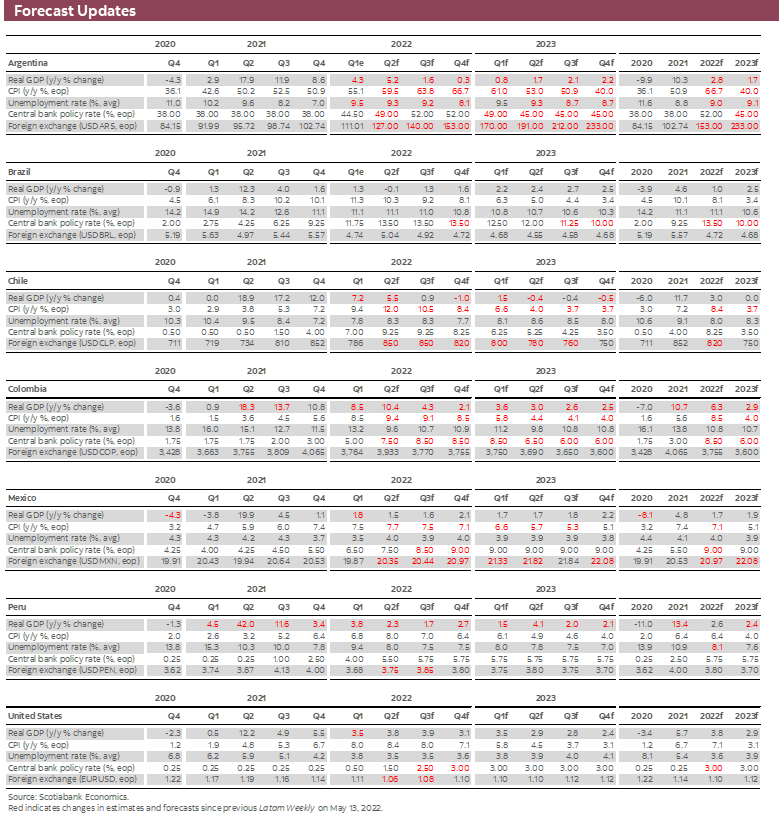

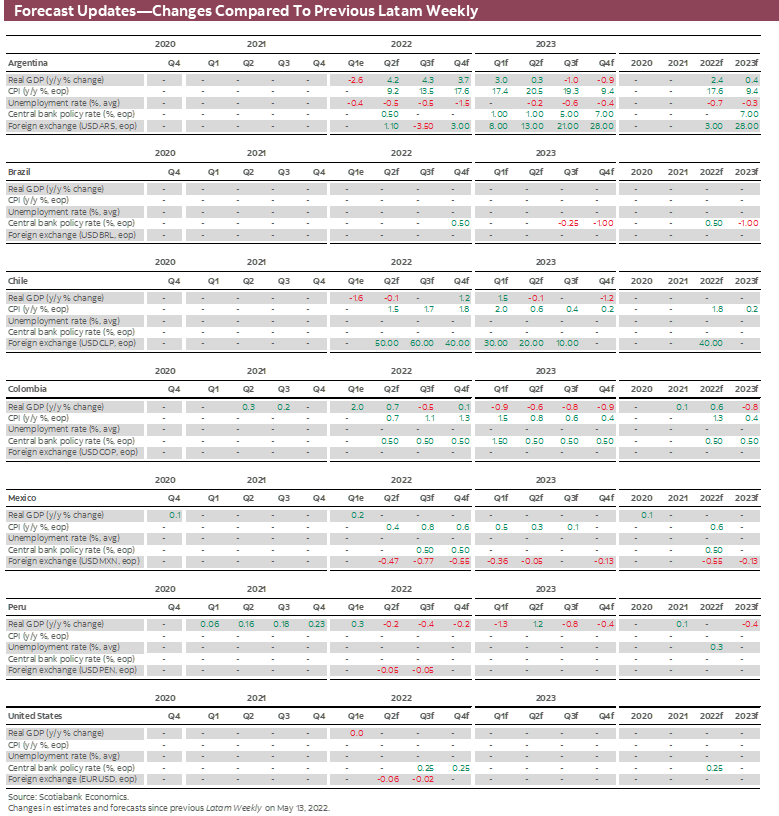

FORECAST UPDATES

- Persistent supply-side shocks combined with commodity price spikes continue to stoke inflationary pressures across the Latam region as growth surprises on the upside in some countries. These developments animate a range of changes to the projections of Scotiabank economists. See their latest forecast updates in the table below.

ECONOMIC OVERVIEW

- Rising inflation rates that erode households’ purchasing power presage more aggressive monetary policy responses and higher interest rates, increasing the risk of recession and fuelling social discontent. Such circumstances may increase the allure of populist policies that undermine the sound policy frameworks and weaken the strong economic institutions that governments across the region have built.

- Resorting to such approaches would be harmful to long-term development goals, however, particularly reducing poverty and inequality. Governments across the Latam region have broken the curse of financial ‘original sin’ which prevented them from conducting counter-cyclical stabilization policies, accentuating the “boom-bust” cycles of the past that stymied progress on these fronts.

- In this respect, while sound policy frameworks and strong institutions alone may not be sufficient conditions to address the problems of poverty and inequality, they are necessary to make progress; their loss would likely entail a return of financial original sin.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

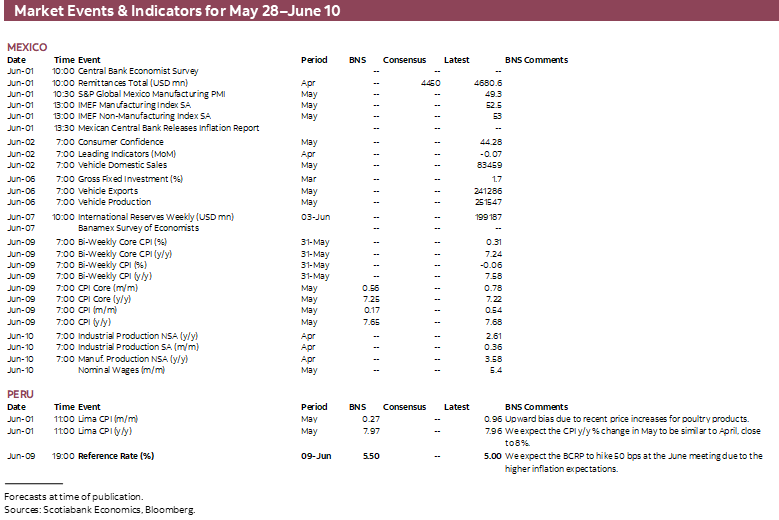

MARKET EVENTS & INDICATORS

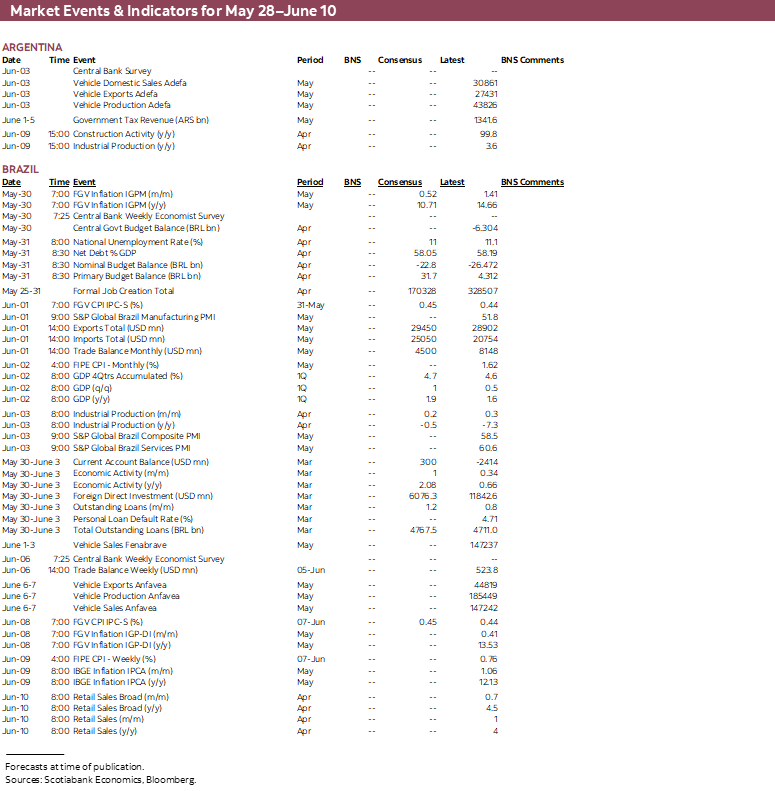

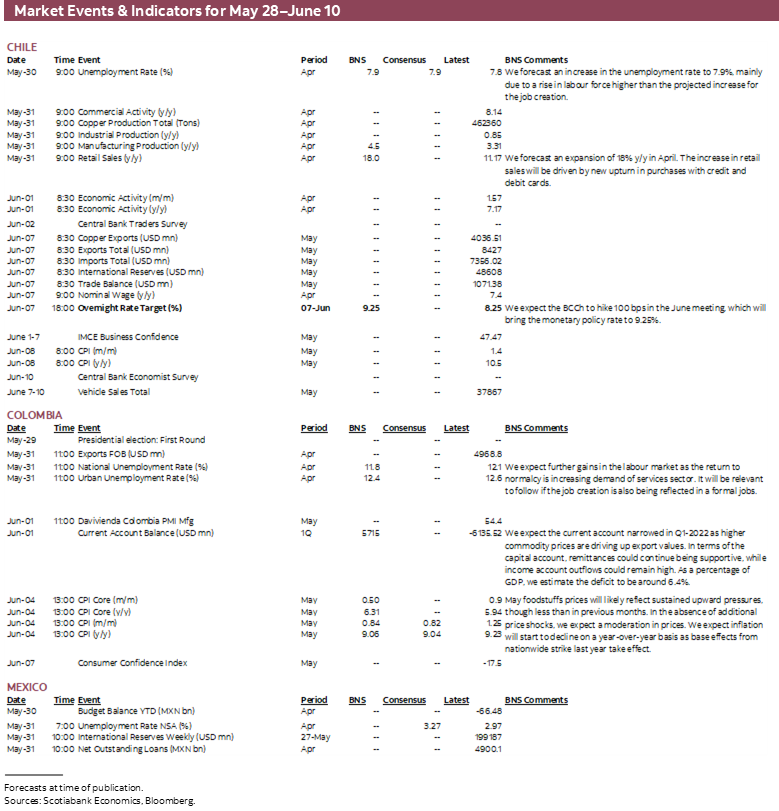

- A comprehensive risk calendar with selected highlights for the period May 28–June 10 across the Pacific Alliance countries, plus their regional neighbours Argentina and Brazil.

Economic Overview: Pandemic Responses and Recovery

James Haley, Special Advisor

416.607.0058

Scotiabank Economics

jim.haley@scotiabank.com

- Latam countries once suffered from the inability to issue domestic currency denominated debt in foreign markets and engage in counter-cyclical stabilization policies. Prominent economists have labelled this phenomenon financial “original sin.”

- But as a result of a wide range of reforms, many implemented in the 1990s, that established sound policy frameworks and built strong institutions, Latam countries have broken the curse of financial original sin. In the midst of the pandemic, most Pacific Alliance countries used fiscal and monetary policies to protect the most vulnerable and support the economy, setting the stage for a robust recovery in output and sustained expansion.

- Yet, though sound policy frameworks and strong institutions may be a necessary condition for the good macroeconomic performance needed to address long-standing problems of poverty and inequality, they are unlikely to constitute a sufficient condition.

- Tackling these challenges will require thoughtful microeconomic approaches. And while there is uncertainty what those policies might be, one thing is certain: populist policies that undermine sound policy frameworks and weaken key institutions would exacerbate social ills and possibly lead to a return of financial original sin.

PARADISE LOST AND REGAINED

John Milton’s epic poem Paradise Lost is a masterpiece of English poetry, made even more impressive by the fact that the blind poet composed it by dictating all 12,630 lines of it and its sequel, Paradise Regained, to his daughter, in what was surely an unparalleled feat of memory. The Biblical theme of the two poems is the fall of mankind, “Of man’s first disobedience and the fruit of that forbidden tree” that led to original sin and subsequent redemption. One does not have to be particularly religious or an adherent of any particular faith to appreciate Milton’s prodigious achievement.

As Ricardo Haussmann, Barry Eichengreen, and other economists have argued, for much of the past century and more, Latam economies suffered from their own metaphorical version of “original sin.” This refers to the inability to issue debt denominated in their own currencies in international capital markets and undertake counter-cyclical stabilization policy. Fiscal policy was largely pro-cyclical, with government spending and investment rising during the “boom” (typically associated with rising global commodity prices) and turning sharply contractionary in the “bust.” Central banks, mindful of the consequences of depreciation on external debt payments and the mismatch between debt denominated in foreign currencies and domestic currency tax revenues, were constrained in their ability to support economic growth. Progress made towards economic development in expansions was thus reversed in the recessions that inevitably accompanied global slowdowns. And lacking the borrowing capacity to smooth consumption over periods of low growth, the effects of this “stop-go” growth were felt most acutely by the poor.

But there are grounds to believe that this pattern has been broken. More than a decade ago, the global financial crisis triggered (to then, at least) the most severe contraction in world output since the Great Depression. While all countries were adversely affected, remarkably, Latam countries did not enter a prolonged and painful period of economic stagnation that completely reversed the economic gains made over the previous decade, as had been the case in the “lost decade” of the 1980s. Part of the reason for this fortuitous conjuncture is that the epicentre of the global financial crisis was the key advanced countries that experienced the greatest excesses of risking-taking (and subsequent deleveraging). That is not the whole story, however. Governments across the Latam region also engaged in counter-cyclical stabilization policies, with fiscal policy supporting demand and central banks with well-grounded inflation-targeting frameworks providing the liquidity needed in the face of financial market dysfunction. In a sense, that innovation marked a redemption from financial “original sin.”

Other factors contributed to breaking Latam free from these boom-bust cycles. Independent central banks anchoring inflation facilitated the development of viable local currency borrowing markets by reducing inflation risks. In addition, with the pension reforms that took place in much of Latam in the 1990s, domestic pension funds provided local investor bases, which in turn allowed longer term local currency yield curves to develop. These “captive local investors” reassured global investors, as there was now a buyer of last resort for their investments in Latam—making foreign portfolio investment positions in Latam debt more resilient.

Governments were able to adopt counter-cyclical responses because of the efforts previously made erecting sound policy frameworks, including fiscal rules to limit debt accumulation and ensure medium-term sustainability, and building strong institutions, particularly independent central banks. These sound frameworks and strong institutions paid dividends in the pandemic and continue to do so now, in recovery and expansion.

Most governments in the region responded to the pandemic with robust fiscal supports to assist the most vulnerable and with extraordinary measures, such as allowing access to pension funds, to smooth consumption more broadly through the public- health-mandated lockdowns. These responses likely also played a role in protecting household balance sheets and preserving idiosyncratic firm-specific human and relationship capital, which may have paved the way for a rapid recovery and sustained expansion. Meanwhile, central banks with credible inflation targets provided liquidity to financial markets in periods of intense market dislocation, while ensuring that monetary conditions were highly accommodative to support consumption, even as shocks to global supply chains led to the propagation of severe inflationary pressures as recovery took hold.

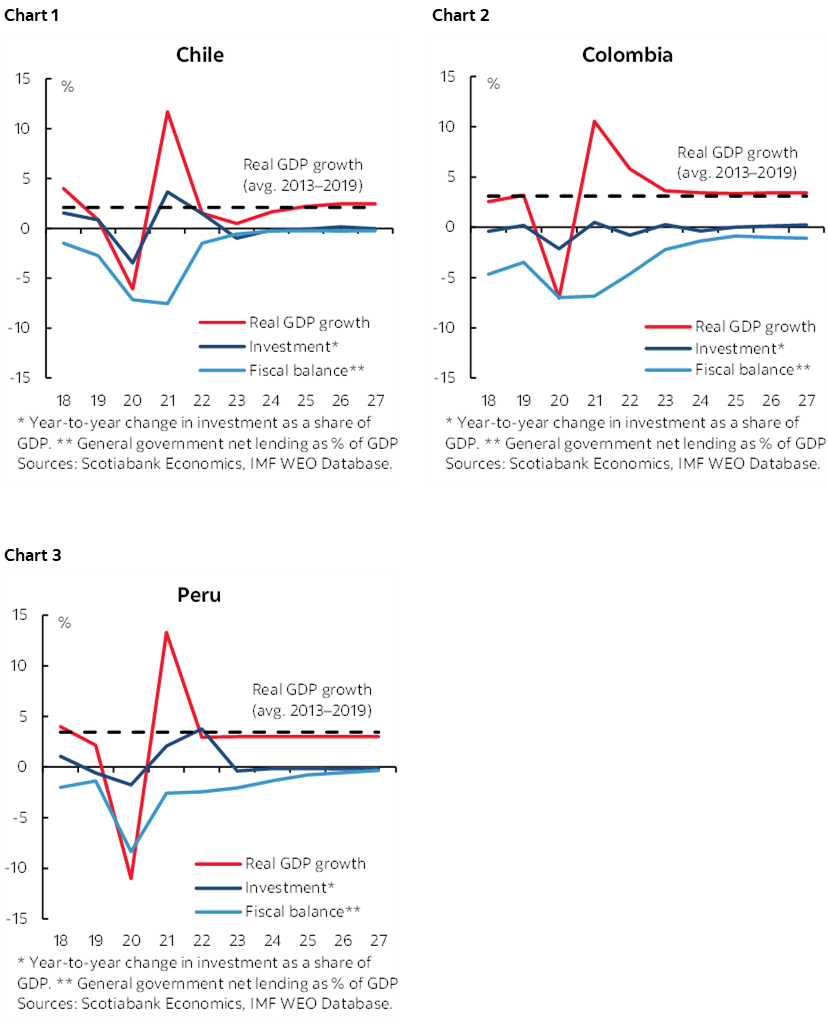

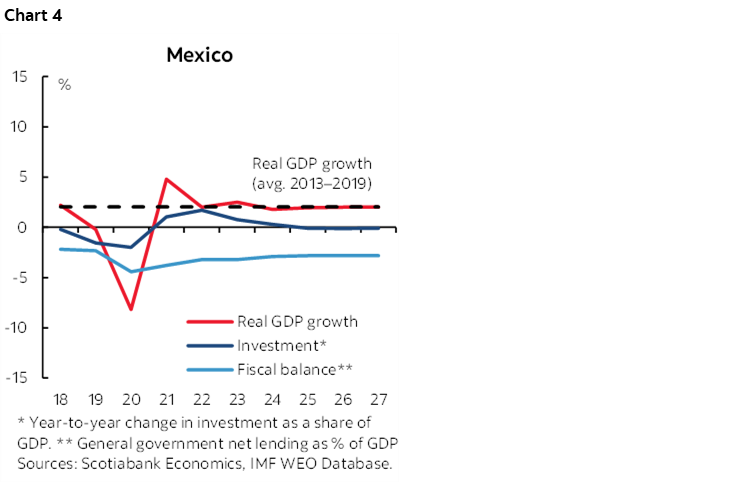

Evidence of these felicitous effects in Pacific Alliance Countries (PAC) is readily discernible in the accompanying charts. All four countries experienced a severe collapse of output in 2020 once the COVID-19 pandemic spread around the globe and lockdowns went into effect. And as the charts show, fiscal balances as a percentage of GDP also deteriorated significantly. This deterioration reflected lower GDP, but also the counter-cyclical responses by governments. Yet, as severe as the drop in output was, the rebound across most PAC members has been equally vertiginous. While Chile (chart 1) and Colombia (chart 2) enjoyed robust recoveries in 2021, Peru’s rebound (chart 3) was especially strong, though this partly reflects base level effects given the deep contraction in 2020. As Scotiabank’s team in Bogota note below (see country notes), Colombia’s is rapidly moving from recovery to expansion as growth surprises on the upside.

Mexico (chart 4) is something of an outlier. It experienced a sharp decline in economic activity comparable, say, to that of Colombia. But the subsequent rebound was far less pronounced, accounting for the fact that it lags its regional peers in terms of recovering output lost to the pandemic. This tepid recovery may, of course, reflect several factors—including the Mexican government’s more restrained fiscal response to the pandemic. While this response largely avoided the large deterioration in fiscal position that its PAC peers experienced, it may have contributed to a slower recovery as household balance sheets were impaired and valuable firm-specific human and relationship capital was destroyed.

This observation is not necessarily a critique of the policy response. In fact, the fiscal discipline demonstrated by the Mexican government, together with Banxico’s adroit management of monetary policy, undoubtedly accounts for the remarkable stability of the Mexican peso through the pandemic, in contrast to other regional currencies. For a country whose financial markets are entwined with those of the US and whose trade flows are highly integrated with US and Canadian production, the resulting exchange rate stability may well have been an important policy objective. Memories of the 1993 currency crisis, and the fear of extrapolative expectations should the peso be allowed to depreciate significantly, may have likewise motivated the policy choice. Meanwhile, Mexico’s consumers, particularly in the lower income segments appear to have benefited from US fiscal stimulus, through a 15–20% jump in remittance inflows.

That said, the benefits from this decision should be weighed against the potential cost, measured in terms of a more tepid recovery.

Such an evaluation would include the fact that rapid recoveries are expected to pay lasting fiscal dividends for most of the PAC. This is because countries that experienced the largest deterioration in fiscal balances are projected by the IMF staff to also see a rapid improvement in fiscal balances. Fiscal positions in Chile, Colombia, and Peru are all expected to return to balance (or near-balance) over the Fund’s forecast horizon as growing economies, coupled with fiscal rules, will close deficits. Moreover, as Scotiabank’s experts in Lima highlighted last month, the fiscal recovery in Peru has been particularly strong, likely already making the IMF’s April WEO projections stale. Once again, Mexico stands out: while its fiscal position initially weakened by less than other PAC members, the Fund projects only a modest narrowing of the budget gap over the medium term, with the gap remaining open over the entire forecast period.

The discussion thus far has focused on the recovery in output and the medium-term fiscal outlook, both of which are important.

The prospects for long-term growth and development are equally important. These prospects hinge critically on investment: higher rates of investment can increase the capital available to workers, raising the capital/labour ratio, resulting in progressively higher incomes; in contrast, investment rates that fail to keep pace with growing labour forces or the depreciation of the existing capital stock lead to a decline in the capital/labour ratio and declining real incomes. In short, long-term prosperity is tied to investment.

At the same time, as the Scotiabank team in Mexico point out below, investment that raises potential output can alleviate near-term domestic price pressures and bring inflation down. In this respect, the outlook for investment takes on added importance given existing inflation, which currently exceeds central bank inflation targets, and the challenges of accurately assessing the level of excess demand and underlying inflation.

So, what is the outlook for investment over the medium term?

Ideally, we would want to look at the evolution of capital/labour ratios to assess the implications for economic development. Data limitations preclude that approach, however. An imperfect alternative is to map the evolution of investment as a share of GDP from one year to the next. Using this approach, investment flows that keep investment as a share of GDP constant over time would result in convergence on the x-axis; points above the axis indicate an increase in investment’s share of GDP, points below reflect a decrease in investment as a share of GDP.

IMF economists expect investment to remain broadly stable as a share of GDP over their forecast horizon. That result is somewhat reassuring, on the one hand, in that it seemingly rules out a sustained fall in investment rates. On the other hand, it is cause for concern: While investment is projected to remain roughly unchanged as a share of GDP, as GDP growth converges to pre-pandemic rates, this result does not bode well for economic development, especially addressing endemic poverty and inequality, given the overarching need to raise growth.

These long-standing problems undoubtedly account for the frustration with prevailing economic paradigms that fuels populist policies when progress made towards solving them is reversed. Such responses are understandable. But as the policy responses to the pandemic have shown, sound policy frameworks and strong fiscal and monetary institutions provide enduring economic benefits. Significant, durable progress towards economic development and reducing inequality is unlikely without them. This does not justify complacency; while they are necessary for progress in these areas, they alone are not sufficient.

Attempts to make progress by undermining sound policy frameworks and weakening key institutions would prove ephemeral. Worse still, they would likely entail a return of financial original sin.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Preliminary Takeaways on Draft Constitution

Jorge Selaive, Head Economist, Chile

+56.2.2619.5435 (Chile)

jorge.selaive@scotiabank.cl

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

Waldo Riveras, Senior Economist

+56.2.2619.5465 (Chile)

waldo.riveras@scotiabank.cl

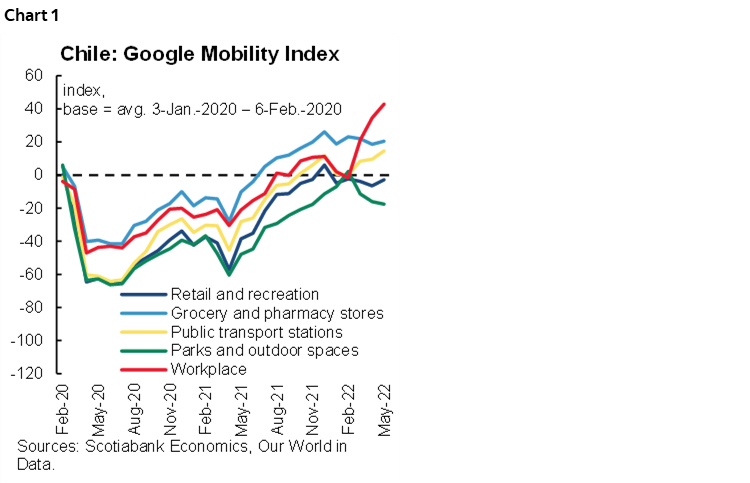

COVID-19 SITUATION IN CHILE

The daily number of confirmed COVID-19 cases has continued to increase in recent days. The test positivity rate rose to 9%. For now, however, occupancy rates of ICU beds and COVID-19-related death rates are stable at low levels. Meanwhile, the vaccination campaign has reached 92.2% of the eligible population. The rollout of booster (third) doses continues—reaching 14.3 million people—and the new booster dose (fourth) is in progress—with 5.9 million people covered. Overall, mobility has continued to increase in May, which will support the economic activity, mainly services (chart 1).

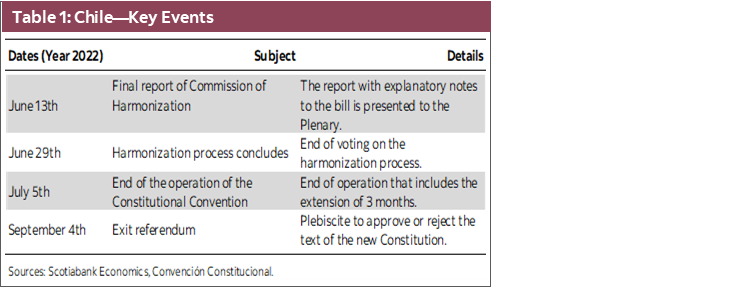

Q&AS ON THE DRAFT OF THE NEW CONSTITUTION

On Monday, May 16, the constituent assembly delivered the draft of the new Constitution, ending the constitutional debate that lasted 10 months (table 1). The work of three new commissions now begins: the Commission of Harmonization, in charge of consistency and coherence; the Commission of Transitory Norms, which will ensure a gradual implementation; and the Preamble Commission, which communicates the intentions of the framers and the purpose of the document.

The constituent assembly will conclude its work on July 5. President Boric will then call for an exit referendum, to be held on September 4 (table 1). We have received many questions regarding the process that we summarize in the following Q&As:

1. Did the central bank’s objectives drastically change?

No, there are no changes in the objectives of the central bank (only administrative and accountability modifications).

- The central bank’s objective continues to be ensuring the price stability and the normal functioning of internal and external payments.

- The mandate to make decisions consistent with the general orientation of economic policy is maintained.

- The prohibition of financing public spending is maintained. Furthermore, the recent modifications requested by the central bank regarding the possibility of acquiring or selling public debt instruments in the secondary market, in exceptional and transitory situations, are included.

- The number of Board members is increased from five to seven. Several studies from the IMF (including Berger et al. 20061) point out that “larger and more heterogeneous countries, countries with stronger democratic institutions, countries with floating exchange rate regimes, and independent central banks with more staff tend to have larger boards (the average board has 7–9 members)”.

- The possibility of Congress requesting the dismissal of a Board member by a simple majority is included. This issue will be referred to the Supreme Court for resolution.

2. Are the concepts of fiscal responsibility and fiscal sustainability included?

Yes. In contrast to the previous Constitution, the principle of sustainability and fiscal responsibility is explicitly included as the driver of fiscal policy.

The principle of sustainability and fiscal responsibility will guide the actions of the State in all its institutions and at all levels.

However, the president loses the exclusive initiative in terms of fiscal spending, enshrining what has been observed since the social unrest in October 2019. The Lower House could also present spending bills, although they can only be approved if the President of the Republic gives his sponsorship.

3. Would there be any significant changes to the mining industry’s regulation?

The rejection of the nationalization of mining interests has been received as good news by industrial associations. However, the draft of the new Constitution introduced some elements that, if ratified, could hinder the development of new mining projects and also establish higher levels of uncertainty. Specifically, private participation in the mining sector will be defined by a simple law, since it does not refer to concessions. In the case of nationalization or expropriation, it is established that compensation will be for a “fair price”, a concept that admits interpretation. In addition, the draft ends the current notion of “water rights” and makes it non-negotiable, which could introduce rigidities for its efficient use and make it difficult to start up new projects. Regarding this point, specialists point out that despite being non-negotiable, water rights could be transferable if determined by a future law.

4. Would the new Constitution destroy the private pension system based on pension fund administrators (AFPs)?

The new Constitution puts an end to the private capitalization system managed solely by AFPs and rules out a new solely government-managed solidarity system. Consequently, a mixed system could be implemented. However, the Constitution establishes the “public” character of the social security system, which will allow the intervention of private administrators in the management of social security. Specifically, the Constitution will allow the participation of the AFPs, among other managers. Given the recent signals from the government, and if the new Constitution is approved, we consider it likely that the government will present a pension reform that establishes a mixed system in Q3-2022.

5. Are there any changes to the parliamentary system?

Congress will continue to be bicameral, although the current Senate will be replaced by a Chamber of the regions. The political system will be based on two asymmetric chambers, where the greatest weight will be in the Deputies (155 members), while the regional representatives will only intervene in some laws (by regional agreement).

On the other hand, the assembly retained the presidential system, in which the President of the Republic will have a four-year term and may be re-elected.

6. How did the quorums change to carry out constitutional reforms?

The assembly rejected the proposal to set the necessary quorum for constitutional reforms at four sevenths. In the absence of an agreement, for this type of procedure, the normal quorum for the formation of the law would apply: either a majority of those present, or a majority of the parliamentarians in office. Consequently, autonomous institutions such as the central bank could be reformed by simple majority. In this respect, some parliamentarians are studying initiatives to give temporary stability to the new Constitution. In our view, economic or institutional reforms would be more dependent on the political cycle.

7. Is there any impact of the restitution of lands considered ancestral?

The new Constitution does not indicate what the land restitution process will be. This is an identity norm that was certainly influenced by the situation of violence in the South of Chile. In a joint reading with the consecration of the property right (Art. 20), it would imply an important fiscal burden assuming that the interpretation of “fair price” corresponds to the advance payment of the market value of the lands that are registered as ancestral indigenous property. All in all, we see negative effects on the forestry industry that, although it could receive market compensation, would likely see an impact on its production levels given the uncertainty regarding the consideration of ancestral land that will be mandated if the new Constitution is approved. On the other hand, the provision could be transformed into an opportunity to pacify the South of Chile in cases where land demands are indeed the problem. There is disagreement on this point.

8. How to interpret two justice systems, one for indigenous people and the other for the rest of the population?

One of the questions that has arisen is how the courts of the indigenous people should be established so that they function effectively and in coordination with the National Justice System. The constituent assembly has explained that the details will remain in the law and not in the Constitution. Some members have pointed out that the Constitution establishes the need for coordination with the justice system with common crimes excluded. Other experts contend that such issues will be part of the implementation process of the new Constitution. There is a minor risk of generating opportunities for arbitrage between the indigenous justice system and the system for the rest of Chileans, which would accentuate the problems of animosity.

9. What is the likely outcome of the referendum on new Constitution?

Currently, the polls show more people in favour of rejecting the new Constitution (46% according to the Cadem poll). However, we expect a tight result in the exit referendum on September 4.

10. How would markets react to the new Constitution? Have they priced in the related impact?

During the last two weeks before the end of the plenary voting for the drafting of the new Constitution, members of the assembly from the socialist party began to vote against extreme proposals (nationalization of mining sector, a pay-as-you-go pension system, among others), all of them originated from minority groups. In this context, the expected scenarios for asset prices have eliminated the probability of a new Constitution with dramatic changes. Thus, it is reasonable to expect a decrease in the risk premia on Chilean asset prices. In any case, a high degree of uncertainty persists with respect to the work of the harmonization commission, which will merge articles and could even lead to further debate and changes. The fact that the polls are pointing to rejection will probably lead the socialists to maintain a conservative position, but there is no guarantee of that.

11. Are material changes likely to come from the commission of transitory norms or harmonization?

The harmonization process will conclude its work on June 13 (table 1 again). Although the regulation allows the presentation of rejected norms to the transitory norms commission, particularly those that were not reviewed in a second proposal after their rejection, we assign a low probability of approval.

A LOOK AHEAD

Lastly, in the fortnight ahead, the central bank will release the monthly economic activity, on Wednesday, June 1, and will publish the Monetary Policy Report on Wednesday, June 8, following the monetary policy meeting on Tuesday, June 7. For its part, the statistical agency (INE) will publish the May’s CPI on June 8.

1 Berger, Nitsch and Lybeck (2006). “Central Bank Boards Around the World: Why Does Membership Size Differ?”. IMF Working Papers.

Colombia—Strong Inertia in Economic Growth is Pointing to Higher Monetary Policy Rates

Sergio Olarte, Head Economist, Colombia

+57.1.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Maria Mejía, Economist

+57.1.745.6300 (Colombia)

maria1.mejia@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.1.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

In the aftermath of the pandemic, the world economy has faced several shocks that have propagated exceptional volatility in both the financial and real sectors. The world, it seems, goes from euphoria to sadness very quickly, while economic activity vacillates between the “highs” generated by strong household demand fueled by higher savings and some remaining countercyclical expenditure, and the “lows” of supply channel bottlenecks (owing to China’s zero COVID-19 policy and Russia’s invasion of Ukraine). Supply disruptions are reducing productive capacity, increasing prices to historical highs. And these price pressures are now spilling over to expectations, raising the probability of a global recession as central banks accelerate and increase the pace of monetary policy tightening. In this conjuncture, long-run analysis and forecasting confront an additional challenge, the uncertainty around how much wealth the world lost due to the pandemic, making it even more difficult to talk about potential growth or long-run inflation levels.

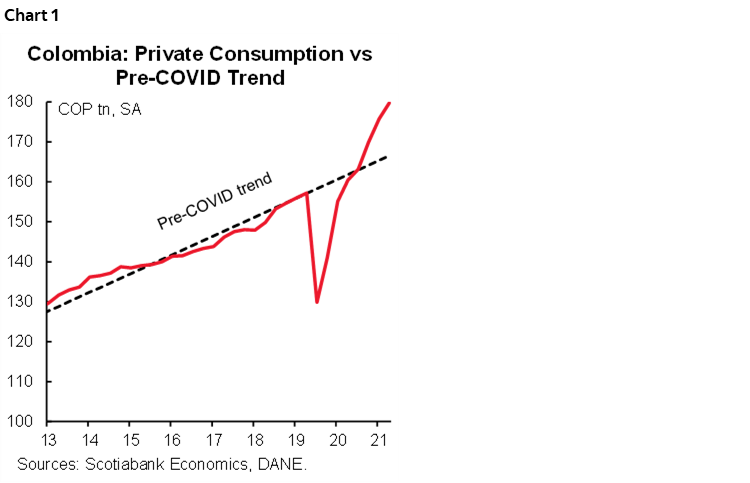

Luckily for Colombia, the net effect of many shocks has thus far been positive, and economic activity has been well above government, BanRep and market expectations. In fact, 4Q-2021 and 1Q-2022 came in much higher than any forecast, growing 10.8% y/y and 8.5% y/y, respectively. Moreover, recent data show that domestic demand is stronger, with private consumption about 5% above the calculated pre-COVID-19 trend (chart 1). Public consumption is growing above 8%, and investment is catching up to these trends, having now turned in two quarters with q/q increases above the underlying GDP growth rate. As a result of this performance, GDP is now at 94% of pre-COVID-19 levels with a positive trend going forward, especially for machinery and equipment investment that is already 34% above pre-COVID-19 levels. In addition, leading indicators such as energy demand, household expenditure surveys, and preliminary imports indicators point to a still strong 2Q-2022. Therefore, although we recently upgraded our 2022 GDP forecast to 5.8%, recent results indicate that Colombia will grow more than 6% in 2022. Accordingly, our new forecast is 6.4%, which reflects higher investment and private consumption. While those components will likely decelerate to more stable levels by the second half of the year, they will nevertheless continue to propel the economy.

Factors behind the strong performance of Colombia’s economy include:

1. Still-high level of savings from high-income individuals that supports services consumption.

2. Remittances continue to boost consumption by the lower-income population. First quarter 2022 remittance inflows were around USD 2.0 billion, which is 5% higher than 1Q-2021. Recent COP depreciation increase the disposable income of households that receive remittances. For instance, USD 200 on average is equivalent to a monthly minimum wage in pesos in Colombia.

3. The informal and underground economy has been an important support for economic activity recovery in rural areas. That support will continue, since informality is very flexible and remains above 45% of the nationwide labour force, while according to BanRep, 78% of low-value transactions in Colombia are paid with cash, which allows the underground economy to continue growing.

4. COP weakness has assisted traditional exports recover, which now surpass historical highs, helping employment and facilitating exports by domestic firms, especially in the agricultural and chemical industries.

5. High oil prices have helped markets to reduce the twin deficits (fiscal and current account), boosted FDI (especially in oil and energy sectors), and raised portfolio investment to finance the current account deficit.

Many of these factors are sustainable and will lead to continued momentum in economic activity going forward. However, we cannot ignore the fact that inflation is high and will eventually weigh on private consumption. Our forecast therefore builds in a deceleration in private consumption that also leads to lower, and more sustainable, growth next year of 2.9%.

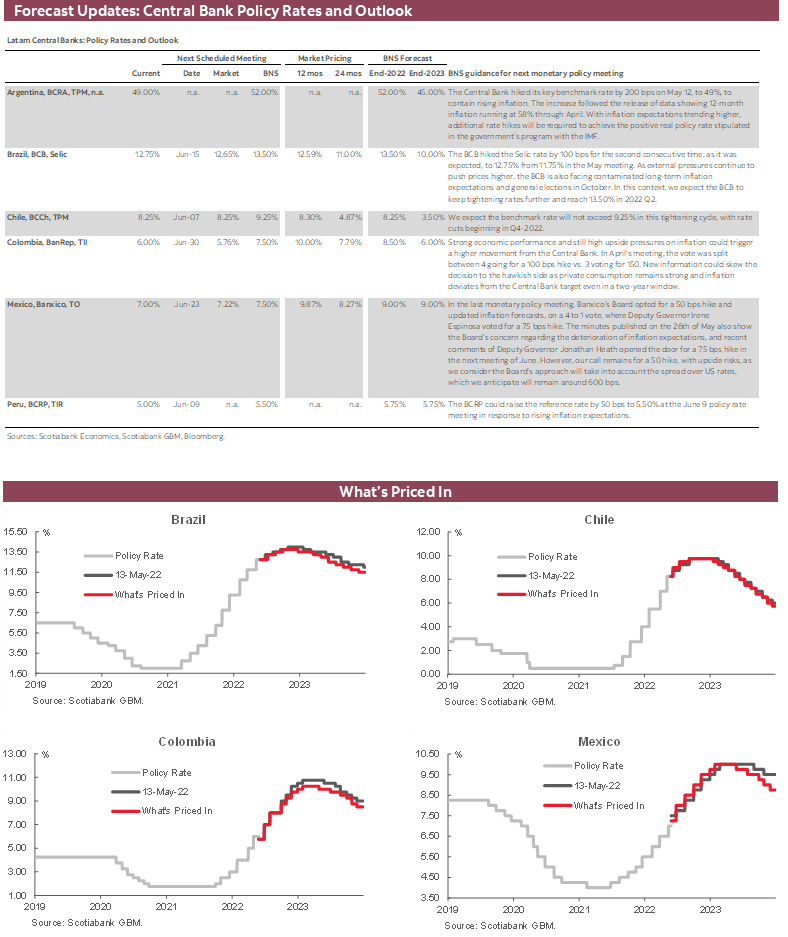

Moreover, while this piece is focused on recent economic activity and what it means for GDP projections, nor can we ignore the fact that GDP may be running above potential output, even as inflation is more than double BanRep’s target ceiling. As a result, we also have updated our terminal monetary policy rate to 8.5%, which we anticipate will last for one year until July 2023 and then start to gradually converge to a neutral rate of 5.5% by early in 2024.

Mexico—What Should Banxico’s Terminal Rate Be? We Think the Safe Answer Lies in Market Prices

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

Mexican bi-weekly inflation showed a modest decline, from 7.65% y/y a month earlier, to 7.58% y/y in the first two weeks of May. The decline was marginally smaller than consensus expectations of 7.57% y/y and may reflect the package to combat inflation that was recently announced by the government (especially gasoline subsidies, which have been in place for a few weeks). And while we are not quite there yet, inflation in Mexico is likely close to its near-term peak, though we expect its decline will be slow.

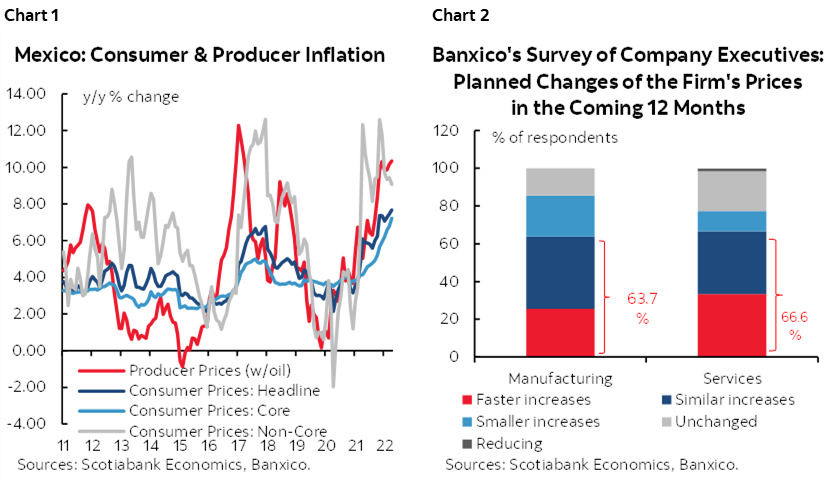

In past cycles, PPI inflation has led CPI both on the way up, and down, in virtually every single case. In the latest data, however, PPI is still heading north (chart 1). In addition, we believe that supply-side bottlenecks, as well as disruptions from the conflict in Ukraine still pose important risks. At the same time, surveys of domestic price setters continue to reveal plans to accelerate price increases (chart 2). All this means that there is still additional upside to prices from the external and domestic fronts.

We also believe there are important structural changes that make estimating output gaps incredibly complex, including permanent changes in both consumer and business behaviour. Three factors stand out:

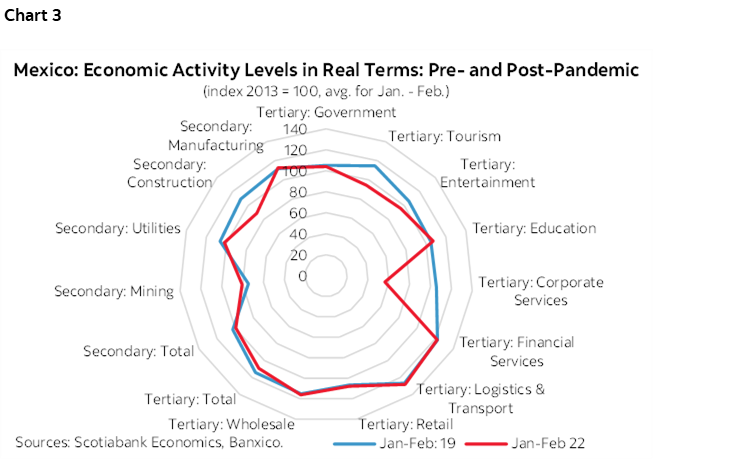

- First, the sectors of the Mexican economy in which slack would appear to be highest (corporate services, business travel, entertainment, etc.) are likely to be sectors reflecting permanent changes in consumer and business habits (less business travel, less consumption in restaurants for workers now working from home, more consumption of streaming and fewer visits to the movies, etc.). In this respect, Mexico’s IGAE, CPI, GDP are all calculated based on 2013 weights, which we believe do not represent post-pandemic spending habits.

- Second, if we look at sectors where the recovery in output has run its course (chart 3), slack exists in business services, tourism, entertainment services, and construction. The spare capacity in business services could be permanently affected by, among other factors, the wider use of home offices. In entertainment services and tourism, a reduction in business travel could be long-lasting, as might be the case with respect to services such as restaurant consumption. Construction should eventually recover, but the shock to business confidence has kept it depressed since the 2018 airport cancellation.

- Third, investment in Mexico over the past three years has been negative, so it is unlikely that potential output has increased materially. Our sense is that the output gap in Mexico is now likely closed. Hence, we think current inflationary pressures in Mexico are a combination of supply-side pressures from global disruptions, supply-side pressures from domestic policy (restrictions in the use of outsourcing, increases in corporate tax costs, energy price pressures etc.), as well as demand-driven pressures.

Where will Banxico’s terminal rate sit?

There are two ways to estimate where the neutral terminal rate will end up. The first is using the traditional statistical models in central bank toolkits. But these models face challenges in determining both the amount of slack in the economy and the underlying inflation level in a world that has seen important structural shifts. The second approach to determining the terminal rate, and the one we prefer using at this point, is similar to the philosophy for pricing assets used by Antti Ilmanen and Clifford Asness in “Expected Returns: An Investor Guide to Harvesting Market Rewards” that assesses fair value interest rates based on the price premium on the underlying asset.

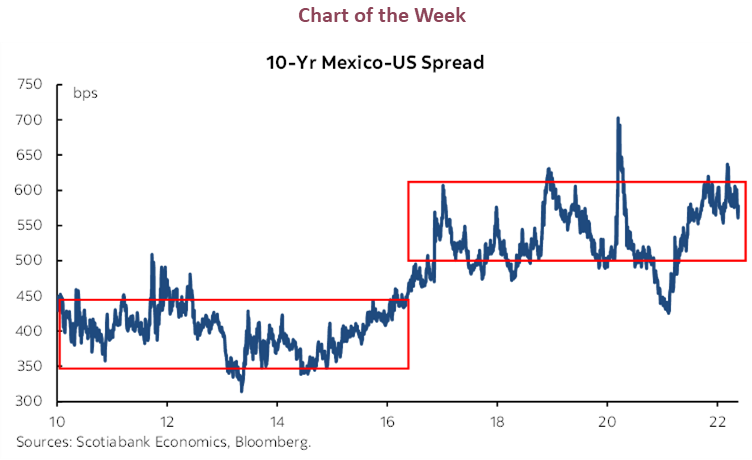

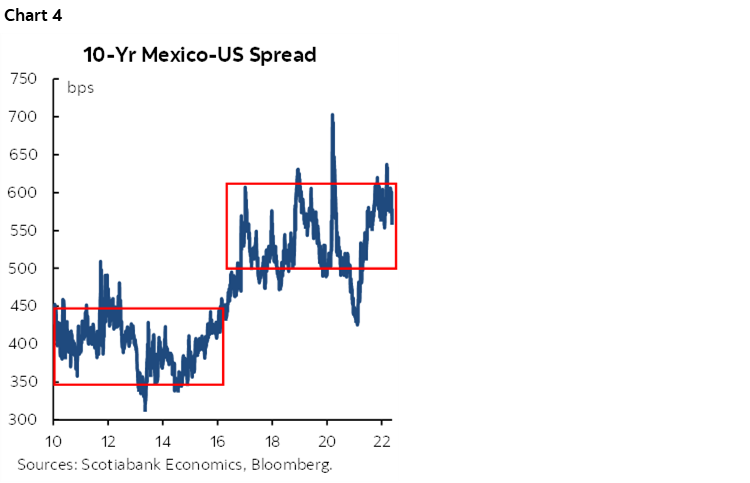

Essentially, interest rates are the price of money, which should be determined by supply and demand dynamics. Using either approach in the 2010–2018 period would lead to a very similar “steady state” neutral policy rate, with a spread of around 400 bps over US rates and a real domestic interest rate of around 200 bps (with a Mexico-US inflation differential of around 200 bps). However, the Mexico-US spread (the risk premium demanded by markets) over the past three years has widened around 150–200 bps (chart 4). To us, this suggests that, if Mexico and the US sit at similar points in their economic cycles, the spread between the two countries should be maintained at around that level (550–600 bps).

One way of analyzing the widening spread between Mexico and the US is to split it into its components. We can easily estimate the change in Mexico’s credit premium by looking at the change in the country’s credit default swaps (which has only moved about 20–50 bps). The residual of the wider spread is then explained by a change in the liquidity and inflation premiums. The liquidity premium has changed very little (at most 20 bps), which suggests that of that 150–200 bps of extra spread that markets are demanding from Mexico, about 100–150 bps is explained by a higher inflation premium. This higher inflation premium is likely to influence the terminal rate that markets demand from Banxico.

Based on all this, we think the safe bet for Banxico will be to maintain a 550–600 bps spread over US policy rates, which seems to be in line with what swap markets are pricing for both countries (a US terminal Fed Funds rate of 3.0–3.25% and a Banxico terminal rate of 9.0–9.25%).

Peru—A Look at 2022–2023 Growth, as Inflation Hopefully Begins to Stabilize, but Political Noise Continues as Raucous as Ever

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Mario Guerrero, Deputy Head Economist

+51.1.211.6000 Ext. 16557 (Peru)

mario.guerrero@scotiabank.com.pe

This past week, Q1 GDP growth figures were released, a sixth withdrawal from pension funds was approved by the government, inflation came within a hair of 8.0% in April, and key Cabinet members were changed.

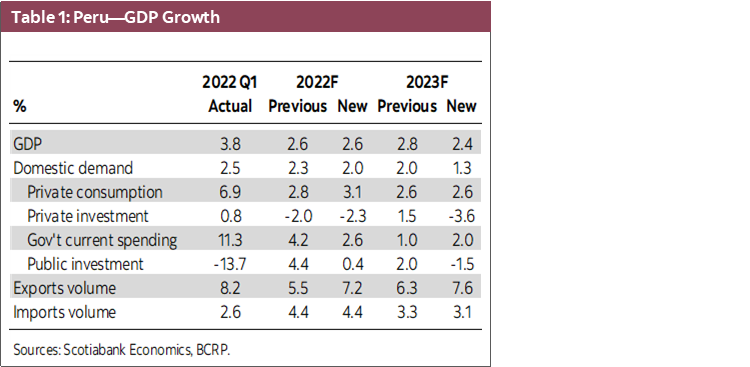

GDP figures for Q1 were robust, but not far off expectations. First quarter GDP growth has given us a better view of trends. And based on what we’ve seen, we are keeping our aggregate GDP growth forecast for 2022 at 2.6% but tweaking some of the demand components (table 1).

The component most aligned with expectations was private investment, rising only 0.8% y/y. Investment is showing the slowdown that we were expecting, and compares with 2.5% y/y in Q4-2021, and 22.5% y/y in Q3-2021. We’ve only tweaked down our private investment forecast for 2022, from -2.0% to -2.3%.

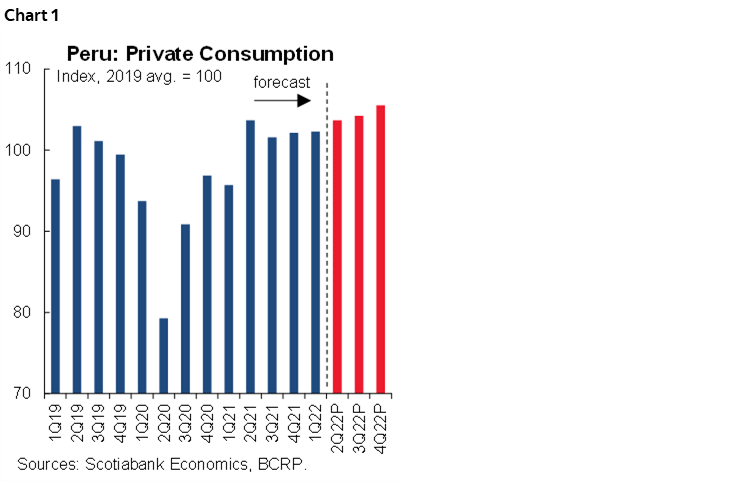

The strength in Q1 GDP came from consumption and exports. We are raising our consumption forecast from 2.8% to 3.1%, and exports volume from 5.5% to 7.2%.

Both of these changes require a bit of an explanation. Consumption was the greatest surprise in Q1, rising an outstanding 6.9% y/y (chart 1). Note, however, that this was off a very low base as Peru was in partial lockdown in Q1-2021, and is not sustainable going forward. Having said that, we do expect consumption to continue to be fairly robust, as the employment environment is improving modestly and, more importantly, new pension fund withdrawals and access to worker compensation funds (CTS) were sanctioned by the government and Congress in a rare instance of concurring viewpoints. These funds could account for as much as 5% of GDP, although a large portion could go into savings and reducing household debt rather than consumption.

Exports are also performing better than expected, rising a hefty 8.2% y/y in Q1. This was not only, or even mainly, due to metals, as growth was particularly strong in agroindustry and textiles exports.

In contrast, we are lowering our forecast for public investment (from 4.4% y/y to 0.4% y/y) and government current spending (from 4.2% y/y to 2.6% y/y). The case for lowering government investment is straightforward: Q1 results were negative to a degree we did not expect. And, although the government hopes to raise investment henceforth, execution is likely to continue to disappoint.

High government current spending growth of 11.3% y/y in Q1 was off a low base. The slow-down we expect henceforth mainly reflects a changing base, with government spending stable in Q/Q terms.

A final note regarding why we do not see the 3.8% y/y GDP growth in Q1 continuing is that it was still benefitting from a rebound in sectors that were in lockdown in Q1. This will still be felt to some extent early in Q2 but dissipate afterwards.

We are revising our GDP number for 2023 down from 2.8% to 2.4%. There are two reasons for this. The first is that we’ve lowered our forecast for public investment from 2.0% to -1.5%. Note that the regional elections in October 2022 will mean a total overhaul of regional authorities, as public officials cannot be re-elected. We expect far too many newly elected authorities to lack proper state management expertise, thereby hampering public investment.

We’ve revised our private investment forecasts from 1.5% to -3.6%. The change is mainly in mining investment growth, which we revised downward from -10% to -15%, as we’ve deferred into the future the Minera Zafranal project and updated the investment schedule of other projects. Of course, the main reason that mining investment is declining is that investment in the large Quellaveco mine is ending, and there is no project of the same size replacing it.

Twelve-month inflation to April came in at 8.0%. We expect inflation to stabilize in the vicinity of 8.0%–8.4% in May–June. The true test for inflation will be in July, when monthly figures began to rise in 2021. If monthly inflation this year stays at current levels, then 12-month inflation will start to decline towards our year-end forecast of 6.4%. The appreciation of the PEN may help assuage inflation, if only marginally. The PEN appreciated over 4% in the last two weeks, to the mid-3.60s, as offshore flows into government bonds increased.

Leaving politics for last, the Castillo Regime changed four Cabinet members in May, while a fifth was removed by Congress. The changes by President Castillo were at the Ministry of Energy & Mines, Ministry of the Interior, Ministry of Transportation and Ministry of Agriculture. The most controversial designation was Minister Juan Arce at Agriculture, who has no experience in the sector and whose appointment appears to be a concession to the Perú Libre party. There have now been 37 Cabinet changes in the ten months of the Castillo Regime, which is certainly not good for policy consistency and stability. However, these new designations do not seem to imply a major change in the agenda or performance of the Anibal Torres Cabinet.

It is not clear if the same can be said about the removal by Congress of the Minister of Labour, Betssy Chávez. The intriguing aspect here is that Minister Chávez was ousted by Congress with the votes of the government party, Perú Libre. It would thus appear that Vladimir Cerrón, the leader of Perú Libre, wanted to send President Castillo a message. President Castillo would have gotten that message in person, as Cerrón was very ostentatiously seen entering the government palace to visit the President that same day. What the message is has not yet emerged, although a likely bet is that Perú Libre is vying for an even greater share of power.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.