- Preliminary indications of the results from Sunday’s mid-term elections could begin to emerge as early as 8pm (9pm EDT) that evening in Mexico City.

- The governing Morena party and its coalition partners appear likely to secure an absolute majority of representatives in the Lower House, but not the two-thirds qualified majority needed to advance constitutional changes.

SUNDAY AND WHAT COMES AFTER

On Sunday, June 6, Mexico will hold mid-term elections, where among many other public positions, electors will vote for 15 of the country’s 32 governors, as well as all 500 members (300 through direct regional representation and 200 via proportional lists) of the Chamber of Deputies, the Lower House of Congress. Our May 3 guide to the elections and their possible economic implications laid out the key policy issues that could be up for consideration in the second half of Pres. López Obrador’s six-year term.

Results will start to be released by the National Electoral Institute (INE) on Sunday through two mechanisms:

- The preliminary electoral results program (Programa de Resultados Electorales Preliminares, PREP) should start providing unofficial indications on the trends for Congressional districts around 8pm in CDMX (9pm EDT), about an hour after the last states are scheduled to close their voting stations. For some races, likely some of the tighter ones, we may not see the PREP initial vote counts come out until 8pm local time on Monday June 7; and

- Gubernatorial results could start to emerge around 11pm (midnight EDT) on Sunday evening in Mexico City from the rapid counting system (Conteo Rápido). This system will also be used to provide preliminary guidance on the likely composition of the Chamber of Deputies based on a random sampling of polling stations.

The preliminary and official results will appear on the INE website.

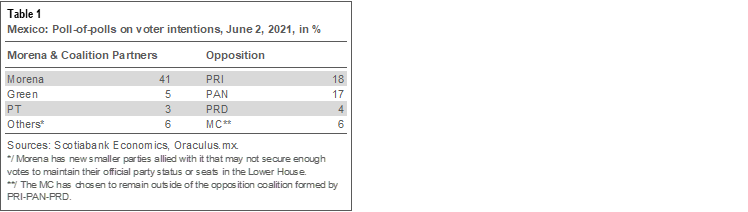

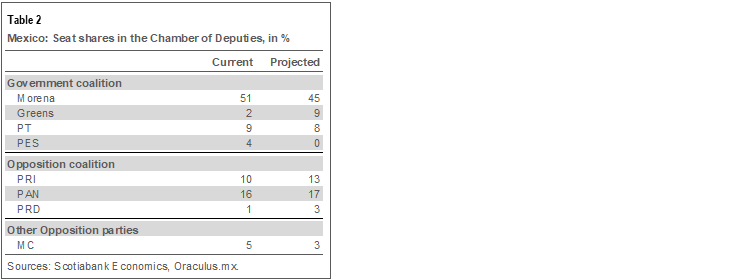

The latest poll-of-polls compiled by Oraculus implies that voter intentions are currently distributed as shown in table 1, but the eventual shares of seats in the new Chamber of Deputies are likely to vary from these numbers. Small parties counted amongst “Others” in the Morena-led coalition may not individually garner enough votes to earn district-based seats nor representation in the Chamber under the proportional system. Based on the Oraculus poll-of-polls, and with adjustments for local races and minimum thresholds for party lists to gain a seat, the composition of the new Lower House is currently expected to come out along the lines shown in table 2.

IMPLICATIONS FOR LEGISLATION

The eventual composition of the new Chamber of Deputies will be critically important for policy and legislation in the coming years. There are two key thresholds in the Lower House: some legislative moves require an absolute majority (50% + 1 vote) for passage in the Chamber, while other initiatives need a qualified two-thirds majority of representatives’ support in order to go forward.

These thresholds come into play in the following ways:

- Budget. Annual budgets are passed by an absolute majority in the Lower House. Budgets do not need to go to the Senate for approval;

- Laws. Laws have to be endorsed by an absolute majority in both the Chamber and the Senate. Morena holds 55 of 128 Senate seats, while its coalition holds a total of 76 seats, or 59.3% of the Senate, though this does not assure such support on any individual vote. Morena has shown, however, that it could secure the backing of other parties on a negotiated basis. The annual revenue bill, which is the legislation that funds the budget, qualifies as a law, as would the fiscal reforms that the president has identified as an action item for the second half of his administration; and

- Constitutional amendments. Constitutional amendments require a qualified majority in both houses. In addition, for a constitutional amendment to be ratified it must be approved by an absolute majority of the state legislatures (i.e., at least 17 of 32).

The projected Lower House seat shares derived from the Oraculus poll-of-polls (table 2, again) imply that Morena and its allies shall likely secure an absolute majority in the Chamber of Deputies—enough to pass laws, approve the budget, and endorse the president’s anticipated fiscal reform package. However, the same poll-of-polls implies that the Morena-led coalition shall fall short of the two-thirds majority in the Lower House needed to advance constitutional changes.

ADDITIONAL CONSIDERATIONS: THE CHAPULINES

- It’s worth recalling that in Mexico there are often post-election re-alignments of political forces as candidates change their allegiances (the so-called grasshoppers, or chapulines). This could happen as a result of individuals shifting parties or through entire parties changing their coalition partnerships—just as the Green Party moved to ally itself with Morena after the 2018 election results were announced.

- Shifts in party membership after the 2018 election left Morena with 51% of seats in the Chamber of Deputies (see table 2, again), some 5 percentage points (ppts) more than the 45.8% share of votes that Morena garnered at the polls. A recent ruling by the Mexican electoral arbiter (Tribunal Electoral del Poder Judicial de la Federación) has put a limit on the extent to which newly-elected representatives can change parties after an election: such shifts in affiliation may not result in a deviation of more than 8 ppts between the share of votes a party received in an election and its share of seats in the Lower House. This ruling does not, however, prevent coalitions, whether formal or more casual, between the parties on a durable basis or on ad hoc issues.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.