ECONOMIC OVERVIEW

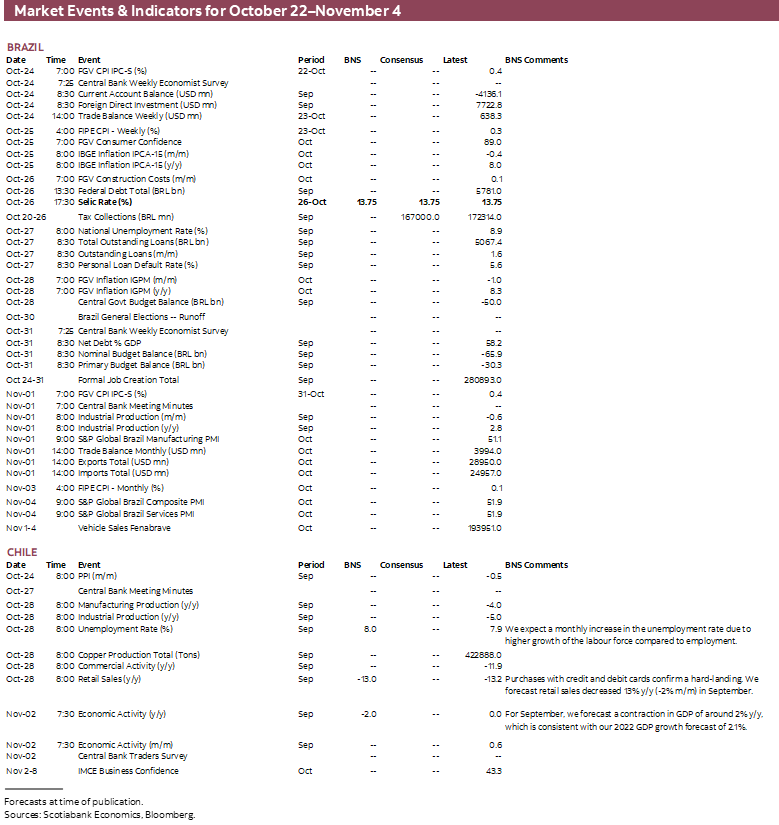

- Brazil is in the regional spotlight next week with October inflation data, the BCB’s policy decision, and a highly contested second round election.

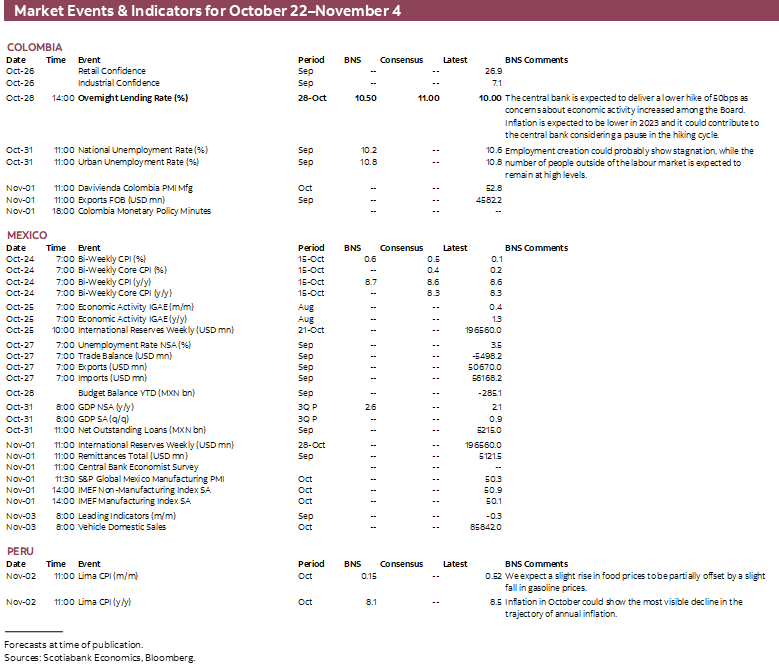

- In Colombia, BanRep’s policy decision will be closely watched to see whether the bank shifts to a lower pace of hikes.

- Elsewhere in the region, Chile publishes retail sales data while we monitor tax reform debates in Congress and Mexico will release inflation data for the first half of October. Peru’s week ahead is quiet.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period October 22–November 4 across the Pacific Alliance countries and Brazil.

Economic Overview: Brazil Looks Ahead to Second-Round Election; BCB and BanRep Meet

Juan Manuel Herrera, Senior Economist/Strategist

+44.207.826.5654

Scotiabank GBM

juanmanuel.herrera@scotiabank.com

- Brazil is in the regional spotlight next week with October inflation data, the BCB’s policy decision, and a highly contested second round election.

- In Colombia, BanRep’s policy decision will be closely watched to see whether the bank shifts to a lower pace of hikes.

- Elsewhere in the region, Chile publishes retail sales data while we monitor tax reform debates in Congress and Mexico will release inflation data for the first half of October. Peru’s week ahead is quiet.

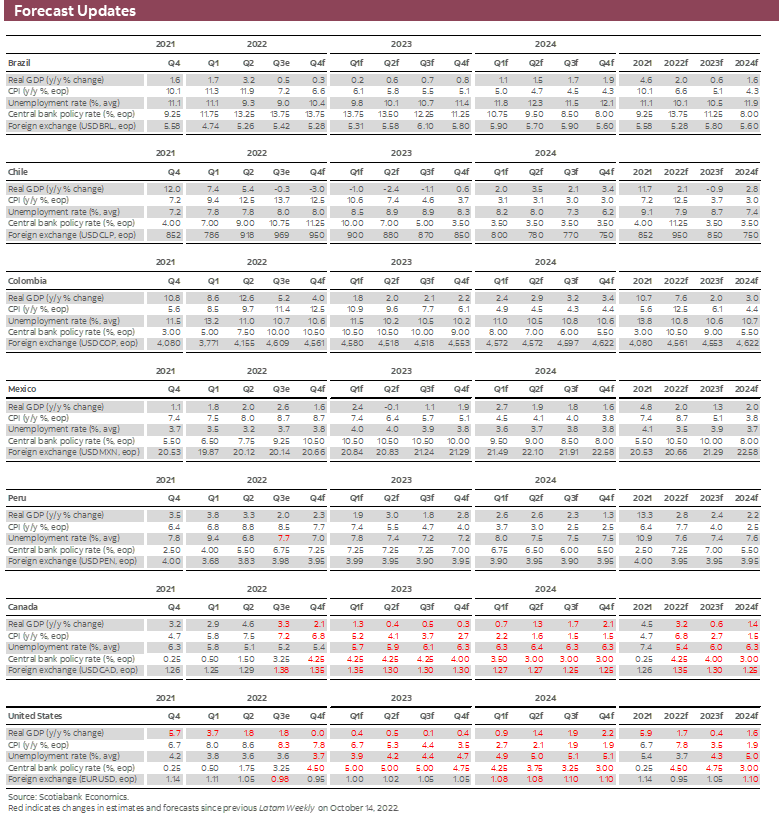

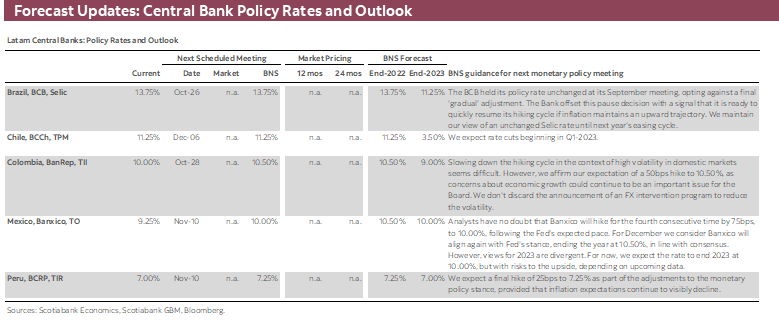

Brazil is in the regional spotlight next week with October inflation data, the BCB’s policy decision, and a highly contested second round election on the 30th that will keep markets on edge. Polls in the aftermath of the first-round vote in early-October had held steady in favour of a victory for former President Lula until recently, but recent surveys have moved within the margin of error—and ‘hidden’ Bolsonaro voters may still come out en masse to support the incumbent. The BCB is expected to stand pat for the second consecutive time as its hiking cycle seems to have the intended impact on inflation—with political considerations also likely to influence their communications.

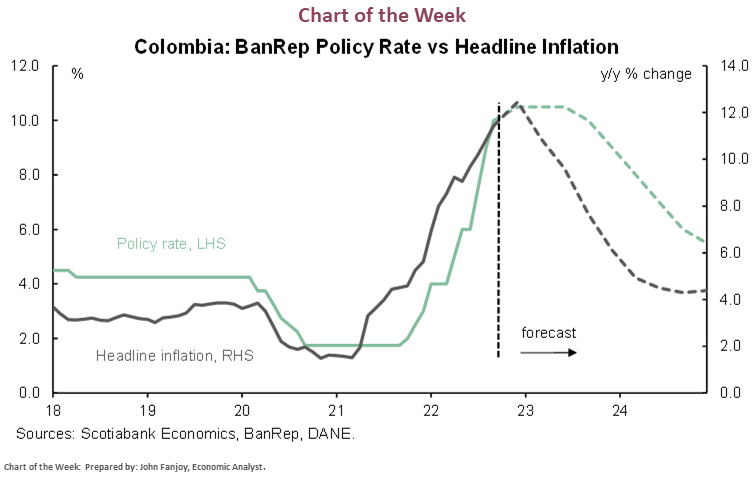

In Colombia, BanRep’s policy decision will be closely watched to see whether the bank shifts to a lower pace of hikes—which poses risks to a weakened exchange rate in light of market-unfriendly comments by President Petro.

Elsewhere in the region, Chile publishes retail sales data while we monitor tax reform debates in Congress and Mexico will release inflation data for the first half of October. Peru’s week ahead is quiet outside of political intrigue with continued calls for the impeachment of President Castillo. The global focus will be on the selection of a new prime minister in the UK, as well as monetary policy decisions in Canada and the Eurozone as we await the Fed’s own rate-setting meeting the following week.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Structural Reforms Amid Weak Economic Activity Indicators

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

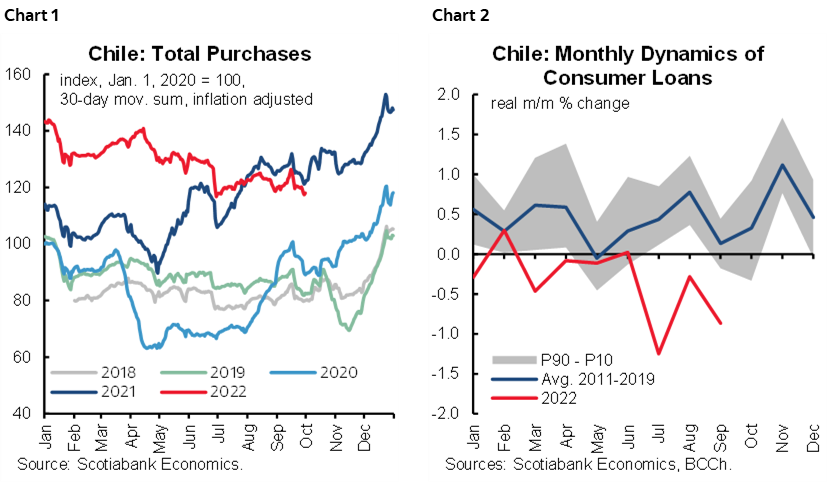

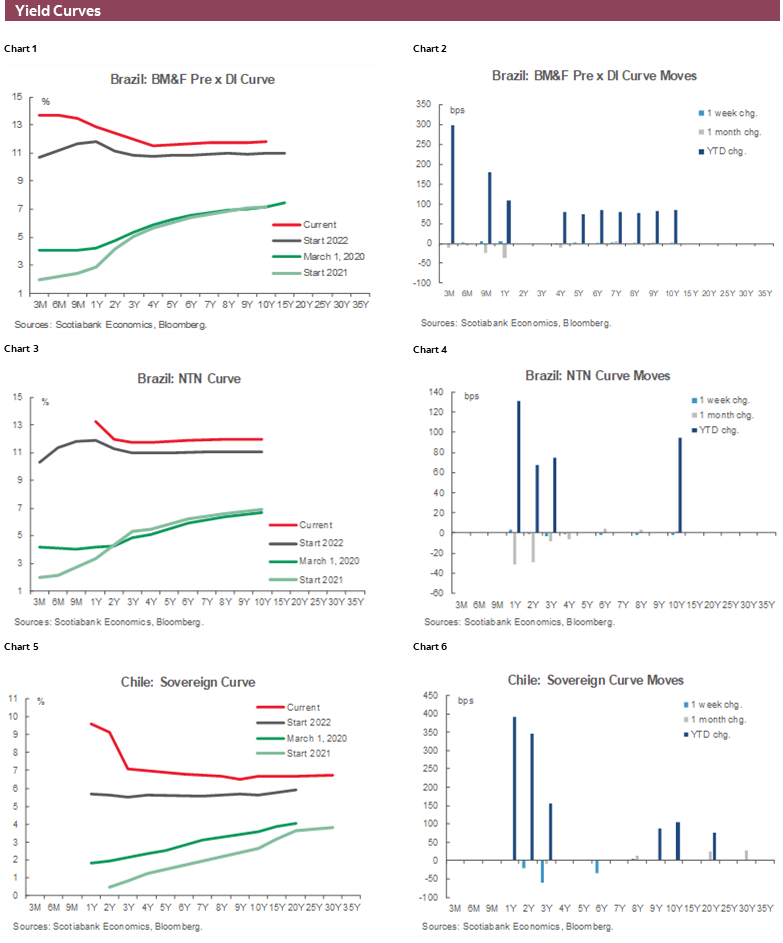

The government has kicked off an energetic agenda of structural social reforms (pensions, healthcare), which would be financed by the tax reform (see our Latam Daily). On Monday, October 24, Congress will begin the article-by-article discussion of the tax reform, which intends to collect 3.6% of GDP to finance the social agenda. In the days following, the government should send the pension reform to Congress. This comes amid weak indicators of economic activity and an expected increase in the unemployment rate.

Purchases with credit and debit cards are confirming a hard-landing. On Friday, October 28, the statistical agency (INE) will release September retail sales, for which we expect a 13% y/y contraction, based on our high-frequency indicators of purchases with debit and credit cards (chart 1). We observe a deceleration in consumption imports, mainly durable goods, and a strong deceleration in banking credit (chart 2). In this context, we see a more intense usage of credit cards in low-income segments (especially in supermarkets), which is aligned with dwindling household disposable funds and the weakness of the labour market. These conditions could be reflected in a slight increase in the unemployment rate to up to 8.0% that we expect for the quarter ending in September (from 7.7% in the three months to August). The main drivers of the rise would be higher labour force growth compared to employment, which is below pre-pandemic levels.

The government will send the pension reform no later than the first week of November. The bill would include the elimination of one of the current pension options called “programmed withdrawal”, the creation of a new public manager, the replacement of the current five multi-funds with a new “generational fund”, among others (more details in our Latam Daily). We anticipate a slow discussion in Congress and possible changes to the bill, which will be needed to obtain the support of the right-wing parties in both houses of Congress.

Colombia—Challenging Backdrop Ahead of BanRep Meeting

Sergio Olarte, Head Economist, Colombia

+57.1.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

María Mejía, Economist

+57.1.745.6300 (Colombia)

maria1.mejia@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.1.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

On October 28, BanRep is expected to continue its hiking cycle, however, we are in a crucial moment in which “too much” tightening would be negative for the real economy, while “too little” would be bad for markets. Since the September meeting, Colombia has continued to face a challenging international and domestic environment. The hawkish mantra from the Fed continued applying pressure on all global central banks and yields. However, in Colombia, many things are occurring in parallel to the monetary policy developments. The fiscal reform under discussion is increasing uncertainty in the business sector that now expects higher taxes against already troublesome high rates and consumers with lower disposable income. The fiscal reform still has to proceed to debate in plenary sessions, and now even declared pro-government parties such as the Liberal party are proposing changes to some initiatives which increase uncertainty in the domestic picture.

As for the real economy, data are still supportive, but confidence indicators are showing weaker consumer and business sentiment and expectations. Regarding inflation, forecasts continued increasing as expected indexation effects and still relevant supply-side upside pressures are reducing BanRep’s capacity to achieve a faster reduction in inflation.

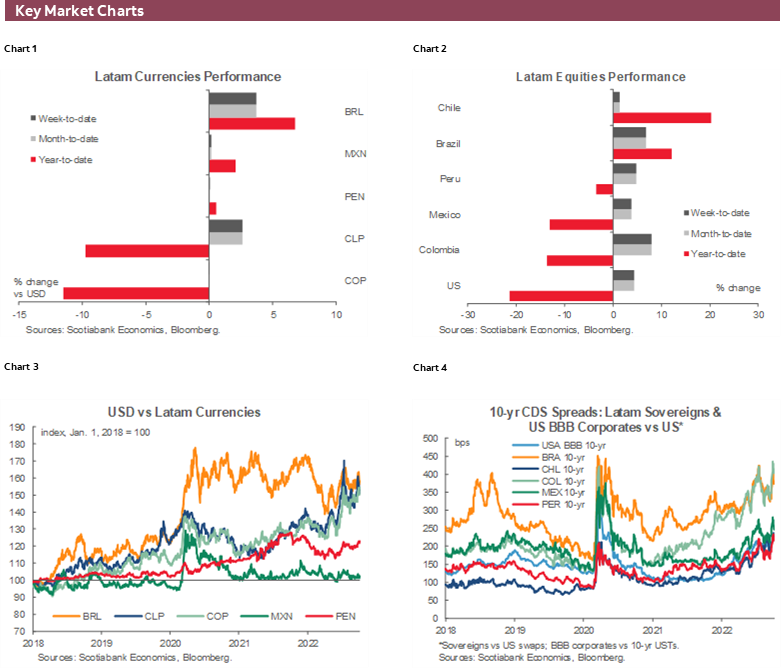

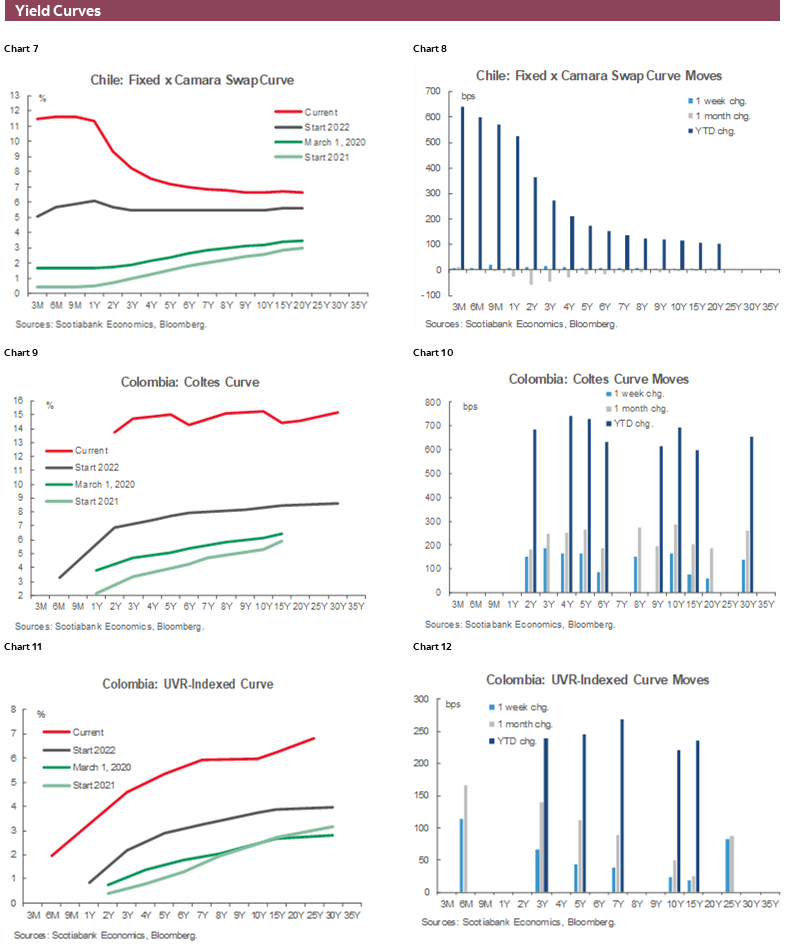

Meanwhile, despite the technical staff of the MoF sending strong messages of fiscal and macroeconomic responsibility, communications from other government officials are preventing agents to be completely comfortable with their positioning in Colombia. All of the above has been reflected in a weakening of Colombian debt with the COLTES curve sitting at 14.5% yields on average, accompanied by increases to record highs in CDS spreads and the USDCOP.

That said, BanRep is facing a difficult decision. Increasing the rate by 100bps would be a “market-friendly” move, but it would weigh negatively on investment decisions on the real-economy side. A 50bps will be compatible with gradual signaling that the end of the hiking cycle is approaching but would trigger even more negative effects on the COP. It is difficult to anticipate what is a good mix, but for now, we affirm our call of a 50bps rate hike, with a high probability of announcements of FX intervention through instruments to reduce volatility (forwards, or options, but not direct sales from international reserves) if markets continue showing strong pressure on the domestic currency.

Mexico—Changes at the Economy Ministry; H1-October Inflation Projected Slightly Lower

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

Miguel Saldaña, Economist

+52.55.5123.1718 (Mexico)

msaldanab@scotiabank.com.mx

MEXICO’S ECONOMY MINISTRY CHANGES & IMPLICATIONS

Following the changes to Mexico’s Economy Ministry (where Tatiana Clouthier was replaced by former Tax Collection Agency Head Raquel Buenrostro, and Under Secretary Luz Maria de la Mora was replaced by Alejandro Encinas Najera), the Ministry reinforced that the current priority is obtaining a negotiated outcome of the energy sector dispute with the US and Canada under USMCA, before the extended consultation period ends, to avoid going to an arbitration panel. The new Secretary & Undersecretary have no obvious experience in trade and trade disputes, but the Head of the USMCA office in Washington DC, Cesar Remis, remains in place—and he does have material experience in trade-related matters. Last week, the consultation period was extended for another 75 days, suggesting that if a solution is not found before the end of the year, arbitration will be the next step. Our take is that from the US/Canada perspective, there are two possible solutions, each with its own advantages:

- Negotiating a truce that allows US and Canadian companies to continue to operate with the contracts that were negotiated in past administrations, selling power to CFE at the previously agreed upon conditions. This could allow avoiding getting to arbitration, but risks setting a negative precedent in USMCA. It also means that Canadian and American companies that plan to enter the Mexican market in the future would not be protected under the agreement.

- Alternatively, the US & Canada could stand firm and continue on with arbitration, protecting the principle of the trade agreement. This would force the Mexican government to backtrack on favouring the public sector’s CFE over private investors, but it would likely lead to continued/escalated tensions between Mexico and the US, which both governments could decide against given already complex geopolitical issues with China and Russia.

Trade experts we’ve spoken to believe that if Canada & the US decide to pursue arbitration, they will likely win, but the process will take time. In addition, the range of the potential compensation is very wide, as there will likely be a dispute over the “opportunity cost” of the investments, rather than the invested amounts to date.

INFLATION FOR H1-OCTOBER IS EXPECTED TO MODERATE, YET YEAR-END FORECASTS REMAIN ON THE RISE

In terms of indicators, our focus will be on inflation numbers for the first half of October. Participants in the Citibanamex Survey expect a 0.51% 2w/2w sequential change for headline and 0.36% in the core component. This implies 8.61% y/y inflation (8.64% in September H2), and a core basket inflation on the rise, from 8.29% to 8.32%.

On the non-core side, it might be too soon to see any effect of the anti-inflation plan update, focused on the basic consumption basket. However, we’ll pay particular attention to possible implications of the tax and tariff exemptions in food items that were recently announced by Lopez Obrador in the plan.

Year-end inflation expectations remain on the rise, but starting to stabilize, this time changing from 8.50% to 8.54% in the Citibanamex Survey. However, this time end-2023 inflation projections also rose, from 4.93% to 5.11%, suggesting that analysts foresee some sticky price dynamics.

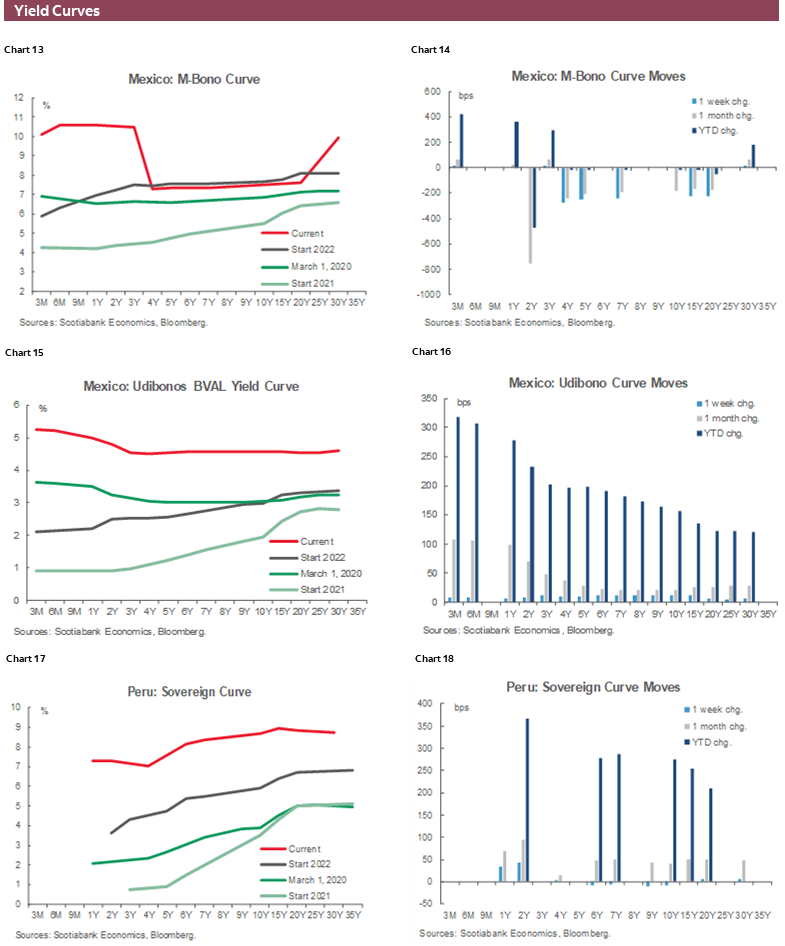

Other indicators include the GDP index for August, which could hold a very modest pace of growth, yet with positive growth readings in both services and industry. The trade balance for September could show a lower deficit for the third consecutive month, owing to a higher pace in manufacturing exports. Regarding the labour market, the unemployment rate is expected to slightly move higher, yet labor conditions are also expected to improve as participation rates reach pre-pandemic levels, while formal jobs growth in the last 12 months has maintained a solid 4.0% y/y pace.

Peru—Don’t Blink: A Softening Economy Amidst Political Lawfare

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

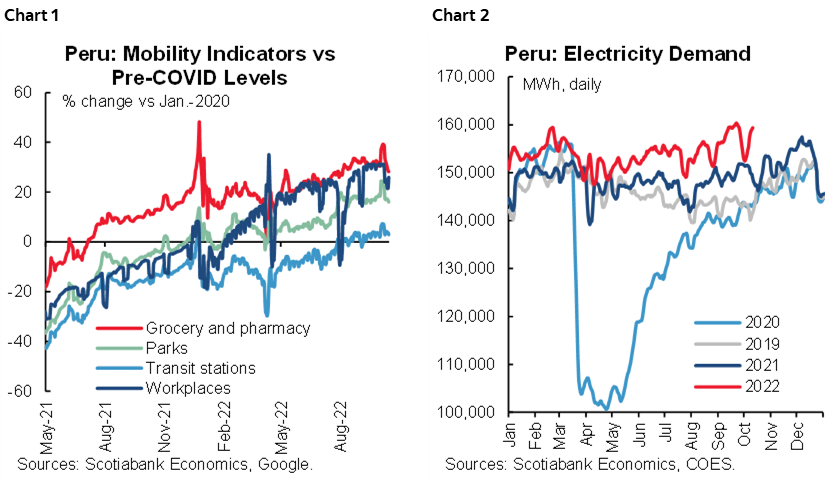

Peru’s economy seems to be ending the year with a whimper. Recent growth indicators are weak. GDP came in below 2% y/y in August (1.7% y/y) and in July (1.4%). This is Peru’s new reality. Factors that may provide a bit of temporary buoyancy in the coming months include a new government transfer of PEN1.2bn (USD300mn) to low-income households to compensate for inflation and the Quellaveco copper mine coming online. One hopeful sign is that leading indicators such as electricity and transportation/mobility have improved in October (charts 1 and 2).

Another issue authorities are grappling with is inflation. So far, data for October point to a ‘benign’ month that could pull yearly inflation down to around 8.1–8.2% from its September level of 8.5%. If so, the improvement should revive within the BCRP the vital question of whether to pause its tightening cycle. Meanwhile, the BCRP has been busy reining in the FX rate, which has been showing signs of wanting to break over the USDPEN4.00 mark. Markets are showing the BCRP some respect...for now. However, one wonders if there will not come a time when the BCRP feels that the PEN is misaligned in respect to other regional currencies, in particular those of Chile and Colombia, and it could therefore allow the USDPEN to drift upwards with more determination.

The novelty concerning fiscal accounts is that the fiscal deficit surprisingly fell to 1.1% of GDP in September, after having risen to 1.6% the month before. This trend won’t last for long for a number of reasons, namely owing to lower metal prices but also due to the recent announcement that the government would fund a USD1bn capital increase to Petroperú, the state oil company. This alone will add nearly 0.4 percentage points to the fiscal deficit when it occurs.

The third leg of the uncertainty tripod is politics. There are so many moving pieces on the political chessboard that it’s hard to determine where the political stream leads. The word of the moment in Peru is “lawfare”, as both sides of the President Castillo polemic submit legal documents. The Attorney General’s office submitted to Congress a Constitutional Demand for collusion and influence-peddling against President Castillo. Congress requested that the Constitutional Court interpret the Constitutional clause on presidential impeachment (“vacancia”). Members of Congress are seeking support for a third presidential impeachment, and the government formally reached out to the Organization of American States, OAS, requesting that it activate clauses in its statutes for situations in which a country’s democratic institutions are at risk. It will be interesting to see what position the OAS takes. Some of these issues will play out in the coming days—don’t blink.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.