FORECAST UPDATES

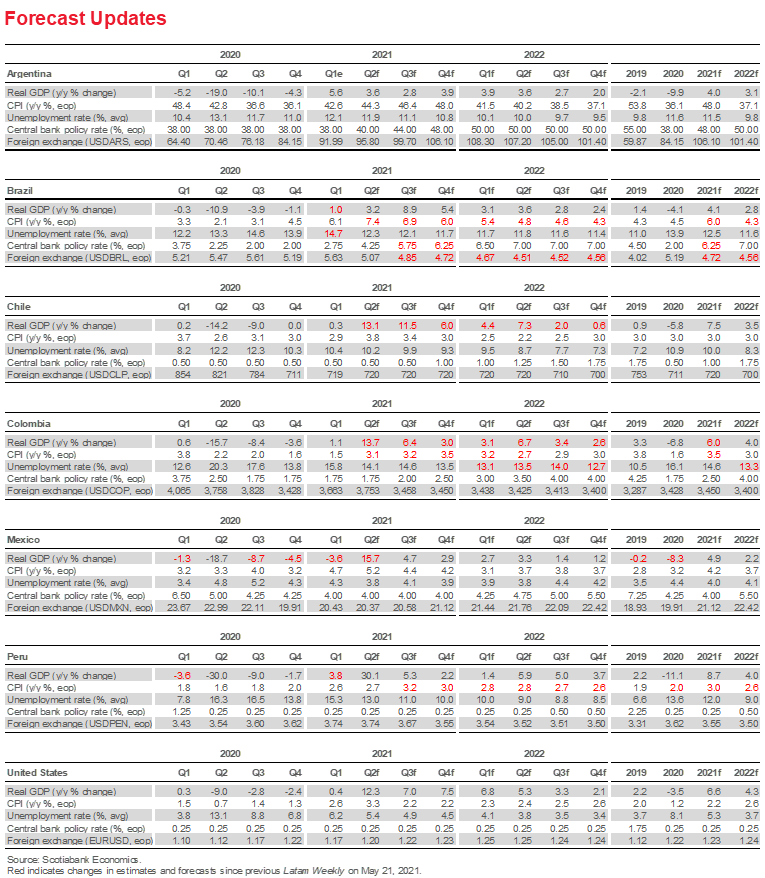

- Our inflation forecasts for end-2021 have been nudged up in Brazil, Colombia, and Peru, but in all three cases price pressures are expected to subside in 2022 and take headline inflation back toward each country’s respective central bank target. Colombia’s real GDP growth projection for 2021 has also been raised from 5% y/y to 6% y/y following multiple data points that underscore increasing adaptability and resilience in the face of the country’s latest public-health restrictions.

ECONOMIC OVERVIEW

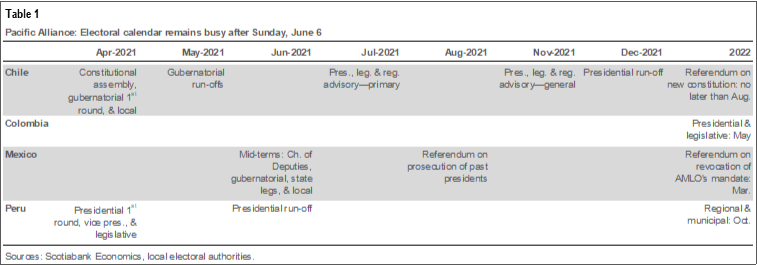

- The political calendar in Latam hits a key milestone on Sunday, June 6, with Mexico’s mid-term elections and Peru’s presidential run-off vote. The next 18 months through end-2022 are set to remain busy with electoral events in the Pacific Alliance countries. Amidst political uncertainty and a transitory hump in inflation, policy makers are staying the courses they have set for re-opening and recovery.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

MARKET EVENTS & INDICATORS

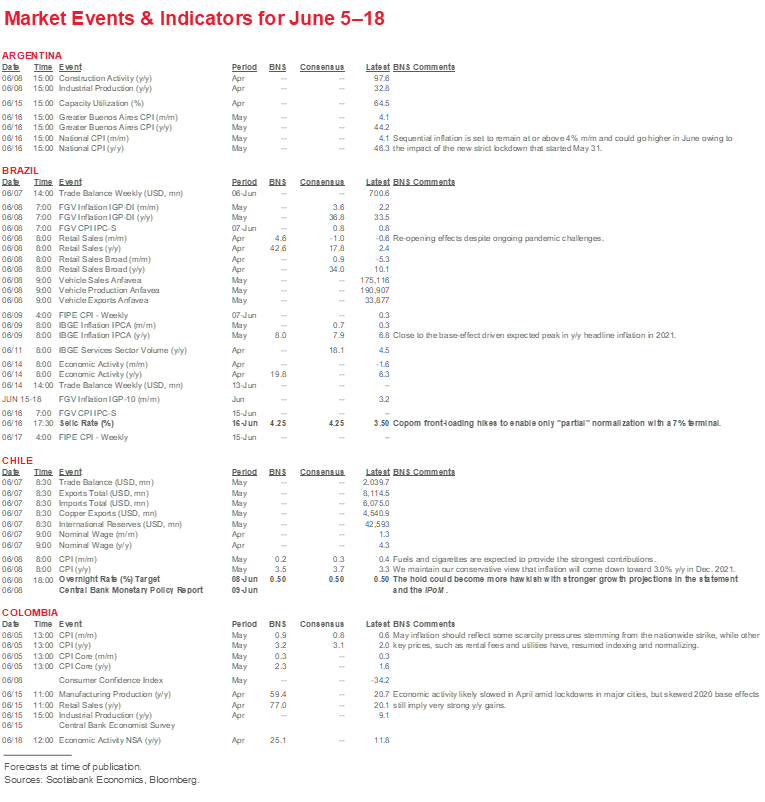

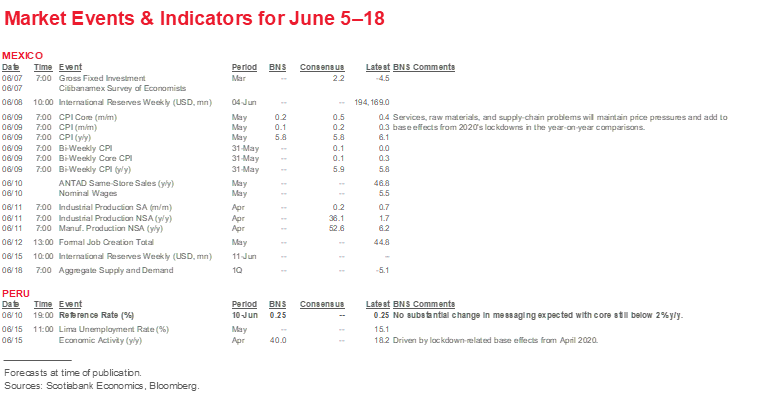

- A comprehensive risk calendar with selected highlights for the period June 5–18 across the Pacific Alliance countries, plus their regional neighbours Argentina and Brazil.

Economic Overview: Politics and Policy

Brett House, VP & Deputy Chief Economist

416.863.7463

Scotiabank Economics

brett.house@scotiabank.com

- Our inflation forecasts have been nudged up in Brazil, Colombia, and Peru, but the recent increase in prices is still expected to be a broadly transitory phenomenon in the Pacific Alliance economies.

- Sunday, June 6 will see mid-term elections in Mexico and the presidential run-off in Peru, but the electoral calendar is set to remain busy across the Pacific Alliance through end-2022.

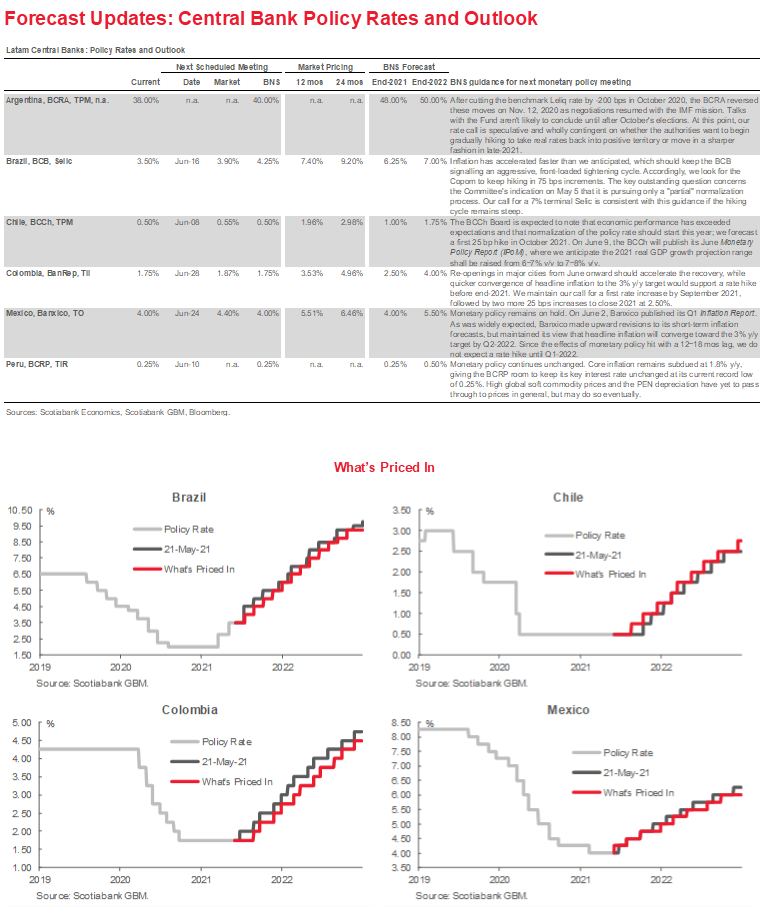

- Central bank boards in Chile and Peru are expected to stay on hold in their next rate decisions, while Brazil’s BCB is projected to stick with its front-loaded “partial” normalization path.

FORECAST REVISIONS: A LITTLE MORE TRANSITORY INFLATION

Our inflation forecasts for end-2021 have been nudged up in Brazil, Colombia, and Peru (see Forecast Updates, p. 2). In all three cases, price pressures are expected to subside in 2022 and take headline inflation back toward each country’s respective central bank target—but the convergence process is set to be a touch slower than previously forecast in Peru.

- Brazil. End-2021 headline inflation has been moved up from 5.3% y/y to 6.0% y/y, while the end-2022 headline forecast has risen a negligible 10 bps from 4.2% y/y to 4.3% y/y.

- Colombia. A combination of resilience in the face of the third wave of COVID-19, supply-side pressures in the midst of protests and strikes, and renewed price indexing of key fees and utilities charges have pushed our end-2021 headline inflation forecast up from 3.0% y/y to 3.5% y/y, still well inside the 2–4% y/y target band. Our forecast for end-2022 remains unchanged at 3.0% y/y. Colombia’s real GDP growth projection for 2021 has also been raised from 5% y/y to 6% y/y following multiple data points that underscore increasing adaptability in the face of the country’s latest round of public-health restrictions.

- Peru. Headline inflation is now set to end 2021 at 3.0% y/y, the top of the BCRP’s 1–3% y/y target band, compared with the 2.6% y/y previously forecast. Similarly, our end-2022 inflation projection has been pushed up from 2.3% y/y to 2.6% y/y. Still, Peru’s particularly strict (for an emerging market) 2% y/y inflation target isn’t expected to prompt a rate hike from the BCRP before mid-2022 owing to persistently wide output gaps that have kept core inflation below 2% y/y.

VOTING: SUNDAY ISN’T THE END

Recent political developments reach at least a provisional denouement on Sunday, June 6, with mid-term elections in Mexico and the presidential run-off vote in Peru. Our May 3 guide to the Mexican mid-terms and today’s curtain-raiser on the process by which results will be released sum-up what’s at stake and when we’ll know how Mexico’s voters have spoken. Similarly, our report on Peru’s contest provides some context on what a Castillo victory could mean—and what might be out of scope.

Sunday won’t mark an end to consequential electoral developments in the Pacific Alliance countries. All four countries are set to see substantial choices put before their citizens over the next 18 months (table 1) that could have major implications for their economic outlooks and financial markets.

KEEPING THEIR COOL

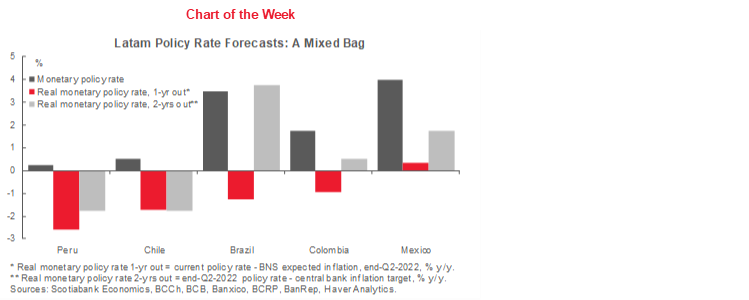

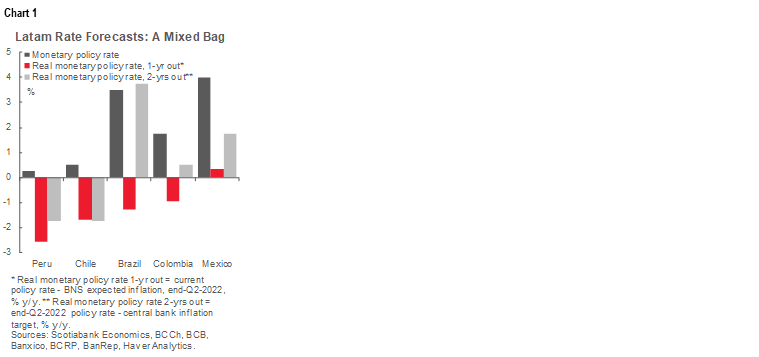

Central bank policy decisions in Chile (June 8), Peru (June 10), and Brazil (June 16) over the next fortnight are expected to bring more of the same from all three monetary authorities even as transitory price pressures mount and political developments remain in focus. All four Pacific Alliance inflation-targeting central banks are set to follow the BCB’s lead and begin normalizing interest rates over the next year, but even after these moves monetary policy is forecast to remain very accommodative at the edge of the two-year policy horizon in Chile, Colombia, and Peru—less so in Brazil and Mexico (chart 1).

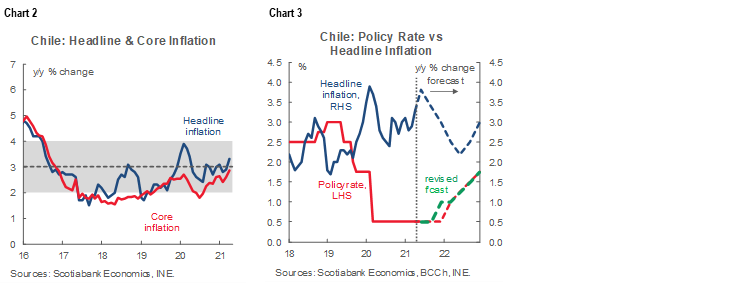

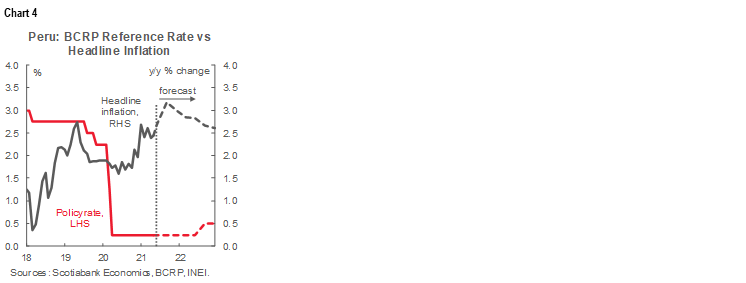

- Chile. The Board of the BCCh is scheduled to release its next policy-rate decision on Tuesday, June 8; both our team in Santiago and the consensus of analysts expect another hold at the 0.5% technical minimum. In the statement that followed the Board’s unanimous decision to keep the policy rate unchanged on May 13, members observed that the economic outlook had strengthened since the March Monetary Policy Report (IPoM) owing to the receipt of better data on the Chilean economy, the implementation of demand-boosting policy measures, and improvements in the global environment. As a result, the Board viewed Chile’s economy as positioned to grow in line with the top of the March IPoM’s forecast scenarios; that is, above the BCCh staff’s baseline of 6–7% y/y. Although the Board advised that the convergence of headline inflation, currently at 3.3% y/y (chart 2), to the 3% y/y target over the two-year policy horizon would still require monetary stimulus to be highly expansionary, Scotiabank Economics observed that the Board’s assessment implied that the BCCh would need to proceed in the upper part of the “policy-rate corridor” laid out in the March IPoM. As a result, we pulled forward our projected date for a first rate hike from Q1-2022 to Q4-2021 (see the May 14 Latam Daily; chart 3) after the May Board meeting.

In its statement on the June 8 decision, we expect the BCCh Board to underscore again that economic data are exceeding expectations and that this should prompt the normalization of monetary policy sometime later this year—in line with our anticipation of a lift-off in October, with the possibility of a second move in December. The June IPoM, due for release on Wednesday, June 9, shall likely feature an upgrade to the BCCh staff’s 2021 growth forecast, as well as refreshed estimates of the neutral rate and potential GDP growth rate. Our Chile team expects the central bank’s rule of thumb for the nominal neutral rate to come down from 4% to 3.5%, which implies slightly less pressure on the rate normalization path to ensure inflation converges to the 3% y/y target. The BCCh’s 3.0–3.5% y/y estimate for potential GDP growth is likely to remain unchanged.

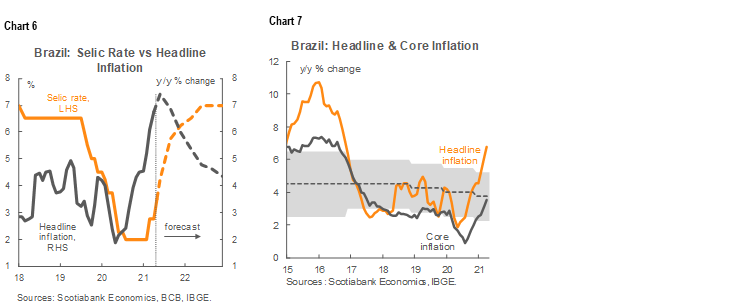

- Peru. The next rate decision in the Pacific Alliance follows on Thursday, June 10, when the Board of the BCRP is universally expected to keep its key policy rate unchanged at 0.25%, where it has been since the onset of the pandemic (chart 4). The Board’s communiqué following its May 13 decision to stay on hold at 0.25% repeated its forward guidance from previous months, noting that the benchmark rate would remain low for an extended period and, in any event, for so long as the pandemic’s effects on inflation and its determinants persist. The Board repeated its commitment to use “diverse instruments” to support its accommodative stance and to ensure that monetary policy is transmitted into long-term interest rates.

We don’t expect the BCRP Board to signal any substantial change in its monetary policy settings in its communications following the June 10 meeting. It’s worth recalling that the space for innovations in the Board’s messaging is particularly constrained by the meeting’s proximity to the run-off presidential vote on Sunday, June 6; as a result, even small changes are likely to be notable. Members appear to be focused on the fact that core inflation remains just below the 2% y/y headline inflation target (chart 5), which the Board views as a by-product of output gaps that are likely to persist into next year. In fact, the May 13 statement advised that the Board still expects headline inflation to remain “in the lower half of the target range”; that is, between 1% y/y and 2% y/y during 2022. Our team in Lima is becoming a bit more skeptical that price pressure will prove quite as transitory as the BCRP currently forecasts: Scotiabank Economics in Peru has raised its end-2021 projection from 2.6% y/y to the top of the target range at 3.0% y/y, and shifted up its end-2022 forecast from 2.3% y/y to 2.6% y/y.

- Brazil. In what we expect to be a continuation of Latam’s earliest and most front-loaded hiking cycle, both our Brazil economist and the consensus of analysts expect the BCB’s Copom to bring in another 75 bps hike to the Selic at its Wednesday, June 16, rate meeting (chart 6). This would be a third 75 bps increase following similar moves at the Copom’s March 17 and May 5 meetings, and would bring the Selic up from 2.00% at the start of 2021 to 4.25%. Headline inflation at 6.76% y/y in April (chart 7) is running hotter than both we and the market had anticipated. We look to the Copom to continue advising in its next set of communications that it is pursuing an aggressive set of moves to tighten monetary policy. Our forecast that this hiking cycle will likely conclude at a 7% terminal rate in 2022 is consistent with the Copom’s statement following its May 5 meeting where it indicated that it is pursuing only a “partial” normalization process—but a 7% Selic and partial normalization are only mutually consistent if the Copom’s moves remain clearly front-loaded. Recall that the BCB’s inflation target steps down from 3.75% y/y to 3.5% y/y in December 2021, which makes its policy framework even more demanding. The minutes of the meeting are scheduled to be published on Tuesday, June 22.

USEFUL REFERENCES

Hofman, D., M. Chamon, et al. (2020), “Intervention Under Inflation Targeting—When Could It Make Sense?”, IMF Working Paper, No. 20/9, IMF, Washington, DC, January 17: https://www.imf.org/en/Publications/WP/Issues/2020/01/17/Intervention-Under-Inflation-Targeting-When-Could-It-Make-Sense-48938.

Ilzetzki, E., C. Reinhart, and K. Rogoff (2020), “Will the Secular Decline in Exchange Rate and Inflation Volatility Survive COVID-19?”, NBER Working Paper, NBER, Cambridge, MA, November: https://www.nber.org/papers/w28108.

Kalemli-Ozcan, Sebnem (2021), “A COVID-19 Tantrum”, Finance & Development, IMF, Washington, DC, Summer: https://www.imf.org/external/pubs/ft/fandd/2021/06/federal-reserve-emerging-markets-private-debt-kalemli-ozcan.htm.

Pradhan, Mahmood (2021), “Emerging Markets in Flux: An Interview with Richard House and David Lubin”, Finance & Development, IMF, Washington, DC, Summer: https://www.imf.org/external/pubs/ft/fandd/2021/06/emerging-markets-in-flux-pradhan-house-lubin.htm.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Activity Surprised in April as Economy Showed Adaptability to Restrictions

Jorge Selaive, Chief Economist, Chile

56.2.2619.5435 (Chile)

jorge.selaive@scotiabank.cl

Carlos Muñoz, Senior Economist

56.2.2619.6848 (Chile)

carlos.munoz@scotiabank.cl

As the economy re-opens and mobility restrictions are gradually lifted, health indicators are improving, but at a slower-than-expected pace. New cases of COVID-19 remain above 5k per day, although this is well below April’s peak. The health system has been able to accommodate the rise in cases since March 2021: ICU-bed occupancy has declined slightly in the past weeks, in a context where 53% of the target population has been fully vaccinated. In fact, the pace of vaccine delivery has recently increased following the introduction of free transit passes for people who are fully inoculated against COVID-19. Still, roughly 33% of the national population remains under lockdown.

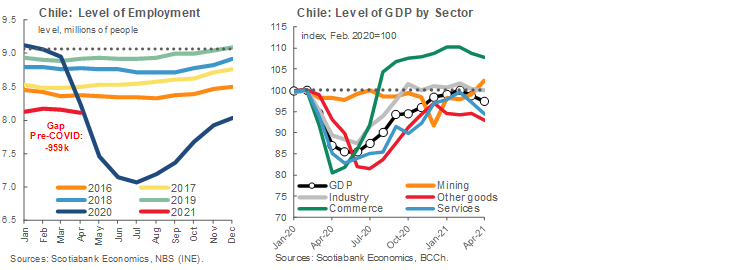

On the economic side, April employment and sectoral data were released on Monday, May 31 (first and second charts). During the moving quarter ended in April, about -44k jobs were lost, which still leaves us with a wide gap of -959k jobs compared to pre-pandemic levels (February 2020). The unemployment rate stood at 10.2%, down only slightly from 10.4% in the previous moving quarter. At the sectoral level, the 44% y/y growth in April retail sales was notable: fueled by very favourable base effects and greater household liquidity stemming from fiscal packages and pension asset withdrawals, April commercial numbers were in line with our expectations. On the other hand, manufacturing production increased 5.9% y/y, with a sequential decline of only -1.2% m/m sa owing to public-health restrictions—considerably smaller than the annual drop of -5.7% m/m sa we saw in April 2020.

In data published on Tuesday, June 1, monthly GDP for April exceeded all expectations with an expansion of 14.1% y/y (-1.4% m/m). The economy has been able to adapt quickly to quarantine measures; commerce and manufacturing have benefited from the strong injections of liquidity that families and companies have received—since August 2020, pension fund administrators have transferred USD 48 bn into contributors’ pockets. Additionally, we have seen solid execution of public spending with 36.5% of the year’s program having been implemented since April. Public investment has been particularly positive with real growth of 4.1% y/y in April.

In the fortnight ahead, Tuesday June 8 will see the release of May inflation data and the central bank’s fourth rate decision this year. We expect an increase of 0.2% m/m sa in the CPI in May, below the market consensus of 0.3% m/m sa. Although products such as gasoline and cigarettes should show price increases, the mobility restrictions in place during May likely put downward pressure on many services prices. If our projection is realized it would put annual inflation at 3.5%–3.6% y/y in the month. We maintain our longstanding conservative projection for inflation during the rest of the year, with a forecast of 3.0% y/y for December 2021, again below market expectations.

We expect the BCCh Board again to hold its key policy rate at 0.5% at its monetary-policy meeting. After the May meeting, when the BCCh characterized the economic outlook positively and gave a hawkish bias to its monetary stance, we expect a June statement along the same lines. The Board is likely to note that economic performance has exceeded expectations and that the normalization of the policy rate should start this year. Consistent with this, we continue to forecast the first 25 bps hike to arrive in October 2021. The following day, Wednesday, June 9, the BCCh will publish its June Monetary Policy Report (IPoM). We anticipate that the central bank staff will raise its projection for 2021 real GDP growth from the March IPoM’s 6%–7% y/y range to 7%–8% y/y. Our forecast remains at 7.5% y/y, but with an upward bias given the strength of the latest activity figures. We also expect the June IPoM to feature new estimates of the neutral policy rate and potential GDP.

Colombia—Retrospective on 2021 So Far and What We Expect in H2-2021

Sergio Olarte, Head Economist, Colombia

57.1.745.6300 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Economist

57.1.745.6300 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

At the beginning of the year, we highlighted that 2021 would likely feature discussions on adjustment strategies, particularly on fiscal issues. A solid economic recovery and the start of the vaccination rollout were considered appropriate prerequisites for a shift toward thinking about long-term policies again. But the introduction of possible fiscal reforms has been difficult, and these challenges have put social demands squarely back on the national agenda with the resumption of the nationwide strike that started in November 2019. It’s worth taking stock of what has happened and what it implies for events in the months ahead.

Colombia—despite facing a second wave of the COVID-19 contagion—has shown resilience.

- Most economic activities have adapted to successive rounds of lockdowns and this has been reflected in a strong positive surprise in economic growth in Q1-2021 of 1.1% y/y and 2.6% q/q sa. In the first quarter, 10 out of 12 economic sectors surpassed their pre-pandemic production levels. In some cases, businesses took advantage of rapid improvements in digital infrastructure in response to the pandemic; in other cases, pandemic-induced changes in demand drove growth in non-traditional sectors.

- The current account deficit widened in Q1-2021 to -4.8% of GDP as stronger domestic demand drove larger capital-goods and raw-material imports, while international companies repatriated rising profits through the income account. So far, financing hasn’t been a concern as inbound FDI and the liquidation of external public assets have covered the widening in the current account deficit from USD -3.1 bn in Q4-2020 to USD -3.6 bn in Q1-2021.

- Still, despite Q1-2021’s strong economic performance, Colombia’s employment levels in April remained 10% below pre-pandemic norms. The labour market has been much more sensitive to lockdowns than economic activity as a whole (see the June 1 Latam Daily), in part because labour-intensive service sectors remain the most impaired by public-health restrictions.

Inflation is normalizing at a somewhat faster pace than generally expected since traditional indexation rules have been re-imposed on some regulated prices and increased domestic demand has pushed up key prices for some services and rents. We project inflation to exceed the BanRep’s 3% y/y target sooner than previously expected and we have revised our inflation forecast for end-2021 from 3.1% y/y to 3.5% y/y. However, in 2022, headline inflation should stay anchored close to the central bank’s 3% y/y target.

Colombia’s macro performance since the beginning of the year points to a faster-than-expected recovery. Therefore, the central bank has progressively improved its macro view by raising its real GDP growth forecast for 2021 from 4.5% y/y in January’s Monetary Policy Report to 6.0% y/y in the statement and minutes related to the BanRep Board’s April 30 policy-rate decision. The Board and staff of the central bank still, however, expect inflation to converge to the 3% y/y target in 2021 and 2022, but uncertainty is set to remain high. Therefore, BanRep has kept its benchmark rate at 1.75%, although the latest staff projections imply that the Board is considering the start later this year of a gradual normalization of its benchmark policy rate.

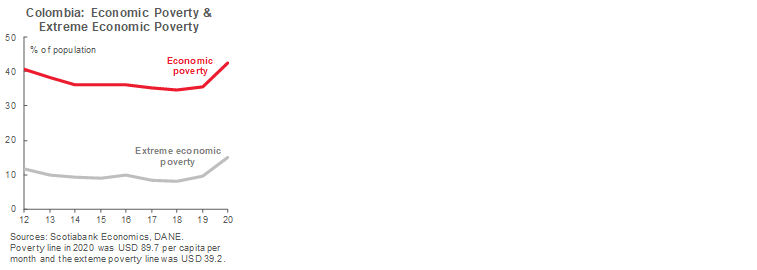

The economy’s strong start to 2021 has been undermined by the government’s abortive launch of its fiscal reform effort at end-April. The package’s ambitious proposals for changes to Colombia’s tax structure haven’t been well received by either key political parties or civil society. If anything, they re-energized the protests that have simmered off and on since November 2019, which have been further fuelled by the recent pandemic-induced marked rise in poverty (first chart) that has reversed a decade of social progress. The dent to economic activity has been clear: in May, energy demand contracted by -5.7% m/m and some industries worked below capacity. These developments have dimmed our optimism for the rest of H1-2021.

A number of key events are still pending in June that will determine the economy’s hand-off into H2-2021. We continue to expect the government to resume the fiscal reform discussion (although in a watered-down version) since some social programs created during the pandemic expire in June and there is urgency to find fresh resources to finance their continuation. The capital, Bogota, and other major regions are scheduled to normalize completely economic activity in the coming weeks, which would reinvigorate the rebound in H2-2021. As a result, our real GDP growth forecast has been changed from 5% y/y to 6% y/y for 2021 (second chart). For 2022, we have kept our projection for the real GDP expansion at 4% y/y, in line with an ongoing gradual recovery in the economic activity.

Discussions on social welfare aren’t going to end soon; however, the government is taking positive steps to enhance programs for education and youth employment, accelerate the vaccination process, and extend credit support in key sectors to meet the main demands of the protesters. A new, more modest tax reform package should be sufficient for Colombia to register a message of fiscal responsibility and stabilize public finances for a couple of years.

Finally, the second half of 2021 could be politically charged ahead of the presidential elections scheduled for May 29, 2022. Although initial polls show leftist candidate Gustavo Petro leading voting intentions, he is currently the only explicitly declared candidate and it’s too early to infer much from these surveys. It’s worth remember that 2018’s initial polls also gave Petro an advantage, while Duque, the current president, wasn’t even included in these interviews.

Mexico—A Busy Summer Begins, Packed with Politics and Data

Eduardo Suárez, VP, Latin America Economics

52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

Mexico’s mid-term elections on Sunday, June, 6 will help shape the legislative outlook for the second half of President López Obrador’s term. This includes the prospects for key initiatives such as proposed modifications to the tax code under AMLO’s promise to pursue fiscal reform and changes to the National Electoral Institute (INE), as well as the constitutional amendments the president has pledged for the power sector after his earlier legal reforms stalled in the courts. In addition, with all of Congress’ Lower House up for election, even the government’s capacity to pass an annual budget without needing to negotiate with the opposition is in play. Recent polls imply that Morena and its allies shall retain an absolute majority in the Chamber of Deputies (i.e., the 50% + 1 vote threshold needed to pass laws and approve a budget), but will fall short of a qualified majority (i.e., the two-thirds majority needed to amend the constitution). However, it is worth noting that Mexican electoral history suggests that post-election coalition realignments are a possibility: if Morena and its partners end up close to a qualified majority, post-vote negotiations could ensue to secure it. Early estimates of results could start to emerge from the PREP (the quick counting system run by the INE) on June 6 from 8pm Mexico City time (CDT) onward. Final PREP estimates should be out by 8pm CDT on Monday, June 7. For the gubernatorial races, estimates of the results could start to emerge at 11pm CDT on Sunday.

Even though the June 6 mid-term elections dominate the voting calendar for the next 12 months, they are not the only time Mexicans will be called to the ballot box. President López Obrador has announced that on August 1 a referendum approved by the INE will be held on whether former presidents can be put on trial. In addition, the law now states that in March 2022, Mexicans will be called on to vote in another referendum on the possible revocation of President López Obrador’s mandate, which would prevent him from staying in power to the close of his term in December 2024. Both votes could be relevant from a political, social, and economic standpoint; they may also provide early indications of key issues that will shape the 2024 presidential elections.

On the data front, over the next two weeks we will get inflation numbers for May on Wednesday, June 9, where we expect a continued gradual decline from 6.08% y/y in April to 5.78% y/y. In addition, on Monday, June 7, INEGI is scheduled to release investment data for March; trade data imply that we will get an improvement in capital equipment spending (1.4% y/y, up from -4.5% y/y in February). Also worth watching will be industrial and manufacturing output for April (Friday, June 11), which will likely continue to show supply-chain-related disruptions amidst an overall improving trend.

On the policy front, on Wednesday, June 2, Banxico’s latest quarterly Inflation Report provided us with updated economic views from the central bank. These included important upward revisions to the growth outlook (the former central growth scenario of 4.8% y/y in 2021 was revised to 6% y/y, first table), as well as new inflation forecasts that see 2021 closing above the 4% y/y top end of Banxico’s target range, but rapidly converging to the 3% y/y mid-point by Q2-2022 (second and third tables). Given a policy transmission lag of 12–18 months, and a two-year policy horizon, we take these updated forecasts as a signal that Banxico sees inflation coming back to target without any rate hikes by end-2021; they may also signal that Banxico’s hiking cycle could be tied to the Fed’s.

Our own inflation forecasts are less benign than Banxico’s: we see services-related price pressures plus higher raw materials inflation and supply chain disruptions prompting a start to the central bank’s tightening cycle in Q1-2022. However, with the president announcing that Governor Diaz de Leon’s mandate will not be extended, a change in leadership could add some uncertainty to our call. We are likely to make some revisions to our forecasts within the next couple of weeks: our potential changes could include a stronger growth number for 2021 and a modestly better MXN path.

Peru—Elections Overshadow an Improving Economy

Guillermo Arbe, Head of Economic Research

51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Mario Guerrero, Deputy Head of Economic Research

51.1.211.6000 Ext. 16557 (Peru)

mario.guerrero@scotiabank.com.pe

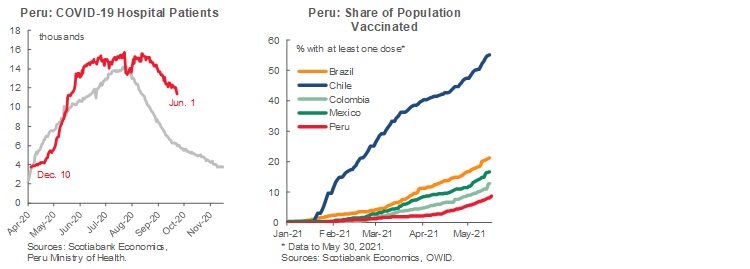

Everything revolves around the elections these days—and yet there is so much more happening. For one, Peru made global headlines when it updated its COVID-19 fatality count from 69,000 to 180,000, making the country the world leader in fatalities in per capita terms. At the same time, however, trends in cases, hospitalizations (first chart), and fatalities are improving very quickly, and nearly 9% of the population has received at least one dose of a COVID-19 vaccine (second chart). When the new government is sworn in on July 28, the COVID-19 situation will likely be much more under control, with a large percentage of the population at least partially inoculated.

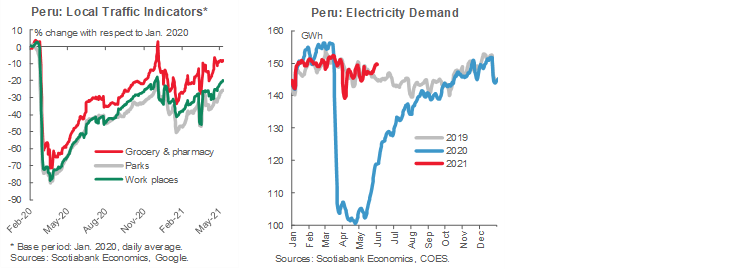

Another story that has been overshadowed by the elections is the strength of GDP growth in recent months. The last official real GDP growth figure was 18.2% y/y for March. However, initial data for April point to a hefty 40% y/y rate of growth, if not higher. May is likely to be similarly strong, as the April–May period was the height of last year’s lockdown. Even though the high growth figures largely reflect a low base for comparison, they are strong enough to imply that the rebound is not just a statistical artefact. A number of activity indicators have surpassed pre-COVID levels. The most recent indicators we have are traffic and electricity. Traffic numbers are still below pre-COVID-19 levels (third chart), as mobility restrictions remain in place in Lima and other cities. Electricity demand, however, has been in line with 2019’s pre-COVID-19 levels for some time now and, since late-May, has surpassed 2019 levels (fourth chart). Once the elections uncertainty is resolved and we have a clearer idea of the priorities of the next government, we will need to revise our growth forecasts for 2021 based on the strength of the first half of the year. Whether economic growth accelerates or slows in the second half of the year will hinge strongly on the elections results. Beyond the results per se, we will also be evaluating the extent to which the future government tips its hat on three fronts: institutional independence, economic policy, and governing capabilities.

High metal prices are also contributing to growth expectations. For one, they soften fiscal concerns which, in normal times, would boost business confidence. This would be a strong positive if not for the elections and can become one again with time. For now, however, business confidence and markets have been overwhelmed by political concerns. The value of the sol has been fluctuating widely, in accordance with the changing gap between Pedro Castillo and Keiko Fujimori in the polls. Overall, the PEN has been mostly depreciating, with the USDPEN reaching record highs on multiple occasions, and even approaching 3.87 at one point. Our year-end projection of USDPEN 3.55 is another forecast which we may need to revise following the elections.

Headline inflation, at 2.5% y/y in May, remains in the upper half of the BCRP target range (1% y/y to 3% y/y). The BCRP is not concerned as core inflation is stuck at a comfortably lower 1.8% y/y, which allows the central bank to argue that inflationary pressures are temporary. We have our doubts: rising global prices for oil and soft commodities, together with the depreciating PEN, are likely to carry through to domestic prices more generally at some point this year. As a result, we are raising our inflation forecast for end-2021 from 2.6% y/y to 3.0% y/y. This is something we need to continue to monitor closely, as both an acceleration in domestic demand, or a slowdown that is due to political reasons, could add upside pressure to inflation.

The tight presidential race will culminate in the Sunday, June 6, run-off vote with the two candidates currently running neck and neck. Once the elections are over, there will still be questions regarding the exact nature and profile of the next government—but at least we’ll know who the next president is, which will lift one layer of uncertainty even as it exposes others.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.