Consumers racked up more credit and debit card transactions during the recent holiday shopping season, with higher volumes during late November and early December than a year ago, Scotiabank Economics' analysis of customer retail transaction data shows.

But activity dipped in mid-December, when various provinces such as Ontario, Quebec and Alberta imposed lockdowns aimed at curbing rising COVID-19 case numbers.

Following the conclusion of the holiday shopping season, consumer transactions continued to average below levels seen a year ago. However, growth in card transactions improved later in January, climbing back up to near 2020 levels, the report added.

This resilience seen in spending in January is perhaps a sign that the new restrictions had the largest impact during the usually busy post-Christmas (Boxing Day and year-end sales) shopping season, Scotiabank economists said in the report.

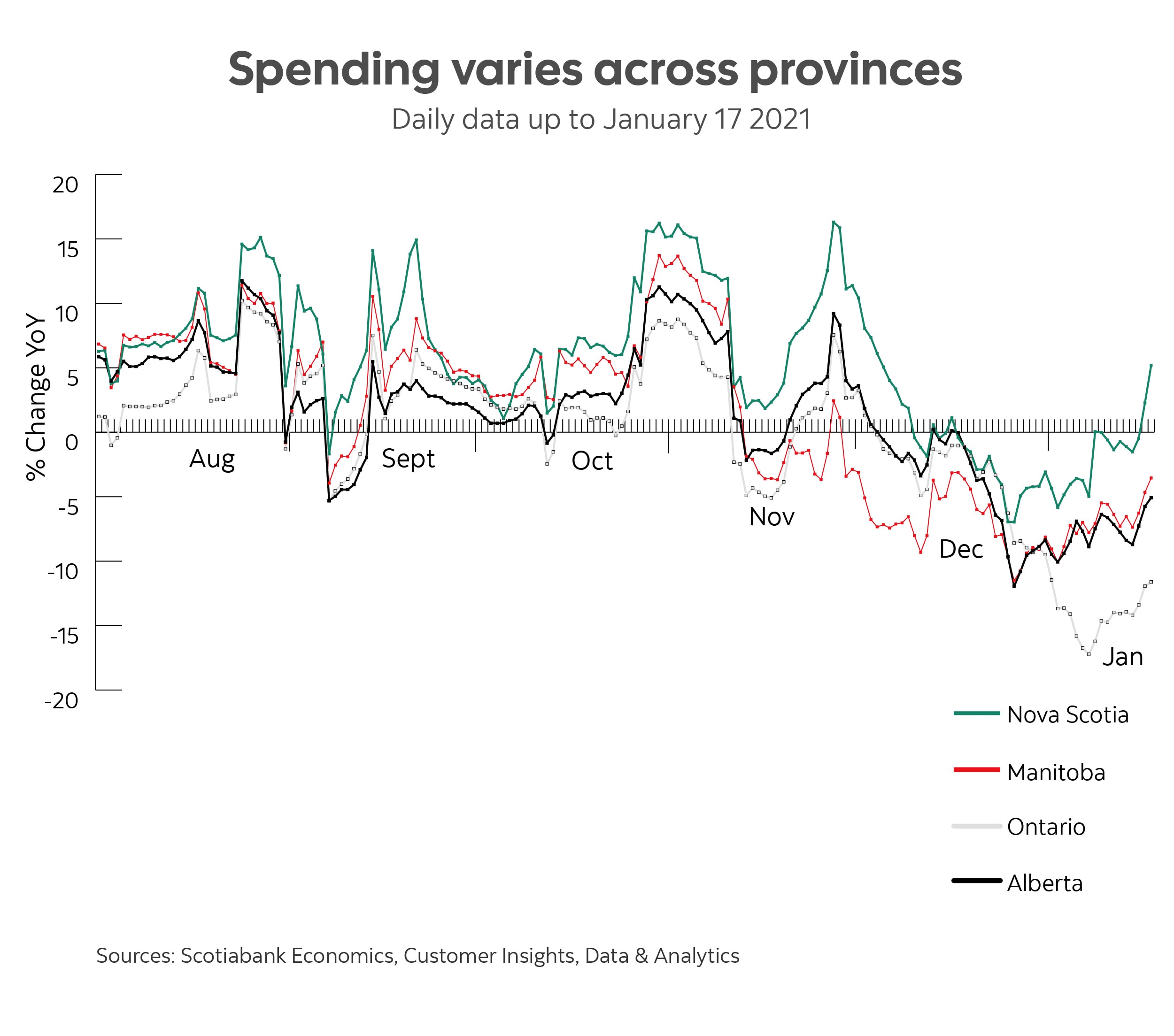

However, this pattern differs slightly between provinces, the data shows.

Card spending growth bottomed out to levels lower than a year ago in early January in Ontario, Quebec, Alberta, BC, Saskatchewan and Manitoba, provinces that imposed stricter lockdown measures at the end of December. The Atlantic provinces, where COVID-19 case numbers are lower, continued to outperform the national average in recent weeks.

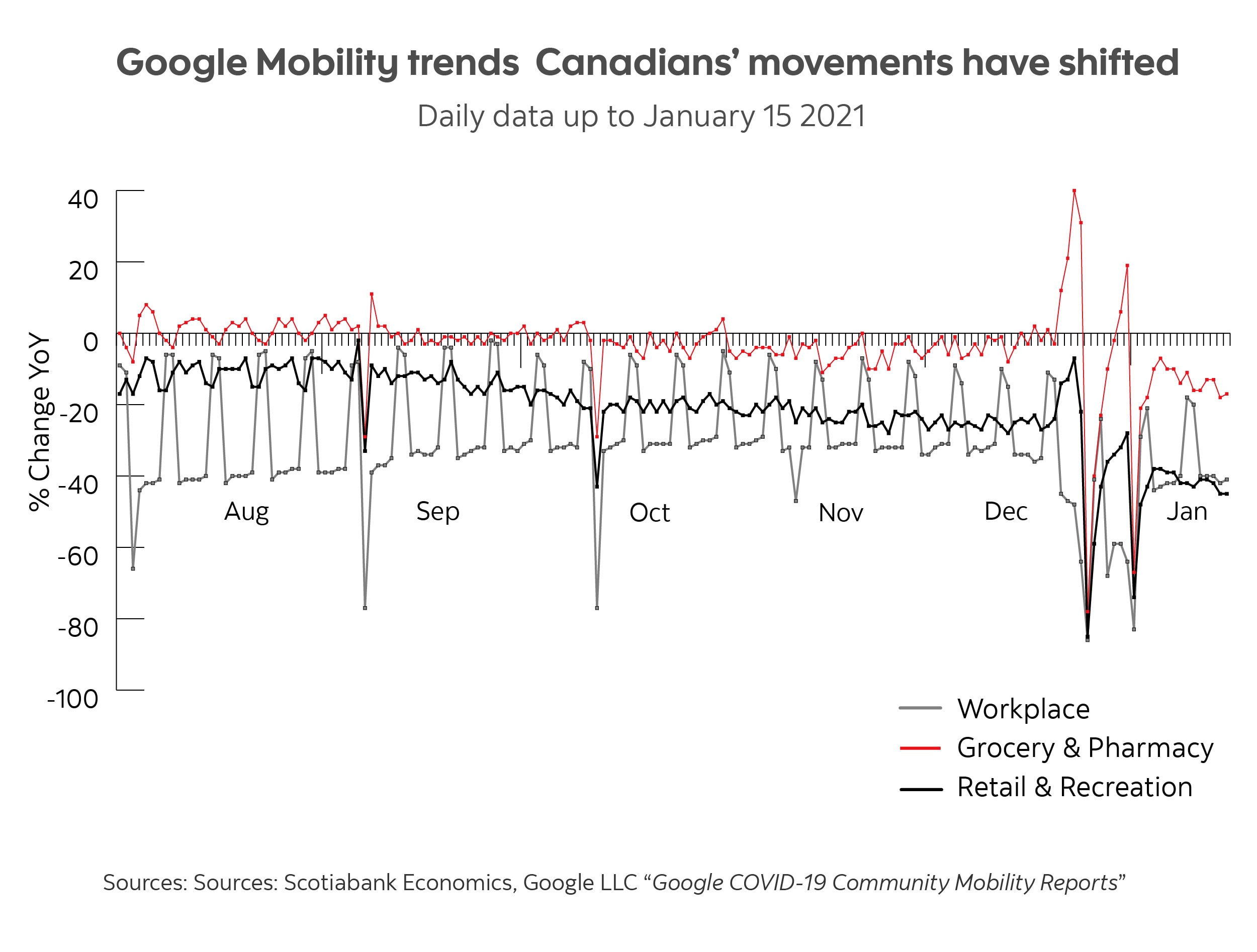

Meanwhile, Google Mobility trends in Canada also shows how Canadians’ movements have shifted over the past few months. Recent data show that although retail and recreation activity has remained below baseline levels since the beginning of the pandemic, there was a slight uptick before taking a steep decline in mid-December. Grocery and pharmacy activity has remained steady most of the year, hovering at the baseline; movement saw an uptick in early December before slipping as well. With many Canadians working from home now, time spent at workplaces remains lower than normal, but levels fell in mid-December amid the holiday season and new restrictions.