Myles Zyblock, Chief Investment Strategist of Scotia Global Asset Management — which manages over $200 billion* for millions of investors in Canada and around the world — shares his latest market and investing insights.

This month, Zyblock looks at the growth of the ‘Magnificent 7’ group of stocks and addresses concerns that they are overvalued.

Analysts at Bank of America first coined the term “Magnificent 7” back in 2023 to capture seven companies within the S&P 500 recognized for their market dominance. The companies are Meta, Amazon, Microsoft, Apple, Tesla, Nvidia and Alphabet. They are very large with all, apart from Tesla, having market values today exceeding $1 trillion. But that’s where their similarity ends. These companies have revenue streams spanning diverse areas which include advertising, cloud computing, e-commerce, hardware, cars, and semiconductors.

From a portfolio lens, the interest clusters around their influence on the behavior of the S&P 500 given that they represent a near 30% weighting in the index. On any given day, the gyrations of this small group of very large companies can set the tone for index performance. Imagine that the other 493 companies were down by 0.4% on the day, the index could still eke out a small gain if the seven were up by about 1%. And, of course, the math cuts both ways. A bad day for this small group of very large stocks makes it more difficult for the capitalization weighted index to advance.

Mag 7 in a Leadership Role to Start 2024

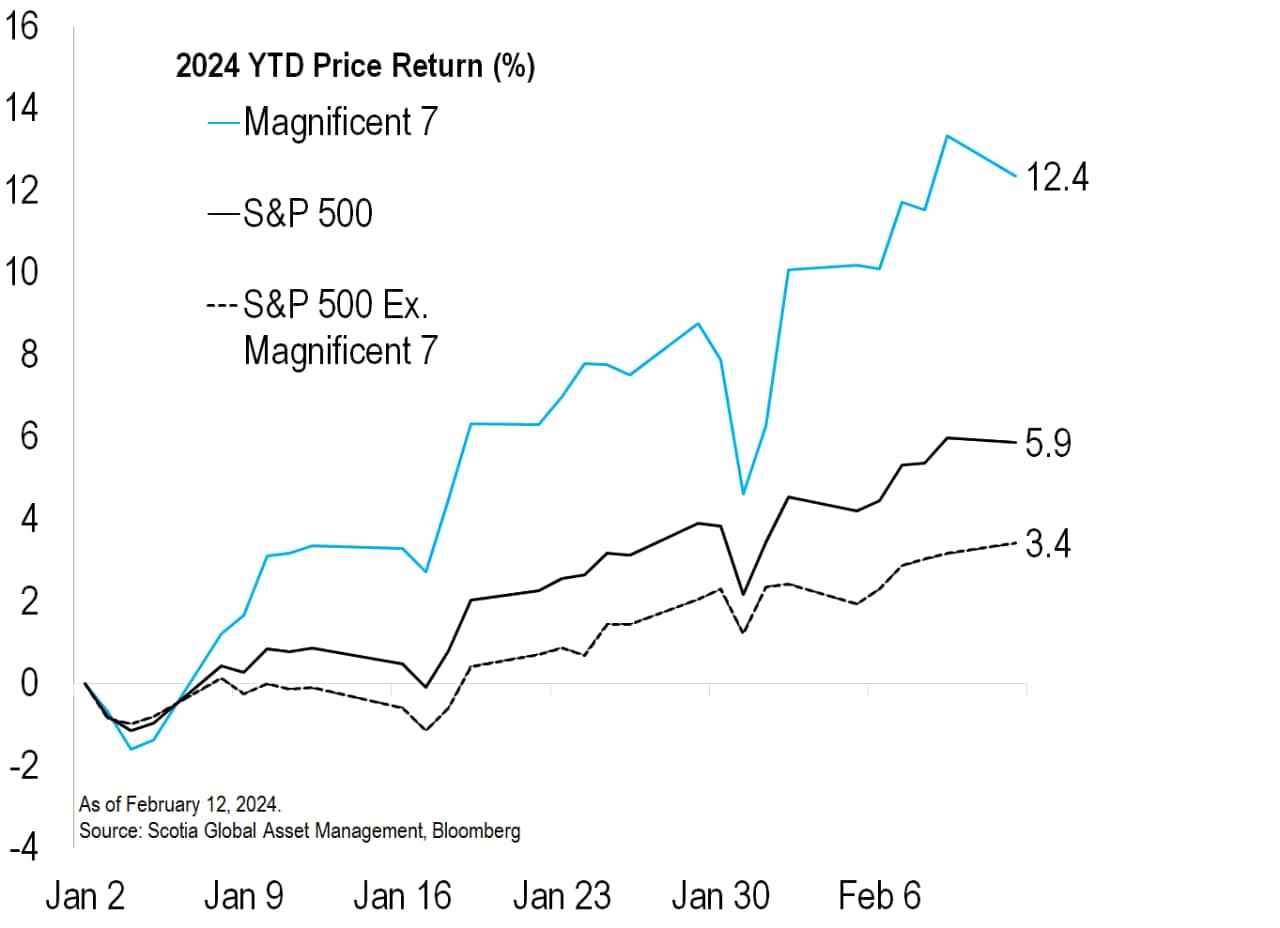

The Magnificent 7 continue to power ahead, up by just over 12% to start 2024. The rest of the market is up by a little more than 3%. But, as one can see, the S&P 500 is up by closer to 6% with the help provided by these seven behemoths (see chart below).

While this subject matter might feel like it’s getting a little tiring or dated, the sheer size and importance of the stocks within the cap-weighted indexes argues that it’s a topic unlikely to disappear any time soon.

Complicated Valuation Arithmetic

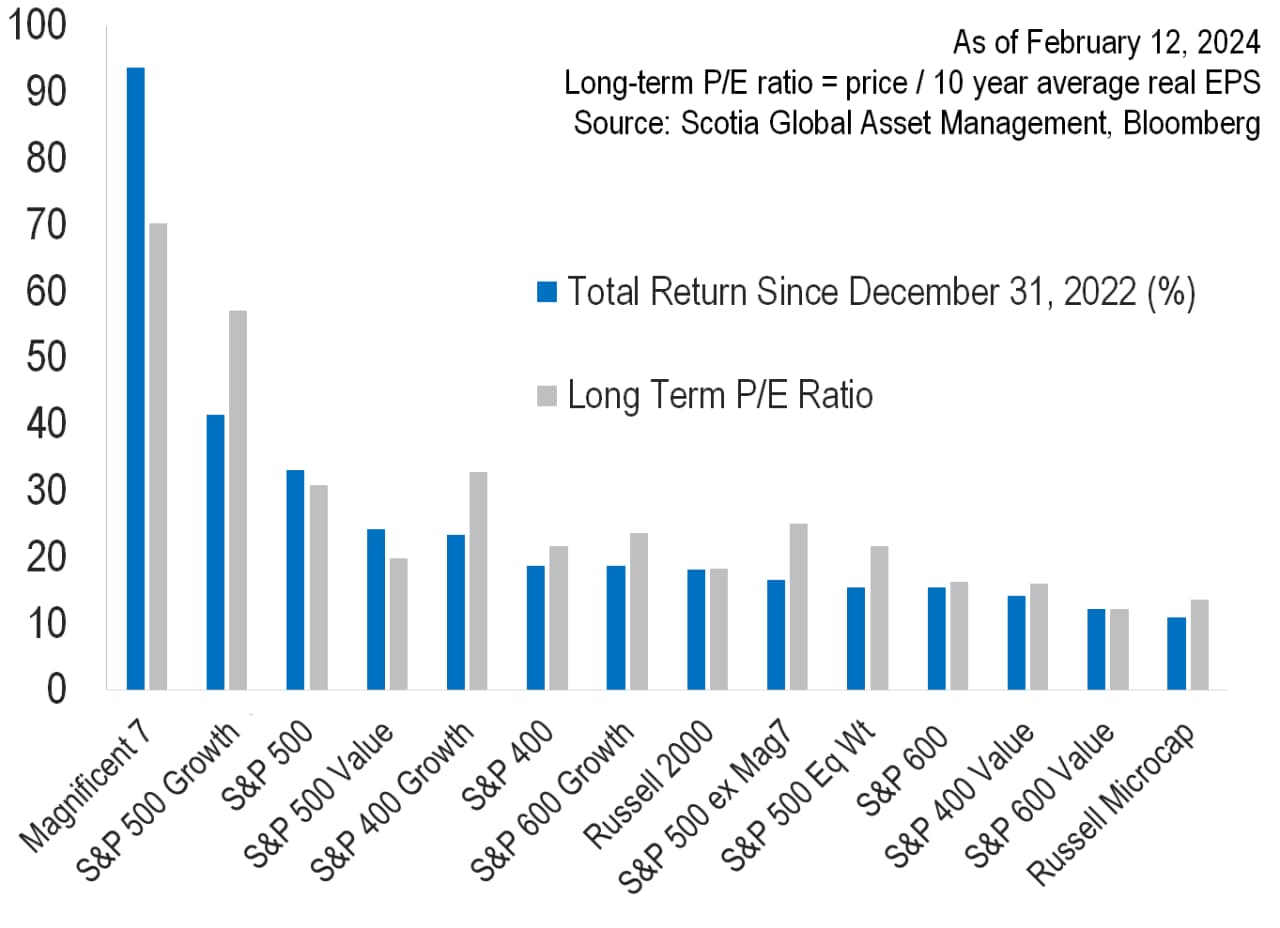

In the chart below, we look at returns from the start of 2023 to the present alongside normalized earnings valuations for various groups of stocks in the market. After the huge upward move in price over a little more than a year, the Magnificent 7 (‘Mag 7’) look richly valued on this metric, not only in absolute terms but relative to most other segments of the U.S. equity market. Because of valuation measures like this, some analysts are saying that the Mag 7 is a group of bubble stocks at risk of popping on any hint of negative news.

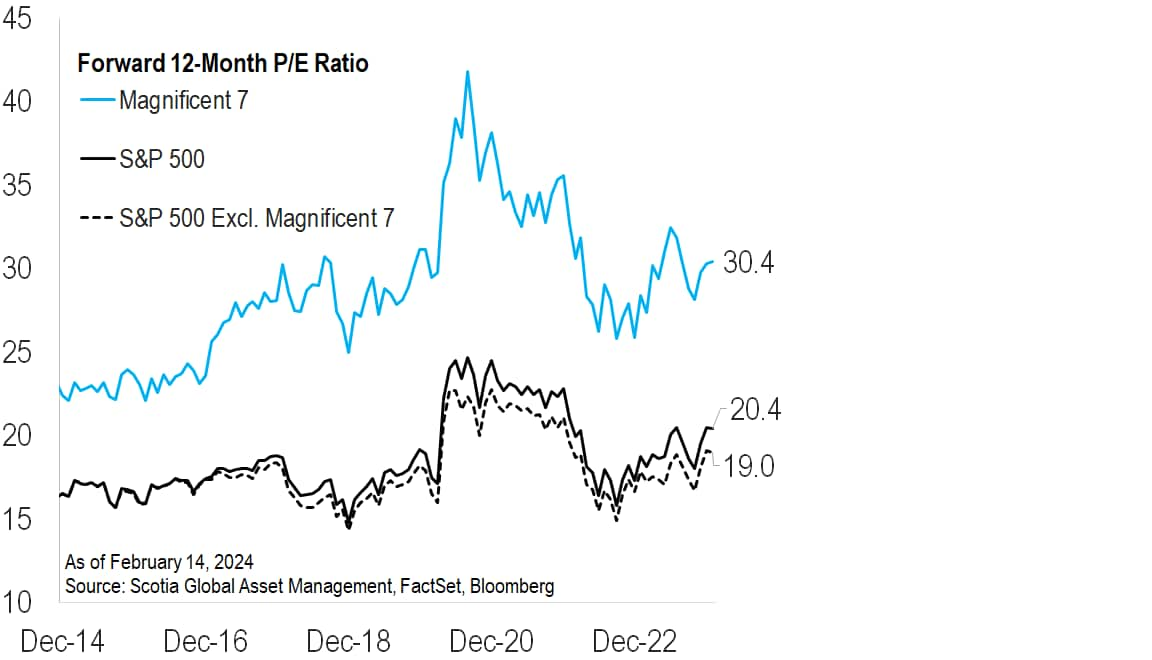

According to a forward earnings measure, shown on the chart below, the valuations for the Mag 7 look much less extreme although the group still trades at a sizable premium to the rest of the market.

The bubble analogy for the Mag 7 might be a stretch. But their valuations are not entirely comforting, which is why investors could consider reallocating a portion of their gains in this group of winners to other areas of the equity market. This is not an attempt to call a top, rather it is a form of portfolio risk management.

Fundamental Dominance

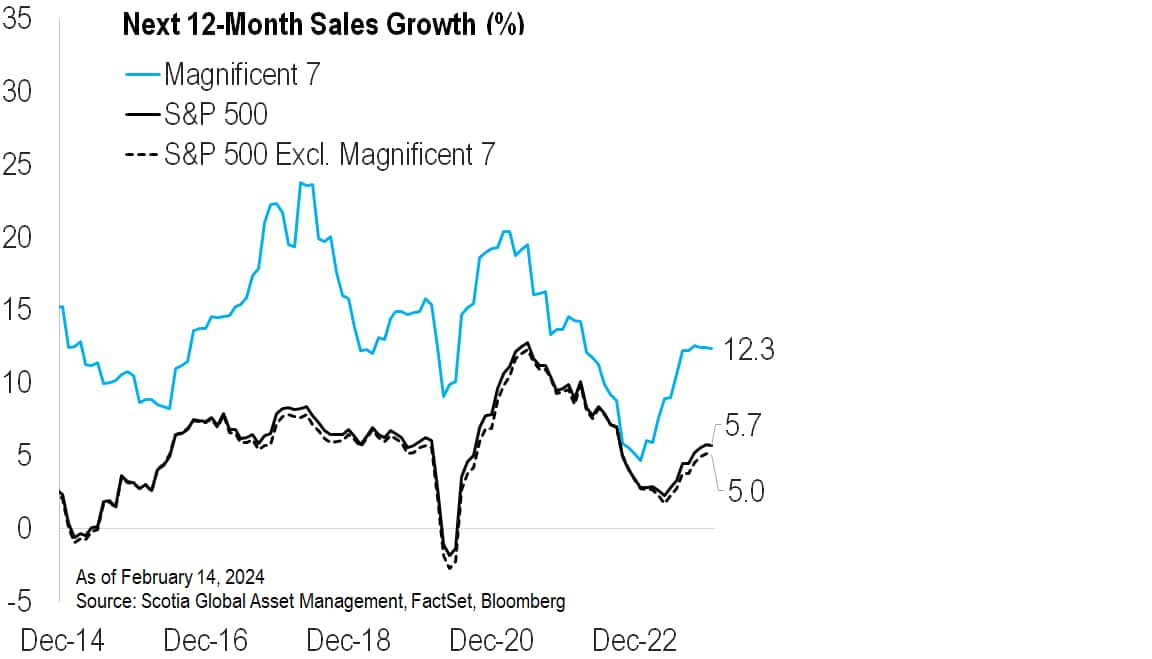

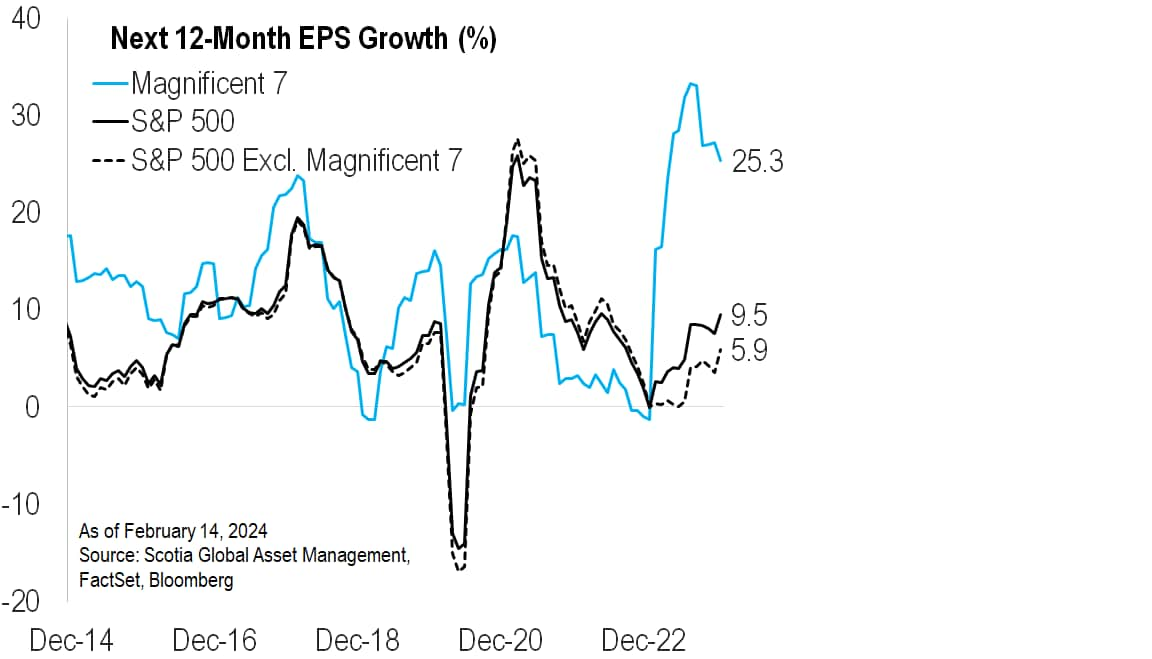

This next set of charts seems to make clear why the Mag 7 have not only performed so well but are also trading at a valuation premium to the rest of the market. They have grown revenue and earnings at a much faster rate than the rest of the market, and this is expected to continue.

Mag 7 revenue is forecast to rise by 12%, or more than double the rate forecast for the rest of the market, over the next year.

And at 25%, earnings growth for this group is expected to be more than 4 times the growth rate in the rest of the market.

Adjusting the valuations shown earlier for expected growth makes the Mag 7 seem much less pricey as a group. Keep in mind, if their fundamentals fail to live up to expectations, for whatever reason, the focus will shift back to those premium valuations.

Myles Zyblock is a recognized North American strategist, regarded for his investment insights that blend finance and psychology to capture major inflection points in financial markets. Myles has over 25 years of experience in guiding and advising on asset allocation for a diverse set of institutional and retail advisors globally. Myles joined the firm in 2013 as the Chief Investment Strategist, working closely with the Investment Team. His experience spans multiple asset classes and geographic regions.

*Total assets managed by 1832 Asset Management registered investment professionals. Scotia Global Asset Management includes 1832 Asset Management L.P., a limited partnership, the general partner of which is wholly owned by Scotiabank.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Views expressed regarding a particular company, security, industry or market sector are the views of the writer and should not be considered an indication of trading intent of any investment funds managed by 1832 Asset Management L.P. These views should not be considered investment advice nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based upon markets and other conditions, and we disclaim any responsibility to update such views. © Copyright 2022 1832 Asset Management L.P. All rights reserved.