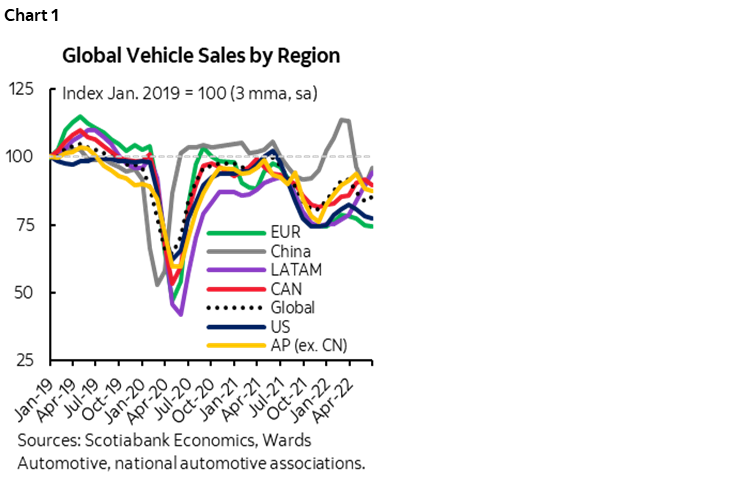

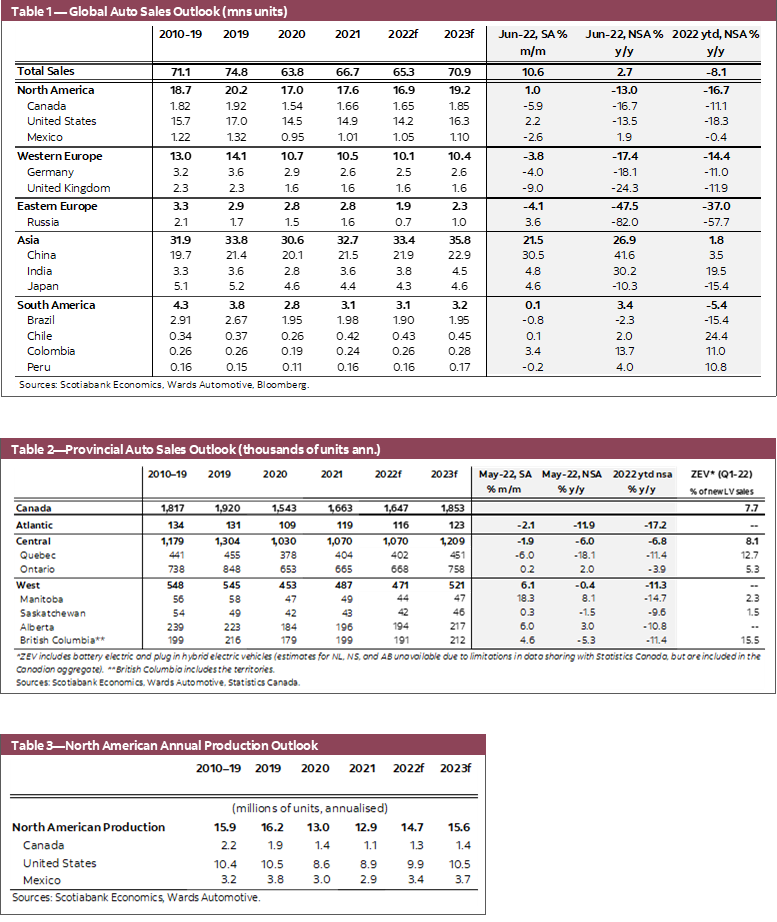

- Global auto sales saw a gain of +10.6% m/m (sa) in June—mostly on the back of a strong rebound in China—bringing the annualised sales rate to 71.1 mn saar units, slightly below pre-pandemic levels (chart 1).

- By mid-year 2022, global auto sales sat at an annualised 66.2 mn saar units, -7.3% below first-half 2021 levels as supply chains struggled to improve.

- The headline numbers mask still-high volatility in most markets, especially in North America, Western Europe and Japan, where sales were largely capped by persistent supply shortfalls.

- Looking ahead, production will likely remain the bottleneck for the sales outlook. With automakers frequently slashing their targets for the year, the recovery in purchases remains likely slow and bumpy.

- Consumer demand should still have some steam left for the rest of this year and next. Higher inflation trajectories and consequent central bank hiking paths will likely offset some pent-up demand, but labour market tightness could support continued gains in disposable income in both Canada and the US.

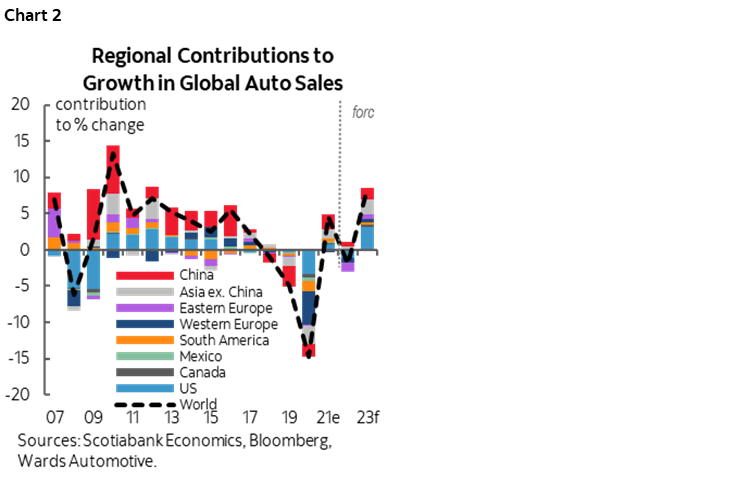

- We have pencilled in a slight contraction in global auto sales of -2% in 2022, with major losses concentrated in Europe and North America (chart 2). This includes nudging down our outlook for Canadian auto sales to 1.65 mn for the year (from 1.75 mn) owing to tight inventory still not yet showing signs of pivoting durably. We also expect a stronger rebound in 2023 relative to this year as production picks up, but with more downside risks on the demand side.

- Canadian EV sales picked up in the first quarter despite inventory shortage and rising prices, while longer term, the resurrection of a now-more favourable US policy agenda for regional EV manufacturing is a bright spot for Canadian manufacturing.

A BUMPY RIDE IN THE FIRST HALF OF 2022

Global auto sales posted another month-over-month gain in June following a similar rebound in May (chart 1)—mostly on the back of the reopening effect in China, where auto sales jumped by +30.5% m/m (sa) in June. Most markets around the world still grappled with strained supply chains—sales in Western Europe dropped by -3.8% m/m (sa) in June, while North American sales remained flat after a sizable decline in May. Outside of China, other markets in Asia Pacific also face high volatilities as sales rebounded by +22.3% m/m (sa) after a similar size drop in the month prior.

Overall, June’s improvement in purchases did little to boost the mid-year tally. Largely pulled down by declines in March and April, global auto sales ended the first half of 2022 at 66.2 mn units saar, -7.3% lower than same period last year, and well below around 72 mn units annualised sales in 2019 before the pandemic struck. Chinese auto sales picked up quickly after suffering double-digit dips in March and April due to COVID-19 lockdowns, and pulled off a 3.5% gain in the first half of 2022 relative to the same period last year. The stimulus packages announced by all levels of government will continue boosting auto sales in the second half of the year, but the speed might cool down once inventory tightens and pent-up demand runs out.

Apart from the direct volume losses in Eastern Europe due to the Russia-Ukraine war, auto sales disappointed across the world. Auto sales have been below fundamental demand due to supply shortfalls stemming from the microchip shortage and compounded by widespread production disruptions from the war, especially in North America, Western Europe as well as Japan, where year-to-date purchases were -16.7%, -14.4% and -15.4% below the first half of last year, respectively. Auto sales in South America benefited from a strong post-pandemic rebound for the most part of 2022—the Pacific Alliance minus Mexico saw sales up +18% relative to the first half of 2021—yet the year-to-date headline purchases were still -5.4% below the first half of last year due to weakness in Brazil.

LOOKING AHEAD AT THE BACK HALF OF THE YEAR

As the impacts of major events such as the Russia-Ukraine war and COVID-19 lockdowns gradually abate, supply constraints should continue to improve slowly for the back half of the year. Meanwhile, additional headwinds mount as the world economic outlook softens with risks of higher inflation and potential recessions tilting to the upside. Financial conditions are tightening around the world, weighing on global demand. In an environment of persistently tight supply, demand conditions will matter more once production catches up. We will be monitoring both sides of the equation. Nevertheless, we expect global auto sales to post a slight y/y contraction of -2.0% (to 65.4 mn) in 2022, with major losses concentrated in Europe and North America (chart 2).

1. PRODUCTION STILL UNDER MUCH PRESSURE

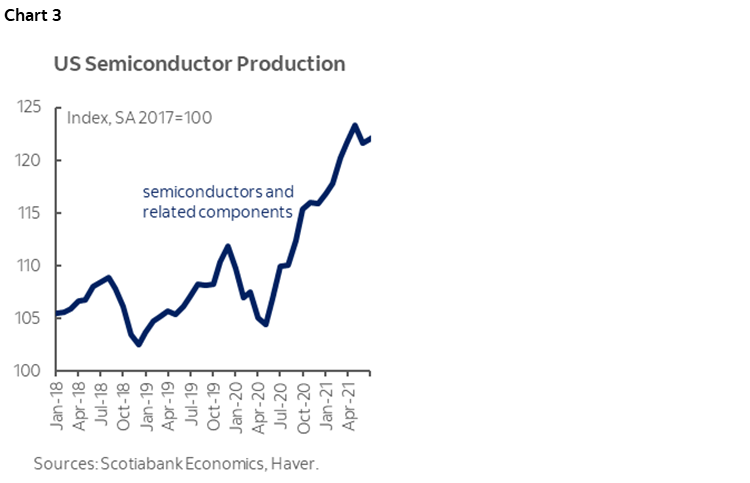

Automakers around the world have been cutting their 2022 production targets owing to slower-than-anticipated supply chain recoveries. AutoForecast Solutions projects 3.6 mn fewer vehicles will be produced in 2022 due to semiconductor shortage, with North America accounting for over 30% of production losses. S&P Global PMI™ Commodity Price & Supply Indicators reported heightened pricing pressure and higher supply shortages of semiconductors in June, and still far from returning to pre-pandemic levels. Barring further disruptions, the microchip crunch in North America should see signs of relief in the second half of 2022 with producers expanding capacity and ramping up production (chart 3). The "Chips and Science" act that was just passed by the US Senate will provide subsidies for US domestic semiconductor chip manufacturing, including auto-grade chip production, although it might take years for the industry to build up that extra capacity.

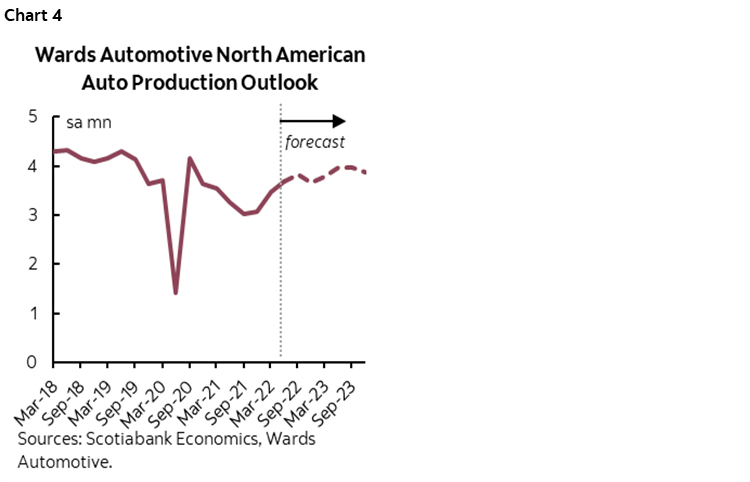

As the auto industry has a long supply chain, even if chip production picks up and meets production demands, it will still take time for the market to normalize. North American production accelerated rapidly by +12% q/q in the second quarter to an annualised rate of 15.5 mn units, narrowing the gap with the 16.2 mn units produced in 2019. Inventory levels showed little sign of improvement, and with sales trending at around 16.2 mn units—well below the weak 17.6 mn units sold last year—the current speed of recovery is not enough to absorb the pent-up demand.

Wards Automotive is forecasting a slower recovery in North American auto production in the third quarter, before softening in the final quarter, ending the year with annual production volume at 14.7 mn units (chart 4). Production recovery will likely pick up in 2023, bringing the annual production level to 15.7 mn units—still -3.4% below 2019 levels. With automakers revising production targets on a high-frequency basis, the speed of recovery will likely remain a wild card for the rest of this year and next, and production shortfalls will continue to constrain sales during this lengthy period of recovery.

2. DEMAND-SIDE HURDLES ON THE BACK BURNER… FOR NOW

Consumer demand should remain resilient over the course of 2022 and 2023. In our latest forecast note, we continue to believe that a high level of pent-up demand on the household side will support the 3.5% real growth forecast in Canada this year and 1.6% next year. We also expect slowing expansion in the US at 1.9% this year and 1.4% in 2023. Despite recent GDP data from the US indicating two consecutive quarters of contraction, consumption has been relatively resilient particularly once supply-driven vehicle sales and its consequent impact on consumption are discounted (here for more). Risks of a recession associated with higher inflation, weaker equity valuation and higher interest rates are indeed elevated, but will likely be avoided in our baseline scenario. The strong labour market conditions, in which the unemployment rates are extremely low and job vacancies are historically high, offer some leeway in the case of a mild contraction.

Rising interest rates, plummeting consumer confidence, decades-high inflation, and weaker financial markets are potential risks that might erode some demand. With inflation appearing greater than anticipated, central banks are raising interest rates aggressively to tame inflation. We expect the policy rate to peak at 3.50% in Canada and 3.25% in the US by year-end, and stay there for the duration of 2023. This should help moderate inflation, but expect it to slow only gradually towards the end of 2022 and through 2023 given resilience in the economy and anticipated wage pressures.

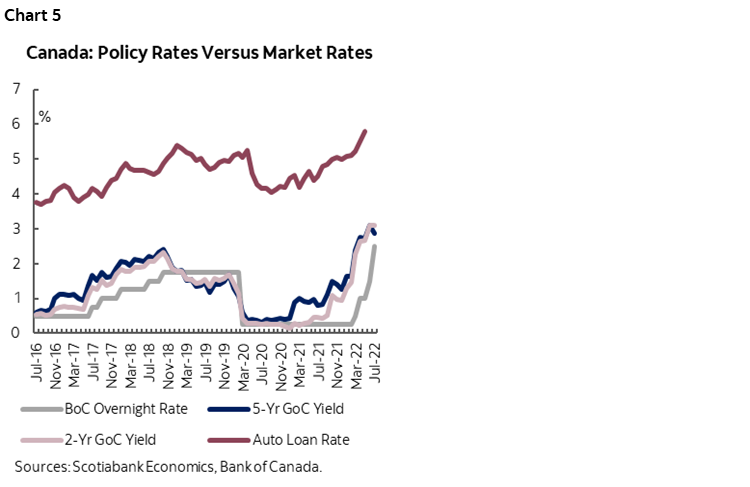

Persistent inflation pressure and consequent central bank hiking paths could push borrowing costs even higher, creating more hurdles for large-ticket consumption including for automobiles. In Canada, auto loan rates have surpassed 2019 levels in April, up 70 bps since the Bank of Canada liftoff, and could edged higher following the Bank of Canada’s 1% policy rate hike in July (chart 5). Since auto loan pricing is influenced by the overnight rate and Government of Canada bond yields, pressure could potentially start to soften over the course of 2023 as growth slows and inflation cools down. In the US, auto loan rates took off only after the Federal Reserve started hiking target federal funds rate, and was up 90 bps in May since the Fed liftoff. Nevertheless, demand-side factors will start to matter if/when production catches up in 2023, though the US economy benefits less for a positive terms-of-trade shock that is providing some buffer to Canadian national wealth.

A LONG PATH TO RECOVERY IN NORTH AMERICA

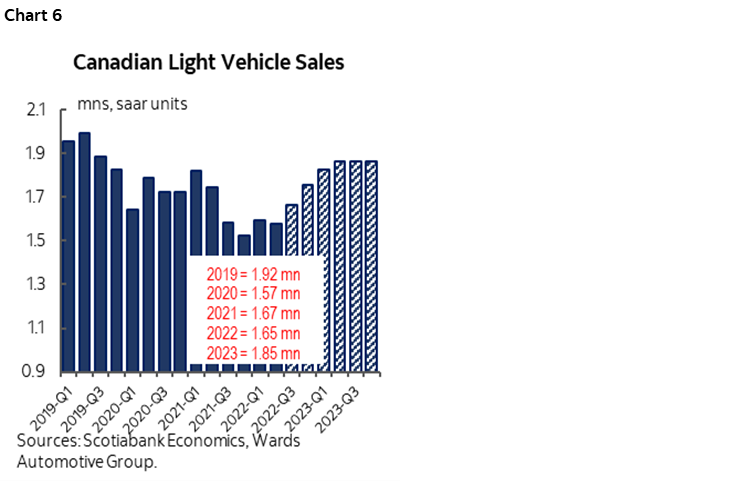

Canadian auto sales have been trending low for the first half of 2022, with the year-to-date selling rate sitting at a weak 1.59 mn saar units according to Wards Automotive (and just above 1.5 mn saar units reported by DesRosiers Automotive Consultants Inc.). The slower-than-anticipated recovery in production has kept days supply historically tight and the runway is shortening to make up for lost sales this year. Hence, our initial annualised sales target of 1.75 mn for 2022 wouldn’t be realistic and we are revising down our forecasts to account for the slower-than-anticipated recovery in supply. Assuming continued production recovery for the rest of this year, Canadian annual sales could end the year at 1.65 mn units, which is a -1% y/y contraction relative to 2021 sales owing to the anticipated persistence in inventory shortages (chart 6). A faster-than-expected vehicle production recovery would put sales closer to 1.7 mn units, but there is plenty of downside risk that would put sales rate closer to 1.6 mn units. We expect a higher sales rate in 2023 once production catches up—where we expect sales to land closer to pre-pandemic levels at 1.85 mn units—lower than our initial forecast of 1.91 mn units to account for a lengthier production recovery—and with more downside risks that slower growth and rate hiking cycle putting pressure on sales from the demand side.

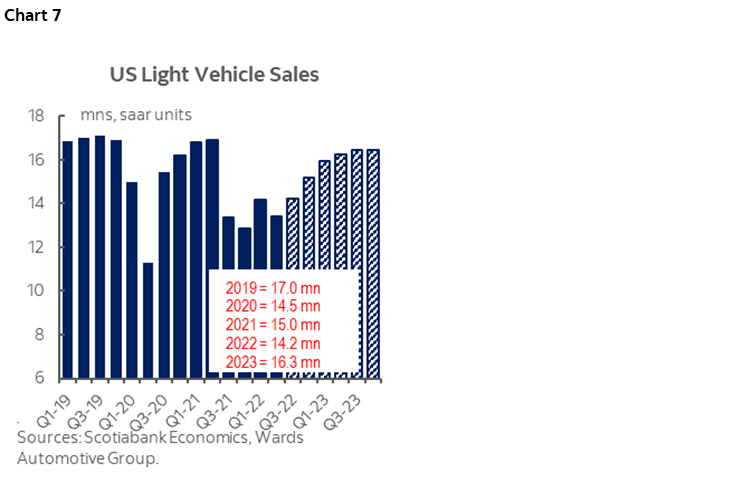

Auto sales in the US also felt the pinch of the supply shortage and struggled to recover, ending the first half of 2022 with a year-to-date selling rate of 13.8 mn units, -18.2% below same period last year. As US manufacturers ramp up production, new-vehicle inventory should start to improve as the year advances, at least with domestic brands. Similar to the Canadian market, the slower recovery in inventory is weighing heavily on the remainder of the year while recession-risk remains slightly more elevated as well. With weak volume in the first half of the year, we are lowering our full-year forecast for 2022 from 15.5 mn units to 14.2 mn units, -4.8% below 2021 sales (chart 7). This implies that some pent-up demand would be pushed out to 2023, and with production gradually normalizing, we are cautiously pencilling in a much stronger sales rate at 16.3 mn units for 2023. That said, while not in our baseline, any eventual recession would put a far more serious dent in this outlook.

EV PICKING UP POPULARITY DESPITE LIMITED INVENTORY AND HIGH PRICING

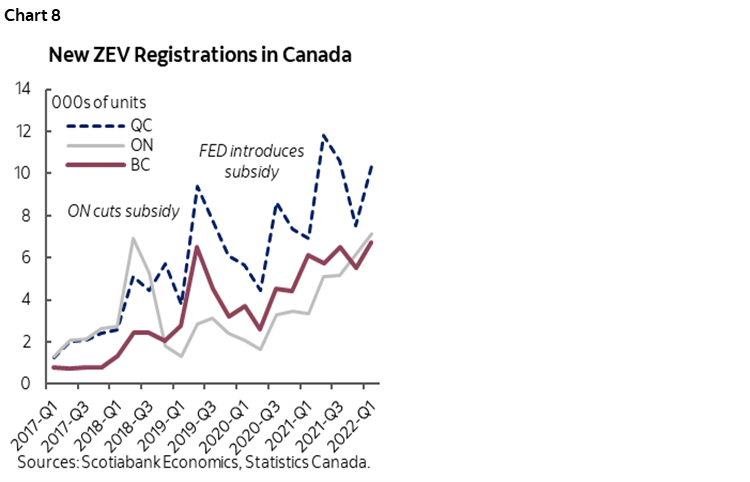

EV sales in Canada had a head start in 2022 with a 25.2% q/q growth in volume, accounting for 7.7% of new sales in the first quarter of 2022 (chart 8). BC continued to be the leader among provinces with 15.5% of new vehicle sales EVs, with Quebec as a close second at 12.7%. Supply likely played a role in this distribution—with limited EV inventory, automakers might choose to prioritize BC and Quebec, which are currently the only provinces with ZEV mandates, along with provincial purchase incentives topping up federal subsidies. The federal government pledged to bring EV sales to at least 20% by 2026, 60% by 2030, and eventually reach 100% by 2035 in the 2030 Emissions Reduction Plan. EV manufacturers have laid out plans to expand production in Canada, especially once the amended Buy American proposal passes in Congress that would make Canadian-made EVs eligible for eventual purchase subsidies in the US.

When consumer preference largely shifts toward EVs, a main challenge would be vehicle affordability, which is unlikely to improve this year. Rare metal prices, especially lithium, surged since Russia invaded Ukraine. The International Energy Agency estimated that if rare metal prices in 2022 remain at first quarter levels (even though prices have softened somewhat since then), battery packs could cost 15% more this year relative to 2021, which has led to EV makers such as Tesla to raise their prices. For large adaptations of EVs, more affordable models are needed. Among major EV markets, BEV prices were the most expensive in the US at an average price of over USD 51,000, compared to USD 48,000 in Europe and USD 27,000 in China. Compared to conventional ICE vehicles, the average BEV price was 20% more expensive in China as of 2021, compared to 45–40% in Europe and the US.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.