most important factors for the USDMXN strength are:

- The flow of remittances recorded in recent years, which in 2023 exceeded $60 billion dollars. This contrasts with around $48 billion, which would be the amount of inertial receipt of remittances. Furthermore, a significant slowdown in the US economy is not expected, after the latest data showed that job openings and employment remain solid, so the flow of remittances would stand at similar levels.

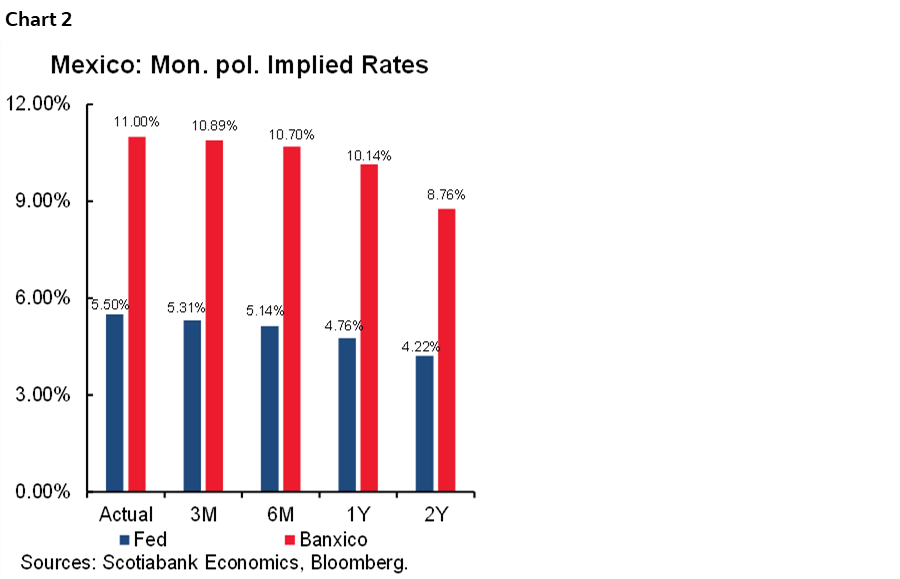

- The real rate remains in restrictive levels, although Banxico cut to 11.0% in the last monetary policy meeting, and most analysts anticipate the next change in June—the consensus is not yet broad, as some analysts consider it appropriate for another cut in May given lower than expected readings in economic activity indicators. In this sense, if the Fed does not cut soon, it could put some pressure on Banxico to maintain its rate longer. Implicit rates have been increasing, now they expect rates close to 10.0% in twelve months and 8.75% in two years (chart 2). Mexico has one of the highest real interest rates among the thirty-two most liquid currencies in the world.

- Tourism data indicates a growth in the sector’s GDP of 7.6% seasonally adjusted y/y in Q3 2023. The INEGI International Traveler Survey shows that in February 2024, 6.626 million people entered the country, equivalent to a annual growth of 12.2% annually, increasing the demand for pesos.

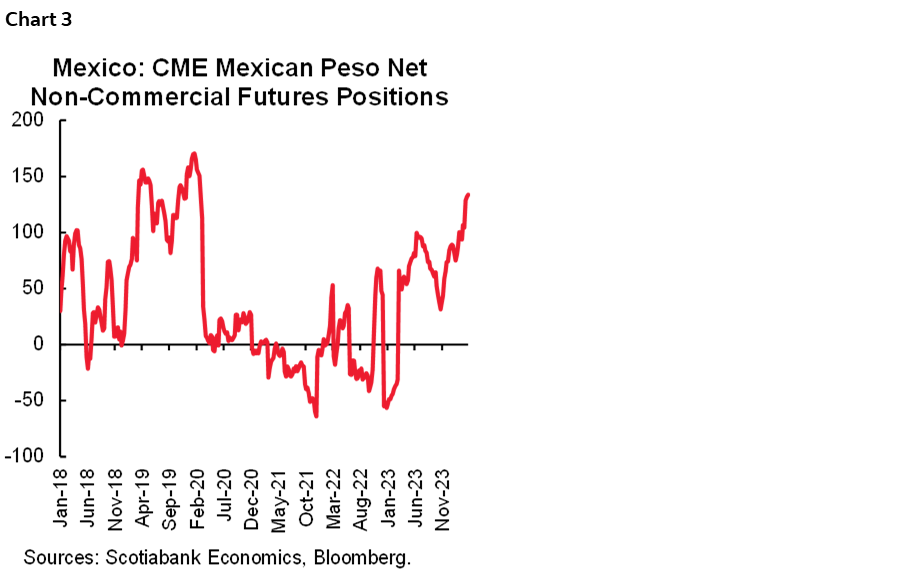

- The net speculative position that is built with futures and options of non-commercial operators shows that they are betting more on an appreciation of the Mexican peso (chart 3).

- Although the federal government projects higher public debt for 2024, it has remained at relatively stable levels since the pandemic, in contrast to the behaviour in other emerging markets. According to IMF data, gross debt is around 52.7% as a percentage of GDP, registering healthier levels than developed economies, for example, Japan 255.2%, France 110%, Canada 106.4%, among others. The above may have generated a certain level of confidence and contributed to an appreciation of the peso.

- Optimism over nearshoring continues, as well as expectations for the Mexican economy in general, although this may deteriorate if the gross fixed investment and FDI data do not support the view that more companies are coming to settle in Mexico.

Something also surprising about this strength is the contrast with G10 currencies, since year-to-date they have all depreciated. Just to mention some of them, the GBP has fallen 2%, the EUR -3.5% and the JPY -8.0%. On the other hand, a significant change has not yet been seen in the indicators because of nearshoring, in fact, the World Bank just lowered the growth forecast for Mexico to 2.3% (2.6% previously), although the data is still scarce. Even so, we estimate that growth will not present a significant slowdown, so we estimate 2.8% in 2024, linked to the increase in the fiscal deficit and that consumption remains at good levels, which can help the exchange rate in the short term.

Peru—GDP Growth and the Weather Both Turn Positive

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

On April 15th, the figure for February GDP growth will be released. We expect growth of approximately 2.6% YoY, based on preliminary sector growth figures. This is not all bad at first glance. Note, however, that February 2024 was a leap year, which adds one day to growth. It’s also off a low base, given the social protests a year ago. So one must take the February figure, which could feasibility turn out to be the highest monthly growth rate since mid-2022, with caution as it will be overstating the real strength of the economy.

February GDP figures for certain sectors have already been released. The most significantly positive figure that has released is mining GDP, up 17% YoY in February. This alone should add 1.6 percentage points to growth. On the other hand, fishing GDP declined 31% YoY and, together with processing, 0.6 percentage points off growth.

Domestic demand sectors would have held up well, although this is where the leap year additional day would have helped. We do not have much evidence yet, outside of cement demand and public sector investment which, together suggest that construction GDP growth could have surpassed 4% YoY.

February will have been the second consecutive month of mild, but clearly positive, growth, and ratifies that the 2023 recession is over. GDP growth in March may be subdued a bit, due to the Easter week calendar change, but what March loses to this will be regained in April. In any event, what is now also officially over is El Niño. Coastal waters are adequately cold, and the weather is fine!

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.