ECONOMIC OVERVIEW

- September kicks off with a busy week of central bank decisions in Chile and Canada, a flood of key global economic releases including US employment figures, and the start of Mexico’s new Congress.

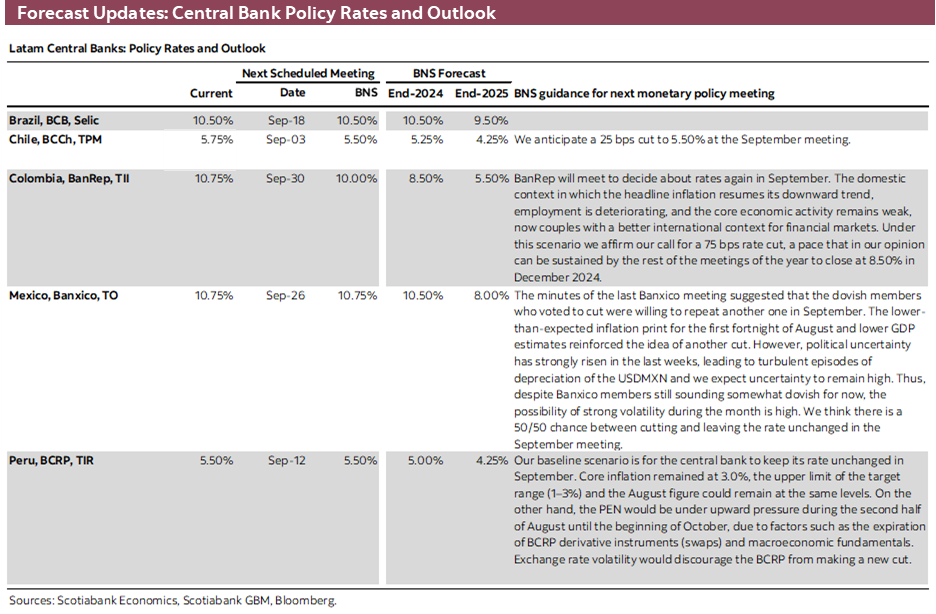

- Chilean and Peruvian CPI await, the latter over the weekend and the former after Tuesday’s BCCh’s decision where we expect a 25bps rate cut. Colombia’s calendar is quiet, but in today’s weekly our local team gives an update on the country’s economy.

- Mexican unemployment and investment data may be worth a look, but markets will focus on the start of the legislative session and the possible passage of constitutional reforms, with judicial reform first on the docket.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in Colombia.

MARKET EVENTS & INDICATORS

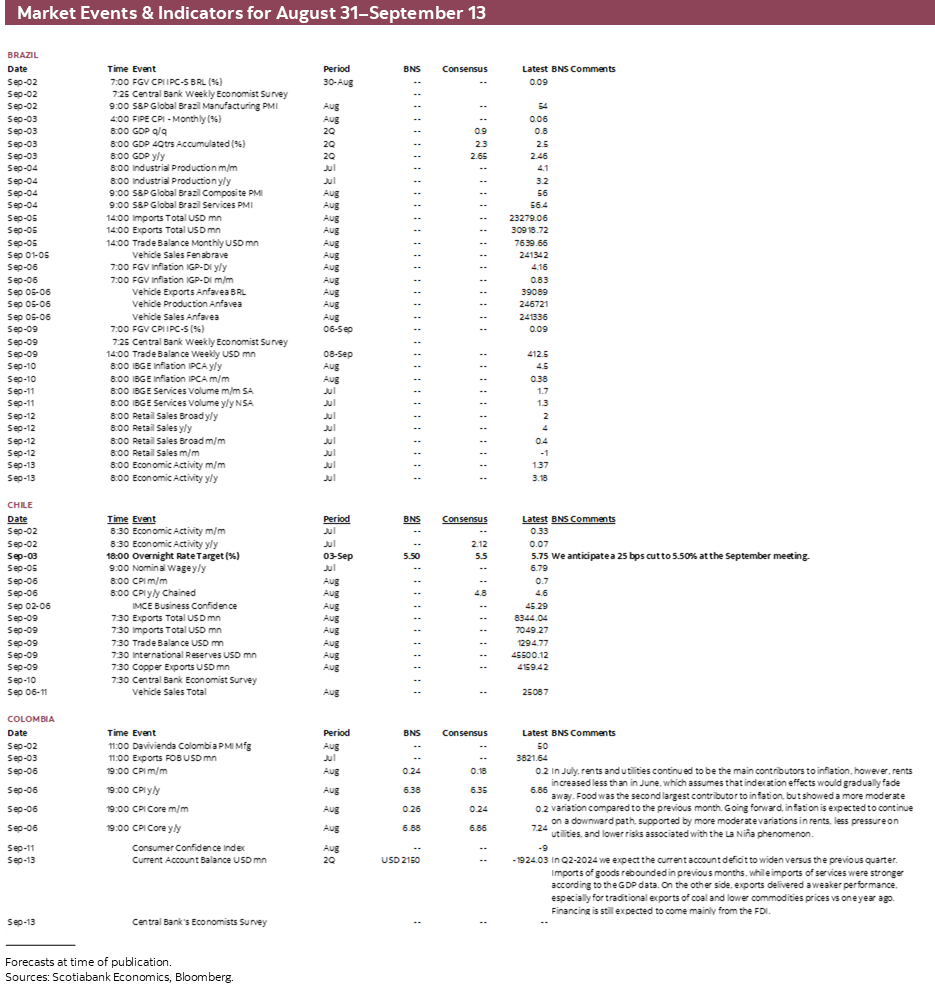

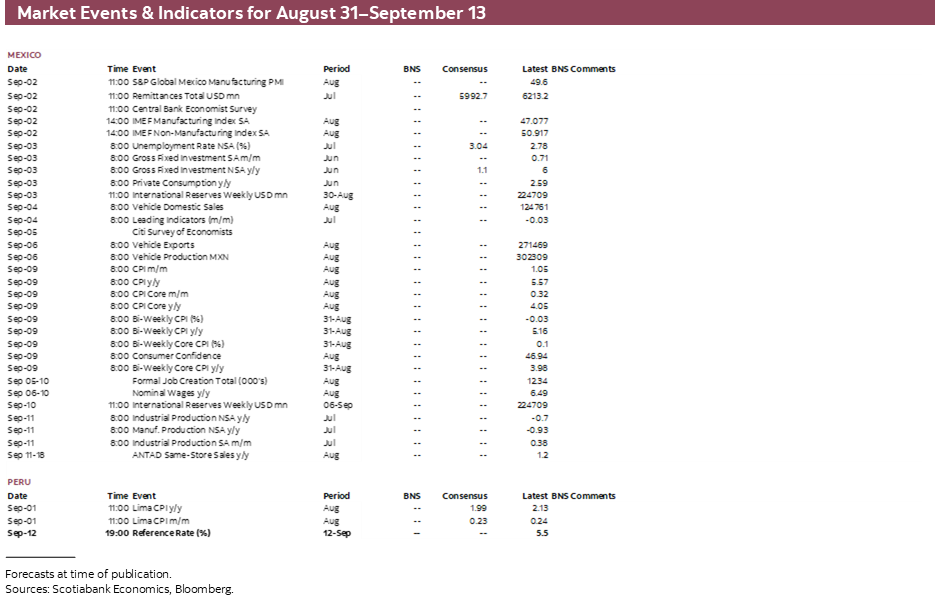

- A comprehensive risk calendar with selected highlights for the period August 31–September 13 across the Pacific Alliance countries and Brazil.

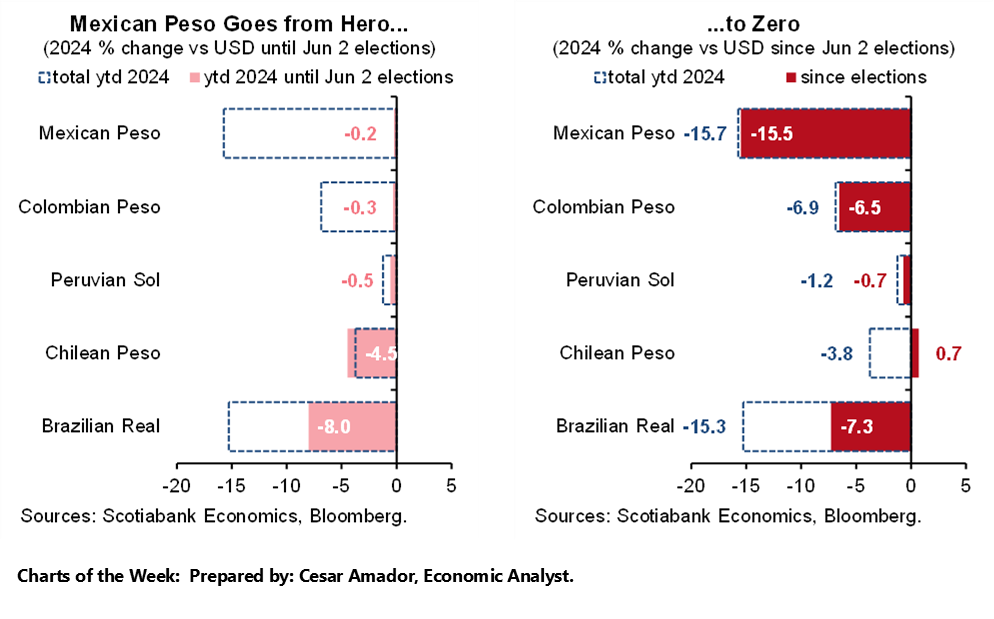

Charts of the Week

ECONOMIC OVERVIEW: CHILE RATE DECISION, MEXICO REFORMS

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- September kicks off with a busy week of central bank decisions in Chile and Canada, a flood of key global economic releases including US employment figures, and the start of Mexico’s new Congress.

- Chilean and Peruvian CPI await, the latter over the weekend and the former after Tuesday’s BCCh’s decision where we expect a 25bps rate cut. Colombia’s calendar is quiet, but in today’s weekly our local team gives an update on the country’s economy.

- Mexican unemployment and investment data may be worth a look, but markets will focus on the start of the legislative session and the possible passage of constitutional reforms, with judicial reform first on the docket.

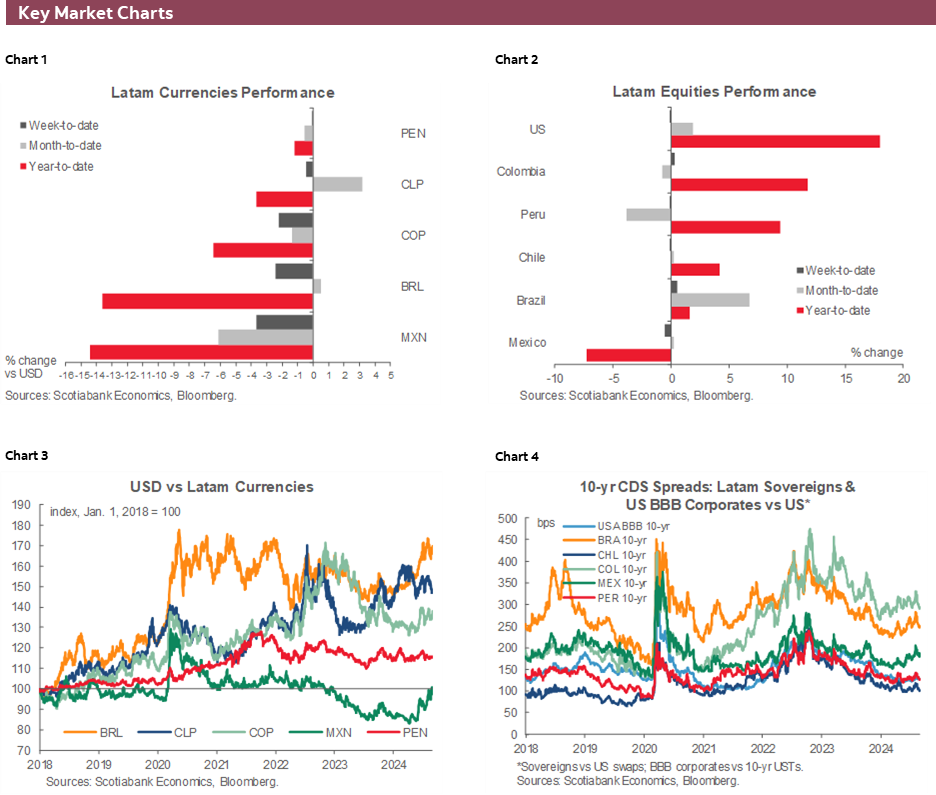

Into the final month of the quarter we go, kicking it off with a busy week in Latam and the G10 with central banks back in action alongside key data releases and the beginning of Mexico’s 66th Legislature. While the week may start somewhat quietly—as US and Canadian markets sit out Monday for local holidays—it’s bound to be choppy trading throughout as markets shift anxiously in the lead-up to, and following, Friday’s release of US employment data.

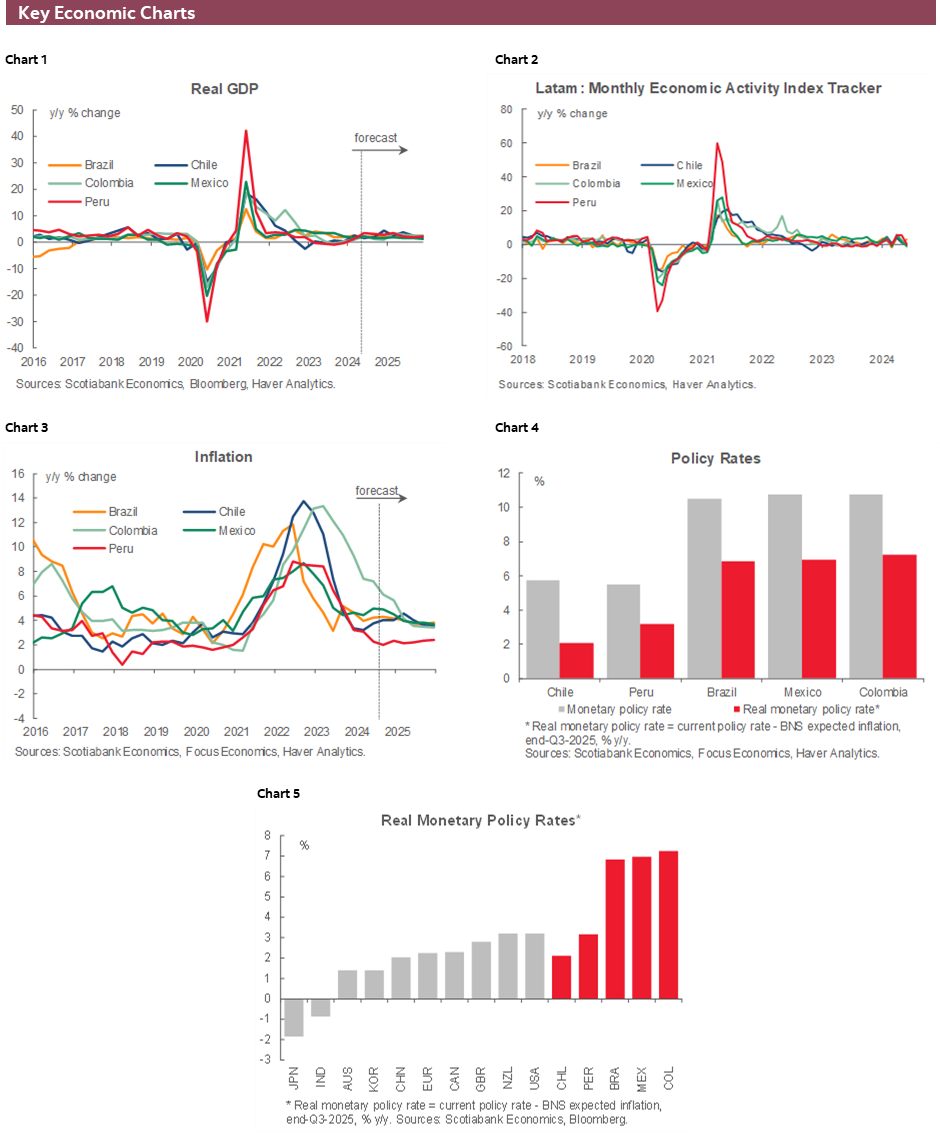

Rate cuts by the BCCh and BoC, the possible passage of constitutional reforms in Mexico, Chilean economic activity and CPI, Brazilian GDP, US ISM surveys, Canadian employment, Chinese PMIs, and Eurozone wages all await. Before all that, Peru releases August CPI data on the 1st (Sunday) that we expect will show right on target inflation at 2.0%. Aside from that, Peru’s week will be as quiet as that of Colombia, with both countries having an empty calendar that leaves local assets at the mercy of international developments. In today’s report, our team in Colombia recaps the country’s economic performance over the first half of 2024 and outlines expectations for the balance of the year.

Monday’s Chilean economic activity figures (IMACEC) for July will be the final bit of information that the BCCh will get ahead of its rate decision on Tuesday, just three days shy of the release of the August CPI print. Today’s industrial/mining output data showed an improvement from a weak June in secondary sector activity (owing to utilities and manufacturing) thanks to a 5%+y/y jump in manufacturing. On the flip side, retail volumes growth slowed sharply in a natural reaction following June’s spike on early-month CyberDay offers.

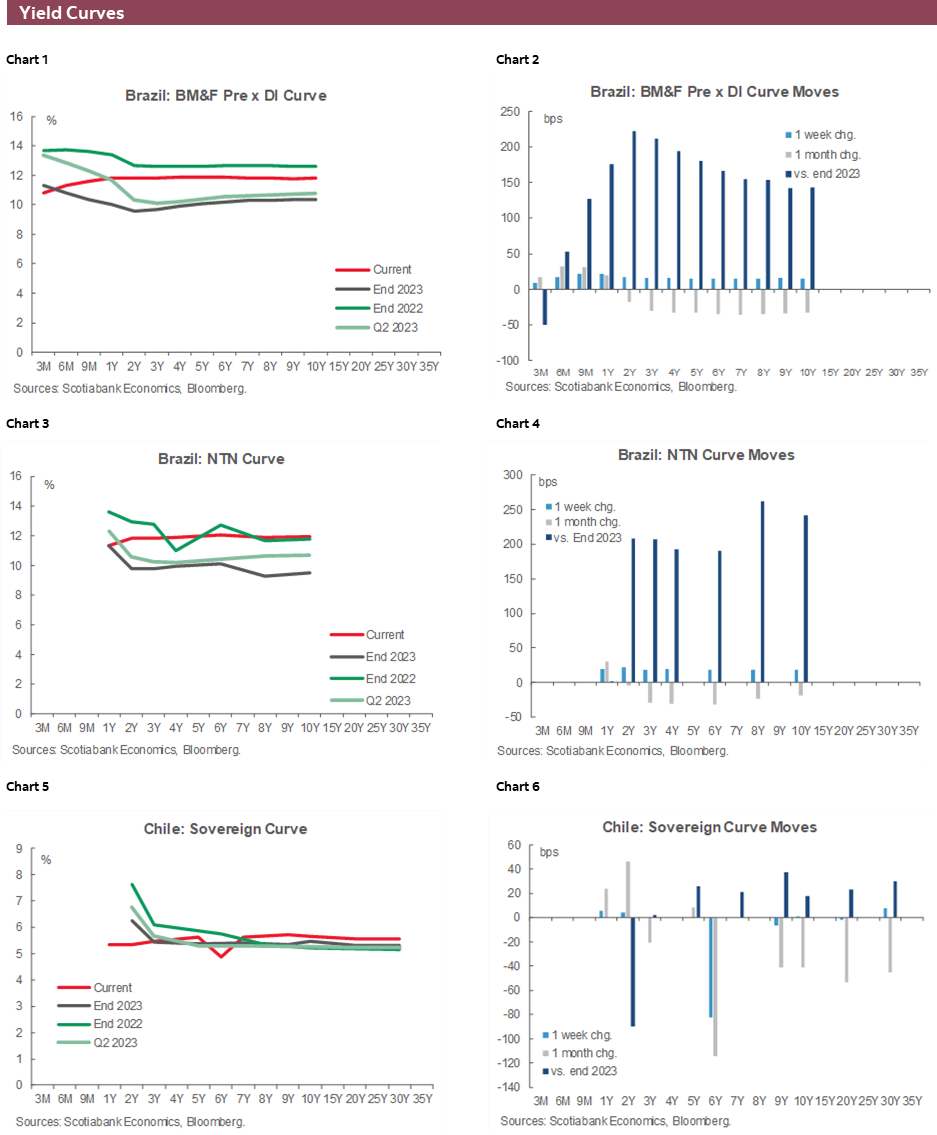

The July IMACEC is projected to show a solid rise to follow the mediocre 0.2% recorded in June. As for CPI, prices are seen rising 0.2/3% m/m, in line with historical averages for August. CPI data in line with expectations (let’s assume), signs of ‘just ok’ growth (and some jobs weakness?), and the totality of data and guidance received since the BCCh’s July hold have built a solid case for the bank to resume rate cuts next Tuesday. The 25bps move to 5.50% that we, and traders and economists polled by the BCCh, expect may be followed by a rate hold in October, but it will likely not be the last of the year with another 25bps move seen in December.

Mexico’s calendar also has a few data releases that are worth a look. Unemployment rate for July and private consumption and investment data for June are on tap, with an overall expectation that these figures will reinforce Banxico doves’ view that the domestic economy is decelerating, and policy need not be as tight (political risks may have also weighed on investment). Still, even usual hawk Heath sounded much more open to additional rate cuts in comments a couple of weeks ago so there’s not much more convincing to be done. One thing that may change their minds, however, is currency weakness emerging from political risks—though that didn’t sway the board’s hand in choosing to cut in early-August.

Any other week there may have been a marginal reaction in local assets to these data, but next week will be all about the likely passage of a collection of constitutional reforms in Congress as its 66th session opens on September 1st. Outgoing President AMLO will enjoy a one-month overlap with the new Congress, where in the Lower House his coalition has a two-thirds majority and in the Senate it is just one seat shy of two-thirds (which we may assume will come when a vote is needed). The President will attempt to push through up to twenty constitutional changes over his remaining four weeks in office, where a priority is the passage of judicial reform that may come as soon as next week and is the greatest source of uncertainty for market and private participants. Brace for (additional) Mexican market volatility.

PACIFIC ALLIANCE COUNTRY UPDATES

Colombia—Recovery or Just a Hot Streak?

Sergio Olarte, Head Economist, Colombia

+57.601.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Daniela Silva, Junior Economist

+57.601.745.6300 (Colombia)

daniela1.silva@scotiabankcolpatria.com

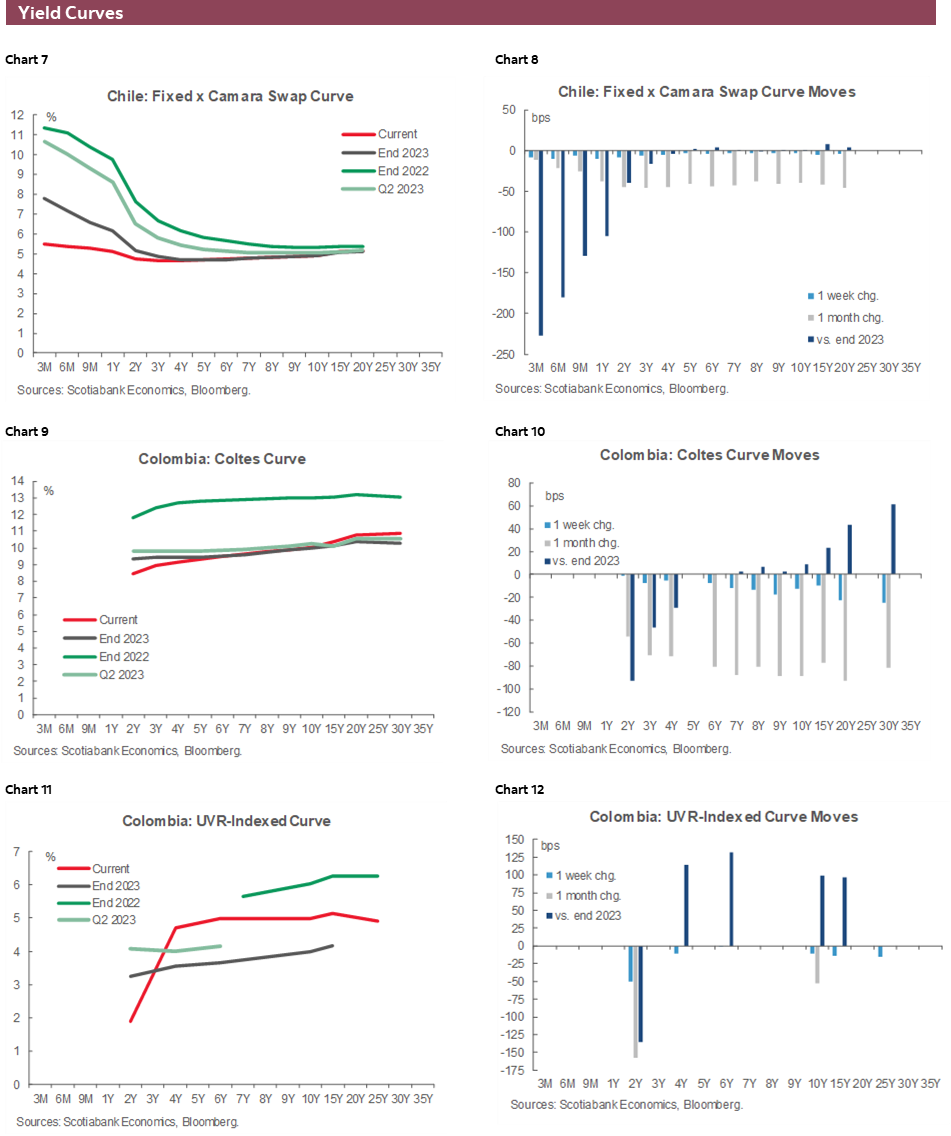

After the boom in 2022 Colombia has faced many challenges—world and domestic inflation, higher interest rates, geopolitical conflicts around the world and the uncertainty around a potential change in the status quo due to a new way to think from President Petro. Although, many of them are already vanished or in process to vanish, economic activity is still processing the information, producing a slower transition through the economic cycle. The first half of 2024 continued to present significant challenges for the Colombian economy. In fact, a more robust rebound was expected after the previous year’s slowdown, economic growth has been slower than anticipated, generating a debate around monetary policy and the decisions that BanRep could make in upcoming meetings.

During the first part of 2024, the economy has shown signs of a moderate and at the same time uneven recovery across different sectors. Nine out of the twelve subsectors have shown weak balances. On the positive side, the agricultural sector has been the key sector to drive economic growth. This sector has shown the best performance since 2017, with growth of 10.2% in Q2 of 2024, partly due to better coffee harvests and a boom in banana exports, in addition to lower risks associated with climatic factors such as the La Niña phenomenon. However, this recovery can be temporary due to a change in the seasonality of the harvests and less favourable statistical bases.

As for the secondary sector, which includes industry and construction, the performance has been weaker than expected, maintaining a negative balance for five consecutive quarters and although it has shown a timid recovery at the margin, difficulties persist in different key subsectors. Fuel refining, which represents nearly 40% of the industry, has faced operational and logistical problems, affecting production capacity and domestic supply. On the other hand, vehicle production has suffered a slowdown, attributed to the exit of some agents from the market. In addition, the textile industry has registered falls in its production amid a demand from consumers that remains weak.

Construction was one of the sectors most affected during the pandemic and has not yet managed to recover to pre-lockdown levels. Having said that, in 2024 there has been a slight recovery, especially due to public infrastructure projects, while the housing market still faces challenges, with demand not reaching pre-pandemic levels despite better credit rates for this segment.

The services sector has kept a positive dynamic, however, according to the Economic Monitoring Indicator (ISE), in June it fell 0.6% y/y, which could mark a phase of deceleration. Public administration has been the second subsector to contribute the most to the recovery, given higher public spending in the first part of the year. However, the austerity plans proposed by the government, such as the COP$20 trillion cut in the 2024 budget, could imply a deterioration of this subsector in the remainder of the year. Trade, for its part, has had a mixed performance, showing favourable dynamics in tourism and accommodation, but weak retail trade, in which a weak performance of the textile and vehicle sectors stands out. At the same time, entertainment has been one of the subsectors that stands out the most within the services sector, registering a 20% year-on-year growth in June 2024, leveraged by sporting events and other types of leisure activities.

The second half of 2024 is seen as a crucial period for the Colombian economy, in which interest rates would play a key role in the recovery. Although BanRep has adjusted its economic growth projection from 1.4% to 1.8% for 2024, we believe that this is due to transitory events and could generate counterweights given lower government spending and more moderate harvests in the coming quarters implying lower growth. Scotiabank Colpatria estimates that the economy will grow 1.5% in 2024, still with some clouds in the sky since key sectors of the economy such as industry and commerce, which account for just over 40% of jobs, will not show a faster recovery.

All in all, we do see that the Colombian economy hit bottom in Q4-2023, however the recovery has been and will continue to be uneven and gradual. Lower interest rates, a more stable FX, lower inflation and a bit less uncertainty perception should increase the recovery pace next year. Therefore, we ratify our 1.5% GDP growth forecast for 2024 and 2.9% for next year.

In this economic activity environment, BanRep has reduced the interest rate by 2.50 ppts from its maximum of 13.25%, however, it has done so at a cautious pace, and without showing greater haste or concern about economic activity. Even so, recent economic activity data show that growth would be leveraged by a minority of sectors, which would be soon to enter a cycle of deceleration, putting a greater weight on economic recovery. With all the above, we expect that BanRep’s board finds greater confidence in the inflation data and considers that the scenario is favourable to accelerate the easing cycle by 75bps in its last three meetings so that the monetary policy rate closes 2024 at 8.5%.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.