ON DECK FOR MONDAY, JULY 15

KEY POINTS:

- Trump trade, Powell and strong US bank earnings compete for market attention

- Soft and mixed evidence of a ‘Trump trade’

- How much more confident will Powell sound today?

- BoC surveys are likely to post lower inflation expectations

- PBOC holds as growth slows

- The condemnable attack revealed a plethora of ironies

- Reminder: Global Week Ahead — Gauging Powell’s Confidence here

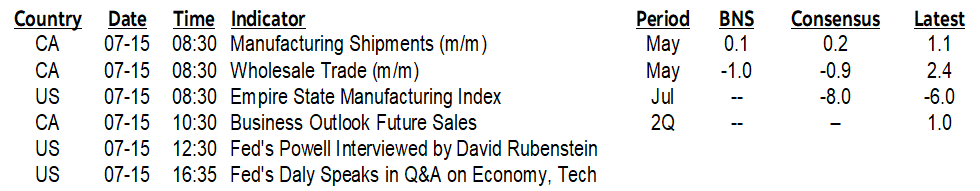

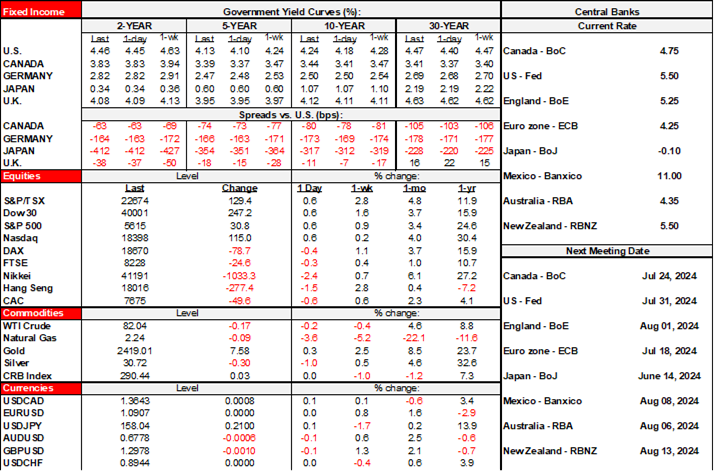

The week is kicking off with major potential developments, but so far relatively minor market moves. It’s difficult to disentangle the myriad effects on markets from one another amid the general sentiment that the assassination attempt added to the polling advantage Trump already and that will be further informed by polls in the aftermath (chart 1). Is it the Trump trade driving slightly outperforming US equity futures and a mild bear steepener? If so, then it’s not much of a trade. Or is it some combination of anticipation ahead of Powell’s appearance, plus expectations into the continuation of the US bank earnings season this morning relative to soft European earnings?

Soft ‘Trump bump’ Evidence

The hubris behind the Trump bump headlines is greater than the observed market effects and lacks consistency in my opinion. For instance, TIPS breakevens are flat in 10s, and slightly lower in 2s which leans against a Trump-trade lifting inflation expectations because of his plans for tariffs and fiscal expansion. The US curve is steeper because longer-term yields are up by about 3–5bps and thus underperforming other markets, which might be a combination of the market’s assessment that US growth risks pivoted higher on a more priced Trump victory, and/or that markets are bracing for more debt issuance and possibly more inflation notwithstanding the breakevens evidence. One manifestation of the assassination attempt’s effects is probably the fact that MXN is underperforming, though the yuan was little changed overnight. European equities are underperforming, but mixed into the effects were some disappointing earnings. CAD is holding flat.

How Much More Confident is Powell?

In my opinion what matters more is that Federal Reserve Chair Powell will appear at the Economic Club of Washington starting soon after noon ET. He will be interviewed by David Rubinstein. Key will be the degree to which he may signal increased confidence after last week’s softer than expected core CPI print. He may be asked about the weekend’s developments but has been around long enough to know that the best response is signal disapproval while dodging election questions in public.

Better US Bank Earnings

The Q2 US bank earnings season continues this morning after a soft start on Friday. Goldman Sachs beat on EPS, revenues and PCLs. BlackRock also beat with EPS of US$10.36 (consensus $9.93) but revenues and AUM both very slightly missed.

BoC Surveys

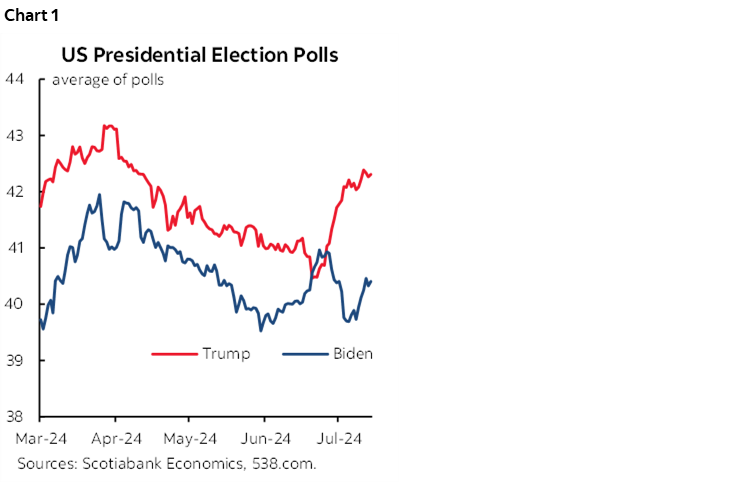

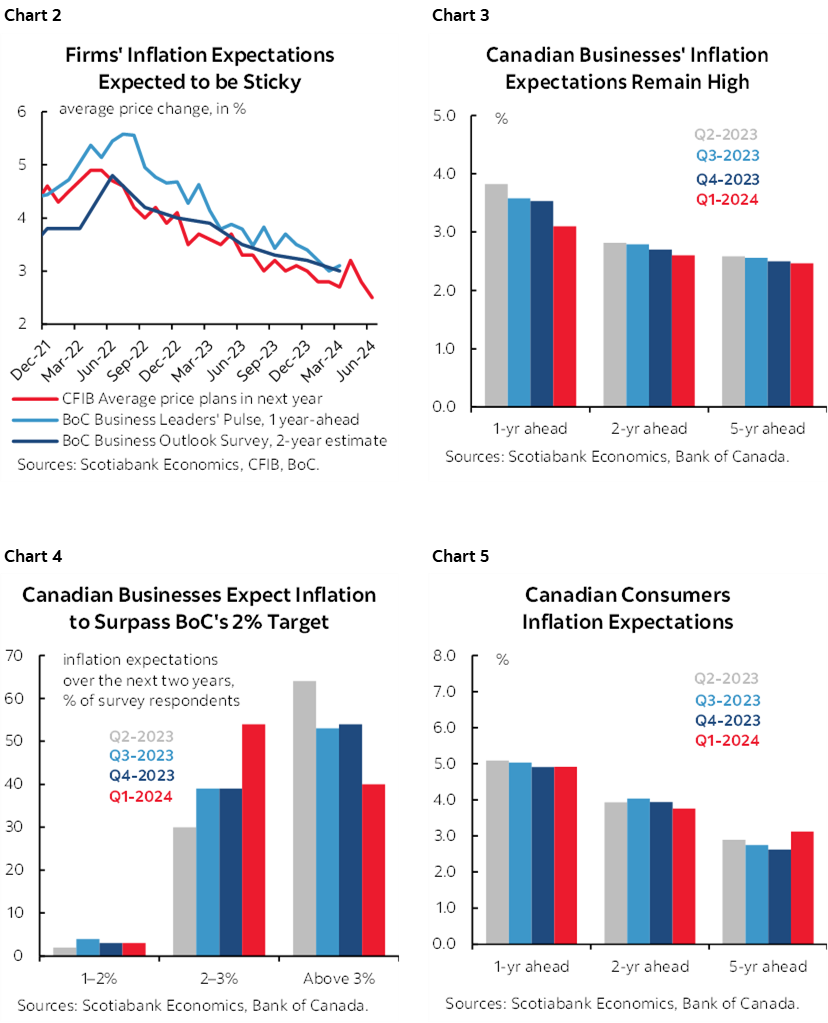

The Bank of Canada releases the Q2 versions of its Business Outlook Survey, Business Leaders’ Pulse and the Canadian Survey of Consumer Expectations this morning (10:30amET). Key will be expected further progress by the measures of inflation expectations given that more timely measures of small business expectations have declined and are highly correlated to the BoC’s measures (charts 2–5). The business gauges are coming back within the BoC’s 1–3% policy target range. Consumers’ expectations are always higher in every country and are arguably formed in more naïve fashion.

Canada will also update minor measures including manufacturing sales and wholesale trade, both of which are expected to be soft but details like volumes will factor into how May and Q2 GDP are tracking (8:30amET).

PBOC Holds as China’s Growth Slows

The PBOC held its 1-year Medium-Term Lending Facility Rate unchanged at 2.5% last evening as expected.

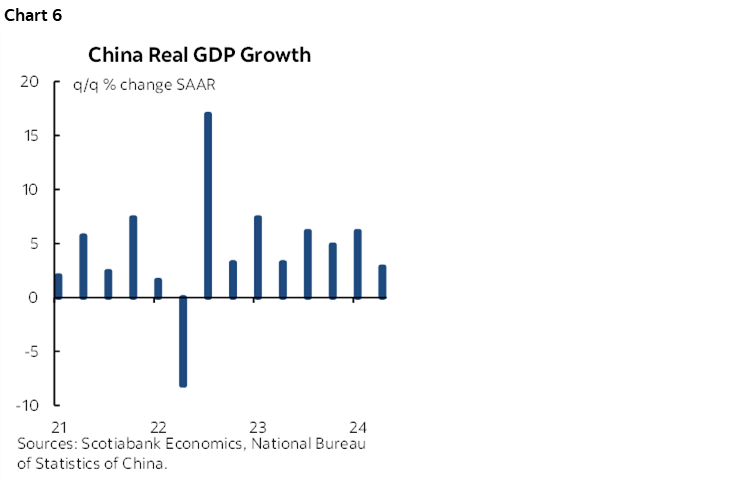

China’s economy slowed a little more than expected in Q2 (chart 6). GDP was up by 0.7% q/q SA nonannualized (0.9% consensus, 1.6% prior). The way the quarter ended in terms of higher frequency gauges offers a soft hand-off to Q3. For instance, retail sales slipped by -0.1% m/m SA in June which is the latest in a string of generally soft numbers this year. Industrial production was up by 0.4% m/m SA which was roughly an average pace.

Ironies Aplenty

Beyond the markets, the assassination attempt reveals multiple ironies. For one, a man who has been and remains a grave threat to US democracy was subject to the most vile, condemnable form of assault on democracy.

An extraordinarily divisive individual invited public unity in the response against the attack.

A draft dodger who has always gotten others to do his dirty work is being portrayed as a tough guy.

Trump says he threw out today’s speech at the RNC because “he can’t say those things after what I’ve been through” which may indicate that he learned to turn down the temperature.

A man who has driven deep divisions in the US and world promises to deliver a unity speech today.

The US secret service’s secret is apparently its inability to protect a presidential candidate against obvious security lapses and a stunningly slow response to an emerging threat.

We look to markets to assess the potential effects of a Trump victory, and yet markets—especially in the short-term—are arguably incapable of forming of accurate expectations of the complex and competing effects of Trump’s plans for macroeconomic policies especially in isolation of everything else.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.