HIGHLIGHTS

As national growth continues to follow its expected trajectory of decline, the influence of recent idiosyncratic risks should prove relatively minimal in altering the course forward. Weather-related disturbances and the strike dampened growth in Q2, resulting in a slight contraction in real GDP. But excluding net trade and inventory effects, the domestic economy still expanded 1%, only a slight decrease from the 1.2% in Q1. Idiosyncratic risks such as wildfires might have shaved over -0.1% off Q2 GDP and should continue to weigh on certain provinces, with impacts most pronounced in the mining sector in Quebec and agricultural activities in the prairie provinces, but are unlikely to alter the paths forward. Economic activity is nevertheless expected to stall in the coming quarters, looking through these transitory shocks. Despite the strength in the first half of the year, most provinces outside of the Maritime provinces are projected to end the year with sub-par growth rates, though the likelihood of an full-blown recession remains low.

Growth ranking remained relatively unchanged as signs of a slowdown became more prevalent in some provinces (chart 1). Alberta maintains its position as the front-runner of growth this year, fueled by a surging population and a positive outlook for commodity prices. Ontario has slightly outperformed the national average and should continue to be boosted by upside in business investments. British Columbia experienced sharper slowdowns but is now showing early signs of stabilization, although challenges still lie ahead. Saskatchewan, initially sheltered from the downturns thanks to lower household indebtedness and a robust natural resource sector, is now grappling with declining momentum due to dry crop conditions and reduced potash production. While natural disasters cast a shadow over recent activity in the Maritime provinces, the ongoing population surge and tourism boom justify growth rates above historical trends in these provinces.

Hiring inevitably decelerated in most provinces due to the delayed effect of monetary policy tightening (chart 2). Provinces that initially experienced sharp declines in hiring, such as British Columbia and Quebec, are now displaying signs of stabilization. In contrast, Saskatchewan and Manitoba are grappling with more pronounced headwinds and should see employment contract in the upcoming quarters. The slowdown is least pronounced in Alberta and PEI, where employment continues to grow at an annualized pace exceeding 4%. A subdued participation rate in many regions outside of Ontario has helped keeping a lid on the unemployment rate in an environment of declining employment growth and surging population. Nevertheless, the unemployment rate is on the rise across the country (except for Newfoundland and Labrador), with most provinces witnessing rates that are 2–3 ppts higher than their lowest points from last year. We expect the ongoing moderation in hiring to continue pushing the unemployment rate upward through mid next year.

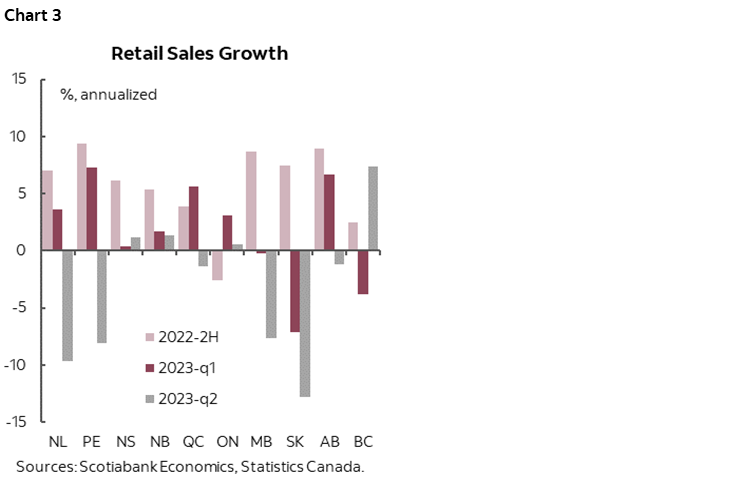

A broad-based slowdown in consumer spending is in progress with no exception (chart 3). Growth in real household spending decelerated sharply to 0.2% on an annualized basis in the second quarter of 2023 as per capita spending contracted by 0.7% q/q. Continued tightening in real rates through more disinflation is expected to persistently impede spending well into 2024, eroding some growth advantages in certain provinces. Consumers in Manitoba and Saskatchewan have started to feel the pinch of elevated inflation and interest rates, resulting in sharp declines in retail sales this year. British Columbia and Ontario, where the consumer sector growth stalled first following BoC’s rate liftoff, have been posting some small gains this year, although growth remain muted nevertheless. Quebec’s consumer sector has displayed incredible resilience compared to the rest of the country but cracks have started to appear as the impact of significant government income support dwindles.

The housing markets have shifted into a wait-and-see period, with headline activities returning to more normal levels, albeit with major regional differences in response to additional rate hikes and further tightening in longer-term borrowing costs (chart 4). Resale activities in Ontario and British Columbia have proven to be highly sensitive to rate changes and made a U-turn following the Bank of Canada’s insurance rate hike in July, and the continued descent should impede the growth prospects this year. Quebec has also seen a drastic contraction in residential investments. The housing rebound in other provinces remains largely resilient, with oil-producing provinces maintaining sales rates well above pre-pandemic trends. Residential investments should continue slipping throughout the year, although the speed of decent has evidently slowed. In 2024, anticipated reductions in borrowing costs are likely to release some pent-up demand across all housing markets, particularly in Ontario and British Columbia, where current sales rate sit well below fundamental levels. These provinces could expect the largest growth in the residential sector next year, accompanied by some erosion of housing affordability.

Despite rising business investments as of the second quarter this year, capital stock continues its decent on a per capita basis in all provinces except for British Columbia, weighing on growth prospects moving forward (chart 5). Non-residential investments have shown some incredible resilience despite tightening financial conditions, rebounded from pandemic-induced lows, and has returned to 2019 levels in real terms. British Columbia stands out with its steady uptrend in non-residential investment with growth well above the rest of the country, which helped compensate for some growth losses in the residential sector. Ontario holds the second position in terms of business investments, with significant investments in electric vehicle (EV) plants continuing to support growth. In oil-producing provinces, namely Saskatchewan, Alberta and Newfoundland and Labrador, investment flows have dipped slightly compared to last year but have remained positive. However, the winds are shifting rapidly as the impact of rising interest rates takes hold. Business investment, which had initially been a catalyst for growth in the first half of 2023, is now turning into a drag to growth in some provinces. This effect is particularly pronounced in the Maritime provinces, where investments have already contracted. The declining levels of capital stock, exacerbated by the impact of high interest rates, will dampen worker’s productivity and variably constrain provinces’ potential growth.

Demand for Canadian exports has remained robust, supporting strength in the manufacturing sector, while stronger headwinds could be anticipated in 2024. US economic growth is tracking very positively in the third quarter and will likely finish the year with real growth around 2%, but it also braces for a sharper slowdown in the following year. Within the manufacturing sector, durable goods have been experiencing an uptick in activity, while non-durable goods have constantly posted declines. Benefiting from steady demand from the US, Ontario and Quebec could expect some resilience in non-energy exports. Ontario, in particular, stands to further gain from pent-up demand in the auto sector following curtailed auto production due to supply chain disruptions. On the other hand, growth in British Columbia is further hampered by plunging exports and manufacturing shipments.

Robust oil prices provide modest growth upside for oil-producing provinces, but constrained by production disruptions. The wildfires in Alberta have led to production curtailments, resulting in a -15% production decline in the second quarter. Saskatchewan’s production remained relatively unaffected, while output in Newfoundland and Labrador continued to trend more than -10% below last year’s already weak levels. With recent gains, WTI averaged US$82/bbl in the third quarter, with extended supply cuts from Saudi Arabia and Russia sustaining the strength.

BRITISH COLUMBIA

British Columbia continues to anticipate a tepid performance this year. Disruptive shocks such as the port strike and wildfires put a strain on growth, which justifies a slight downward revision to growth, but the growth trajectory forward is more predominantly determined by the province’s high household debt levels and vulnerabilities in its key industries. Despite some positive developments such as population growth and some early stabilization in the housing market helping to temper the slowdown, growth in British Columbia is expected to trail most of its peer provinces this year. Elevated household debt levels in BC have made it particularly susceptible to the impact of high interest rates, reflected in an evident slowdown in retail sales, which have been lagging the national average growth despite strength in recent months, suggesting a challenging year in household spending. With the most substantial rebound in housing resale earlier this year, BC will likely face less downside in the housing sector after experiencing the largest decline in resales last year, although it could be further curtailed by the tightening of long-term interest rates. Non-residential investment remained robust and continued to increase in real terms (chart 6), offsetting some of the weaknesses in the residential sector. We anticipate further drag to growth from the province’s exports, which should face strong headwinds once the backlogs created by port strikes are clear, with vulnerabilities especially pronounced in forest products.

ALBERTA

Despite temporary setbacks in the oil sector due to severe wildfires, Alberta’s economy continues to lead in provincial growth for 2023. The oil sector experienced a -17% drop in oil sands production in the second quarter, rebounded in the third quarter but output levels still sat at -18% below Q1’s strong performance. If the 2016 Fort McMurray wildfire is any guide, a swift rebound in production can be expected in the coming months (chart 7), setting the stage for another year of robust activity in the oil sector, especially given the tailwinds from strong oil prices and a narrow WCS spread. Drilling is ramping up, and the Alberta Energy Regulator expects oil and gas capital spending to increase by 18% this year and remain around levels higher than in years preceding the pandemic, yet still well below 2014 peak levels.

The interest-rated induced slowdown is less pronounced in Alberta. The province boasts higher employment gains than other parts of the country and anticipates strong annualized growth north of 4% in Q3, while many other provinces are witnessing a cooling in hiring. Strong population growth and a buoyant labour market support robust consumption amidst high interest rates and elevation price inflation, but a slowdown is still underway just like in the rest of the country, reflected in declining retail sales in the second quarter.

Resilience in Alberta’s housing sector stands out as a main growth advantage. Unlike the country’s overall -27% curtailment in resale activity last year, Alberta saw a minimal decrease of just -5%. This year’s rebound in activity has persisted even as additional rate hikes have subdued housing markets in other parts of the country. Sales prices have also been more stable in Alberta, with only a 6% decline from last year’s peak, in contrast to the national average of 15%. This could be attributable to the fact that housing in the prairies remained relatively affordable, having avoided the 50% price surge witnessed in the rest of the country during the pandemic.

SASKATCHEWAN

In Saskatchewan, the potential growth advantage from the oil sector is brought down by setbacks in crop and mining production outlook, limiting the province’s economic prospects. Severe drought conditions during the growing season have led to a significant reduction in wheat and canola output projections in Saskatchewan, with levels now estimated to be -18% and -6% below last year’s figures, respectively. Potash production was disrupted due to the Vancouver port strikes, through which the majority of its exports pass. Nutrien, a key player in the industry, has halted its production ramp-up plan as potash prices normalized to levels preceding Russia’s invasion of Ukraine. Production in the first half of this year declined by -13.4% compared to the same period last year, but total mineral sales remained elevated compared to historical levels with growth opportunities ahead (chart 8), especially in uranium production, which benefits from rising demand for nuclear energy. Capital investments anticipate another year of robust real growth, especially in the mining sector.

Cracks have starting to show in certain parts of the economy. The labour market in Saskatchewan is showing more vulnerabilities compared to the rest of the country, with employment contracting in the second quarter and expecting further losses in the third. The sluggish labour market performance has also played a role in dampening consumer spending within the provinces, as evidenced by two consecutive quarters of sharp declines in retail sales. Benefiting from its relatively affordable housing markets, Saskatchewan saw the largest population gain outside of the Maritime provinces and Alberta this year, providing a buffer to the consumer sector.

MANITOBA

Manitoba’s resilient economy and well diversified industries position itself for a moderate expansion in line with the national average (chart 9). The province is also contending with dry growing conditions, but the impact is more muted than in Saskatchewan due to expanded harvested areas. Manitoba’s vital manufacturing sector enjoyed a strong first half of the year, with durable goods shipments up 13% year-to-date, surpassing the 6% national average growth rate. Solid domestic and global demand for Manitoba’s exports further bolster economic growth.

The consumer sector is showing more weaknesses than the rest of the country, with retail sales on a steady decline this year. Employment is losing some steam and should start to contract in the third quarter after posting middle-of-the-pack performance in previous quarters, further weighing on household spending. Residential investment in Manitoba declined faster than other Prairie provinces, but at a pace in line with the national average. Meanwhile, non-residential investments outperformed most provinces, giving Manitoba’s growth prospects some edge.

ONTARIO

Ontario’s economy outperformed the national average in the first half of the year despite taking a larger hit in rate sensitive sectors, and we expect strength in manufacturing and business investment to help the province avoid a sharp downturn as the ongoing monetary policy tightening takes full effect. A slowdown is evident in Ontario, yet the province exhibits considerable resilience and a strong buffer. Employment growth in Ontario slowed as in the rest of the country but remained positive in the third quarter. Ontario is the only province that has seen participation rate return to pre-pandemic levels, and the continued pick-up in labour force growth coupled with high participation rate drove unemployment to over 2 ppts higher this year. High debt servicing costs are challenging household consumption in Ontario due to the province’s substantial indebtedness, keeping a lid on consumer spending and overall economic growth. With strong population growth and robust fundamental demand, recent drops in homes sales in the third quarter following the Bank of Canada’s additional hikes could stabilize soon.

The manufacturing sector and business investments are drivers to growth this year. Manufacturing of durable goods is experiencing a robust rebound this year, bolstered by the recovery in auto sales. The lingering pent-up demand resulting from disrupted supply over the past three years positions the sector well as a growth driver, but with significant downside risks due to demand erosion linked to affordability challenges, as well as looming strikes that could expose the sector’s vulnerability. The $25 bn investment in EV supply chain announced in recent years should offer a significant boost to business investment in the province. As Stellantis-LG and Volkswagen EV battery plants start to break ground, we anticipate that real non-residential structures investment will continue its gain for the remainder of the year, having achieved 6.7% increase in real terms year-to-date (chart 10). On the other hand, machinery and equipment investment faced strong headwinds and dropped by -6.6% so far this year, weighing on the headline.

QUEBEC

The downturn in Quebec has appeared more pronounced than the rest of Canada. The province’s real GDP contracted by an annualized rate of -1.9% in the second quarter, a much deeper decline than the slight -0.2% annualized dip in national GDP. The underperformance can be attributed in part to population, which is growing at half of the rate of that in the rest of Canada, constraining growth potential with lower aggregate demand and a more severe labour shortage. In per capita terms, the province’s real GDP also saw a sharper slowdown than the national average, with weaknesses most pronounced in residential investments (chart 11). Real residential investments continued its fifth quarter of double-digit decent, slumping to over -18% below pre-pandemic levels in the second quarter. The Bank of Canada’s resumption of rate hikes this summer curbed housing resale activity in the province and will likely keep sector growth subdued for the remainder of this year.

Household spending, after a period of incredible resilience, has turned into a drag to growth as support from an elevated savings rate and fiscal stimulus fizzles out. Consumers sector is poised to lose momentum as employment growth decelerates rapidly, and the province will see stagnant or even contracting hiring in the coming quarter. While 2023 saw an improvement in Quebec’s participation rate, resulting in a decent growth in the province’s labour force, the labour market is expected to remain tighter than the national average going forward. The province’s mining sector, accounting for one-fifth of national output, faced some setbacks in the second quarter due to mine closures caused by wildfires leading to a sharp reduction in iron ore mining. Nevertheless, the sector holds significant growth potential once it overcomes these near-term disruptions. The delayed slowdown in the US economy suggests a stronger-than-anticipated growth profile this year, which in turn supports the continued expansion of Quebec’s non-energy exports. However, there is a risk of a rapid deceleration in US growth next year, creating more headwinds to the province’s growth. Quebec’s longer-term economic prospects remain constrained by demographic challenges but opportunities in mining, manufacturing, and increasing hydroelectricity exports offer growth potential, especially as the province becomes an integral part of the EV supply chain through significant investments.

MARITIME PROVINCES

We expect above-average growth in the Maritime provinces, driven by a substantial population surge and robust household spending. The consumer sector in the Maritime provinces has demonstrated incredible resilience as anticipated. Retail sales have seen a strong 4% year-to-date increase with the rebound particularly notable in auto sales, which had underperformed the rest of the country last year albeit with some expected volatility in the near-term. While household spending is expected to slow down as the result of restrictive interest rates and the broader erosion of purchasing power from high inflation, the deceleration should be more gradual as consumption is well-supported by solid employment growth and the lowest household debt burdens in the country. Although there have been early signs of cooling in Nova Scotia. Labour demand remained strong in Prince Edward Island and New Brunswick.

The maritime provinces should continue to benefit from a historic population boom, which appears to have some lasting effects (chart 12). Net international migration has been the primary driver of population growth this year, accounting for over 70% of the increase, half of which was contributed by non-permanent residents (NPRs). Interprovincial migration trends have persisted in the first half of the year even as more workers return to the office, which suggests increased appeal of the region due to its many merits. The population gains have the effect of raising growth potential by adding to aggregate demand and, eventually, supply, providing a buffer against the slowdown in progress this year and next.

Following a moderate correction last year, home sales in the Maritime provinces remained at weak levels this year. Prince Edward Island stands out as an exception with its housing market still firing on all cylinders. While the region didn’t witness the same rebound as seen in British Columbia and the oil producing provinces, property values have appreciated significantly. Average sale prices have returned to their peak levels, which could provide some support for residential investment especially given the need for increased housing supply to meet demand from its population expansion.

NEWFOUNDLAND AND LABRADOR

Newfoundland and Labrador is poised for another challenging year with significant headwinds faced by its main industries but long-term prospects remain optimistic. Oil production was down -12.8% year-to-date, and the corresponding value decreased by -32.2% due to weaker prices earlier this year. The province is unlikely to capitalize on the upside in oil prices due to ongoing production constraints particularly with the Terra Nova reopening pushed out to 2024. Investment in the sector remains strong with construction activity under the West White Rose and Terra Nova projects, but further expansion in the sector depends on a decision on Equinor’s $16 bn Bay du Nord project. The mining sector also braces for more headwinds with declining mineral prices from last year’s high levels (chart 13). The province recently launched a Green Transition Fund using payments from West White Rose, which could potentially boost green investments in Newfoundland and Labrador.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.