ECONOMIC OVERVIEW

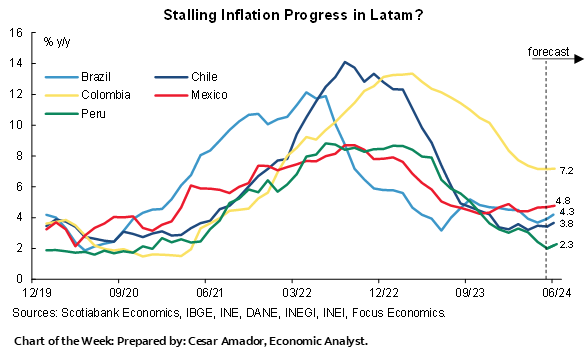

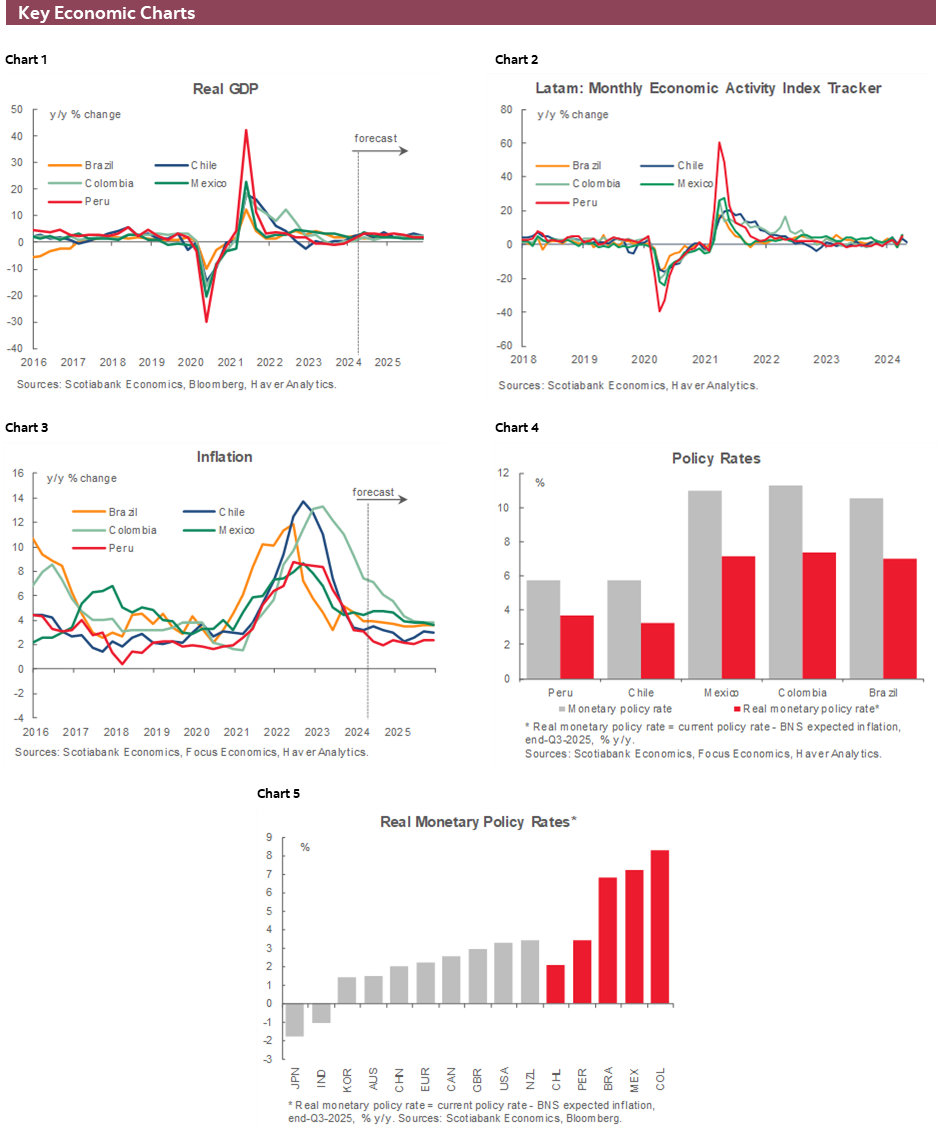

- A flood of inflation data in Latam awaits to influence expectations for upcoming policy decisions. Political risks and US CPI data are also bound to shape regional trading.

- Stubborn Mexican inflation may counteract the recent Banxico dovish surprise, while data out of Chile could make or break a July cut.

- Colombian inflation will further dampen larger cut bets, while Brazil’s BCB is challenged by unfavourable base effects and uncomfortable inflation readings in the months ahead.

- Peru’s central bank will likely stand pat again at its Thursday announcement, for the second consecutive meeting as core inflation fails to break into the target range.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile and Peru.

MARKET EVENTS & INDICATORS

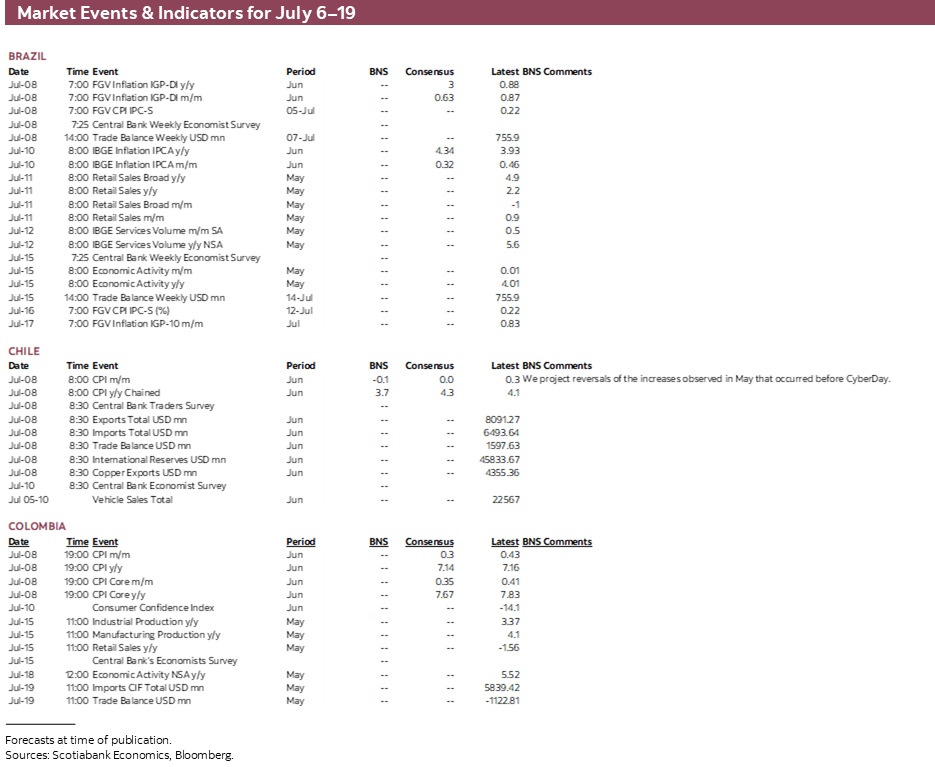

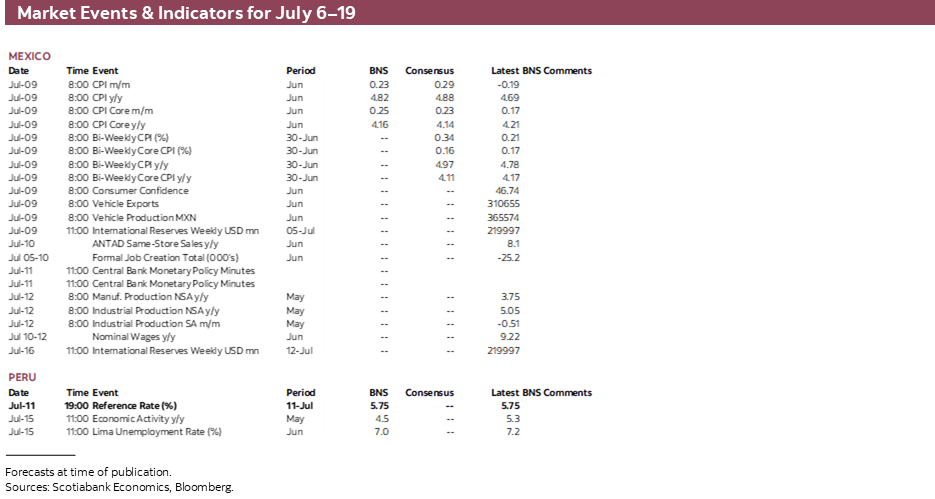

- A comprehensive risk calendar with selected highlights for the period July 6–19 across the Pacific Alliance countries and Brazil.

Chart of the Week

ECONOMIC OVERVIEW: CPI WEEK, BCRP ANNOUNCEMENT

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- A flood of inflation data in Latam awaits to influence expectations for upcoming policy decisions. Political risks and US CPI data are also bound to shape regional trading.

- Stubborn Mexican inflation may counteract the recent Banxico dovish surprise, while data out of Chile could make or break a July cut.

- Colombian inflation will further dampen larger cut bets, while Brazil’s BCB is challenged by unfavourable base effects and uncomfortable inflation readings in the months ahead.

- Peru’s central bank will likely stand pat again at its Thursday announcement, for the second consecutive meeting as core inflation fails to break into the target range.

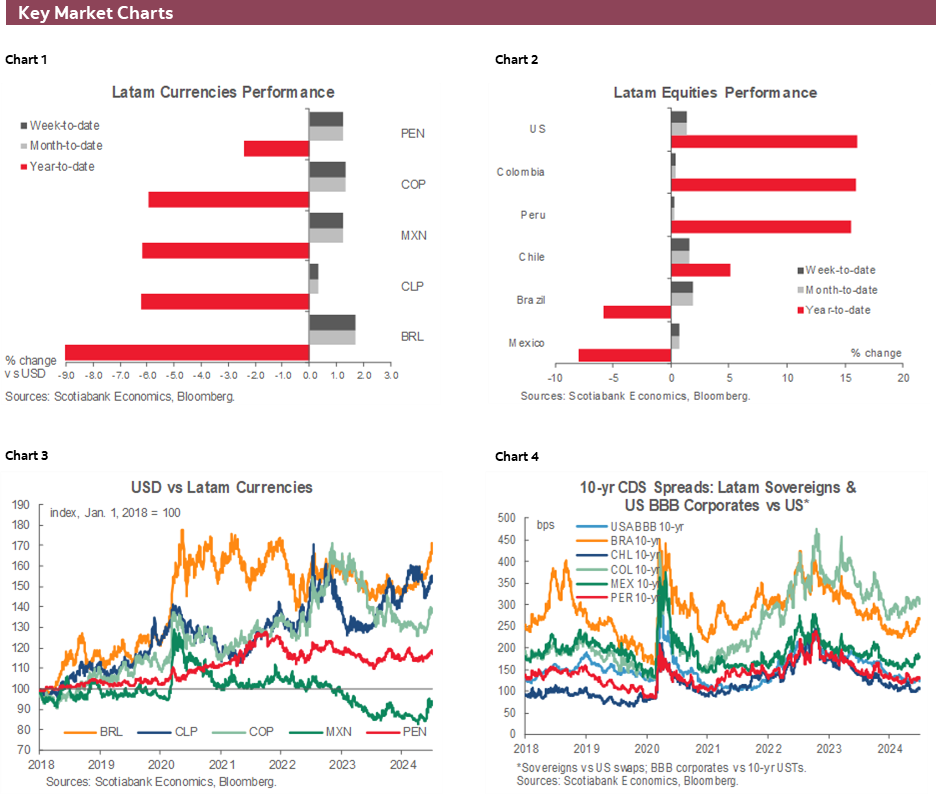

Political developments have been countered by benign US data to have markets trading somewhat erratically or unconvincingly over the past few days, with volumes thinned out by US holidays and clearer signs of a ‘summer lull’. The latest round of G10 and Latam data was welcome news for central bankers, but the feeling remains that more data are needed to determine a clearer path for policymakers.

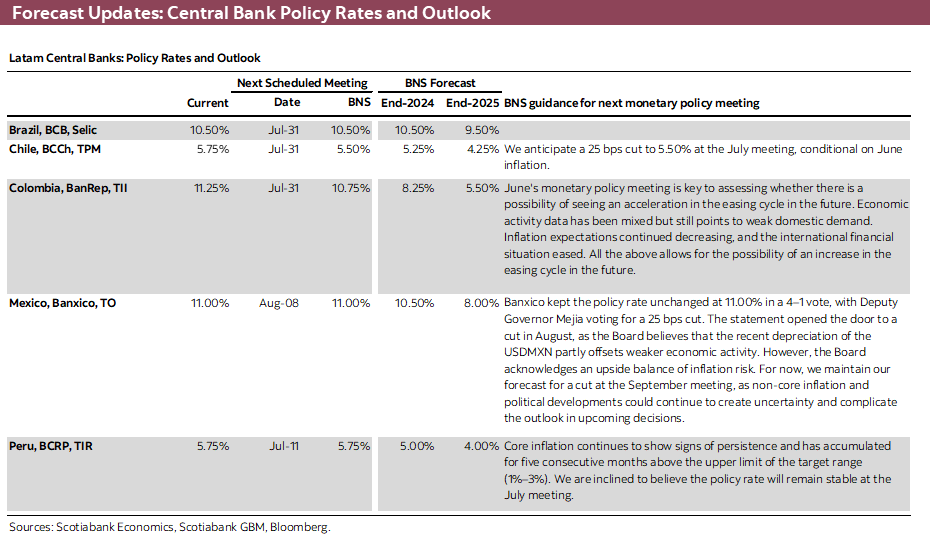

With that in mind, next week’s calendar is full of Latam and G10 CPI releases that will be key in shaping expectations for upcoming central bank decisions. Recent policy announcements or speeches have shown that most central banks are looking to proceed carefully, from a majority in BanRep’s board practically shooting down the possibility of 75bps moves to ECB officials indicating that they’re highly unlikely to cut rates again on the 18th.

Alongside a close focus on economic data, markets are on edge on the rising possibility of a second Trump presidency and the outcome of France’s second round elections on the 7th. On Monday, markets will open to French results that are likely to show a hung parliament and the aftermath of a Biden ‘redemption tour’ that may or may not be enough to resist calls to pass the baton to a different Democratic candidate.

Disappointing US ISM services and manufacturing data and constructive CPI/PCE figures have built a bit more confidence on the path to cuts for the Fed, as did a mixed jobs report, and we’ll see if Thursday’s June CPI release builds on this to help global rates markets retrace a bit more of their year-to-date losses. Powell in Congress, the RBNZ’s decision, and Chinese trade and prices data also stand out in next week’s G20 calendar.

Mexican markets look a bit more at ease with president-elect Sheinbaum opting for continuity across most of her cabinet picks, including keeping Ramirez de la O as finance minister and bringing in former foreign affairs minister Ebrard as economy minister. But, with her cabinet soon to be fully announced, markets may anxiously refocus on AMLO’s reform push.

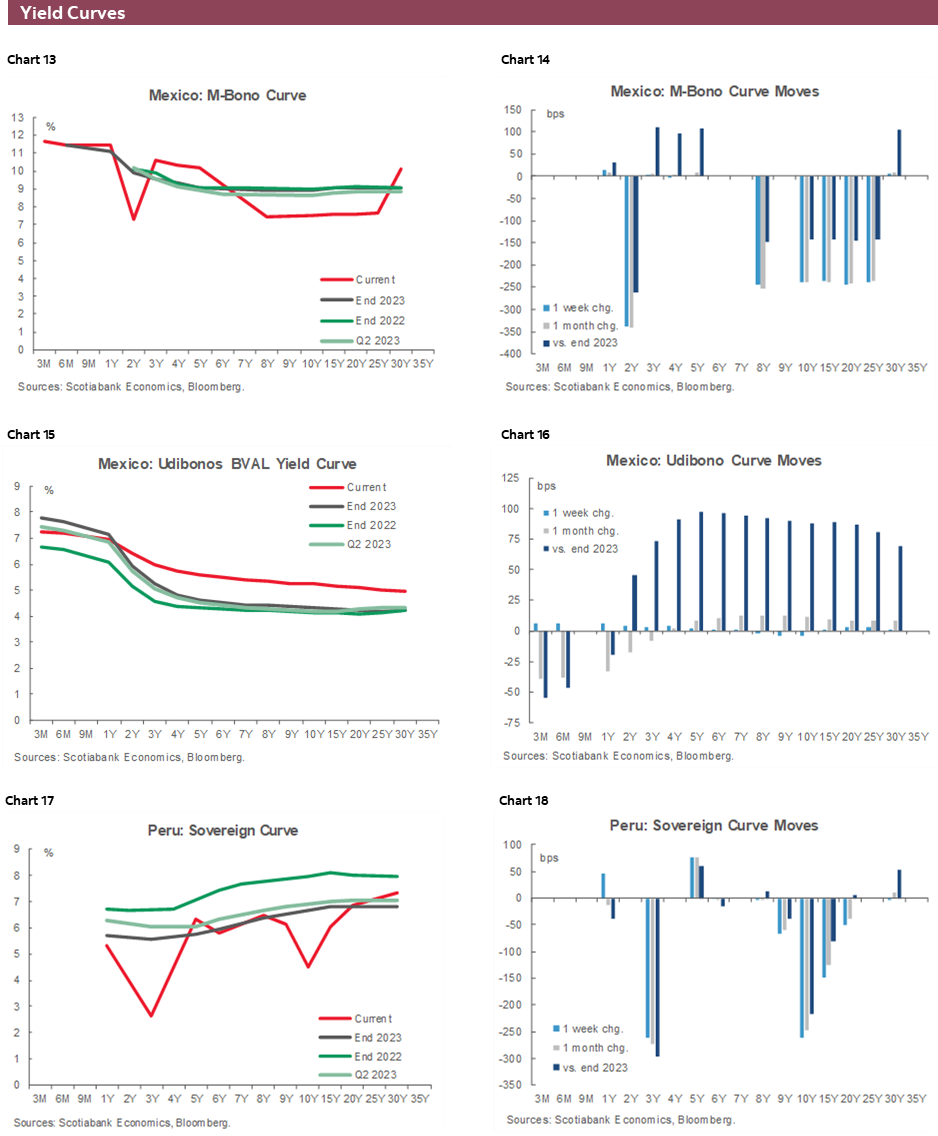

It’s of course not just politics that is in focus for Mexican assets, as the latest surprisingly dovish Banxico decision has rebuilt bets on an August resumption of rate cuts in Mexico. We should get a bit more colour from the bank’s decision minutes that are due for release on Thursday, with the summary of opinions showing one member clearly favouring cuts (Mejia, who voted for a 25bps cut), likely two more open to a move at the August decision, and another two that remain more cautious.

It will also be up to next week’s June CPI release to guide markets. For Tuesday’s data release, economists believe there will be a practically unchanged core inflation reading in the low-4s while headline inflation is seen rising to the high-4s as guided by bi-weekly data. In fact, it is not outside of the realm of possibilities that bi-weekly headline inflation prints with a 5-handle—a result that could heavily impact August cut bets and fan worries for some at Banxico of inflation expectations de-anchoring.

Mexico’s inflation data may be the most impactful in the region as far as its impact on the uncertain path for the country’s central bank, but data out of Chile (Monday), Colombia (Tuesday), and Brazil (Wednesday) will also play a big role in expectations for their respective central banks—though here markets seem to have a narrower view of what to expect.

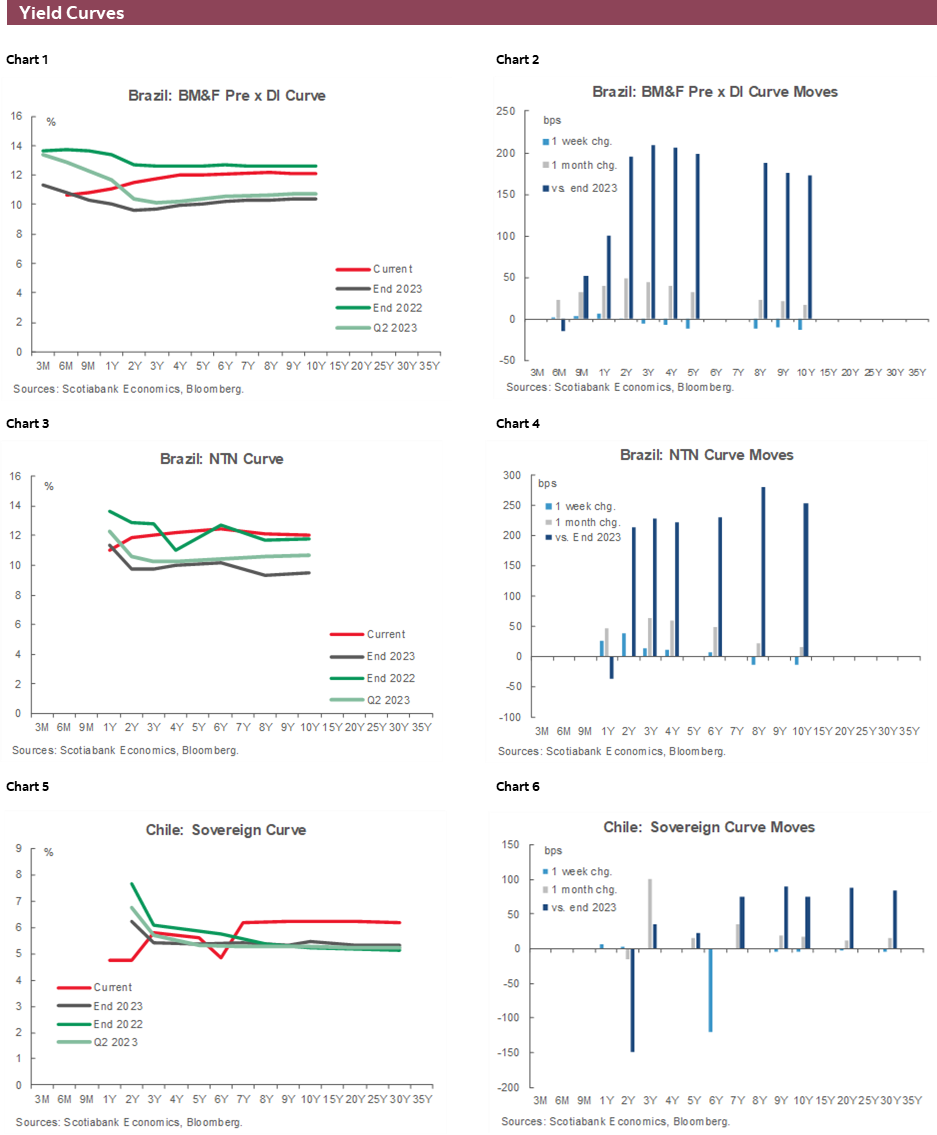

Our team in Chile expects a 0.1% m/m decline in prices in June, somewhat below the median call for no change, as the prices of certain consumer goods reverse gains made in May that got ahead of seasonal ‘discounting’ counteract a rise in services prices (see our team’s preview here). With such a result, our economists expect that the BCCh will choose to continue cutting rates, by 25bps at its late-July announcement; markets are assigning a roughly 40% chance of a cut and we’ll see what other economists think in the results of the BCCh survey out on Wednesday. In today’s report, our team in Santiago gives a quick update on the pension reform process and public debt issuance in the year-to-date.

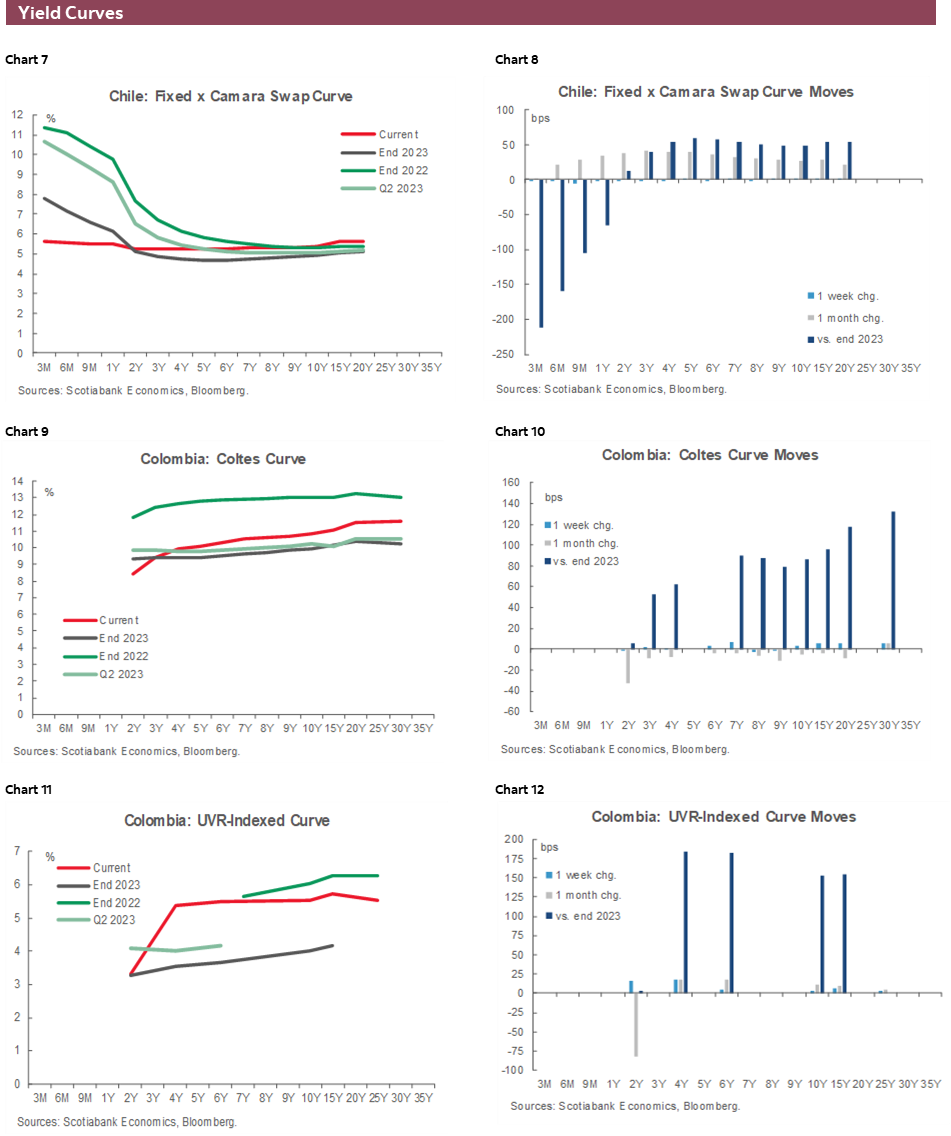

Colombian inflation is projected to have held relatively unchanged in June from May, around 7.15%, according to our economists in Colombia and the median respondent to the Bloomberg survey; rents continue to place upward pressure on headline prices growth on a year-on-year basis with an additional tailwind from base effects in food prices. There’s not a lot of progress being made on the inflation front in Colombia since headline prices growth came in at 7.4% in March (after closing 2023 at 9.3%) so it’s no surprise that BanRep’s latest decision threw cold water on expectations for a faster pace of rate cuts; with that, next week’s data won’t help, and it’s also important to highlight that we project only a minor slowdown in core inflation.

There’s quite a bit of data out of Brazil next week, as on top of Wednesday’s IPCA release, Thursday’s retail sales figures and Friday’s services activity readings will inform our view of the growth trajectory for the country. Wednesday’s inflation data will give the BCB a big headache, as headline prices growth is expected to jump from 3.9% to 4.3% with base effects, particularly in food, driving inflation higher while underlying measures look better behaved. Nevertheless, the remainder of the year look set to keep headline inflation in a 4.00–4.50% band that will pose difficulties for the BCB’s task to anchor inflation expectations, justifying an on-hold stance for the time being.

Similarly, Peru’s central bank will also likely choose to leave its reference rate on hold at its Thursday announcement. In June, the Velarde-led central bank surprised most with an unchanged rate decision, backed by a lack of progress on the core inflation front. Last week’s June CPI release showed that rate of core inflation remains outside (just about) the 1–3% target band, at 3.1%. Peru’s central bank is not in a huge rush to continue easing policy and no one would blame it if it were to leave settings unchanged next week—as guided by sticky core inflation data that prompted a rate hold last month. To boot, Peruvian economic activity is improving. In today’s report, our economists in Peru analyse recent economic data out of the country that suggests their 2.7% GDP growth projection for 2024 is on track to undershoot.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Update on Pension Reform and Public Debt

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

VOTING TO LEGISLATE ON PENSIONS IS APPROACHING

Intense negotiations are taking place in Congress to advance the idea of legislating regarding the Pension Reform. The bill has been in Congress for nineteen months and, most recently, a technical table was formed that will prepare a report where the most technical aspects of the reform would be agreed upon. There are several aspects where there is no consensus regarding the distribution of the additional mandatory contribution (6 ppts), the separation of the industry and the mechanisms to improve competition. Some parliamentarians have indicated their intention to vote in favour of the idea of legislating, while others (an important part of the opposition senators) indicate that the progress is not enough to commit their support. The government needs twenty-six votes in favour to advance the Pension Reform. An eventual approval of the idea of legislating that has support from the opposition, respecting the guidelines of the technical agreement, could mean a reduction in the uncertainty that has affected the pension system for several years. Additionally, the possibility of having new withdrawals of pension funds would substantially decrease. Consequently, we expect a favourable impact on Chile’s risk perception if approval is achieved for the idea of legislating that comes with support from the opposition and respects the main concerns raised by the opposition political bloc that is the majority in the Senate.

GOVERNMENT ISSUED DEBT FOR EUR 1.6 BN IN FOREIGN CURRENCY

On Monday, July 1st, Chile’s Ministry of Finance reported the issuance of Treasury bonds in EUR for a total of EUR 1.6 bn (USD 1.7 bn) in foreign markets as part of the USD 16.5 bn debt financing for 2024 approved by law. With this, the government has issued debt in foreign currency for around USD 3.3 bn (21% of the total amount for this year), above what was previously announced (USD 1.7 bn, 10% of the total). Adding issuances in local currency, Chile has issued public debt for a total of around USD 6.5 bn in 2024, with a remainder of around USD 10 bn.

Peruvian Economy Continued to Recover in May

Pablo Nano, Deputy Head Economist

+51.1.211.6000 Ext. 16556 (Peru)

pablo.nano@scotiabank.com.pe

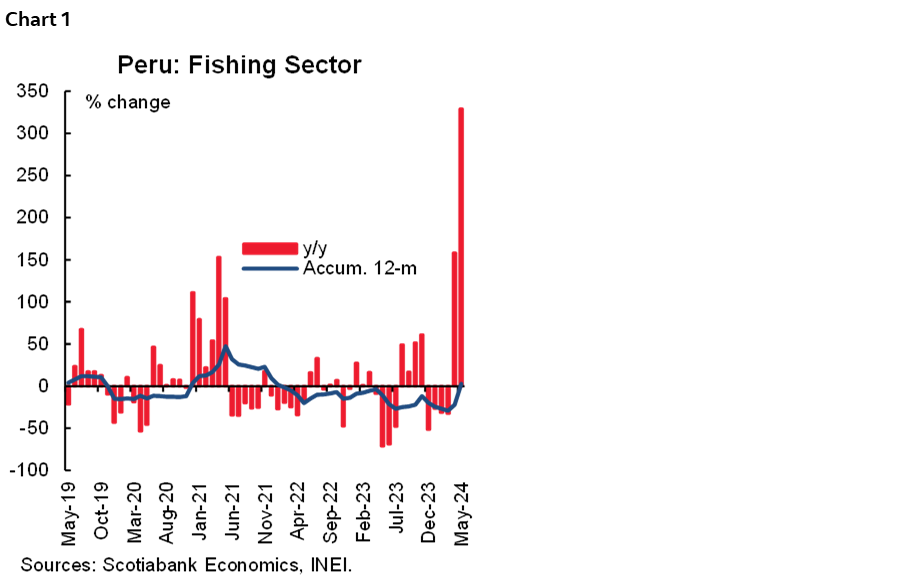

INEI recently published the leading indicators of economic activity for May, which confirm our perception that economic activity continued to recover. Thus, we estimate that GDP has grown around 4.5% in May, after the strong rebound of 5.3% in April. Considering that both figures are above our initial estimates, our GDP growth projection of 2.7% for the year 2024 is currently biased upward.

As in April, the fishing sector (+329.2%) led the expansion of economic activity, benefiting from the successful first anchovy fishing campaign—to date more than 90% of the quota has been caught, different from May 2023 when, due to El Niño, the fishing season did not open. This, together with the indirect effect on resources manufacturing—greater production of fishmeal—explained that both sectors contributed close to 2 percentage points to GDP growth in May (chart 1).

On the other hand, the agricultural sector (+2.6%) continued to recover due to the normalization of climatic conditions, although at a slower pace than in April. The mining and hydrocarbons sector (+1.8%) continued to show modest growth rates, due to an unfavourable base effect after 2023 was the first full year of operation of the Quellaveco copper megaproject. In fact, copper production fell slightly in May, unlike the dynamism in the extraction of gold and molybdenum. It should be noted that, although mining production has been showing modest growth, its generation of foreign currency has been increasing steadily thanks to the high prices of gold and copper.

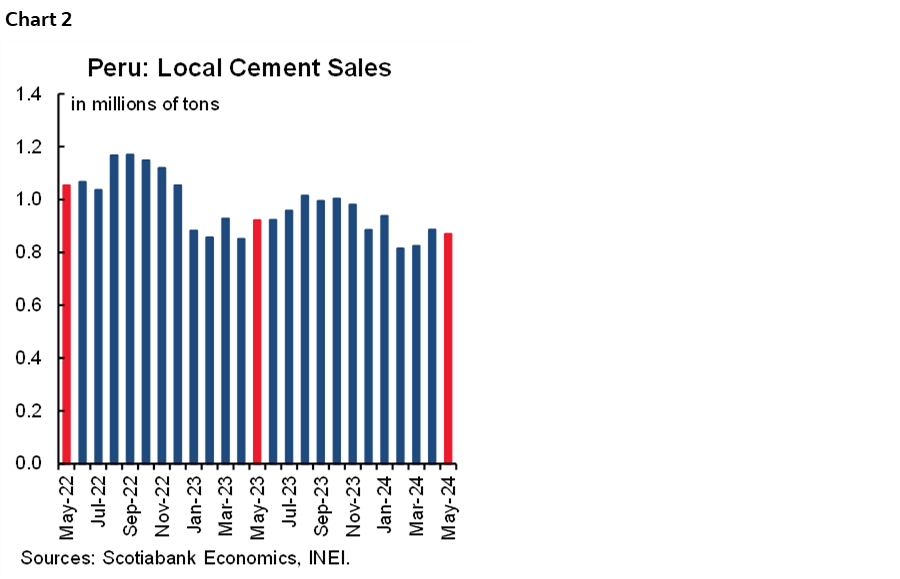

Non-primary sectors linked to domestic demand would have continued their gradual recovery in May, although at a slower pace than we would like to see. Construction would have closed with slight growth in May driven by public investment (+44%), particularly from regional and local governments. However, domestic cement consumption (-1.7%), which mainly reflects private sector demand, has not yet managed to consolidate a sustained recovery (chart 2). On the other hand, non-resources manufacturing would have grown for the second consecutive month, benefiting from a base effect—it fell double digits in May 2023 due to the recession—as well as from a gradual recovery of domestic demand and exports—in particular textile and chemical products.

Finally, we expect the positive evolution of the commerce and services sectors to continue, hand in hand with the progressive recovery of employment and the fall in inflation, which increases the purchasing power of consumers. Furthermore, the extraordinary income from the partial release of pension funds, as well as the availability of the entire CTS, a type of unemployment insurance, would allow greater dynamism in these sectors linked to consumption in the coming months.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.