CANADA

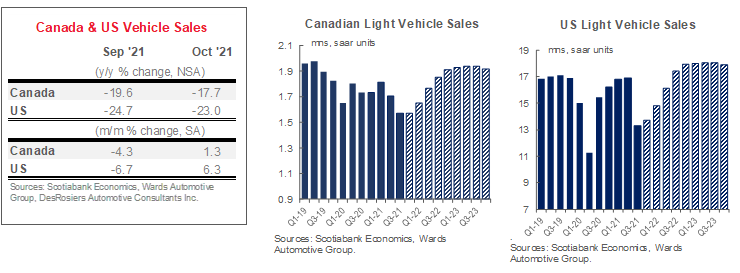

Canadian auto sales pulled off a modest improvement in October despite inventory challenges. While it may offer very tentative signs of a turn-around, the path to recovery will be long. DesRosiers Automotive Consultants Inc. estimated 128 k vehicles were sold. This works out to a 1.3% m/m (sa) improvement, but levels are still down by -17.7% relative to last October and at a still-weak seasonally adjusted annualised sales rate of 1.57 mn units according to the same source. Supply is by far the dominating factor behind weak auto sales. Proprietary data pointed to a double-digit decline in September inventory relative to August—not surprising given North American vehicle production decelerated by over -10% m/m (sa) in September—setting the stage for a weak sales month in October. COVID-19 outbreaks in South Asia are expected to have continued to slow auto production through October (data still pending) as semiconductor chips remain in short supply. Otherwise, fundamental demand-side factors remain largely intact, if not robust, once supply impacts are netted out. The September jobs print surpassed consensus, fully recouping jobs lost during the pandemic, while wage growth is strong. Though preliminary guidance on retail sales suggests weakness in September, this is likely mostly a supply story. Consumer confidence ticked up by over 3 ppts in October after two months of decline though much of the increase was attributed to views on the employment landscape whereas inflation is impacting consumer confidence over future finances even if household savings remain elevated (in fact, ticked up again to 14.2% in the second quarter under third-wave restrictions). The acute supply-demand imbalance continues to drive new vehicle price inflation: 7.2% y/y in September CPI though increases stalled on a month-over-month basis for the first time in half a year. Our sales forecast sits at 1.67 mn units and 1.80 mn units in 2021 and 2022, respectively. While shortages will fuel pent-up demand, production capacity likely limits the ability to fully unwind this over the course of 2022. We consequently expect to see continued growth in 2023 at 1.93 mn units.

UNITED STATES

The US etched out a solid 6.3% m/m (sa) increase in vehicle sales in October. Annualised sales nevertheless stood at a weak 13.0 mn units from September’s 12.2 mn saar units. Very modest improvements in inventory are reportedly behind the increase, led by production upticks at Ford and GM plants, in particular, according to Wards Automotive, though there may also be stronger rebound factors at play as the country emerges from the Delta variant wave as well as a much sharper downturn in sales this summer. Nevertheless, the inventory-to-sales ratio still sits below one so the climb back for auto sales will continue to be constrained by limited inventory. Otherwise, demand-side factors have been robust on the back of a highly supportive policy environment. Though September job growth fell shy of expectations, jobless claims shifted lower over the course of October, while major purchase intentions posted a 1 ppt lift (also October) according to The Conference Board. September retail sales underscored consumer resilience with a 0.7% m/m gain despite weak auto sales. Limited inventory continues to put upward pressure on new vehicle prices in September (8.7% y/y; 1.3% m/m, sa). Our outlook for 2021 auto sales at 15.2 mn units likely has more downside still if production does not pick up materially in the remaining two months of the year with any lost sales pushed out to the years ahead owing to the production capacity constraints in a high-demand environment.

Trends in Canadian Provincial Vehicle Sales

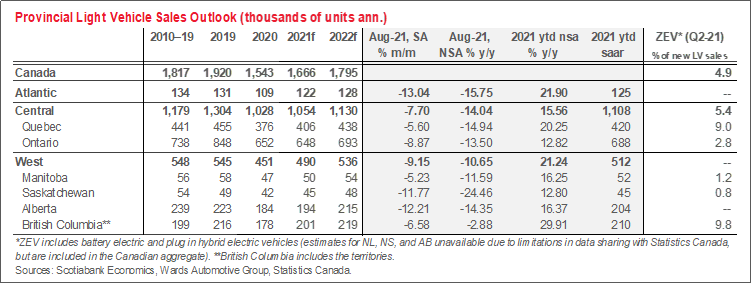

- Lagging provincial auto sales data confirm that inventory shortages curbed sales across the country this summer. Recall, national auto sales in August were down sharply (by -11.4% m/m, sa) despite national retail sales posting a solid 2.1% m/m (sa) improvement. August auto sales data from Statistics Canada show universal declines across provinces despite differing economic and pandemic contexts as inventory shortages took hold. The range in slowdowns was wide with smaller provinces on the extremes: from a sharp -19% m/m (sa) contraction in Prince Edward Island sales to a smaller -5% m/m (sa) decline in Manitoba. Declines continued through September (-4.3% m/m, sa), but a modest uptick in October (1.3% m/m, sa) offers weak signs that recovery is underway (national data according to DesRosiers Automotive Consultants Inc.), but it will be another couple of months before we see the distributional impacts across provinces from Statistics Canada.

- The larger markets may very well have benefited from a slight advantage in access to inventory with Ontario, Quebec and British Columbia all posting slightly more modest declines in August sales relative to the national average. These three provinces saw retrenchments in sales of -9% m/m, -6% m/m, and -6.5% m/m, respectively. Differences only emerge when looking at year-to-date sales—and better yet—year-to-date relative to pre-pandemic sales over the same period in 2019. Ontario auto sales are still down -21% ytd relative to 2019 as the toll of the pandemic has been much larger on the province, while more recent auto production slowdowns are also more pronounced. Quebec and British Columbia auto sales, on the other hand, are down -9.5% ytd and -6.5% ytd relative to the same period in 2019. (Nationally, auto sales were down by -15% ytd relative to 2019.)

- Alberta’s auto sales in August pulled down the national average with a -12% m/m (sa) slide. Pandemic-related factors likely also affected purchase activity as COVID-19 cases spiked that month. It was the only province to see largely flat August retail sales. Income effects from strengthening oil prices should support a stronger recovery in auto sales as Alberta remerges from the latest pandemic wave, but its sales are still down by -12% ytd relative to 2019. Furthermore, its sales in 2019 were already weaker than the national average owing to consecutive oil shocks that preceded the pandemic.

- Atlantic Canada’s auto sales deteriorated sharply in August with double-digit monthly declines for all four provinces. Otherwise, the region as a whole has been experiencing a stronger year-to-date in auto sales against more limited impacts from COVID-19. Prince Edward Island is in fact the only province where sales sit above pre-pandemic levels, while regional sales on a year-to-date basis are down by -8.5% relative to 2019 ytd.

- Just-released second quarter electric vehicles sales increased in Canada to a 4.9% share of total new vehicle purchases (from 4.6% in the first quarter of 2021). Volumes are still small which magnify the increases: EV sales surged by almost 40% q/q in the second quarter. British Columbia and Quebec still drive increases in the EV market with the share of total sales closer to 10% in both markets, owing to more generous purchase incentives (underpinned by solid economic fundamentals). Expect another surge if and when Ontario reintroduces demand support now that it is vested in the market.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.