- Chile: Unemployment rate surprises favourably (8.3%), but is explained by a strong contraction of the labour force

- Colombia: The labour market is resilient to the economic deceleration

European markets are relief trading to start the week but there remains an overall rates-negative mood in a hangover from their Friday selloff. French election results broadly came in line with polls and the vote split suggests the National Rally will fall short of a majority at Sunday’s second round elections. This leaves European bourses up nicely but well off their best levels at the open as a pronounced (rather unexplained) selloff in rates markets weighs on equities.

US equity futures are little changed and currencies are trading mixed, from the MXN’s 0.3% loss to the EUR’s 0.5% gain, while commodities are in decent shape with oil and copper up ~0.5% and iron ore spiking 3.0%+ on decent activity readings and a 36% m/m jump in new home sales in China in June. Global markets now await the release of German inflation data at 8ET (after state-level data point to a small miss in the national aggregate) and US ISM manufacturing readings at 10ET. Colombian and Canadian markets are closed today for holidays.

Peru’s official journal has reported a 0.12% m/m increase in Lima CPI that virtually matches the Bloomberg median of 0.10% while coming in slightly above our team's forecast of -0.04%. The monthly gain translates into a 2.28% y/y print (vs 2.3% median) that brings the headline rate away from the on-target 2% reading in May due to less favourable base effects. We’ll have to wait until the 11ET release by INEI for details on the drivers of price gains and how core inflation fared given the BCRP’s emphasis on the persistence of above-target underlying inflation—a stated justification for a rate hold last month.

Chilean May economic activity figures out at 8.30ET are expected to show a ~1ppt deceleration in growth to 2.5% from 3.5% in April, as guided by some underwhelming retail sales and manufacturing production data out on Friday; still, it will be the June inflation print (due a week from now) that decides whether the BCCh cuts again on the 31st. We also have the results of the latest Banxico economists’ survey out at 11ET, which may show a larger number of respondents calling for an August cut after relatively dovish decision.

—Juan Manuel Herrera

CHILE: UNEMPLOYMENT RATE SURPRISES FAVOURABLY (8.3%), BUT IS EXPLAINED BY A STRONG CONTRACTION OF THE LABOUR FORCE

- The sharp drop in the labour force concentrated in construction (own-account) is linked to permanent factors, but may also be weather-related.

- The loss of employment in the manufacturing sector (15k) could owe to more permanent factors.

- The disappearance of employment linked to the Population and Housing Census in the third quarter of 2024 would have a significant upward impact on the unemployment rate. Without these jobs, the unemployment rate would have been 8.6% in the quarter ending in May.

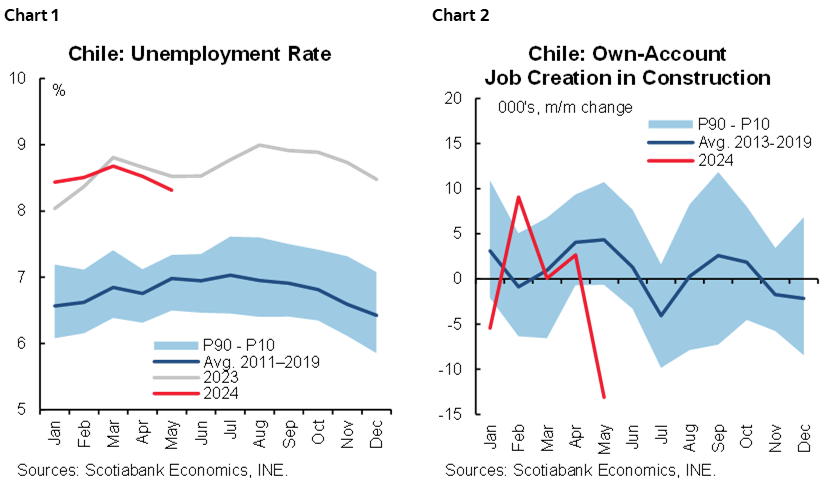

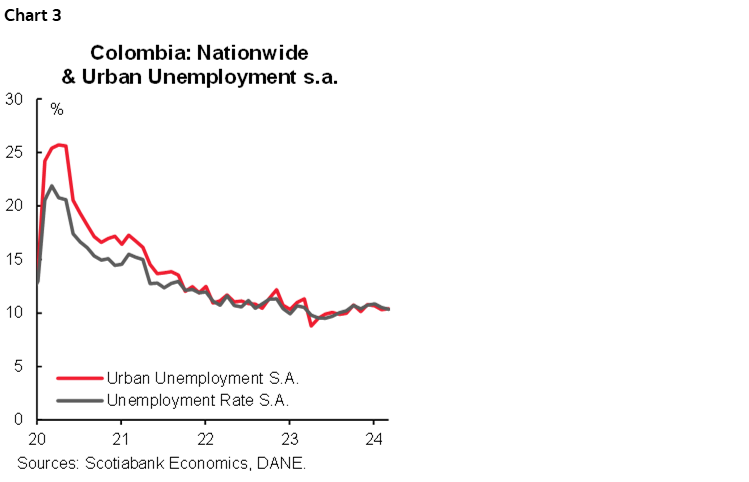

The unemployment rate surprisingly fell to 8.3% in the quarter ending in May (chart 1), which is largely explained by the sharp decline in the labour force (-32k). The effect on the unemployment rate was particularly important given that total employment experienced a slight drop (-8k). Regarding employment, there is a significant increase in public sector employees, in line with hiring linked to the Population and Housing Census. On the other hand, sectors such as manufacturing and construction destroyed employment (chart 2), which could be partly explained by transitory weather factors. For its part, the drop in the labour force—which was the largest in three years—is closely related to an increase in the reasons for habitual inactivity, especially study and retirement. However, we estimate a deterioration in the labour force for climatic reasons, which would have especially affected informal and own-account jobs.

Employment linked to the Census has allowed us to sustain no small part of the total job creation since last March. This factor has allowed the creation of between 25k and 30k salaried public jobs, but they should disappear next July/August once the national survey process concludes, and the tabulation of the collected records begins. The impact on the unemployment rate and total employment could be significant, although muted given the quarterly employment gains. The INE employment record for September should be clearer about the salaried employment linked to the Census and, consequently, we should observe a gradual increase in the accumulated unemployment rate of “nothing less” than 0.3 ppts from July to September, since a normalization of the labour force is also expected. All of the above would occur prior to the municipal elections (October 26–27th).

—Aníbal Alarcón

COLOMBIA: THE LABOUR MARKET IS RESILIENT TO THE ECONOMIC DECELERATION

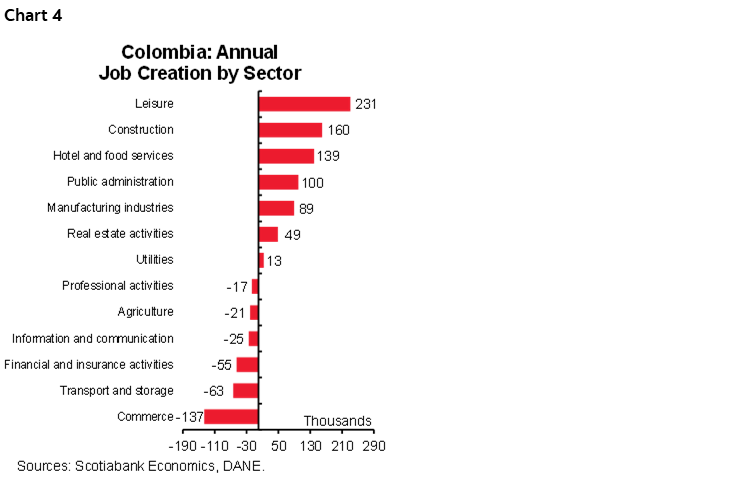

On June 28th, DANE released the labour market data for May. The national unemployment rate stood at 10.3%, decreasing slightly from 10.5% in May 2023. The urban unemployment rate also stood at 10.3%, showing a decrease of 0.9 p.p. in the same month of the previous year. On a seasonally adjusted (S.A) basis, the national unemployment rate stood at 10.3%, falling by 0.2 p.p. from 10.5% in April, while the urban unemployment rate increased slightly from 10.3% in April to 10.4% (chart 3). It is worth noting that despite this improvement, the economic activity deceleration is impeding Colombia from reaching again a single-digit unemployment rate.

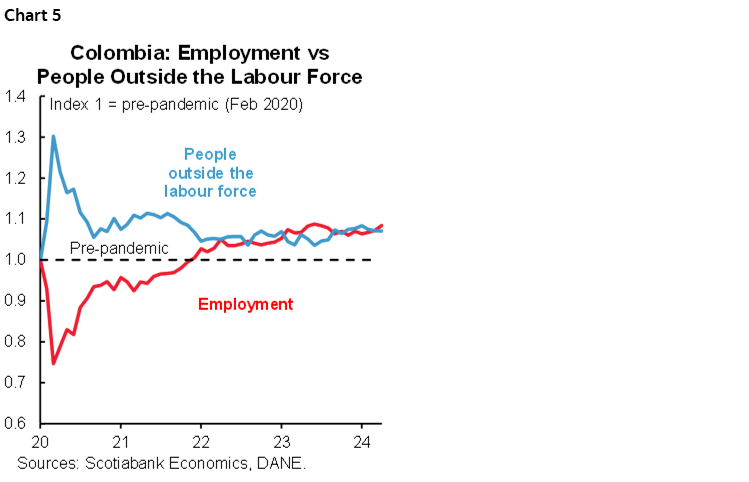

It seems that economic growth has been sufficient to maintain a seemingly stable labour market; although there was a bump in the road with the destruction of jobs in March, job creation has returned to a positive trend. In May, +463 thousand jobs were created, of which almost 50% came from the category of artistic activities and entertainment, associated with some musical events in that month. Additionally, the creation of jobs in the construction sector (+160 thousand) and the manufacturing sector (+89 thousand) stands out, which in the last two months had shown decreases in job creation. It is also important to highlight that urban job creation represented around 95% of total job creation (chart 4).

Despite the positive picture in some sectors, the context remained challenging for the sector of commerce and vehicle repair, which accounts for the largest number of jobs in the economy (~17% of total employment is concentrated in this sector), had a destruction of 137 thousand jobs, which is discouraging considering that it is one of the activities that usually has the greatest dynamism in May, due to the celebration of Mother’s Day. The result of this activity is highly correlated with some surveys that indicate that merchants did not reach the sales expectations they had for this period of the year, even though the prices of durable goods continue to be favourable for purchase.

The results of the labour market are added to economic activity data that show better dynamism in key sectors such as industry and construction; however, lower internal demand could eventually counteract these advances.

Key information on employment data:

- In annual terms, +463 thousand jobs were created. Artistic and entertainment activities added the most to the total, creating 231 thousand jobs, followed by the construction sector, which added +160 thousand jobs. On the negative side, the activity of trade and vehicle repair remains at -137 thousand jobs, followed by transportation and storage with -63 thousand jobs.

- The gender gap was at 3.1%, the lowest of all the months of May since 2016. The female unemployment rate fell by 1.1 p.p., standing at 12.1% from 13.2% in May 2023, while the unemployment rate of the male population increased by 0.6 p.p., standing at 9%. We have to highlight that part of the improvement in female unemployment rate was attributed to a decrease in the participation rate, which is something to monitor in forthcoming publications.

- The proportion of informal employment remained relatively stable, standing at 55.6%. Job creation was divided almost proportionally between formal employment (+228 thousand) and informal employment (+235 thousand), which prevented a greater improvement in the proportion of formal employment. The proportion of informal employment in rural areas decreased by 0.3 p.p., reaching 84.2%. At the same time, informal employment in urban areas increased by 0.4 p.p. to 41.8% (chart 5).

—Jackeline Piraján & Daniela Silva

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.