- Colombia: Monetary Policy Preview—BanRep will continue with a cautious rate cut; however, it is time to see signals of future acceleration in the easing cycle

- Mexico: Banxico to hold, timing of next cut remains uncertain

- Peru: GDP growth and monetary policy: settling down

COLOMBIA: MONETARY POLICY PREVIEW—BANREP WILL CONTINUE WITH A CAUTIOUS RATE CUT; HOWEVER, IT IS TIME TO SEE SIGNALS OF FUTURE ACCELERATION IN THE EASING CYCLE

Tomorrow, BanRep will hold the fourth monetary policy meeting of 2024. At Scotiabank Colpatria, we expect a 50bps rate cut to 11.25%, still in a split vote and maintaining cautious language. Despite BanRep’s anticipated maintenance of the pace in the easing cycle, we believe the vote division will be key to see if there is any possibility of accelerating the easing cycle in forthcoming meetings. In April, the vote division was five members voting for a 50bps cut, one for 75bps, and one for 100bps; if in June we see an additional board member voting for 75bps, it will be a signal of potential acceleration that increases the probability of seeing our projection of 8.25% by the end of 2024. For now, we project an 8.25% rate by Dec-2024 and the possibility of reaching the terminal rate of 5.50% by mid-2025.

During April’s meeting, the board expressed concerns about the tightening of international conditions, and it motivated the board to continue with the 50bps pace in rate cuts, trying to avoid surprises for markets. At this meeting, the central bank staff also released its monetary policy report, revising to the upside GDP growth projections for 2024 to 1.4% (previously 1.1%), which tilted the economist’s staff toward the hawkish side in their assessment of interest rates.

Since April, macroeconomic data has pointed to mixed signals that support the cautious approach from the central bank. The performance of the economic activity is mixed across sectors but still shows weak private demand and investment activity. Headline annual inflation stopped its deceleration, but inflation expectations are still decreasing. The current account deficit posted a concerning low deficit that represented less than 2% of GDP. In contrast, in the case of international markets, the Federal Reserve’s announcement of fewer cuts in 2024 had moderate impacts on financial conditions. All in all, mixed information is supportive of maintaining a cautious approach; however, at Scotiabank Colpatria, we see June’s meeting to affirm or discard the possibility of having an acceleration in the easing cycle in July.

Key points about June’s BanRep meeting:

- Economic activity performance showed a robust picture attributed to temporary fundamentals. GDP in Q1-2024 stood at 0.7%, higher than expected by the central bank, while the economic activity indicator for April grew by 5.5% y/y, well above the market consensus of 2.5%. However, these upside surprises are hiding a mixed picture. The agricultural and public administration sectors are leading gains but are not expected to be sustainable, while in the case of manufacturing, the rebound was due to the effect of more business days in April 2024 vs April 2023. For the “ultra core” part of economic activity, we still see a picture of weak demand and investment activity. Consumer credit is still an annual contraction, while the sentiment of private business remains cautious.

- Headline inflation pared to decline, while inflation expectations are still going toward BanRep’s target. May’s inflation stood stable at 7.16%, while ex-food and regulated prices continued going down by 37 and 24bps to 7.82% and 6.13%, respectively. Inflation expectations of one-year ahead went down by 22bps to 4.37%, while in the two-year window were affirmed at 3.6%. June’s inflation is expected to continue hovering around 7.2%, so it could likely contribute to seeing a cautious BanRep board for now.

- Political and fiscal pictures are slightly clear now. The MoF released the Medium-Term Fiscal Framework, affirming their willingness to comply with the fiscal rule; the government is coupling the fiscal income shortfall with lower fiscal expenditures. Despite the fact that the government could require further adjustments in fiscal spending in the future, the MTFF message gives confidence in the management of fiscal accounts. It will be relevant to follow if the MTFF-2024, this time, could change in any way concerns from the board around fiscal accounts.

- Congress approved pension reform. The central bank will be responsible for safeguarding the pension savings of the new sovereign pension fund. Although this topic is not directly related to monetary policy, it is important to see the board’s assessment of it.

—Sergio Olarte & Jackeline Piraján

MEXICO: BANXICO TO HOLD, TIMING OF NEXT CUT REMAINS UNCERTAIN

This afternoon, Banxico will release its monetary policy decision, in which we believe, along with the consensus, that it will leave the rate unchanged at 11.0%. The monetary policy outlook has changed since the last policy meeting in May, when we believed that the board would relax its stance at this meeting. As we mentioned earlier, the recent post-election volatility in the domestic financial market, the uptick in inflation owing to food and energy increases, along with a more restrictive stance from the Fed could change the tone of Banxico’s statement to a more cautious guidance.

The results of the Citibanamex Survey showed that there is no clear consensus on the next policy cut. Several analysts (nine out of thirty-four) responded that Banxico could cut this time (although we believe that some of them modified their call after the inflation print in the first half of June, which came in above expectations); others (ten out of thirty-four) expect it to happen in August, and the majority (twelve out of thirty-four) anticipate the cut at the September 26th meeting, once the new legislative term has started and one day before Claudia Sheinbaum’s inauguration (October 1st); two more anticipate the cut in November, and the last one in March of next year. Thus, the year-end rate consensus is now at 10.25%, although we believe it will move after this meeting to 10.50%, in line with our year-end expectation. In this sense, we will be watching the tone of the statement, looking for details on the Board of Governors’ stance regarding the uncertain political environment, the balance of inflation risks and its forecast.

—Brian Pérez & Miguel Saldaña

PERU: GDP GROWTH AND MONETARY POLICY: SETTLING DOWN

On Monday we shall receive data on June inflation, and on early indicators of GDP growth for May.

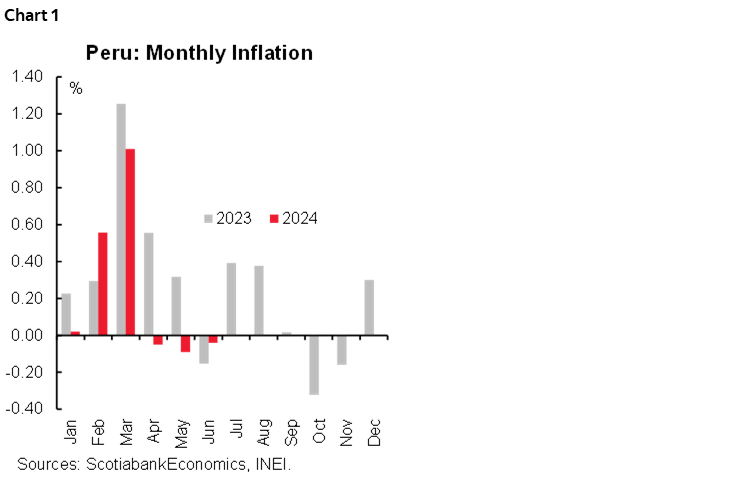

The key prices we follow are trending slightly negative so far in June, at around -0.04%. If, in fact, monthly inflation turns out to be negative, as it might, this would be the third consecutive month of negative monthly inflation, and, if it is positive, it should be very low. However, this does not mean that yearly inflation will decline from its current level of 2.0%. Monthly inflation in June 2023 was -0.15%. Thus, it is quite likely that yearly inflation may rise slightly in June, to 2.1%, or at best remains stable (chart 1).

This may not matter much to the BCRP when it meets on July 11th to decide on its policy rate. The BCRP left the reference rate stable at 5.75% on June 13th. This was a surprise, as it came on the back of headline inflation reaching the 2.0% target. The BCRP Inflation Report, published on June 21st, addressed this apparent inconsistency, and in doing so gave clear signals that the BCRP intends to slow down the pace of reference reductions going forward. The Report stated that:

- The BCRP is shifting from a “dovish” stance to a “neutral” stance.

- The BCRP gives more importance to the core inflation than to the headline number. In particular, it stated: “if core inflation is persistently above total inflation, and also above the target range, then a more restrictive monetary policy will need to be kept in place for a longer period of time.”

This is a strong statement. Yearly core inflation was 3.1% in May. Our view of June price trends puts yearly core inflation a hair above 3.0% for June, just nudging the target range ceiling. In general, core inflation is proving stickier than headline inflation, and the BCRP expects this to continue, as evidenced by fantail graphs in the Inflation Report, which show core inflation forecasts above headline inflation for the whole of 2024 and 2025.

Another aspect that may be behind the BCRP decision for a policy pause is the improved numbers we are seeing in GDP growth. The BCRP mentioned in its report in this regard that it sees the gap between GDP and potential GDP, which has been negative since 2022, turning positive by the end of 2024.

These are sufficient arguments for us to rethink our reference rate forecasts. We now expect more pauses between rate reductions. As we’ve seen, core inflation is likely to continue to hover around 3.0% in June. Given the importance that the BCRP has stated regarding core inflation versus headline inflation, we now expect the BCRP to maintain its reference rate stable once again in July.

In line with this, we are raising our year-end reference rate forecast from 4.50% to 4.75%.

However, our forecasts carry a greater quota of uncertainty. For one, we’ll need to be very observant on Fed timing, because as the PEN rate has approached the Fed rate, this has become a factor that has had a greater bearing on the BCRP’s decisions. In addition, it really isn’t clear what a more paused approach means. For instance, will it be two monthly reductions for every monthly pause, or two pauses for each reduction? There is scope for both.

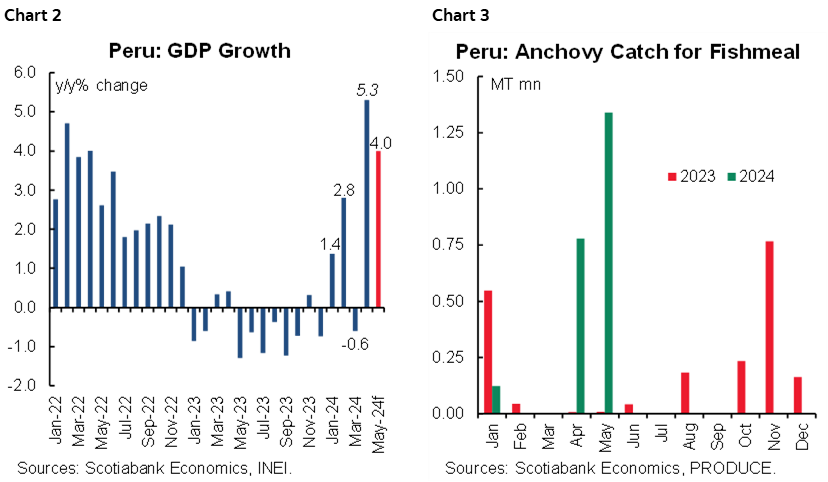

Early GDP growth indicators for May will also be released on July 1st, in particular fishing and mining GDP.

Overall, May promises to be another robust month, albeit not as strong as April (5.3%). We forecast 4% growth for May (chart 2). The caveat is that half of this growth is likely to come from fishing and fish-processing. Fishing GDP growth had already been a strong 158%, YoY in April. Well, May will be even better, as fishing output was higher in May than in April. Note, however, that this is all anomalous in that fishing growth was off a very low base, as El Niño prevented a normal fishing season in 2023 (chart 3).

Mining GDP disappointed in April with negative growth. We’re prepared to be disappointed by mining again in May. But, even if this is the case, it is likely to be the only important sector with weak to negative growth. One encouraging figure that has been released, and which underlies our belief in the continual recover y in domestic demand, is public investment, which rose 44% YoY, in May.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.