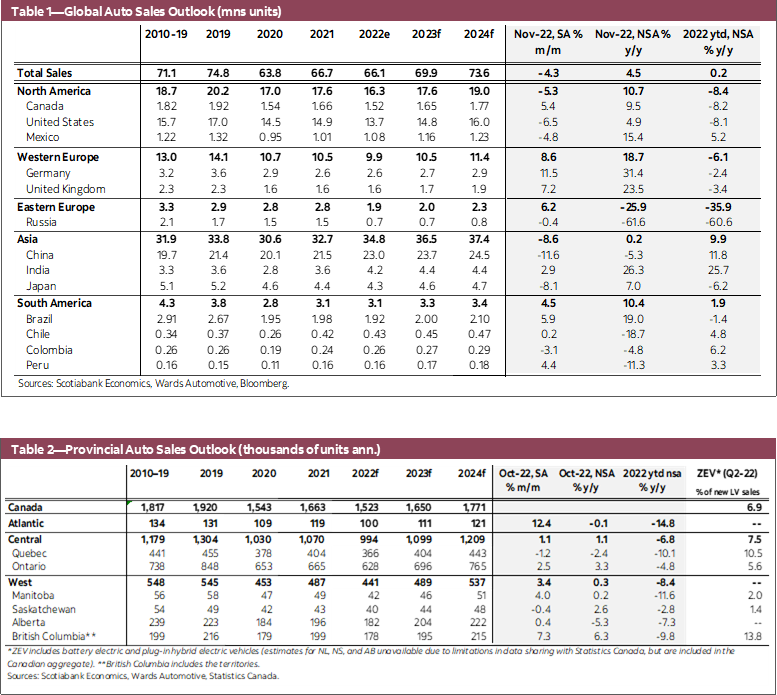

- Auto sales in the US and Canada ended the year on a weak note, posting declines of -8.1% and -8.4% in 2022, respectively. The annual sales rate stood at around 20% below pre-pandemic levels in both markets.

- Sales should improve in 2023 as supply-demand conditions ease. Although rising interest rates, broader cost of living pressures along with elevated vehicle prices will continue to weigh on sentiment in the near term, an aging vehicle stock should support sales recovery down the line, with a caveat that deteriorating vehicle affordability could permanently remove some demand compared to pre-pandemic.

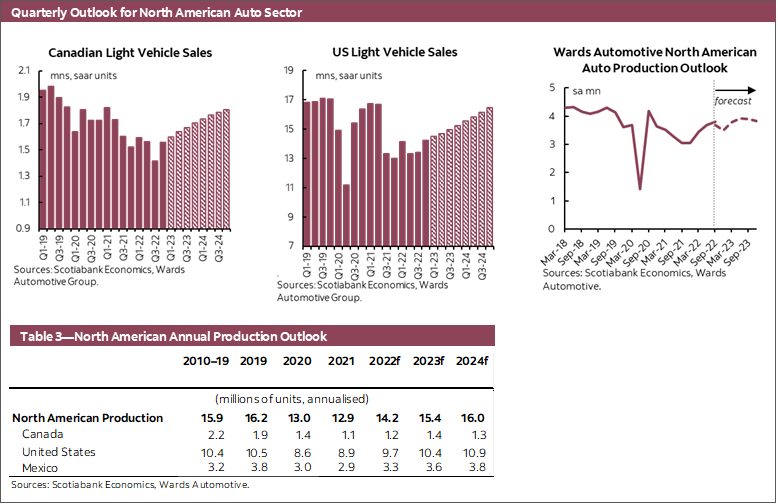

- We continue to expect the sales rate in Canada and the US to improve and reach 1.65 mn and 14.8 mn units in 2023, respectively—still well below pre-pandemic levels.

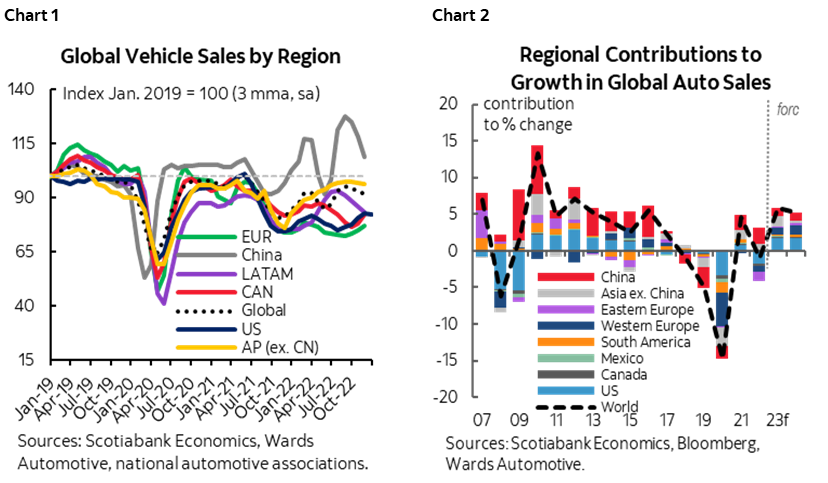

- Global auto sales pulled back again in November with a -4.3% m/m (sa) decline (chart 1). The sales rate slid to 65.4 mn saar units, well below the 75 mn units sold in 2019, but still improved from the 62 mn saar units that were trending in the second half of 2021.

- Given November’s weak sales activity, we now expect global auto sales to wrap up 2022 at 66.1 mn units, a slight -1% contraction from the sales rate in 2021. As vehicle availability improves, global auto sales should expand in 2023 and 2024—we pencilled in global auto sales growth of around 6% in 2023 and 5% in 2024, with a high degree of uncertainty around this outlook (chart 2).

GLOBAL AUTO SALES: A MIXED BAG

Global auto sales posted another month-over-month decline in November following three consecutive pull-backs, largely driven by losses from the Chinese market, which makes up around 35% of global auto sales. Auto sales in China decelerated sharply since August and plunged again in November by -11.6% m/m (sa) as a result of covid lockdowns that lasted until early December 2022 when the country relaxed its zero-COVID policy. Regional performances have been a mixed bag in a highly volatile environment as the sector braces for a global slowdown. Sales regained some ground in Western Europe with large improvements in Germany, France and Italy driving the headline sales rate to 10.9 mn saar units—the highest since July 2021. Global auto purchases are nevertheless still depressed with annualized sales in November at around 65.4 mn units—over 12% below 2019’s 75 mn units.

We expect global auto sales to gradually improve in 2023 to around 70 mn units—+6% higher than 2022 sales. The recovery is expected to be led by North America and Western Europe—the two regions that dragged down growth in 2022. We have pencilled in Chinese auto sales growth of around +3% in 2023 after the eye-popping gain of +7% in 2022 despite the pandemic lockdowns. There is heightened uncertainty around this outlook as rising cost of living continues to dampen growth around the world, layered on top of geo-political risks that also cloud the outlook.

CANADA AND THE US: WHEELS SHOULD START TO TURN IN 2023

Canadian auto sales pulled off a 10% improvement in Q4, but the latest sales rate remained depressed. Purchases dropped slightly in December by -0.4% m/m (sa) after the +5.4% m/m (sa) rebound in November. The 1.58 mn saar units sales rate is better than the 1.4 mn saar units trending in Q3, but still below the meagre 1.66 mn saar units sold in 2021.

Auto sales in the US faced two consecutive m/m setbacks at the end of 2022 despite improving inventory, offsetting some recovery between June and October. Sales dipped by -6.6% m/m (sa) in November, followed by another -6.4% m/m (sa) drop in December, bringing the sales rate down to 13.3 mn saar units, well below the 15 mn saar units sold in 2021.

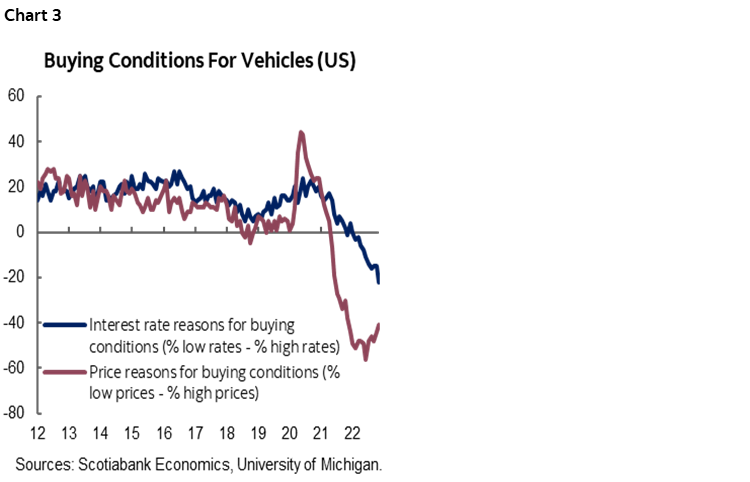

The recent softness in purchases could be the result of consumers opting to stay on the sideline amidst a weakening economic outlook. Despite solid balance sheets and wage gains, gloomy consumer sentiment could continue to weigh on major purchases in the near term (chart 3). With rising interest rates, broader cost of living pressures along with still-elevated vehicle pricing in a tight supply environment, it seems very rational to wait at this point in the cycle if a car is not immediately needed. On a more positive note, delayed purchases could turn into a tailwind down the line as economic conditions normalize, especially when central banks eventually pivot and start cutting rates, bringing some weary buyers back on the market with cheaper financing costs.

The 2023 sales outlook will largely hinge on supply recovery and affordability. Supply-demand conditions are easing, which should underpin higher sales in 2023. In the US, the chronic inventory shortages seem to be turning the corner as inventory picks up by an average of 5% m/m (sa) since February. Inventory-to-sales ratio is trending up as a result, but still remains well below pre-pandemic levels and continues to constrain sales. Auto production in North America rebounded from depressed levels in mid-2021, but softened in the last quarter of 2022 and remains around 15% below 2019’s levels. Wards Automotive Group estimates 2022 production ended the year with an improvement of close to 10% relative to the sub-13 mn units produced in 2020 and 2021, and continue to grow by another 7% in 2023 to 15.2 mn units, but still well below the 16.2 mn units in 2019.

Improved vehicle availability should remove some pricing pressure on new vehicles, but high prices could persist well into 2023, eroding some fundamental demand and start to weigh on sales once production catches up. Vehicle affordability has been declining sharply in Canada and the US. According to Cox Automotive, consumers need to spend 43.3 weeks of median income to purchase the average new vehicle, 30% more than the weeks of income needed in 2019. In Canada, the average selling price of a new passenger vehicle is currently $45.5k, over 30% higher than the average price of vehicles sold in 2019, outpacing the 17% increase in household disposable income since the pandemic. The deterioration of affordability compared to 2019 indicates a potential reduction of demand compared to pre-pandemic, especially in the lower end of the market—currently masked by supply constraints. However, the rebalancing of the supply-demand dynamic should remove some upward pressure on new vehicle prices, and the anticipated improvement in the supply of more affordable models should also help slow down further deterioration of affordability in 2023.

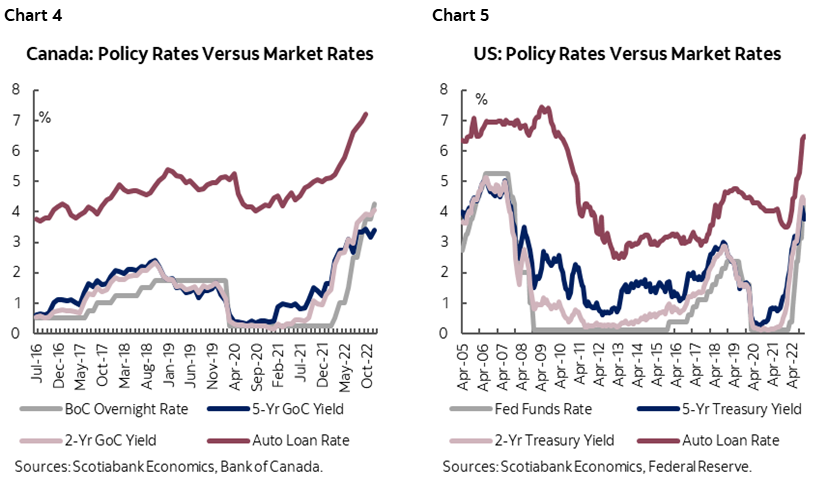

Elevated financing costs are likely to persist into 2023 as monetary policy remains restrictive. Rates on newly-issued auto loans reached 7.2% in Canada as of October—over two percentage points higher than the same month a year prior (chart 4). In the US, the average new auto loan rate stood at 6.5% in December, up almost three percentage points since the beginning of 2022 (chart 5). Even with aggressive overnight rate hikes since the beginning of 2022 that take interest rates well into restrictive territory, inflation will take time to come back to target. Headline inflation has shown durable signs of moderating on both sides of the border, but it is still high on a y/y basis and only started to decline on a m/m basis in December. Core CPI seems to be cooling with m/m increases on a downtrend—more evident in Canada than in the US—but it is running at an annualized m/m growth rate of 3.4% in Canada and 3.7% in the US. As monetary policy gradually works through the system, central banks should be approaching the end of their hiking cycles, and given the anticipated slowing in growth and inflation, they could begin rate cuts in the back half of 2023 and into 2024.

Looking past strong near-term headwinds, demand fundamentals remain relatively solid entering 2023, supported by structural factors and resilient labour markets. As supply recovery stretches out, production shortfalls in the past three years should support higher replacement purchases. Despite depressed sales rates, registered vehicles in Canada still increased by 1.3% and 1.5% in 2020 and 2021, respectively, and vehicle ownership continued to rise on a per capita basis, indicating still-solid demand fundamentals (Canadians still need more cars to get around). A rapidly declining replacement rate and aging vehicle stocks support demand for new vehicles in the coming years, underpinned by explosive population growth as record-number of new immigrants arrive.

The labour markets remain resilient as the central banks walk the inflation-recession tightrope. Despite the fact that monetary policy has been in restrictive territory for a few months, unemployment rates remained at all-time lows in December in both Canada and the US—favourable for auto demand. However, this could spur further wage growth and create upward pressure on inflation, forcing the hand of central banks. Labour market tightness has shown some early signs of easing, but with strong caution. In the US, wage growth decelerated m/m in December, and job openings declined by -9% relative to levels in early 2022. Wage growth is also on a m/m downtrend in Canada, and the Bank of Canada is hoping to cool the economy by reducing job vacancies without causing a spike in unemployment. Nevertheless, the labour market takes time to rebalance and we might still see the lagged effect of wage growth on inflation, which could potentially drive tighter monetary policy, and push up unemployment rates further.

LUXURY CAR SALES FARED BETTER THAN OTHER SEGMENTS

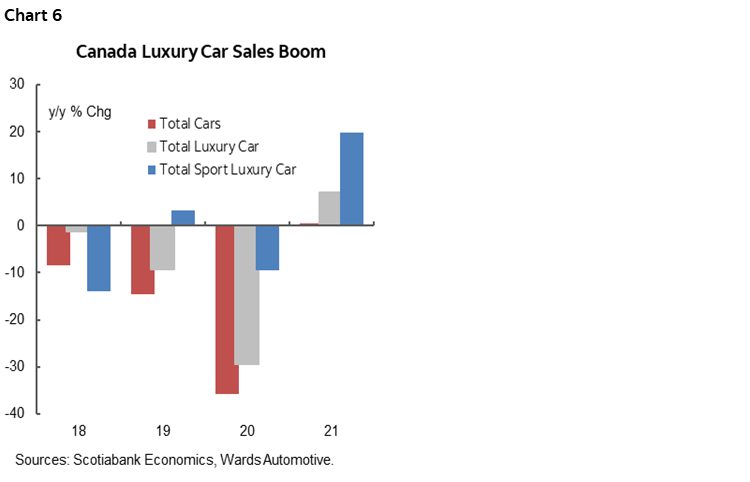

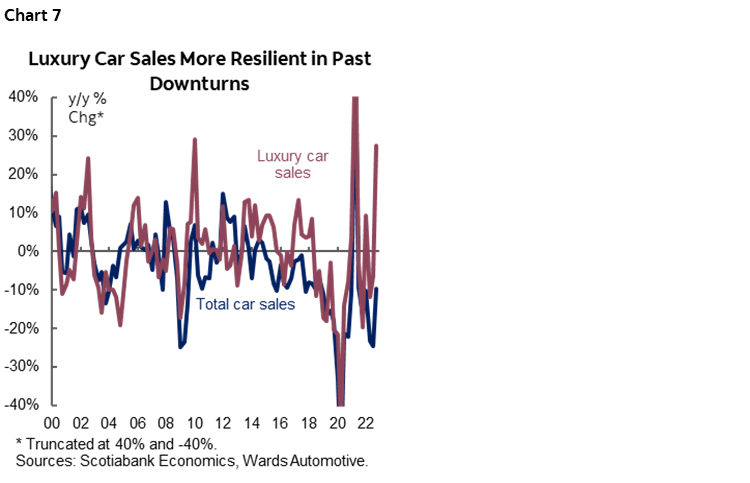

As vehicle sales decline on limited inventory, expensive models make up a larger share of purchases. Luxury cars as a share of total car sales have been rising since 2014 and the speed accelerated during the pandemic—due to supply disruption, automakers have been prioritizing more expensive models. Since 2019, total car sales have been suppressed by supply shortages, and are still struggling to recover. Luxury car sales have also been affected by inventory constraints, but were relatively resilient compared to other segments. The sports luxury car segment performed even better—sales dropped slightly by less than -10% in 2020 (compared to -29% for luxury cars and -36% for all cars), and picked up again in 2021 (chart 6).

As the auto industry recovers from the supply shortage that has been holding back sales for close to two years, luxury car sales should have some steam left, but with heightened uncertainty ahead due to strong economic and policy headwinds. Luxury auto sales have historically been relatively shielded from economic slowdowns (chart 7). But headwinds have been mounting, notably escalating financing costs as the Bank of Canada raised policy rate to the restrictive territory in an effort to tamp down inflation. Falling household wealth as a result of the housing market downturn also suggests a bit more pain yet for the segment. In addition to these economic headwinds, the federal government's new tax on luxury vehicles that came into effect in September could dampen demand for vehicles over $100k, but we have not yet seen any material impact from the new tax.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.