- Colombia: Agricultural and public sectors drive growth, while the secondary sector contracts

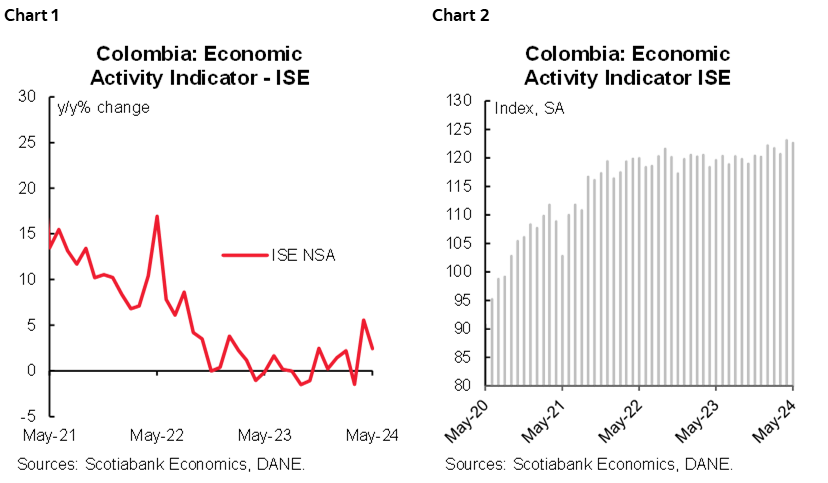

On Thursday, July 18th, DANE published the data from the Economic Activity Indicator (ISE) for May. The indicator stood at 2.4% (chart 1), exceeding the 1.2% expected by the market. The results illustrated that five of the nine sectors showed positive behaviour compared to the previous month, with the agricultural sector and public sector activities being the ones that added the most to the general result. In inter-monthly terms, the indicator contracted -0.4% (chart 2). Public sector activities in this case were the ones that decreased the most.

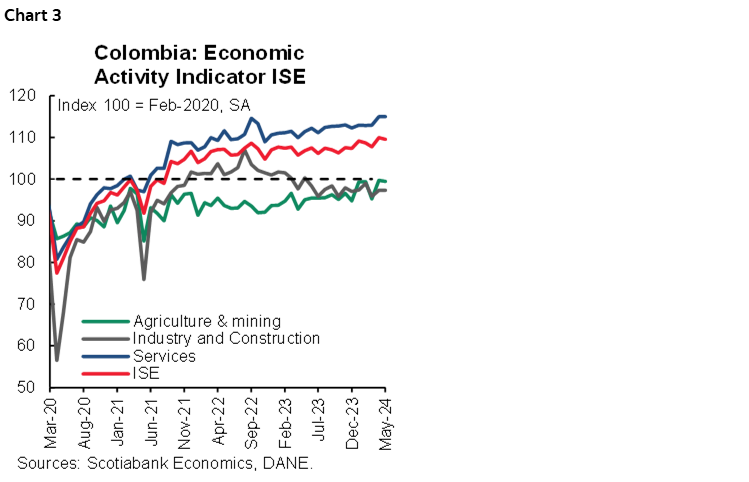

Economic activity was driven only by specific sectors due to seasonal effects. In April, economic activity showed a growth of 5.6% y/y, reflecting favourable behaviour in eight of the nine activities; however, May shows that the results of the previous month were the product of more working days for manufacturing production, and the response of the agricultural sector and utilities to the El Niño phenomenon. On top of that, economic activity remains weak, showing that the secondary industry and commerce continues to have difficulties in recovery, amid a lower consumer appetite.

We believe that BanRep will cut its interest rate by 50 basis points at its meeting on July 31st. The data provides room for the Board to feel some peace of mind to continue with the cautious stance, however, the time for an acceleration in the rate cut could be close, if inflation returns to its downward path and if eventually the Board is somewhat worried about the low domestic demand.

Highlights:

- The agricultural sector continues to drive the economy. The primary industry had a growth of 4.60% y/y, associated with a better coffee and banana harvest that is reflected in better exports of both products.

- Secondary activities fell -2.95% y/y in May. The recovery observed in April is associated with more working days in 2024, something that could happen again in June. However, structurally, a sustained recovery in manufacturing is not seen, while the construction sector does not maintain good dynamics.

- Tertiary activities maintain a positive performance, growing 3.15% y/y. Activities related to the public sector continue to show good performance, growing 9.0% y/y in May. The utilities reflect the use of thermoelectric power for energy supply during the “El Niño” phenomenon. On the negative side, trade fell 0.2% y/y, reflecting weak demand behaviour (chart 3).

—Sergio Olarte & Daniela Silva

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.