FORECAST UPDATES

- Following April’s upside inflation surprise in Mexico, our team in CDMX has removed the one further cut in Q3-2021 that it had maintained until now in its forecast. Banxico is now expected to stay on hold until early-2022.

ECONOMIC OVERVIEW

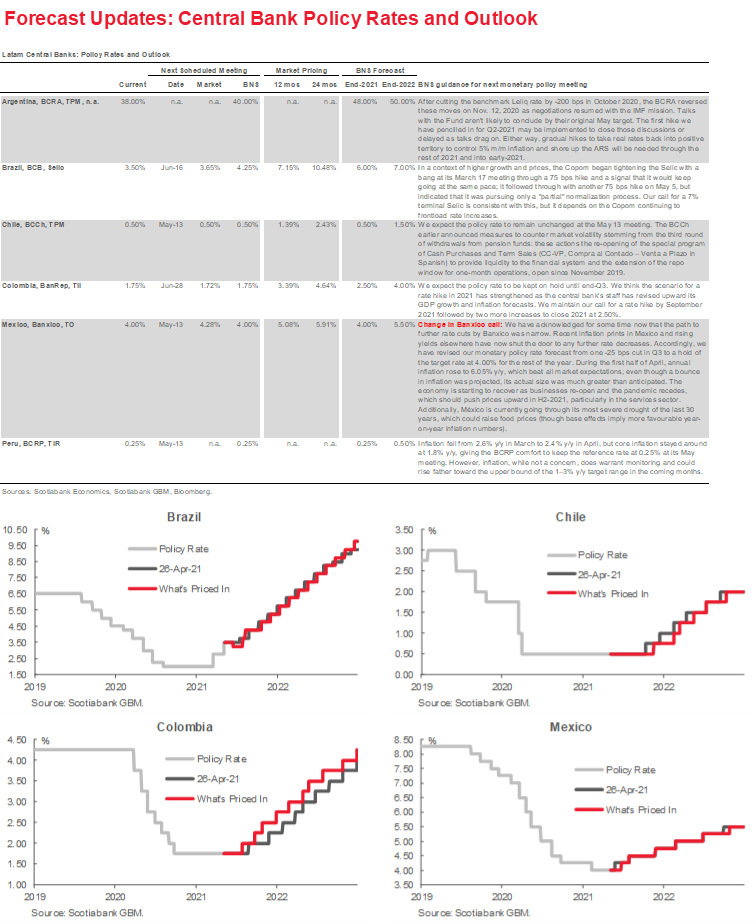

- Base effects are pushing headline inflation rates up in Q2 and Q3 across developed and emerging markets. While Brazil’s Copom is moving proactively to contain price pressures, and we think Banxico won’t ease further, we continue to see a first hike from Colombia’s BanRep in Q3-2021, while central banks in Chile and Peru are set to stay on hold until 2022.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

MARKET EVENTS & INDICATORS

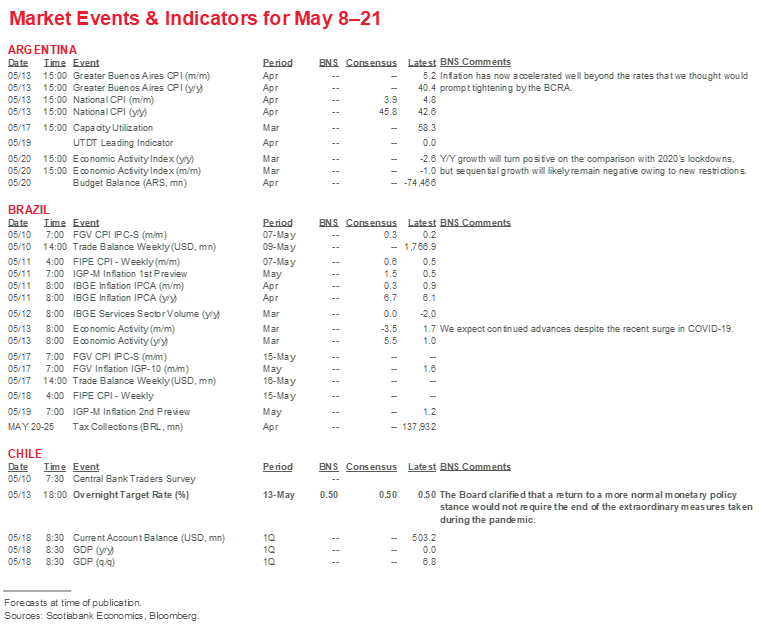

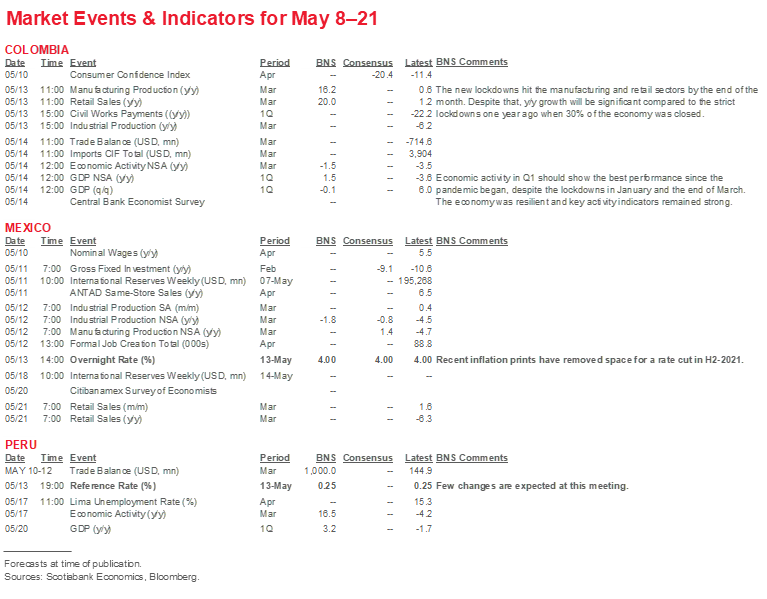

- A comprehensive risk calendar with selected highlights for the period May 8–21 across the Pacific Alliance countries, plus their regional neighbours Argentina and Brazil.

Economic Overview: Navigating Base Effects

Brett House, VP & Deputy Chief Economist

416.863.7463

Scotiabank Economics

brett.house@scotiabank.com

Eduardo Suárez, VP, Latin America Economics

52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

- Base effects are pushing headline inflation rates up in Q2 and Q3 across developed and emerging markets.

- While Brazil’s Copom is moving proactively to contain price pressures, and we think Banxico won’t ease further, we continue to see a first hike from Colombia’s BanRep in Q3-2021, while central banks in Chile and Peru are set to stay on hold until 2022.

SUPER THURSDAY AHEAD

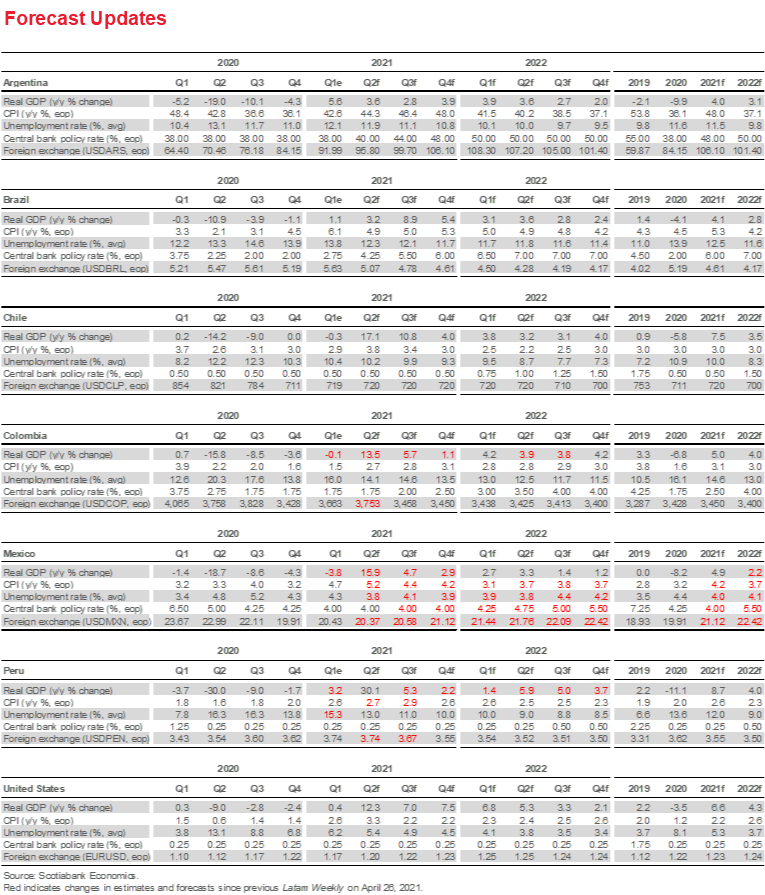

Across developed and emerging markets, year-on-year inflation readings are set to rise over the coming months owing to base effects from the early stages of 2020’s COVID-19 induced lockdowns. Throughout Q2 and Q3 it will be more important than ever to monitor seasonally-adjusted sequential monthly inflation rates more closely rather than skewed annual readings to gauge the extent to which individual central banks could be forced to curtail their exceptional monetary-policy support more quickly than we currently anticipate (see our Forecast Table on p. 3).

While rebounding economies and rising headline inflation rates may put some lift under the wings of central bank hawks and could drive short-run moves in rates markets, three broad considerations should contain a wholesale re-assessment of monetary-policy stances in Latam:

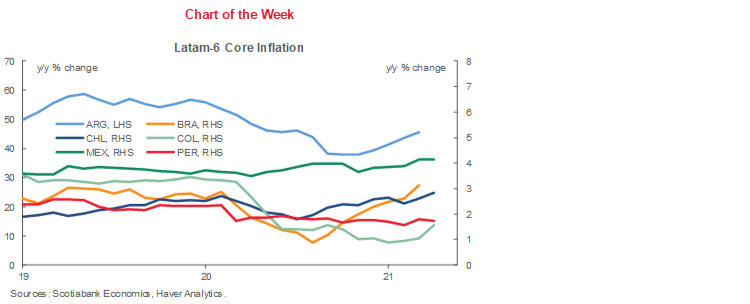

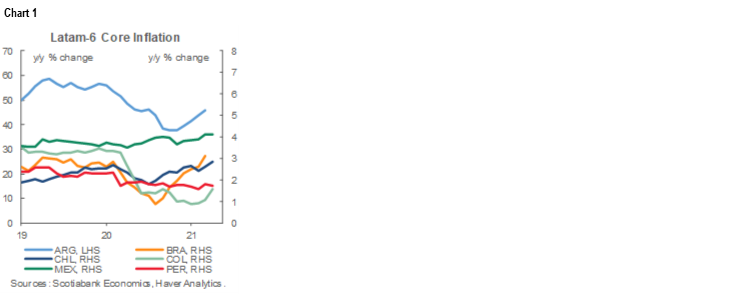

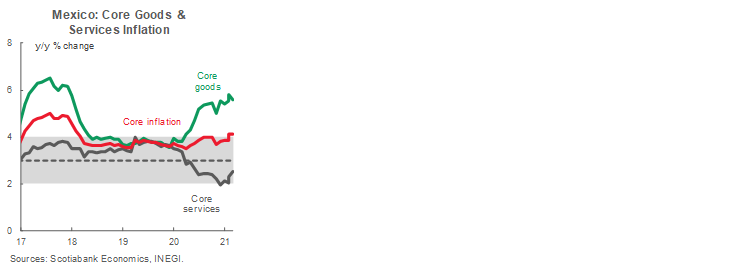

- Core inflation remains reasonably well contained. As the chart of the week on p. 1 and chart 1 show, core price increases remain generally well-behaved outside of Argentina. Core inflation in Brazil, Colombia, and Peru remains below their headline inflation targets, while core is at the target in Chile and at the top end of the target band in Mexico. Nevertheless, the consistent rise in core prices in Brazil is motivating front-loaded increases in the Selic by the BCB Copom, while the persistence by which core inflation has remained at the top of Banxico’s target band is one of the reasons our team in CDMX has removed a cut in Q3 from our forecasts;

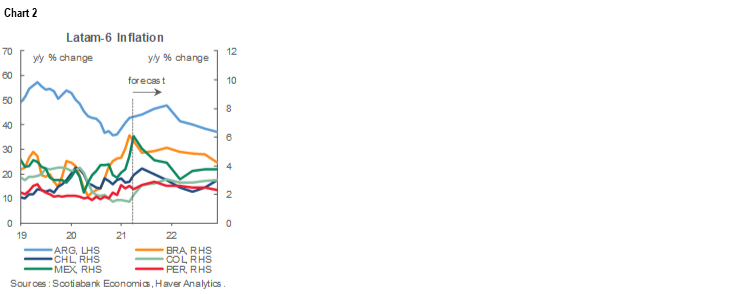

- Annual headline inflation is expected to subside once the exceptional base effects from 2020 begin to roll out (chart 2). Our teams in Latam believe we are passing inflation’s peaks in Brazil and Mexico, with only moderate increases remaining in Chile, Colombia, and Peru before pressures abate; and

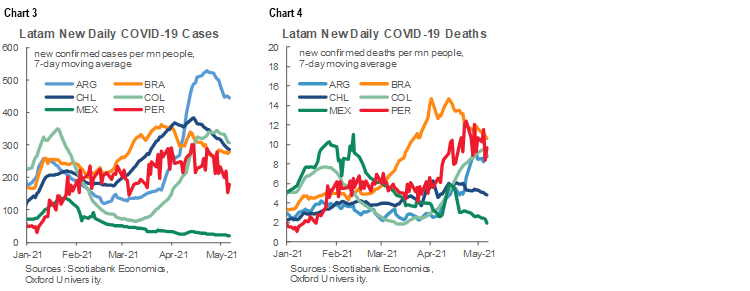

- So long as COVID-19 remains a present concern (charts 3 and 4), central bankers are likely to remain cautious about removing stimulus too proactively.

Looking at recent central bank moves and those in the offing for the fortnight ahead, Brazil’s Copom signalled on Wednesday, May 5, that it is going to continue implementing 75 bps hikes to head off further price increases, while central banks in Chile, Mexico, and Peru are scheduled to make their next rate decisions on Thursday, May 13. Their communications will provide a fresh opportunity to assess their thinking on how they expect to navigate the next couple of quarters of higher headline inflation.

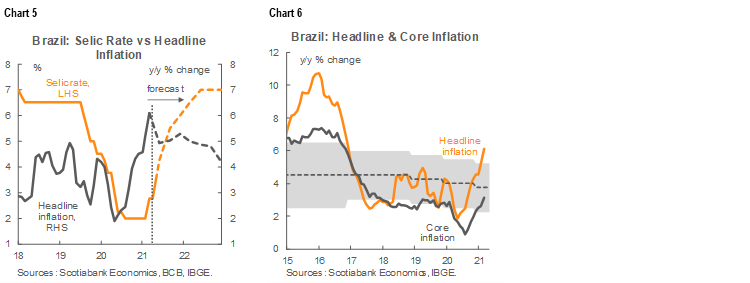

- Brazil. On May 5, the BCB delivered its latest and widely anticipated 75 bps hike (chart 5) in response to rising inflation (chart 6). The Copom signalled that its next likely move is another 75 bps hike: “the Committee foresees the continuation of the partial normalization process with another adjustment of the same magnitude in the degree of monetary stimulus”. However, the Committee inserted a moderately dovish signal with its reference to a “partial normalization”. We estimate that the neutral real rate lies somewhere in the 3–4% range, but the BCB is signaling that it does not plan to reach that terminal rate in the policy horizon. The Copom appears to be heading for a terminal rate closer to 5–6%, but DIs now have 900 bps of hikes priced into the next three years, with 685 bps of those hikes in the next 2 years (from current 3.50%), which is materially greater than the path the Committee is signalling. Our call for a 7.00% terminal nominal rate is much closer to the BCB’s implicit communications compared with the >12% terminal nominal rate priced into DIs. Discriminating between these two views depends on one’s assessment of how much the BCB will be forced to compensate for fiscal slippage. If Brasilia’s fiscal adjustment falls well short of what is needed, or the Copom doesn’t follow through on front-loaded rate increases, the eventual terminal nominal rate will need to be higher than our projections.

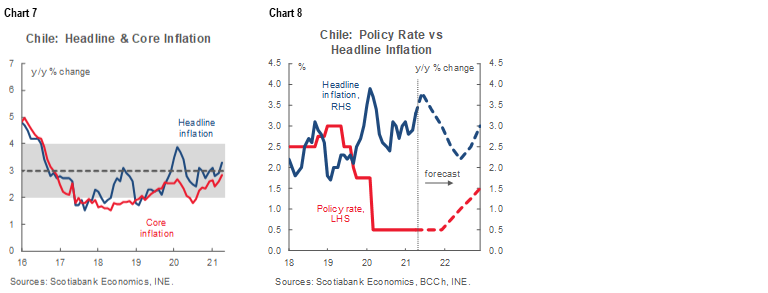

- Chile. The BCCh Board is scheduled to meet on Thursday, May 13 and hold its benchmark policy rate at the 0.5% “technical minimum” (chart 7). At its March 30 meeting, the Board indicated that it would look through recent upswings in non-core prices and some improvement in the central bank’s growth outlook on the rationale that the medium-term satisfaction of the 3% y/y inflation target would require highly stimulative monetary policy for several more quarters (chart 8).

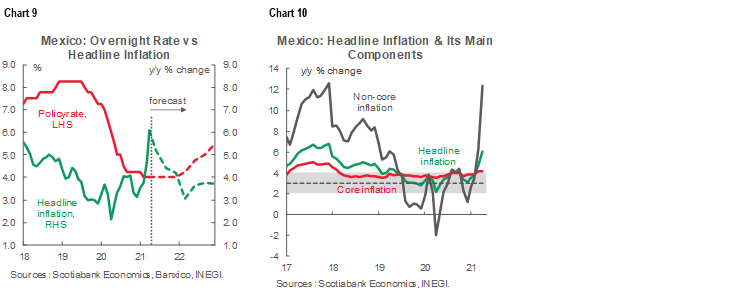

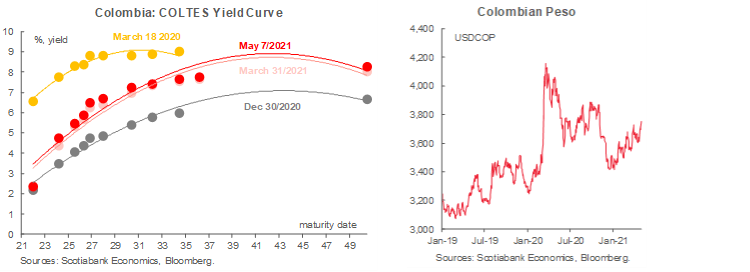

- Mexico. Our team in CDMX expects Banxico’s Board to keep the overnight target rate on hold at 4.00% at its meeting on Thursday, May 13 (chart 9). After removing a possible cut from our outlook in Q3-2021 in response to April’s price spike (chart 10), Scotiabank Economics expects Banxico to stay on hold until early-2022.

- Peru. In what we generally expect to be another uneventful meeting on Thursday, May 13, the BCRP Board is widely projected to hold its main policy rate at its record-low 0.25% (chart 11), with unchanged forward guidance. The April Quarterly Inflation Report maintained a balanced assessment of inflation risks owing to offsetting influences from the pandemic, political uncertainty, higher food prices, and rising commodity prices (chart 12). As a result, policy rates are still expected to stay unchanged into 2022.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Economic Recovery Continues While Some Mobility Restrictions are Lifted

Jorge Selaive, Chief Economist, Chile

56.2.2619.5435 (Chile)

jorge.selaive@scotiabank.cl

Carlos Muñoz, Senior Economist

56.2.2619.6848 (Chile)

carlos.munoz@scotiabank.cl

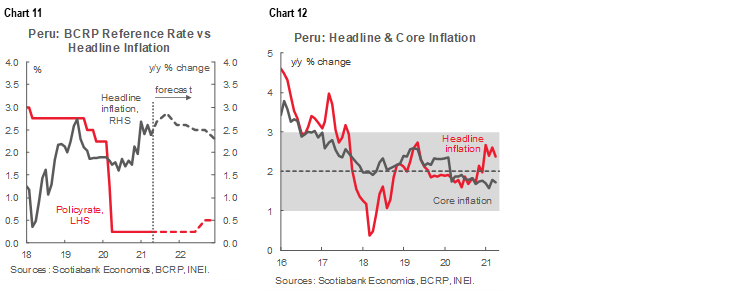

After some very tough weeks in terms of the evolution of the COVID-19 pandemic, the latest data for Chile indicate that the worst might be over. There has been a reduction in new cases, deaths, and ICU bed occupancy in the health system (first chart). Moreover, the vaccination process continues at a fast pace, and the authorities expect that, by July, Chile will reach herd immunity. This improvement in health indicators has been coupled with a lifting of some mobility restrictions. Currently, some parts of Gran Santiago are no longer in full lockdown, and free mobility is permitted during weekdays (confinement is still enforced during weekdays for the whole metropolitan area). We expect to see the remaining parts of the metropolitan area reduce restrictions in the coming weeks.

There have been important developments in the political arena over the past weeks. On Tuesday, April 27, the Constitutional Court rejected the week-old request from President Piñera’s government to hear a challenge against the third round of pension-fund asset withdrawals approved by Congress. After this setback, President Piñera decided to enact the original third-withdrawal bill approved by Congress, and the first requested fund withdrawals were processed on Monday, May 3. The AFPs began to deposit the funds in the contributors’ accounts by Wednesday, May 5.

The pension fund regulator estimates that the third withdrawal would lead to disinvestment of around USD 19 bn in assets. On Thursday, April 29, the BCCh announced measures to counter market volatility stemming from the third round of withdrawals from pension funds. These measures include the re-opening of the special program of Cash Purchases and Term Sales (CC-VP, Compra al Contado – Venta a Plazo in Spanish) to provide liquidity to the financial system along with the extension of the REPO window for one-month operations, open since November 2019.

On Tuesday, May 4, Ministers and representatives of both chambers of Congress met to flesh out the so-called “common minimum agenda” on which they agreed last Friday, April 30, to unblock the political stalemate that accompanied the third round of pension-fund withdrawals. One of the government’s main proposals would provide a universal emergency subsidy, a concession to the main demand of Opposition representatives. The move would increase the coverage of the IFE (Emergency Family Income) from the current 80% of the Social Household Registry (i.e., the most vulnerable households in the country) to 100%. This would imply raising the number of beneficiaries from 13 mn at present to about 14.5 mn, with an additional fiscal cost of approximately USD 200 mn per month, at least until the June 21 date for new aid mentioned by the government.

In April inflation data received Friday, May 7, the CPI expanded 0.4% m/m, slightly surprising our expectations and that of the market (0.3% m/m), and showing that there is still high household liquidity in a context in which supply chains for goods remain somewhat stunted given last month's strict quarantine measures. In annual terms, generalized inflation of goods is beginning to subside, which confirms our view that the second semester presents a slightly disinflationary risk despite the third withdrawal of pension funds.

In labour-market data published Friday, April 30, the unemployment rate stood at 10.4% for the moving quarter ended in March, slightly above the 10.3% registered during December–February. The re-imposition of quarantines and some seasonal factors led to both slow employment growth and job destruction in March. However, this was the first month since July 2020 in which job destruction has been observed. On Monday, May 3, monthly economic activity data for March were released and showed an expansion of 6.4% y/y (second chart), which exceeded expectations by a wide margin. The BCCh’s Economic Expectations Survey consensus was 1.6% y/y, while the Bloomberg market consensus was 4.5% y/y. In seasonally adjusted sequential terms, economic activity fell by -1.6% m/m sa, a smaller retreat than had been expected during a month in which quarantines were re-imposed throughout the whole country. The performance reflected a certain adaptation of the economy to public-health restrictions, and shows that sectors such as commerce, industry and mining have recovered pre-pandemic levels (second chart again).

For the fortnight ahead, we expect to see further improvement in health indicators, which will allow more areas of the country to get out of lockdown. On Thursday, May 13, the central bank will meet again. We don’t expect changes in the monetary policy, as measures regarding the stability of the financial system have already been announced by the central bank. We maintain our view that the first hike in the policy rate will happen at the January 2022 meeting.

Colombia—Recent Political and Social Developments and Potential Resolution

Sergio Olarte, Head Economist, Colombia

57.1.745.6300 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Economist

57.1.745.6300 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

The presentation of the fiscal reform before Congress triggered substantial social discontent and the main parties (including the government's party) emphatically rejected the proposal. As a result of the intense social pressure, the government decided to withdraw the bill, which was followed by the resignation of the Minister of Finance, Alberto Carrasquilla, who was immediately replaced by José Manuel Restrepo.

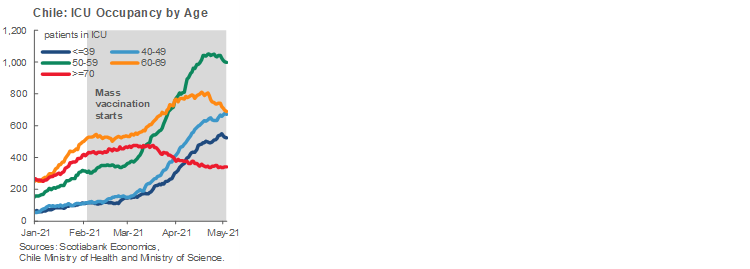

Now Colombia is facing two significant issues simultaneously; the first is the necessity of fiscal consolidation while trying to keep alive vital social programs. The second concern is that the social unrest and protests have become violent, mostly in the country's main cities. Both events brought uncertainty to the markets and resulted in a significant decline in Colombian assets (first and second charts). The main questions are: How long these events can last? And could markets deteriorate further?

On the first issue, the new economics teams of the government seem to have a much better relationship with Congress, which improves the likelihood of passing a fiscal reform sooner. In fact, Minister Restrepo is already negotiating with the main parties in Congress and, on his first day in office, said that he had dropped the most problematic topics for the new proposal that the Ministry of Finance is preparing. The VAT modifications, the increase to individuals’ tax base, along with other items that were in the initial proposal, are now entirely off the table.

Additionally, some consensus has been reached on proposals such as increasing taxes for the wealthiest people and postponing some reductions in corporate taxes, and even includes some temporary surcharges. One further incentive to pass the tax reform before the end of June is that the social expenditure implemented during the pandemic expires in July and, ahead of presidential elections, we think Congress does not want to eliminate these aids to low-income people.

Regarding the second issue of social unrest and resulting market uncertainty, we think there are more challenges to come. We believe uncertainty will continue until the government can find agreements with the protest leaders. President Duque initially has said that he will sit with social leaders on May 10th which has extended the uncertainty because, in the meantime, the national strike continues, and more protests occur. We think that in the end the government will find agreements with the protest leaders, but timing is key, so the longer the protests last, the larger the hit to economic activity and markets. In fact, although we now expect a better Q1-2021 GDP (due on May 14th) we are not yet changing our 2021 GDP growth forecast of 5% y/y due to the April and May mobility restrictions and the protests that have caused some sectors to temporarily close.

In the markets, the impact was immediate on the fixed income side; the curve erased the appreciation of April and rates increased on average 80 bps since the fiscal reform was first presented. The social protest outbreak deepened the negative impact after the national strike which began on April 28 and has continued until May 7 (and counting). On the currency side, USDCOP reached the highest level of the year, losing the traditional relationship with key fundamentals completely. That said, based on the scenario of a resolution in which the dialogues with the protest leaders go positively, along with the approval of a fiscal reform significant enough to keep the public finances afloat for the next couple of years, we think the local assets could find improved levels in the medium term, more compatible in the context of better oil prices, stable treasury rates, and a positive mood in foreign markets.

April’s inflation, published by DANE late on Wednesday, May 5, stood at 0.59% m/m, once again well above both market consensus (BanRep survey 0.32% m/m) and our projection (0.29% m/m). Foodstuffs inflation and the lodging and utility groups contributed the most to the positive surprise. It is worth noting that core inflation stood at 0.30% m/m, also above the market consensus of 0.22% m/m. This reflected further upward price pressures amongst key components—a signal of the strengthening economic environment and further normalization of prices. That said, annual headline inflation rebounded from 1.51% y/y in March to 1.95% y/y in April, which makes it possible that inflation could close above the 3% target this year; at the same time, annual core inflation increased from 1.06% y/y in March to 1.56% y/y in April. We continue to expect the BanRep Board to keep its benchmark policy rate on hold at 1.75% until at least September-2021, when we look for the first hike.

Mexico—Revising Our Forecasts as Higher Inflation Path Shuts the Door on Further Easing

Eduardo Suárez, VP, Latin America Economics

52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

Mexican inflation continued to soar in April, printing at 6.1% y/y. Although the spike was expected, it still puts CPI 200 bps north of the ceiling of Banxico’s target range and, looking at its components (chart), we see spikes in food (which could be aggravated by a record drought in Mexico), as well as energy prices which could have a spillover effect into other components. In addition, for the second half of the year, we see risks that services inflation could also add fuel to the fire as reopening continues to run its course and services sector businesses find themselves desperate for higher revenues after a year where many of them operated at 30–40% capacity. On top of very weak utilization over the past year, costs have been pressured by material minimum wage hikes, and could be further escalated by restrictions to outsourcing, the fiscal reform, and potentially higher pension contributions due to the expected pension reform. Hence, we see risks of volatile but persistent above-target inflation, which has led us to eliminate the final rate cut we had recently downgraded to tentative.

We anticipate that Banxico will kick off its tightening cycle after Governor Diaz de Leon’s term ends on December 31, likely at the first MPC meeting of 2022 which we expect to be in February (we don’t yet have a meeting calendar for next year). However, we have penciled in a gradual lift-off for Banxico, in part because we have a relatively smooth outlook for financial variables. Our MXN path is not dissimilar to what is currently discounted into the FX swaps curve. However, we may see higher volatility —particularly into H2-2022—when several factors of uncertainty start coming together, including questions on credit ratings which will depend on the country’s capacity to sustainably re-accelerate growth beyond 2021 and the expected fiscal reform. As we are seeing in Colombia, raising fiscal revenues is never easy, but it can be particularly challenging while exiting a major recession.

On the growth front, we had already made upward revisions to our forecasts, but in the components, we have made some marginal tweaks. Our manufacturing recovery path looks a little softer, in part due to persistent disruptions in some sectors due to chip scarcity, while in the services sector we continue to see a strong rebound in H2-2021. The main component where we now see a stronger performance, which offsets the modestly weaker path we see for manufacturing, is investment. The latest trade balance prints point toward somewhat stronger capital spending, and investment announcements have also started showing a pulse once again. Overall, the pleasant surprise in our 2021 economic outlook is that growth looks more balanced, particularly towards the second half of the year, where employment will also benefit from a service sector recovery.

Peru—The Economy Improves, but Politics Remains Uncertain

Guillermo Arbe, Head of Economic Research

51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Mario Guerrero, Deputy Head of Economic Research

51.1.211.6000 Ext. 16557 (Peru)

mario.guerrero@scotiabank.com.pe

The current COVID-19 wave, with record daily contagions and fatalities, seems to be showing the first signs that it could be cresting, at least this is our perception as the vaccination process advances. As of now, 1.2 mn people have been vaccinated (3% of the population) at least with their first dose. While Peru is still significantly behind its regional peers and much of the world in the delivery of COVID-19 vaccinations, this advance and the announcement that new batches of vaccines set to be received into the country are encouraging.

On the political front, some hopeful signs are also emerging. The latest Ipsos poll showed a reduction in the gap in support between the presidential candidates Castillo and Fujimori. The space between them has come down from 11 ppts (April 16) to 9 ppts (April 30). Early indications following the first debate on May 1 imply that the race may have tightened a little more since then. As Castillo and his positions become better known, his negative ratings have increased (up from 0% in March to 36% in April), while aversion to Fujimori's candidacy has dropped from 70% to 50% over the same period.

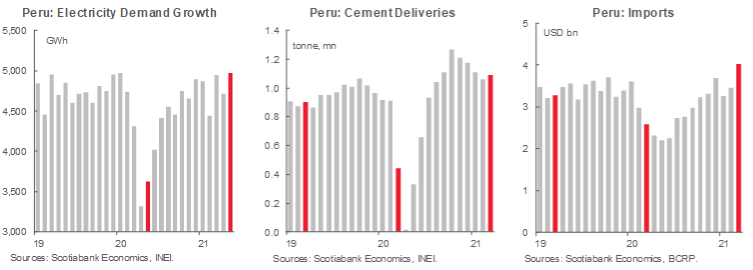

On the economic front, leading economic activity indicators for March imply a faster-than-anticipated recovery continues. The low base of comparison given the start of the lockdowns on March 16, 2020 massively skews upward any year-on-year growth rates, but the March data look favourable even when contrasted with numbers from March 2019. Leading indicators for March 2021 show strong performances over March 2019, particularly in sectors linked to domestic demand, such as cement deliveries, as we’ve previously noted (+20% compared to March 2019), electricity demand (same level as March 2019), public investment (+64%) and imports (+23%).

The base-effects factor is even more significant in April, as Peru’s economy was subjected to one of the strictest lockdowns in the world in April 2020. The demand for electricity, for example, increased more than 41% y/y in April 2021, and registered an increase of 0.3% compared to April 2019. Data for the first days of May suggest that this trend is accelerating (2.5% compared to May 2019) (first chart). Cement sales are even more impressive. According to official figures, cement deliveries increased 145% y/y in March, 20% higher than in March 2019 (second chart). This strong performance was driven by the increase in public investment which jumped 129%—64% higher than in March 2019 (third chart).

Based on these indicators, the GDP may have posted a rate of growth of more than 15% in March, led by the construction sector—which may have printed triple-digit growth and exceeded its pre-COVID-19 level—along with manufacturing, commerce and mining, the latter should print double-digit growth due to the statistical effect. We raised our growth forecast for Q1-2021 from 1.5% to 3.2% y/y. For Q2-2021 we maintain our expansion forecast of around 30% y/y mainly due to the statistical effect, since it was in Q2-2020 that the lockdowns had the greatest impact on economic activity. With a copper price at a 10-year high, we could be tempted to raise our forecast. However, these are not normal times. It seems prudent to us not to raise our forecasts until the electoral uncertainty dissipates. Therefore, we maintain our growth projection of 8.7% of GDP for 2021 and revised downwards our forecast for H2-2021 due to the greater uncertainty generated by the results of the first electoral round. It is probable that an economic scenario different from the one originally assumed could affect business confidence and private investment.

The government has also left unchanged its figures for GDP growth rate at 10% y/y for this year—above the market consensus (9.5% y/y) and our forecast (8.7% y/y). In the revision of its macroeconomic forecast for 2021–2024, the most important thing was the change to a lower fiscal deficit and a lower level of public debt for this year, which is the trend we were looking for. The official fiscal deficit forecast falls from 6.2% of GDP to 5.4% of GDP, mainly due to lower public spending. This is a good sign, as we see the private sector recovering faster than anticipated. The public debt falls from 38.0% of GDP to 35.9% of GDP. This is another favourable signal for the sustainability of public debt, a sensitive variable for the country’s credit rating. There are also important changes in public funding. The projected balance of financing via sovereign bonds is now lower (17.5% of GDP) than that forecast in August 2020 (22.5% of GDP), partially offset by the increase in the projection of global bonds outstanding (from 8.7% of GDP to 11.7% of GDP), which include global bonds that the government prudently issued during Q1-2021. It follows from the foregoing that a greater use of public savings is being contemplated.

Inflation came in at 2.4% y/y for April, a pace that is in line with our forecast of 2.6% y/y for year-end. Core inflation fell slightly to 1.7% y/y, remaining below the 2% target. At its board meeting on April 8, the BCRP kept its benchmark rate at its historic low of 0.25% and gave no signs that this would change anytime soon. The Board complied with the mandate from Congress to publish the methodology that caps the interest rates of consumer loans and SMEs, setting a threshold of twice the average rate of consumer loans (83.4%) with staggered application according to the type of loan.

So, better-than-expected economic performance, improved fiscal forecasts, price stability, and still-timid signs of progress in vaccination against COVID-19 contrast with the climate of electoral uncertainty. The most recent polls suggest that the gap is narrowing, but it is not clear that it is happening fast enough for Fujimori to overtake Castillo. There is still time and many things can happen in the remaining four weeks. The uncertainty is reflected in the USDPEN FX, which reached a new all-time high, oscillating in the 3.80 to 3.84 range. However, moderate recoveries were observed in the bond market and the Lima stock market (which went from an initial drop of -15% following the first round to -10% currently).

On the political front, Castillo emphasized some well-known proposals, such as the intention to change the Constitution and the nationalization of natural resources (gas, mining, fishing, etc.), and specified others such as the purchase of debt from SMEs by public banks. Castillo has shown little predisposition to new debates and media interviews—fronts where he has been vulnerable—and that could cost him part of the support earned thus far. On her side, Fujimori seems to have found footing in the public challenge to the Castillo campaign. She is adding support for her candidacy from political parties and personalities, but it is not clear if that will be enough. Meanwhile, the feeling of waiting to see what the next polls say continues.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.