In order to focus in greater depth on Scotiabank’s key markets in the Pacific Alliance, we are stepping back from detailed coverage of Argentina and Brazil with this issue of the Latam Weekly. For both countries, we will continue to provide forecasts of key economic variables and highlight coming risks events, with only periodic analysis of their major macroeconomic developments.

FORECAST UPDATES

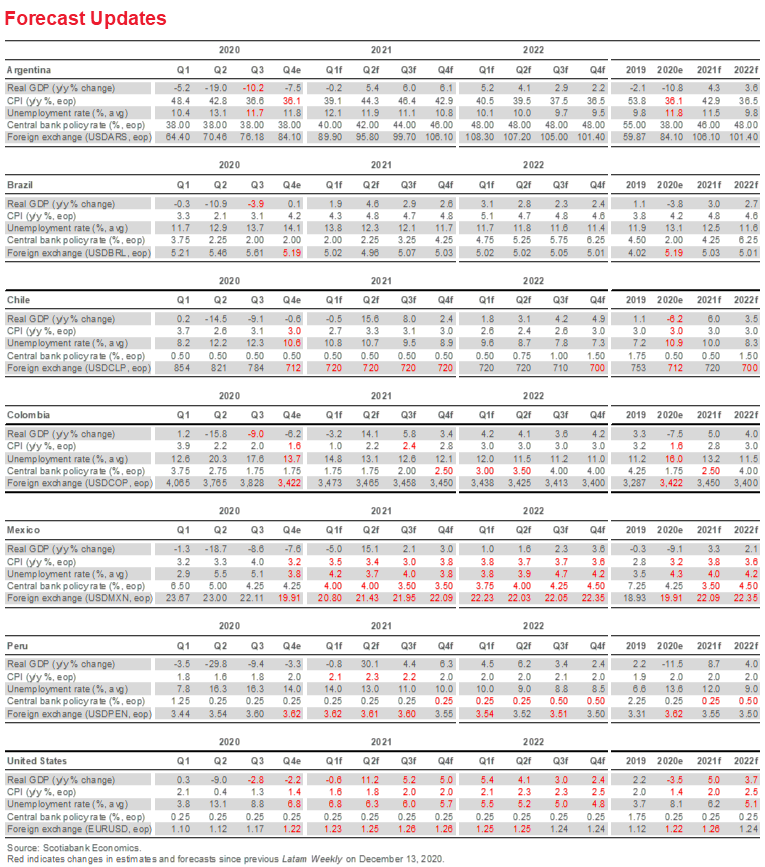

- Our team in CDMX has provided a comprehensive update to its macroeconomic forecasts for Mexico in 2021 and 2022. In Colombia, Mexico, and Peru, our monetary-policy rate paths have been tilted more dovishly as COVID-19 numbers rise again across Latin America.

ECONOMIC OVERVIEW

- We look at how the second waves of COVID-19 in Latin America have adjusted our expectations for recoveries in economic activity and the normalization of monetary policy in the region.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the first weeks of 2021 and highlight the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

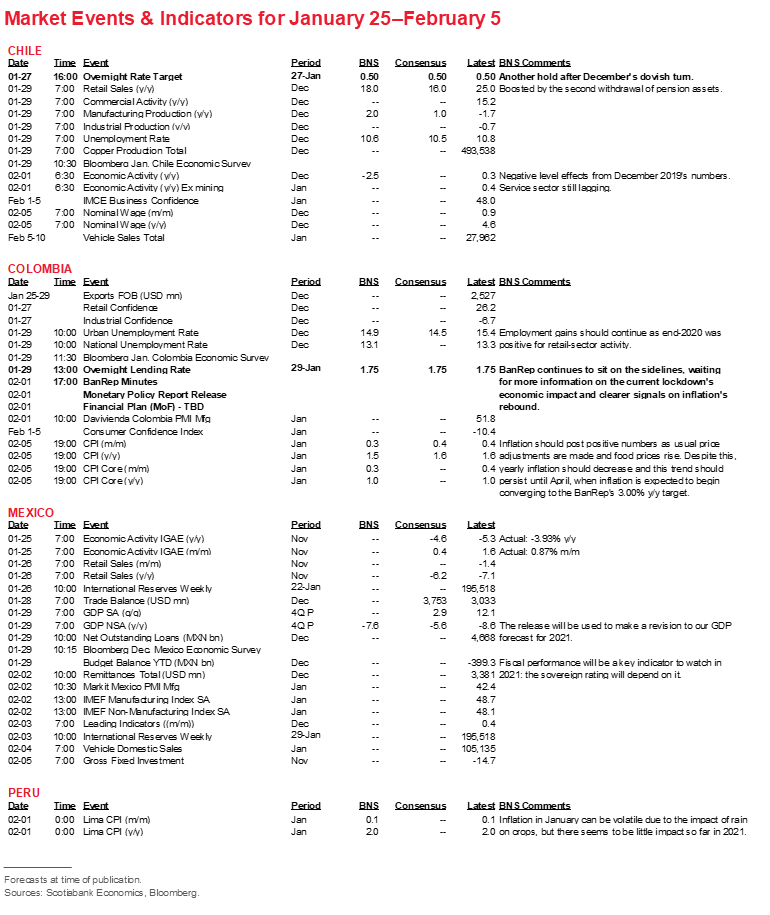

MARKET EVENTS & INDICATORS

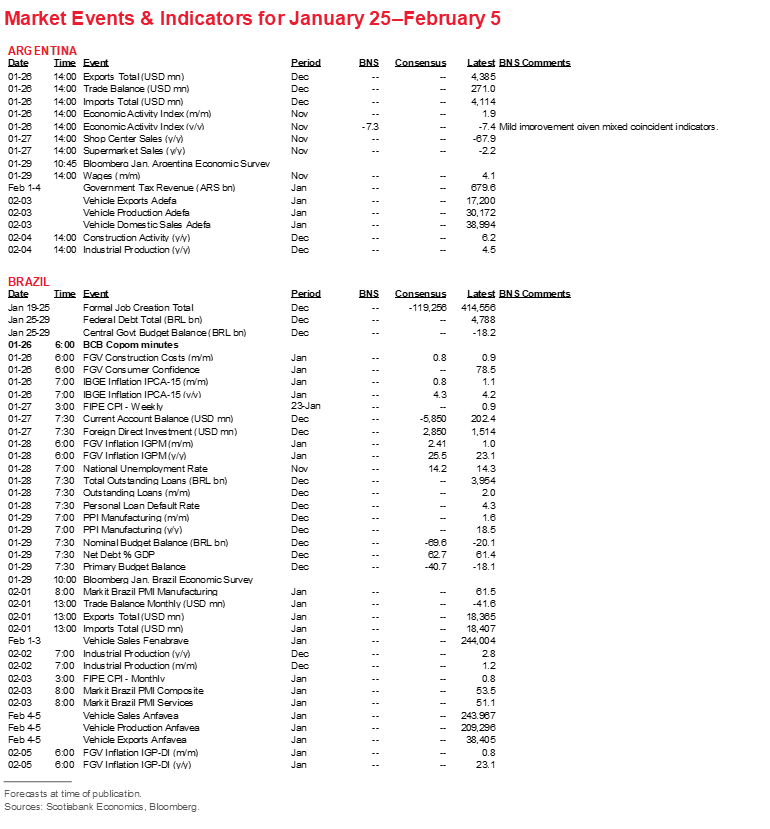

- Risk calendar with selected highlights for the period January 25–February 5 across the Pacific Alliance countries, plus Argentina and Brazil.

Economic Overview: Second-Wave Softening

Brett House, VP & Deputy Chief Economist

416.863.7463

Scotiabank Economics

brett.house@scotiabank.com

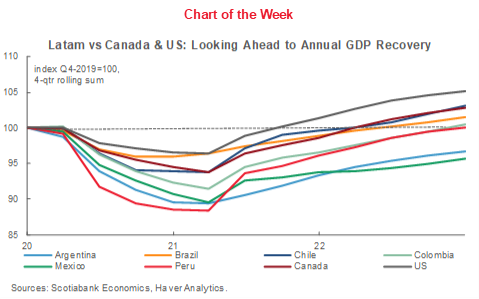

Second waves of COVID-19 prompt some elongation of our forecasts for the economic recovery in Chile and the monetary-policy normalization process in Colombia, Mexico, and Peru

Holds expected from Chile’s BCCh and Colombia’s BanRep this week

RECOVERY AND RATE NORMALIZATION: A BIT MORE GRADUAL

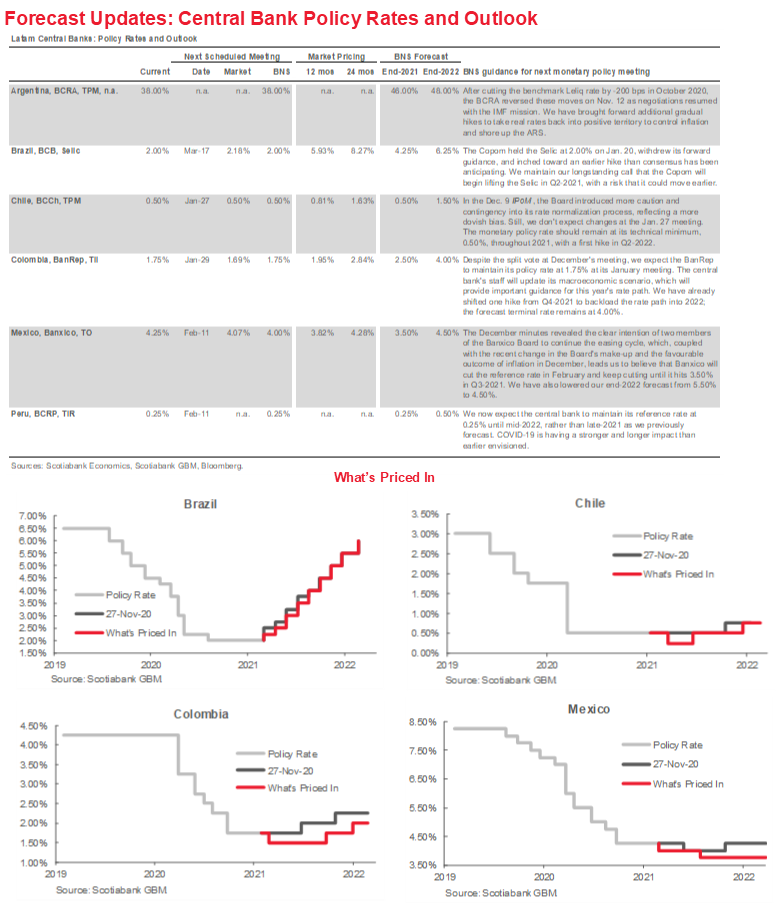

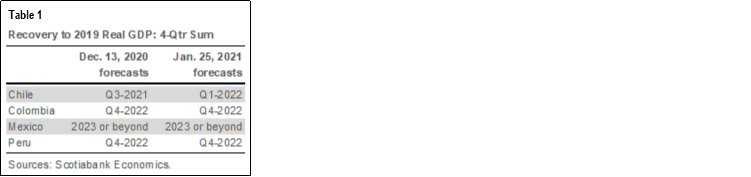

As we detailed in our latest Latam Charts Weekly on Friday, January 22, Latin America’s resurgence in COVID-19 new infections mirrors, with a lag, second waves that have risen across many other parts of the world. In the race between rising case counts and nascent vaccine distribution, we have softened a bit further our outlook for the Pacific Alliance countries. We now have an expectation that GDP recovery will happen a touch more slowly in Chile (table 1) and that the monetary-policy normalization process will proceed a bit more gradually than previously anticipated in our December 2020 forecasts (see forecast table, p. 2) in Colombia, Mexico, and Peru.

- Colombia. The BanRep’s rate hikes have been made a touch more gradual, with one 25 bps increase pushed from end-2021 into early-2022. While the terminal rate of the forecast tightening cycle is unchanged at 4.00%, it’s achieved a quarter later than previously anticipated.

- Mexico. A further round of policy rate cuts, amounting to -75 bps from the current 4.25% to 3.50%, is now expected from the Banco de Mexico. In part, this reflects a concern that testing rates remain lower than they should be in Mexico, which may understate the extent to which the second COVID-19 onslaught has already taken hold—and the range of measures that may be necessary to contain it. The revision also follows the recent changes to Banxico’s Board and the latest round of macro data prints. Rates are still projected to be raised from Q1-2022 through end-2022, and possibly beyond, but the forecast for end-2022 has been lowered from 5.50% to 4.50%.

- Peru. A first hike from the BCRP’s effective lower bound of 0.25% has been pushed from Q4-2021 to Q3-2022.

CENTRAL BANKS AND MACRO DATA

Central bank activity over the two weeks ahead is frontloaded with Brazil’s BCB minutes on Tuesday, January 26, followed by nearly universally-expected holds from Chile’s BCCh, on Wednesday, January 27, and Colombia’s BanRep on Friday, January 29.

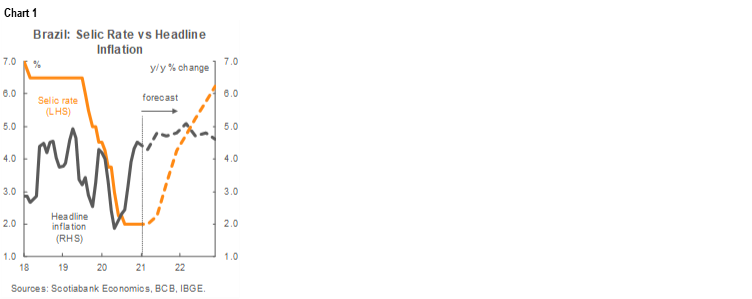

- Brazil. The BCB shall publish at 08:00 local time on Tuesday, January 26, the minutes from the Copom’s Wednesday, January 20, meeting at which the Committee voted unanimously to hold the Selic at it’s all-time low of 2.00% for a fifth meeting (chart 1). As we noted in our January 21 Latam Daily, the Copom also elected to withdraw from its statement the forward guidance that it instituted in August. We expect the minutes to provide additional colour on the Copom’s hawkish shift, while at the same time retaining the Committee’s flexibility to act at coming meetings on a data-dependent basis.

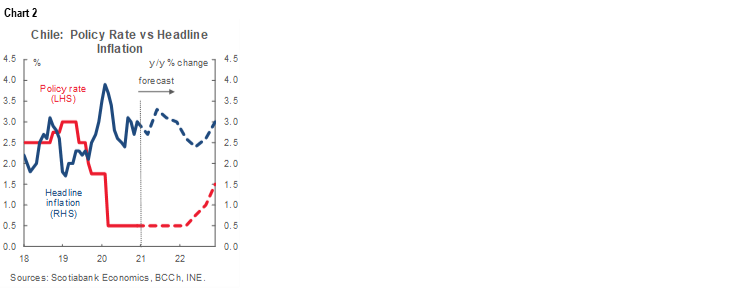

- Chile. The Board of the BCCh is scheduled to meet on Tuesday–Wednesday, January 26–27, and in line with consensus, we expect the policy rate to be held again at its 0.5% “technical minimum” with language that should imply maintenance of this already-extended hold through the coming quarters (chart 2). The Board’s concluding statement and the minutes of its December 7, 2020 meeting contained few changes compared with its October deliberations. The communiqué reiterated October’s guidance that the Board expected to keep the policy rate “at its minimum level over much of the two-year monetary policy horizon.” The Board also noted that it would maintain its holdings of bank bonds and the conditions on its lending programs unchanged over the next six months, but could consider future modifications.

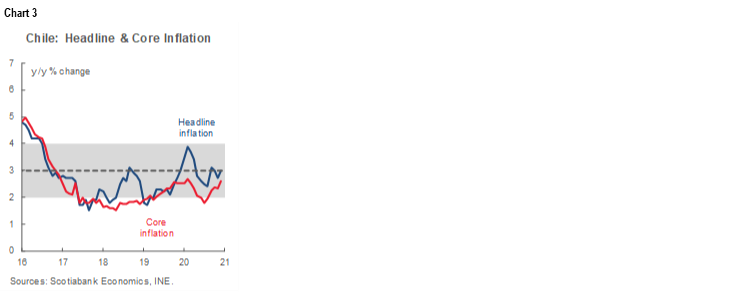

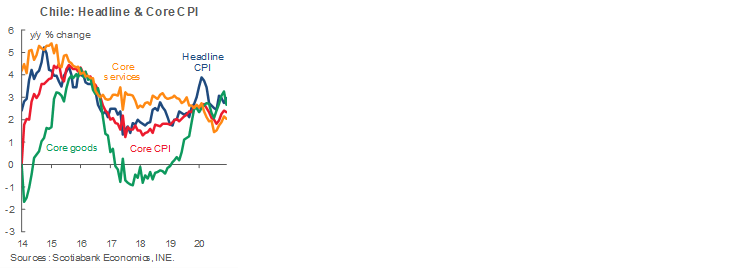

However, one day after the December meeting, the BCCh published its December Inflation Report, which added a much more dovish bent to its forecasts. As a result, we expect the central bank to look through the impact of recent boosts to retail activity from pension withdrawals and fiscal support. Our team in Santiago maintains its view that the BCCh will remain on hold until Q2-2022 given that inflation remains well behaved (chart 3).

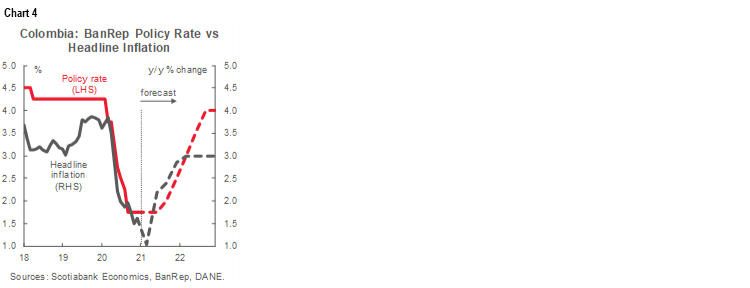

- Colombia. The BanRep Board is set to have its next monthly monetary-policy meeting on Friday, January 29, at which our team in Bogota expects a further hold at 1.75% with the maintenance of a neutral forward stance (chart 4). The meeting could see a split vote following the Board’s divided 5–2 decision at its December 18, 2020 meeting. In its statement, the Board noted that inflation expectations remained well-anchored and that the recovery was on track as credit markets had responded to the central bank’s monetary-policy adjustments while Colombia’s external financing conditions were favourable.

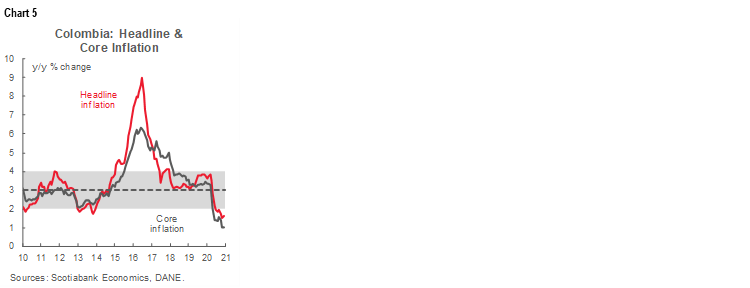

In the minutes of the December meeting, the five-member majority made clear that it had looked through recent and impending softness in prices (chart 5) and was focused instead on the outlook for inflation over the next two years. The majority made clear that it felt Colombia’s ongoing recovery did not require further monetary stimulus and that, on the contrary, an additional cut could be destabilizing for markets. In contrast, the two-member minority noted its concern that the recent decline in headline inflation could reflect a wider-than-estimated output gap whose closure would require further support from the central bank.

Since the December meeting, November employment numbers stumbled, while retail, and manufacturing prints were weaker than expected, and December headline inflation came in higher than consensus, though with marked softness in the core metrics. But the Board’s majority indicated in December that it was prepared to hold firm even with the dip in inflation widely expected in Q1-2021. As a result, we maintain our expectation of another hold at this meeting—but with a slightly shallower normalization path from late-2021 into late-2022.

Other major risk events and macroeconomic data releases are detailed in the calendar at the back of this report.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—As the Vaccination Process Advances, an Uneven Economic Recovery Continues

Jorge Selaive, Chief Economist, Chile

56.2.2939.1092 (Chile)

jorge.selaive@scotiabank.cl

Carlos Muñoz, Senior Economist

56.2.2619.6848 (Chile)

carlos.munoz@scotiabank.cl

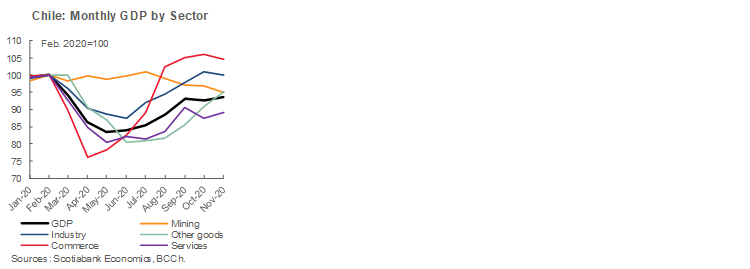

The new year started with mixed economic news in Chile. On January 4, monthly GDP data for November were released, showing an increase in activity of 0.3% y/y, with monthly growth of 1.4% m/m sa in non-mining activity. The heterogeneity of the recovery continued, with commerce being the sector that showed the strongest year-on-year dynamism, though its growth showed some deceleration as it experienced a slight seasonally adjusted contraction of -1.3% m/m (first chart). We expect this monthly contraction to be reversed in December as a result of the liquidity injections provided by the government and, to a greater extent, by the second withdrawal of funds from the AFPs that hit contributors’ pockets before Christmas. Good news comes from the recovery in services, which grew by 1.9% m/m sa in November. Given that many services are linked to investment, the partial re-opening of the economy during November may have brought some recovery in capital spending. But the re-imposition of isolation measures during December and January will negatively affect this sector again.

On January 7, almost a quarter of the total population was subjected to strict movement restrictions. Faced with a sharp increase in COVID-19 cases in recent weeks—between 3,000 and 4,000 new cases a day—the government implemented changes in its plan that regulates the mobility of citizens with the aim of reducing new cases and avoiding a crash of the healthcare system. Then, on January 8, inflation data for December was published, showing an increase of 0.3% m/m sa, a print that was higher than market expectations and our own estimates, with a large contribution by the clothing sector. Hence, annual inflation ended 2020 at 3.0% y/y (second chart), fueled during recent months by pressure on the prices of mass consumer goods due to the strong increase in disposable household incomes and still relatively limited supplies. The note of caution came from the replenishment of inventories, which had already begun in prior months and is being carried out at a significantly appreciated exchange rate.

Elections for four sets of offices will be held on April 11: mayors, municipal councillors, regional governors and members of the new constitutional assembly; the deadline to register candidates expired on January 11. While the Opposition ended up divided into four lists for the vote on members for the constitutional assembly—which could split their support and favour the performance of the centre-right, as they have admitted—Chile Vamos (the government’s coalition) and the Republican Party (the far-right party) agreed to a single list. This situation could prevent the Opposition from controlling two-thirds of the seats in the Assembly, which could stymie agreement on new constitutional articles as those parts of society that voted “no” in the constitutional referendum last October may be over-represented in the new assembly.

The fortnight ahead will bring some important data and events. First, the current Minister of Finance, Ignacio Briones, may resign to embark on a presidential campaign, a decision on which we will have clarity prior to the end of January. Then, on January 27, the first central bank meeting of the year will take place. We anticipate that the Board will maintain its dovish stance and keep the monetary policy rate unchanged at 0.5%. On January 29, sectoral and employment data will be released. We project a decline in the unemployment rate toward 10.6%, as employment has grown faster than the workforce in the past months. Our transaction data point to an increase of 18% y/y in retail sales during December, while we project manufacturing production expanded 2% y/y in the same month. On February 1, monthly GDP data for December will be released, where we expect a decline of -2% y/y as isolation measures were reinstated in the month. December 2019 provides a high level for comparison and some services are still underperforming. For the January inflation print, to be published February 8, we project an increase of 0.5% m/m sa, above market expectations, as fuels and the second withdrawal of pension assets will continue boosting goods prices.

Finally, Chile continues with its vaccination process. In December, the Pfizer/BioNTech vaccine was approved for its use in the country and on January 20 the Sinovac vaccine was also given the green light. The goal is to vaccinate the majority of the ~5 million people in the “at-risk groups” during Q1 and the majority of the 15 million adult population during the first half of 2021.

Colombia—The First Quarter of 2021 Will Focus on the Pandemic and Fiscal Events

Sergio Olarte, Head Economist, Colombia

57.1.745.6300 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Economist

57.1.745.6300 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

In 2021, the world is again facing great challenges as the pandemic is still not under control. This is a year of adjustment for many countries which, in 2020, materially increased their fiscal expenditures to fight the economic and social impact of COVID-19, and also suffered a considerable tax collection shortfall amid the pandemic’s economic weakness. This is the case in Colombia, which received a confidence vote from the credit-rating agencies that maintained Colombia at investment grade under certain conditions: a rebound in economic growth in 2021 and delivery of fiscal reform that ensures sustainability in the country’s debt dynamics.

From the start of 2021, the government has been responding to a new COVID-19 outbreak, which has led to revived, targeted restrictions in Colombia’s main cities; nevertheless, the government still anticipates that landmark discussions on fiscal measures will soon begin. In this vein, fiscal developments have been very active in recent days and will continue in the forthcoming weeks. The Treasury made its first debt swap in USD-denominated bonds of 2020 and additionally launched a new 15-year COLTES benchmark, which demonstrated still-strong appetite from offshore investors who were, in fact, Colombia’s principal debt buyers in 2020.

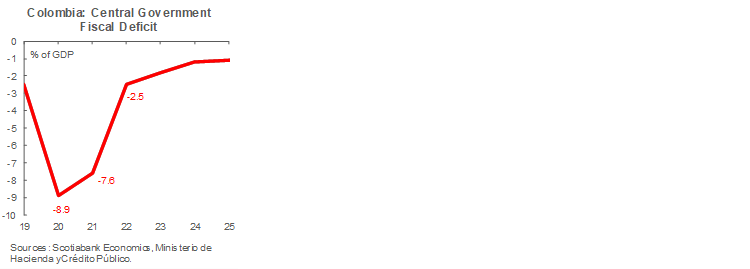

On February 1, the Ministry of Finance will release its Financing Plan, a document that will explain the financing sources (COLTES auctions amount, foreign debt issuances, among others) for this year. In February, the Fiscal Rule Committee will meet again and we anticipate that the structural path of the fiscal deficit will be revised since, in November, the expected deficit worsened for 2020 and 2021. Resuming compliance with the fiscal rule implies the need for a reduction in the deficit from -7.6% of GDP in 2021 to -2.5% of GDP in 2022 (chart). Although recent COVID-19-related events could generate volatility, significant debt issuance will likely occur following the February 1 Financing Plan announcement, and, with the Fiscal Rule Committee announcement, deficit targets are likely to change. In March, we anticipate that the government will finally launch its fiscal reforms after receiving a recommendation from its expert committee on potential tax-exemption adjustments.

In all, in the first quarter of the year, Colombia will be shaped by substantial fiscal announcements as it continues to fight against the COVID-19 second wave. For now, we affirm our broad outlook for 2021 since, despite the current lockdowns, the economy is broadly working. On the inflation side, we expect a return to levels slightly below the central bank’s 3% target starting in Q2-2021. That said, the monetary policy rate will likely stay on hold in the forthcoming months, and we still expect hikes to begin only in H2-2021. Nevertheless, we’ve shifted one hike from end-2021 to early-2022, and our forecast 4.00% terminal rate is shifted back to Q3-2022 from Q2-2022 in our December forecasts.

Mexico—Cautious Optimism to Start the Year

Mario Correa, Economic Research Director

52.55.5123.2683 (Mexico)

mcorrea@scotiacb.com.mx

Recent economic activity indicators in Mexico have presented some positive signs that should be taken with some caution. Industrial production grew 1.1% m/m sa in November, mainly driven by a 2.2% m/m sa increase in construction. In October, gross fixed investment grew 2.8% m/m sa while private internal consumption increased 1.1% m/m sa. These numbers imply that the economy is on the road to recovery, but it should be noted that there is still a long way to travel, especially for the economy’s internal engines—private consumption and investment—that remained in November well below the levels reached a year before (i.e., -9.8% y/y and -13.7% y/y, respectively).

There are tough challenges to overcome, starting with the COVID-19 pandemic: it is raging again and collecting a tragic toll of lives. A fresh round of confinement measures could have a new, negative impact on economic activity. Sales reported by the ANTAD (Association of Department and Self-service Stores) were quite weak in December, with a -6.2% y/y drop in same-store sales, affected by contagion-control measures concentrated in Mexico City where the authorities’ COIVD-19 “red traffic light” was activated. There are also some controversies around the vaccination process in Mexico, which is going slowly even when viewed under the kindest light, which is generating uncertainty regarding the expected timing by which the pandemic will finally be brought under control.

New frictions between AMLO’s government and the US authorities are emerging. On January 11, 2021, a letter was issued by President Trump’s Administration in which it expressed concern over actions by the Mexican government that allegedly instructed independent energy regulators to favour Mexican state-owned energy companies over US firms, some of which are funded by the US taxpayer. On the other hand, the Mexican Attorney-General recently decided not to press charges against former Defense Secretary Cienfuegos, who was detained in the US and later released at the request of the Mexican government. The dossier submitted by the US DEA was made public by the Mexican government and accusations were made against the DEA. The US Department of Justice complained about the release of the dossier, which violated cooperation agreements. There are some ongoing issues that will be contentious between the two governments, mainly in the energy sector, security cooperation, and labour regulations.

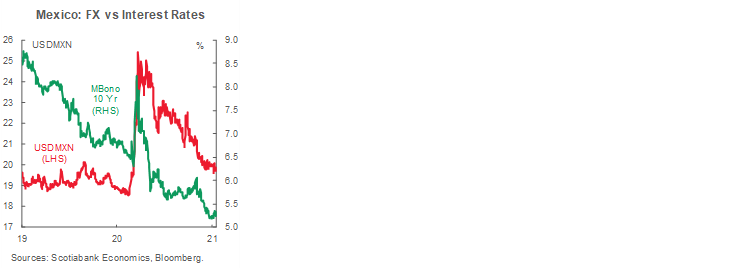

On the positive side, financial variables had a very good start to 2021. The MXN appreciated to levels close to 19.60 per USD, while the 10-year MBono rate reached a 5.25% yield, maintaining a downward trend for many months, as can be seen in the accompanying chart. A very optimistic global sentiment in financial markets has produced a risk-on wave, where investors are searching for yield and are taking for granted that there are no significant risks for the time being—which is supporting Mexican financial assets.

Inflation ended 2020 with a favourable decline in the general index, thanks to an unusual drop in fruits and vegetables prices, which brought the headline down to 3.15% y/y for the year. Core inflation was not as well behaved, as it rebounded following the lower prices of the “buen fin” weekend sales event in November and returned to its regular levels, ending the year at 3.80% y/y. Both inflation readings were within the acceptable range for monetary policy (between 2% y/y and 4% y/y). In the first half of January, inflation numbers presented a new surprise, this time on the upside. General inflation was 0.51% 2w/2w in the first half of January, above the 0.39% 2w/2w expected by the consensus in the latest survey, as energy prices rebounded 2.91% 2w/2w. Core inflation was 0.24% 2w/2w, slightly above the market average forecast of 0.17% 2w/2w. In the year-on-year comparison, general inflation rebounded to 3.33% y/y while core inflation crawled to 3.83% y/y—both within the target range. Since much of the rebound is explained by energy prices, this should not alter the Banco de Mexico Board’s basic views about its next steps in monetary policy.

The change in Banco de Mexico’s Board, with Ms Galia Borja replacing the hawkish Mr Javier Guzman, represents a marked shift. We think Ms Borja will have a more dovish view on monetary policy, particularly with inflation inside Banxico’s target range while economic activity is struggling. Given that she joins two other Board members intent on restarting Banxico’s easing cycle, we have changed our rate outlook and now expect three more cuts during 2021, to take the headline policy rate from 4.25% to 3.50%. We’ve also pared our forecast for the rate normalization process, with the policy rate now expected to end 2022 at 4.50% versus 5.50% in our December forecast.

In the coming weeks we will have a great deal of economic information to digest. The preliminary estimate of Q4-GDP will be released on January 29, which will serve as a base for updates to our forecasts for 2021. In the coming days we will also get retail sales for November, as well as trade balance, financial activity, and public finance figures for December. Attention will also be focused on the vaccination efforts to contain COVID-19 and initial steps to set the agenda between the Mexican government and the new US administration.

Peru—Which Way is the Wind Blowing?

Guillermo Arbe, Head of Economic Research

51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

The countervailing headwinds and tailwinds with which Peru enters 2021 are so strong that it is hard to tell which way the resulting wind is actually blowing. Let’s start with the tailwinds. Peru’s economy is entering 2021 with the benefit of:

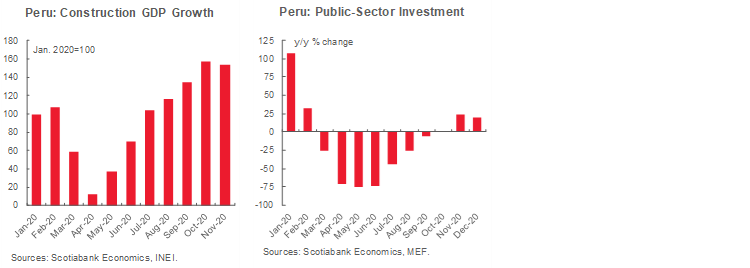

(1) unexpectedly high metal prices (especially copper); (2) a robust recovery trend in Q4-2020; (3) a strong construction sector (first chart); and (4) a notable acceleration in public-sector investment (second chart). These are the likely reasons why the BCRP has increased its growth forecast for 2021 to 11.5% y/y, well above our own outlook.

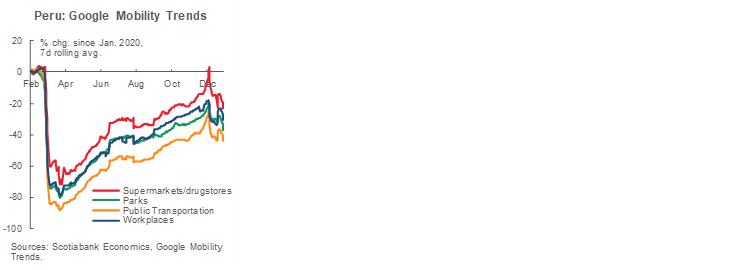

These tailwinds are confronting a large headwind as a second wave of COVID-19 surges. New cases and hospitalizations are below the peak levels of last August, but both are picking up; ICUs are already stretched. Mobility had already declined at end-2020 (third chart); in January, the government expanded restrictions, but did so rather mildly (e.g., adding hours to the curfew and reducing capacity use in public spaces). The risk is that much more drastic measures will need to be put into place, perhaps as soon as February. At the same time, the political campaign season has begun in earnest, and business and market sentiment will be wary given the risk of a non-market-friendly outcome in April’s votes. These elections are particularly unusual as they are taking place amid a distracting pandemic, with new, more restrictive, rules on political communications, which include a ban on privately-financed publicity. It’s not clear how campaigns will be conducted when public meetings are frowned upon because of COVID-19. Additionally, there is a host of candidates with little governing experience and weak party backing. It’s little wonder that a quarter of voters are currently undecided. All of this adds to the aura of uncertainty that surrounds these elections.

GDP growth for Q4-2020 is likely to close the year in the vicinity of -3.0% y/y or better, which will make it the strongest quarter of 2020. However, Q1-2021 will be more interesting: year-on-year GDP growth in January–February could well continue to be slightly negative as the economy has not quite returned to pre-COVID-19 levels. The key for the quarter will be March, as it will be the first month of year-on-year growth off of the base of 2020’s lockdowns. GDP fell -16.3% y/y in March 2020, which makes for an easy rebound compared with a year ago. The key question for 2021 and onward, however, concerns the extent to which the economy can grow beyond a simple rebound. So far, only agriculture, construction, fishing, telecoms, financial services, and government services are seeing growth that is above and beyond a rebound off a low base.

We are beginning 2021 with poor visibility on many things, but there is one thing that is clearer for us. We are changing our forecast for when the BCRP will raise its policy rate from 0.25% to 0.50% and we now expect this first rate hike to take place in mid-2022, rather than late-2021. We made our original forecast back in May 2020, when COVID-19 was still a bit of an enigma and late-2021 seemed far away. Now that 2021 has begun, we believe the BCRP will take more time before beginning to unwind its highly expansionary monetary policy.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.