- Peru: BCRP remained cautious once again in April; Trump tariffs spook the copper market, but there is no impact on growth data

- Mexico: Banxico minutes reinforce expectations for an additional 50bps cut

PERU: BCRP REMAINED CAUTIOUS ONCE AGAIN IN APRIL

The Board of Directors of the Central Reserve Bank of Peru (BCRP) decided to keep its reference rate unchanged at 4.75% for the third consecutive month, in line with our estimation and market consensus (the Bloomberg median). Despite low inflation levels, the uncertainty caused by U.S. tariff policies holds greater significance in the BCRP’s decision-making process. Positive economic expectations support for the decision.

Regarding the statement, we see that the BCRP has placed greater emphasis on the potential impacts of trade tensions. 1) The BCRP mentioned that inflation expectations in several major economies, particularly the U.S., have increased. As a result, the convergence of inflation toward its target could be slower than anticipated. 2) It indicated that the global economic outlook has deteriorated, financial market volatility has intensified, and risks to the global economy have grown.

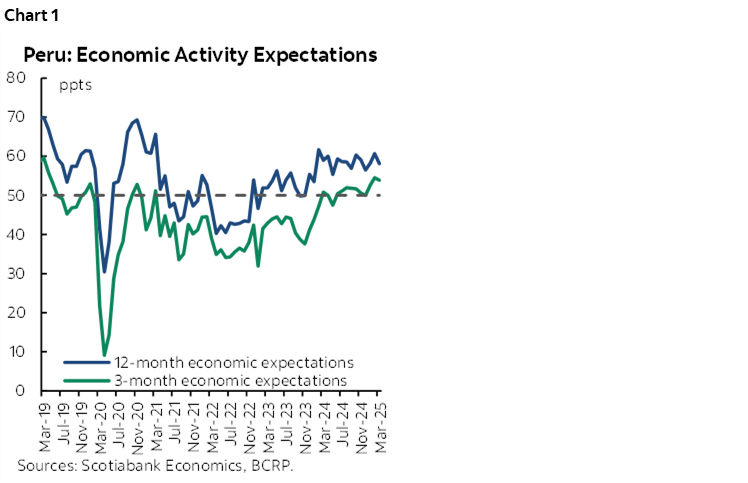

The BCRP also highlighted that economic expectations indicators showed a recovery and remained in the optimistic range for the third consecutive month, within a context of economic activity around its potential level (chart 1). These positive indicators reinforce the BCRP’s confidence regarding the current interest rate level.

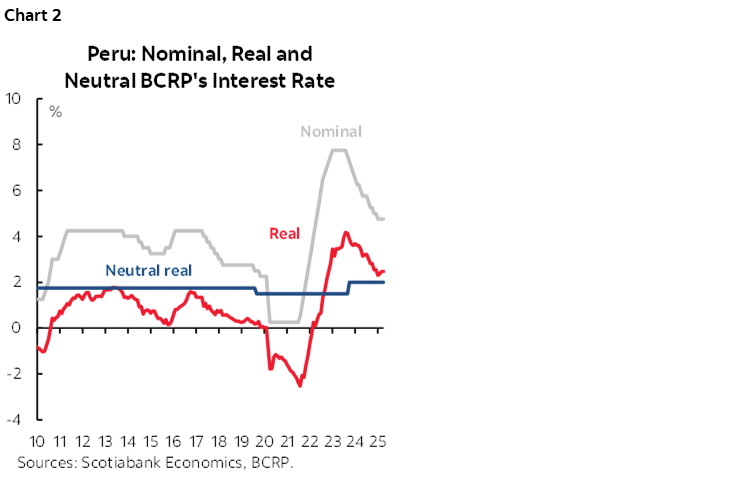

With the decision, the real interest rate remains stable at 2.38%, above the 2.00% level considered neutral, indicating the BCRP has room to make one or two additional cuts of 25 basis points (chart 2). However, the BCRP would remain cautious until it gains more clarity on the potential impacts of trade tensions. It might even wait for the Fed's moves to continue easing its monetary policy.

On the other hand, regarding April’s inflation, we expect it to be above +0.1%, in contrast to the -0.05% recorded in the same month of 2024. With this, annual general inflation would be positioned between 1.4%–1.5%, confirming our rhetoric that the bottom was reached in March (1.3%).

—Ricardo Avila

TRUMP TARIFFS SPOOK THE COPPER MARKET, BUT THERE IS NO IMPACT ON GROWTH DATA

After the US government released a flood of tariff measures on April 2nd, we were set to revise our Peru growth forecasts to the downside. Only, wait! The measures were then paused! We paused our revisions. Except, no. Tariffs on Chinese goods were actually increased! Peru is too vulnerable to China, due to its importance in metal markets, not to take this into account. Maybe we will need to revise our forecasts after all. Or not. Copper prices have since been actually rebounding, rather than declining further. It’s not easy forecasting these days (sigh!).

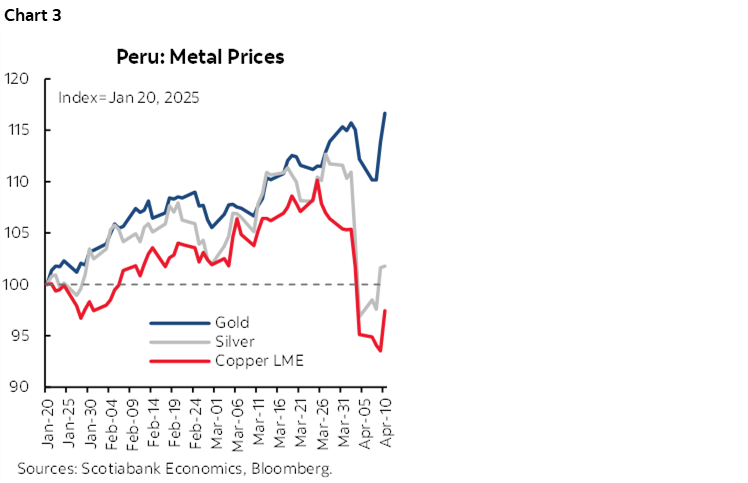

The main external risk for Peru’s economy is typically a decline in metal prices, more specifically: copper. The price of copper (and gold) had been performing quite well since the Trump presidency began (see chart 3). This gave us confidence that Peru GDP could grow 3.3% in 2025. As long as metal prices held up, domestic growth trends could continue.

We are aware that part of the reason that copper was outperforming expectation in February–March was temporary stockpiling in anticipation of the possibility that the US impose a product specific tariff on copper. The question was how long this would last, and how much it would correct. The plunge in the price of copper after April 2nd is a harbinger of risks to come. If the price of copper remains around US$4.00/lb, things should be ok. There is a real risk, however, that copper may fall further than this. Eventually. For now, copper is rebounding nicely.

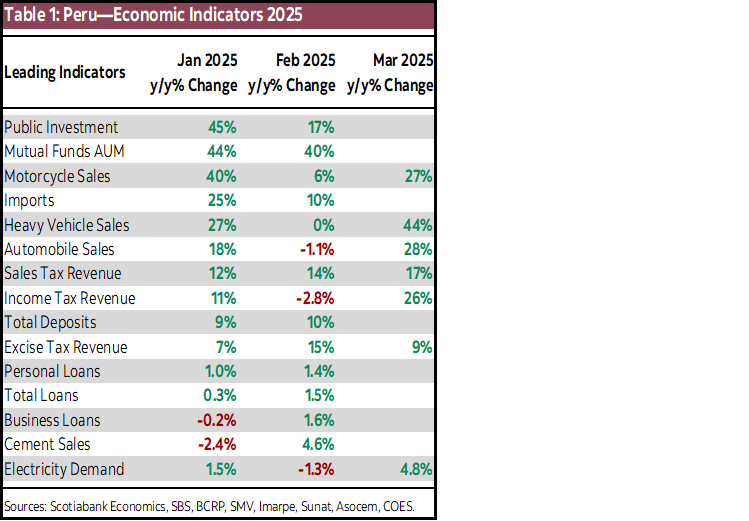

Meanwhile, back at the ranch, the economic data that is coming in does not reflect external events. Not yet, anyway. On April 15th the GDP growth figure for February will be released. We expect GDP growth of 3.1%, with some upside. This is a notch higher than we were expecting previously, namely because we’ve taken into account the 4.3% y/y Agriculture & Livestock GDP growth figure that was released earlier this week. This adds to Fishing GDP, up 24.6% y/y (albeit, in an off-fishing season month), and Mining, down 1.4% y/y, that had been previously released. We had expected worse, given that February 2024, the comparison base, was a leap year, adding an additional work day last year. The growth figure for February will come in below the +4.0% trend the economy has been following, solely because February 2024 was a leap year. The breakdown of leading indicators is still quite healthy.

The same can be said for March, where early leading indicators are coming in even better, overall, than in February. GDP growth in March should surpass 4.0% once again.

One of the things that stands out in the Leading Indicators table is the strong performance of sales tax, income tax and excise tax revenue in March. The current March–April tax season is going very well. So well, in fact, that by the time the tax season is over, at the end of April, the fiscal deficit could well decline to 2.6% of GDP, from 3.5% of GDP in February, when the figure was last released.

—Guillermo Arbe

MEXICO: BANXICO MINUTES REINFORCE EXPECTATIONS FOR AN ADDITIONAL 50BPS CUT

- The arguments of the Governing Board for an additional 50 bp cut focused on economic sluggishness, the current level of inflation, and the uncertainty generated by tariffs.

- They noted that private consumption has moderated, largely due to a slower pace in both domestic and imported goods, and that investment remains weak.

- The statement mentioned that the disinflationary process continued and a decline in global economic activity was observed during the fourth quarter of 2024, expecting the weakness to continue in Q1 2025.

- The Governing Board highlighted that both headline and core inflation remain close to their historical average, with recent prints showing greater stability.

- We believe there are increasing risks and greater uncertainty regarding the trade relationship between Mexico and the U.S.

- We consider that, in the next monetary policy meeting, Banxico will opt to repeat a 50 bps cut.

- But expect a year-end rate at 8.00%, in line with the consensus of analysts.

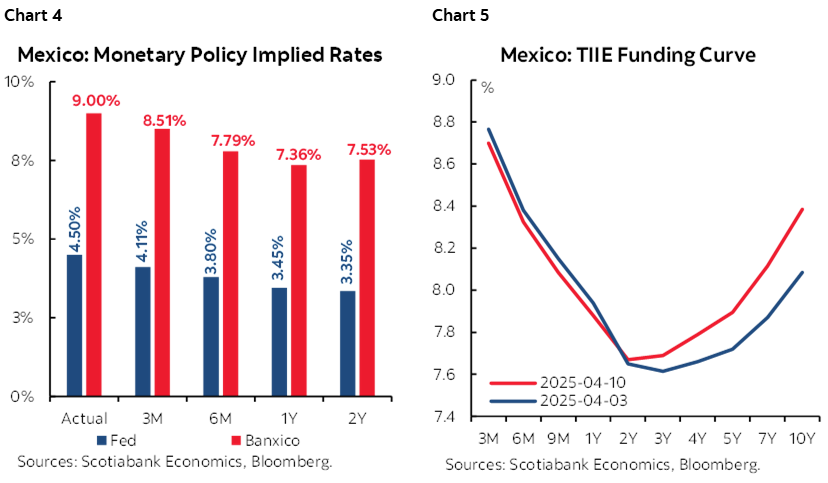

The Bank of Mexico published the minute of the March 27th meeting, detailing the discussion on inflation and monetary policy within the Governing Board, with a unanimous decision to cut 50 basis points to reach a reference rate of 9.00%. Overall, we highlight the arguments of the Board members that revolved around the process of moderating inflation. All members suggest repeating a cut of the same magnitude at the May meeting, although some question whether the cutting cycle should continue due to the international and domestic context.

Regarding the economy in Mexico, comments highlighted economic weakness, with a GDP contraction in the fourth quarter of 2024, resulting from declines in primary activities and industry, while services slowed down, and while weakness is expected to continue during 2025. They referred to January’s GDP proxy, which showed negative variations due to the weakness of manufacturing, construction, and mining. They noted that consumption has moderated due to lower consumption of both domestic and imported goods. Additionally, most members mentioned that investment showed a significant contraction. It is also noteworthy that some Board members expect a reduction in growth expectations and recognize that the probability of recession has increased, affected by uncertainty related to potential tariffs from the United States on Mexican products. Regarding employment, the statement noted that job creation has slowed down, although there has not been a significant increase in the unemployment rate.

On the international outlook, they mention that global economic activity is expected to decrease during Q1 2025, because of increased uncertainty regarding U.S. trade policy, leading to downward revisions in global growth expectations. However, the members comment that the disinflationary process has continued, despite the inflation trajectory has been different in each country and region. In line with this, an economic slowdown is expected for the United States, due to lower private consumption, supported by a significant decrease in consumer confidence. They also mention that the Federal Reserve maintained its rate unchanged amid an uncertain outlook. On the other hand, they recognized that markets have shown volatility but remember that this meeting came in before the reciprocal tariffs’ implementation.

Regarding inflation, the Governing Board highlighted again that both headline and core inflation are close to their historical averages, although showing greater stability in recent readings. Several members pointed out a recent moderation in services, which could continue to slow in the coming periods due to greater economic weakness. On the other hand, some members talked about the expectation of increases in merchandise prices; although according to the majority, the increase would be overcompensated by the slowdown in services. Regarding analysts' expectations, one member mentioned that since 2023 they have overestimated the inflation trajectory, particularly of core inflation, and that analysts may be underestimating the effect of economic weakness on prices. Regarding risks, the majority considered that the balance remains upward biased, although downside risks have gained relevance. In particular, the majority noted that changes related to U.S. trade policy entail both downside and upside risks, although some members considered that the effect of greater economic weakness would have a bigger extent and relevance than the upward effect of the USDMXN depreciation.

In the monetary policy discussion, we noticed a clear forward guidance of the members to repeat a cut of the same magnitude at the May meeting. The comments revolving for this cut are still based on the current inflation level, close to the historical average, and the downward pressures that prices will have due to weaker economic activity, which could be enlarged with the imposition of tariffs in the United States. However, in the medium and long term, we noticed some differences of opinion among some members. We highlight the comment of one member, who points out that, although in the short term there is space to act independently of the Fed, "eventually, this rate spread cannot be significantly below its historical average". Coinciding with this member, we believe that a spread below 400 basis points could generate volatility problems in the USDMXN and the financial market. Another member argued that in the future the monetary stance should remain restrictive as it should "ensure that an eventual price adjustment occurs without contaminating price formation". Finally, another member argued that "in the long term, the reconfiguration of global trade could lead to structural changes, including in price formation".

Looking ahead, given the comments of the Governing Board members, we believe the May meeting will repeat a 50 basis point cut in the reference rate to 8.50%. However, due to the highly uncertain environment, an upward risk balance, and the restrictive stance of the Federal Reserve, we believe the year-end rate will remain in restrictive territory at 8.00%.

—Rodolfo Mitchell, Brian Pérez & Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.