CANADA

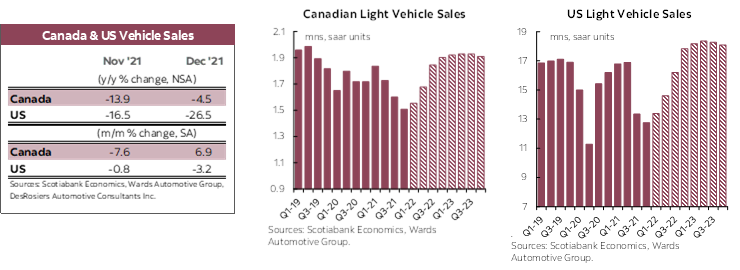

Canadian auto sales ticked up in December in a highly volatile environment as the sector braces for yet more headwinds. DesRosiers Automotive Consultants Inc. estimated 103 k vehicles (-4.5% y/y) were sold at a seasonally adjusted annualised rate of around 1.55 mn units. This works out to about a +7% m/m (sa) increase, following the -7.6% m/m (sa) retreat in November, according to the same source. Annual sales landed at 1.64 mn units—a 6.6% improvement relative to 2020 but almost -15% below 2019’s 1.92 mn auto sales. Looking through monthly volatility, inventory shortages continue to constrain sales. North American auto production had been improving through November (latest read), but from seriously low levels and at a pace not yet leading to material changes in vehicle inventory levels. The sudden surge in omicron cases threatens to stall the nascent recovery in auto production in the early months of 2022, which would, in turn, impact auto sales. Otherwise, demand-side factors remain strong: job and wage growth through November continued to surprise on the upside, while still-elevated household savings and hesitant consumer sentiment suggest pent-up demand is building. There is an upside demand risk that even more fiscal support could be added in early 2022 as provinces enact further lockdowns and income benefits are effectively re-opened. The acute supply-demand imbalance continues to drive new vehicle price inflation (6.1% y/y in November CPI; 0.3% m/m). There should be some softening in pricing as supply (and selection) pick up—with increased uncertainty as to when this will occur—but not likely in the first half of the year at least. For now, we anticipate soft-but-not-negative first quarter auto sales as a result of omicron impacts (mostly through supply chain and production channels), followed by strengthening sales alongside inventory improvements over the remainder of 2022. This would drive 1.75 mn in sales for 2022—still well-below fundamental demand—as capacity constraints in production would limit the pace of recovery. Clearly, there is considerable uncertainty to this outlook including the risk that first quarter sales retreat once again before a prolonged recovery begins. Recall, impacts of the delta-variant outbreak saw North American auto production decline by -10% q/q (sa) in the third quarter of 2021. It is premature to pencil in this magnitude of supply shock, but with auto production typically slower over the holiday periods anyway, it may only be in the early weeks of January that automakers begin revising down production plans owing to these latest setbacks.

UNITED STATES

US auto sales ended the year on a low note as sales pulled back by -3.2% m/m (sa) in December for a second consecutive month of decline. December’s selling rate of just 12.4 mn saar units dragged the annual sales volume down to 14.9 mn units—barely 3% above 2020’s sales—and almost -12% weaker than the 16.9 mn vehicles sold in 2019. Modestly improving auto production since October provided some assist to December purchases on an unadjusted basis (e.g., 1.2 mn vehicles sold in December versus 1.0 mn in November), but inventory gains were not sufficient to support the traditional post-holiday shopping spree. Importantly, escalating COVID-19 cases towards the end of the month also likely dampened consumer activity, while well-informed consumers were also aware that bargain prices would not be found this year. New vehicle price appreciation reached new heights in November (11.1% y/y, nsa; 1.1% m/m, sa), eclipsed by only a few other basket items including used vehicles. Though demand-side factors remain strong, we expect auto sales to continue to face headwinds through 2022 as supply recovers. This imbalance risks widening once again in the first quarter of 2022 if omicron outbreaks seriously dent production plans. We have lowered our auto sales forecast for 2022 to 15.5 mn units based on a softer-than-anticipated first quarter this year with accelerating activity thereafter. There is still considerable downside to this outlook owing largely to production plans.

Trends in Canadian Provincial Vehicle Sales

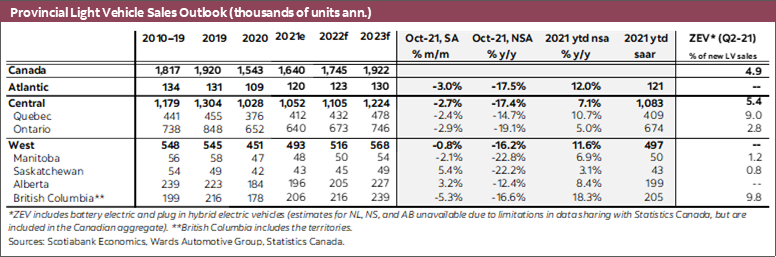

- Lagging provincial auto sales data confirm a volatile recovery in auto sales across the country—along with considerable variability across data sources. With the move to quarterly reporting by the industry, caution is warranted in reading too much into one month’s sales print. DesRosiers Automotive Consultants Inc. and Wards Automotive had both earlier reported national auto sales increases for October (+1.3% m/m, sa and +2.1% m/m, sa, respectively), whereas Statistics Canada has recently released provincial sales data showing a -2.2% m/m, sa decline for the same month. The difference in methodologies (i.e., StatsCan reporting on vehicle registrations versus the two other sources estimating OEM sales) could account for some of the variation as inventory shortages have increasingly led to pre-sales and longer vehicle delivery times (hence delayed registrations).

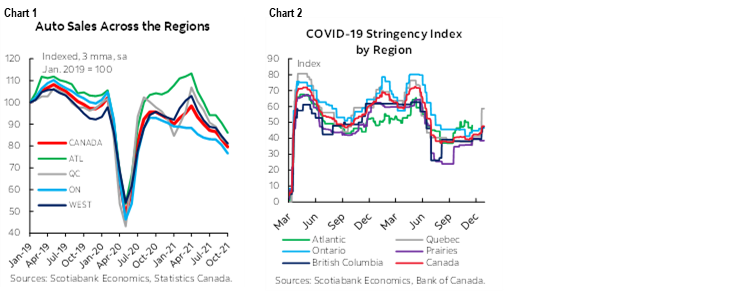

- Nevertheless, all data sources point to auto sales trending down since early Spring last year across the country as inventory shortages eclipsed the broader economic recovery (chart 1). Towards the end of 2020 and early 2021, there had been some notable differentiation across markets: Atlantic Canada’s auto sales recovery was less impacted by pandemic constraints via third and fourth waves; Quebec’s shorter and less stringent lockdowns, along with robust economic fundamentals drove an earlier surge in auto sales; Ontario’s weaker economic path—in large part owing to broader pandemic effects—weighed more heavily on its auto sales; while Western Canadian sales were fueled by rebounding commodity prices and stronger economic fundamentals in British Columbia. However, inventory shortages have universally pulled down sales across the regions since then. October auto sales data only reinforced this broad-based trend.

- With additional restrictions enacted towards the end of December to varying degrees across provinces (chart 2), pandemic factors are likely to continue to affect auto sales in the months ahead. It will likely only be well into 2022 before we start to see differentiation across markets based on more traditional economic drivers as limited inventory continues to put a cap on auto sales in an environment of pent-up demand.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.