ECONOMIC OVERVIEW

- A very busy week awaits global markets, packed full with key inflation and employment data, central bank decisions and speakers, and important milestones ahead of 2024 elections.

- Mexico, Chile, and Colombia release inflation data for February. Peru’s central bank is set to announce a 25bps rate cut while the ECB and BoC stick to a hawkish stance. Powell gives testimony to Congress and a flood of data from US employment to Tokyo CPI await in the G10.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile and Peru.

MARKET EVENTS & INDICATORS

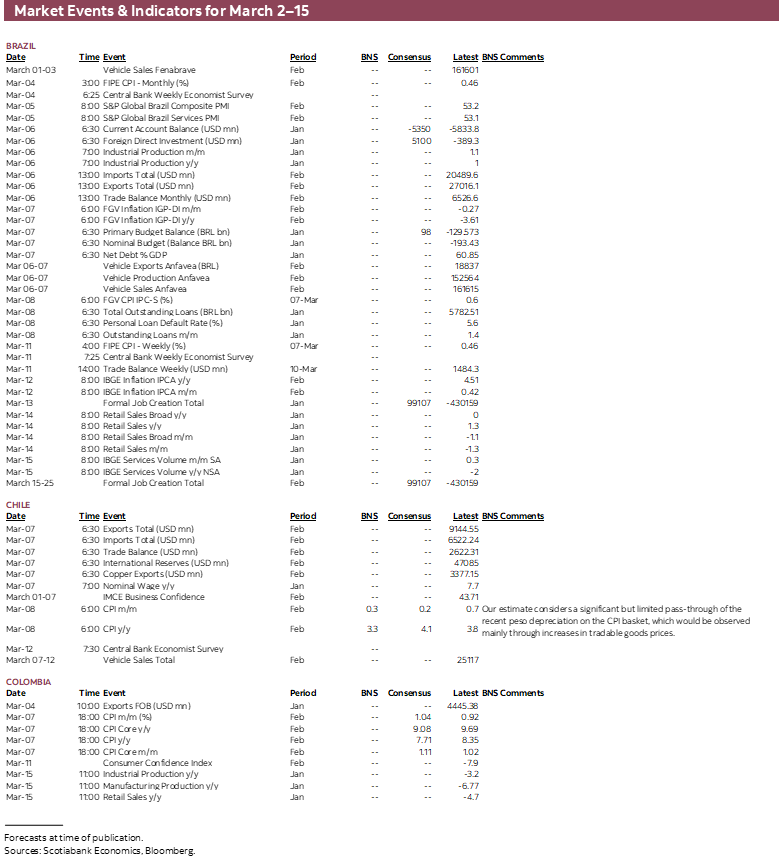

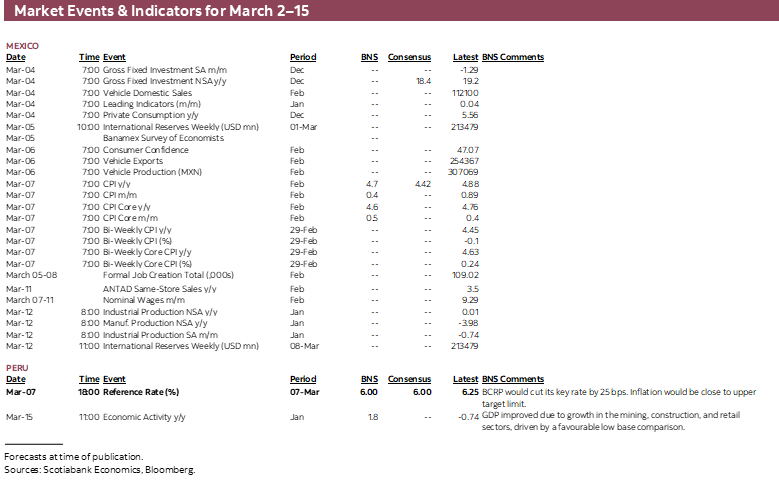

- A comprehensive risk calendar with selected highlights for the period March 2–15 across the Pacific Alliance countries and Brazil.

Charts of the Week

ECONOMIC OVERVIEW: REGIONAL INFLATION, BCRP DECISION AND PACKED G10 CALENDAR

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- A very busy week awaits global markets, packed full with key inflation and employment data, central bank decisions and speakers, and important milestones ahead of 2024 elections.

- Mexico, Chile, and Colombia release inflation data for February. Peru’s central bank is set to announce a 25bps rate cut while the ECB and BoC stick to a hawkish stance. Powell gives testimony to Congress and a flood of data from US employment to Tokyo CPI await in the G10.

A very busy week awaits global markets, packed full with key inflation and employment data, central bank decisions and speakers, and important milestones ahead of 2024 elections. The week will start out quietly, thankfully, with only second tier data out of Latam and the G10 and little else on Monday that will allow market players and observers to save their energy for the flood of data and events that awaits them over the balance of the week.

Starting with politics, Mexican presidential candidates officially kick off their campaigns today, March 1st, for a three-month long period of closely-watched polls and debates that ends on May 29th, just a few days before the June 2nd vote. We’ll watch for more details on the policy plans of the two leading candidates, Sheinbaum and Galvez, over the coming days. But, the biggest political risk for Mexican markets next week may come from abroad, with Tuesday’s Republican primaries in fifteen US states set to give former President Trump a virtually insurmountable lead over his opponent, Haley. The bigger Trump’s victory and the more he talks about protectionist trade policy or a tougher immigration response, the more Mexican assets may hurt.

Staying with Mexico, we’ll monitor December gross fixed investment figures out on Monday and the results to the latest Citibanamex economists survey on Tuesday, but neither should have much impact on markets. December data is in the rearview mirror, knowing that the economy closed out 2023 in a weak standing and we also don’t expect that economists changed their view on when Banxico may start rate cuts, currently seen in March.

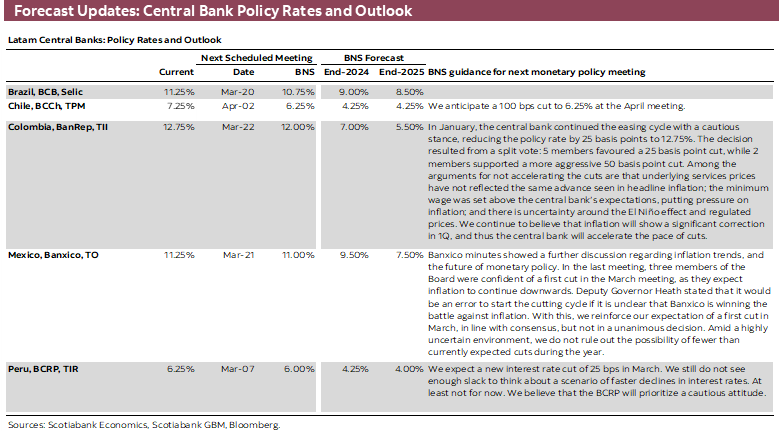

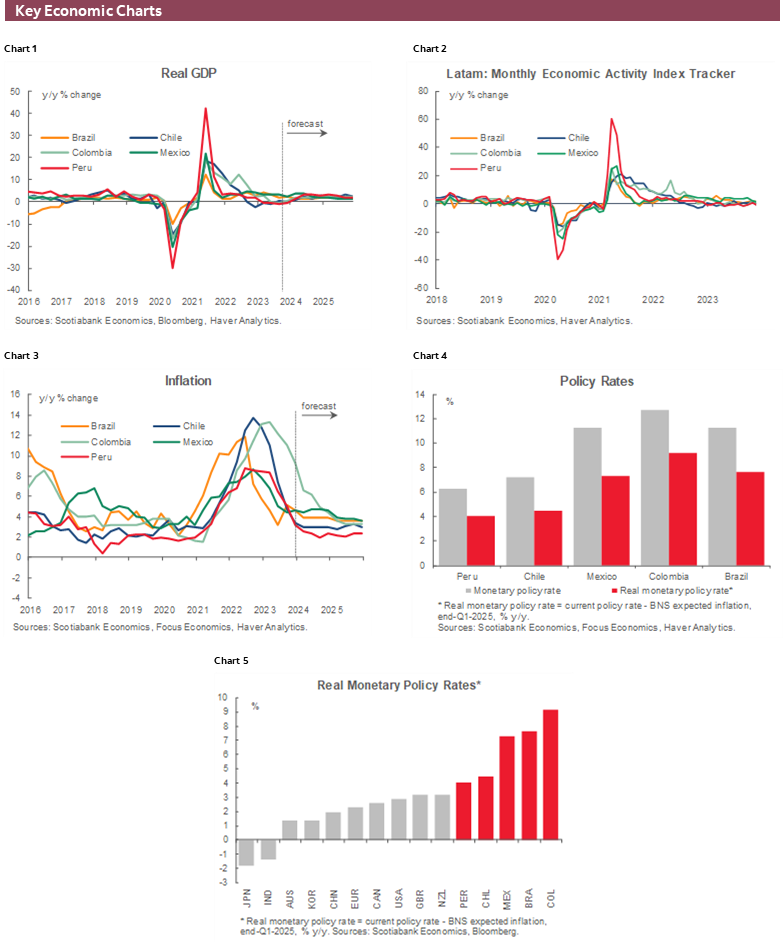

It may have been a closer split across bets for the first rate reduction in Mexico had it not been for the recent string of Banxico releases and economic figures. Over the past few weeks, Q4 GDP figures greatly disappointed (almost showing no growth q/q) and H1-Feb CPI surprised to the downside in both headline and core terms. Banxico’s February meeting minutes, and the publication and presentation of its quarterly report told us that officials are still very much eyeing a March rate cut—albeit in a split vote.

It may be difficult to change the minds of Banxico officials away from a 25bps move on the 21st, but if there’s one thing that could, it’s February inflation data due for release on Thursday. Now, it’s a high bar of course since we already have H1-Feb CPI readings, so the full-month picture surprising to the point of delaying cuts would take inconceivable price increases over the second half of the month. Still, there has to be a bit more progress being made on the core inflation side of things and if we don’t get much next week, then maybe Banxico won’t do back-to-back cuts.

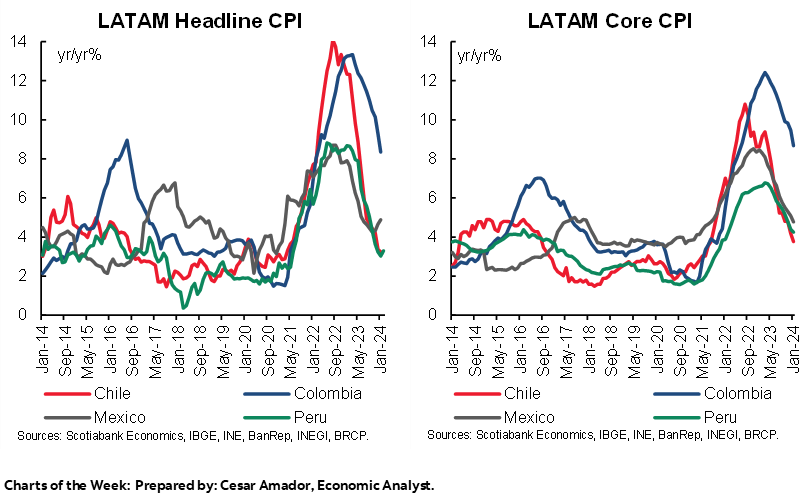

Mexico is not alone in publishing CPI data next week, and not even on Thursday when we also get Colombian inflation for February. This is the country’s only release worth following next week, and yet, with an 18ET release time, local markets will only be able to react to it the following morning. It may be an aggressive open in markets as declines in Colombian inflation accelerate (with the support of base effects) and when moves get large these can result in decent beats or misses that shake up markets. Our economists in Colombia project that headline inflation fell to 7.61% from 8.35% in January, with core inflation coming in at 8.99% from 9.69% y/y. If the large deceleration in inflation is confirmed then the team’s call of a 75bps reduction at BanRep’s next meeting will look even more likely.

Chile is the last of the Pacific Alliance countries to publish February inflation data, closing out the Latam data week with CPI readings due on Friday. We may be limited in how much we can glean from these data as the INE will again not publish the BCCh’s preferred ex. volatiles inflation reading. The January 3.8% y/y increase greatly exceeded the economist median forecast of 3.5%, but the introduction of a new CPI basket sharply skewed the results higher. For our economists, the 3.2% y/y constant-basket inflation reading for January is the better representation of prices growth in the country. That aside, as they outline in today’s report, they project that inflation accelerated slightly in February owing to a weaker CLP and indexation practices. Over the past couple of days we’ve got stronger than expected economic data that may see some reassess their projected BCCh rate path, but our economists believe that the convergence of inflation towards target will continue, allowing sizeable policy rate cuts, with the next one being 100bps at the April meeting.

Lastly, in the Pacific Alliance, Peru may not give us a lot next week on the data front—in fact, nothing to write home about. But, the BCRP’s decision awaits alongside the multitude of regional data/events on Thursday. We expect the BCRP will continue at its steady 25bps pace of rate cuts with little to pull in either direction, or in a way being offset by something else. In mid-February, December GDP was a big negative surprise, showing a 0.7% y/y decline in the final month of 2023 against the median forecast of 0.4% and our call for little changed output. But, just this morning, CPI data for February surprised in the opposite direction, coming in at 3.3%, overshooting the consensus call of 2.9%—and even our higher 3.2% forecast. So, the GDP print maybe told some that the BCRP could cut by more than 25bps and then the CPI print this morning told them “not so fast”; we’re steady in our expectation of a 25bps reduction next week. Throughout all of this data noise, we’ve had political noise to distract us, as well. In today’s report, our Lima team talks about the recent moves at Petroperú and scheduled protests against the National Board of Justice, but they note that, at least, late-2023 trends are teeing up an improvement on the growth front in Q1-24.

We can’t give next week’s G10 calendar the respect it deserves in this publication, but we do want to highlight the collection of releases and events that are bound to shift Latam local markets. As noted previously, Monday is a quiet one and we have the US Super Tuesday on...Tuesday. That same day, Tokyo inflation will be a risk for rates markets as will the release of US ISM services figures; Chinese private PMIs could also shape the risk/high-beta mood. Wednesday will have the BoC’s rate decisions and press conference (we expect limited changes), the release of US ADP employment and JOLTS report, and a key appearance by Fed Chairman Powell in Congress. Thursday’s ECB rate announcement with updated forecasts—and likely continued guidance that the first rate cut will not come until June—should ripple through global markets. All of this will take place before the release of US and Canadian employment reports on Friday and final comments by Fed officials ahead of their communications blackout period that begins on the 9th.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—We Project February CPI of 0.3% m/m, Above Market Expectations

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

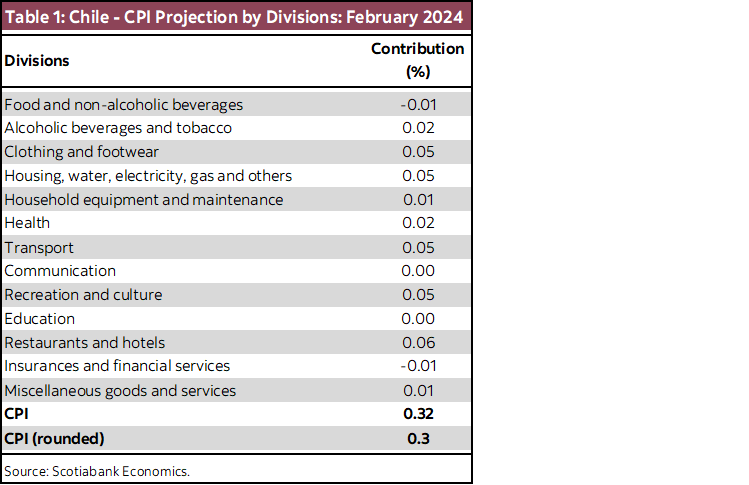

- CPI ex food and energy to fall to 3% in February, the lowest level since April 2021

We project February CPI of 0.3% m/m (table 1), above market expectations expressed in forwards (0.05%) and surveys (Traders Survey: 0.1%; Economists Survey: 0.2%). Our estimate considers a significant but limited pass-through of the recent peso depreciation on the CPI basket, which would be observed mainly through increases in tradable goods prices (0.3% m/m). In addition, we project that indexation effects would continue to be observed in some services, as would be the case of public transportation and other indexed services. With this, services inflation would be 0.4% m/m. If our projection materializes, the CPI would register an increase of 3.3% y/y which, although it would represent a slight acceleration with respect to January’s figure (3.2%), it does not compromise the convergence to the 3% target as soon as March. On the contrary, the above-market “summer inflation” that we expect in the first months of the year would support, but not ensure, that inflation converges to 3% by December 2024 and does not fall sharply below that level.

Core inflation (CPI ex food and energy) would fall below 3% in February. Our projection also considers a 0.4% m/m increase in core CPI, which would put this inflation at 2.7% y/y, its lowest level in almost three years (since Apr 2021). For now, INE will continue to not publish the ex-volatile CPI, the central bank’s preferred measure of core inflation, which will be delivered by the BCCh in March. However, the last official record of this indicator was 5.4% y/y in December, so we will undoubtedly see a sharp drop in this inflation when it is published.

Peru—Political Noise just Cannot Cease, Even as Growth is Poised to Resume

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

These are eventful times in Peru. The government announced a USD 1.3bn rescue plan for Petroperú, which would consist of a USD 800bn loan guarantee plus an additional USD 500bn credit line from the State bank, Banco de la Nación. This was less than half of the USD 3bn that Petroperú was requesting.

More dramatically, the government removed the entire Board of Directors at Petroperú. And just so there would be no doubt as to the reasons behind this decision, finance minister José Arista stated in a press interview that the board members had the bad habit of lying to high cabinet members, and that this was something ingrained in their culture. The new board members consist mostly of prominent economists who do not have as much hands-on experience as one might hope in the oil industry per se. The designations may reflect that the priority is to shore up financial accounts.

Petroperú has recently been placed under 60% control of the Ministry of Finance. The Ministry of Finance is clearly uncomfortable at the prospect of having to eternally bail out Petroperú, and what this may mean for fiscal accounts over time. The impact on fiscal accounts may not be clear until an actual, more thorough plan, to refloat Petroperú is put together. This will be the main responsibility of the company’s new Board of Directors.

The other aspect that is polarizing public opinion, or at least the segment of public opinion that is involved enough to care, is the Junta Nacional de Justicia, JNJ, which can be translated as the National Board of Justice. The entity is crucial, in that it oversees the appointing of judges and other authorities in the judicial system. The current situation is confusing even for political analysts and specialists, as it mixes a real need for change and order, with possible intentions on the part of political parties to tamper with the system to their benefit. The press and social networks are clearly focusing on the latter, to the extent that public protests have been scheduled. Judging by other recent protests, it doesn’t seem like the new protests will be sufficiently substantial to influence Congress. The real importance of the topic of the JNJ and all the noise revolving around it may be how it reflects on the continual institutional weakening that has occurred in recent years in the country.

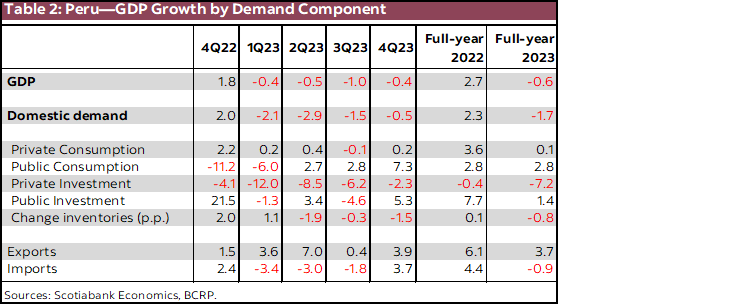

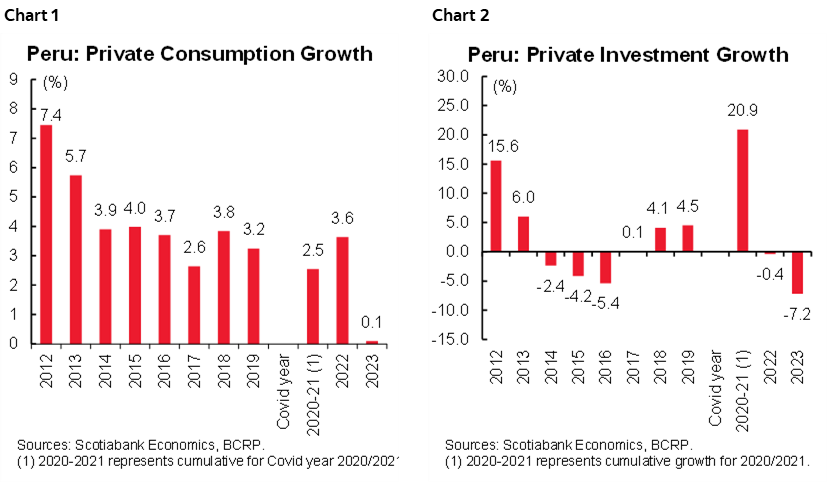

The BCRP released the final figures for Q4 and full-year 2023 GDP growth this week. The figures ratify that the year ended just as weak as it had begun, with -0.4% quarterly growth on both ends of the year (table 2). A few bright spots: exports (volume) grew in each quarter of the year, and government spending had a strong fourth quarter (public consumption up 7.3%, see chart 1 and investment 5.3%, see chart 2). One more, somewhat tentative, bright spot was that private consumption rose in Q4 and in the year, if only barely. Add to this that the decline in private investment has been weaker with each quarter, and you have some hope going into 2024.

All these trends seem to ratify that Q1 2024 is likely to show positive growth. But the onus is on private consumption and private investment. Both performed extremely poorly in 2023 in historic terms. In 2024, lower inflation, which means less deterioration of household real income levels, should help consumption rebound, while private investment, while not robust, should no longer be weighed down by the ending of the Quellaveco investment project.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.