ECONOMIC OVERVIEW

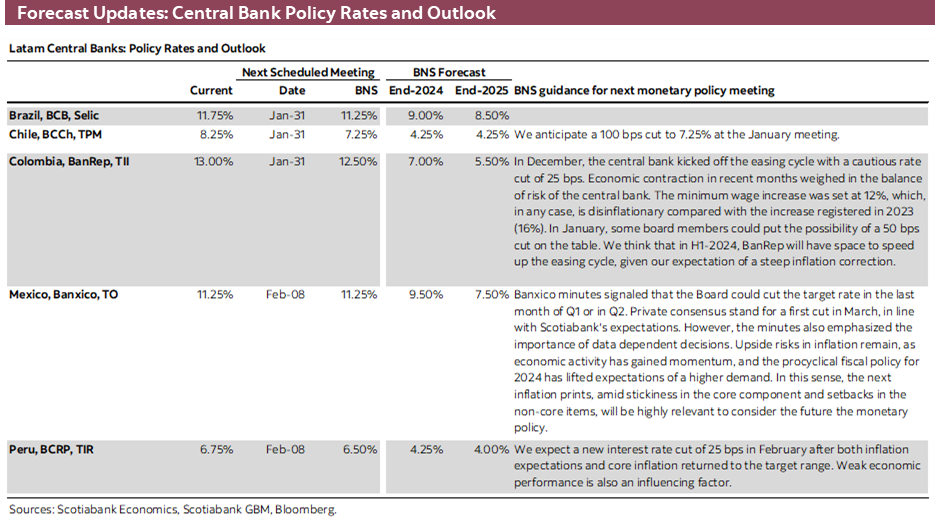

- An eventful week of key global data, escalating geopolitical risks, and rate cuts pricing pushback by central bankers weighed on market sentiment over the past few days, taking Latam assets along for the ride. Next week may be a bit more of the same, with rate announcements from the BoC, ECB, and BoJ, among others, as well as global PMI data for the first month of the year and US GDP/PCE set to influence markets in the Pacific Alliance and Brazil.

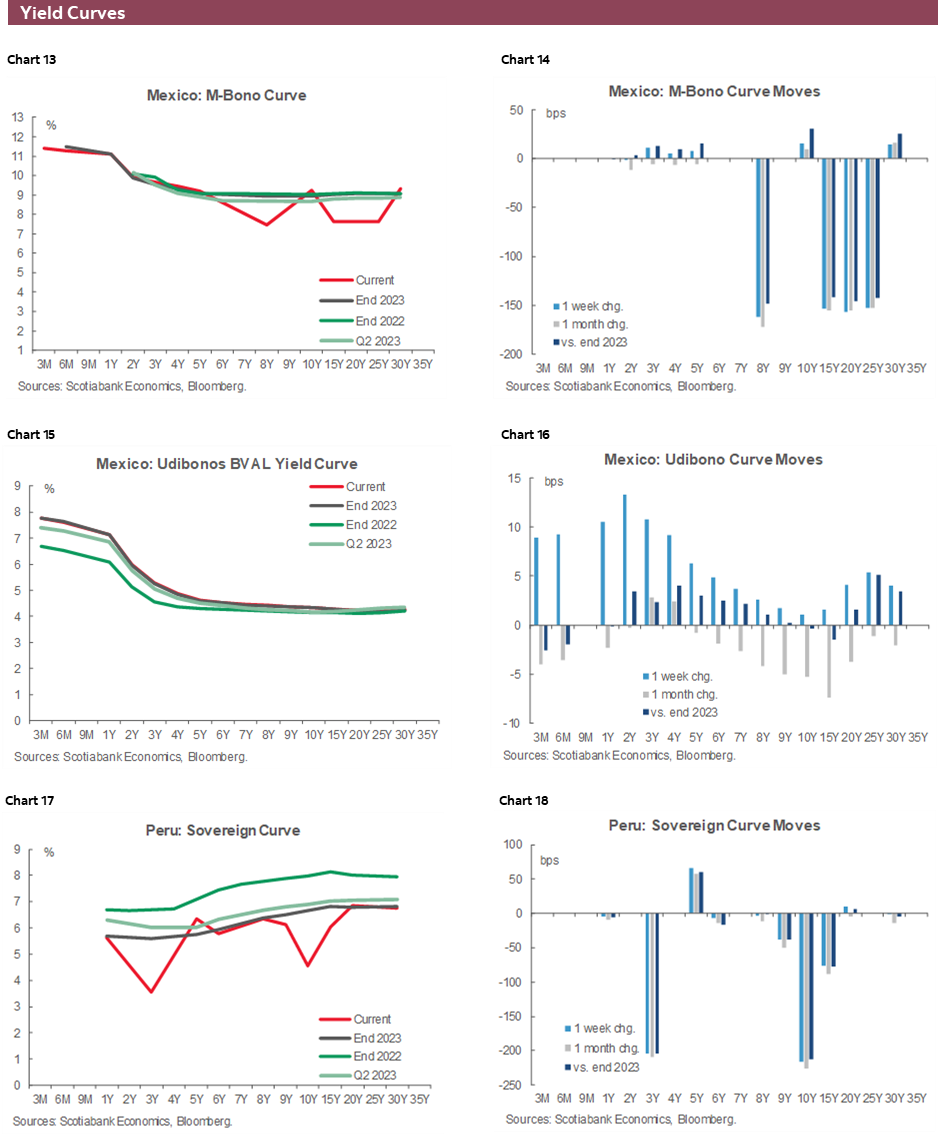

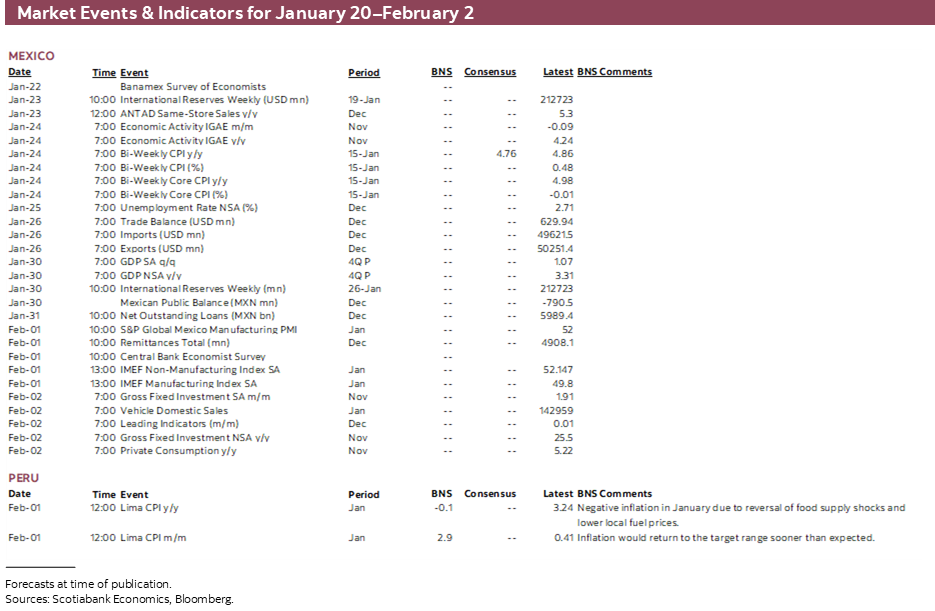

- Mexico and Brazil kick off the release of 2024 inflation data next week, but economists think inflation will only slightly decelerate in each of these countries, perhaps providing only limited value to Banxico and BCB expectations that, at the moment, look fairly settled. Mexican economic activity figures for November should show a decelerating, but still solid, economy.

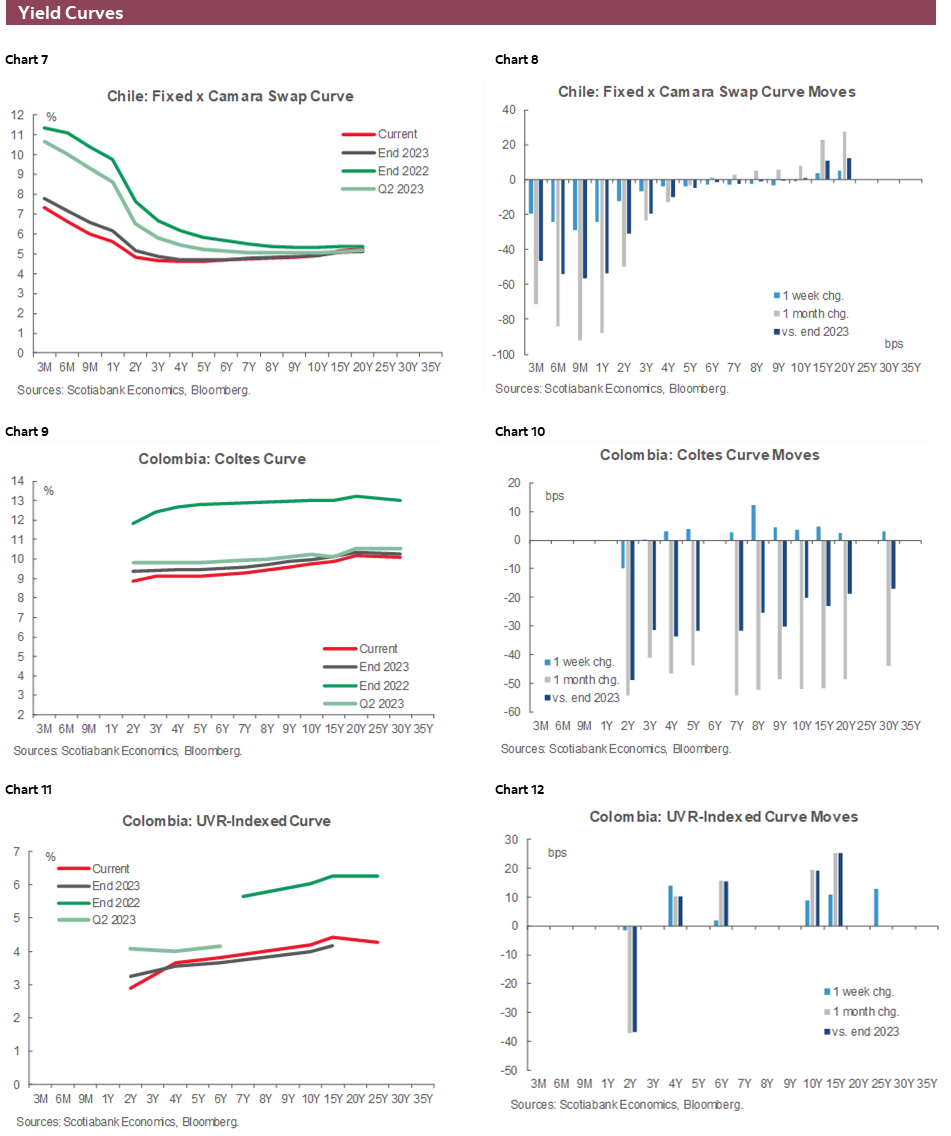

- Chile PPI data and the BCCh’s survey of economists are also worth a look as more analysts may be coalescing around a greater than 75bps cut by the central bank in late-January. In today’s weekly, our team in Chile outlines the current state of reform processes in the country. Colombia’s calendar has second-tier releases on tap while Peru’s is bare of data and events.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in Chile.

MARKET EVENTS & INDICATORS

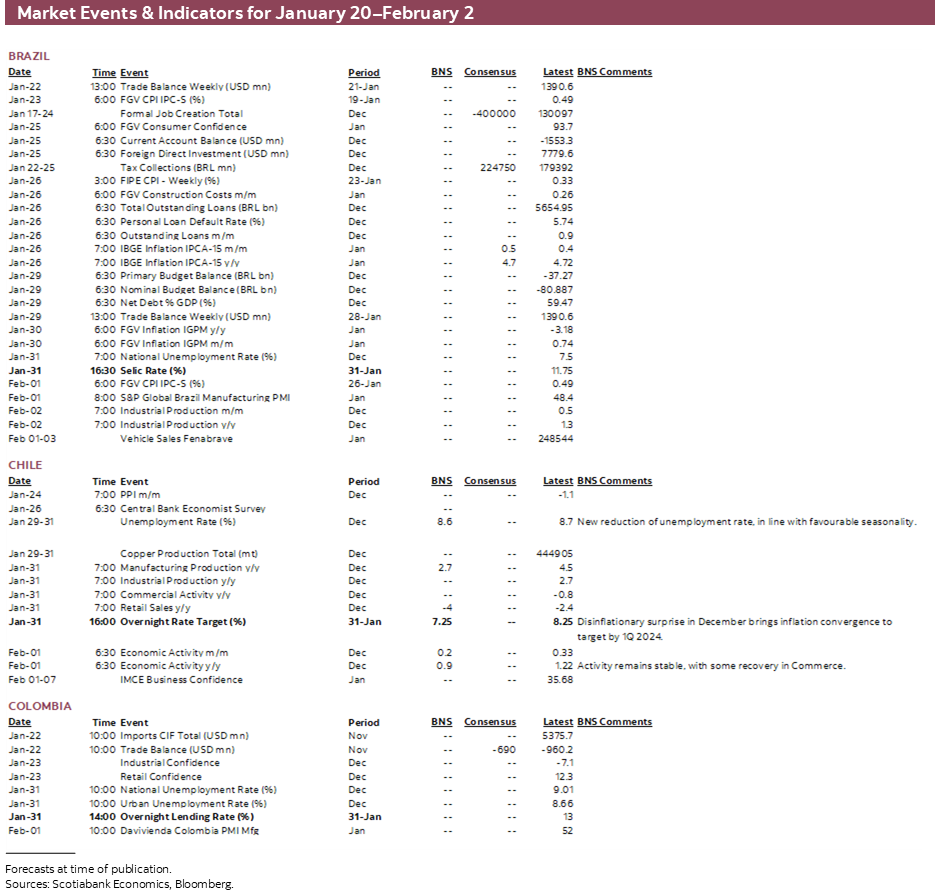

- A comprehensive risk calendar with selected highlights for the period January 20–February 2 across the Pacific Alliance countries and Brazil.

ECONOMIC OVERVIEW: FIRST LATAM INFLATION AND G10 RATE DECISIONS OF 2024

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- An eventful week of key global data, escalating geopolitical risks, and rate cuts pricing pushback by central bankers weighed on market sentiment over the past few days, taking Latam assets along for the ride. Next week may be a bit more of the same, with rate announcements from the BoC, ECB, and BoJ, among others, as well as global PMI data for the first month of the year and US GDP/PCE set to influence markets in the Pacific Alliance and Brazil.

- Mexico and Brazil kick off the release of 2024 inflation data next week, but economists think inflation will only slightly decelerate in each of these countries, perhaps providing only limited value to Banxico and BCB expectations that, at the moment, look fairly settled. Mexican economic activity figures for November should show a decelerating, but still solid, economy.

- Chile PPI data and the BCCh’s survey of economists are also worth a look as more analysts may be coalescing around a greater than 75bps cut by the central bank in late-January. In today’s weekly, our team in Chile outlines the current state of reform processes in the country. Colombia’s calendar has second-tier releases on tap while Peru’s is bare of data and events.

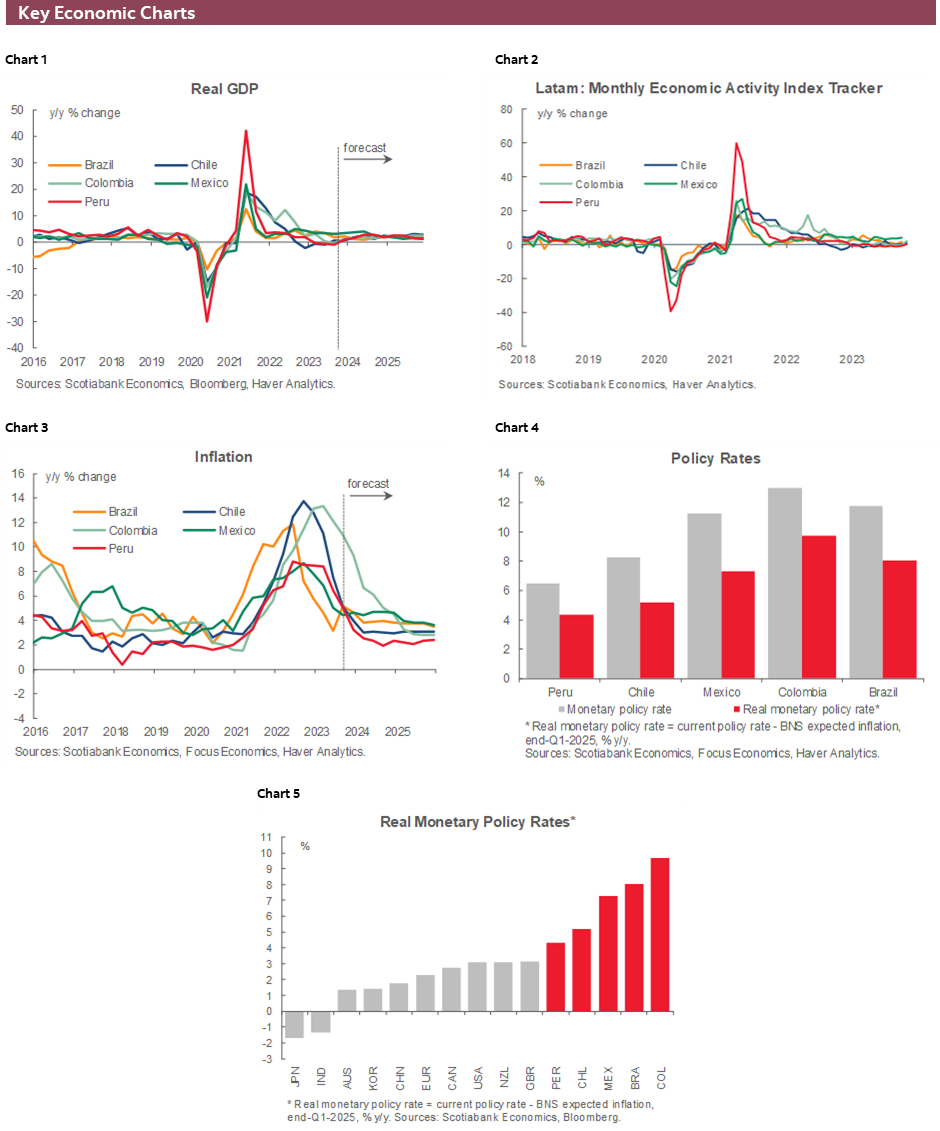

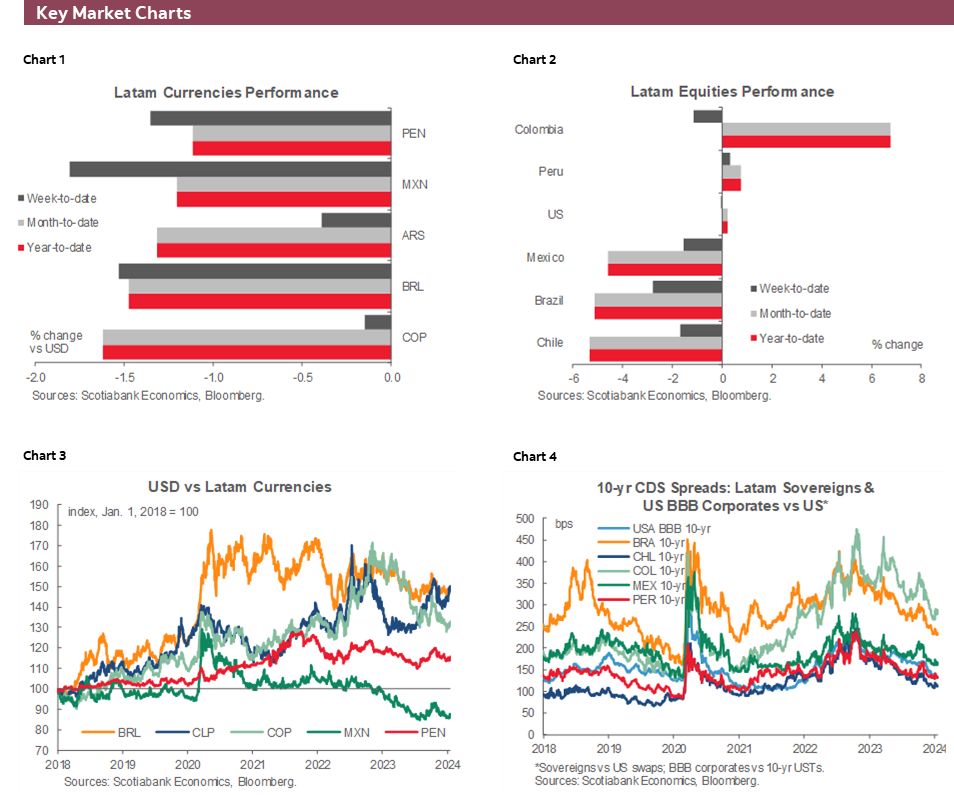

It hasn’t been an easy week for markets, with multiple headwinds over the past few days triggering risk-averse trading globally. Trump’s landslide victory in Iowa’s Republican primary on Monday, Tuesday’s somewhat disappointing Chinese GDP data with no clear way out and a slide in local equities, the growing conflict in the Middle East and its impact on maritime trade, and inflation beats in Canada and the UK alongside hawkish central bank speakers and a strong US retail print all soured global sentiment—and Latam sentiment, where local developments proved more secondary.

At writing, all global currencies of note are recording losses since Friday, but one size does not fit all across the performance of Latam FX, which helps to contextualize the response of local markets to external vs internal events, as domestic bourses were generally offered and local debt tracked global rates. Some regional currencies fared ok, like the CLP and COP that are only slightly weaker over the period, resisting the USD-positive trend in contrast to losses of ~1.5% in the MXN, PEN, and BRL.

The CLP’s performance this week looks better on net terms than it does on the charts, however. Losses in the currency since around mid-December continued through Wednesday to take the USDCLP to its highest levels since October through 930 pesos. As flows called the shots on the way up for the cross, they did on the way down to the 910 area at writing. Thursday’s FinMin’s announcement of a reduction in planned USD sales over Q1 had no real impact on the currency. In the case of the COP, better than expected November economic activity and retail sales data, and a decent rise in crude oil prices were supportive, but investor flows played a key role in the COP’s outperformance. S&P’s rating outlook change from ‘stable’ to ‘negative’ for Colombian sovereign debt and Ecopetrol on Thursday was a brief drag on the currency at the start of the Friday session, but this impact faded shortly after the open.

The MXN’s decline is understandable, all things considered. Higher odds of a Trump victory with resulting protectionist and tough-on-immigration policy is a negative, as is a rise in US yields on scaled-back cut bets—US10s are up ~25bps this week—that the Mexican peso is highly sensitive to. A big outflow of funds from an ETF tracking Mexican shares on Wednesday seems symptomatic of US election anxiety; New Hampshire’s Republican primary on Tuesday awaits. The PEN’s and BRL’s performance looked generally aligned with broad currency action, with neither the sol nor the real making much out of better than expected November GDP/economic activity prints at home.

Next week presents another collection of key external events but also has important data in some countries in the region that will help us refine expectations for the upcoming round of Latam central bank announcements. Outside of Latam, the BoJ, ECB, and BoC decisions will likely set a hawkish tone ahead of the Fed the following week; officials in Norway, Turkey, and South Africa also decide on policy. US policymakers will also get Q4 GDP and Dec PCE data, and markets will follow global PMI releases for January.

In Latam, Mexico’s calendar is the busiest of all. The week will kick off with the results of the bi-weekly Citibanamex survey of economists that last showed the median expecting a year-end Banxico rate of 9.25%; one wonders whether the recent reassessment of Fed cut expectations has influenced the view of Mexico economists. On Wednesday, we get the main data releases of the week in November economic activity and H1-Jan CPI.

INEGI’s early economic indicator tees up a 3.1% y/y rise in output that if translated into next week’s IGAE data would represent the slowest pace of year-on-year growth in Mexico since April’s 1.7% rise, with primary and secondary sectors expected to be behind the deceleration in November. Retail sales data for the month published on Friday disappointed, increasing the chance of the IGAE reading undershooting INEGI’s ‘nowcast’. The first Mexican inflation reading of 2024 is expected to show only a minor deceleration in prices growth towards the 4.6/7% y/y zone from 4.86% in H2-Dec thanks to a correction lower in food inflation that jumped in the final month of 2023; core inflation should also fall a couple of decimal points from 4.98% prior. Thursday’s unemployment data and Friday’s international trade figures, both for December, should not be major market moves

Brazil’s IPCA-15 Jan inflation data are also on tap at the end of the week, but there’s practically no deceleration in headline inflation expected, to hold around 4.7% y/y. It won’t be the kind of print that changes the BCB’s near-term path in either direction, however, and Brazilian markets may end up paying more attention to developments on the fiscal front as FinMin Haddad continues to encounter resistance in Congress to his plans to reach a zero primary deficit in 2024.

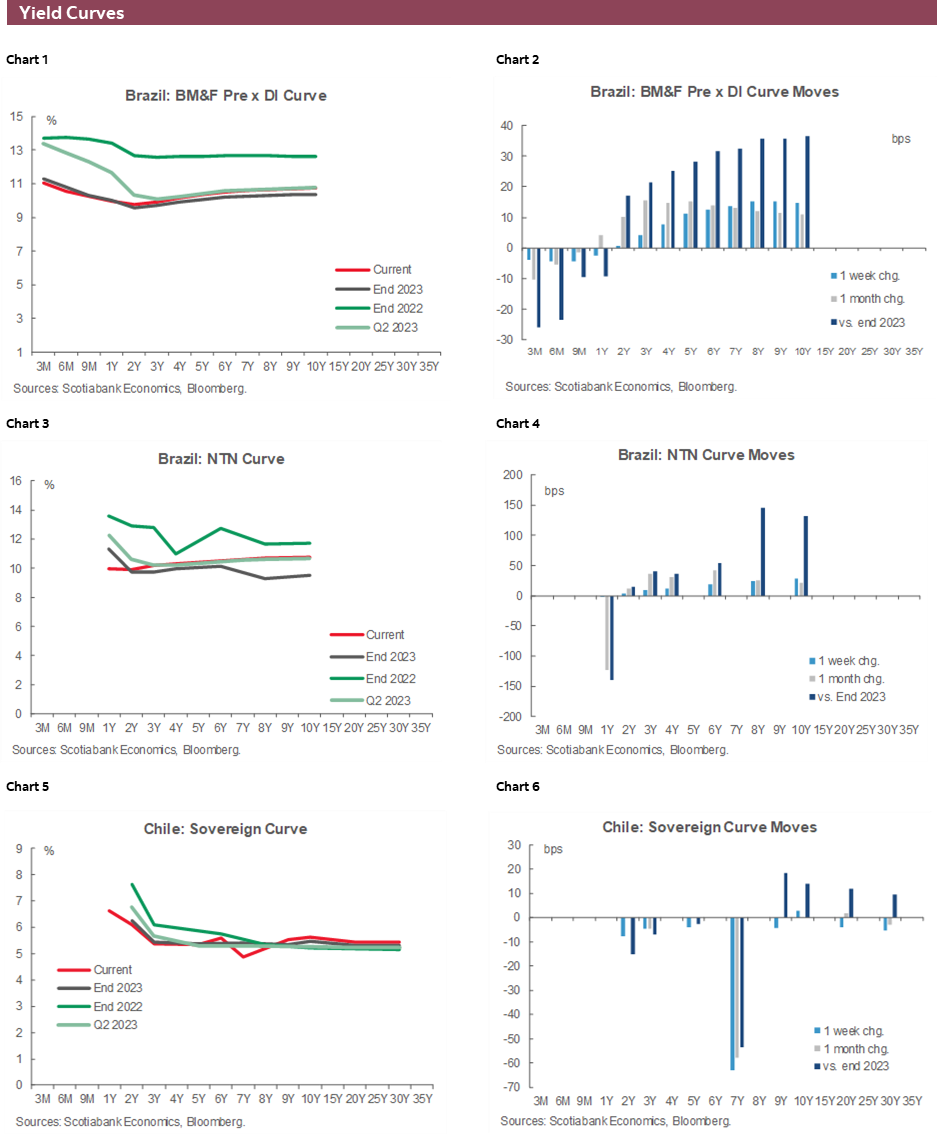

Chile’s December PPI data may provide some colour into the big miss in inflation for that month (3.9% vs 4.4% median) as well as what may await for prices growth. Friday’s BCCh economists’ survey results will likely show more respondents aligning with our view of a BCCh cut greater than 75bps at its decision on the 31st. In today’s report our team in Chile discuss recent developments on the reform front.

The rest of the region’s calendars are all rather quiet or only have second-tier figures to monitor. Colombian November imports data and December industrial and retail confidence could give us a feel of the state of domestic demand in the country, but look stale with November economic activity and retail sales data already at hand. Peru’s schedule is bare of key releases or events.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Status of Structural Reforms

Waldo Riveras, Senior Economist

+56.2.2619.5465 (Chile)

waldo.riveras@scotiabank.cl

Fiscal Pact: progress on tax reform and pro-growth measures

- Reduction of tax evasion and avoidance: During the week of January 22nd, the government will present the project on Tax Compliance (anti-evasion and avoidance measures). There is political willingness to address these issues, but the expected collection of these measures (1.5% of GDP) would be overestimated according to some political parties.

- Reduction of corporate tax: The proposal is still under discussion and elaboration and may be released in March. Measures are being evaluated to compensate for the lower tax collection due to the reduction in Corporate tax.

- Increase in personal taxes: For the time being there is no political agreement to increase personal taxes. The result of the plebiscite does not change this assessment. However, a proposal to increase personal taxes is expected to compensate for the lower tax collection, through higher taxation on personal income from capital and higher incomes. According to the contents of the fiscal pact, the government will not insist on the proposals on wealth tax and tax on the stock of retained earnings.

- Surprising new tax revenue (SQM-Codelco): During February, the government will deliver the estimate of additional revenues resulting from this agreement. The magnitude of the additional collection would allow adjustments in the other sources of financing proposed by the government (evasion and avoidance and personal taxes).

- Increase in corrective taxes: There is a willingness to address these issues, but there is no bill yet. Initially, the government stated that they do not expect to generate additional revenues with these measures, but we find it difficult that this is the case. CO2 sources and "healthy" taxes (fats, salt, etc.) have been mentioned.

- Mining royalty: as of January 1st, 2024 the new mining royalty law came into force. This law was approved in May 2023 after a four-year legislative process, and seeks to collect 0.45% of GDP per year (USD 1.35 bn).

- Pro-growth measures: This week, the government presented the first two bills contained in the “Fiscal Pact”, these are:

I. Intelligent Permitting System: The bill will enter congress next week and seeks to streamline and optimize permits for investment projects, reducing total processing times by about 24%. It is indicated that, for large mining projects, the processing time could be reduced by 45%.

II. Environmental Assessment 2.0: The project entered congress this week and aims to modernize the environmental assessment system. It eliminates political instances such as the Committee of Ministers and advances the processes of citizen participation, among other measures. Doubts arise due to the expected slow processing of this bill. It is estimated that after the approval of the law, the regulations will have to be prepared, so it would take about two years for the reforms to enter into force.

Pension Reform: discussion of government proposals

- Increase in the mandatory contribution of 6 pp charged to the employer: There is broad consensus on this issue.

- Destination of the additional 6pp: There is no agreement yet on this issue. The government proposed 3pp to solidarity, 2 to individual capitalization and 1pp to support female employment. This week, the government accepted the proposal of parties of the political center, proposing a distribution of 3pp to individual capitalization and 3pp to solidarity.

- Increase in the amount and coverage of the PGU: There would be agreement to increase the PGU (Universal Guaranteed Pension) to $250 thousand and expand its coverage, as proposed by the government. It is politically costly for the parties to oppose this measure.

- Reorganization of the pension industry: In the Chamber’s Labour and Finance Commissions, several rules were approved in general, including:

I. AFPs are eliminated and Private Pension Investors are created.

II. The State is allowed to participate as manager of pension fund investments.

III. A Pension Administrator is created for the tasks of support and collection, among other tasks currently performed by the AFPs.

IV. A generational fund scheme is created.

V. A balance-based fee model is introduced, as opposed to the current model which is based on a percentage of salary (flow), among other rules.

Timing of Reforms

- Pensions: During January, the Chamber’s Labour and Finance Commissions would dispatch the Pension Reform bill for a vote in the chamber. It seems easier in the Chamber of Deputies than in the Senate to approve the idea of legislating. Political fragmentation and substantive differences in the project suggest that there will be no Pension Reform before the second semester 2024.

- Taxation: (I) Projects of Environmental System and Sectorial Permits would be discussed and perfected in January. Approval in chambers not before March/April; (II) Tax Compliance Bill would be sent to congress on January 22nd and its discussion would not begin until March. Additionally, once the estimated revenues from the SQM-Codelco agreement are known, the other sources of revenues (personal and corrective taxes) will have to be presented. Political fragmentation and substantive differences in projects suggest that there will be no Tax Reform/Fiscal Pact before 4Q24.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.