ECONOMIC OVERVIEW

- Next week’s regional and global calendars bring key inflation releases that will help refine central bank expectations for the remainder of the year and into next.

- Mexico’s and Peru’s central banks will deliver widely-expected rate increases, and Colombia, Chile, Mexico, and Brazil publish October inflation data.

- Domestic markets will focus on their respective inflation releases and central bank decisions, but the global market’s attention will be on US CPI data due Thursday as well as Tuesday’s midterm elections.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

MARKET EVENTS & INDICATORS

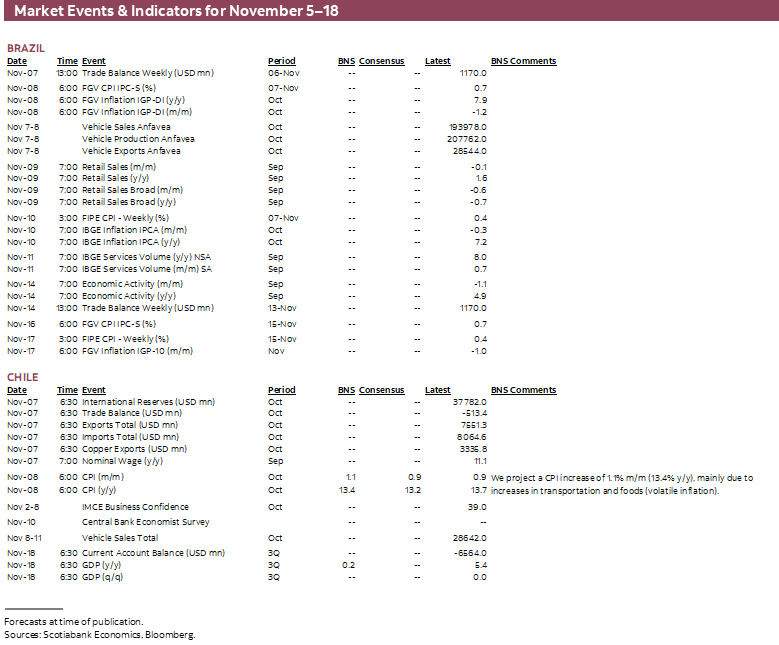

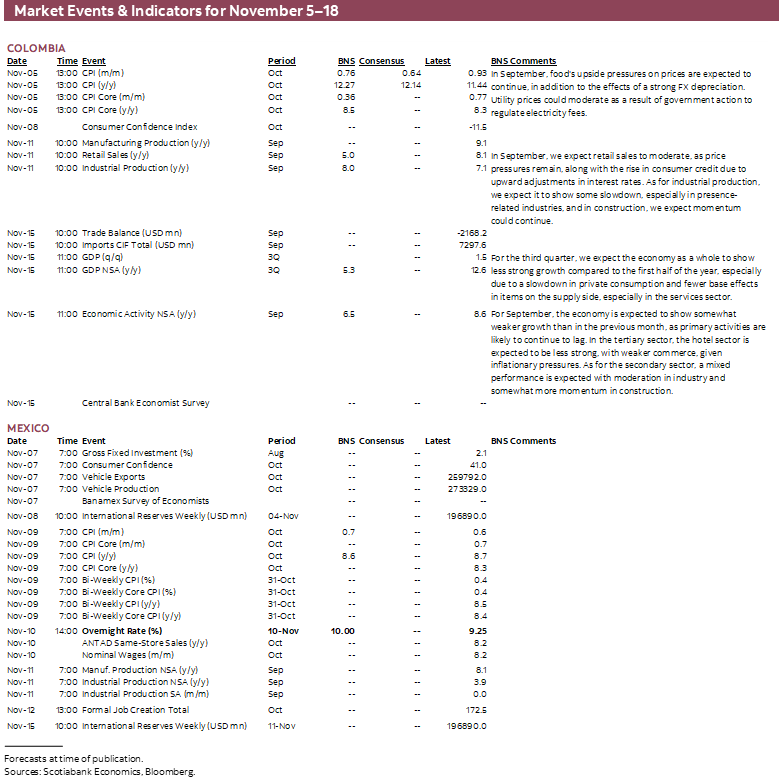

- A comprehensive risk calendar with selected highlights for the period November 5–18 across the Pacific Alliance countries and Brazil.

Economic Overview: Banxico and BCRP to Hike Alongside Key Inflation Data

Juan Manuel Herrera, Senior Economist/Strategist

+44.207.826.5654

Scotiabank GBM

juanmanuel.herrera@scotiabank.com

- Next week’s regional and global calendars bring key inflation releases that will help refine central bank expectations for the remainder of the year and into next.

- Mexico’s and Peru’s central banks will deliver widely-expected rate increases, and Colombia, Chile, Mexico, and Brazil publish October inflation data.

- Domestic markets will focus on their respective inflation releases and central bank decisions, but the global market’s attention will be on US CPI data due Thursday as well as Tuesday’s midterm elections.

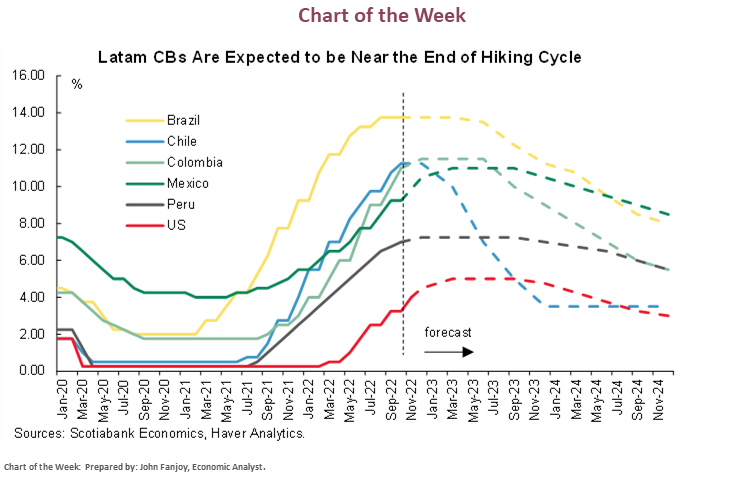

Next week’s regional and global calendars bring key inflation releases that will help refine central bank expectations for the remainder of the year and into next. Mexico’s and Peru’s central banks will also deliver widely-expected rate increases, with the former expected to continue tracking the Fed while the latter may reach the end of its hiking cycle (see Mexico and Peru sections).

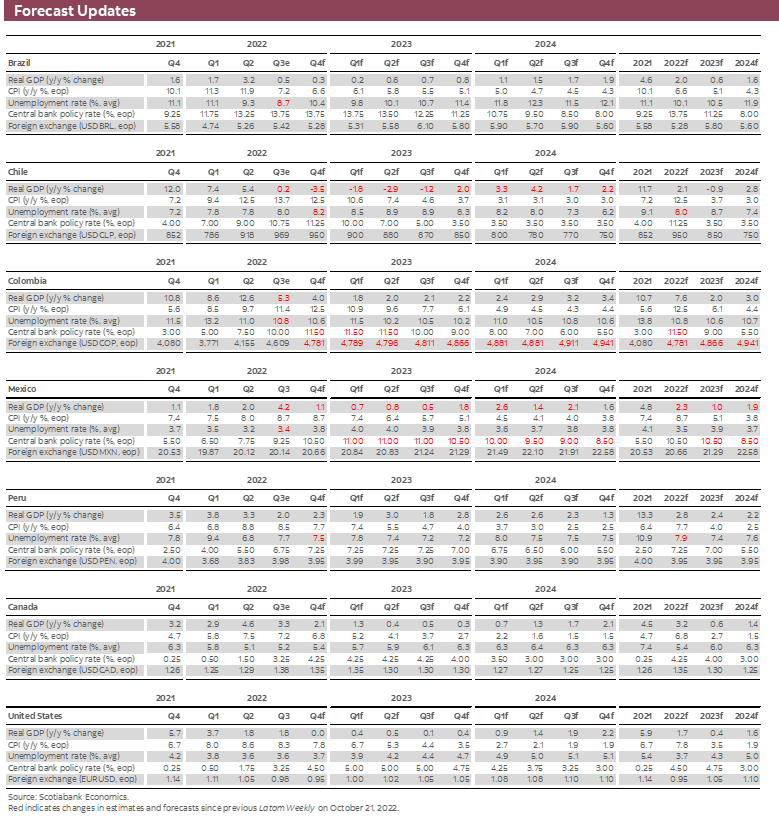

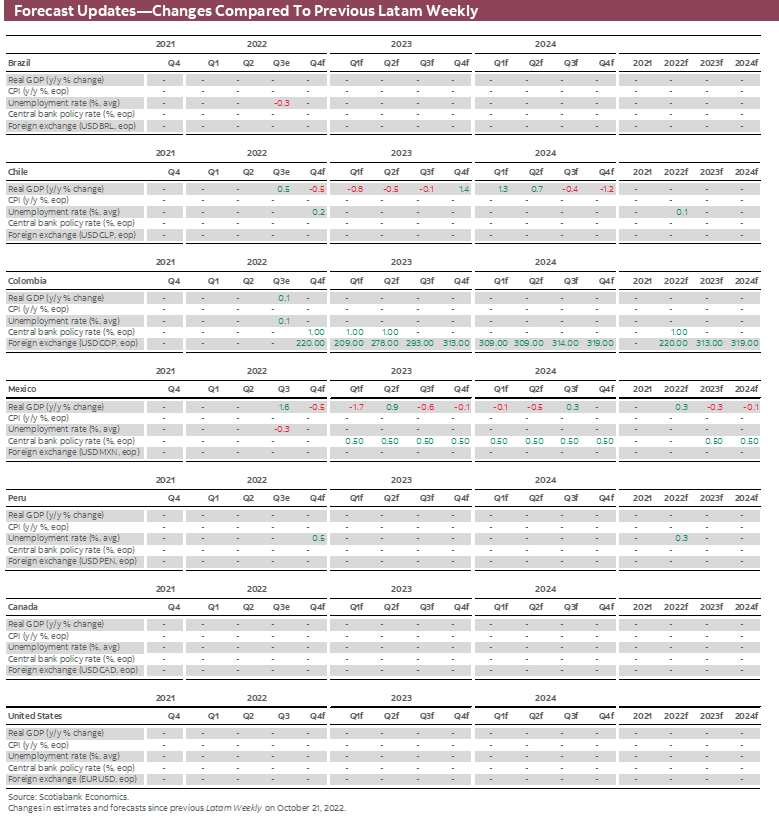

The week starts with Colombian markets shut for the All Saints’ Day holiday after the release of inflation data on Saturday. BanRep recently hiked 100bps with the minutes of the meeting considering that this move was a strong response to market volatility while reflecting some concern about a potential economic downturn (see Latam Daily). Our Bogota economists forecast that Colombian CPI rose 12.3% y/y and 0.8% m/m in October (see Colombia section and indicator tables at the back).

Chile, Mexico, and Brazil also publish October inflation data throughout the week, with economists expecting that year-on-year prices growth decelerated last month in each of these countries. We think Chilean inflation will accelerate on a month-on-month basis, though owing to volatile components rather than a wholesale acceleration (see Chile section), while the y/y figure is seen declining 0.3ppts. As for Mexico, the bi-weekly data released last week teed up a modest deceleration in the year-on-year reading while core prices growth accelerated. Similarly, Brazil’s H1-Oct IPCA data showed a 0.9ppts slowdown in inflation from its previous print and economists are expecting a decline of comparable magnitude for the totality of the month.

On Thursday, we expect Banxico to raise its overnight rate by 75bps—in line with the Fed—while we see the BCRP lifting its reference rate 25bps in what may be its final hike of the cycle. Despite recent comments from dove Esquivel noting that Banxico could start talking about decoupling from the Fed, we think it is much too early for that and markets on edge over the Fed’s hawkishness may retaliate on the MXN too harshly. Peru’s BCRP has launched 675bps in tightening during this cycle that have lifted the real policy rate at least 0.50% above what it considers its neutral rate—i.e., it has moved into restrictive territory. But, the bank wants to make sure inflation returns to its target range, with an additional quarter-point increase helping to achieve this.

In Chile, we will also monitor discussions on the pension reform plan presented by the government on November 2. Our economists anticipate a slow discussion in Congress and possible changes to the bill as debate proceeds, with these modifications proving necessary to obtain the support of right-wing parties in both houses of Parliament (see Chile section).

Domestic markets will focus on their respective inflation releases and central bank decisions, but the global market’s attention will be on US CPI data due Thursday. After a hawkish 75bps hike on Wednesday, markets are seeing little change in prices growth in the US—reinforcing the Fed’s view that the economy needed another large increase with the terminal rate seen around 5%. See our take on the Fed’s policy decision here. US midterm elections also take place on November 8th, with polls pointing to the Republican Party regaining control of both Houses of Congress.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Expectations Should Adjust to Lower GDP Growth and Inflation in 2023

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

M/M INFLATION TO ACCELERATE IN OCTOBER, MAINLY DUE TO VOLATILE COMPONENTS

We project a 1.1% m/m rate of inflation in October—above survey expectations and forward markets pricing (between 0.8 and 0.9% m/m). In our view, inflation in October (data out on November 8) will show an acceleration from September’s 0.9% m/m pace, mainly due to increases in volatile items such as air transportation fares and tourism packages, which would contribute 0.3ppts to inflation m/m. Increases in the prices of gasoline, cigarettes, and food would further inflationary pressures. Nevertheless, we estimate a slowdown in core inflation m/m in October (excluding volatile items) thanks to a lower contribution from goods prices. In year-on-year terms, inflation should continue to slow, going from 13.7% to 13.4%.

Looking ahead, we expect November and December’s price data to reflect lower inflationary pressures due to volatile items, which would allow monthly inflation prints slightly above the historical average during the final two months of 2022. With these estimates in mind, we expect year-end inflation at 12.5% y/y.

ECONOMIC EXPECTATIONS SURVEY: WE EXPECT REVISIONS TO GDP AND INFLATION FORECASTS

The central bank will release the results to its Economic Expectations Survey on November 10, where we expect an upward revision in GDP projections for 2022 (today at 2%), after the better-than-expected GDP data for in September that showed growth during the month. However, deteriorating macroeconomic fundamentals (labour markets and household liquidity) should lead to a downward revision to GDP growth forecasts for 2023 (today at –1%), and a decline in 12-month inflation expectations (today at 6.3%). Taking all of the above into account, we see upside risks to our GDP growth forecast for this year against a downside risk for our 2023 projection.

WE ANTICIPATE A SLOW DISCUSSION ON PENSION REFORM IN CONGRESS

On November 2, the government presented its pension reform plan which aims to increase mandatory savings, strengthen government benefits, reduce the role of the private pension managers (AFPs) and preserving the inheritance of personal funds, as expected. Considering how other issues have proceeded through Parliament this year (with the Budget bill and Tax reform), we anticipate a slow discussion in Congress and possible changes to the bill during its debate, with these modifications necessary to obtain the support of the right-wing parties in both houses of Parliament.

Colombia—Between Macro and Volatility

Sergio Olarte, Head Economist, Colombia

+57.1.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

María Mejía, Economist

+57.1.745.6300 (Colombia)

maria1.mejia@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.1.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

BanRep’s staff released a fresh set of forecasts and scenarios around the convergence of inflation. Our take on this new scenario is that the concerns about an overheated economy—that produces a delay of the inflation convergence towards the 3% target—have increased. BanRep now sees the country’s 2022 output gap at 2.3%, 0.8ppts higher than the previous monetary policy report, namely due to higher-than-expected private consumption. Additionally, the recent strong depreciation of the peso and high indexation effects also lead the staff to believe that inflation convergence may take longer. Therefore, although they do not publish the path of policy rate implicit in these models, they do say that on average the path during the next two years is higher than the analyst consensus which currently points to a rate of 10.7% in 2022, 9.2% in 2023 and 6.66% in 2024.

With a relatively hawkish path implied in the October report published yesterday we believe that the staff, which now has a vote in the board, is advising the rest of the board to be more aggressive in the hiking cycle. However, we think the BanRep board is cautious and has more concerns about a potential recession down the road induced by higher inflation, historically high policy rates, and a much weaker international environment. Therefore, although the message from the staff could see us consider a higher terminal rate, the most recent post-decision press conference shows a still data-dependent board whose view aligns with our expectation of a historically-high 11.50% terminal rate—to be maintained for at least six months.

On the FX side, Colombia is facing strong pressures due, in our opinion, to diverse factors:

1) Persistently-elevated uncertainty around the government communications that have brought volatility to markets. During the first two months of Petro’s administration, we have seen strong messages that afterward ended up being softened by the administration which has mined credibility.

2) BanRep’s hiking cycle is less aggressive than that expected by markets. This is in addition to a muted response from the bank to recent FX volatility.

3) Long and rocky tax reform negotiations that, again, undermine the government’s credibility and pose risks around fiscal stability in Colombia; and

4) Very low liquidity in markets and the adverse international environment, which have not helped EM recently.

In the medium term, the country’s institutional framework is working and we expect the tax reform negotiations to demonstrate that. If these kinds of automatic political stabilizers called ‘institutions’ are enough to convince markets, we would expect more moderate volatility and Colombian assets would pick up steam. However, uncertainty will remain relatively high. Therefore, we think the COP will hover around 4800-5100 for the rest of the year, which will pressure BanRep to continue to hike its policy rate with at least 50bps in the December 16 meeting.

On Saturday, the DANE publishes September CPI data, where upside pressures from food on the aggregate basket are expected to continue, further to the impact of a sharp FX depreciation. Utility prices should moderate as a result of government action to regulate electricity fees. That said our skew vs the market is to the upside. We expect the inflation to peak in December at 12.50% and start to ease in 2023.

We also get sectoral activity data in Colombia next week, ahead of the GDP report out in mid-month. We expect economic activity to remain strong and lead by the services sector’s performance. As the economy is still expected to be robust, the data should strengthen our expectation that the hiking cycle hasn’t ended yet.

Mexico—Headline Inflation Eases But Core Trends Higher; Banxico to Follow Fed with 75bps

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

Miguel Saldaña, Economist

+52.55.5123.1718 (Mexico)

msaldanab@scotiabank.com.mx

Brian Pérez, Quant Analyst

+52.55.5123.1221 (Mexico)

bperezgu@scotiabank.com.mx

Mexican CPI data for October out on Wednesday could show a deceleration in the year-on-year headline inflation against a core gauge still on the rise. Commodity prices have exerted a downward pull on inflation but producer prices still suggest some continued pass-through in the price formation process. In the first half of October, headline inflation decelerated more than economists expected (8.53% y/y, vs 8.64% previous, 8.62% consensus), but core inflation exceeded expectations (8.39% y/y, 8.29% previous, 8.32% consensus). With this in mind, we anticipate that the print for the totality of October will show a slowing in headline inflation but maintain the upward trend in core inflation. The non-core sub-index has led to some relief in prices growth; however, it is also the most volatile component, and significant upside risks persist, including a prolonged duration of the war in Ukraine, adverse weather events, as well as disruptions in supply chains owing to continued lockdowns in China. Therefore, we do not rule out an episode of persistent price pressures, despite restrictive moves in monetary policy. Historically, in Mexico, the peak in CPI has come 3–6 months after that of PPI, which suggests inflation will reach its maximum point near year-end, but we do see some risks to this due to price-setter surveys continuing to show inflation inertia. In this regard, forecasts for the end of the year continue to rise, with analysts now expecting inflation to close the year at 8.50% according to the median of the Banxico Survey, also reflecting stickiness in prices as the forecast for 2023 was revised higher to 5.09%. The forecast for core inflation also continues on the rise, seen 8.29% and 5.01% by the end of 2022 and 2023, respectively.

On Thursday, Banxico will release its policy decision and statement, where we expect a 75bps hike to 10.0%. Inflation has slightly decelerated, but Banxico’s restrictive stance should not change significantly for two reasons:

1) The Fed has guided that its tightening cycle may take longer than previously expected with a higher terminal rate.

2) Mexican Q3 GDP growth beat consensus at 4.2% y/y, suggesting that there is some room for additional hikes before growth is impacted more significantly by the lagged monetary policy effect. Therefore, we expect a policy rate of 10.50% by the end of 2022, although the outlook is more uncertain as to how Banxico will conduct monetary policy through 2023. We anticipate another 50bps hike in early-2023, remaining at 11.0% for most of the year until reductions in the final months of 2023. Thus, the effects of monetary policy are expected to reduce inflation gradually, ending 2023 still far from the target. In our baseline scenario, the policy rate does not rise above these levels but we do not rule out alternative scenarios depending on data in the months ahead. Some members of the board have been signaling that the time is approaching for smaller hikes and that they expect that Banxico will deviate from the Fed soon. However, Deputy Governor Gerardo Esquivel’s term is due to end on December 31 and there is no clear candidate to fill the position, which could leave the board with four members, where Governor Victoria Rodriguez’s vote would be decisive.

Banxico has started to suggest it could decouple from the Fed down the line, but we think the appropriate window for this is after Q1-2023, when rates markets have already discounted this decoupling—without an adverse impact on the stability of Mexican markets. For now, we think it’s prudent for Banxico to remain aligned with the Fed, seeking to preserve local market stability but also continuing to signal concerns over still rising core inflation.

Peru—Next Week’s Policy Meeting May See the Last BCRP Reference Rate Increase

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

We expect the BCRP to raise its reference rate next week to 7.25% from 7.00% currently. Most of the market agrees with us on this. We believe the BCRP will hike with some reluctance, given that the policy rate is already quite high and the economy—particularly domestic demand—is running at a sub-2% y/y pace. At issue is that inflation is simply not coming down with enough conviction. Year-on-year inflation in October was 8.3%. True, inflation is off its peak of 8.8% y/y in July, but it’s also true that three months after the July peak inflation remains firmly above the 8.0% mark. The fact that inflation remains at this elevated point must be a disappointment for the BCRP which has yet to see its restrictive monetary policy cycle (going on for over a year now) significantly dampen price trends.

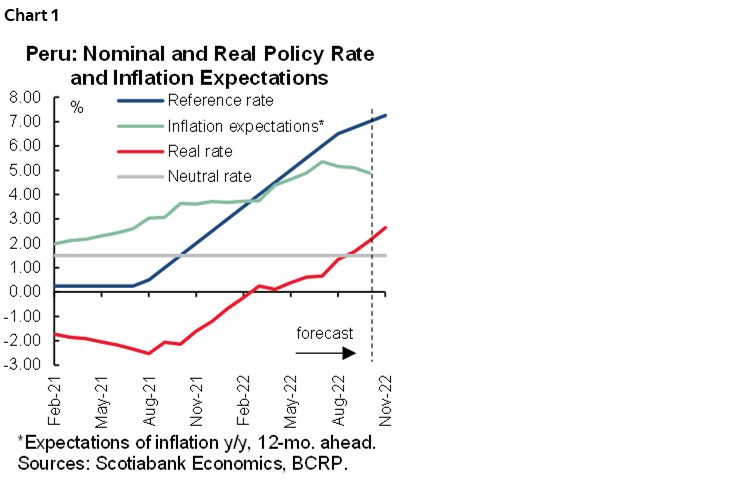

If inflation is not declining with conviction, then, why believe that the BCRP will stop raising rates after November? Well, the BCRP hiking again down the road cannot be entirely ruled out. At the same time, we know that the BCRP keeps a close watch on inflation expectations and what these means for the real reference rate. The last published figure placed the real reference rate at 2.1%, which is above the BCRP-defined neutral rate of 1.5% (chart 1). Moreover, an increase in the nominal reference rate to 7.25% next week, together with a likely decline in inflation expectations in the Friday release of the BCRP’s survey, will increase the real reference rate to what we estimate will be between 2.5% and 2.7%. Given this, any further rate increases would take the real rate into a 3%+ territory which begins to be quite uncomfortable.

What’s more, the BCRP is most certainly also keeping an eye on GDP growth. Although the official figure for September GDP will not be released until November 15, i.e., by the BCRP’s November 10 policy meeting, the bank should by then have a pretty good idea of how well, or how poorly, the economy performed in September. We have already received sufficient data to forecast approximately 2.0% GDP growth for the month. Modest positive growth like this is not a scenario that will tilt the BCRP’s balance of concerns decisively one way or the other, however, but may motivate some caution.

What the BCRP has going for it in its intention to control inflation is that most believe that inflation has peaked and will begin to trend down in more earnest fairly soon. Experts are aware that there are no domestic demand components driving prices higher, and that rising prices are due to supply-side factors both global (soft commodities and oil prices) and domestic (the impact of reduced fertilizer use on domestic crops). Thus, consensus has inflation declining twelve-months out. Furthermore, we see incipient signs of moderation in price increases. Enough, in fact, for us to maintain our full-year 2022 forecast at 7.7%, and our end-2023 forecast at 4.0%.

What has been under control is the FX rate. This control hasn’t been direct, but rather indirect with the BCRP providing signals that have helped guide market action. The USDPEN has been bumping against the 4.00 level on multiple occasions of late—seeking to cleanly break through and past it, but unsuccessfully. We don’t know to what extent there is a real intention on the part of the BCRP to control the exchange rate, but a stable sol is certainly helpful in seeking to stabilize inflation.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.