ON DECK FOR TUESDAY, APRIL 15

KEY POINTS:

- Market gullibility is lifting equities…

- …as Trump gives and takes on tariffs…

- …with trust having been fundamentally trashed…

- …and still leaving intact a punitively high effective tariff rate

- Canada Week kicks off today...

- ...as Canadian inflation is likely to post a sharp jump in headline CPI...

- …but key will be core persistence…

- …yet the BoC’s script is already set for tomorrow

- Gilts outperform on soft jobs data

- US bank earnings continue, minor other releases on tap

Market gullibility toward the Trump administration’s next moves is lifting equities higher while ignoring another form of retaliation from China as it freezes plane orders from Boeing. My there’s some swamp land in Florida waiting for the folks buying the S&P at a 1.4% dividend yield and 20.2 times forward earnings into high risk of a recession.

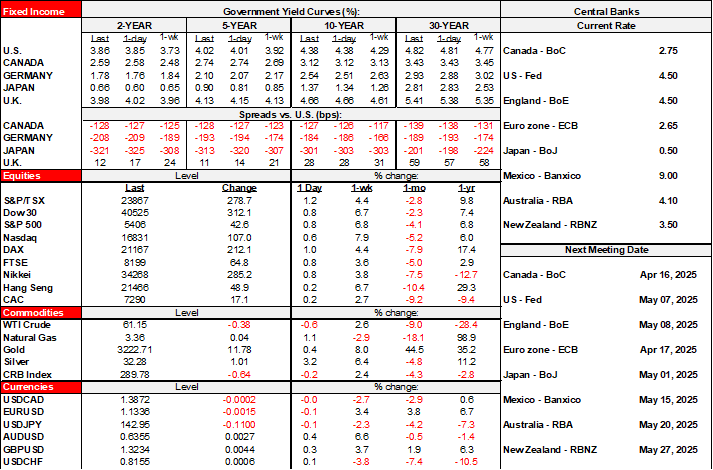

US equity futures are up a smidge with European cash markets up by between ¼% and 1¾%. Yields on US Treasurys and EGBs are gently higher with gilts outperforming (post jobs, see below) and Canada’s curve little changed ahead of CPI. The dollar is mixed with modest gains against the euro and related crosses offset by losses to sterling, Antipodean crosses and the yen. CAD is squarely in the middle ahead of CPI.

At the heart of relative market stability this week is whether to believe that the Trump administration is deescalating tariff wars or merely reloading. Further, even if it’s the former, is it enough to merit a more upbeat perspective? I know where I stand on those two issues, as trust has been fundamentally trashed by the US administration.

Take tariffs. And it starts with the humiliating mismanagement of the autos file. Trump is “looking at something to help car companies” compared to his assault on them with 25% tariffs. The tone suggests a temporary move (“a little bit of time”), a bias toward giving them more time to switch to parts made in the US, and “to help some of the car companies.” That still leaves a lot of ambiguity and a lot of likely tension with Europe and Asia.

And regardless of what Trump may or may not be signalling on autos, it stands to reason that he is taking back from other key sectors by launching investigations into the broad electronics and pharmaceuticals industries that are likely to lead to tariffs on those industries. Here too, the Trump administration has behaved extremely erratically including Friday night’s exemptions of some electronics, and then Sunday’s guidance that this was temporary.

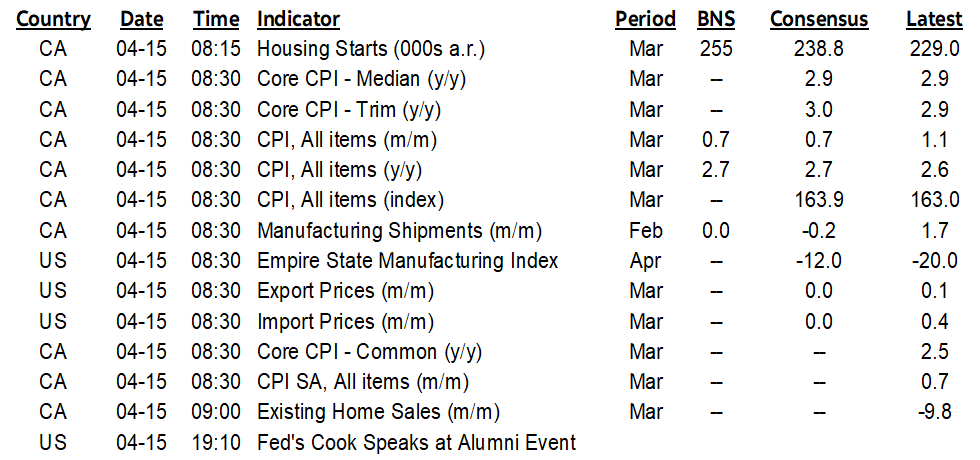

As it stands now, the weighted average effective tariff rate on US imports is still around a stunning 30% with the exact rate dependent on assumptions regarding CUSMA/USMCA compliance on avoiding some of the tariffs imposed on Canada and Mexico (chart 1).

And so buy equities? You’ve gotta be kidding me. The US economy and earnings will suffer at anything remotely close to such tariffs and the damage has been done by way of severely impaired trust in US policymaking. Policy uncertainty has shot through the roof and with that the desire to spend and invest is suffering.

CANADA WEEK STARTS WITH CPI

‘Canada Week’ kicks off today with three days of data, policy decisions and debates keeping a heavy focus upon Canadian developments.

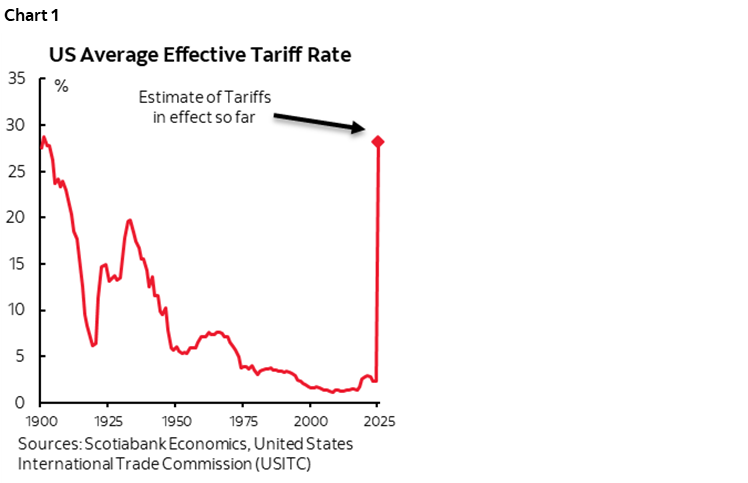

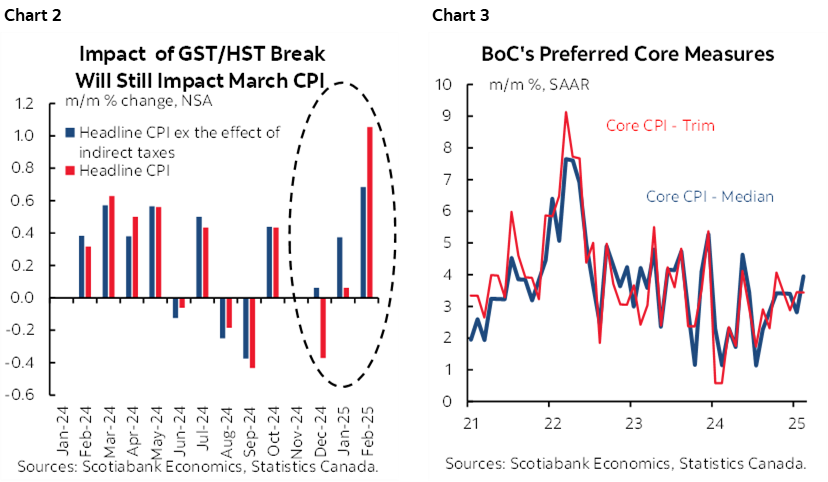

It starts with CPI today. I think it has little ability to influence the next day’s BoC decision. A fuller explanation is here. The other half of the effect of dropping the GST/HST cut in mid-February (chart 2) along with seasonal factors will be the main drivers behind my estimated 0.7% m/m NSA headline boost. Key, however, will be whether the BoC’s preferred core gauges continue to run hot as they have been all the way back to last May on a m/m SAAR basis (chart 3) and how the core gauges react around the end of the tax cut. For instance, will retailer margins be compressed in the face of the tax increase?

Then we have tomorrow’s BoC decision and the two days of election debates on Wednesday and Thursday evenings in an election race that is the Liberals to lose. See my weekly for the cases for a cut and for a hold. It’s a close call and we have a hold. I think only one of the ‘big six’ domestic banks has a cut. Markets are priced for around a one-in-three chance of a cut.

SOFTER UK JOB MARKET FANS MILD GILTS OUTPERFORMANCE

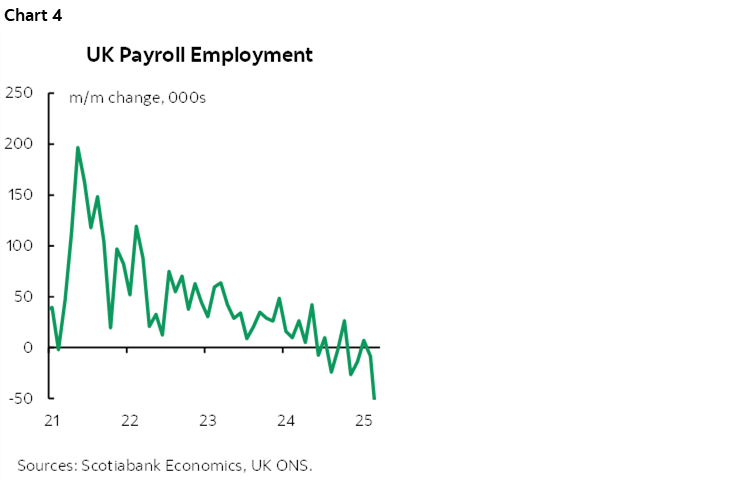

Gilts are outperforming partly on the back of soft UK labour market readings.

- UK payrolls fell by 78,467 in March for the biggest drop since toward the start of the pandemic in May 2020 (chart 4). This is the freshest reading of the bunch.

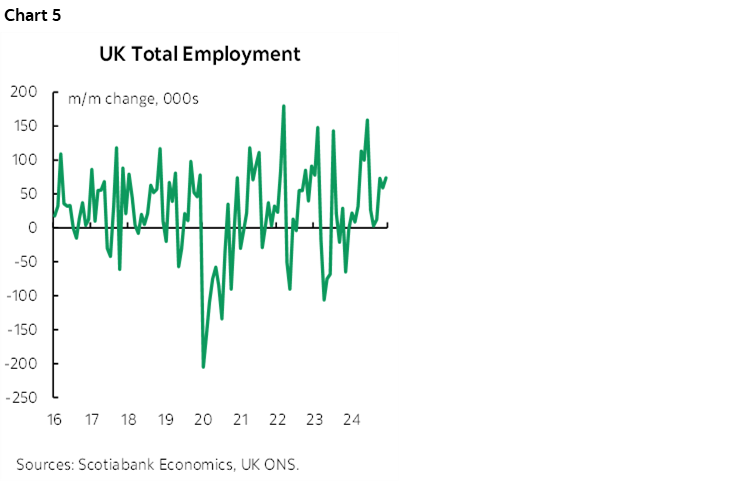

- UK total employment lags, but the February reading posted an increase of 74k (chart 5). Payrolls that month had fallen by about 8.3k but this must have been offset by off-payroll employers, namely small businesses.

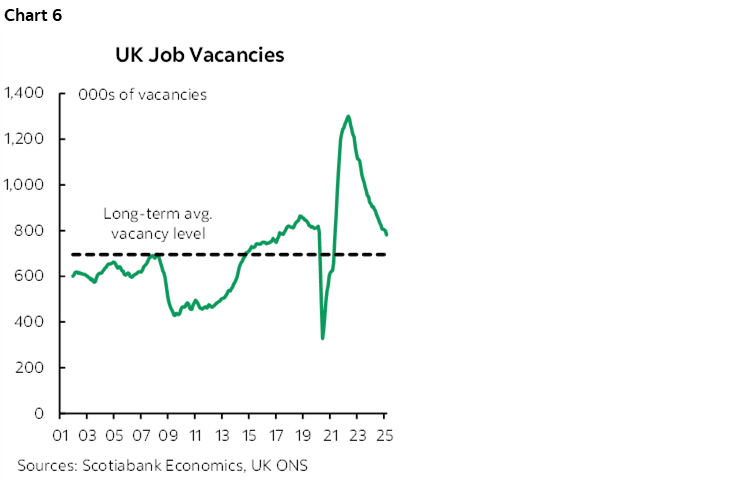

- UK job vacancies fell to their lowest since May 2021 but remain above the long-run average (chart 6).

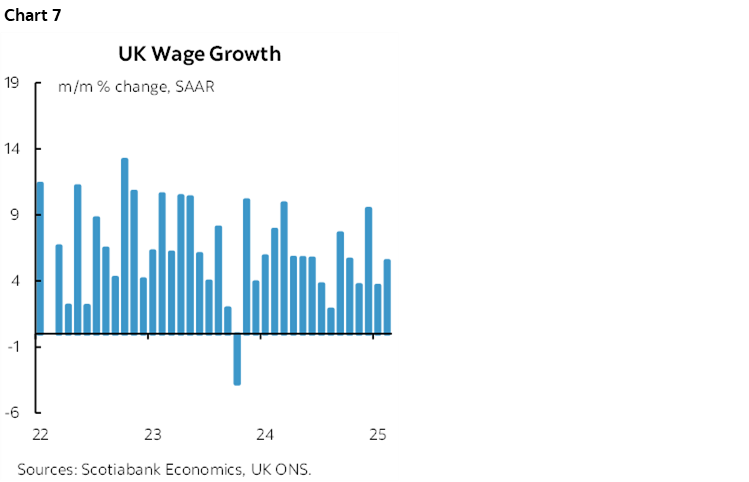

- A fly in the ointment is that wage growth picked up to 5.5% m/m SAAR from 3.7% the prior month (chart 7). The 3-month moving average is 6.2% m/m SAAR. Wage growth lags deteriorations in job markets.

US BANK EARNINGS CONTINUE AND LIGHT DATA

US bank earnings also continue with BofA already out and Citi out at 8amET.

German ZEW investor expectations fell to the lowest since July 2023.

Other minor data will include US import prices in March (8:30amET, future releases will matter more), revised Canadian manufacturing shipments for February (8:30amET), the US Empire gauge (8:30amET) that kicks off the regional surveys on the path to the next ISM-manufacturing report, and a pair of Canadian housing releases (existing home sales at 9amET and starts at 8:15amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.