ECONOMIC OVERVIEW

- Next week’s BanRep and BCCh decisions are not done deals. BanRep looks like a toss-up and there’s a small chance that the BCCh could deliver a 75bps cut and not the 50bps we expect. Another large unknown for Chile’s markets will be the results of Sunday’s vote on a new constitution. In today’s weekly our teams in Bogota and Santiago preview BanRep, the BCCh, and the possible implications of the referendum.

- After Banxico’s relatively hawkish rate hold, Mexico’s calendar is packed with data, including key H1-Dec inflation figures that are in focus after the bank’s upward revisions to its inflation forecasts. Retail sales, economic activity, and international trade data are also on tap. Colombia and Brazil economic activity data are also out next week, and their respective central banks will publish minutes to their December meetings.

- In the G10, US, Canada, UK, and Japan inflation data, the BoJ’s announcement, and the last big wave of central banker appearances of 2023 will shape global markets.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in Chile and Colombia.

MARKET EVENTS & INDICATORS

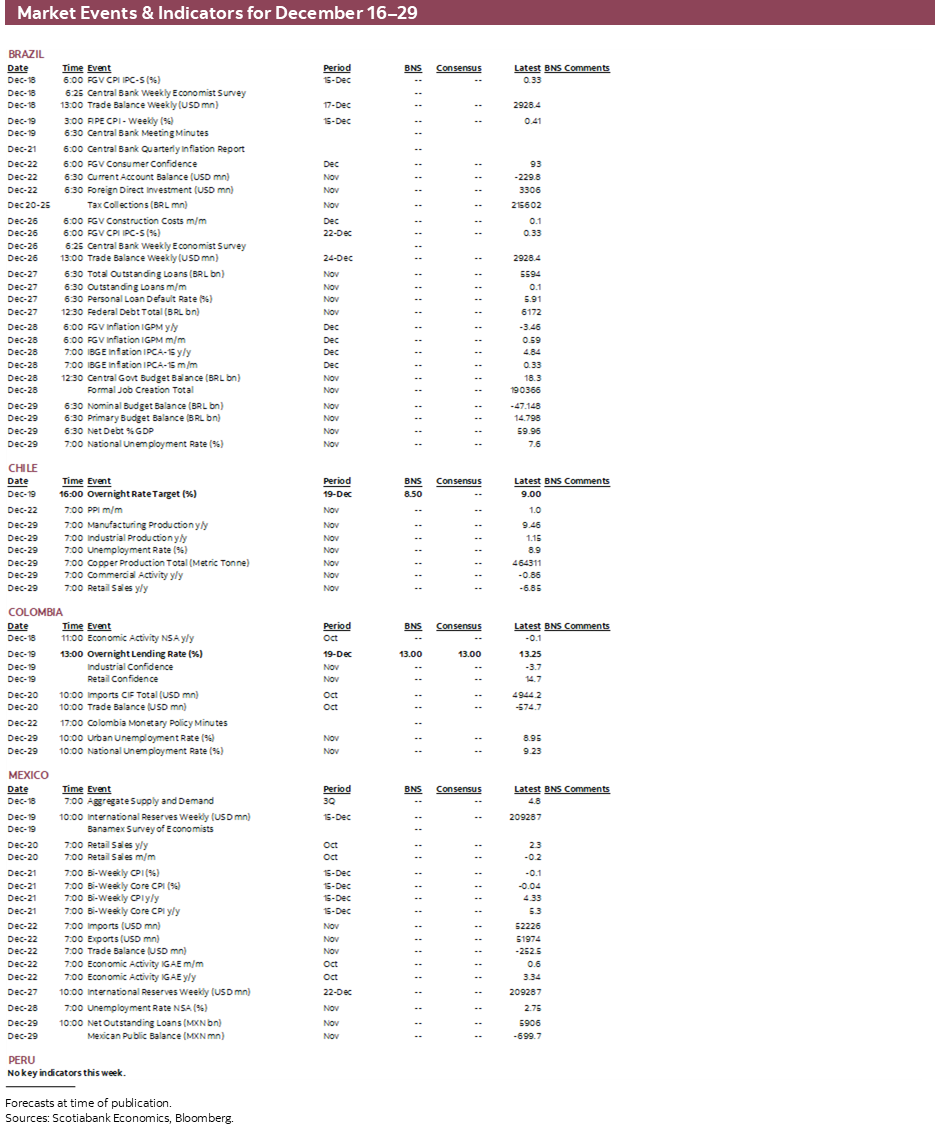

- A comprehensive risk calendar with selected highlights for the period December 16–29 across the Pacific Alliance countries and Brazil.

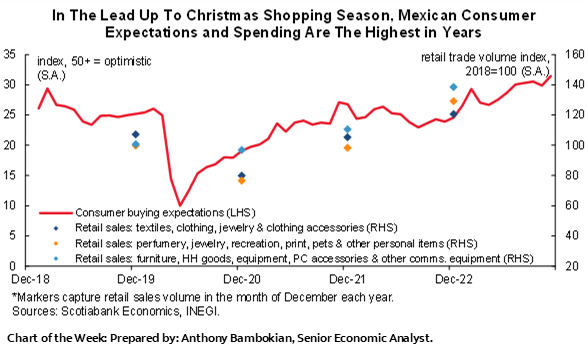

Chart of the Week

ECONOMIC OVERVIEW: IT’S BANREP AND THE BCCH’S TURN; CHILE CONSTITUTION VOTE

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- Next week’s BanRep and BCCh decisions are not done deals. BanRep looks like a toss-up and there’s a small chance that the BCCh could deliver a 75bps cut and not the 50bps we expect. Another large unknown for Chile’s markets will be the results of Sunday’s vote on a new constitution. In today’s weekly our teams in Bogota and Santiago preview BanRep, the BCCh, and the possible implications of the referendum.

- After Banxico’s relatively hawkish rate hold, Mexico’s calendar is packed with data, including key H1-Dec inflation figures that are in focus after the bank’s upward revisions to its inflation forecasts. Retail sales, economic activity, and international trade data are also on tap. Colombia and Brazil economic activity data are also out next week, and their respective central banks will publish minutes to their December meetings.

- In the G10, US, Canada, UK, and Japan inflation data, the BoJ’s announcement, and the last big wave of central banker appearances of 2023 will shape global markets.

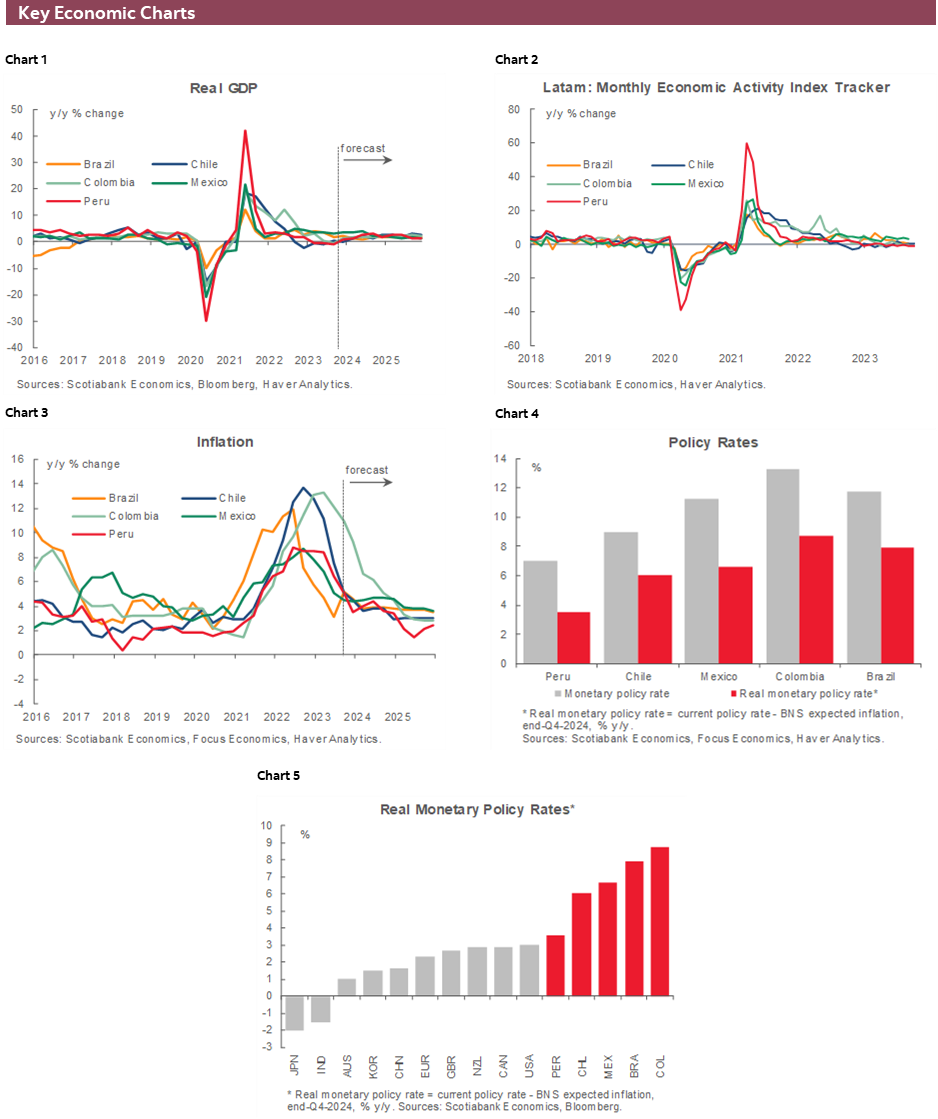

After a busy week that saw a surprising lack of push back to cuts pricing by the Fed, relatively more hawkish decisions from Banxico, the ECB, the BoE, and mostly as expected announcements by the BCB and the BCRP, we have BanRep, the BCCh, and the BoJ over the next few days to close out the December and 2023 cycle of central bank decisions. The Fed’s neutrality (see our take) added to a market rally that began last week after a late-November/early-December period that had a more range-bound feel to it.

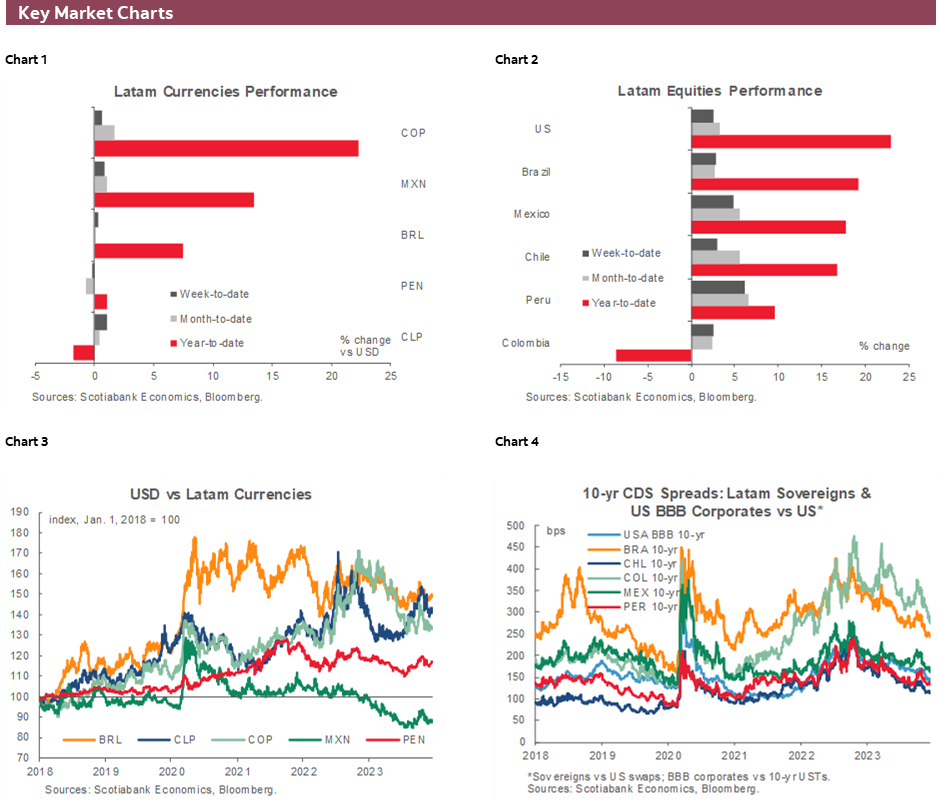

Since last Thursday/Friday, Latam currencies have been mixed. Some have followed the risk-positive and dollar-negative mood (MXN, COP, and CLP) but their performance significantly lagged that of G10 FX that were perhaps more responsive to the slide in US yields. On the other side, the PEN, down slightly 0.2/3%, is in an exclusive club of four currencies that weakened this week, joined by the MYR (-0.1%), the TRY (down -0.3%), and only doing a bit better than the official ARS drop of ~55% (by policy, of course).

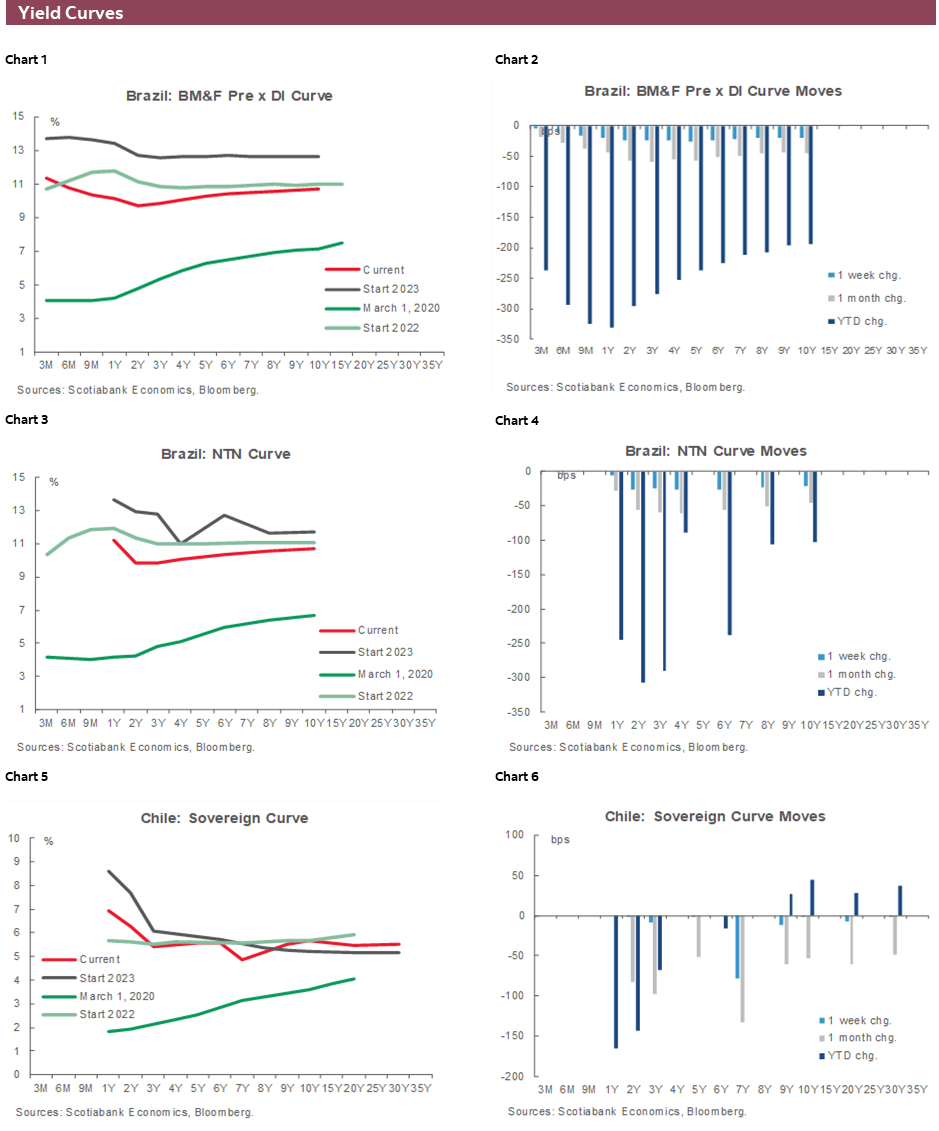

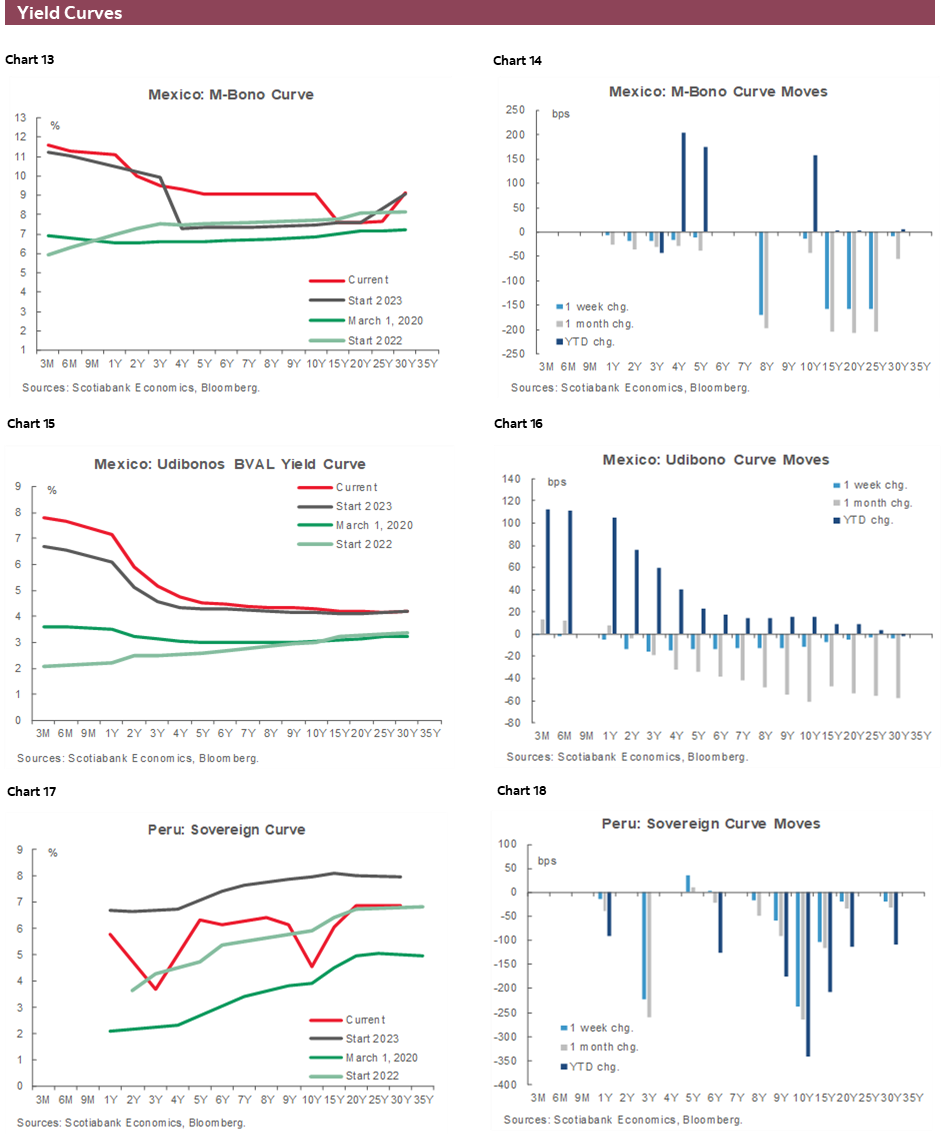

Local rates markets tracked moves in Treasurys more evenly across the curve, though in Mexico Banxico’s more hawkish than expected decision (see our recap here) trimmed front-end gains, and domestic equity indices also took their cue from those in the US, showing 3–6% gains across the Pacific Alliance and Brazil. Next week, from a G10 standpoint, it may be the BoJ surprising markets with a policy tweak or a beat in US core PCE that stands as the main risk for Latam markets from abroad, but upbeat momentum looks strong and traders may not want to fight the trend ahead of the holidays (though they may want to trim positions in anticipation).

In Latam, there remains some uncertainty going into BanRep’s and the BCCh’s meetings, and Chile’s markets will open to the results of Sunday’s vote on a new constitution. In today’s weekly, the Santiago team previews the BCCh’s announcement where they expect a 50bps cut and also look at the possible impact of the vote’s results (it’s anyone’s guess whether ‘for’ or ‘against’ will win). Their view is that political after-effects will be greater than those in markets (see our Latam Insights). The baseline view in markets, and the last polls ahead of the vote, is that ‘against’ will win but it’s very narrow margins.

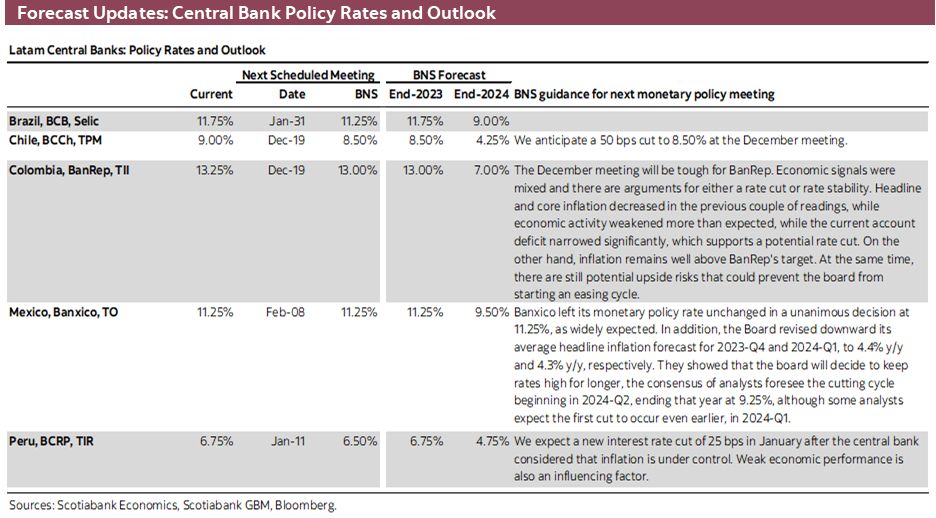

On the central bank decisions, our economists in Colombia discuss today the case for a hold and the case for a cut, seeing it as a toss-up decision with both sides having arguments that support their view. We project that Colombian economic activity data due on Monday will show a 0.3% y/y contraction in October, for a third (small) y/y decline in output in a row that would support policy easing. In the case of the BCCh, the November inflation beat prompted our team (see flash report) to change their expectation for next week’s meeting to a 50bps cut, a view that is widely shared among economists and markets (with residual odds of a 75bps reduction).

Data-wise, Mexico’s release calendar is the busiest of all, with retail sales, economic activity (IGAE), H1-Dec CPI, international trade, and the bi-weekly Citibanamex survey of economists all on tap. We’ll of course focus on the inflation data after Banxico’s upward revision to its forecasts for prices growth that suggests the bank may take its time with rate cuts—when they come. The INEGI’s advance indicator of economic activity points to a 2.86% y/y rise, slowing from the 3.34% IGAE print for September to its slowest since April.

Elsewhere in the region, Brazil publishes October economic activity figures that are expected to show flat growth alike in September, Chilean November PPI and Colombian industrial/retail confidence and imports/trade balance should be an afterthought for markets. We also get the BCB’s Quarterly Inflation Report but don’t hold your breath for much that could alter the clearly laid out path of 50bps cuts at the next few meetings; minutes to the decision out on Tuesday may be more informative. BanRep’s meeting minutes out on Friday will be worth a look to gauge the bank’s next steps. In the G10, US, Canada, UK, and Japan inflation data, the BoJ’s announcement, and the last central banker appearances of 2023 will also keep us busy.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Our Take on the December 17th Referendum

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

On December 17th, the exit referendum for a new constitution takes place and our view is that we could see more political than financial impacts (see our Latam Insights). The baseline scenario for the market is a victory of “En Contra” (against), which is what most of the surveys anticipate. In this context, our view is that a victory of “A Favor” should be read positively by local financial assets, especially the exchange rate. However, we do not expect relevant or significant impacts in financial markets.

The political reaction to the result may be much more important than the implications for local financial assets. On the one hand, a victory for “A Favor” would position the extreme right party’s (Republicans) José Antonio Kast as the most likely presidential candidate for the 2026 election. On the other hand, a victory of “En Contra” would provide some political respite to Boric’s ruling coalition, avoiding a third political defeat after the rejection of the last constitutional proposal and the overwhelming election of right-wing councilors in the most recent constitutional assembly vote.

Subsequently, on December 19th, the Central Bank (BCCh) will hold its monetary policy meeting, for which we expect a 50bps cut in the benchmark rate to 8.50%. At the same time, the BCCh will present its Monetary Policy Report, in which it will update its macroeconomic scenario, the long-term GDP growth estimate and the neutral monetary policy rate. We believe that the current range of the neutral rate estimate will be revised upwards, around 25 to 50 bps, in line with what may have been observed in other economies.

Colombia—To Cut or Not To Cut

Sergio Olarte, Head Economist, Colombia

+57.601.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

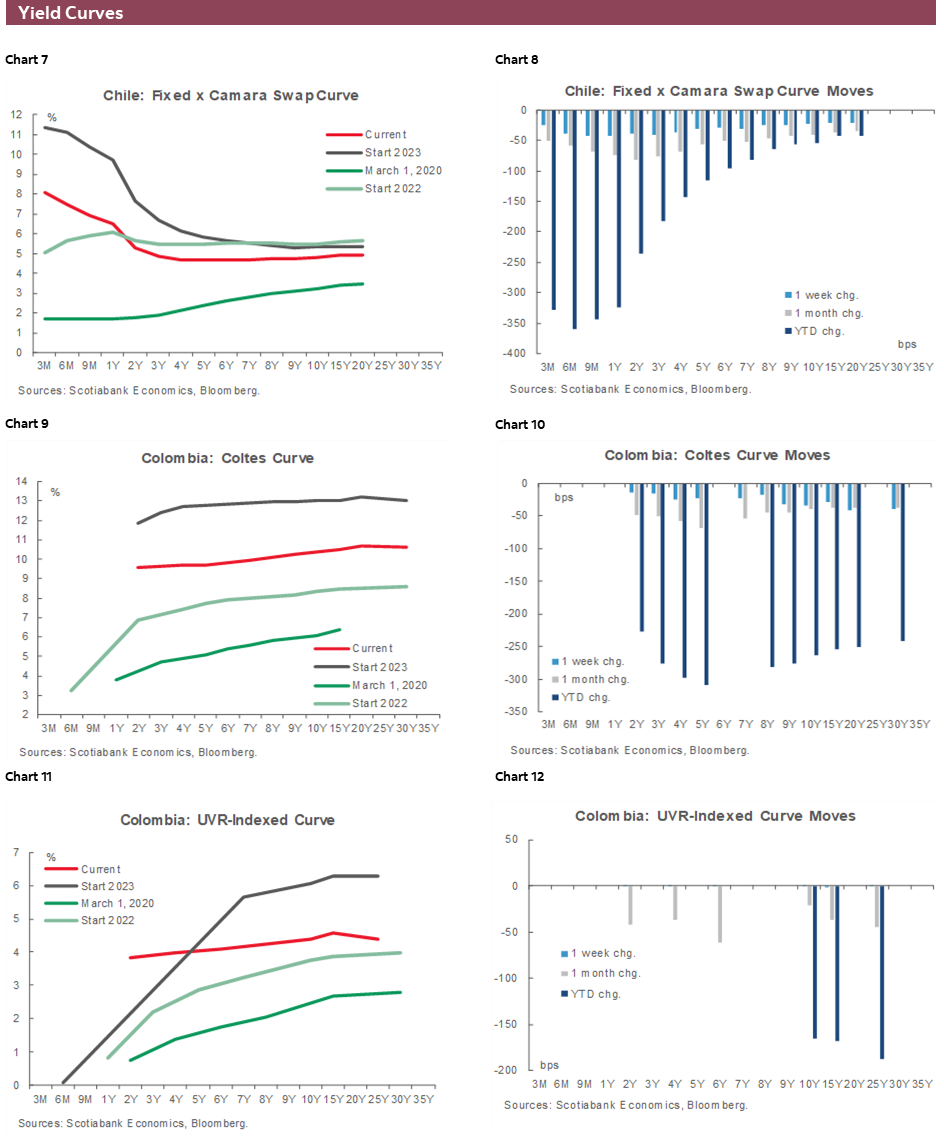

On December 19th, BanRep will hold its last decision-making meeting of the year, and markets are wondering if the Board will kick off a gradual easing cycle or wait a bit more, expecting further deceleration in core inflation. We think there are reasons for both sides, and it will depend on how worried part of the Board is about the deceleration of economic activity. It is important to remember that for two meetings in a row, the Board has decided to keep the policy rate at 13.25% in a split decision since two board members have voted to cut the policy rate by 25bps to 13.00%. Therefore, it takes two board members to change their minds to begin the easing cycle in December 2023.

On one side, it seems wise to wait a bit more before starting the easing cycle since headline inflation is more than three times the target, especially due to services inflation (48% of the basket) that is very sticky at 9.03% y/y and has only fallen by 3bps from the May print, while headline inflation has dropped 2.21ppts over the period. Therefore, core inflation (ex-food and regulated) only gave up by 60bps in the last five months. Additionally, regulated prices, which include gasoline and electricity fees, have increased by 1.2pp since June, which can create some second-round effects that delay hitting the inflation target for Colombian inflation. Also, although economic activity shows stronger signs of deceleration, the level of GDP continues well above potential output, giving some time to the monetary policy authority to wait for further CPI deceleration. Finally, the real interest rate in Colombia is still relatively low compared to its peers (ex-post real rate in Brazil is 7.09%, in Chile is 4.01%, in Mexico 6.64%, in Peru 3.24%, while in Colombia it is 2.8%).

On the other side, the dovish side, some board members can argue that headline inflation has dropped 3.2pp since its max in March, while tradable goods and food inflation (44% of the basket combined) are in faster convergence, which should help headline to get closer to target at a faster pace next year, once indexation effects vanish. Additionally, economic activity deceleration has been higher than expected, making some sectors enter into some kind of recession. In fact, construction (4.2% of the GDP) has fallen on a y/y basis for the last four quarters, while manufacturing (11.7% of the GDP) has fallen on a y/y basis for the previous two quarters, same as commerce-related sectors (17.6% of the GDP). Finally, market inflation expectations consensus shows a gradual but firm next year inflation deceleration that will make the real rate even more positive and restrictive, while economic activity will go rapidly from a positive output gap to a negative output gap and the risk of recession increases.

We think both sides have solid arguments to defend their positions. Therefore, BanRep’s December 19th meeting result is a 50/50 kind of meeting. Nevertheless, the official call of Scotiabank Economics continues to be that BanRep will start a very gradual easing cycle in the December meeting by cutting the policy rate by 25bps, which is not material to inflation or GDP dynamic but sends a message of the next steps from BanRep.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.