ECONOMIC OVERVIEW

- BCCh, BanRep, BCB, Fed, BoJ, and BoE rate decisions await next week alongside a flood of key data, ranging from Mexico GDP and Peru CPI to US jobs and Eurozone CPI.

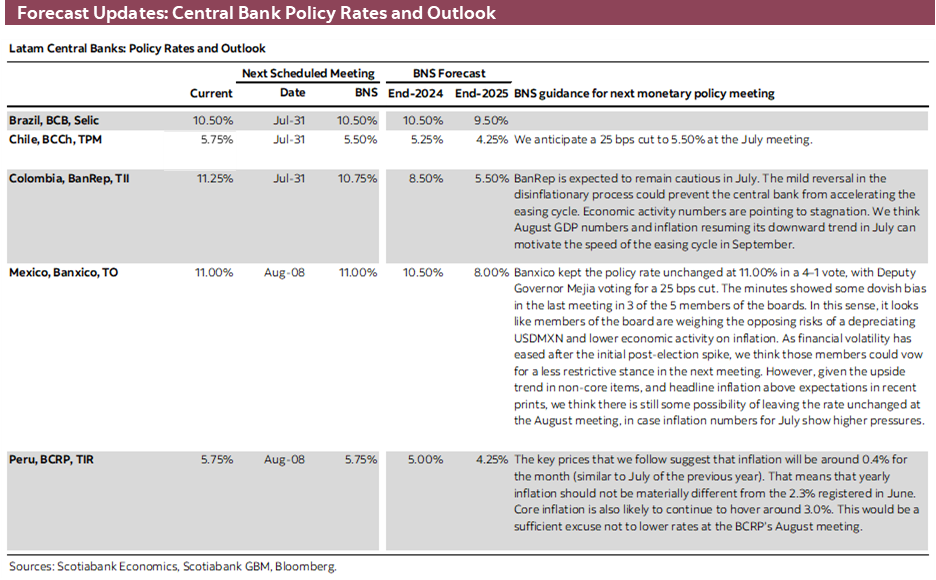

- We expect 25bps and 50bps rate cuts from the BCCh and BanRep, respectively, a somewhat misleading rebound in Mexican GDP growth, and steady Peruvian inflation at levels that do not yet permit another BCRP cut.

- In today’s Weekly, our team in Chile writes on the recent progress made on the reform front, our team in Peru outlines their CPI and GDP forecasts, and our economists in Mexico discuss their expectations for the GDP print.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Mexico, and Peru.

MARKET EVENTS & INDICATORS

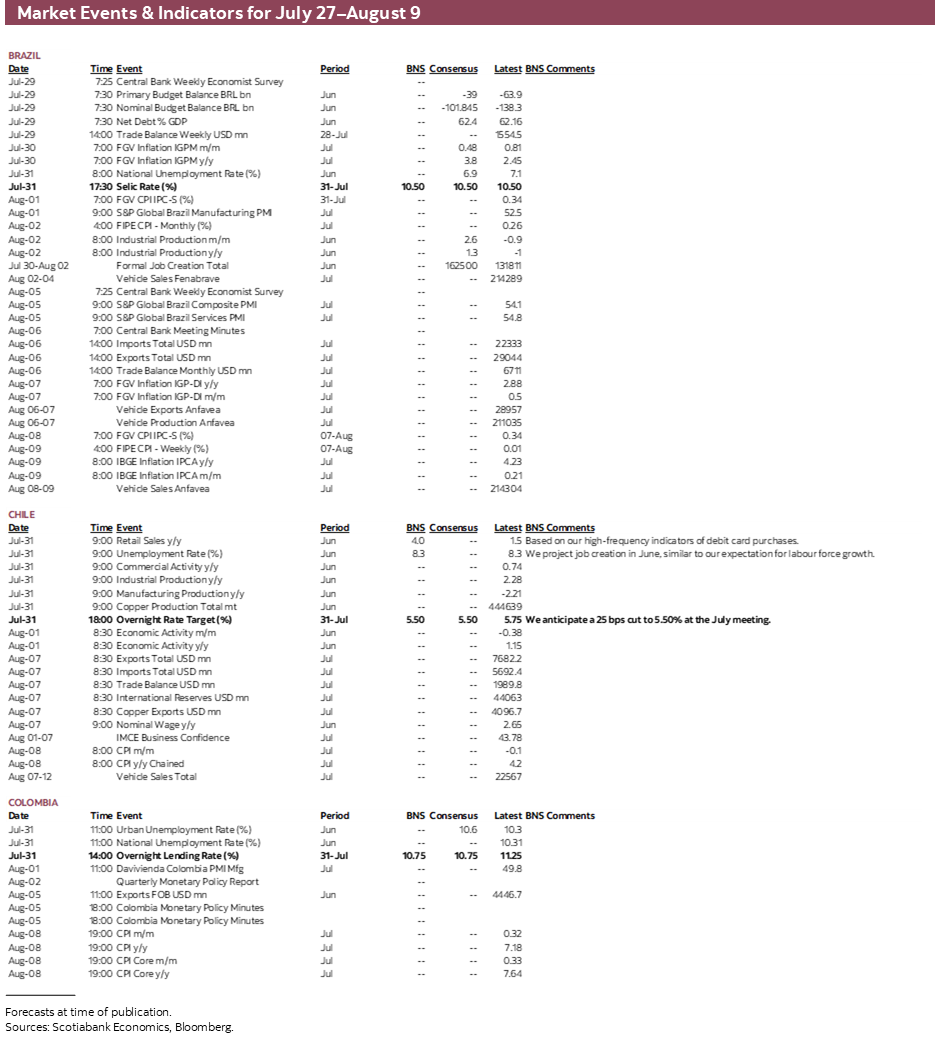

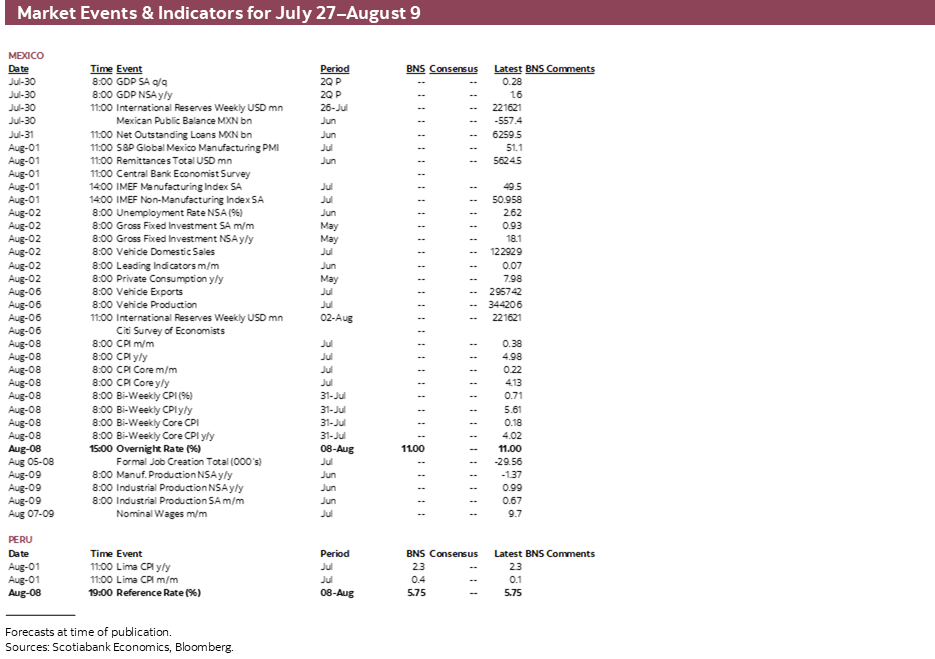

- A comprehensive risk calendar with selected highlights for the period July 27–August 9 across the Pacific Alliance countries and Brazil.

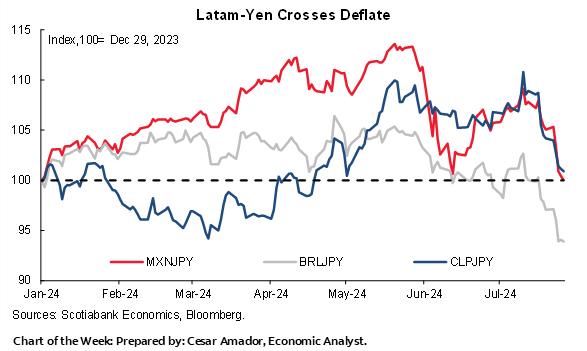

Chart of the Week

ECONOMIC OVERVIEW: KEY DATA AND CENTRAL BANK DECISIONS; CHILE REFORMS UPDATE

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- BCCh, BanRep, BCB, Fed, BoJ, and BoE rate decisions await next week alongside a flood of key data, ranging from Mexico GDP and Peru CPI to US jobs and Eurozone CPI.

- We expect 25bps and 50bps rate cuts from the BCCh and BanRep, respectively, a somewhat misleading rebound in Mexican GDP growth, and steady Peruvian inflation at levels that do not yet permit another BCRP cut.

- In today’s Weekly, our team in Chile writes on the recent progress made on the reform front, our team in Peru outlines their CPI and GDP forecasts, and our economists in Mexico discuss their expectations for the GDP print.

An eventful week awaits in Latam and G10, full of central bank decisions clustered on Wednesday and Thursday, and a flood of key data releases covering labour markets, inflation, and GDP growth. The BCCh, BanRep, BCB, Fed, BoJ and BoE will update policy settings or guidance. Mexico, Canada, and the Eurozone release GDP figures. Peru, the Eurozone, Australia, and Switzerland publish CPI data. We get jobs/wages, ISM, and labour costs data, and more, out of the US. And, Chinese PMIs may shake up the risk and commodities mood.

Rate decisions in Latam and the US should, on the whole, not surprise markets or economists as far as rate moves are concerned, but guidance could be in focus to throw markets a curveball. Meanwhile, the BoJ’s policy announcement is too close to call between a rate hold or a rate hike, and Thursday’s BoE decision also hangs in the balance, but between a hold or a cut.

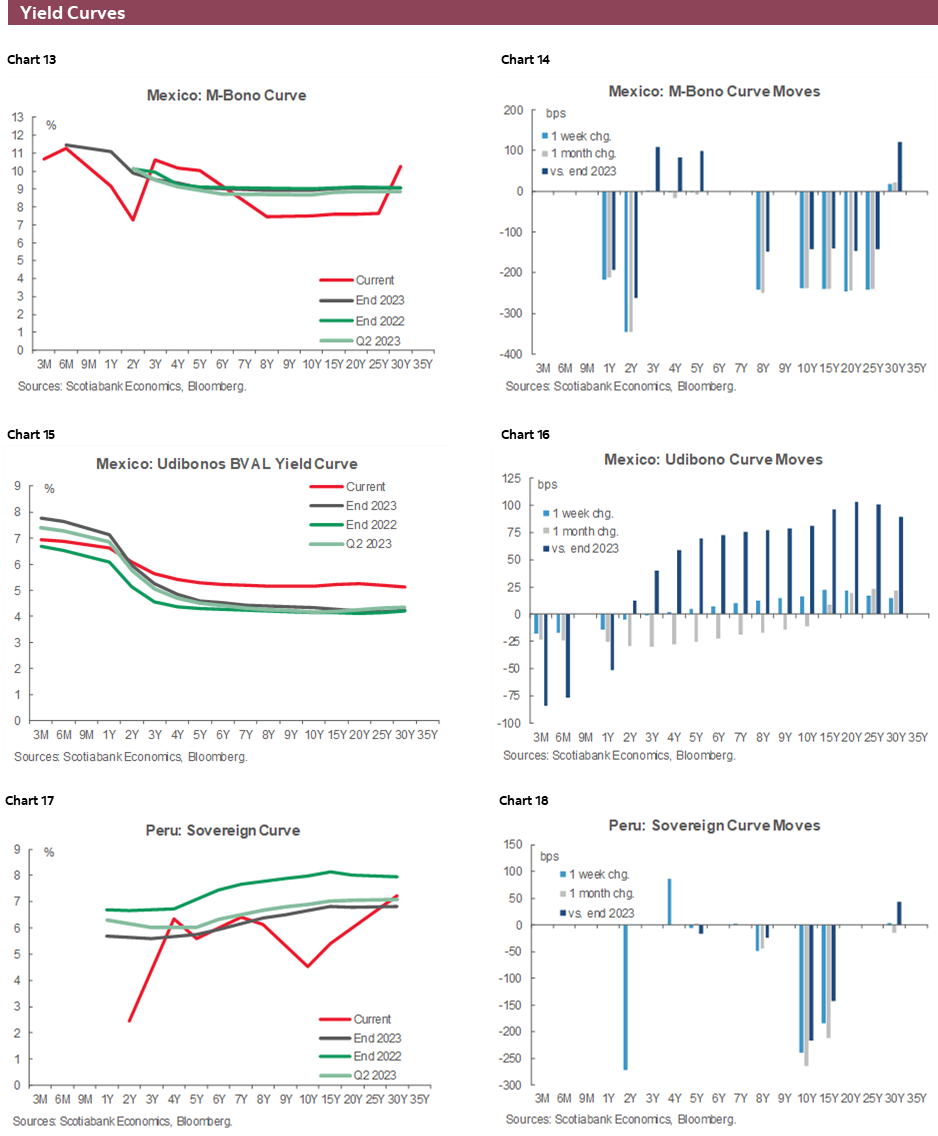

After a quiet Monday, Mexico kicks off next week’s key Latam events run with the release of Q2 GDP data on Tuesday. Based on monthly economic activity figures (which recently surprised to the upside, see here) and leading indicators, the Mexican economy is tracking a 2.5%–2.7% y/y increase in Q2, accelerating from the 1.6% pace recorded in Q1.

Although this would represent the first acceleration in Mexican y/y GDP growth since Q3-22, the timing of Easter holidays in late-March translates into a base effect rebound in Q2 that overlooks that the economy has performed less strongly than expected so far in 2024. This underperformance has left Banxico in a tough spot as it faces a steep acceleration in headline inflation through 2024, even if driven by non-core prices (see here), that challenges a decision to cut rates next month based on weakening growth; markets have about a 40% chance of a cut built in.

Chilean markets will have a flood of data to digest on Wednesday morning, nine hours before the BCCh’s rate announcement. June retail sales, unemployment rate, commercial activity, and industrial/manufacturing/copper production data are all on tap at 9ET. According to our team’s tracking of credit card data, retail sales should have a strong showing, with a 4% y/y rise after a softish May reading of 1.5%, while the unemployment rate is seen holding at 8.3%. Thursday brings June economic activity figures, but the market will open with a reaction to the previous day’s BCCh decision.

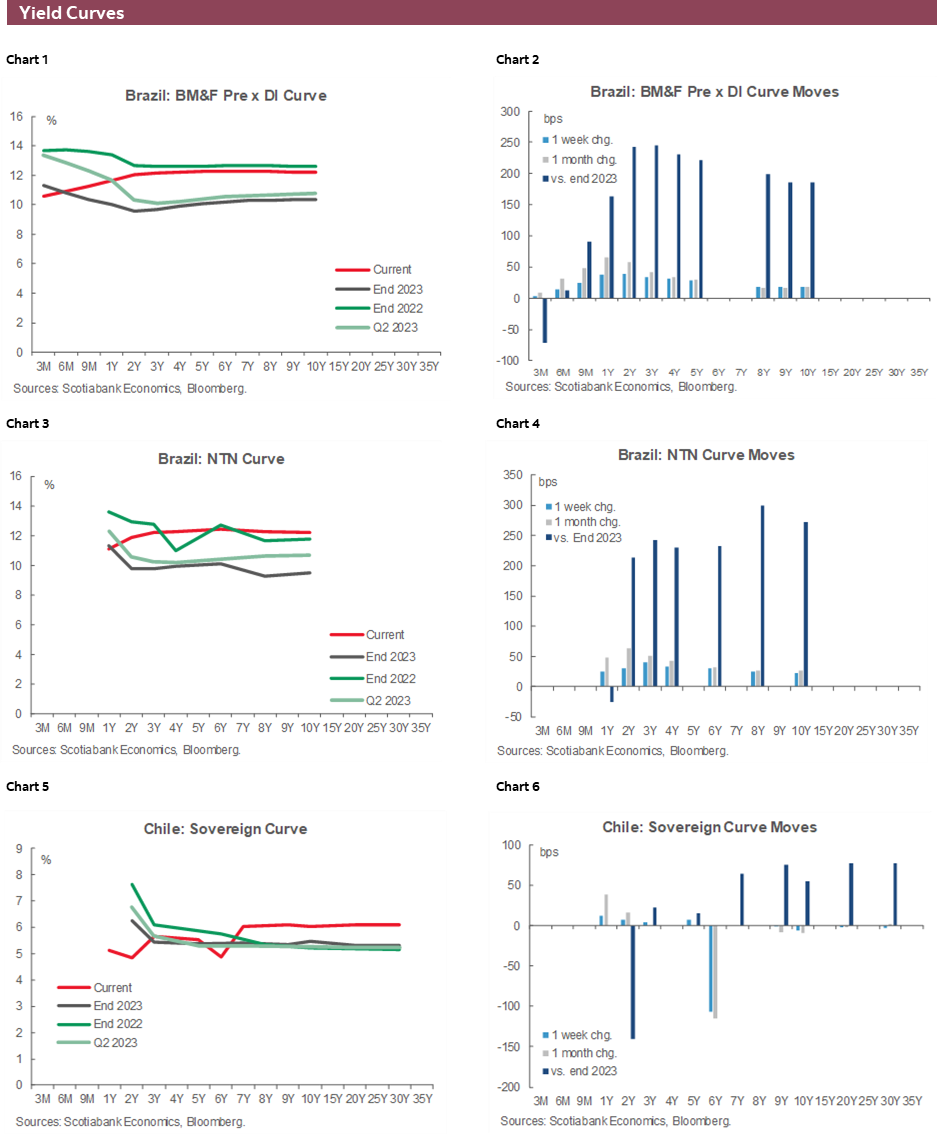

Our team thinks there’s a strong case for Chile’s central bank to roll out another 25bps reduction. Recent inflation strength has rested on electricity tariffs hikes and one-offs like pre-Cyber Day price increases in May. Outside of these factors, there’s a clearer broad-based deceleration in inflation that should comfort the BCCh. Markets are leaning in the direction of a cut, but with much less confidence considering there’s about a 30–40% implied chance of a hold. In today’s report, the team discusses the recent progress made on the structural reforms front regarding tax compliance and pensions.

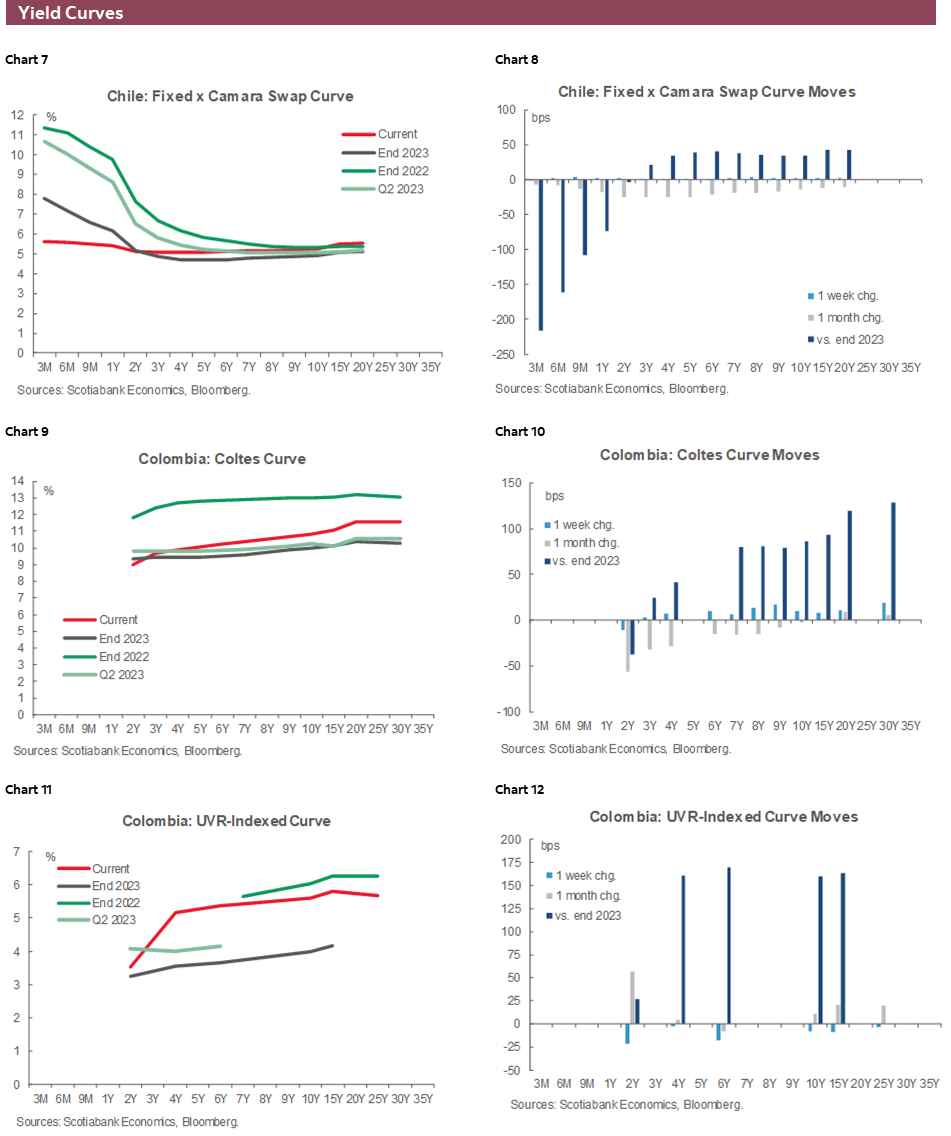

Colombia’s BanRep is set to lower its overnight rate by 50bps to 10.75%—according to us and a broad economists’ consensus—just a few hours before the BCCh’s decision on Wednesday. Colombian officials have seen the disinflationary process run into a wall as the last three CPI prints, from April to May, have seen headline inflation stuck at 7.2%. Data were trending in a clearer direction earlier in the year, with inflation falling from 9.3% at end-2023 to 7.4% as of March of this year. Had that trend held, we think officials would be considering larger moves. Alas, that is not the case but the right combination of data over the coming weeks could push them in that direction. We’ll see whether guidance at next week’s meeting leaves the door open to that; the bank’s updated Monetary Policy Report forecasts should also provide hints.

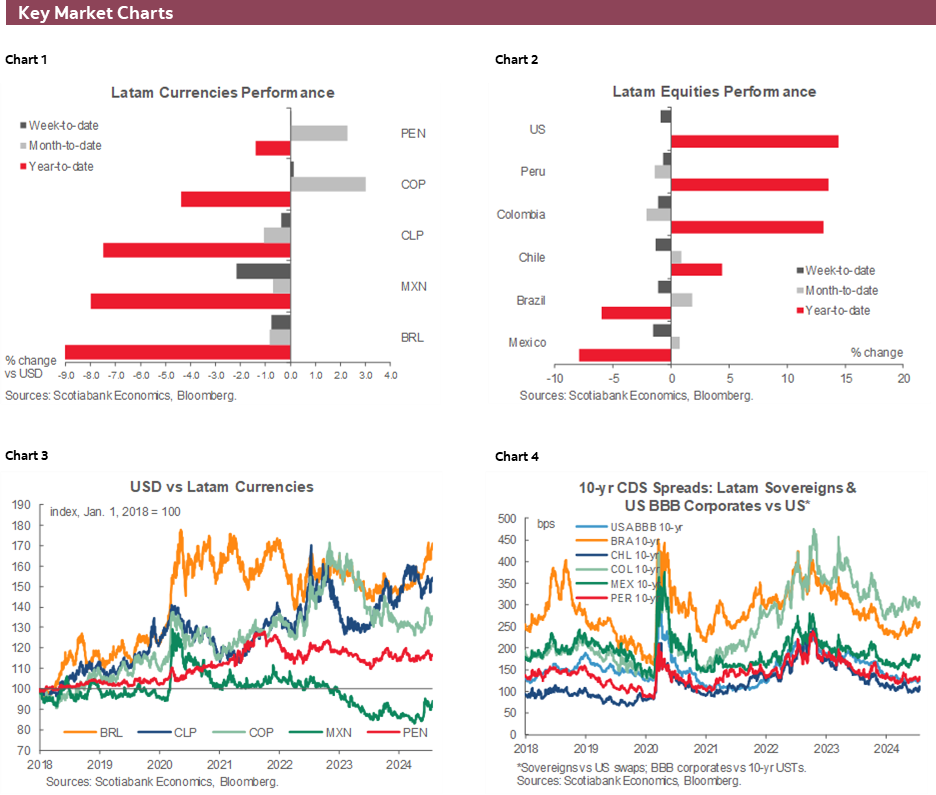

The BCB’s decision on Wednesday will probably be the most uneventful of all of those on Wednesday. A rate hold at 10.50% is a done deal and we shouldn’t see guidance suggesting that cuts may resume soon. Inflation remains hot and is due to stay hot over H2 amid less favourable base effects and BRL weakness. The Brazilian real looks on track to reach a 15% year-to-date decline against the USD—its current drop of 13.5% is about double the MXN and CLP’s losses, and triple the COP’s—owing to the unwinding of carry trade positions, risks around Lula’s incoming appointments to the central bank (as he may pick ‘cut-friendly’ officials), and overarching fiscal risks. We probably have a few more months of rate holds in Brazil (a rate hike is highly unlikely) before the refreshed BCB board in 2025 shows more openness to easing; inflation should also be better behaved by then.

On Thursday, Peru’s INEI is the first in the region to publish full-month July inflation figures. Unfortunately (or maybe it plays into their hands), the BCRP will not see much progress made in its inflation fight in either of headline or core inflation. For three consecutive meetings, Velarde’s board has left the reference rate unchanged at 5.75%, highlighting upticks in or a stalling of core inflation that remains just above 3%. In today’s report, our economists in Peru outline their expectation for unchanged headline and core inflation at 2.3% and 3%, respectively, to reinforce their call for another rate hold by the BCRP on August 8th. The INEI also publishes cement demand, fishing, mining, and public investment data for June on Thursday that will be key in refining GDP growth forecasts for the month that our economists currently estimate between 2% and 2.5%, a much more reasonable (read ‘normal’) pace than the 5.3/5.0% y/y gains seen in April and May thanks to fishing output.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Progress on Structural Reforms

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

TAX COMPLIANCE BILL ADVANCES IN SENATE AND TAKES PRESSURE OFF INCOME TAX INCREASE

On Wednesday, July 24th, the Finance Committee of the Senate approved the idea of legislating the tax compliance bill, which aims to collect 1.5% of GDP in regime through the reduction of tax evasion and avoidance (E&A). With this, the discussion in the Senate could begin during the last week of July. Additionally, a protocol of agreement was signed between the senators of this Committee and the Government to establish common principles within the discussion of the tax compliance bill, which would facilitate the progress of the same bill in its vote in the Senate. The protocol includes measures on which there is complete agreement for its approval, such as progress in the anti-E&A regulations, the modernization of the IRS, the strengthening of the General Treasury of the Republic and the National Customs Service, among others. At the same time, it includes matters on which further discussion is required in order to reach agreements, mainly in relation to banking secrecy. Finally, the protocol of agreement raises short-term challenges, such as updating the tax collection estimates and specifying the destination of the resources, specifying the amounts that will be used to finance the Basic Pension (PGU) and investment in public safety. According to Government estimates, the tax compliance bill would be approved before the end of September of this year.

On the other hand, the Minister of Finance acknowledged lower future financing needs thanks to new sources of income for the Treasury, such as the resources from the agreement between SQM and Codelco and the possible approval of the universal childcare bill after the Government has sent indications (increase in the mandatory contribution by 0.2 ppts charged to the employer). With this, the Government recognizes less pressure to raise the income tax, indicating that it will only send the project to Congress once the tax compliance bill has advanced in Congress.

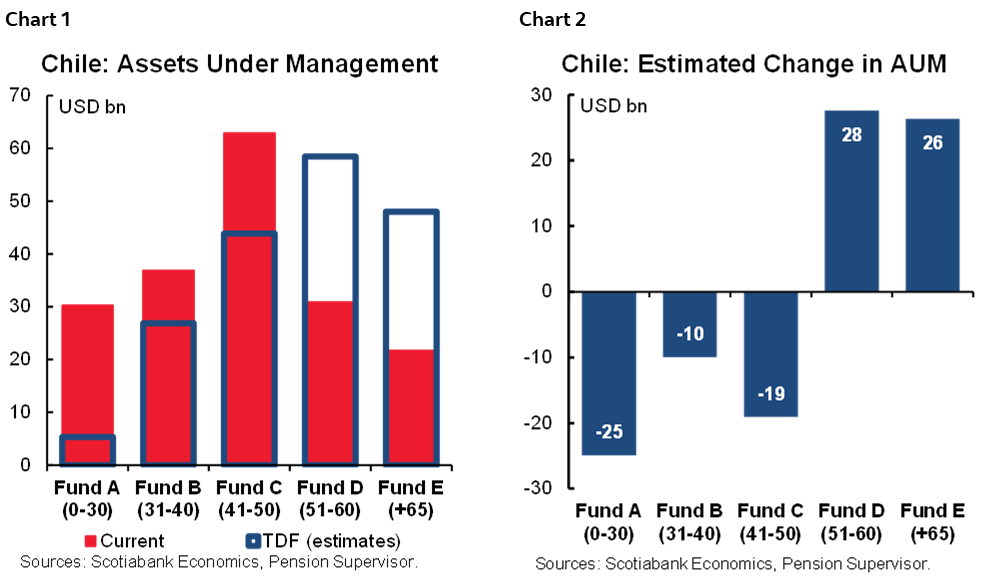

TRANSITION TO TARGET DATE FUNDS: WE ESTIMATE A STRUCTURAL INCREASE IN APPETITE FOR LOCAL FIXED-INCOME ASSETS AFTER ITS IMPLEMENTATION

Recently, the Pension Reform bill also showed substantial progress. It should be recalled that the Pension Reform would have a fiscal cost of 1.2% of GDP, which includes increasing the PGU (universal pension guarantee) and mandatory contributions by 6 ppts. In this context, the Technical Committee was able to reach partial agreements on relevant points such as the increase of the mandatory pension contribution by 6 ppts, charged to the employer, increasing the taxable ceiling used for unemployment insurance and the transition from the multi-funds scheme to target date funds (TDF), which will serve as an input to advance in the parliamentary discussion in Congress. In this regard, we estimate the implications of the transition to TDF on the capital market, where we estimate that it would structurally increase the appetite for local fixed income assets to the detriment of equities (mainly foreign). According to our calculations, migrating from multi-funds to TDF would mean mobilizing slightly more than USD 54 bn (16% of GDP) given the relevant assets under management (AUM) and the high degree of sub-optimality (contributors are in sub-optimal pension funds from a life-cycle perspective). In other words, it would imply transferring resources from the current risky funds (A, B and C) to conservative TDF, similar to the current D and E multi-funds (charts 1 and 2). Adding to this transition effect is the additional long-term flow to more conservative TDF.

Mexico—Q2 GDP Expectations

Brian Pérez, Quant Analyst

+52.55.5123.1221 (Mexico)

bperezgu@scotiabank.com.mx

Miguel Saldaña, Economist

+52.55.5123.1718 (Mexico)

msaldanab@scotiabank.com.mx

Next week, attention will be set on GDP flash estimates for Q2-2024 due to several key economic factors. First, economic activity has not met expectations so far this year, showing signs of moderation in several components. As for private consumption, it presented a monthly variation of -0.9% in April, dragged by slow domestic goods and services. Apparently, the increase in government spending was not enough to boost household consumption during these first months as the formal labour market has dropped in May and June. Gross fixed investment, while still strong thanks to non-residential construction and imported machinery and equipment, but with residential construction stagnating, shows signs of deceleration, and will be surely affected by greater political uncertainty in the second half of the year both due to constitutional reforms and the U.S. elections, as exemplified by the recent announcement by Tesla that it is pausing its investment plans until at least after U.S. elections . On the other hand, the trade balance holds a deficit from January to May of -4,460 million dollars (vs. -6,563 million dollars in the same period last year), although with advances in both imports and exports, particularly automotive exports.

In recent surveys, growth expectations by private analysts have been on downtrend, where in the latest Citibanamex Survey they were revised to 1.9% for 2024 (2.0% previously), and 1.5% for 2025 (1.6% previously), affected by monthly indicators that have already been showing a moderation, mainly due to the slower pace of industry, mostly in manufacturing.

We believe that in the second quarter, the moderation in economic activity will persist, despite a more favourable pace in services activity, while industry would remain weaker, owing to recent declines in mining and manufacturing, although construction could drop in a sequential basis. As for primary activities, due to their volatile characteristics, they could fall on a quarterly basis, as droughts and floods are having an adverse effect on crops, which has manifested itself in higher prices, particularly in certain fruits and vegetables.

Peru—Expect Mild GDP Growth for June and Inflation Unchanged At 2.3% for July

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Peru’s inflation figure for July will be released on Thursday next week. The key prices that we follow suggest that inflation will be around 0.4% for the month, which would put it nearly on par with July last year (July is a seasonally high inflation month due to increases in travel prices during the winter break period and the Independence Day holiday season). If so, then yearly inflation should not be materially different from the 2.3% register in June. Core inflation is also likely to continue to hover around 3.0%. We expect this lack of progress in lowering inflation to bolster the position that the BCRP has been signaling in favour of dragging its feet towards its next reference rate cut. In particular, we do not expect the BCRP to lower its rate in August.

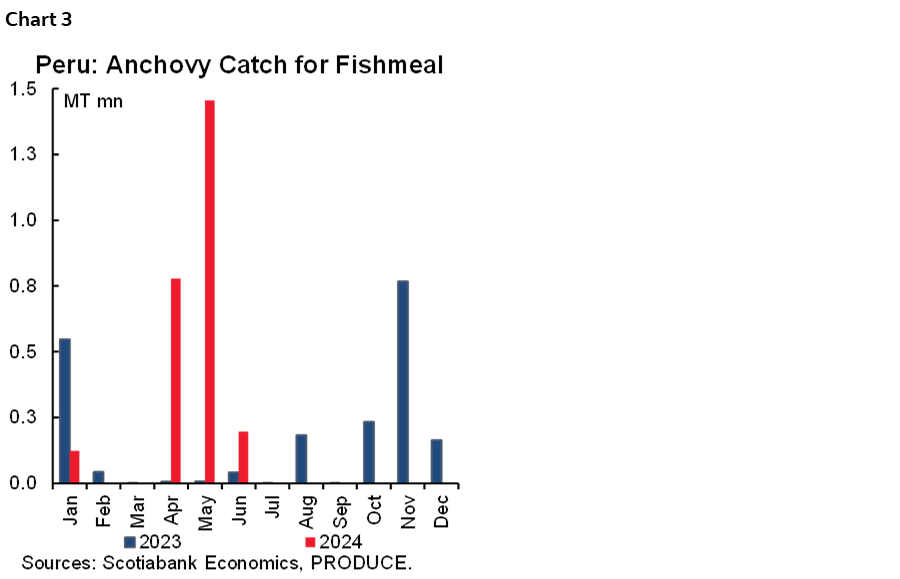

Also on August 1st, we should get early releases on June GDP growth for fishing and mining, as well as cement demand and public sector investment. The figure for fishing is the one to look at, as fishing has represented nearly half of aggregate GDP growth during April–May. By June, however, the fishing season was winding down, so the impact should be much, much lower for the month (chart 3).

Initial figures for cement demand show a 9% YoY decrease in sales for June. Therefore, construction GDP should be low and more dependent on public sector investment for growth. Given June cement sales plus the figures we have for fishmeal fishing, we are expecting aggregate GDP growth for June somewhere between 2.0% and 2.5%. This is a level that is more aligned with sustainable domestic demand than the 5% growth levels of April–May.

Political noise has, perhaps, not lessened in recent weeks, but it has become much more focused on normal political events. One of these events is occurring as we write and involves the election of the new president of Congress, which is renewed every July. The president of Congress is a key position, as it determines the congressional agenda—that is, which issues and initiatives will be introduced into debate, and which will not. At the time of this writing, Thursday July 25th (the election in Congress takes place on July 26th), Eduardo Salhuana is the candidate with the greatest likelihood to preside over Congress during the next twelve months. Salhuana belongs to the centrist Alianza para el Progreso party. He has been accused of having links to illegal mining, but this may simply reflect that he represents Madre De Dios, a region dominated by illegal mining. In any event, if chosen, he is not likely to change the current congressional trajectory of favouring initiatives that benefit interest groups linked to the informal economy. But, then again, his opponent, Silvana Robles (Bancada Socialista party), is not likely to do so either. Either way, Congress is likely to continue to be a source of controversy.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.