FORECAST UPDATES

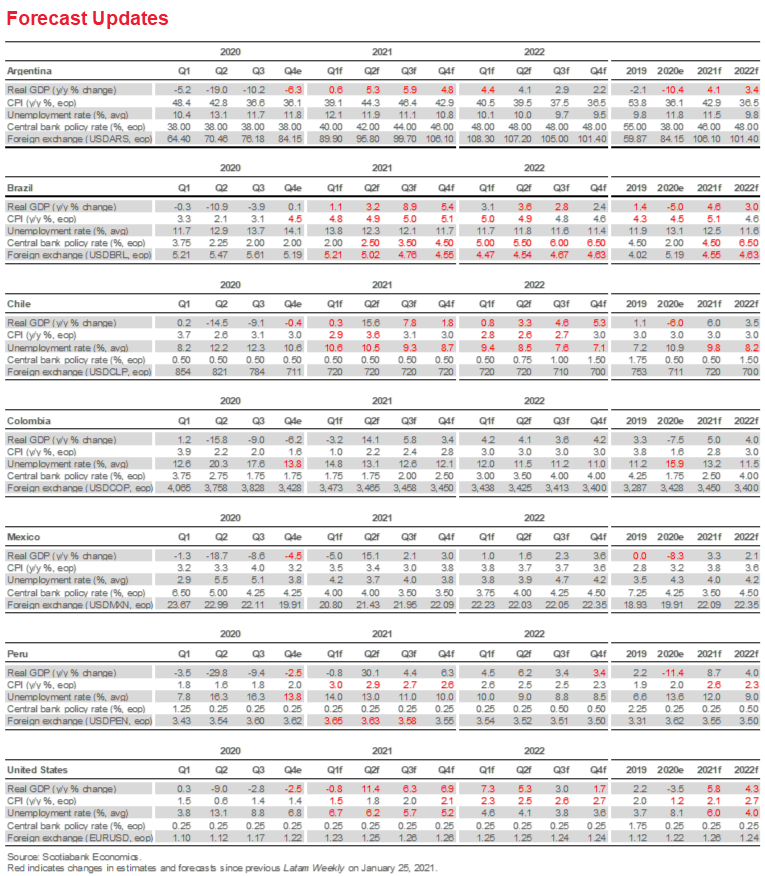

Growth in Chile and Mexico ended 2020 on stronger notes than we had anticipated, but we have held our 2021 and 2022 forecasts unchanged for now. The recent intensification of price pressures in Peru, however, led us to raise our inflation outlook from the BCRP’s 2.0% y/y target over the next two years to 2.6% y/y at end-2021 and 2.3% y/y at end-2022. Our outlook for Brazil now features stronger price pressures and a more front-loaded hiking cycle from the BCB’s Copom.

ECONOMIC OVERVIEW

Herd immunity likely won’t be achieved across Latam until 2022, but the Pacific Alliance countries remain on a sustainable footing to finance additional fiscal support through further borrowing, if necessary.

Central bank decisions during the next two weeks are expected to feature a -25 bps cut by Banxico to initiate a new -75 bps easing cycle, while Peru’s BCRP is forecast to stay on hold until Q3-2022.

PACIFIC ALLIANCE COUNTRY UPDATES

We assess key insights from end-2020 data and the first weeks of 2021, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

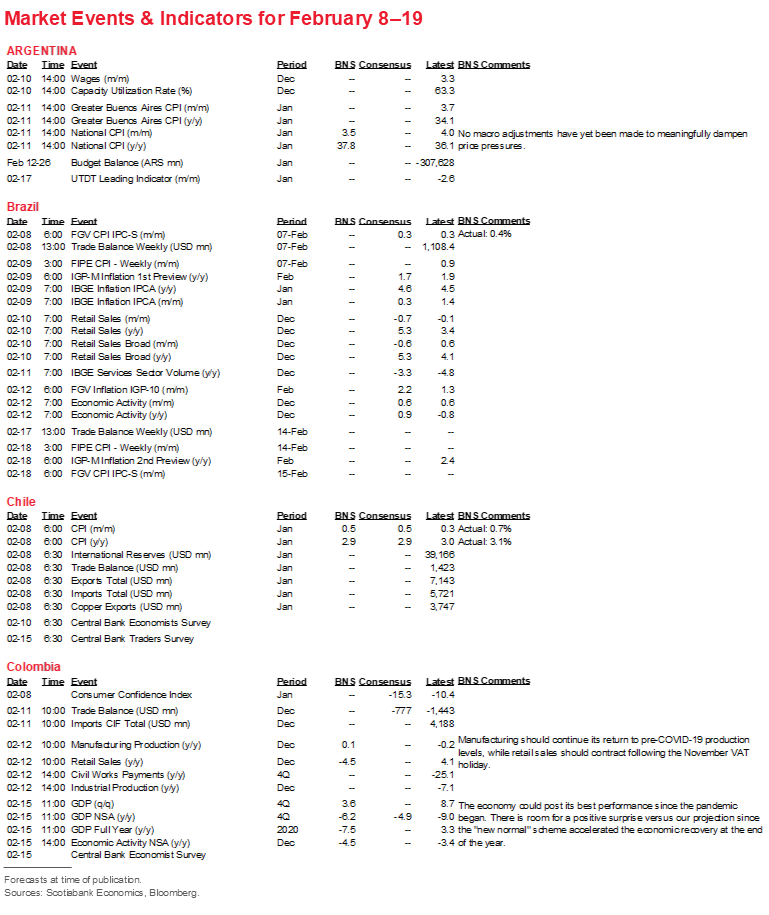

MARKET EVENTS & INDICATORS

Risk calendar with selected highlights for the period February 8–19 across the Pacific Alliance countries, plus Argentina and Brazil.

Economic Overview: Herd Mentality

Brett House, VP & Deputy Chief Economist

416.863.7463

Scotiabank Economics

brett.house@scotiabank.com

Herd immunity likely won’t be achieved across Latam until 2022, but the Pacific Alliance countries remain on a sustainable footing to finance additional fiscal support through further borrowing, if necessary.

Central bank decisions coming up during the next fortnight are expected to feature a -25 bps cut by Banxico to initiate a new -75 bps easing cycle, while Peru’s BCRP is forecast to stay on hold until Q3-2022.

FORECAST UPDATES: END-2020 DATA REVISIONS

Across the Pacific Alliance countries, our estimates and forecasts have been updated to reflect the arrival of data for end-2020 (see Forecast Updates, p. 2). Chile’s Q4 economic activity came in a touch better than expected and narrowed the year’s contraction from our forecast of -6.2% y/y to -6.0% y/y. In Mexico, Q4 growth also beat expectations and cut 2020’s losses from -9.1% y/y to -8.3% y/y. For both economies, however, we kept our outlook essentially unchanged, with a strong rebound expected in Chile and more anaemic gains in Mexico. The recent intensification of price pressures in Peru, however, led us to raise our inflation outlook from the BCRP’s 2.0% y/y target over the next two years to 2.6% y/y at end-2021 and 2.3% y/y at end-2022.

Elsewhere in Latam, our forecasts have firmed up a bit. Our estimate of Argentina’s real GDP contraction in 2020 has been pared slightly from -10.8 y/y to -10.4% y/y on the back of better-than-expected progress during Q4-2020 in reviving the economy. Our forecast for Brazilian growth in 2021 has been lifted from 3.0% y/y to 4.6% y/y to reflect a weaker base at end-2020 and some better expectations for 2021. Stronger inflationary pressures also led us to front load a bit more heavily moves by the BCB’s Copom to raise the Selic, with 50 bps of increases in Q2-2021 (up from 25 bps in our January 25 forecasts) and a higher terminal rate of 6.50% (revised from 6.25%).

SECOND WAVES AND DEBT SUSTAINABILITY

Second waves of COVID-19 are hitting the Pacific Alliance countries and the extent of the pandemic’s resurgence is likely being underestimated by inadequate testing everywhere but Chile. Our companion Latam Charts Weekly report from Friday, February 5, laid out progress in the Pacific Alliance countries on the procurement of vaccines and the roll-out of vaccinations across the region. The current pace of public-health developments—both promising and challenging—implies herd immunity won’t be obtained in the region until some time in 2022.

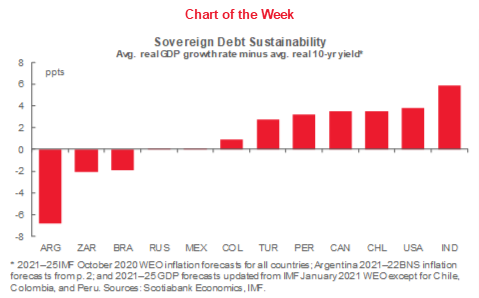

With herd immunity at least a year off—or farther out—across Latam, we anticipate some restrictions on economic activity through the end of 2021. These restrictions will likely occasion the need for further fiscal support from governments to businesses and households or, at a minimum, an extended delay in the withdrawal of existing measures. Given the large COVID-19 packages already implemented in Chile, Colombia, and Peru, some concerns are beginning to be raised about the financial sustainability of additional borrowing and spending, not just in Latam, but across emerging markets. It’s worth noting that on the most basic metric of sovereign debt sustainability—the differential between expected real GDP growth rates and real borrowing costs—the IMF’s forecasts imply that additional debt issuance by Pacific Alliance governments should remain macroeconomically bankable over the next five years (chart of the week, p.1, and chart 1).

A NEW SET OF CUTS FROM BANXICO, WHILE BCRP STAYS ON HOLD

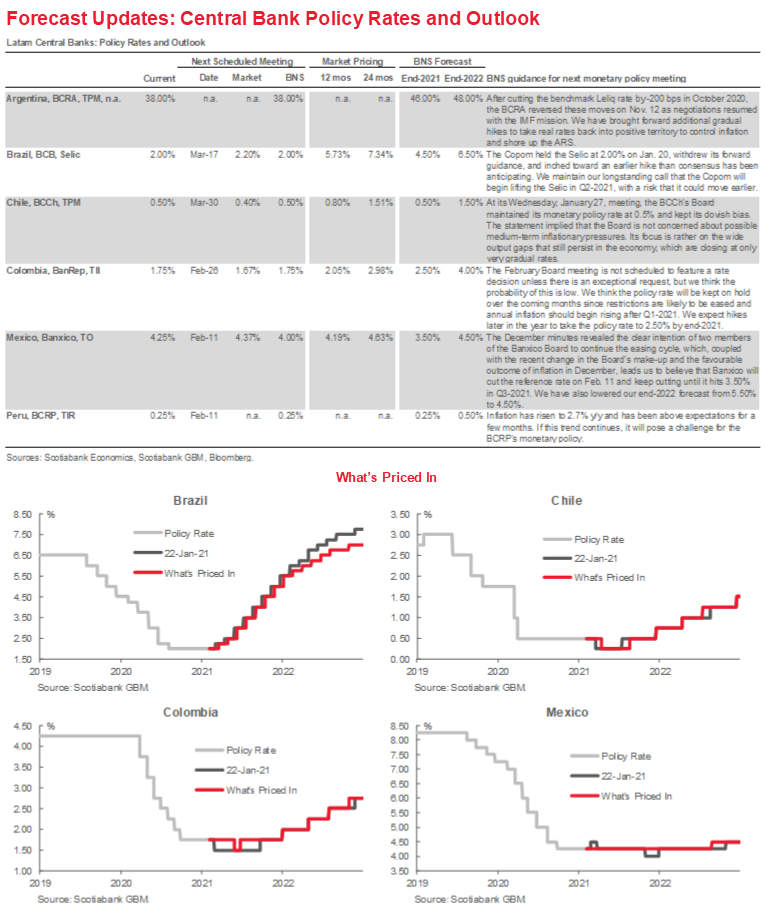

In upcoming central bank activity, our team in Mexico City expects the Banxico Board to deliver on Thursday, February 11 the first of three -25 bps cuts to take the target rate down from 4.25% to 3.50% by Q3-2021. In contrast, Peru’s BCRP is projected to hold again on the same day despite a recent rise in annual inflation numbers. Chile’s BCCh will also release the minutes from its January 27 rate decision on February 11.

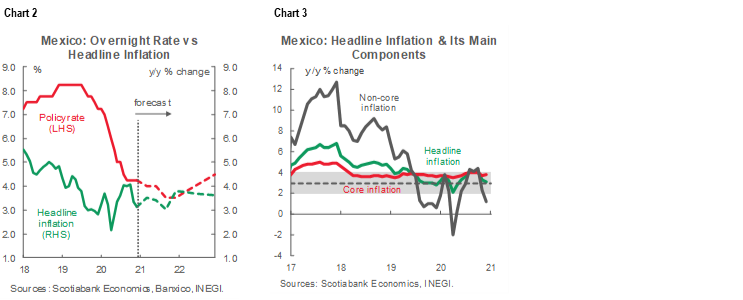

- Mexico. Banxico’s Board meets next on Thursday, February 11, and in a challenging call, the Scotiabank Economics team in CDMX expects a -25 bps cut in the target rate from 4.25% to 4.00% (chart 2). The move would follow the split 3-2 decision to hold at the Board’s last meeting on December 17 (see our December 18 Latam Daily). Since then, inflation was higher than expected in the first half of January, but credit data through December showed a further decline in private-sector borrowing, the formal job market remains soft, no new and significant fiscal support appears to be forthcoming, the COVID-19 pandemic is surging again in Mexico, and public-health restrictions have been re-tightened. While the next inflation print due on Tuesday February 9 could surprise further to the upside (chart 3), we believe the conditions for a fresh round of cuts are now in place. See the Mexico Country Update later in this report for more details.

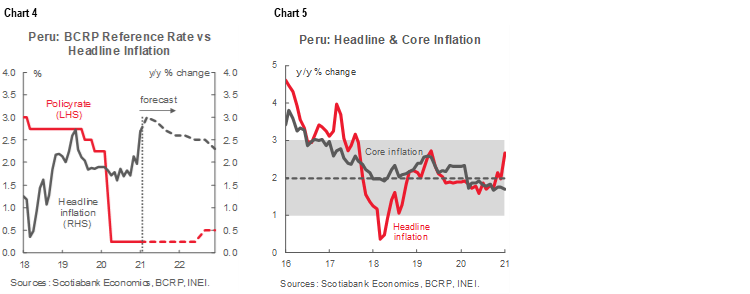

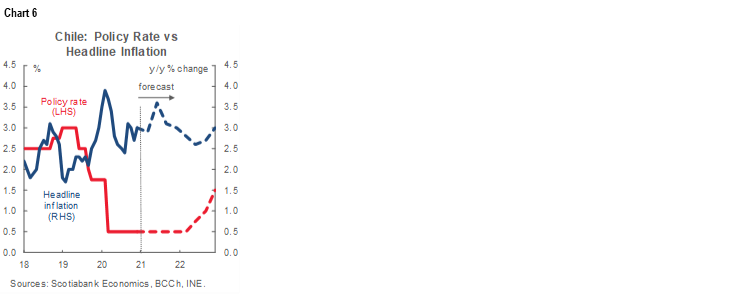

- Peru. The BCRP Board’s next monetary-policy decision is scheduled for Thursday, February 11 and another hold of the benchmark policy rate at 0.25% is widely expected (chart 4). The reference rate has been at this level since it was cut by -100 bps from 1.25% by the Board on April 9, 2020. In the statement from the Board’s last meeting on Thursday, January 14, it signalled that it is looking for a reduction in long-term rates and it reinforced its decidedly expansionary stance by activating interest-rate swaps on long-term loans to lower yields, particularly on mortgage lending. Our team in Lima expects the statement from next week’s meeting to acknowledge the recent rise in annual inflation rates (chart 5), but it does not anticipate a substantial change from the Board’s previous characterization of its inflation-related views—despite market expectations moderately creeping up to 2.0% y/y for the next 12 months after having been in the lower part of the 1–3% y/y target range only a few months ago. Instead, Scotiabank Economics in Peru forecasts the Board to remain focused on coordinating a containment and lowering of long-term interest rates. We continue to pencil in a first rate hike in Q3-2022 (see the forecasts on p. 2 of this report and our February 4 Global Forecast Tables).

,

,

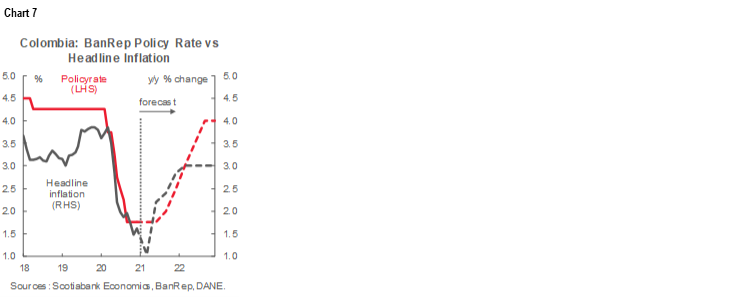

- Chile. The BCCh is scheduled to release on Thursday, February 11, the minutes from its Wednesday, January 27 Board meeting where members decided to keep the policy rate on hold again at 0.50% (chart 6), which was fully anticipated by markets and analysts. At that meeting the Board also decided to expand the FCIC for a third time by USD 10 bn over the next six months while at the same time enlarging he range of eligible collateral for borrowers.

- Colombia. The February 26 meeting of the Board of Colombia’s BanRep is not set to feature a decision on monetary-policy rates. We do not expect any further cuts to the current 1.75% benchmark rate (chart 7).

USEFUL REFERENCES

C. Aschwanden (2020), “The False Promise of Herd Immunity”, Nature, October 21: https://www.nature.com/articles/d41586-020-02948-4

WHO (2020), “Herd immunity, lockdowns and COVID-19”, December 31: https://www.who.int/news-room/q-a-detail/herd-immunity-lockdowns-and-covid-19

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Mass Vaccination Moving Forward, as 2020 Closed with a -6.0% y/y GDP Contraction

Jorge Selaive, Chief Economist, Chile

56.2.2619.5435 (Chile)

jorge.selaive@scotiabank.cl

Carlos Muñoz, Senior Economist

56.2.2619.6848 (Chile)

carlos.munoz@scotiabank.cl

The vaccination process has been the main development during the beginning of the new year, as almost 4 mn doses of Sinovac vaccines arrived in the last days of January and the whole country has started receiving shots. The health regulator has already given the green light to three different vaccines—those from Pfizer/BioNTech, Sinovac, and Oxford/AstraZeneca—and the authorities have closed agreements with an additional two sources: COVAX and Johnson & Johnson. In total, more than 36 mn doses are expected to arrive in 2021.

There have been other developments in the economic sphere. At its Wednesday, January 27 meeting, the central bank’s Board maintained its monetary policy rate at 0.50%, where it has been since end-March 2020, and kept its dovish bias. The statement revealed that the Board is not concerned about possible medium-term inflationary pressures. Its focus is rather on the wide output gaps that persist in the economy and that are closing at only very gradual rates. On January 29, employment data for December were released by the INE. Chile’s national unemployment rate decreased again from 10.8% in the moving quarter September–November to 10.3% in October–December 2020. The reduction reflected greater dynamism in employment growth compared with labour-force participation, despite December’s retreat toward tighter mobility restrictions. This should reverse in the coming months as job search increases, which should keep the unemployment rate at high levels for much of 2021.

December economic activity levels delivered positive surprises despite greater mobility restrictions. The month’s recovery in services particularly stood out in data released on Monday, February 1. December’s monthly GDP contracted -0.4% y/y, positively surprising market expectations (Bloomberg: -2.3% y/y; BCCh’s Economist Survey: -1.0% y/y) and also beating our estimate (-4.1% y/y) based on the month’s weak sectoral figures. December showed a re-acceleration in the monthly dynamism of GDP, which should allow output gaps to narrow somewhat faster than we saw in the latter months of 2020. Although the economy has a long way to go to close these gaps completely, real economic activity is now well above the lows of 2019’s social unrest and is homing in on pre-pandemic levels (first chart).

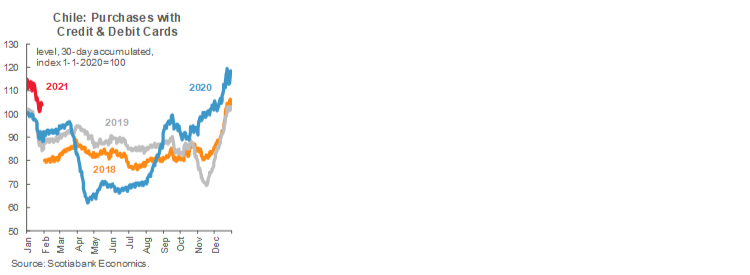

Finally, our high-frequency indicators show that transactions have decelerated in the past weeks (second chart). Data show that the spending coming from the withdrawal of pension funds is losing momentum. By segments, supermarkets is the only category that shows high—though declining—levels of transactions, while department stores, clothing, restaurants, and tourism travel remain subdued.

January’s inflation data on Monday, February 8 came in stronger than expected. We had been expecting a monthly CPI of 0.5% m/m, as we are observing seasonal increases in fruits and vegetables, a rise in transport prices (fuels, tolls), and a general upward pressure on the prices of goods, fueled by the second withdrawal of pension assets, which started at the end of December—but the actual print came in at 0.7% m/m. With this, annual inflation in January stood at 3.1% y/y, higher than the 2.9% y/y we expected. On Thursday, February 11, the BCCh’s minutes for the January meeting will be released. We don’t expect many surprises, as the dovish stance the central bank adopted in its last meeting was clear, but January’s inflation print will increase scrutiny of the Board’s deliberations.

Colombia—What to Expect of the New BanRep Board?

Sergio Olarte, Head Economist, Colombia

57.1.745.6300 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Economist

57.1.745.6300 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

Without question, the Colombian central bank (BanRep) has been one of the most orthodox central banks in the region. In its reaction function, inflation and inflation expectations have the most relevance for monetary-policy movements. Additionally, BanRep has shown that a flexible exchange rate is crucial for its policy framework. Before the pandemic began in Colombia, President Duque had named two out of seven BanRep Board members—which means that the government, on paper, has three Board members (including the Minister of Finance) who would vote in favour of government interests—but the BanRep Board has reacted in a measured fashion to events over the past year. Only once there was evidence of the magnitude of the pandemic-related shocks and their effects on inflation and inflation expectations did the Board decide to cut interest rates in a gradual manner to a historic low of 1.75%.

Additionally, despite the strong currency depreciation seen during March–April (more than 30% y/y and 26.1% compared to Dec 2019), BanRep did not intervene in the FX, arguing that it was a natural market response to the high degree of uncertainty. In fact, the Board decided to buy USD 3.5 bn directly from the government and increase international reserves. This orthodox behaviour has been manifested several times since BanRep became independent in 1991.

In the past, the re-election of two Colombian Presidents (i.e., Uribe and Santos) meant that at points during those administrations the head of state had appointed four out of seven members of the Board plus the Minister. Despite those developments, BanRep has maintained its institutional independence and a firm adherence to its policy framework in response to major shocks (e.g., the 2008 crisis, oil prices shock in 2016, among others).

Additionally, Leonardo Villar’s recent election as Governor also showed that the BanRep Board maintains an arms-length relationship with the government. Recall that the other candidate was Minister Carrasquilla, which would have sent the wrong message to markets. Last week, President Duque appointed two Board members who should help maintain both this distance and BanRep’s devotion to evidence-based policymaking: Mauricio Villamizar, currently head of economic studies at BanRep, who is likely to align his vote with BanRep’s staff recommendations; and Bibiana Taboada, who worked for the Inter-American Development Bank and for the government in the Department of Social Prosperity, which could imply a dovish stance, but one backed by a strong technical background.

All in all, despite some concerns voiced about central bank independence and the possibility in any change of members for the Board to become political, we see the new appointments in a positive light. We expect the newly-appointed Board members to continue BanRep’s tradition of measured behaviour underpinned by both evidence and a devotion to the existing inflation-targeting regime.

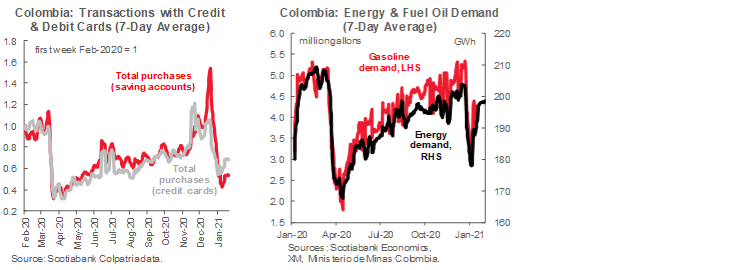

We continue to anticipate a gradual recovery in economic activity and expect annual inflation to start rising toward the 3% y/y target after Q1-2021. Although Scotia Colpatria’s retail transactions volumes pulled back in January owing to new mobility and public-health restrictions (first chart), energy and fuel demand bounced back from the usual holiday lull (second chart), keeping the recovery on track. On Friday, February 5, January inflation came in at 0.41% m/m, which met consensus expectations, but which would have been a positive surprise for the BanRep and reduces pressures on the Board to cut rates in the short term. We maintain our base case scenario under which the BanRep would keep the policy rate at 1.75% over the next couple of meetings and start a discussion on hiking rates by the second half of 2021.

Mexico—Light at the End of the Tunnel, but the Road to Get There is Bumpy

Eduardo Suárez, VP, Latin America Economics

52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

INEGI released preliminary estimates for Mexico’s Q4-2020 GDP, which provided a pleasant surprise, printing at -4.5% y/y versus consensus -5.6% y/y. On a quarterly basis, Q4 GDP growth came in at 3.1% q/q saar, showing a slowdown from the previous 12.1% q/q saar result, but still indicating that the rebound is continuing. Secondary activity expansion slowed from 21.7% q/q saar in Q3 to 3.3% q/q saar, and tertiary activity went from 8.8% q/q in Q3 to 3.0% q/q in Q4. At this point, we do not have the full details of how growth performed by sector, but we do have some clues from other data. Our sense is that external demand remains the primary driver of the rebound, while domestic demand—particularly investment—is still more subdued (gross fixed investment -14.7% y/y in October and -12.1% y/y in November).

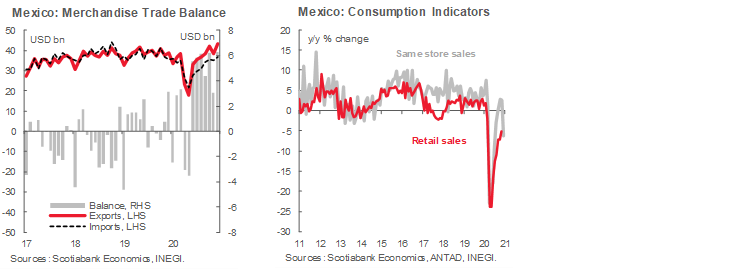

Looking at trade data, the past couple of quarters have seen abnormally large trade surpluses that, despite the healthy recovery in exports, have been driven by weak imports (first chart). Some of the timelier indicators of domestic demand, such as retail sales and ANTAD wholesale data (second chart), seem to support the view that consumption is lagging. In addition, there could have been some inventory build-up in Q3. At this point, it appears that the strongest growth engines are export-oriented manufacturing and the agriculture sector. However, during the second half of the year we expect a gradual improvement in key industries such as entertainment-related services which should benefit from vaccine roll-outs not only domestically, but globally.

The indicators discussed above have mixed implications for growth in 2021. We expect some positive news for domestic demand for the rest of the year including:

(1) remittances may continue to break records, which is expected to be partly explained by US stimulus. The new round of US direct cheques should help Mexico both directly through export support, but also by boosting domestic consumption;

(2) as we mentioned above, tourism should gradually become a driver for service-sector improvements as vaccination efforts roll out globally; and (3) service-sector activity improvements could also help accelerate the jobs recovery, in turn boosting domestic demand. On the flip side, the main sector that seems likely to underperform in 2021 is investment, which has been lagging since 2019, as uncertainty in some important sectors continues to weigh on corporate capital deployment.

From Banxico’s policy standpoint, there was also relevant news that came out over the past week, which added risks not only to our own view, but also to what was priced into the TIIE curve. Deputy Governor Jonathan Heath—one of the two members who have recently leaned more on the dovish side, including by supporting a cut in the last meeting—sounded more cautious during a presentation on Wednesday, in which he suggested easing could resume once a window re-opens in April. Heath, along with Esquivel and possibly new Board member Galia Borja, were expected to be the three most likely Board members supporting a -25 bps cut in the coming February 11 meeting. We see two possible explanations for this newly-found caution: (1) that ongoing market volatility has tilted the central bank’s stance towards caution; or (2) that base-effect-driven annual inflation since the start of the year could be staying the Board’s hand. We give more weight to the first explanation as we doubt Banxico would be caught unprepared by price data when members of the Board were supporting a cut as recently as the last meeting. A final source of uncertainty on the upcoming Banxico decision is the new Board member Galia Borja, as little is known regarding her monetary policy views. We perceive that consensus expects a dovish lean from Deputy Governor Borja, given that the last two members appointed under the current administration have been “prudent doves”. However, we have little to go on but speculation at this point. In a challenging call, are expecting Banxico to deliver a -25 bps cut on February 11, but we see risks that the two further cuts we anticipate could be pushed back a bit.

Peru—Second Wave Uncertainties and Forecast Adjustments

Guillermo Arbe, Head of Economic Research

51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

There is renewed concern in the country as the second COVID-19 wave surges. Hospitalizations have tripled since late December (first chart). The government has re-instated containment measures, which are mostly focused on restricting the mobility of the general public. The measures fall far short of constituting a lockdown, as only some 5% of production is restricted, in our estimate (see our February 1 Latam Daily). However, there is a definite psychological impact, and plenty of nervousness regarding the delay in vaccines and how long the surge, and containment measures, could last. We are maintaining our forecast of 8.7% y/y GDP growth for 2021, but our outlook has lost the upside we had previously foreseen. The containment measures will likely temporarily stifle the strong recovery trend we had been seeing going into 2021.

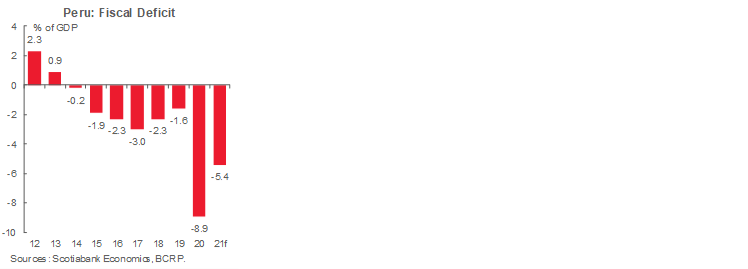

To counter the containment measures, the government has allocated PEN 2.4 bn for safety-net transfers to households and has deferred tax payments for one month. The fiscal impact should be mild, but enough for us to raise our fiscal deficit forecast for 2021 from -5.0% of GDP to -5.4% (second chart).

We have also raised our 2021 inflation forecast from 2.0% y/y to 2.6% y/y. Inflation has consistently surprised to the upside over the past few months. We expect rising import prices—especially soft commodities which Peru imports heavily (e.g., wheat, maize, soybeans)—to continue feeding inflation early in the year. This does not alter our view that the reference rate will remain at 0.25% until mid-2021. The fact that core inflation is only 1.8% y/y gives the BCRP more leeway to keep rates low and continue focusing on stimulating the economy.

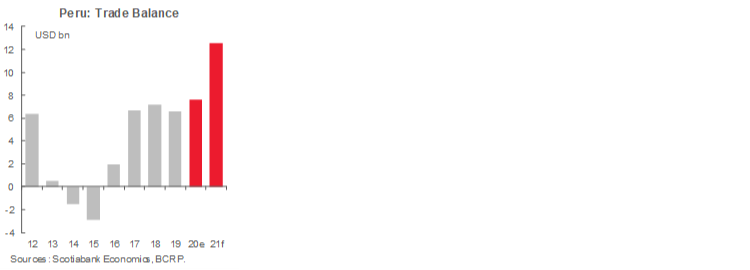

We’re also updating our external account forecasts to take into account persistently high metal prices. We expect a USD 7.59 bn trade surplus in 2020, which is nearly 15% above 2019 (third chart). However, 2021 will likely be even better, with the trade surplus rising 65%, to USD 12.5 bn. We project exports to rise from USD 41.9 bn in 2020 to USD 51.1 bn in 2021. Much of the lift in metal prices took place late in 2020, and volume will rebound. Imports will rise as well, from USD 34.3 bn in 2020, to USD 38.6 bn in 2021. Exports are expected to surpass pre-COVID-19 levels, whereas imports would not. One strong reason is that Peru is a net importer of oil and fuels, and we forecast oil prices to continue to be lower than pre-COVID-19 levels. We anticipate that net international reserves will rise to USD 77 bn, which is equivalent to 24 months of imports—very strong coverage.

Meanwhile, the campaigns for the April 11 elections are in full swing, or as much as is possible, given mobility restrictions. It is still an open election, with the number of undecided voters surpassing the combined voting intentions in favour of the leading two candidates. Congress continues to be a risk. Currently, it is debating the pension reform. Meanwhile, the government has vetoed a law that would eliminate certain bank fees and, more importantly, would open the door to State tampering with market interest rates. There is a good chance that Congress overrides the veto, after which the issue will likely be taken to the courts.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.