ECONOMIC OVERVIEW

- Political developments will be in the Latin American spotlight this week. In Peru, Castillo’s clashes with Congress continue. Brazil’s Lula is expected to clarify fiscal plans and the composition of his cabinet.

- On the Latam data front, this week’s highlights are Peruvian CPI, Chilean economic activity, Banxico’s quarterly report, and unemployment figures in Chile, Mexico, Colombia, and Brazil.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, Mexico, and Peru.

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period November 26–December 9 across the Pacific Alliance countries and Brazil.

Economic Overview: Regional Politics in Focus; Peruvian CPI to Prolong BCRP Hikes

Juan Manuel Herrera, Senior Economist/Strategist

+44.207.826.5654

Scotiabank GBM

juanmanuel.herrera@scotiabank.com

- Political developments will be in the Latin American spotlight this week. In Peru, Castillo’s clashes with Congress continue. Brazil’s Lula is expected to clarify fiscal plans and the composition of his cabinet.

- On the Latam data front, this week’s highlights are Peruvian CPI, Chilean economic activity, Banxico’s quarterly report, and unemployment figures in Chile, Mexico, Colombia, and Brazil.

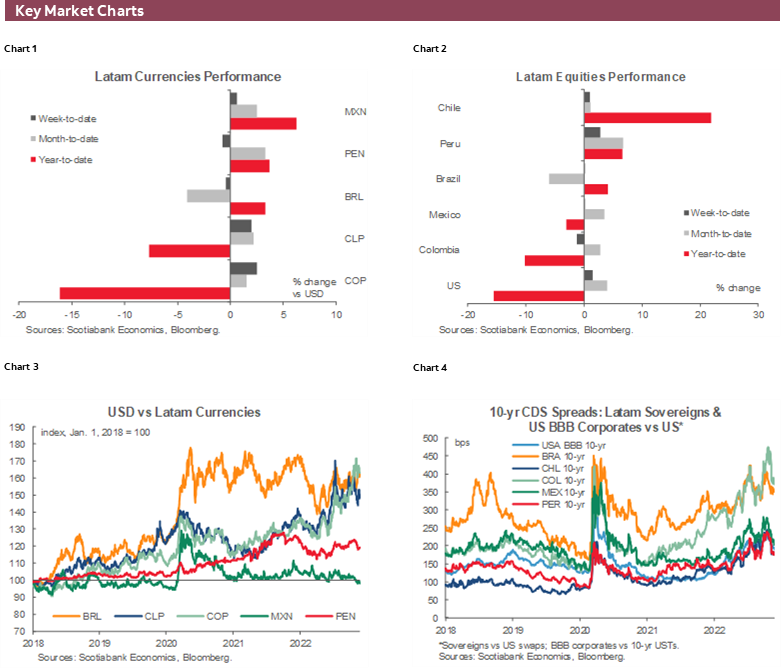

Political developments will be in the Latin American spotlight this week. In Peru, we get another round of palace intrigue as Castillo’s clashes with Congress open up an important degree of political risk in the country (see Latam Flash). Brazil’s Lula is expected to clarify fiscal plans and the composition of his cabinet, as local assets reel from the possibility of a market-unfriendly pick (Haddad seems the most likely candidate).

Meanwhile, the region’s currencies and markets will also be driven by virus developments in China (as we monitor the government’s response to protests) and the impact of this on commodity prices, while US jobs and inflation data and a (likely hawkish) speech by Fed Chair Powell on Wednesday ahead of the bank’s blackout period starting this weekend.

On the Latam data front, this week’s highlights are Peruvian CPI, Chilean economic activity, Banxico’s quarterly report, and unemployment figures in Chile, Mexico, Colombia, and Brazil.

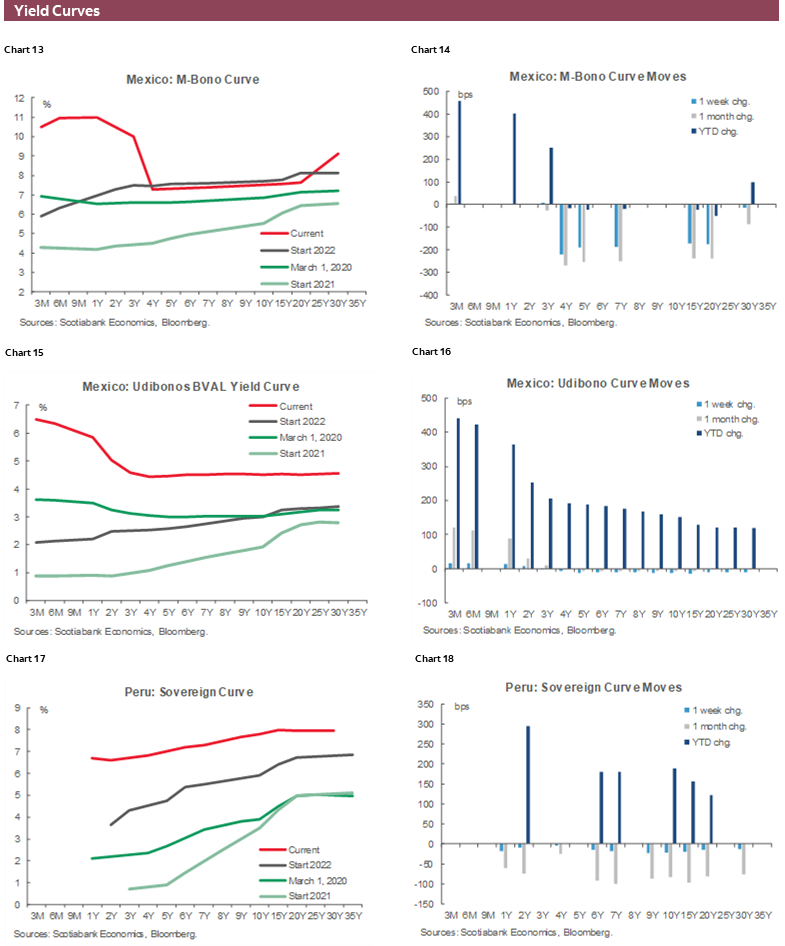

We expect Peruvian inflation to keep the BCRP on its toes, pushing it to deliver another 25bps increase at its December gathering, next week (see Peru section). Our Lima economists forecast that CPI rose 0.4% m/m and 8.4% y/y in November, roughly matching the prices gain in October as inflation remains unreined above 8%. As the BCRP has stated, rate hikes will likely continue until inflation is convincingly decelerating—so far, it has only shown modest signs of doing so.

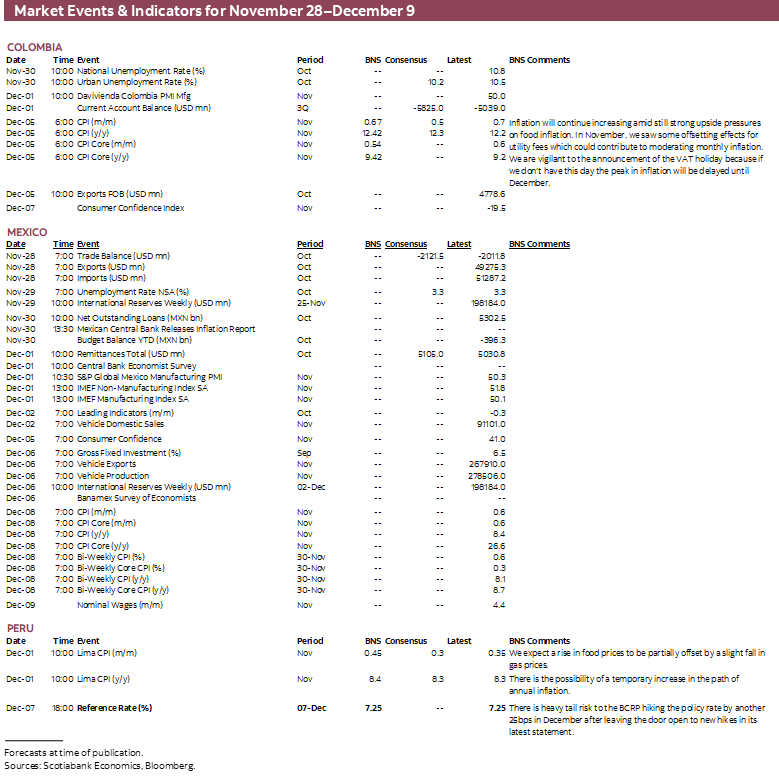

The Mexican central bank’s projections will inform its appetite to keep pace with the Fed over the coming months while the domestic backdrop, namely core inflation, provides enough support for continued rate increases. We anticipate that Banxico will hike by 50bps next month and in January, with the path beyond that point determined by the performance of inflation (and expectations) and the Fed’s cycle.

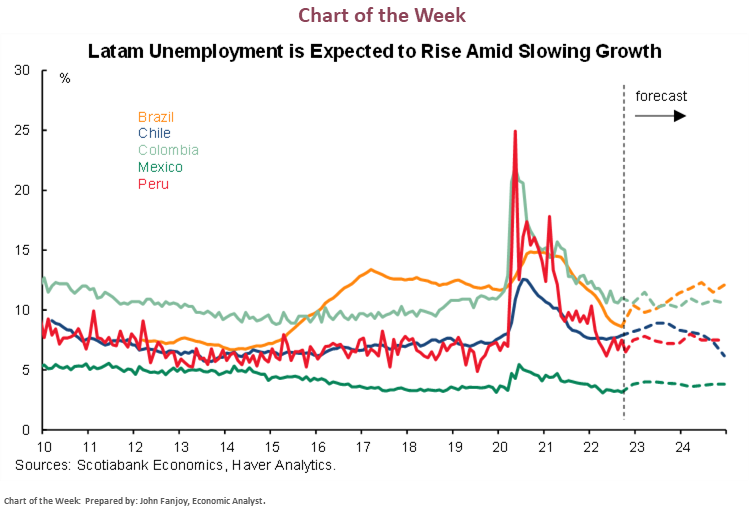

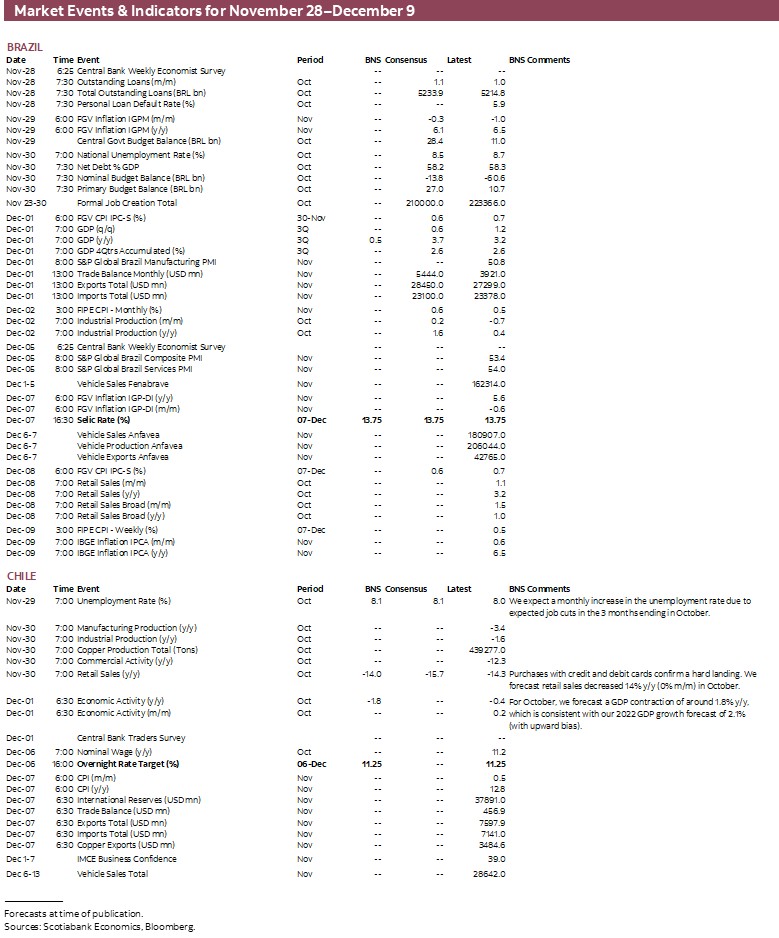

Unemployment data in the region is expected to show only modest changes. However, a clear outlier on the employment front is Chile, where the jobless rate is expected to hold an upwards trajectory, increasing to 8.1% in October from the cycle low of 7.2% last December (see Chile section).

Steep interest rates and high inflation have combined for a pronounced slowdown in Chile, and our economists estimate that output fell by 1.5% y/y last month—its largest year-on-year drop since early-2021. The country’s INE publishes retail sales and industrial production data on Wednesday ahead of Thursday’s economic activity print. A weak economy and declining inflation expectations should see the BCCh begin its easing cycle in Q1, according to our Santiago team.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Anchoring of Inflation Expectations is Complete; Next Up: Reducing Mon-Pol Restrictiveness

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

Economic activity has shown signs of resilience in recent months, underpinning our expectation that GDP growth will be closer to 2.5% this year. However, the outlook for 2023 is worsening, based on an expected weakening of activity in all economic sectors. According to our estimates, if we discount the high base for 2022 carrying into next year, GDP would contract by a similar rate to that observed in the 08-09 financial crisis.

We estimate that the labour situation deteriorated in the quarter ending in October, in data due for release on Tuesday that we expect to show an increase in the unemployment rate to 8.1% from 8.0%. Monthly GDP figures out on Thursday are also expected to show a 1.5% y/y economic decline in October—compared to a 0.4% y/y in September.

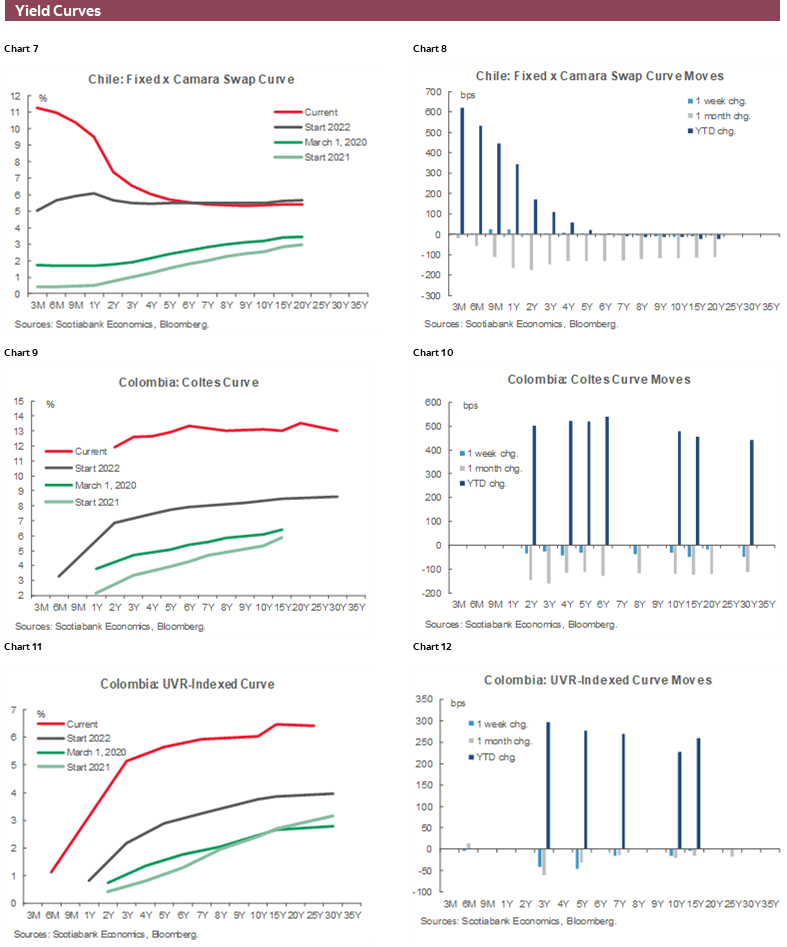

In recent months, inflation expectations have sharply fallen towards the central bank’s target. But, should we expect a convergence of inflation expectations to 3%? In our view, the current level of inflation expectations incorporates an external component that is outside of the central bank’s responsibilities. Inflation among Chile’s main trading partners remains near its highest levels of the cycle and well above their respective central banks’ targets. Abstracting from external factors, we believe that the convergence of inflation to target in Chile is almost complete. Thus, the BCCh has an opportunity to reduce possible damage to the most impacted economic sectors via a cut to the reference policy rate in the short term. We believe that the next monetary policy meeting (December 6) will be a good opportunity to communicate a dovish bias, paving the way for a big cut at the January meeting. On Thursday, December 1, we will know the results of the Financial Traders Survey, which should continue to show a decline in inflation expectations (chart 1).

Colombia—December Begins with a Packed Agenda

Sergio Olarte, Head Economist, Colombia

+57.1.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

María Mejía, Economist

+57.1.745.6300 (Colombia)

maria1.mejia@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.1.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

It was a quiet week in terms of macro data for Colombia. However, policymakers provided some relevant guidance on key topics. The MoF, José Antonio Ocampo, said that Colombia wants to return to the international market with global bond issuance using multilateral warranties such as the World Bank or the IADB. In the same vein, Ocampo said that the Pension Reform, and any reform will be contained to maintain fiscal stability.

At the same time, Deputy Finance Minister, Diego Guevara said that the increase in the minimum wage would be around 15%, as initial demands from labour unions are around 18% and, the government sees a 13% plus productivity. Minimum wage discussions begin in December with the release of economic growth projections, inflation expectations, and productivity estimates. December 15 is the first deadline to reach an agreement on the minimum wage, although negotiations could be prolonged. However, if there is no agreement by December 30, the government will establish the increase by decree.

On the other hand, BanRep’s board member Roberto Steiner said that he disagrees about FX intervention measures to influence the exchange rate trend. Instead, he said that intervention would be justified only in situations when volatility is due to thin liquidity. On Friday, BanRep decided against intervening in FX markets at its non-rate-setting meeting.

In the week ahead, the country’s statistics agency will release labour market statistics for October, where we expect that the reduction in the unemployment rate will be moderate as people return to the labour market (recovery in the participation rate). Job quality is key as informality is at 58.8% nationwide and 45.1% in urban areas.

On Thursday, December 1, the central bank is expected to release the balance of payments report for Q3-22 that should show a higher current account deficit than in Q2-22. A strong economy backed by a rebound in investment lifted imports to a record high, while on the export side the positive effect from international commodities prices was partially offset by lower mining production. Remittances remained high, which would contribute to a narrowing of the current account deficit. On the financing side, FDI is expected to be the main source, reflecting the growth in investment spending.

Friday, December 2 is scheduled as the third VAT holiday of the year. However, the government is working on a decree to cancel this day, arguing that it is not clear if this day provides an impulse to the domestic economy. Our estimation points to a VAT holiday effect of minus 0.06ppts on headline inflation.

Mexico—FDI Data Through Q3 Continue to Show a Recovery in Investment

Eduardo Suárez, VP, Latin America Economics

+52.55.9179.5174 (Mexico)

esuarezm@scotiabank.com.mx

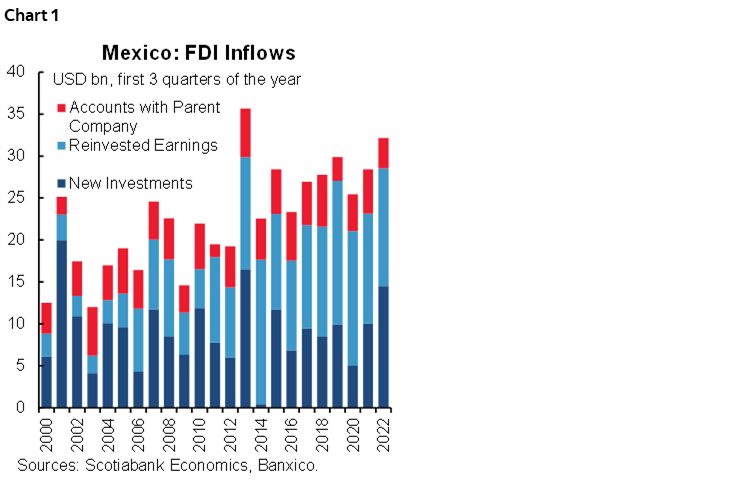

Banxico published Q3-22 foreign direct investment data earlier this week showing a continued recovery in foreign capital flows from their 2020 pandemic low. For the first nine months of 2022, FDI topped USD32bn (chart 1), netting a near USD7bn improvement from the pandemic nadir.

Of total FDI, 45% was new investments, and by origin, countries from outside the USMCA block accounted for a growing share, suggesting some of the inflows are seeking to increased production in Mexico owing to the trade treaty’s rules of origin restrictions. It seems likely that total FDI inflows for the year will total between USD40bn and USD50bn.

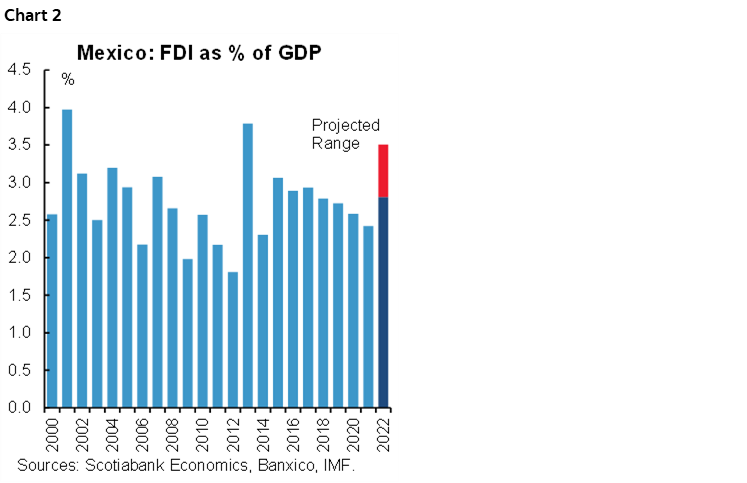

If FDI in fact reaches USD50bn in 2022, it would mean the current year has seen one of the three highest FDI/GDP ratios of the past two decades (chart 2) which would be good news indeed. Even a more conservative estimate still suggests a strong recovery in investment flows from abroad and that nearshoring-related investment is flowing.

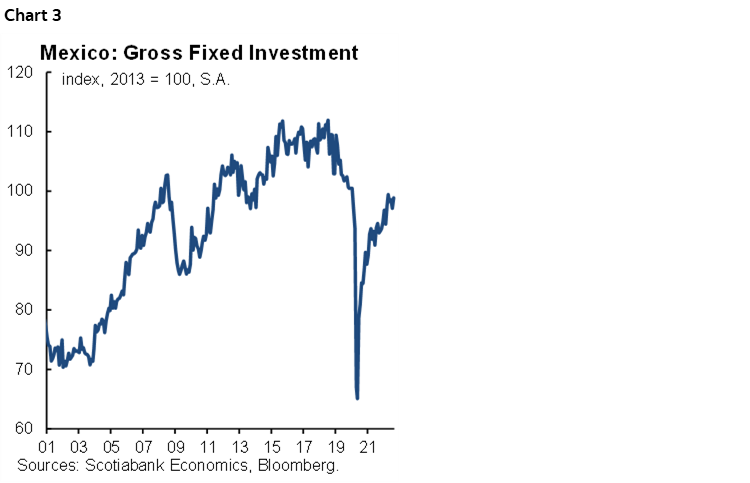

However, as we have written in the past, it’s hard to separate pent-up investment from the pandemic from a structural improvement in flows, and at the same time, structural constraints to investment such as power scarcity, low investment in renewables, high tax costs, and security are hurdles to foreign flows. In addition, despite the consistent recovery in Mexico’s FDI, gross fixed investment is still at relatively low levels around those seen in 2013 (chart 3). It’s worth bearing in mind that FDI is a balance of payments concept (which over coming quarters should see a negative impact from a likely sale of Citibank’s Banamex unit to Mexican buyers). The number that feeds into GDP growth numbers is investment, and although fixed investment is showing a very important recovery, as shown in the accompanying graph (chart 1 again), it remains at depressed levels.

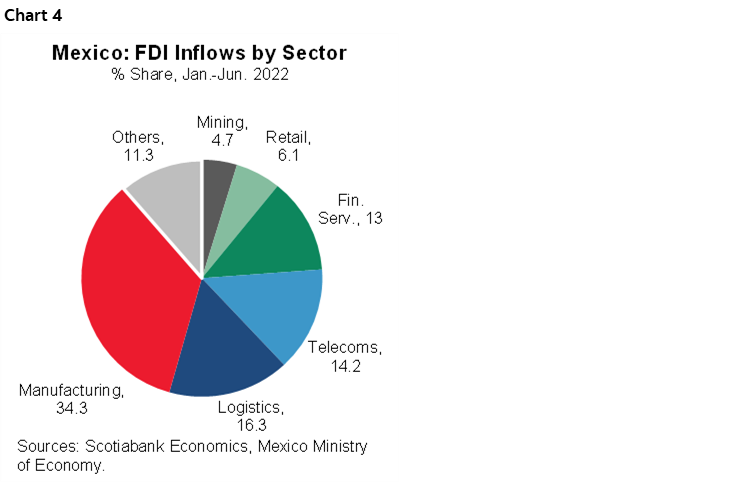

By industry, manufacturing (34%), logistics (16%), telecoms (14%) remain the dominant sectors in FDI receipts (chart 4), supporting the view that the North American supply chain consolidation will benefit Mexico. In addition, financial services, one of the three fastest growing sectors in Mexico for the past two decades was also a top target for FDI, and is likely benefiting from inflows into the growing FinTech sector in Mexico.

Peru—A Country on Pins and Needles Regarding Inflation, Monetary Policy, and Politics

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

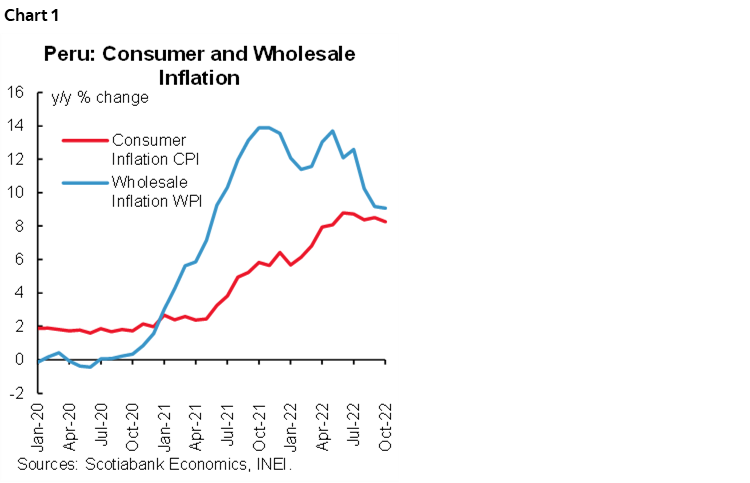

Inflation for November, to be released next Thursday, will be crucial to determine whether the BCRP will raise rates the following week. The key prices that we monitor have been more volatile than usual in November. The most recent estimate points to a monthly inflation that would be in line with the 0.4% monthly inflation figure of November 2021. If so, year-on-year inflation would remain close to the latest print of 8.3% (chart 1). Note, however, that our estimates at different moments in the month have fluctuated between 0.2% and 0.6%. What complicates matters further in the short-run is that a transportation strike began on November 22. In the past, similar strikes have had a short-term impact on inflation, depending on their duration. Our view at the moment is that inflation in November will likely be fairly close to the 8.3% registered in October.

This must be frustrating for the BCRP. Inflation simply seems unable to pierce the 8.0% floor. However, we expect that it will, eventually; more likely in December than in early-2023. Key prices, such as oil and soft commodities, are stabilizing, but the timeframe has been too short for base effects to take this into account. Wholesale price inflation (WPI) is leading this decline, softening from a peak of 13.9% in November 2021 to 9.1% y/y in October 2022. To the extent that inflation has been driven by global developments, the decline in the WPI should begin to weigh on CPI inflation soon. Barring any global surprises, we expect this to occur over the next four months.

Core inflation is not declining, however, and is starting to be a large part of the reason why inflation is stuck above 8%. We expect a decline in global key market prices to outweigh pressures in core inflation down the road, due to differences in their basket weights, but sticky core inflation could slow down the trajectory of headline readings. This is not an environment in which the BCRP would be comfortable in halting its reference rate hikes just yet. The BCRP has signaled that it is close to ending its cycle of increases, but not quite yet. It has also shown less concern regarding GDP growth or unemployment. The 1.7% y/y expansion recorded in Q3-22 was mediocre, though it should pick up to over 2% once the Quellaveco copper mine output is taken into account as of November. The unemployment rate in Lima rose to 7.2% in October, down from 7.7% in September. This is something the BCRP may find encouraging.

Meanwhile, an additional source of political noise is in play. The Organization of American States, OAS, sent a delegation to Lima from November 20 to 23 after the Castillo Government made a request for the application of the Inter-American Democratic Charter for the preservation of democracy in the country. The high-level delegation met with authorities from the executive, legislative, and judicial branches, as well as with a number of political, religious, business, labor, and grassroot leaders and organizations. The envoys must now submit a report to the OAS Permanent Council. The government hopes that the report will validate its contention that the opposition is intent on toppling the government, while the opposition would like to see the report recognize the extent of corruption that they claim the government is involved in. Although political leaders in the country are on pins and needles awaiting the report, we rather expect it will be carefully worded as to rock Peru’s political boat as little as possible.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.