ECONOMIC OVERVIEW

- After a busy week of central bank decisions and key data, we turn the page to a busy week of central bank decisions and key data, with Banxico and BCRP rate announcements and regional CPI prints on tap.

- Both central bank decisions are too close to call, so neither of two cuts nor two holds nor one cut and one hold would greatly surprise economists and markets. In today’s report, our teams in Mexico and Peru discuss their expectations for next week’s decisions, with a likelier cut and a likelier hold in store.

- A hot Mexican CPI print the morning of Banxico’s decision could flip expectations. Chile’s inflation reading could make or break an early-September cut, while Brazilian data will not be enough to motivate more BCB easing.

- On the other hand, a nice slowdown in still-high Colombian inflation may be good enough for a larger 75bps cut in September; BanRep’s meeting minutes may offer some guidance on Monday.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Mexico and Peru.

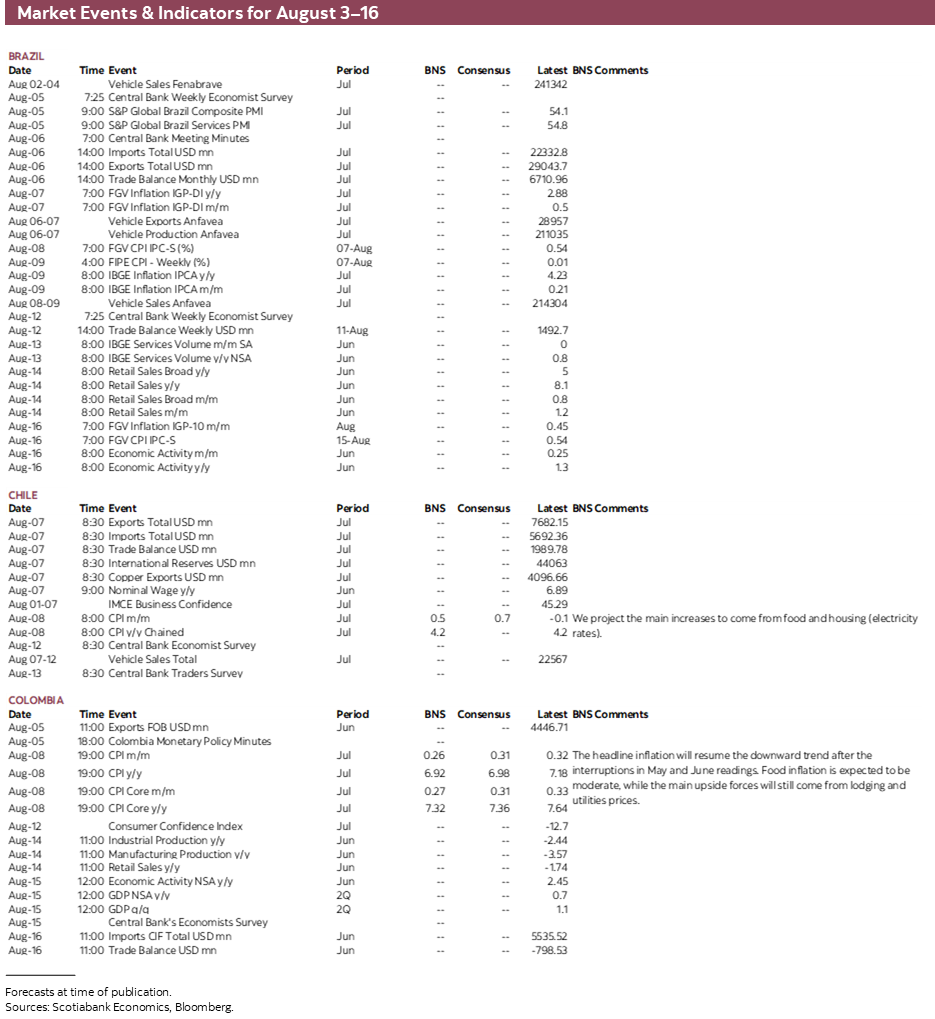

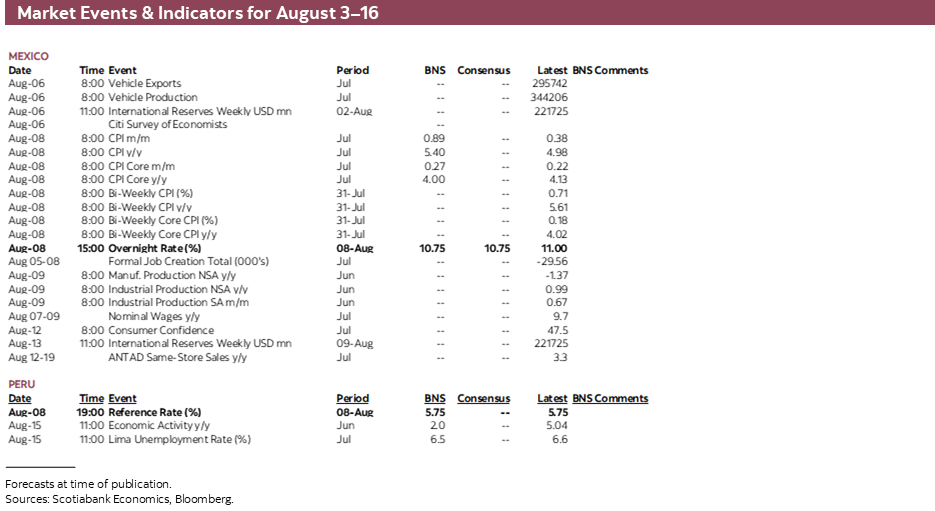

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period August 3–16 across the Pacific Alliance countries and Brazil.

Charts of the Week

ECONOMIC OVERVIEW: BANXICO AND BCRP, LATAM CPI

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- After a busy week of central bank decisions and key data, we turn the page to a busy week of central bank decisions and key data, with Banxico and BCRP rate announcements and regional CPI prints on tap.

- Both central bank decisions are too close to call, so neither of two cuts nor two holds nor one cut and one hold would greatly surprise economists and markets. In today’s report, our teams in Mexico and Peru discuss their expectations for next week’s decisions, with a likelier cut and a likelier hold in store.

- A hot Mexican CPI print the morning of Banxico’s decision could flip expectations. Chile’s inflation reading could make or break an early-September cut, while Brazilian data will not be enough to motivate more BCB easing.

- On the other hand, a nice slowdown in still-high Colombian inflation may be good enough for a larger 75bps cut in September; BanRep’s meeting minutes may offer some guidance on Monday.

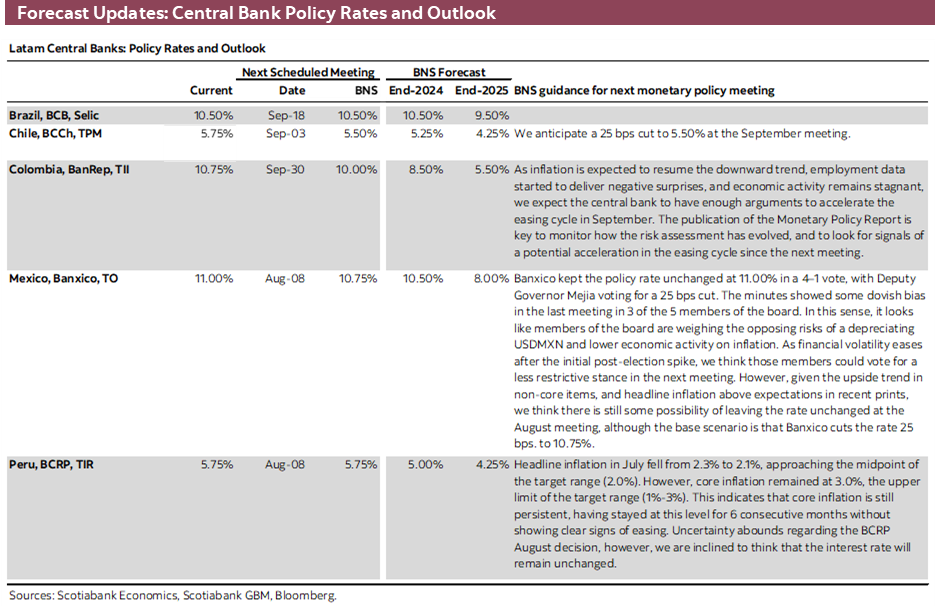

From a busy week of central bank decisions and key data, we turn the page to a busy week of central bank decisions and key data. From an unsurprising 50bps cut by BanRep and no change by the BCB, to a surprising rate hold by the BCCh, we now await highly uncertain rate announcements by Banxico and the BCRP on Thursday. That same morning’s release of Chilean and Mexican CPI and Friday’s Colombian and Brazilian CPI will be in focus on the data front after a relatively quiet first half of the week—more so since Peru and Colombia are closed for business on Tuesday and Wednesday, respectively.

Outside of Latam, things maybe do calm down a bit after the recent run of G10 central bank decisions with only the RBA due to announce a likely unchanged cash rate. Meanwhile, on the ex-Latam data front, US ISM services, Canadian jobs, Chinese international trade and CPI, and New Zealand employment are the highlight. Australian and Canadian markets are also shut for holidays on Monday. As always, central bankers’ comments may move markets as will geopolitical developments with Middle East risks as the top concern.

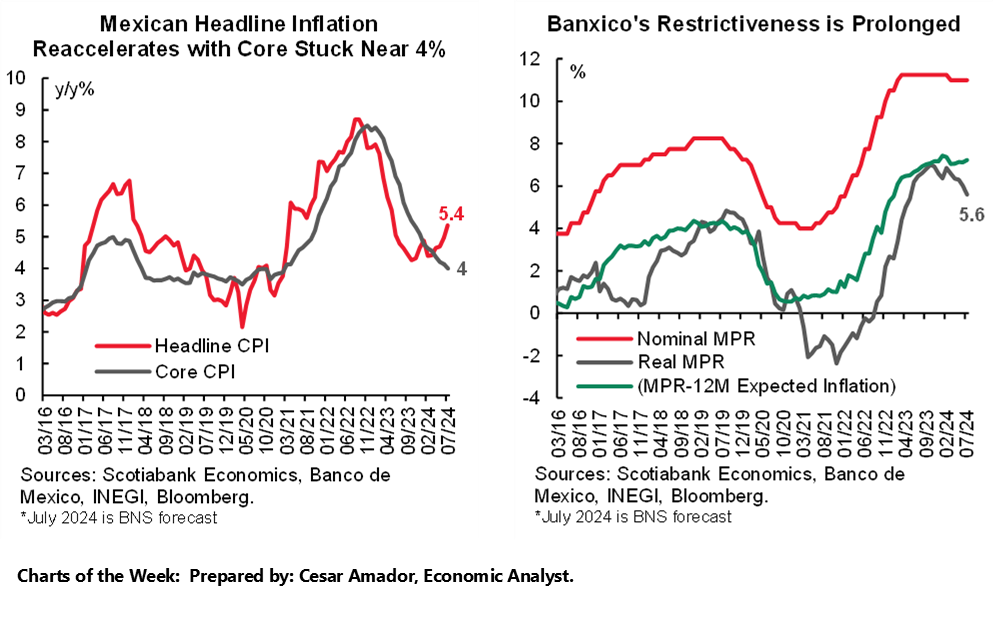

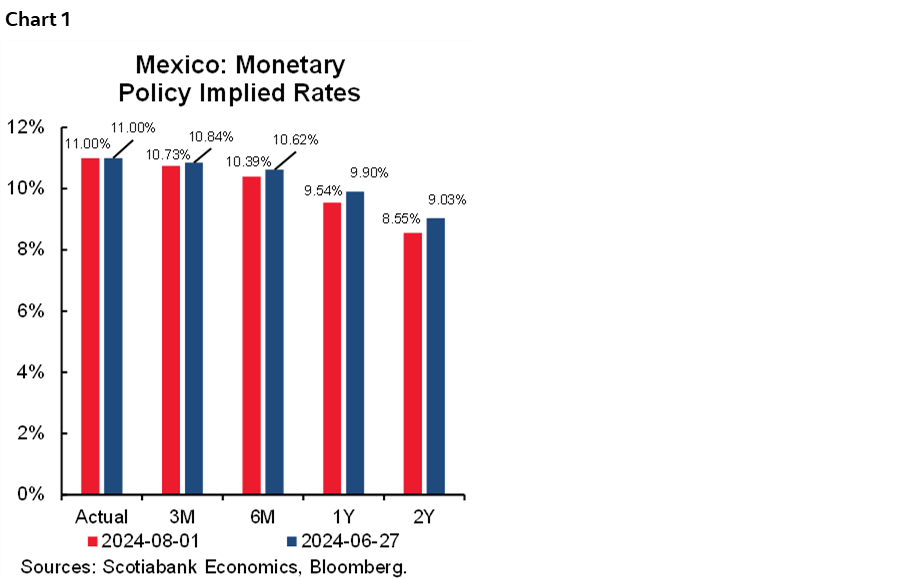

Starting with Mexico, our economists preview next week’s CPI and Banxico decision in today’s report. Banxico’s decision has gone from likely cut, to toss-up, to now maybe likelier hold according to markets (10/11bps priced in pre-US jobs data) but it’s anyone’s guess. The bank’s rate hold at 11.00% at its June meeting came with a relatively dovish statement that was reinforced by dovish meeting minutes. A weaker-than-expected economic performance so far in 2024 would also act as motivation for a cut, as would an expected deceleration in core inflation to very near 4.0% in next week’s CPI release. We think a cut is more likely than a hold.

But, it’s difficult for officials to ignore the significant rise in inflation to 5.61% y/y in the first half of July—even if it’s mainly due to non-core items. The MXN coming under pressure from local and foreign political developments, an overall risk-off market tone, and a massive unwinding of MXN carry trade positions (namely in relation to the JPY, where the BoJ unexpectedly hiked this week), among other drivers, means Banxico needs to be cautious about rate differentials with other countries. To be fair, the near certainty of a September rate cut by the Fed is likely of comfort for Banxico officials.

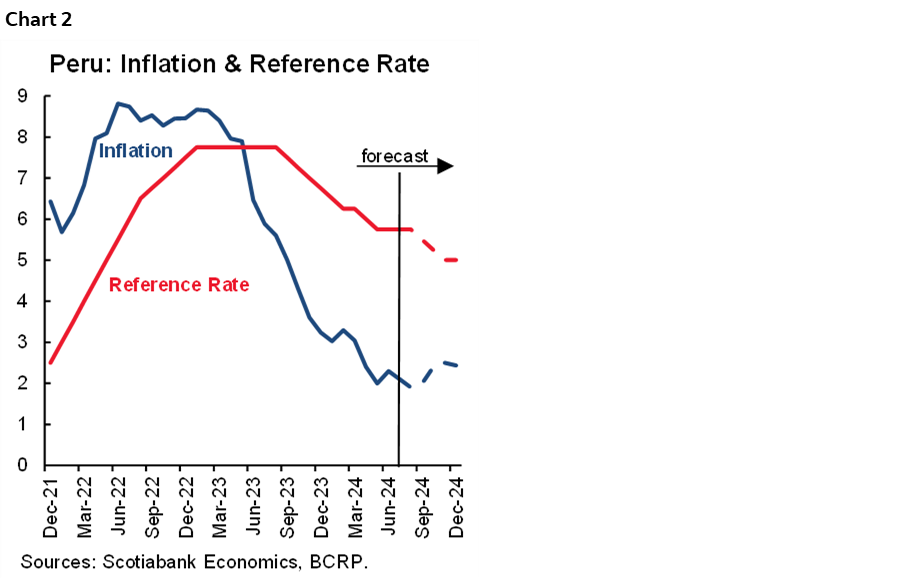

Peru was the first country in Latam to publish July CPI data, with headline inflation surprising to the downside and just slightly above the BCRP’s 1–3% target band, at 2.1%. Considering a two-meeting pause, this result would maybe marginally tilt the balance in favour of a rate cut of 25bps next week. But, our team thinks that the BCRP will hold its reference rate at 5.50% for a third time. As they argue in today’s Weekly, headline inflation remaining stuck just above 3.0% for a number of months and the bank finding itself in no need to rush (it may be better to just wait for the Fed in September) favours a hold. Our economists also write an early look into June GDP growth, with recent data pointing to a soft reading no higher than 2%.

Chile’s CPI print due Thursday will be monitored for signals that would support a restart of BCCh rate cuts at its September 3rd meeting. After a somewhat surprising rate hold (its first in the cutting cycle) earlier this week (see here), our economists think that if next week’s inflation data overshoots the bank’s June projections then the BCCh will opt for another rate hold, choosing to monitor a few more prints before easing again. An on– or below-expectations reading would satisfy conditions for a September cut, with the latter scenario possibly resulting in new Monetary Policy Report projections showing a lower terminal rate.

A 6-handle is finally in store for Colombian headline inflation in data due for release on Friday. Our team in Bogota projects a 6.92% y/y rise in headline CPI as base effects turn more favourable to help the headline reading fall from 7.18% in June. Core inflation will still hold in the 7s, however, as the indexation beast retains its place among the drivers that have prevented a faster convergence of inflation to target. Nevertheless, the 0.3ppts slowdown that our team projects in core inflation, from 7.64% to 7.32%, is a step in the right direction. BanRep’s latest decision, where it chose to lower its overnight rate by 50bps as expected (see here), didn’t give us too much in terms of guidance so we’re hoping that the minutes to the meeting, out on Monday, reinforce our projection for a 75bps cut in late-September—with next week’s nice decline in inflation supporting this view.

It’s a similar week for Brazil, with the BCB’s hawkish hold meeting minutes out on Tuesday and IPCA inflation on Friday. However, another acceleration is expected here towards the mid-4s in headline inflation, a reading that clearly acts to postpone even further another would-be cut by Brazilian officials.

PACIFIC ALLIANCE COUNTRY UPDATES

Mexico—CPI and Banxico Preview

Brian Pérez, Quant Analyst

+52.55.5123.1221 (Mexico)

bperezgu@scotiabank.com.mx

Miguel Saldaña, Economist

+52.55.5123.1718 (Mexico)

msaldanab@scotiabank.com.mx

Banxico’s monetary policy decision on Thursday is next week’s focal point, published some hours after the morning’s release of July’s inflation reading. Since the June decision, in which the central bank held its rate in a split vote, with one member in favour of a 25bps cut, the market reacted by discounting a less restrictive rate over the horizon thanks to a more dovish-than-expected statement. Similarly, the analyst consensus still anticipates that the next cut will take place at this week’s meeting. However, given the inflation print for the first half of July, which came out considerably higher than expected (5.61% y/y vs. 5.33% consensus) owing to a rebound in the agricultural items, and an environment of greater both domestic and international political uncertainty (the progress of constitutional reforms in Mexico, and the surprises of the US presidential election campaign), which has led to a higher USDMXN with greater volatility, have increased the chance that the cut could be delayed until the September 26th meeting.

From the cutting standpoint, the lower-than-expected GDP flash for the second quarter (2.2% y/y vs. 2.4% expected), the declining performance of core inflation (despite the stickiness of services above 5.0%), and the expectation of Fed cuts from September add to the case for a cut this week.

According to our call, the increase in agricultural items could continue to drive headline inflation in July, soaring from 4.98% to 5.40%. On the contrary, we believe that the core component will continue to decline, approaching the 4.0% threshold from 4.13% in the previous month. In this sense, the upsurge in headline inflation does not seem to be enough of an argument for the market (nor for some members of the Board of Governors) to think about another pause, possibly under the consideration that this increase would be transitory, and that it will not pass through to the core component. Nevertheless, an above-expectations headline inflation, or a rebound in the merchandise and/or services components could be a sufficient argument for waiting a little longer and move the cut to the next meeting.

By the end of September, most of AMLO’s proposed reforms will surely have been voted on, or at least the two of them that could have the most implications in terms of rule and state capacity; the reform to the judicial sector, and the reform to dismantle autonomous regulators. Furthermore, if inflation behaves as expected, it would have already passed its highest level of the year after the upsurges in agricultural items, even though year-end inflation expectations have moved up, expecting now 4.65% y/y from 4.25% previously according to the Banxico Survey. Thus, we believe that in the case that Banxico opts to pause this week, the outlook for two cuts during the remainder of the year will remain unchanged, as this rate change would simply shift to the September meeting, maintaining the expectation of an additional cut in December and closing the year at 10.50% (chart 1).

Peru—Uncertainty Abounds Regarding the BCRP August Decision and June GDP Growth

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Yearly inflation came in at 2.1% in July. This is down from 2.3% in June, and below our expectations, also at 2.3% (chart 2). This inflation figure is teetering on the pivot point between just good enough to justify a cut in the BCRP reference rate in August, and not compelling enough to require one. The context surrounding the BCRP decision is also balanced. Peru’s core inflation remained stationed just above 3.0%, and of course the BCRP has stressed on numerous occasions its desire to see core inflation decline in a more convincing fashion before lowering its reference rate again. And, the BCRP, with an eye on the potential impact of changes in interest rate differentials on PEN assets prices and the FX rate, has signaled its desire to avoid taking Peru’s reference rate to par or lower vis-à-vis the Fed rate for any extended period of time. However, market consensus now expects the Fed to lower its rate as soon as September. This could conceivably encourage the BCRP to resume reducing rates in August, as the two rates would coincide at 5.50% for only one month.

The arguments in favour and against the BCRP lowering its rate in August are, therefore, fairly even. This heightens the uncertainty regarding the BCRP’s decision next week. We are inclined to believe that it’s more likely that the BCRP will keep its reference rate stable for one last month. This is for two reasons. The first is the fact that core inflation has hovered around 3.0% for six months now, and, thus, continues to resist falling convincingly into the BCRP target range. The second is simply, from the BCRP’s point of view, why hurry? There is no pressing need to reduce the reference rate quickly.

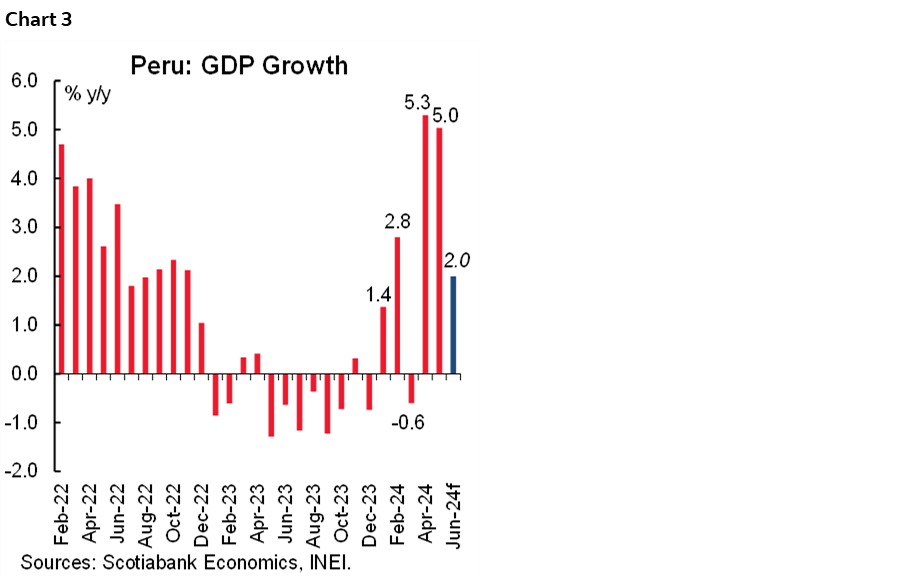

JUNE GDP BLUES

Certain sector GDP growth figures and indicators for June were also released on August 1st. Foremost among these was fishing GDP, up 56.8% y/y in June. In case this seems like a lot, remember that fishing GDP rose 330% y/y in May and 158% y/y in April. In fact, the number for June reflects a fishing season that was winding down. Having said that, it was still a good month.

It was not a good month for mining. Mining GDP plunged 8.1% y/y in June. Every major metal fell, from zinc (-21%), to copper (-12%) to gold (-2.5%). Copper output has been disappointing throughout 2024 so far. This may possibly reflect lower cut-off grades, financially enabled by high copper prices during this period. Production only increased in certain minor metals, namely molybdenum, tin and silver, but their weights are not great. Oil and gas fell -3.5% y/y, although this was more predictable, given the trend of recent months.

To round out a weakish month, domestic demand indicators were also weak, with electricity output up a very marginal 0.06% y/y and cement demand down 5.5% y/y. In past months, government investment offset low cement demand in bolstering construction GDP growth. The impact of government investment for June, 6.7% y/y (as opposed to double-digit figures in previous months) might not be enough to push construction GDP into positive territory.

June GDP, then, will not come close to the 5%+ growth levels of April–May. With luck it might reach 2.0% (chart 3). Maybe.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.