- Colombia: BanRep Survey—Economist consensus affirms expectations for a 50bps cut in July while inflation expectations fluctuate slightly

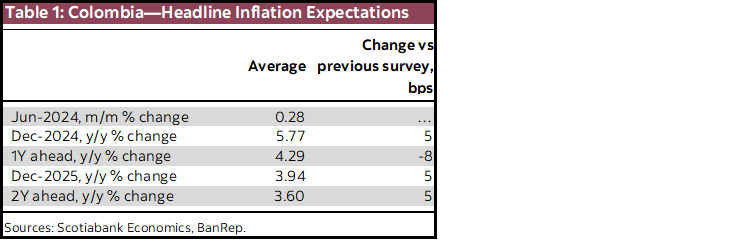

The Central Bank of Colombia (BanRep) released the economist expectation survey for July. Inflation expectations were relatively stable. For Dec-2024 and Dec-2025, expectations are at 5.77% and 3.94%, respectively. The inflation forecast for one-year is at 4.29%, falling by 8bps, while at the two-year horizon (July 2026) it rose by 5bps to 3.60%. Regarding short-term inflation expectations for July, the median sees a 0.28% m/m rise, which could take inflation down from 7.16% to 6.94% y/y. Scotiabank Colpatria’s projection is 0.26% m/m, and 6.92% y/y. We expect modest increases in food and utilities inflation, which will allow annual headline inflation to resume the disinflationary trend.

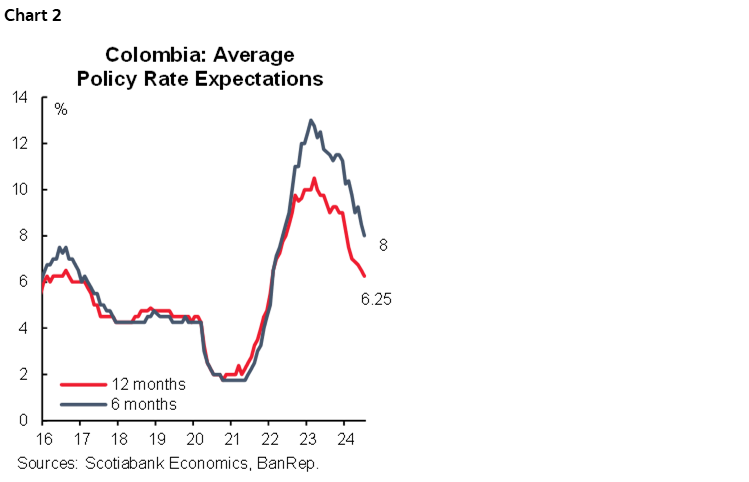

For the monetary policy rate, the market consensus projects a 50bps cut at the July 31st meeting, which is the same as our forecast at Scotiabank Colpatria. For year-end, the economist consensus expectation stayed at 8.50%; for Dec-2025, the expectation is at 6%, while the terminal rate is still projected at 5.50%; however, according to analyst’s consensus, this level could be achieved by Q2-2026. The economist consensus expectation is similar to the expectation at Scotiabank Colpatria. We project an acceleration of the easing cycle since September, cutting the interest rate at a 75bps pace to reach the terminal rate of 5.50% by mid-2025.

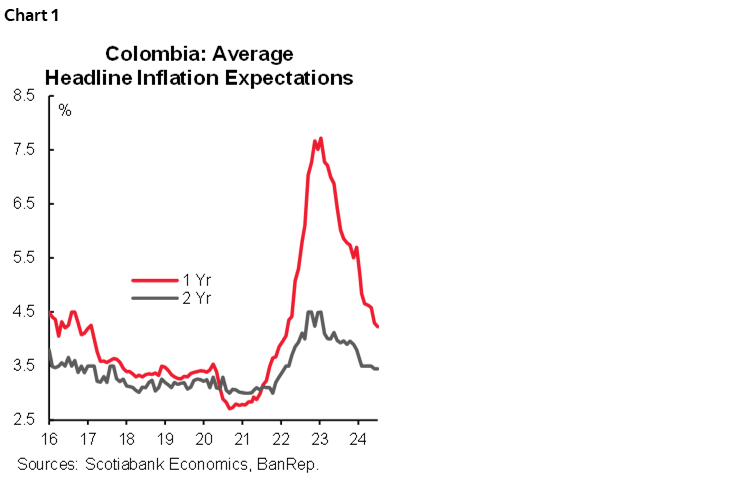

Inflation and monetary policy rate expectations have been relatively stable in recent BanRep surveys, which suggests that the volatility in Colombian macro readings has eased. The expectation for lower rates in the medium-term is affirmed, and the survey shows a gradual anchoring of inflation expectations to the target range. In the last quarter of 2024, we expect to see a more solid anchoring of inflation expectations, which will give confidence to the board to accelerate the easing cycle in September (chart 1).

Survey highlights:

- Short-term inflation expectation. For July, the consensus is 0.28% m/m, which implies an annual inflation rate of 6.94% y/y (down from 7.16% in June). The highest expectation is 0.46%, and the lowest is 0.11%. Scotiabank Economics forecast is 0.26% m/m and 6.92% y/y. Regarding core metrics, inflation ex-food is expected to close the year at 5.83%, and for Dec-2025 is at 3.87%.

- Medium-term inflation expectations were broadly stable. Inflation expectations for December 2024 increased by 5bps to 5.77% y/y (table 1). However, the headline inflation expectation for the one-year horizon continued decreasing and stood at 4.29% (-8bps). The two-year inflation expectation increased by 5bps to 3.60% y/y.

- Policy rate. The median expectation points to a 50bps rate cut at July’s meeting, while in the rest of the meetings during 2024, expectations point to 75bps rate cuts in each one (September, October and December). With previous expectations, economists consensus points to an 8.50% level for Dec-2024 and 6.0% for Dec-2025. Scotiabank Colpatria’s projection is similar, for Dec-2024 we expect 8.50% and 5.50% for Dec-2025 (chart 2).

- FX. The projections for the USDCOP exchange rate for the end of 2024 averaged 4049 pesos (two pesos below previous survey). For December 2025, respondents, on average, expect the exchange rate at USDCOP 4056 pesos (previous 4045 pesos).

—Sergio Olarte & Jackeline Piraján

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.