ECONOMIC OVERVIEW

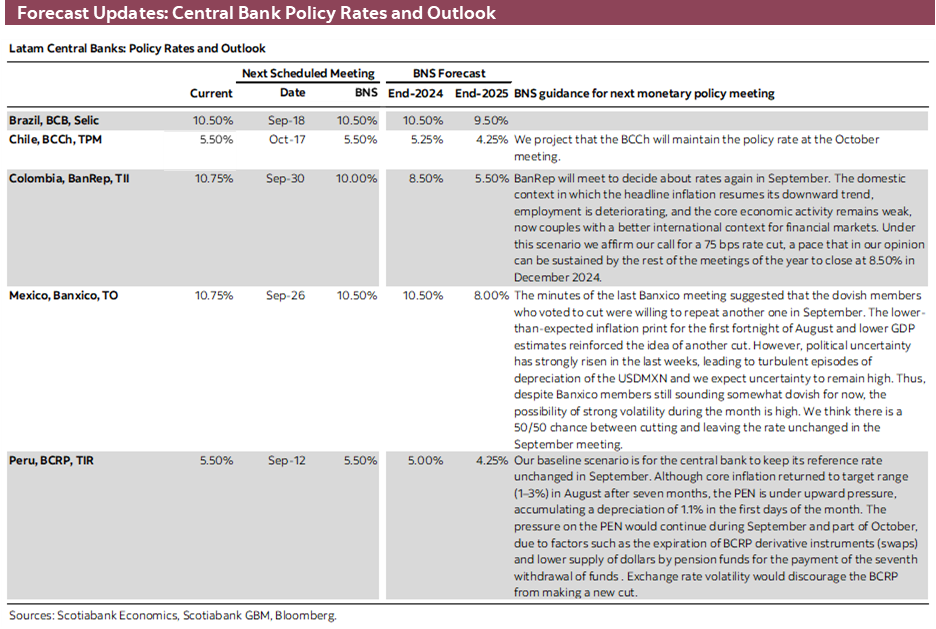

- Volatile trading will likely continue next week with key data releases and central bank decisions on tap across our main markets. CPI data out of Colombia (tonight), Mexico, Brazil and the US awaits, as does an uncertain BCRP decision and a sure-thing 25bps ECB cut.

- In today’s report our team in Colombia discusses recent fiscal developments and the possible impact of the truckers’ strike that just this morning was called off after an agreement was reached. Our economists in Chile go over the BCCh’s latest forecast revisions, while in Peru the team previews July GDP figures due on the 15th, with signs pointing to a strong month.

- Mexican senate commissions begin the approval process of the judicial reform on Sunday, followed by a reading on Tuesday, and debate and vote on Wednesday that will most likely give AMLO his first reform win of September. Mexican inflation is expected to slow in headline and core terms, giving Banxico ammunition to cut this month, with no major concerns regarding MXN weakness.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, Colombia, and Peru.

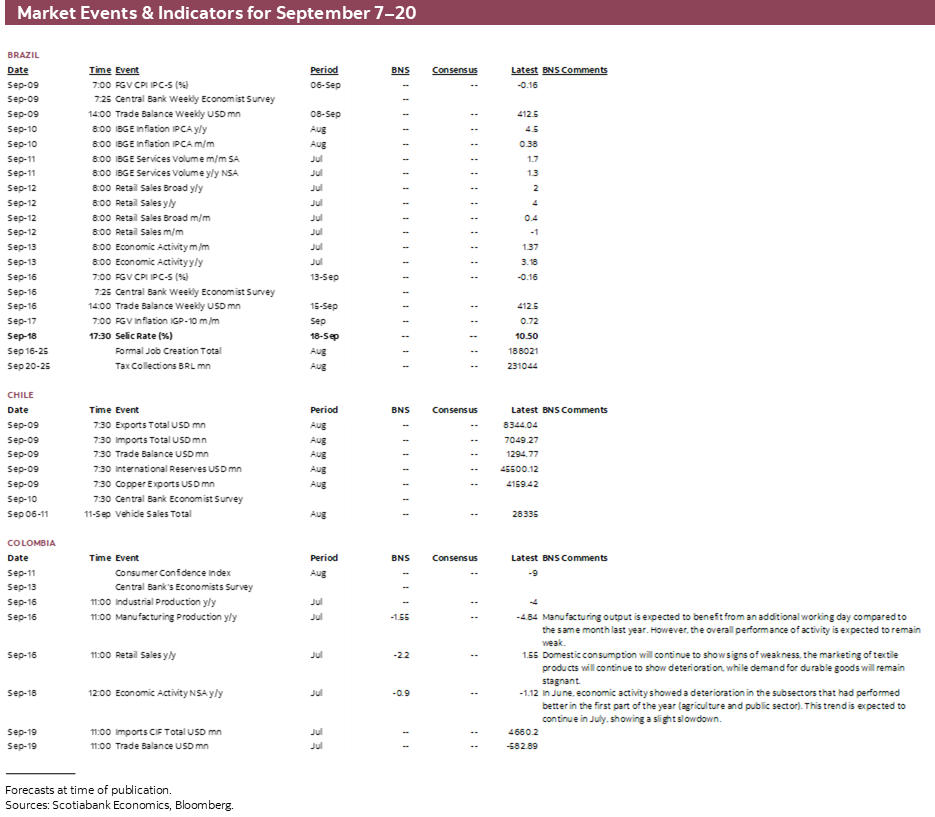

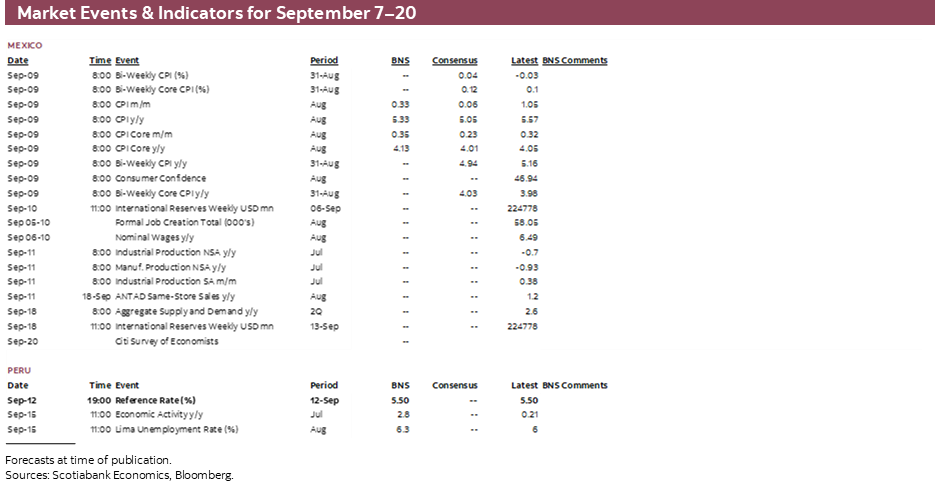

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period September 7–20 across the Pacific Alliance countries and Brazil.

Chart of the Week

ECONOMIC OVERVIEW: MEXICO AND BRAZIL CPI, MEXICAN SENATE TAKES UP REFORM, BCRP DECISION

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- Volatile trading will likely continue next week with key data releases and central bank decisions on tap across our main markets. CPI data out of Colombia (tonight), Mexico, Brazil and the US awaits, as does an uncertain BCRP decision and a sure-thing 25bps ECB cut.

- In today’s report our team in Colombia discusses recent fiscal developments and the possible impact of the truckers’ strike that just this morning was called off after an agreement was reached. Our economists in Chile go over the BCCh’s latest forecast revisions, while in Peru the team previews July GDP figures due on the 15th, with signs pointing to a strong month.

- Mexican senate commissions begin the approval process of the judicial reform on Sunday, followed by a reading on Tuesday, and debate and vote on Wednesday that will most likely give AMLO his first reform win of September. Mexican inflation is expected to slow in headline and core terms, giving Banxico ammunition to cut this month, with no major concerns regarding MXN weakness.

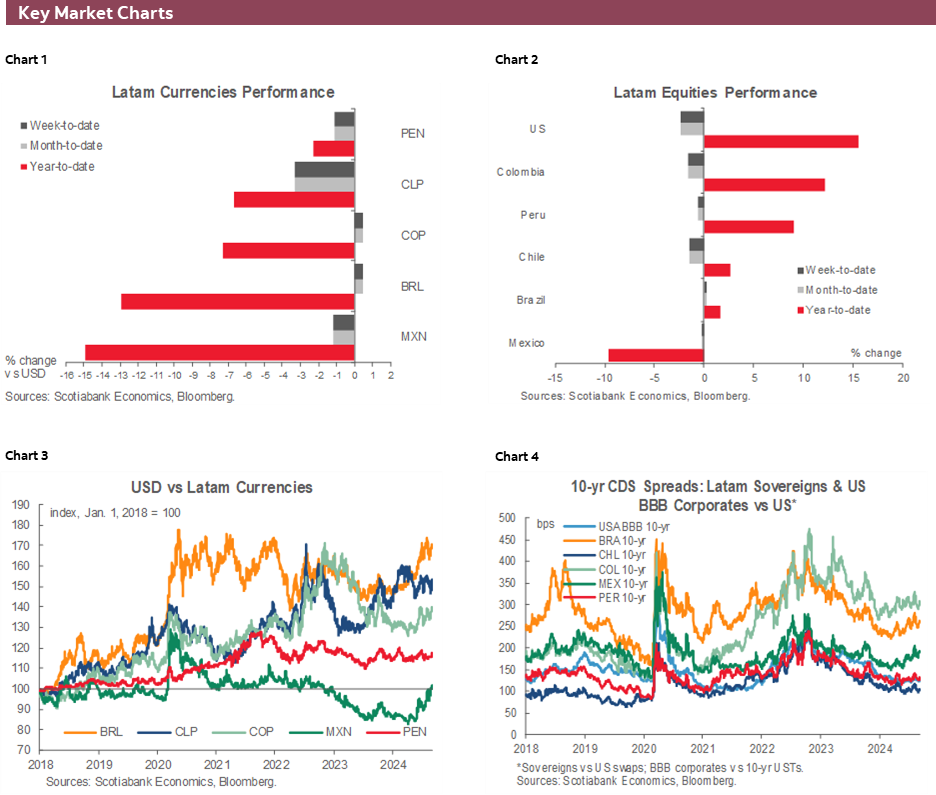

Volatile trading at the start of the month in G10 and Latam markets will likely continue next week with key data releases and central bank decisions on tap across our main markets. Over the past few days, a flood of key US data, the quick approval of Mexico’s judicial reform in the lower house, the BCCh’s more dovish than expected rate cut, and a nice decline in Peruvian core inflation for August were all important catalysts for a possible reassessment of policy or market expectations.

From now until next Friday, CPI readings out of Colombia (tonight), Mexico, Brazil, and the US will likely shake up local and international markets, as may the BCRP’s decision on Thursday which is again a tough one to call (despite core inflation falling below 3% in August) in contrast to the well-telegraphed 25bps cut expected by the ECB that same morning. Brazil’s inflation is due to decelerate decently in core and headline terms, but if at all it limits hike odds rather than tees up a restart of cuts. Chinese CPI and international trade, UK employment, wages, and GDP, and US PPI and U Michigan survey results are also on tap.

Aside from data and central bank announcements, political developments in Mexico and Colombia are in focus. In today’s report our team in Colombia discusses recent fiscal developments and the possible impact of the truckers’ strike that just this morning was called off as drivers agreed to the government’s revised diesel price hike. Our economists in Chile go over the BCCh’s latest forecast revisions, while in Peru the team previews July GDP figures due on the 15th, with signs pointing to a strong ~3% pace of growth with a boost from pension withdrawals.

On Sunday, senate commissions in Mexico will discuss and very likely approve the judicial reform decree submitted by the lower house after the proposal succeeded with 2/3+ support in votes on Tuesday and Wednesday. With the weekend’s small step out of the way, the Senate’s main chamber will have a first reading of the proposal on Tuesday, for an eventual debate and vote on Wednesday.

Some may be holding out hope for a defeat of the reform in Senate, as President AMLO’s ruling coalition only has 85 of 128 seats in the upper chamber and thus not quite the two-third qualified majority needed for the approval of constitutional amendments. But, comments by Morena leaders suggest they may claim 85 is enough (2/3s of 128 is 85.33, round down to 85?) or very simply pull another senator from another party (rumoured to be from the PRI).

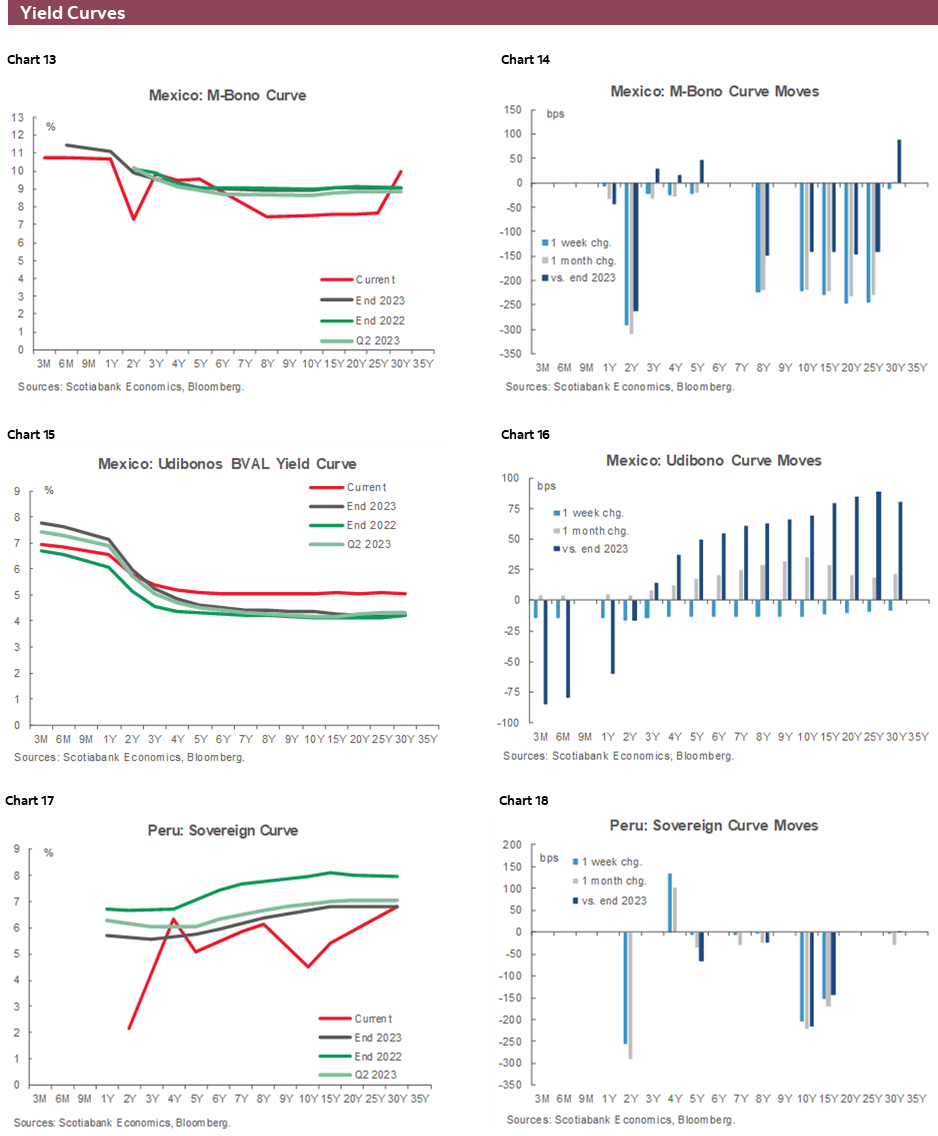

Mexican peso weakness that may continue in the near-term amid business/investor uncertainty due to AMLO’s September reforms rush (before Sheinbaum takes office on October 1st) could possibly be countered by a less dovish stance by Banxico’s board. However, we think it’s unlikely that officials will deviate from what looks like a preset path to a 25bps cut on the 26th, supported by weakening growth and the start of the Fed’s cutting cycle. It would likely take a pronounced capital/currency flight for Banxico to consider holding back on cuts.

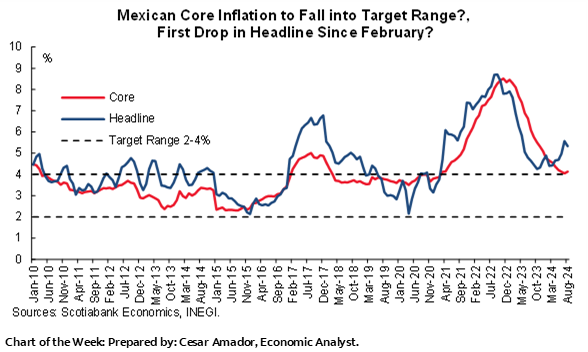

To boot, there’s limited exchange-rate pass through to inflation in Mexico, and next week’s August CPI data are expected to show the first slowing of headline inflation since February (from 5.6% to 5.0%) and core inflation possibly falling inside the 2–4% target range as it just grazes the 4-handle. Manufacturing and industrial production data out on Wednesday may also reinforce the idea that Mexico’s economy has shifted into a lower gear—a gear in which it will likely remain until there’s more clarity on the political front, namely around US elections as far as manufacturing is concerned.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—The BCCh Points to a Faster Pace of Cuts

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

- The cuts will be concentrated throughout the first half of 2025

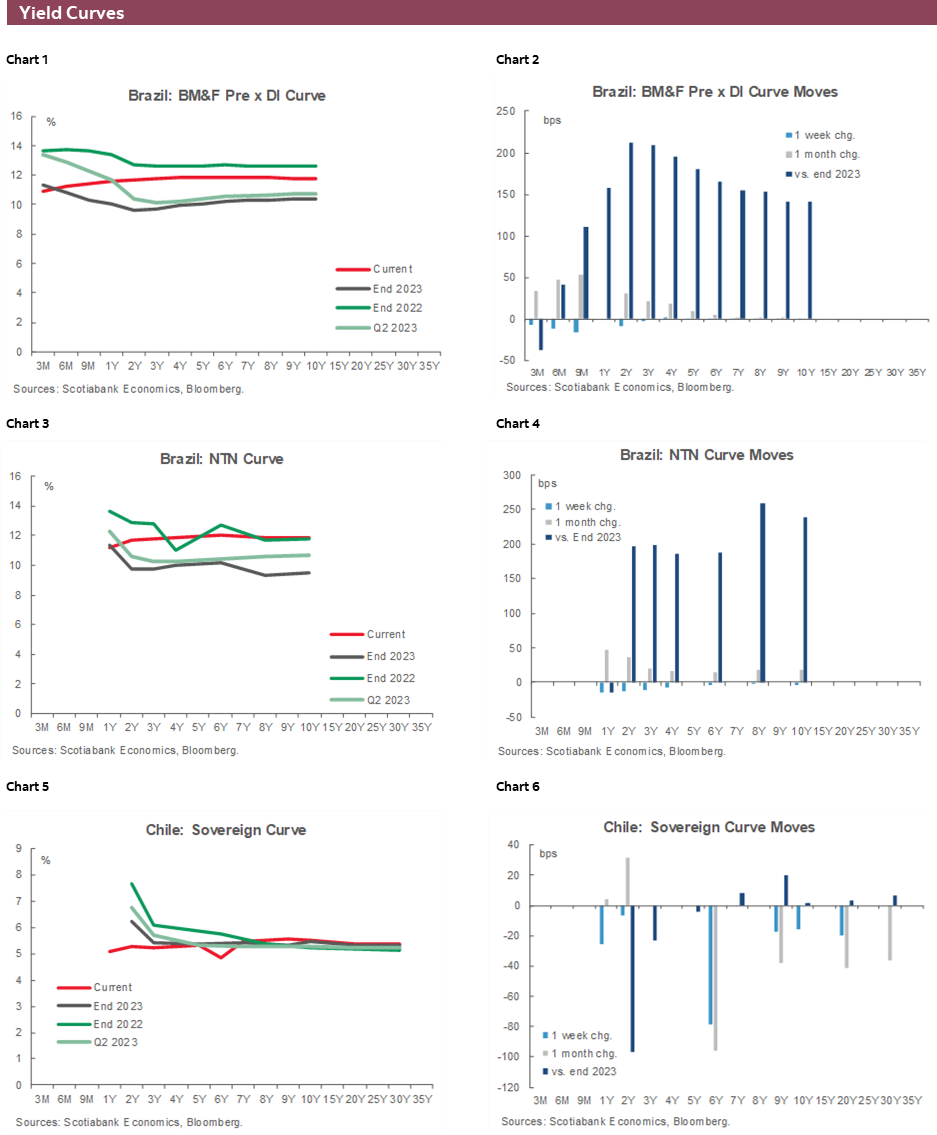

On Wednesday, September 4th, the central bank (BCCh) released its September IPoM (monetary policy report), in which it slightly decreased its GDP growth projection for this year from 2.7% to 2.5% (range of 2.25% to 2.75%), below our projection of 2.7%. By spending components, the BCCh revised downwards its private consumption growth projection to 1.7% (previously 2.5%) as well as its investment projection to -0.8% (previously -0.3%). With this, the BCCh adjusted downward its estimate of the output gap, which would have been practically closed since Q3-24.

Regarding inflation, the BCCh raised its projection from 4.2% to 4.5% y/y for December 2024—in line with our projection—mainly due to a greater upward impact resulting from volatile items this year. Despite this, the core inflation projected for this year and the next remained stable.

The central bank also modified the working assumption for the policy rate for December of this year, from 5.5% to 5.25%. Undoubtedly the news from the Fed and the depreciation of the DXY seem to have contributed somewhat to this revision, giving greater confidence to the BCCh regarding inflationary convergence despite the significant increase in costs linked to the increase in electricity rates. With this, the central bank’s base scenario adds 50bps of cuts during the first half of 2025 compared to June’s IPoM.

At Scotiabank, we expect a rebound in economic activity in the Q4-24, so we do not expect an accelerated pace of cuts before March of next year, conditional on inflation prints in the coming months. Due to the dovish view from the BCCh, we project the CLP ending at 890 this year and 870 in December 2025. Along the same lines, the BCCh modified downwards its projection for the average price of copper for this year to 4.15 dollars per pound. However, the BCCh continues to project a gradual appreciation of the RER for the projection horizon. Finally, the BCCh ratified its previous real neutral interest rate estimation of 1% (4% in nominal terms).

Colombia—Fiscal Constraints and Recent Developments in Colombia

Jackeline Piraján, Senior Economist

+57.601.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

Daniela Silva, Junior Economist

+57.601.745.6300 (Colombia)

daniela1.silva@scotiabankcolpatria.com

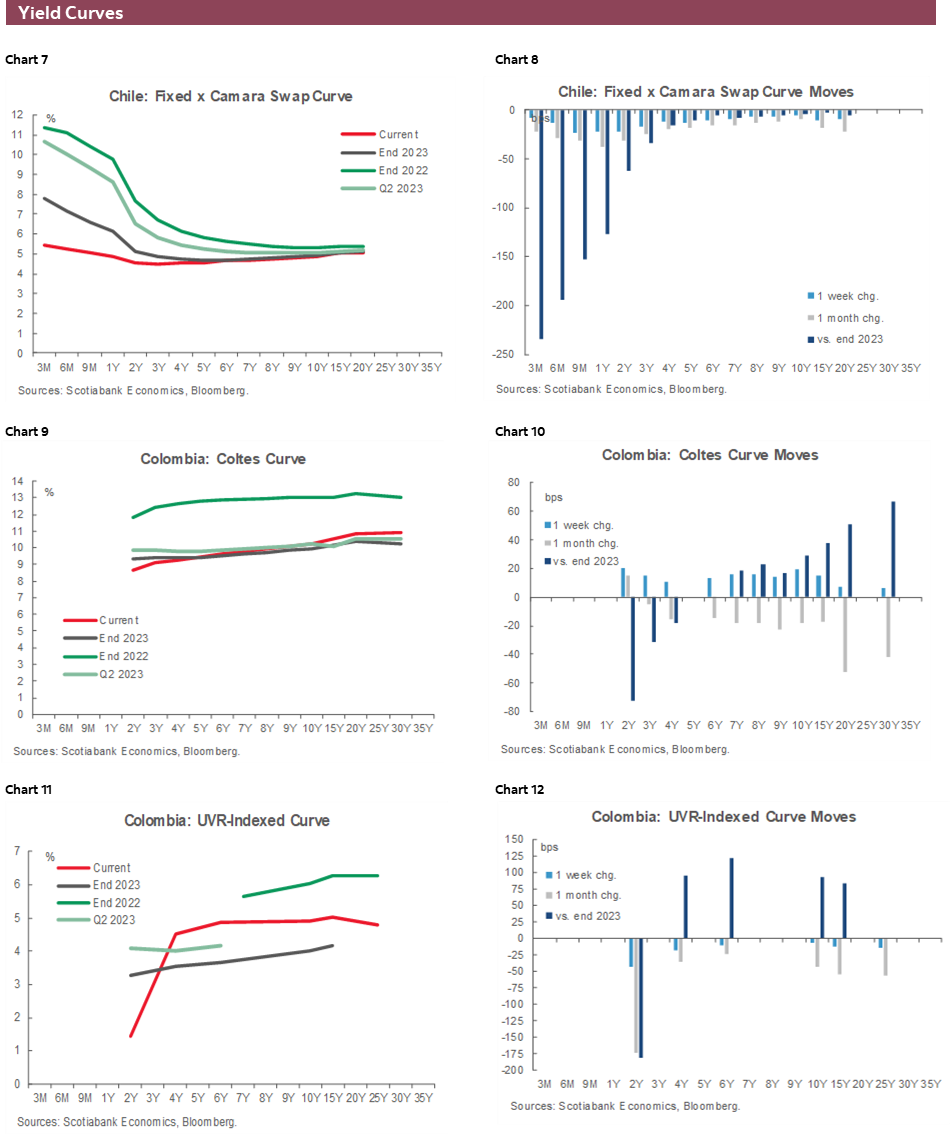

After crossing the halfway point of the presidential period, the government is facing a significant restriction in the fiscal scenario. Since 2023, the economic slowdown has been material, and it has translated into substantial constraints in terms of tax collection. This occurs at a moment when the government wants to pursue an ambitious spending agenda and the economy is also demanding impulse measures.

In September, the government is discussing the size of the 2025 budget with Congress, with a proposal of COP 523 tn that represents a 4% annual increase that combines a rise of 19% in debt payments and a contraction of 17.4% in investment. This budget assumes an increase of fiscal revenue of COP 31,1 tn, part of which will come from higher efficiency of the tax collector DIAN (+COP 14.6 bn), which can be considered as optimistic, meanwhile around COP 12 bn needs to be financed through a tax reform; a debate that is still to come.

Fiscal constraints are motivating diverse government announcements, which increases speculation around the potential content of fiscal reform. However, there are a couple of points that deserve to be analyzed.

1. Negotiation for economic impulse measures. The government considered imposing forced investments by private banks, however, after several discussions with the banking association (Asobancaria), this proposal ended up in an agreement called “Pacto por el crédito,” in which private banks committed to increasing loans in the forthcoming eighteen months to five sectors: housing, manufacturing, agriculture, tourism, and Economía Popular. This was very welcome and was a demonstration of cooperation with the private sector.

A couple of days after this agreement, the central bank announced the reduction of the reserve requirement ratio by 1%, which coincides with the new necessity of banks to increase credit disbursements. This measure provides relief in the liquidity of the economy, but also it will probably reduce the necessity of the central bank to finetune the liquidity using the COLTES purchases. The liquidity relief is around COP 6 tn pesos. It will be relevant to monitor if this measure was a signal from the central bank to complement the expansionary stance of the monetary policy, avoiding the acceleration in the cutting cycle. In our opinion, the central bank still has room to accelerate the easing cycle.

2. Budget constraints finally triggered the increase in diesel prices. By the end of August, the government announced the increase of 1904 pesos, interrupting fifty-six months of freezing, which triggered discontent across truck driver associations.

In the past, the government could afford the subsidy; however, in 2024, the story says otherwise. The government is paying the Oil Prices Stabilization Fund (FEPC in Spanish) using COLTES. In the Medium-Term Fiscal Framework presentation, the MoF estimated payments to Ecopetrol using this mechanism at COP 7 tn. In fact, every month that the diesel prices are frozen increases the FEPC deficit by COP 1 bn, which explains the necessity of increasing prices.

That said, there is limited room to negotiate since increasing the diesel price is fiscally correct; however, the cost is the truck driver's protest. The government and truck drivers reached an agreement early on Friday. For now, they agree to increase diesel prices by 400 pesos in September and 400 pesos in December, something that kicks off the reduction in the FEPC deficit. However, this leaves the door open to potential future hard negotiations to close the gap on prices in 2025.

Now the question is, what will the economic impact of the strike be? We know that the severity depends on the strike’s duration. Inflation in some food products, especially perishable food that represents 3.5% of the CPI basket, has increased 26.5% on average up to September 4th, compared to Friday, August 30th. However, as the strike ended on early Friday, September 6th, we could even have a disinflationary effect as perishable goods could arrive deteriorated in the cities, and their price could go significantly down. It is worth noting that the statistical base effect of food inflation for September 2023 was high (0.74% m/m), and in headline inflation, it was also high (0.54% m/m); that said, the strike effect could not be material to interrupt the slowdown on inflation. For now, we aren’t changing our CPI inflation forecast for the year-end of 5.6%.

On the economic activity side, the interruption of regular activities immediately translates into lower GDP. In 2008, the 16-day truck drivers’ strike contracted the economy by 1.7% m/m, while the strike in 2016, which lasted 46 days, had a cumulative effect of ~3% economic contraction. In the case of the September strike, we think that the potential economic impact is difficult to reverse.

All in all, fiscal issues are in the spotlight, while secondary effects of government actions raise questions about the capacity of the central bank to accelerate the easing cycle. Is reducing the reserve requirement a substitute for a more aggressive rate cut? We don’t think so for now. Are the truck driver strikes a critical challenge for inflation? In our opinion, two impacts will have to be debated by the central bank: inflation, which could have an inflationary but temporary impact, and growth, which could be the most concerning one given the current stance of the economic cycle. As highlighted before, it is essential to continue monitoring the strike’s duration. We continue to favour a 75bps rate cut in the forthcoming BanRep meeting.

Peru—GDP Growth and Inflation Begin to Settle Down to Long-Term Trends

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

On September 15th GDP figures for July will be released. The figure will be interesting for what it tells us about what households are doing with the windfall income they are receiving from pension fund withdrawals. Specifically, how much is being directed towards consumption.

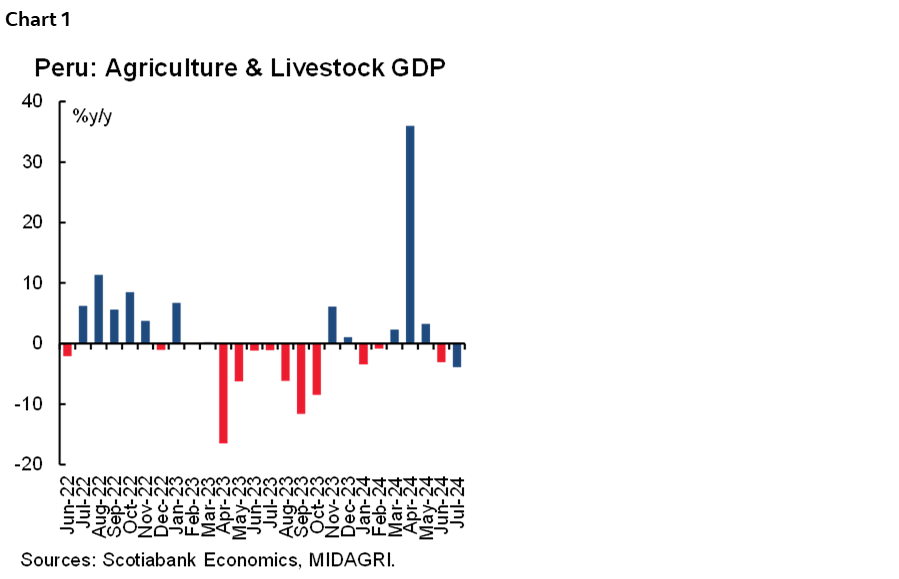

Meanwhile, the figures we have been receiving point to around 3.0% YoY GDP growth for July, which means we see a bit of upside to our 2.8% GDP growth forecast for July. The main reason for a quota of optimism is the expected impact of pension fund withdrawals on consumption. In contrast, resource sectors, figures of which have already been released, are mixed and eclectic. The most recently released figure was agriculture, down a disappointing 7.0% on its own, and -3.9% when livestock is included (chart 1). Agriculture production has been very volatile in 2024, in response to the seasonal havoc wreaked by El Niño in 2023.

Other previously released figures included in our forecast are mining, +0.7%, fishing, +14.9%, and oil % gas, +21.6%. Furthermore, cement demand, a component of construction GDP, fell 0.5% YoY. On the plus side for construction, government investment rose 34%.

What has yet to be released are figures indicative of private consumption. It will be interesting to see the impact of pension fund withdrawal, requests of which total PEN 27bn (USD7.1bn), or about 2.4% of GDP. A large chunk of this will be delivered to households in July. We are already seeing the consequences in banking deposits, which rose 5.5% in July over June. But, this is a passive figure, as withdrawal payments must be made to bank accounts. It will take time for households to dispose of these resources in more meaningful ways. One way is improving household balances by reducing bank debt. This has also begun to occur. In July consumer bank debt outstanding fell by 1.5% versus the month previous. This is a lot for a month.

What we do not know is how much of the withdrawal windfall is being used for consumption. We will become better informed on September 15th. In the meantime, anecdotal evidence suggests a surge in department store sales of electronic appliances during the month. Vehicle sales, which had been lagging, would also have had a good month. We are hesitant to be too aggressive in our guesswork as to how this will bolster growth in GDP in July, but suffice it to say that we see an upside to our figure.

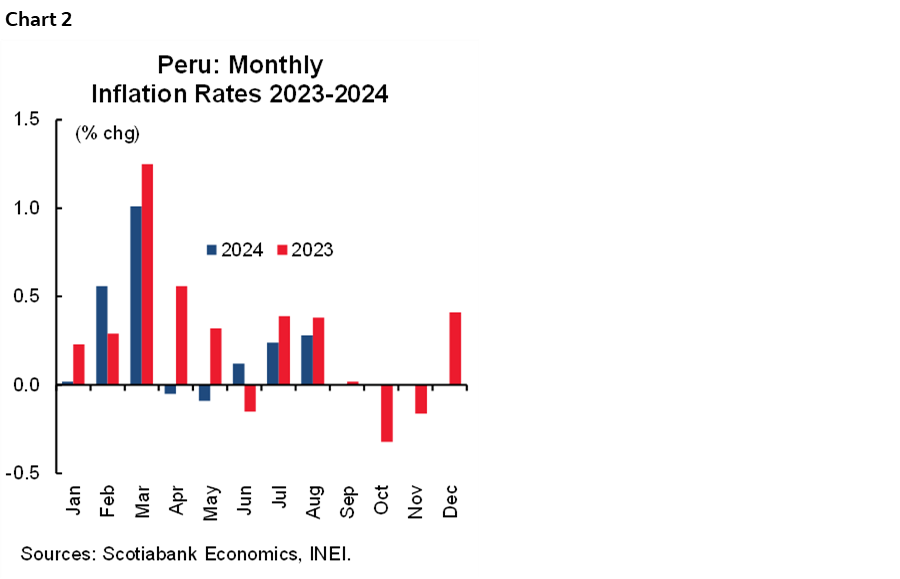

A word on inflation. We recently raised our forecast for 2024 from 2.4% to 2.5%. The fact is, the point of inflation has been reached. Inflation continues to be low. The key prices we monitor point to 0.15% for the month of September (take with a pinch of salt, as its very early days still), but even this low figure raises yearly inflation to 2.1%, from 2.0% in August. October–November will be even more difficult, because we will be comparing with negative monthly inflation in this period in 2023. Thus, our expectation that inflation will rise from 2.0% currently, to 2.5% by year end (chart 2).

Core inflation is another matter. Core inflation, at 2.8% yearly to August, has finally fallen within the BCRP target range. We believe it will stay within this range. The bottom line is that stable inflation and core inflation within target range will give the BCRP the space to continue to lower its reference rate at a leisurely pace.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |