Scotiabank recently celebrated its 188th anniversary of serving Canadians. From its origins in 1832 in Halifax, at the corner of Granville and Duke Streets, until today, the Bank’s goal has been to provide the best possible service to our customers and to be an integral part of all the communities in which we live, through good times and bad.

The ways in which we have served our customers has constantly evolved as we sought to bring a range of banking services to Canadians wherever they happen to be. We’ve gone from banking in branches to banking by mail, on boats, in a mobile trailer and on First Nations reserves, to cutting-edge digital technologies that allow customers to do their banking wherever and whenever they want – including in the safety of their own homes.

Here’s a brief tour of Scotiabank’s customer-service evolution over the past 188 years.

Watercolour Illustration of the first official Bank of Nova Scotia branch in Halifax, N.S., located at the John Romans’ building at Granville & Duke Streets. Courtesy of the Scotiabank Archives.

|

1832 : First branch opens to the public On March 30, 1832 Royal assent was given to the bill incorporating "the President, Directors, and Company of the Bank of Nova Scotia“. A building was rented at the corner of Granville and Duke Streets in Halifax, and on August 29 The Bank of Nova Scotia opened to the public. Service was provided by a cashier, two tellers and a messenger. |

Exterior view of The Bank of Nova Scotia Windsor branch, Nova Scotia, 1932. Photograph taken by Reid Studio. Courtesy of the Scotiabank Archives.

|

1837: First branch network in the province The Bank of Nova Scotia established the first bank network of any bank in the province of Nova Scotia when it opened a location in Windsor on November 20, 1837. The Scotiabank branch in Windsor, today located at 80 Water Street, underwent a major rejuvenation in 2019.

|

Wooden coin bank. Object No. 0006. Courtesy of the Scotiabank Archives.

|

1838: 188 Hollis To better serve its customers and the expanding needs of The Bank, a new building was constructed at 188-190 Hollis Street. It opened in 1838.

|

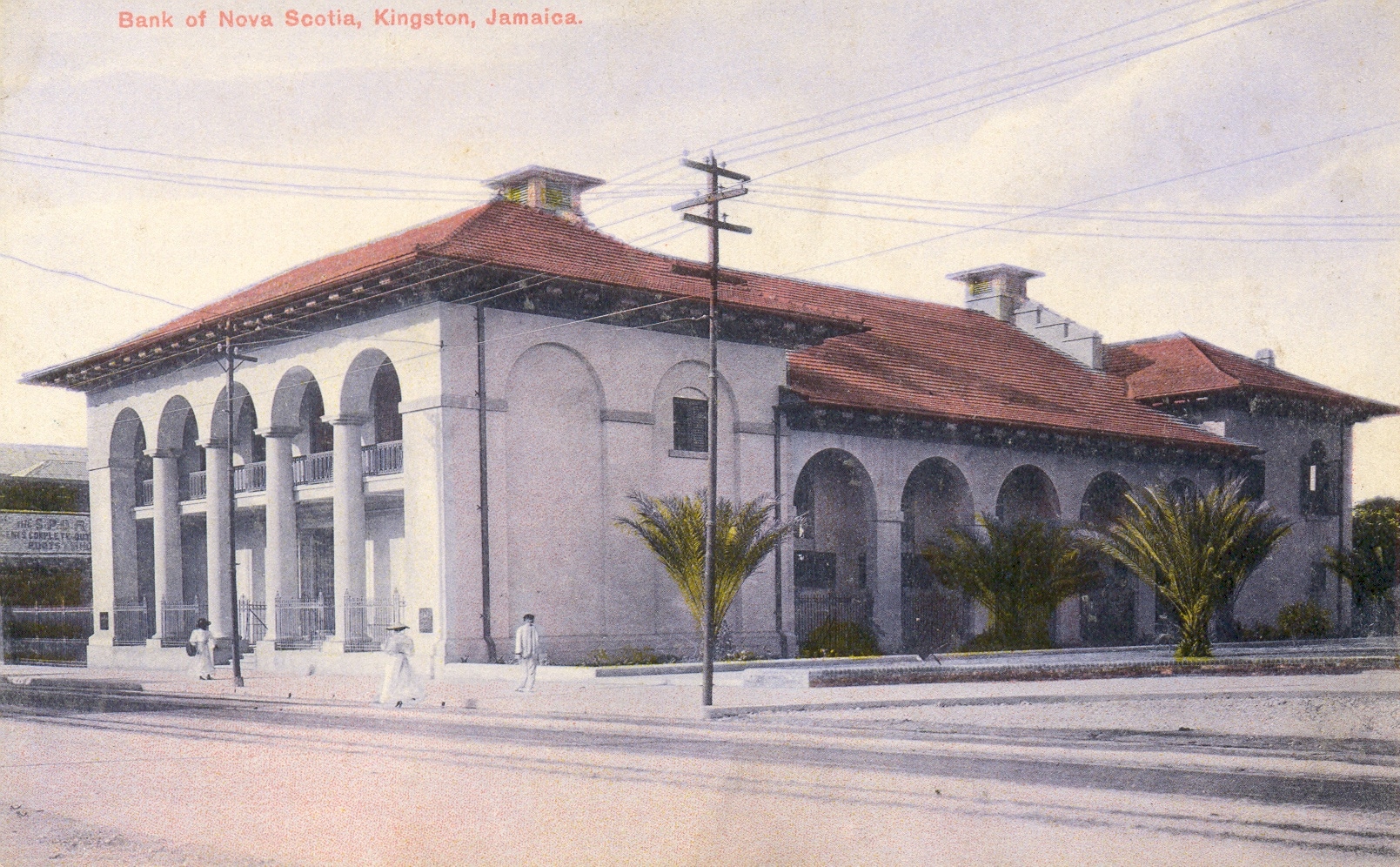

Exterior view of The Bank of Nova Scotia Kingston branch, Jamaica, [191-]. Post card created by H. S. Duperly. Courtesy of the Scotiabank Archives.

|

1889: Jamaica For many years merchants in Nova Scotia trade salt fish, lumber, and potatoes for Jamaican rum and molasses using a barter system. By the late 1880s, the development of the Jamaican economy created the need to place the barter trade on a monetary basis. With only one bank—the Colonial—operating in Jamaica, The Bank of Nova Scotia provided Jamaican and Nova Scotian merchants with an alternative by opening an agency in Kingston in 1889. With this historic move, Scotiabank became the first Canadian Bank to open in the West Indies, and the first Canadian Bank with a foreign operation outside of the United States or the United Kingdom. The Kingston branch opened on August 24.

|

Advertisement from The Bank of Nova Scotia, 1918.

|

1918: Banking by mail At the start of 1918, The Bank of Nova Scotia had 192 branches spanning from coast to coast. These were to a large degree located in larger centres. To better serve those customers not in immediate proximity to a branch, and perhaps to provide an alternative to in-branch banking for those affected by or worried about the threat of influenza (which killed between 30,000 and 50,000 Canadians in 1918-1919) The Bank of Nova Scotia advertised a banking by mail service in 1918. |

||

Rear view of the Scotiabank armoured vehicle advertising Scotia Plan Loans, 1963. Courtesy of the Scotiabank Archives. |

1958: Scotia Plan Loans Once upon a time, banks didn’t offer loans to retail banking customers. Consumer lending by banks was virtually unknown in Canada until The Bank of Nova Scotia introduced Scotia Plan Loans on October 1, 1958. “Wise borrowing is part of good money management; and this new program… will make low-cost loans available easily for any worthwhile purpose.”

|

||

The Bank of Nova Scotia Pocket Guide to Family Spending, 1959. Courtesy of the Scotiabank Archives.

|

1959: Pocket Guide to Family Spending “Good money management makes for happy family living.” In 1959 The Bank of Nova Scotia distributed a Pocket Guide to Family Spending to help customers achieve peace of mind through the development of proper budgeting habits. This wheel chart, adjustable by income and family size, provided dollar figures to serve as a general guide in planning family finances.

|

||

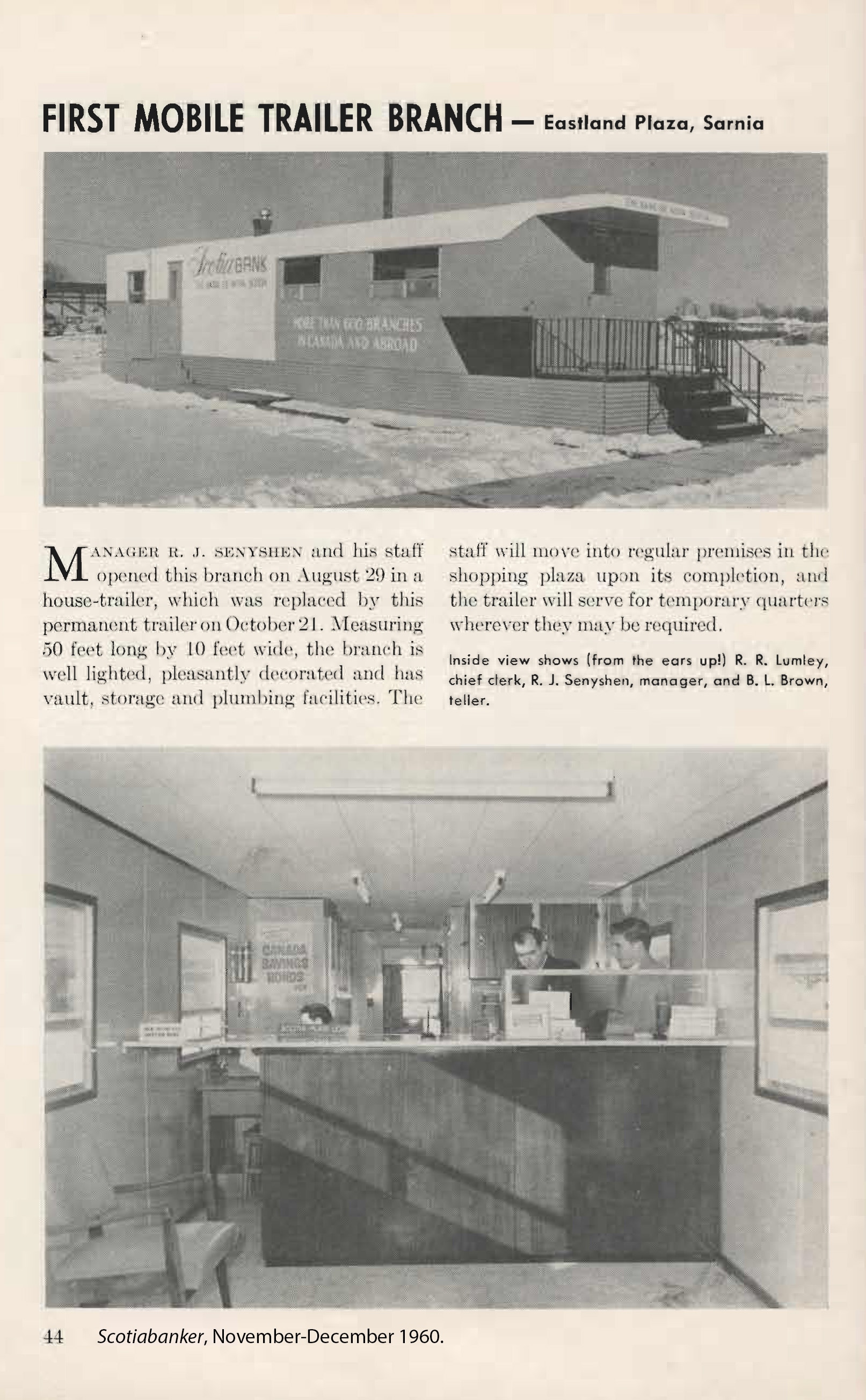

Images of The Bank of Nova Scotia mobile trailer branch extracted from an issue of the Scotiabank staff magazine, Nov/Dec 1960. Courtesy of the Scotiabank Archives.

|

1960: Mobile Trailer Branch Why keep the customer waiting? Having arranged to open a branch in the new Eastland Plaza in Sarnia, Ontario, The Bank of Nova Scotia didn’t wait for the mall to open before starting to serve customers. Instead, they installed a trailer adjacent to the site and began offering banking services from there. This would be the first of many such temporary arrangements for the bank.

|

||

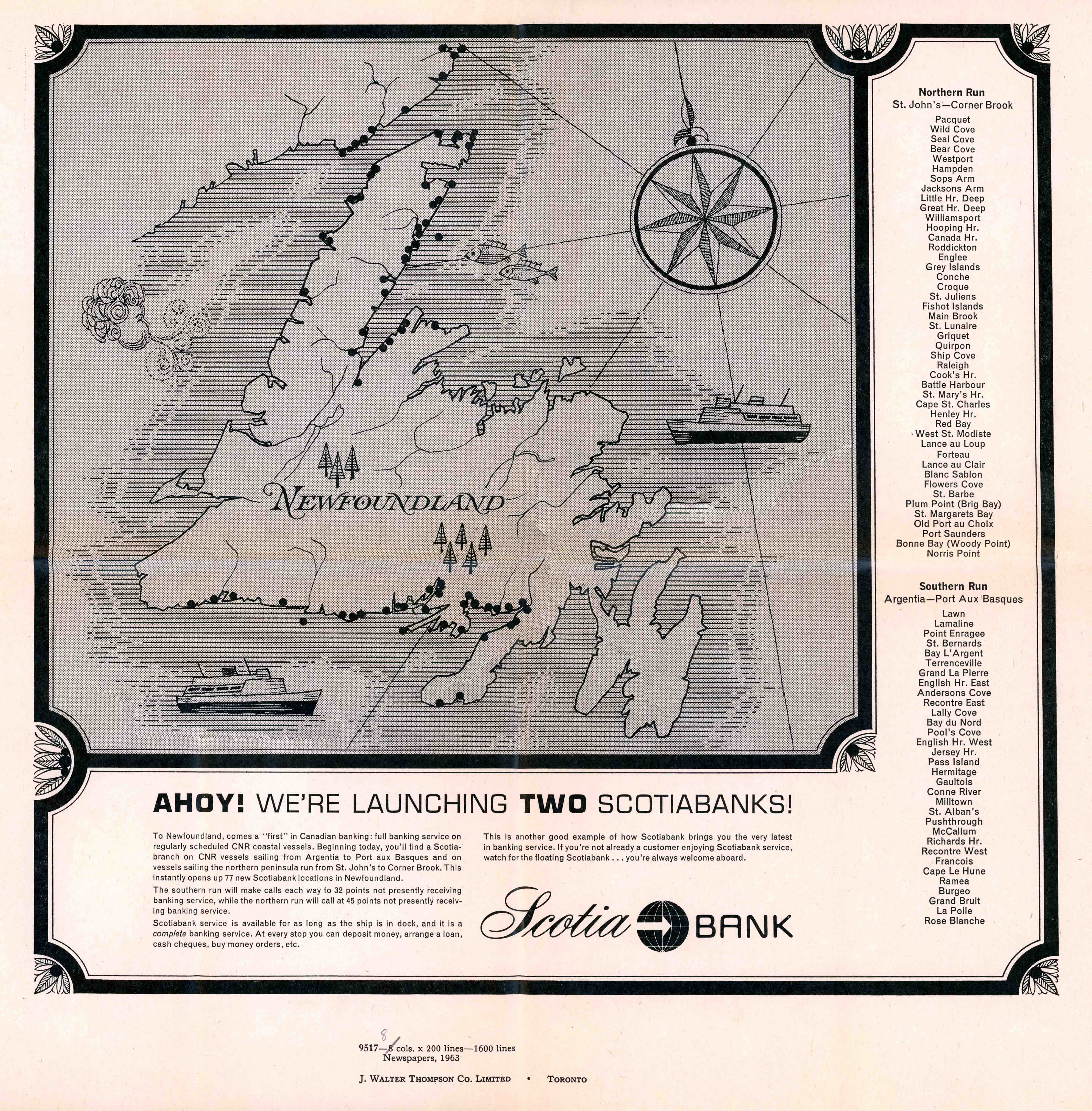

Scotiabank Coastal Banking Services advertisement, 1963. Courtesy of the Scotiabank Archives.

|

1963: Banking by Boat Newfoundland was the first to get an innovative type of branch — full banking service on regularly scheduled coastal vessels. "You'll find a Scotia-branch on CNR vessels sailing from Argentia to Port aux Basques and on vessels sailing the northern peninsula run from St. John's to Corner Brook. This instantly opens up 77 new Scotiabank locations in Newfoundland," the Bank said in an advertisement at the time. "If you're not already a customer enjoying Scotiabank service, watch for the floating Scotiabank...you're always welcome aboard."

|

||

Image of a drive-up teller window at The Bank of Nova Scotia extracted from an issue of the Scotiabanker staff magazine, May-June 1963. Courtesy of the Scotiabank Archives.

|

1963 ca: Drive-up teller windows Drive-up teller windows allowed customers to transact their business without having to leave their cars. Interaction was with a teller, not with an automated machine. Select branches in the Caribbean opened in the 1960s, such as the one pictured at Bay and Deveaux in Nassau, were fitted with this design innovation.

|

||

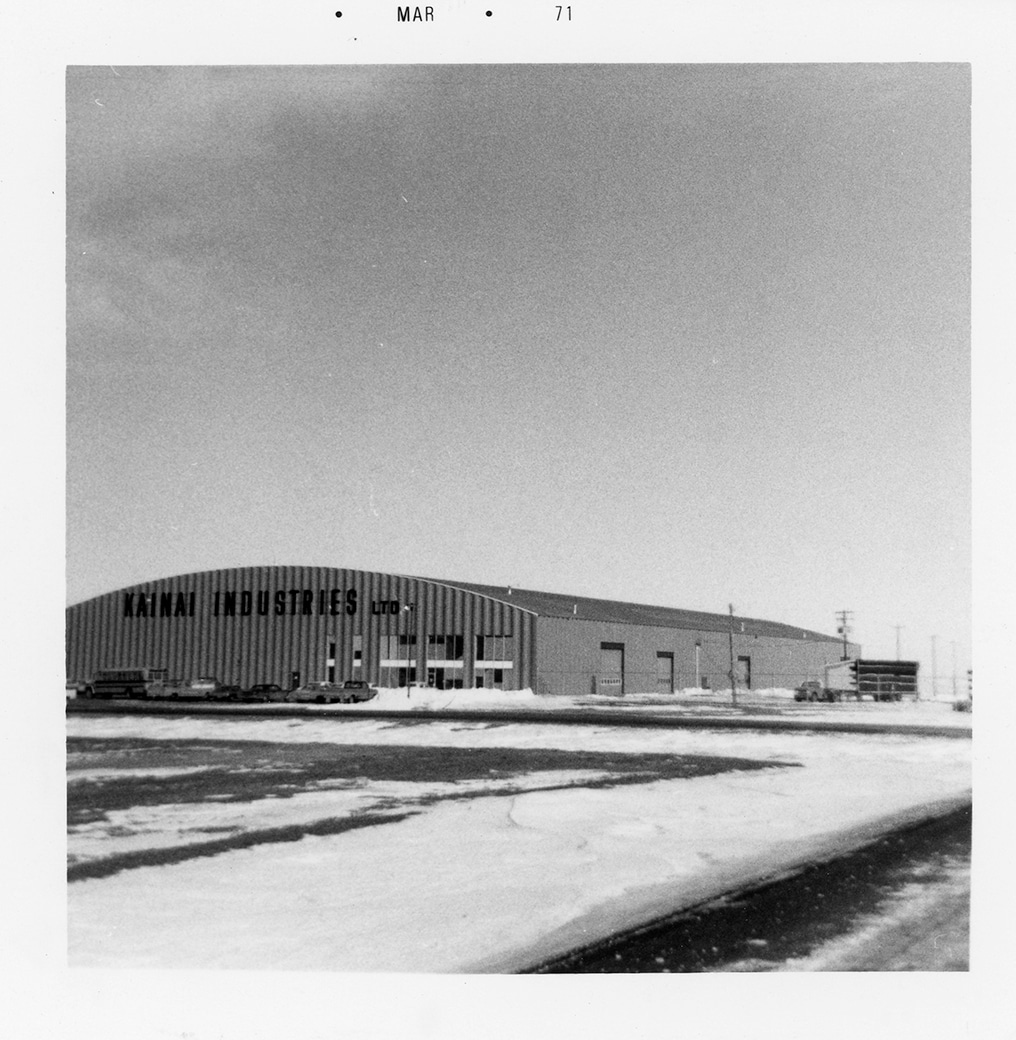

Exterior view of the Kainai Industries building which housed The Bank of Nova Scotia sub-branch extracted from an issue of the Scotiabank staff magazine, July 1971. Courtesy of the Scotiabank Archives.

|

1971: First chartered bank in Canada to open on a reserve Scotiabank became the first chartered bank in Canada to open on a reserve when it opened a sub-branch on the Blood Tribe Reserve in Standoff, Alberta. In 1975, Scotiabank was also the first Canadian bank to open a full-service branch on a reserve, when the branch in The Pas, Manitoba opened on August 13. In 1999, the Standoff branch was expanded and elders were consulted during the redesign process.

|

||

Scotiabank Bank 24 brochure, 1973. Courtesy of the Scotiabank Archives.

|

1973: BANK 24 In 1973 Scotiabank offered customers a way to access their cash 24 hours a day. BANK 24 machines dispense cash in clips of $25, up to $100 per day per customer. Starting with just 12 machines in Toronto and Ottawa, the program quickly expanded.

|

||

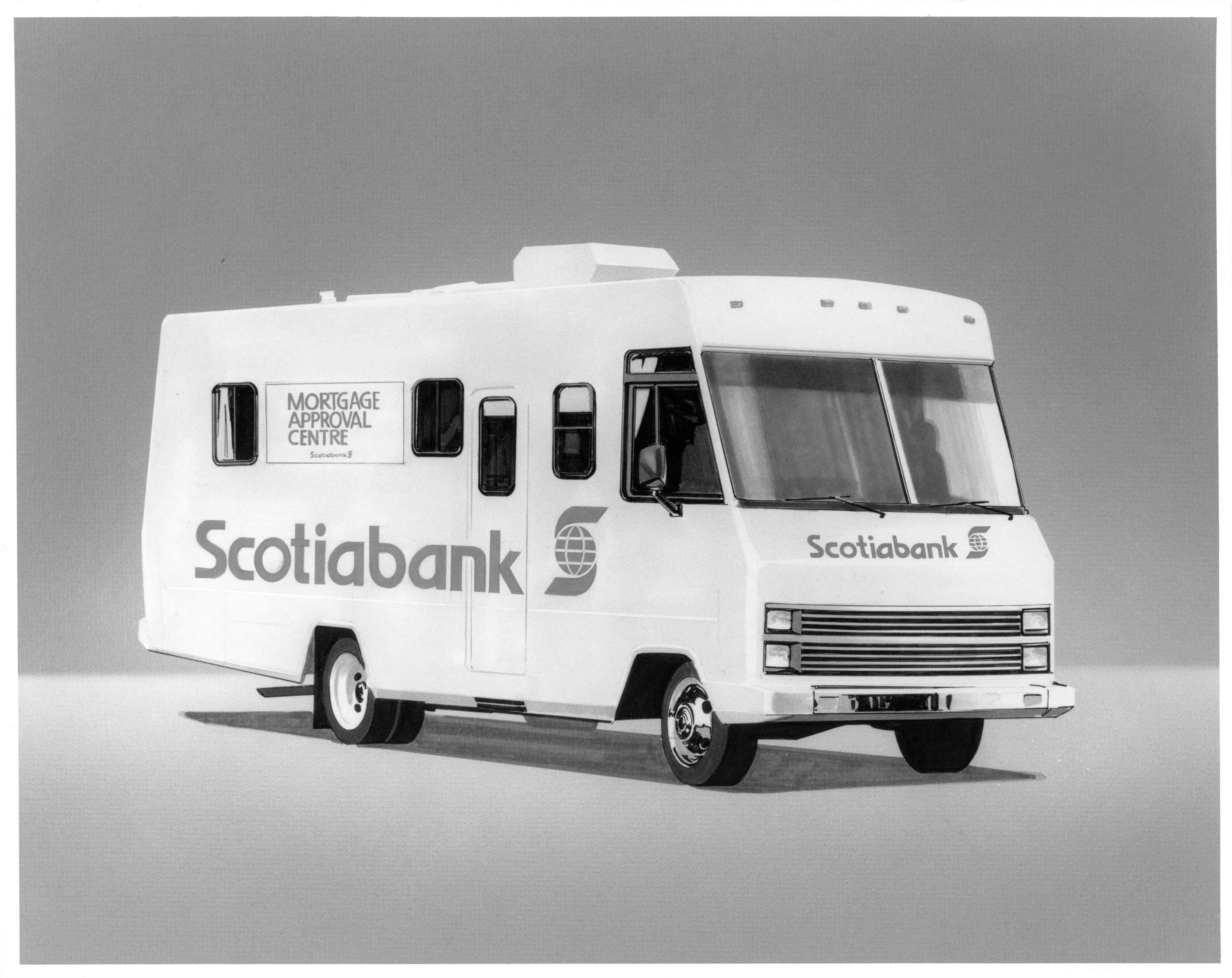

Image of the Mobile Mortgage Approval Centre extracted from an issue of the Scotiabank staff magazine issue, April 1989. Courtesy of the Scotiabank Archives. |

1989: Mobile Mortgage Approval Centre Scotiabank developed a unique way to serve its mortgage customers in the busy Toronto housing market: the Mobile Mortgage Approval Centre. The first of its kind in Canada, the 28-foot converted Winnebago soon became a familiar sight at new housing developments in the Toronto area.

|

||

Image of Scotia 2020 Mobile technology extracted from an issue of the Scotiabank staff magazine issue, February 1999. Courtesy of the Scotiabank Archives. |

1998: Scotia 2020 Mobile Canada's first hand-held, wireless point of sale (POS) terminal, designed to revolutionize the home delivery market was piloted by Scotiabank, Pizza Pizza, Rogers Cantel and IVI Checkmate. After the pilot, it was launched across Canada in September 1999.

|

||

P2P E-mail Money Transfer advertisement, 2002. Courtesy of the Scotiabank Archives.

|

2002: E-mail money transfers In 2002 Scotiabank joined forces with CertaPay and three competitors to bring an innovative new product to our customers. The result was a new person-to-person (P2P) money transfer service – Email Money Transfers – and the first and largest bank-to-bank P2P payment network in the world.

|

||

The Money Clip podcast logo extracted from Servicetalks, March 2007. Courtesy of the Scotiabank Archives. |

2006: The Money Clip The Money Clip, a series of podcasts providing expert advice to customers, was launched in October with a three-part series on mutual fund investing. It was the first podcast from a financial institution in North America (perhaps even the world!).

|

||

Scotiabank Bank the Rest Program advertisement, 2008. Courtesy of the Scotiabank Archives. |

2008: Bank the Rest “Bank the Rest” is an innovative savings program that helped customers save every time they use their debit cards. Canadians using their ScotiaCard to make debit card purchases could choose to round up the total purchase amount to the nearest dollar or five dollars, and have the difference deposited automatically into their Scotiabank Money Master High Interest Savings Account. The service was a first for Canadian customers.

|

||

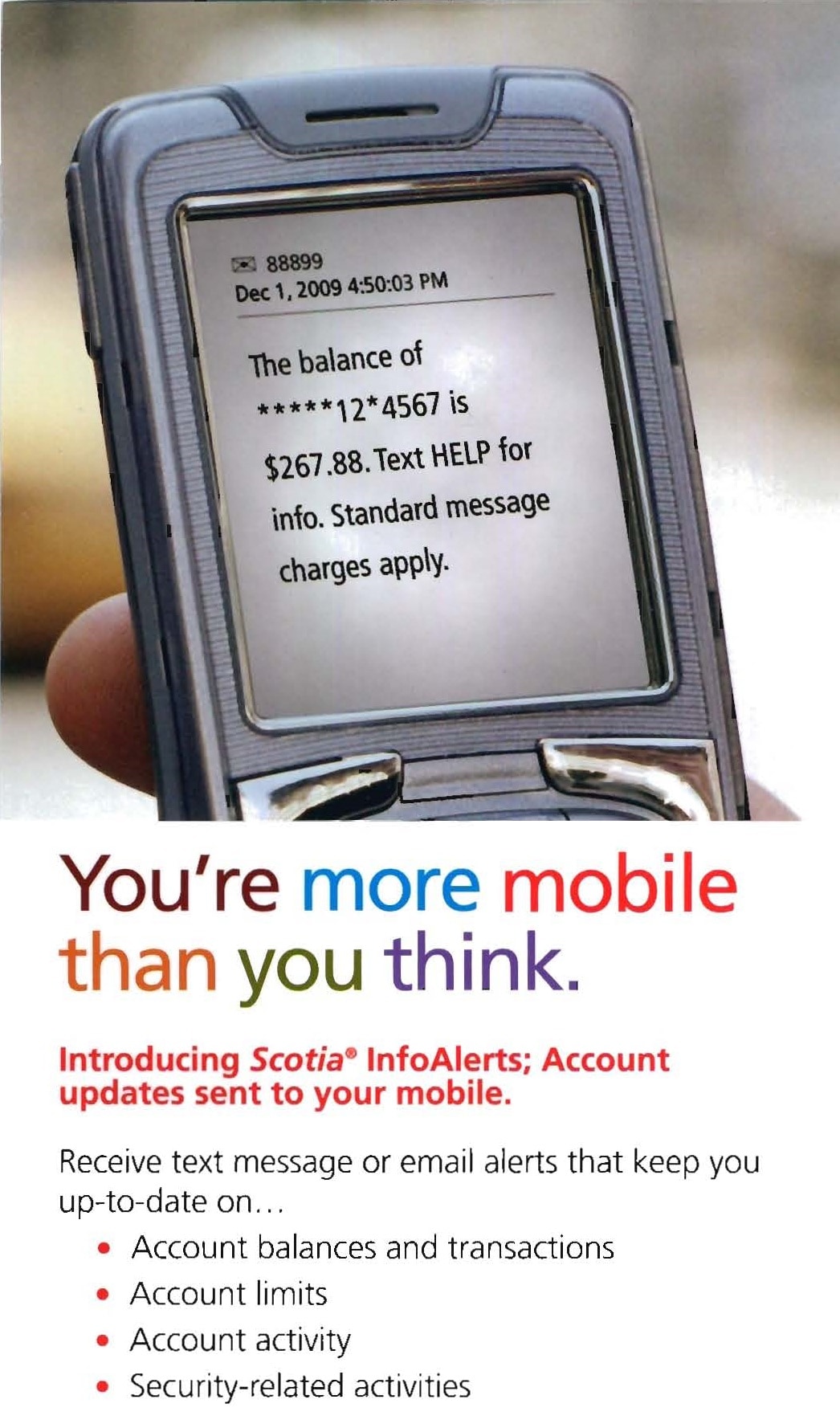

Scotiabank InfoAlerts advertisement, 2009. Courtesy of the Scotiabank Archives. |

2009: Scotia InfoAlerts Scotia InfoAlerts is a service available to Retail and Business customers that notifies them via text message or email of transactional activities in their accounts with various account information and security-related alerts available. In June 2010, the Bank announced it had recently sent out its one millionth alert.

|

||

Scotiabank Mobile Banking advertisement, 2010. Courtesy of the Scotiabank Archives.

|

2010: Mobile banking Scotiabank's mobile banking services operate on the same security platform as Scotia Online Banking, allowing customers to do the same banking transactions that they would do on their computers with additional security measures made for mobile phones. It was launched on June 14 in Trinidad, Barbados and Bahamas, June 20 in Jamaica and October 4 in Canada.

|

||

Courtesy of the Digital Factory. |

2017: The first Scotiabank Digital Factory opens in Toronto Designed to drive collaboration and creativity and serve as a hub for co-creation and incubation of new ideas to deliver world-class customer solutions through digital channels, the Digital Factory houses a team of more than 350 specialists from multiple facets of digital, design, engineering, agile industries, etc. Digital Factories have subsequently opened in the Pacific Alliance countries of Mexico, Peru, Chile and Colombia.

|

||

Courtesy of the Digital Factory |

2019: Scotiabank launches a new mobile app Scotiabank launched a new mobile banking app in Canada that is inclusive and accessible. From dynamic font sizing to screen reader compatibility, we designed our new mobile app for a diverse range of abilities so that more Canadians can bank the way they want and be in control of their finances.

|

|