- The upcoming mid-term elections on June 6 will be critically important for the future of several important initiatives launched by the López Obrador administration, including reforms to the fiscal framework, electricity sector, and pensions.

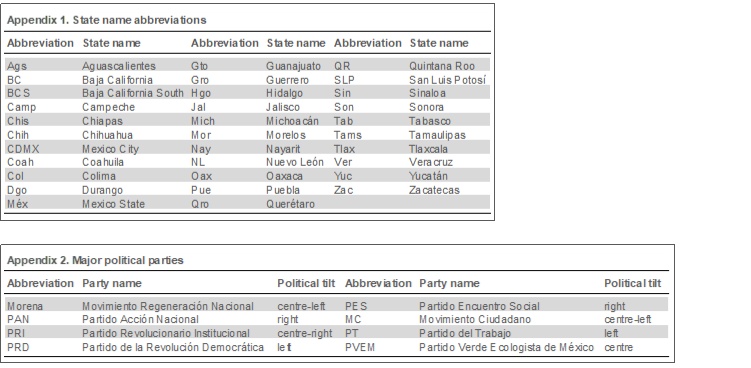

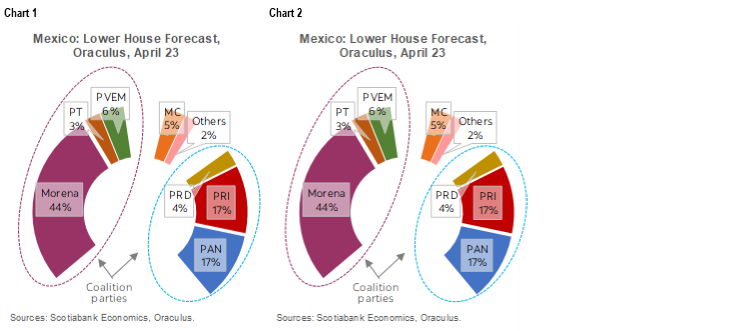

- Polls imply that Morena and its allies should retain an absolute majority (50% +1) in both Congress’ Chamber of Deputies and the Senate, but will likely lose its qualified majority (two-thirds of seats) in the Lower House.

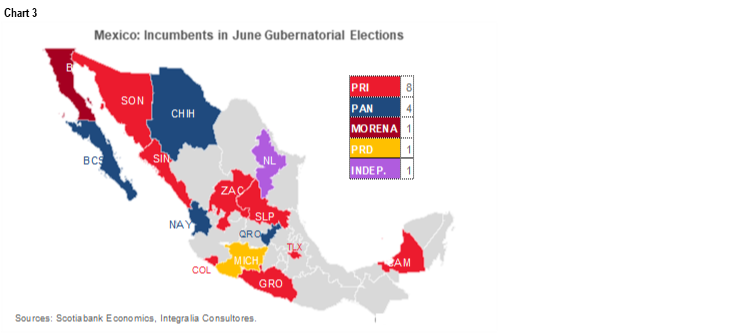

- At the state level, Morena is expected to become a more dominant political force by taking about half the governorships up for grabs.

WHAT’S AT STAKE

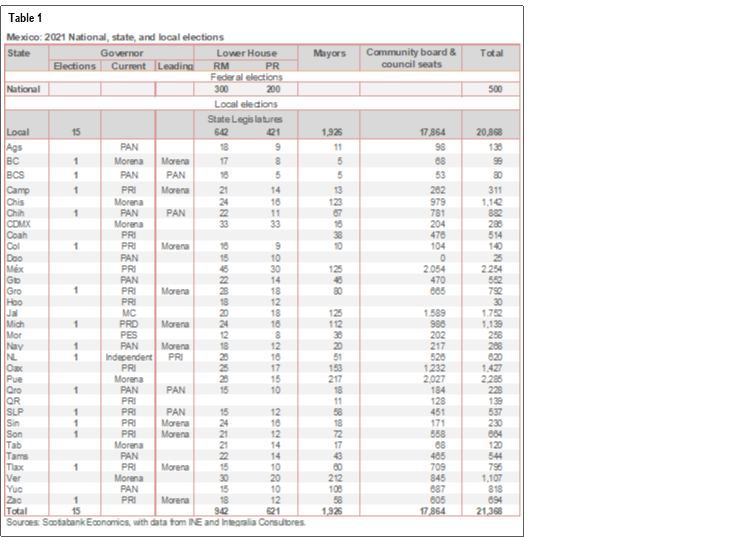

Mexico’s mid-term elections scheduled for June 6, 2021 have been described as one of the most consequential off-cycle set of votes in the country’s modern history. Two key factors underpin this assessment: (1) a historically large number of positions (i.e., 21,368 posts) are being contested at the polls run by the National Electoral Institute (INE, in Spanish); and (2) the results could consolidate or undermine President López Obrador’s political project, which he has marketed as Mexico’s “fourth transformation”—the first three being independence in 1821, the Reform Laws—the most important amongst them being the separation of Church and State—between 1858 and 1861, and the Revolution during 1910–20.

At the federal level, all 500 seats in the Lower House of Congress are up for grabs under a parallel voting system. Of the total cohort of Deputies, 300 will be elected through a simple plurality (i.e., “relative majority” or “first past the post”) in single-member electoral districts, while the remaining 200 seats will be filled through a proportional representation system (i.e., “largest remainder method” under which parties are awarded seats in five multi-state, 40-seat constituencies).

At present, the President’s Morena party and its allies hold a qualified majority (i.e., more than two thirds) in the Chamber of Deputies and an absolute majority (50% + 1 vote) in the Senate. This control of both Houses of Congress has allowed the President and his allies to pass bills and amendments to the constitution in an expeditious manner.

At the regional level, a wide range of posts are also set for votes in June. These include:

- Governors of 15 states;

- Legislatures in 30 states, which are compromised of 642 deputies elected on relative majorities and 421 elected under proportional representation;

- Some 1,926 municipal mayors; and

- Representatives for 17,864 seats on community boards and councils.

The full sweep of the June elections is summarized in table 1. See appendices 1 and 2 for keys to state name and party abbreviations.

RECENT POLLING INDICATIONS

According to the Federal and Local Elections 2021 report published on April 12 by Integralia Consultores, “Morena will receive the most votes of any party, but the electoral tsunami of 2018 will not be repeated.” In the Chamber of Deputies, Integralia projects that “Morena and its allies will lose the qualified majority (⅔), but will achieve an absolute majority (50%+1),” and with this, President López Obrador “will lose the ability to amend the Constitution” with the support of his current coalition. Constitutional changes would require support from two-third of the members in both chambers of Congress, respectively.

The latest available Poll of Polls on the Lower House elections (as of Friday, April 23, 2021) complied by Oraculus, also anticipates that the Morena party will lose some support, as shown in charts 1 and 2. However, some of Morena’s allies could gains seats in the Chamber.

In our view, voting intentions remain fluid and will depend on two key factors: progress on rolling out vaccinations and continued gains in the economy’s rebound.

At the state level, April 8 polls on the 15 gubernatorial elections set to take place in June put Morena in the lead in 10 of these contests, as noted in table 1. As chart 3 shows, if Morena converts these polls into wins, it would represent a net gain of nine state governors’ offices. The aforementioned Integralia Consultores report predicted that, of these races, Morena “would win between 7 and 8 [and] would become the most relevant regional force with 13 or 14 governorships”, thereby surpassing the PRI, which currently governs in 12 states (see table 1, again).

IMPLICATIONS: MORE BALANCE

This year’s mid-term elections have the potential to facilitate a turnaround in Mexico’s economic policies in the second half of the current six-year presidential stint. Depending on the elections’ results, they could produce greater counterweights and balancing forces between the Legislative and Executive branches. In the 2018 elections, the Morena party obtained large majorities in the legislative branches at the federal, state, and municipal levels, which allowed President López Obrador to make significant policy changes and to consolidate and move forward on many of his national projects.

If Morena were to lose its qualified majority in the federal Lower House, but maintain its absolute majority, as several of the main polls so far imply could happen, President López Obrador and the leaders of his legislative factions would still have enough power to continue advancing his budgetary and legislative projects—so long as they do not involve constitutional reforms or appointments that require a qualified majority vote. The greater the loses in the Chamber of Deputies for the President’s coalition, the bigger the hurdle AMLO could face in building consensus for any future constitutional changes, which would complicate some elements of his agenda. More specifically, if the governing coalition were to lose the two-thirds majority in the Lower House, we would likely see hold-ups and modifications in the government’s fiscal, energy-sector, and pension reforms, as we discuss below. Mindful of this possible scenario, the opposition PRI-PAN-PRD parties have decided to form a broad coalition to contain Morena’s control over the political system.

LEGISLATIVE AGENDA FOR THE SECOND HALF OF THE AMLO ADMINISTRATION

Some of the important reform proposals currently under discussion by the government and Congress could see their progress substantially altered by the results of the June elections. The main initiatives that could see changes as a result of the vote include:

- Tax reforms. Since the 2018 presidential campaign, the AMLO Administration has indicated that a major package of fiscal reforms could be introduced in the second half of the current presidential term. The need for fiscal reform is becoming increasingly urgent as a result of the rise in the public debt-GDP ratio caused by the economic crisis of 2020. Action needs to be taken to shore up the country’s investment-grade status. Our estimates and projections indicate that, to anchor the trajectory of public debt, a fiscal adjustment equivalent to around three percentage points of GDP would be needed, of which one point would be necessary to capitalize Pemex. This adjustment could be achieved through cuts to spending that expand the primary surplus or, alternatively, through an increase in public revenue via greater collection efficiency, a broadening of the tax base, the introduction of new taxes, or hikes in some existing taxes. Tax reforms would require only an absolute majority (i.e., 50% + 1 vote) in both chambers of Congress for ratification.

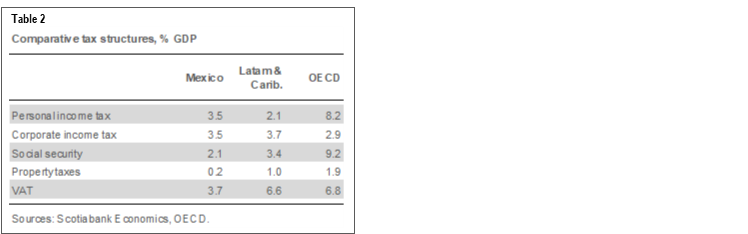

The debate on how to increase public revenues has already begun, but there are differing views on how to do it. Some suggest raising funds through improvements in tax collection under the current fiscal structure: the head of Servicio de Administración Tributaria (SAT), Raquel Buenrostro, as well as President López Obrador, both seem to support this idea. However, others, such as the Secretary of Finance, Arturo Herrera, favour a more ambitious tax reform. Some of the components of Mexico’s tax burden are already heavy relative to those of countries with which Mexico competes to attract investment (table 2)—even more so if we adjust the tax base for the high rate of informality in the country (around 50%), which means that those who pay taxes already shoulder big responsibilities.

In the current environment, in which investment remains the main source of weakness in the economy, it will be important to ensure that a potential tax reform is seen as balanced and friendly to the private sector. Achieving an increase in tax revenues close to 3% of GDP will not be easy without making adjustments to the VAT, such as eliminating the zero rate, raising the overall rate, and/or eliminating exemptions. Any of these changes could strike a blow to the government’s popularity if it were to pursue them.

- Electricity-sector reforms. Following the determination by the courts that the government’s Electricity Sector Reform Law is unconstitutional, there has been talk of making a constitutional amendment to allow the package of changes to move forward. This proposal is critically important for the future of the country, since it would be expected to establish a hierarchy for public entities in the sector (i.e., the CFE would have priority over the private-sector operators in feeding generated power into the grid system) and favour hydroelectric and hydrocarbon-generated energy over solar and wind. A constitutional amendment to allow these changes to go ahead would require the support of two-thirds of both chambers of Congress.

- Pension reforms. The pension reform proposal seeks, among other changes, to gradually increase employer contributions to workers’ retirement funds from the current 5.15% to 13.875% of annual incomes over a period of eight years. Additionally, this proposal would establish that government contributions would support only the pensions of low-income workers. The initiative would also make several changes that affect the replacement rates of the pension system, including a motion to increase these rates from 31% to 54% for workers earning five minimum wages and from 46% to 76% for workers earning three minimum wages. The minimum pension eligibility requirement would also be lowered from 25 to 15 years of work. To be approved, the reforms need the vote of an absolute majority in both legislative chambers.

In addition to the aforementioned reforms, at this time it is likely that both the bill that would limit the use of outsourcing by employers (which accounts for about 20% of formal employment in the country), as well as the proposed changes to the Hydrocarbons Law will be approved by Congress before the June elections.

The coming weeks could be turbulent, as the recent frictions between the President’s party and the INE have already shown. After the INE ratified the cancellation of Morena candidates’ registrations for state elections in Guerrero and Michoacán, the President announced that he would move to reform the INE after the June 6 voting processes are completed to make it truly independent and subject to tighter budget controls. Integralia warns that, “If the results favour the president, he could promote more drastic changes than those seen in the first three years”; however, if the opposite happens, “it is foreseeable that he will redouble his attacks against the opposition, in addition to using popular consultations to pressure Congress to approve the reforms he needs to make his 'mark' and go down in history, among them an energy reform, a political-electoral reform, and even call for a Constituent Assembly to rewrite the Constitution”. In this context, they add, “Companies and investors must prepare themselves for an environment of greater risks and reputational attacks”.

With so much at stake in the upcoming elections, and some battles between the contenders and the electoral authorities already heating up (e.g., the governor’s race in Guerrero), this last month before the votes get cast will likely feature ongoing political controversy. Just as the campaigns intensify, will see important legislation affecting the rail sector, hydrocarbons, labour outsourcing and the judicial system moving through ongoing legislative processes. While this may induce some volatility in Mexican markets, investors have also increasingly come to look through temporary disturbances of this sort.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.