- Mexico: IGAE contracted in April, despite an annual increase; The results of the Citibanamex survey showed uncertainty about the timing of the next Banxico cut

- Peru: The fiscal deficit can no longer be overlooked

The G10 week starts out quietly with today’s calendar showing a few central bank speakers on tap while offering limited data releases. The broad risk mood looks decently positive overnight as most currencies post tiny gains vs the USD (the MXN is eyeing 18) while US equity futures rise slightly. Crude oil and copper are up a touch, but iron ore is taking a 2%+ beating on bloated Chinese inventories. Asia markets took to holding USTs to narrow ranges with a slightly positive flattening bias that has been held roughly unchanged through European hours swings.

Today’s release of H1-Jun Mexican CPI at 8ET will be important for Banxico expectations but it would likely take a large downside surprise for officials to consider resuming cuts at Thursday’s decision. Sticky inflation, a hawkish Fed, and now political risks to the MXN (which have at least eased somewhat) all conspire to keep the bank on hold this week as we and all but one economist polled by Bloomberg expect; we have also updated our call to only two more Banxico cuts this year (see here). For today’s CPI release, we’re roughly aligned with consensus expecting ~4.75% and ~4.2% y/y headline and core inflation prints that would be minor accelerations from the H2-May readings of 4.59% and 4.11% readings. Also watch comments by president-elect Sheinbaum at a press conference scheduled for 15ET.

—Juan Manuel Herrera

MEXICO: IGAE CONTRACTED IN APRIL, DESPITE AN ANNUAL INCREASE

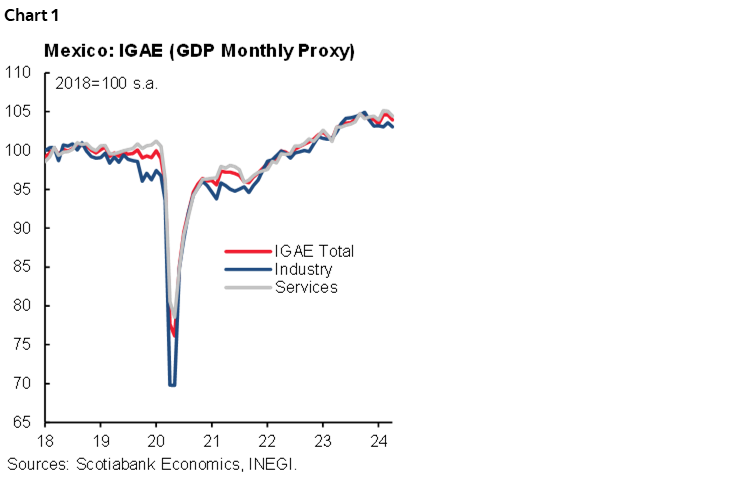

In April, the IGAE (GDP monthly proxy) had a monthly drop of -0.6% m/m, after having stagnated last month at 0.0%, with seasonally adjusted monthly figures. Industry had a slower pace of -0.5% (0.5% previously), services fell -0.6% (-0.1% previously), and primary activities -2.5% (-6.4% previously). In its annual comparison with original figures, the index had a significant increase of 5.4% y/y from -1.3% previously. By sector, industry increased 5.1% (-3.0% previously), highlighting manufacturing, which rose 3.8% (-5.0% previously), and construction 16.1% (5.8% previously). Services rose 6.0% (-0.6% previously), with a higher pace in retail trade of 7.3% (-2.1% previously), and wholesale 11.6% (-2.9% previously). Finally, primary activities had a significant drop -1.3% (4.3% previously).

In the January–April period, the index shows growth of 2.6% YTD, which is why it remains at good levels despite the slowdown. The industry surprises with an increase +1.9%, although pressured by mining (-3.0%), and manufacturing (0.2%), since construction continues to be strong (+12.1%). On the services side, these rose 3.1%, highlighting wholesale trade (5.8%), retail trade (3.1%), transportation (5.4%), among others. We hope that the index can continue to show negative monthly prints or low growth, due to the weakness of economic activity observed since the end of 2023, and due to the effects of monetary policy, however, we do not foresee a significant drop in GDP, supported by retail sales that rose 3.2% y/y in April.

THE RESULTS OF THE CITIBANAMEX SURVEY SHOWED UNCERTAINTY ABOUT THE TIMING OF THE NEXT BANXICO CUT

In the Citibanamex Survey, the results point to Banxico’s next cut being at the August meeting, although some participants still expect it to be in June (nine of the thirty-six participants). The median rate at the end of the year rose to 10.25% (10.0% previously). The range places the rate between 9.75%–11.0%, and by 2025 analysts expect a rate of 8.25%. Average GDP growth fell slightly to 2.1% in 2024 (2.2% previously), and 1.7% is expected for 2025. In terms of inflation, the average at the end of the year is 4.23% (vs. 4.25% previously), and underlying inflation is expected to be 4.02% (4.04% previously), although we expect to see increases in the coming months in accordance with producer prices. Given the recent volatility of the USD/MXN exchange rate, the forecast for the end of the year increased to $18.69 (vs. $18.05 previously).

—Brian Pérez

PERU: THE FISCAL DEFICIT CAN NO LONGER BE OVERLOOKED

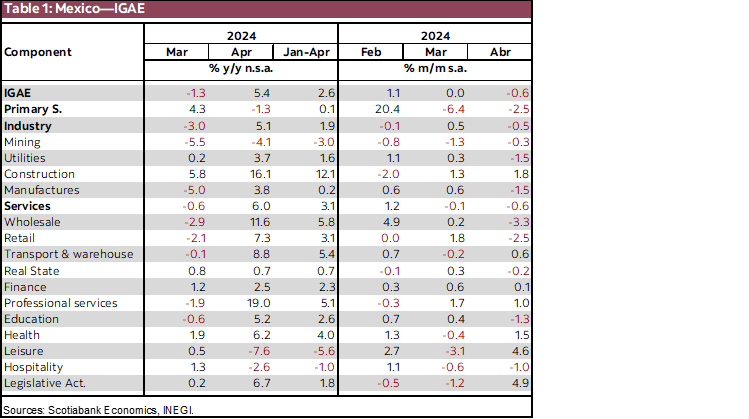

Peru’s fiscal deficit rose to 3.9% of GDP in the twelve months to May. Should we worry? A little bit, yes. This is the highest deficit since Covid, which was, of course, a very special—and temporary—circumstance. It’s much higher than Peru is used to. The question is when might the fiscal balance start turning around? We expect some improvement from here to year’s end, and a somewhat strong improvement in 2025. But, not enough to comply with the fiscal rule proposal.

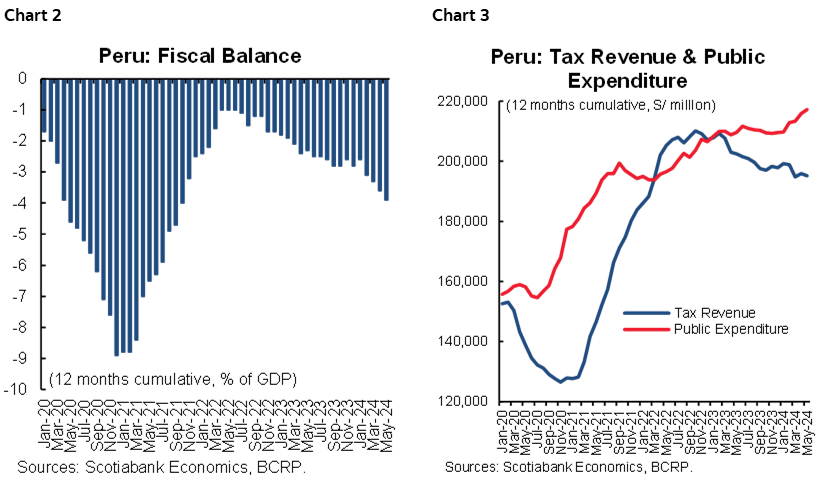

The fiscal deficit has risen throughout 2023 and 2024 to date. This has been due both to low fiscal income growth, and to greater spending. Low fiscal revenue has been taking place since 2023. Fiscal revenue fell 4.5% in 2023, and 2.9%, YoY, in January–May 2024.

Meanwhile, higher fiscal spending is more recent. Fiscal spending has taken off most especially in 2024. Government expenditure rose 1.2% in 2023, and 10.3%, YoY, in January–May 2024.

As a result, the fiscal deficit has risen from 1.7% of GDP in early 2023, to 3.9% of GDP in May 2024.

The first message to convey is that, while the fiscal deficit has become uncomfortably high, it is manageable. Furthermore, we see nothing to indicate that it will not remain manageable throughout the remainder of the current government.

At the same time, the degree of deterioration in the fiscal situation has been unexpected, and as a result we have put our forecasts for 2024, 2.5% of GDP, and for 2025, 2.0% of GDP, under revision. We are also skeptical that the government will comply with its new fiscal rule proposal. The government has sent an initiative to Congress to change the fiscal rule, to a 2.5% of GDP deficit in 2024, and 2.2.% of GDP in 2025. We do not foresee Peru complying with its 2024 goal, and consider it very difficult to reach its 2025 goal.

Non-compliance with the fiscal rule does not mean that the fiscal situation will no longer be manageable. However, it does give greater credence to the likelihood that Peru’s sovereign bond rating may be revised down again. S&P recently reduced Peru sovereign bond rating by a notch from BBB to BBB-. When Moody’s and Fitch review Peru’s rating in coming months, they will need to balance in their considerations the unexpected increase in the fiscal deficit to date, with the soothing impact we expect of high metal prices on the fiscal deficit in 2025.

Peru’s fiscal trend going forward will hinge on a number of factors, including:

1. Metal prices. This is both a hope and a risk. Metal prices in 2024, in particular copper, have been higher than we had been expecting, which should feed into higher tax revenue, to a mild degree in the second half of 2024, and then with greater conviction in 2025. At the same time, however, copper prices are off their recent highs and declining. Too steep a drop could reduce the impact of higher prices going forward.

2. Domestic demand in the formal sector. Sales tax revenue rose strongly in 2021–2022, not only due to the post-Covid rebound in domestic demand, but also due to a change in spending patterns in favour of behaviours that are more easily captured for sales tax purposes. This change in trend away from the use of currency in favour of cards has been exhausted. At the same time, domestic demand is beginning to pick up. Future sales tax revenue will depend on the strength of domestic demand growth.

3. Government spending. Both public investment and government current spending have risen to date in 2024 at rates surpassing our initial expectations. There is a good chance that strong fiscal spending growth will continue in the remainder of 2024 and in 2025. Public investment at the national government level has been rising as the government seeks to stimulate economic growth after last year’s recession. Public investment has been rising at the regional/local government level due to the political cycle. Regional/local authorities typically underspend in their first year in government, which was 2023, and spending then increases in the following years. In addition to this, congressional initiatives have driven up current spending, especially government wages.

4. The 2026 elections. Elections will be held for president/Congress (April) and for regional/local authorities (October). Campaigning starts in late 2025. One would think that upcoming elections would stimulate greater fiscal spending. This has not always been the case, as frequently the campaigning process is a distraction for authorities. We shall see.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.