FORECAST UPDATES

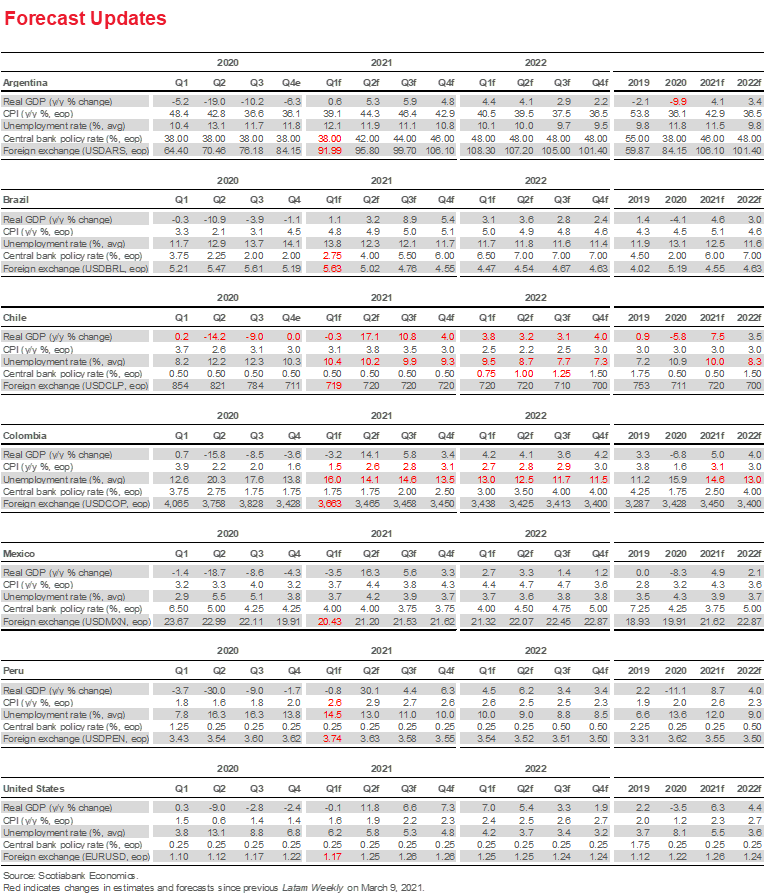

- Aside from housekeeping to reflect recent data prints, forecast updates are focused on Chile and Colombia. Chile’s growth outlook for 2021 has been raised from 6.0% y/y to 7.5% y/y, and the BCCh’s first rate increase has been brought forward from Q2-2022 to Q1-2022. In Colombia, the forecast for end-2021 headline inflation was pushed up from 2.8% y/y to 3.1% y/y.

ECONOMIC OVERVIEW

- In a quiet fortnight for central banks following Easter, focus turns to monthly GDP prints for indications of the impact on growth of recent measures. Additionally, the IMF-World Bank Spring Meetings may yield some insights on possible international policy coordination to prevent the global recovery from becoming a more pointed sequel of the 2013 taper tantrum.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from Q1-2021, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

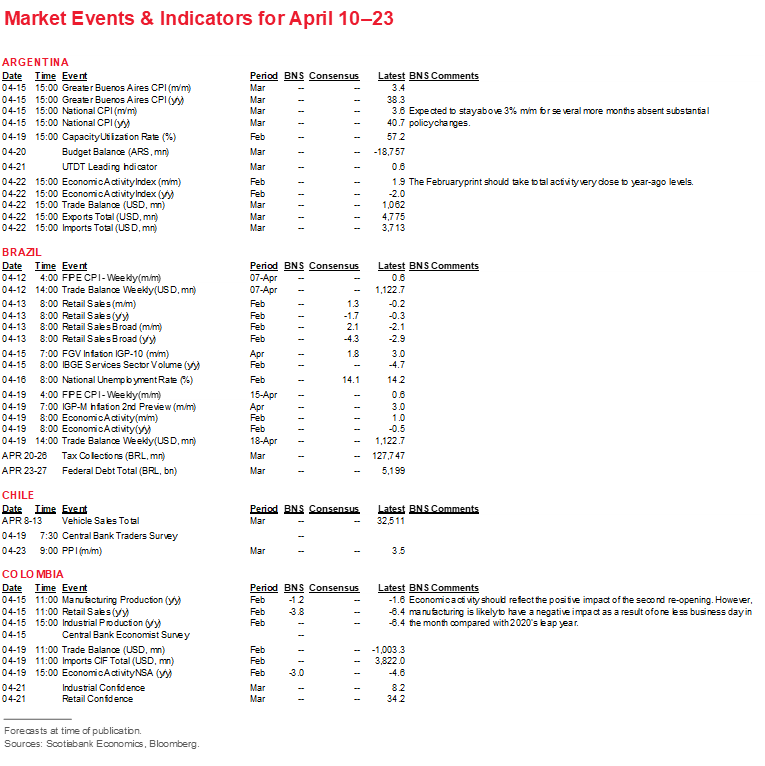

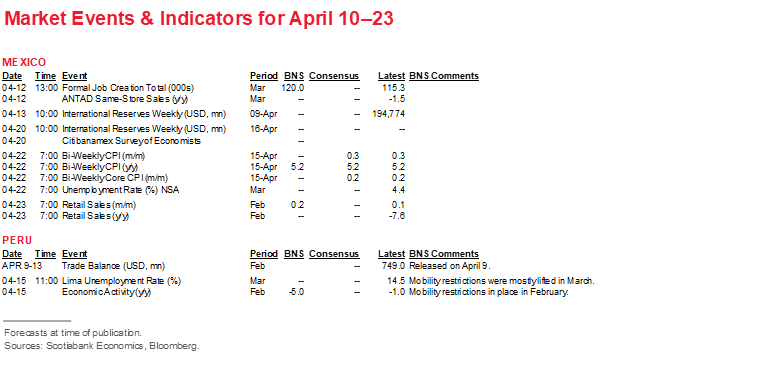

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period April 10–23 across the Pacific Alliance countries, plus their regional neighbours Argentina and Brazil.

Economic Overview: Growth in Focus

Brett House, VP & Deputy Chief Economist

416.863.7463

Scotiabank Economics

brett.house@scotiabank.com

Chile’s outlook has been strengthened, with higher growth in 2021 and a slightly earlier beginning in Q1-2022 for the BCCh’s rate normalization process. Colombia’s end-2021 inflation forecast has also been raised.

The fortnight ahead is quiet for Latam central banks with no rate decisions on the risk calendar. The focus instead will be on monthly GDP prints in Argentina, Brazil, Colombia, and Peru.

What to watch: IMF Spring Meetings.

FORECAST UPDATES AND THE RISK CALENDAR

Aside from housekeeping to reflect recent data prints, forecast updates are focused on Chile and Colombia (see table on p. 2). Chile’s growth outlook for 2021 has been raised from 6.0% y/y to 7.5% y/y, and the BCCh’s first rate increase has been brought forward from Q2-2022 to Q1-2022. In Colombia, the forecast for end-2021 headline inflation was pushed up from 2.8% y/y to 3.1% y/y.

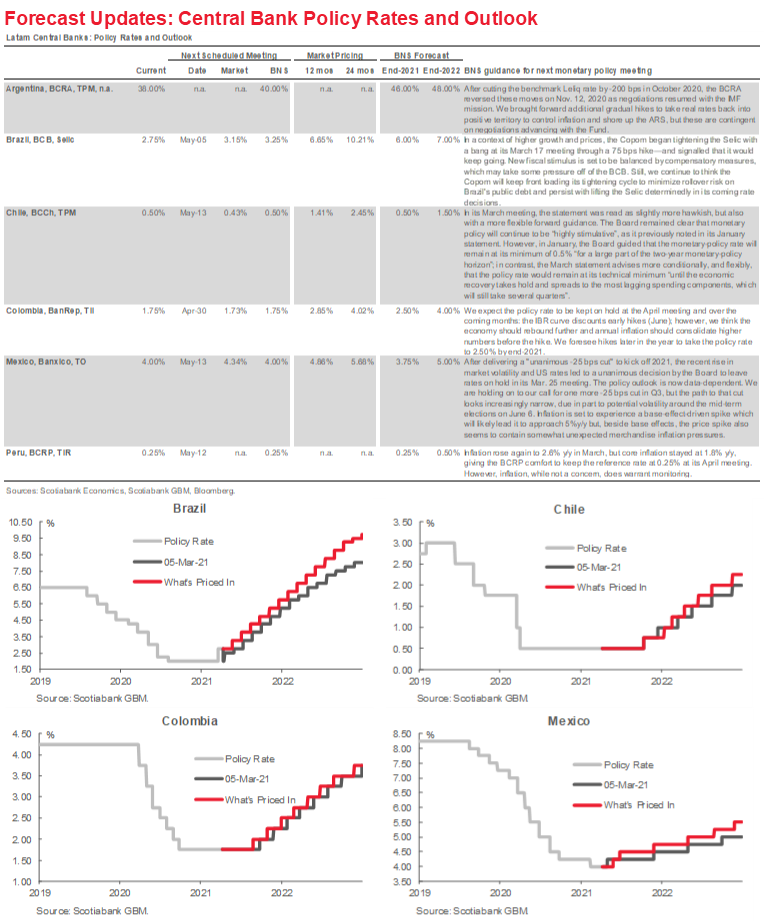

Latam central banks have a quiet fortnight ahead, with no policy-rate decisions scheduled for the remainder of the month of April (see table on p. 3). After its surprise 75 bps hike (50 bps had been widely expected), Brazil’s BCB is expected to keep steadily raising the Selic through the remainder of Q2 and onward through the rest of the year. We have also pencilled in a series of hikes by Argentina’s BCRA through the coming months, but these are wholly contingent on progress on negotiating a new borrowing program with the IMF. So far, talks have progressed only slowly and, while this week’s IMF Spring Meetings may produce some news, the May target for a possible agreement on a new IMF arrangement is unlikely to be hit.

Among the Pacific Alliance central banks, no further rate changes are expected until Q3. At that point, a first rate increase is expected from Colombia’s BanRep in a gradual normalization cycle, while our team in CDMX believes a small window remains for a final cut by Banxico’s Board prior to the beginning of its own normalization process in Q1-2022.

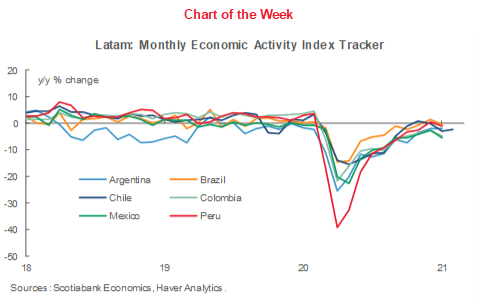

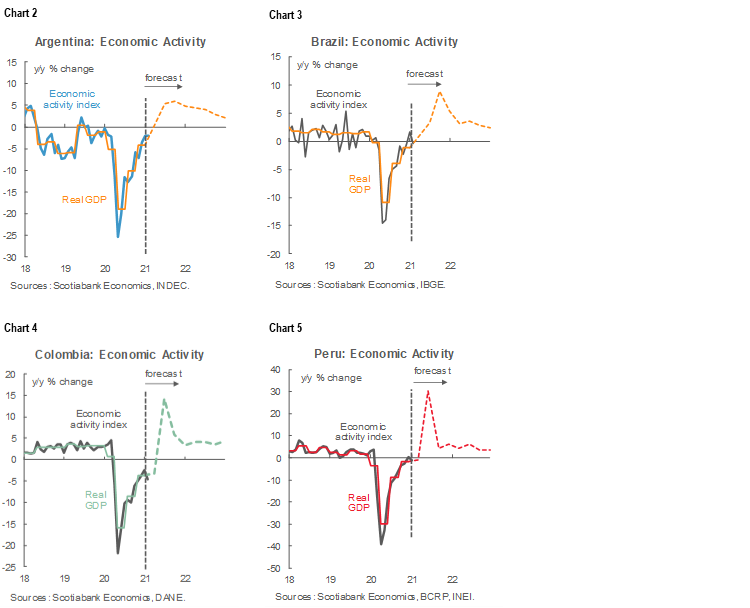

Data developments over the next two weeks will be focused on monthly GDP prints in Argentina, Brazil, Colombia, and Peru, as detailed in the risk calendar at the back of this report. While monthly economic activity across Latam is close to pre-pandemic levels (chart 1), these releases will be closely examined for indications of the marginal impact of the recent imposition of new restrictions to control resurgent waves of COVID-19—and their possible implications for our 2021 growth forecasts (charts 2 through 5), most of which have been revised upward over the last couple of months.

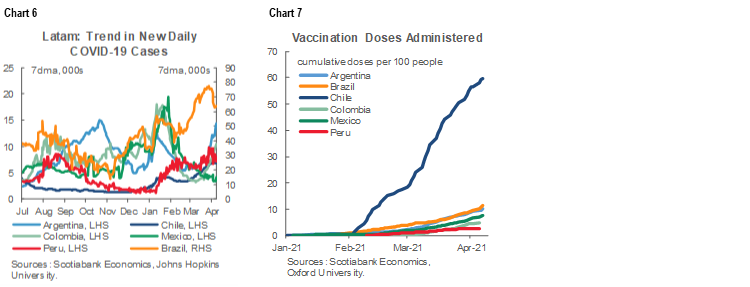

COVID-19: NUMBERS MOUNT AGAIN

Latam’s COVID-19 numbers keep going up, mirroring recent developments in many advanced and emerging economies (chart 6). We greet the recent pull-back in numbers in Brazil and the still-low new case counts in Mexico with a great deal of skepticism: both likely reflect inadequate testing and under-detection. Meanwhile, Chile’s stand-out vaccination program continues to roll ahead, putting it far beyond its regional peers (chart 7). In recent weeks, it has even moved ahead of the UK and US in its per capita delivery of vaccine doses.

WHAT TO WATCH

The IMF-World Bank Spring Meetings are worth watching for some insights on possible international policy coordination to prevent the global recovery from becoming a more pointed sequel of the 2013 taper tantrum.

IMF Spring Meetings—schedule, live webcasts, and replays: https://meetings.imf.org/en/2021/Spring/Schedule

IMF’s latest research and policy papers on sovereign debt: https://www.imf.org/en/Topics/sovereign-debt

SDRs and what the new allocation means for emerging and developing markets: https://www.imf.org/en/Topics/special-drawing-ri

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Successful Vaccination Process Clashes with Second Wave

Jorge Selaive, Chief Economist, Chile

56.2.2619.5435 (Chile)

jorge.selaive@scotiabank.cl

Carlos Muñoz, Senior Economist

56.2.2619.6848 (Chile)

carlos.munoz@scotiabank.cl

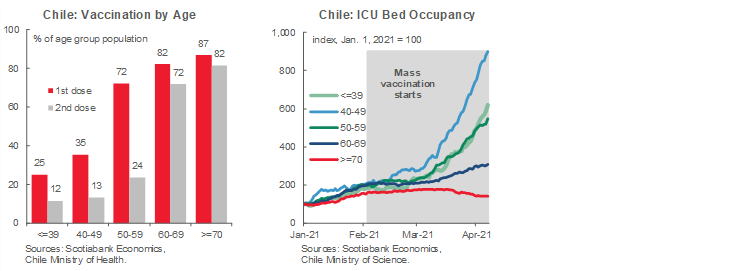

The COVID-19 pandemic shows us its severity and unpredictability again and again. In the past months, Chile has been one of the most successful countries in terms of the vaccination process, but that hasn’t prevented a spike in new cases, renewed stress on the health system, and the reimposition of extreme confinement measures. As a matter of fact, in late-March around 85% of Chile’s population entered a total lockdown to contain the spread of the virus and its new strains, in a context where 37% of its population has received at least one shot of the vaccine and more than 20% has received the two doses (first chart). New cases and hospitalizations are concentrated in the younger population (below 50 years old, second chart), who have received fewer vaccinations, in contrast with the low rates of infection of older people, a sign that the vaccine might be working.

On the economics side, the Board of the BCCh met on Tuesday, March 30, and voted unanimously to hold its benchmark policy rate at its record low of 0.5%, where it has been since March 30, 2020 at the outset of the pandemic. A day after the Board’s rate decision, the BCCh staff released its quarterly Monetary Policy Report. Most notably, the staff raised the central bank’s forecast for real GDP growth in 2021 from a range of 5.5–6.5% y/y in the December Report to 6.0–7.0% y/y. The change reflected better recent data, an improved external environment, and new fiscal stimulus versus the impact of new quarantine measures. We had anticipated a forecast revision along these lines, and we maintain our own projection of 7.5% y/y real GDP growth in 2021.

That same day, March 31, employment data for February was released. The unemployment rate increased to 10.3%, from 10.2% the previous month, explained by the greater dynamism that the workforce continues to show compared to job creation. We hope job creation will accelerate in the coming South American winter months when greater advances are made in vaccination and restrictions on mobility are lifted.

Chile’s IMACEC monthly real GDP proxy, in its latest release on Thursday, April 1, showed the best sequential growth for any month of February since 2010 at 0.9% m/m sa. This was well above the 0.0% m/m sa expected in the Bloomberg consensus, but represented a slowing from 1.3% m/m sa in January. The non-mining component of GDP grew sequentially even faster in February, hitting a rate of 1.1% m/m sa. The recovery of services, with growth of 1.5% m/m sa, stood out as it is one of the drivers of Chile’s rebound: the print highlighted further re-opening of the economy and rising numbers of people who travelled domestically for their summer vacations. February’s real level of services activity was on par with a year earlier (third chart). Commerce (i.e., retail) also continued to show solid dynamism in February owing to the availability of monies from the second round of pension withdrawals at the end of December 2020. February marked the fourth consecutive month in which there has been positive sequential growth in non-mining GDP (fourth chart). In fact, aside from October 2020, non-mining GDP has seen month-on-month gains since June last year. It appears that the economy has adapted to the “new normal” of greater social distancing and mobility restrictions.

Finally, on Tuesday, April 6, Congress approved the postponement of the elections, originally scheduled to be held on April 10 and 11, to May 15 and 16, due to the extreme lockdown measures the country is experiencing. The authorities hope that by mid-May infections will decline and it will be safe to hold elections.

March inflation stood at 0.4% m/m, in line with our forecast, although the market had anticipated a higher print (0.5% in forwards). With this, annual inflation reaches 2.9% y/y, and remains influenced by a high CPI for goods that has offset the low 2% inflation recorded for services. Monthly inflation in March was largely explained by an incipient rise in services prices, including seasonal increases in education services, together with somewhat smaller declines in interurban transport services. Along with services, the rise in fuels stands out, due to the higher international prices of oil and its derivatives, which have continued to be transferred internally through the MEPCO mechanism with weekly increases in all fuels.

There aren’t many tier-1 indicators coming out the following fortnight in Chile. We will continue monitoring the vaccination process and the infection rates, as well as the new initiatives regarding mobility restrictions. Recent quarantine restrictions are likely to lead to new setbacks to GDP in March. We would not rule out the possibility that these effects on growth could continue into April if restrictive measures remain in place beyond the middle of this month.

Colombia—Lessons from Q1-2021 and Milestones for the Coming Months

Sergio Olarte, Head Economist, Colombia

57.1.745.6300 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Economist

57.1.745.6300 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

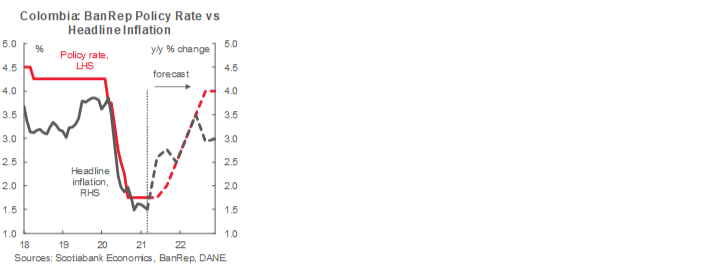

During the first quarter of the year, Colombia continued to face diverse challenges, which motivated unusual volatility in analysts’ forecasts of the main macro variables. The year started with the second wave of COVID-19, which put the economic recovery in question and even, for a moment, discarded the expectation of monetary policy normalization. Fortunately, as time has gone by, the outlook has clarified somewhat. Activity has shown resilience which consolidates the view of economic improvement and confirms that 2021 is the year to make some policy adjustments.

On the economic side, January lockdowns impacted growth moderately, and although we don’t have February’s hard data yet, high-frequency indicators are showing economic activity responding faster to the second re-opening (first chart). That said, even though at the end of March and in April we are experiencing new lockdowns, we highlight that those restrictions are more targeted, and some economic sectors are proving resilient through the adoption of technology and new logistic strategies (productivity shock).

In fact, positive economic growth surprises led the central bank staff to change its view and preliminarily revise to the upside its GDP growth forecast for 2021 from 4.5% y/y to 5.2% y/y, as noted in the last monetary policy meeting. Something similar happened with inflation which, despite having closed 2020 at a weaker-than-expected level, started to normalize in 2021 with the overall economic recovery. In fact, in January's Monetary Policy Report, BanRep staff stated an inflation expectation of 1% y/y by March, far from the actual number of a favourable 1.51%, which in our view will be the y/y lowest figure before it starts its convergence path to the central bank's target of 3%. Prices should continue to normalize due to the following three main factors:

- this year, subsidies on key prices will likely not be repeated;

- better economic activity is providing space to return to more normal prices on core items such education, rent fees, and utilities, among other services; and

- depreciation and bottleneck effects from the international supply chain might be passed through to the consumer more easily than before.

As a result, we affirm our expectation of inflation closing at the central bank target by the end of 2021, with the possibility of eventually slightly surpassing that level.

Having said that, despite the fact that the market consensus has gone from the expectation of further rate cuts to now expecting rate hikes starting as early as June, at Scotia Economics, we affirm our expectation of the start of rate hikes at the September meeting as, by that time, economic growth would have consolidated, and inflation would have shown higher upside pressures (second chart) that would make the real rate more expansionary than needed—triggering an adjustment of the current monetary policy stance to a more neutral ground. Also, considering the context of high volatility and increasing rates in global markets and the volatility that could arise from the fiscal reform discussions, this would motivate the central bank to send an orthodox message in an environment of better economic activity.

Finally, on the fiscal side, Q1 was also a period of high expectation for fiscal announcements; however, despite this, the Ministry of Finance hasn’t released its final fiscal reform proposal yet. In April, we expect the Government to begin the process to approve the reform in Congress. Preliminarily it is expected that the Government’s proposal looks to raise 2.2% of GDP tax income, which would give enough room for negotiating with Congress and deliver a decent final output that would collect around 1.5% of GDP—enough to meet the compromises for fiscal sustainability and debt growth stabilization in the medium term. In the forthcoming months, challenges will remain as the pandemic is far from being subdued; however, in a broad perspective, the Colombian economy will continue to recover, opening the potential for discussions about reducing imbalances created by the pandemic.

Mexico—Uneven Economic Recovery to End-2020 and Start-2021, but Recent Data Continue to Point to Macro Recovery

Eduardo Suárez, VP, Latin America Economics

52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

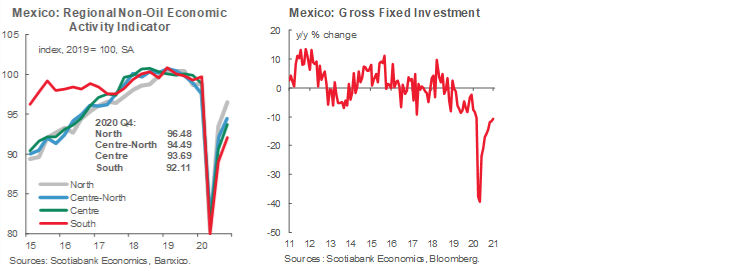

Over the past couple of weeks, an update on the state of Mexico’s growth rebound at the end of 2020 and the beginning of 2021 confirmed its “k-shaped” progression. In Banxico’s Report on Regional Economies, which covers activity up to the end of 2020, we saw that activity in the South (excluding the oil sector), which has been relatively stagnant in recent years, has also been the most sluggish during the recovery from the COVID-19 shock (first chart). Northern Mexico on the other hand, has experienced the most dynamic rebound and its level of activity sits within 500 bps of its pre-COVID-19 levels. In the timelier national monthly GDP proxy (the IGAE) we saw a modest gain in momentum to kick off the year, with the m/m print for January coming in at +0.11% m/m—up from +0.08% m/m in December. However, on an annual basis, the level of activity remained -5.4% below the same month of 2020 (before the pandemic truly hit Mexico). Possibly the best news we’ve had for growth in January is that, after losing some momentum in December, fixed investment resumed its improvement, printing at +3.3% m/m to kick off the year (coming in at -9.6% y/y, second chart). In terms of timelier data, PMIs for March (both IMEF and Markit) showed continued improvement, and the IMEF’s manufacturing and non-manufacturing index prints came in on the expansion side (50.7 and 52.8 respectively) suggesting that—after a slowdown at the start of the year as the pandemic forced a new round of lockdowns—we may have seen some relief heading into March.

During the next couple of weeks, we will continue to receive more color on the state of the economy at the start of 2021. Industrial production for February is expected to lose some momentum, partly due to disruptions in the auto sector caused by supply chain difficulties, while we also anticipate an improvement in formal job creation for March, propped up by some reductions in pandemic-induced lockdowns. Improvements in parts of the services sector related to entertainment and tourism for the second half of the year are also expected. In 2020, certain services, particularly those related to entertainment and tourism, were operating at close to 40% capacity they were among the hardest hit sectors in the economy due to the pandemic but, with vaccination efforts creating some light at the end of the tunnel, a big jump in demand for their services is now looming closer (third chart). An improvement similar to what we anticipate on the jobs front is expected in retail sales for February.

Outside of economic releases, two important items to watch for are Banxico’s operating surplus announcement (part of which is expected to help support Pemex’s debt service), as well as more details on the outsourcing agreement and the proposed legislation that will likely follow on its heels. Outsourcing currently represents about 20% of Mexico’s formal labour force, and the agreement would seek to materially reduce its usage.

Peru—The Elections Take Centre Stage

Guillermo Arbe, Head of Economic Research

51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

The next few weeks will be crucial for Peru. The country is electing a new government and Congress at a moment in which COVID-19 has surged—with hospitalizations (first chart), ICU admissions, and fatalities at or near record levels. At the same time, one of the most consequential elections in recent memory will take place on Sunday April 11, with heightened uncertainty as to which two candidates will make it into the second round (June 6). Markets are betting, based on minor changes in recent poll trends, that the lucky two will not include an anti-establishment or anti-market figure. Based on these expectations, the USDPEN rallied 5% in the first week of April, to 3.58 at last count. If all goes well, this will bear out. Our forecast of USDPEN 3.55 for year-end will hinge to a great measure on the elections results.

Meanwhile, we’re starting to see extremely strong GDP growth figures as Peru is entering a period, from March to July or so, in which y/y comparisons will be vis-à-vis the 2020 lockdown period. Electricity was up 14.8% y/y in March but soared 31% y/y in the second half of March, which compares with the 2020 lockdown period which began on March 16. Vehicle sales in March were more or less in line with pre-COVID-19 levels but, given the lockdown comparison, this meant a nearly 95% y/y increase in sales. Both soaring electricity demand and vehicle sales in March are representative of magnitude we’ll be seeing a lot more of over the next few months, due to last year’s lockdown.

More relevantly, we are seeing some figures that surpass even March 2019 (pre-COVID-19) levels. According to the National Statistics Institute (INEI), cement consumption rose 15% y/y in February, despite mobility restrictions. Government investment rose 17% y/y in February. Both are trending above 2019 levels. Investment in infrastructure has been high over the past few months and has become more important than real estate construction in driving cement demand.

Not all sectors are performing this well. Mining, for instance, continues to disappoint—with output and investment both consistently declining despite high metal prices. Mining GDP fell -5.4% y/y in February, and mining investment plunged -18.2% y/y.

Another encouraging indicator is tax revenue. The tax administrator, Sunat, reported an impressive 41.9% y/y increase in tax revenue in March, ratifying a surprisingly strong trend since December. Although this reflected, in part, higher metal prices and a low base comparison due to tax deferments in March 2020, something else must also have been in play, as tax revenue has been coming in higher than in 2019 (second chart). Compared to the same months in 2019, total tax revenue was up 21.7% in March 2021, up 18.4% in February, and 5.7% higher in January. This was not purely the result of higher metal prices, as domestic IGV tax revenue followed a similar trend when compared with 2019: up 20.9% in March 2021, 10.2% in February, and 6.6% in January. With tax revenue so strong, it would be tempting to adjust our 5.4% 2021 fiscal deficit forecast accordingly, if it were not for the fact that government spending is rising equally strongly. The fiscal deficit (12-month rolling) actually rose to 9.1% of GDP in February.

All in all, the growth figures that we are beginning to see for February and March are moderately better than expected, considering the mobility restrictions in place during this period. However, they are not quite strong enough for us to alter our forecast of 8.7% y/y growth for 2021, as this forecast hinges significantly on the elections results, and on whether or not there will be further COVID-19-related restrictions, given the scale of the current COVID-19 wave.

Headline inflation jumped back up to 2.6% in March, but core inflation continued to be anchored at 1.8%, which gives the BCRP enough comfort to keep its reference rate at 0.25%. Given this, we maintain our view that the BCRP will not move its rate before Q3-2022, although we do believe that inflation warrants careful monitoring going forward. The recent strengthening of the PEN helps, but high global oil and soft commodity prices are likely to continue to filter through to local prices.

But first, the elections on Sunday...

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | carlos.munoz@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Forthcoming |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

| COSTA RICA | |

| Website: | Click here to be redirected |

| Subscribe: | estudios.economicos@scotiabank.com |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.